Global Seed Coating Market Size, Share, Trends & Growth Forecast Report – Segmented By Additive (Polymers, Colorant, Pellets, Minerals/Pumice and Active Ingredients), By Process (Film Coating, Encrusting and Pelleting), By Active Ingredient (Protectants and Phytoactive Promoters) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis From (2025 to 2033)

Global Seed Coating Market Size

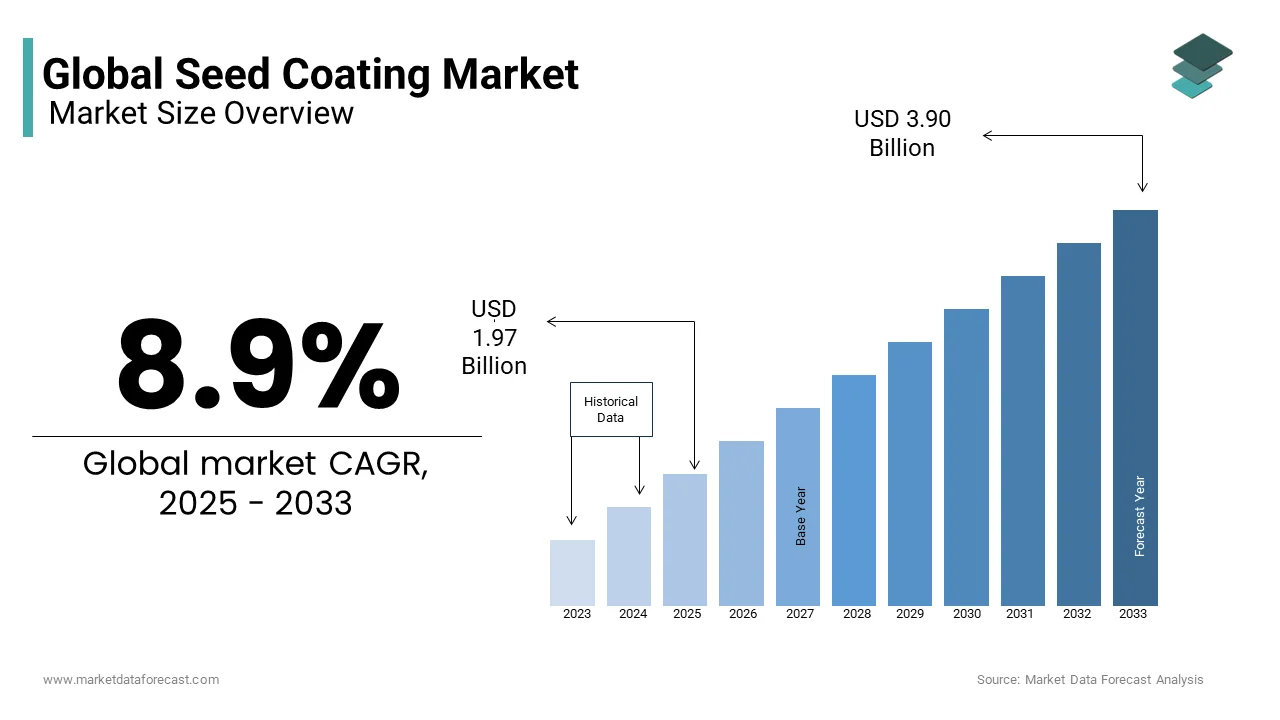

The global seed coating market was valued at USD 1.81 billion in 2024 and is anticipated to reach USD 1.97 billion in 2025 from USD 3.90 billion by 2033, growing at a CAGR of 8.9% during the forecast period from 2025 to 2033.

Increasing demand for quality seed, greater protection against pests and diseases, easy handling, and fluidity in seeders are the key factors expected to drive this market growth.

Seed coating is called seed treatment, a process in which the seed comes into direct contact with chemicals and expels fertilizers and plant protection products to improve the efficiency of the seed. Seed coating is a process in which seeds are directly coated with various materials such as fertilizers, repellants, crop protection chemicals, plant growth regulators, and the like, providing both aesthetic and environmental benefits. With increasing investments in agriculture, the use of modern technologies and the awareness of farmers about the use of genetically modified seeds and hybrid seeds are increasing.

MARKET TRENDS

The world market for seed coatings is developing strongly. The market is experiencing strong adoption, seed treatment, and brand differentiation at unprecedented levels. Therefore, the market is expected to continue its strong growth during the forecast period. The global market for seed coating materials is supposed to specialize in North America and Europe. Currently, these two regions are the main contributors to the global market for seed coating materials. As a result, competition in the sector is likely to become fiercer, and more mergers are expected.

