Global Security Testing Market Size, Share, Trends, & Growth Forecast Report by Type (Network, Application, and Device), Tool (Penetration Testing, Web Testing, Automated Testing, and Code Review), Deployment mode (Cloud and On-Premises), Organization Size, Vertical, & Region - Industry Forecast From 2025 to 2033

Global Security Testing Market Size