MARKET DRIVERS

Increased support from various government and environmental agencies for agricultural development in emerging countries is supposed to boost the market during the foreseen period. The seed coating market is driven by agriculture by rapidly supplying crops in a profitable manner. It also leads to a rapid multiplication of various crops. In addition, the seed coating material provides a high yield and a wide range of agricultural products, minimizes the sowing rate, and more. Due to these various advantages, the seed coating market is foreseen to register healthy growth during the conjecture period. The market is driven by the adoption of genetically advanced crops, the further introduction of hybrid varieties, the injection of modern agricultural knowledge into traditional communities, etc. A better understanding of the potential commercial potential of seeds is also prompting farmers and suppliers to value coating materials.

Strict rules regarding the practice of seed coating act as a means to hinder this business growth.

MARKET OPPORTUNITIES

In addition to supporting innovative agricultural methods, sustainable agriculture is also promoted in several developing countries. Emerging countries offer alternatives through sustainable agriculture, as well as low-capital investment opportunities. This growth is particularly observed in developing regions, where agriculture is the main contributor to the overall economy.

MARKET CHALLENGES

Seed infections and environmental change are just a few of the challenges faced by farmers that could reduce crop yields during the outlook period. Seed diseases and a volatile environment are some of the main challenges faced by farmers that reduce crop yields.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

8.9% |

|

Segments Covered |

By Additives, Process, Active Ingredients, Crop Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BASF SE (Germany), Bayer (Germany), Clariant AG (Switzerland), Croda International PLC (UK), Sensient Technologies (US) BrettYoung Seeds Limited (Canada), Precision Laboratories LLC (US), Germain Seed Technology, Inc (US), and Centor Oceania (Australia). |

SEGMENTAL ANALYSIS

Global Seed Coating Market By Additives

The polymers segment represented the largest market share, followed by the granules and colorants segments. Polymers are widely used due to their functional qualities of enhancing the nutritional value of seeds and their appearance.

Global Seed Coating Market By Active Ingredient

The increasing incidence of soil-borne pests and diseases is one of the main factors expected to drive the growth of the protectants market.

Global Seed Coating Market By Crop Type

The grain and cereals segment is also expected to be the fastest-growing crop type on the world market. The trend to use coated seeds is increasing on a large scale in areas with extensive production and cultivation of grains, grains, oilseeds, legumes, and vegetables.

REGIONAL ANALYSIS

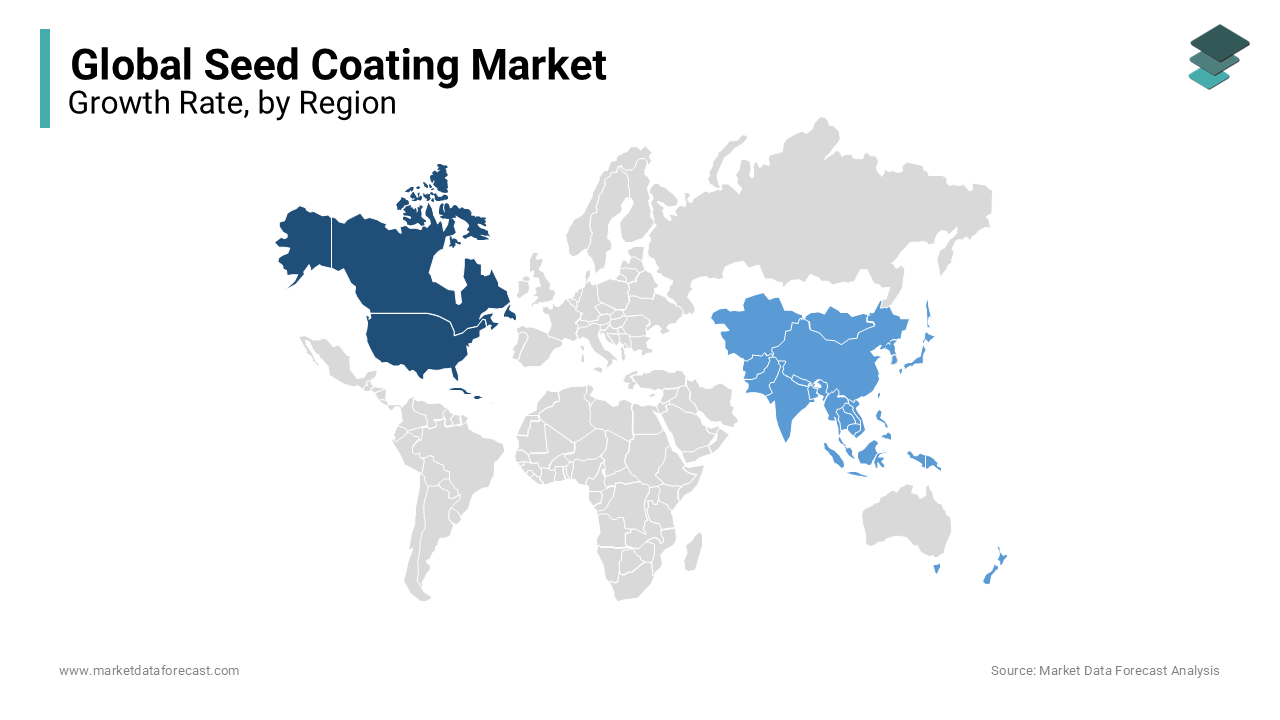

The North American and European regions are experiencing growing demand for cereals, oilseeds and legumes that are used primarily in the food and feed industries. Favorable prices and trade support systems encouraged the import and export of grains and oilseeds to the United States. The employment of seed coatings is known to be a hedging technique and can be seen as safe funding that has resulted in escalated sales of coated seeds in the North American industry. The main manufacturers of food processing industries for grains and oilseeds and legumes are focused on meeting consumer demand, which is shifting towards the consumption of health-enriching food products in the Northern America region. However, European countries are experiencing high demand for biodegradable seed coatings due to European Union (EU) regulations on chemical-based seed coatings, resulting in the accumulation of degradable residues in soil.

The stringent rules of coatings and the rise in the price of raw materials are factors that incentivize makers to decrease production costs, impacting the final cost of seed coating materials in the industry. North America is supposed to maintain its dominant position in the world market. The North American seed coating materials market is expected to have the largest market share between 2021 and 2026, followed by Europe. Increased demand for ready-to-eat foods and soft drinks and the growing influx of healthy products are likely to boost these regional markets. The Asia-Pacific seed coating market is foreseen to record the fastest growth in 2022 - 2027. Increased disposable income, changes in lifestyles, as well as rising expectations of living standards, and growing awareness of modern technologies are estimated to drive the market. The seed coating materials market in South America is also expected to make significant gains, driven by increased innovations in Brazil.

KEY MARKET PLAYERS

Some of the key players identified in the global seed coating market include BASF SE (Germany), Bayer (Germany), Clariant AG (Switzerland), Croda International PLC (UK), Sensient Technologies (US) BrettYoung Seeds Limited (Canada), Precision Laboratories LLC (US), Germain Seed Technology, Inc (US), and Centor Oceania (Australia).

RECENT HAPPENINGS IN THIS MARKET

Precision Laboratories launches a new seed coating polymer. The new seed-coating polymer improves seed uniformity and treatment distribution. The minimal dust removal feature provides increased safety for the operator and the environment, as well as process efficiency.

BASF launched new fungicidal seed treatment to Australian canola growers to control blacklegs. Results from trials conducted over five consecutive years show that ILeVO offers more effective protection against black leg, with significantly better management of early leaf infections, less plant lodging and internal stem infections compared to the current industry standard product.

MARKET SEGMENTATION

This research report on the global seed coating market is segmented and sub-segmented based on the Additives, Processes, Active Ingredients, Crop Type, and Region.

By Additive

- Polymers

- Colorants

- Pellets

- Minerals/Pumice

- Active Ingredients

By Process

- Film Coating

- Encrusting

- Pelleting

By Active Ingredient

- Protectant

- Phytoactive Promoters

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Vegetables

- Flowers & Ornamentals

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East And Africa

Frequently Asked Questions

How big is the global seed coating market?

The global seed coating market was valued at USD 1.97 billion in 2025 and is anticipated to reach USD 3.90 billion by 2033, growing at a CAGR of 8.90% from 2025 to 2033.

what are the market drivers that are driving the global seed coating market?

Increased support from various government and environmental agencies for agricultural development in emerging countries is supposed to boost the market during the foreseen period.

What segments are added in the global seed coating market?

Segments that are covered in the global seed coating market are additive, process, active ingredient, crop type, and by region

who are the market players that are dominating the global seed coating market?

BASF SE (Germany), Bayer (Germany), Clariant AG (Switzerland), Croda International PLC (UK), Sensient Technologies (US) BrettYoung Seeds Limited (Canada), Precision Laboratories LLC (US), Germain Seed Technology, Inc (US), and Centor Oceania (Australia).

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]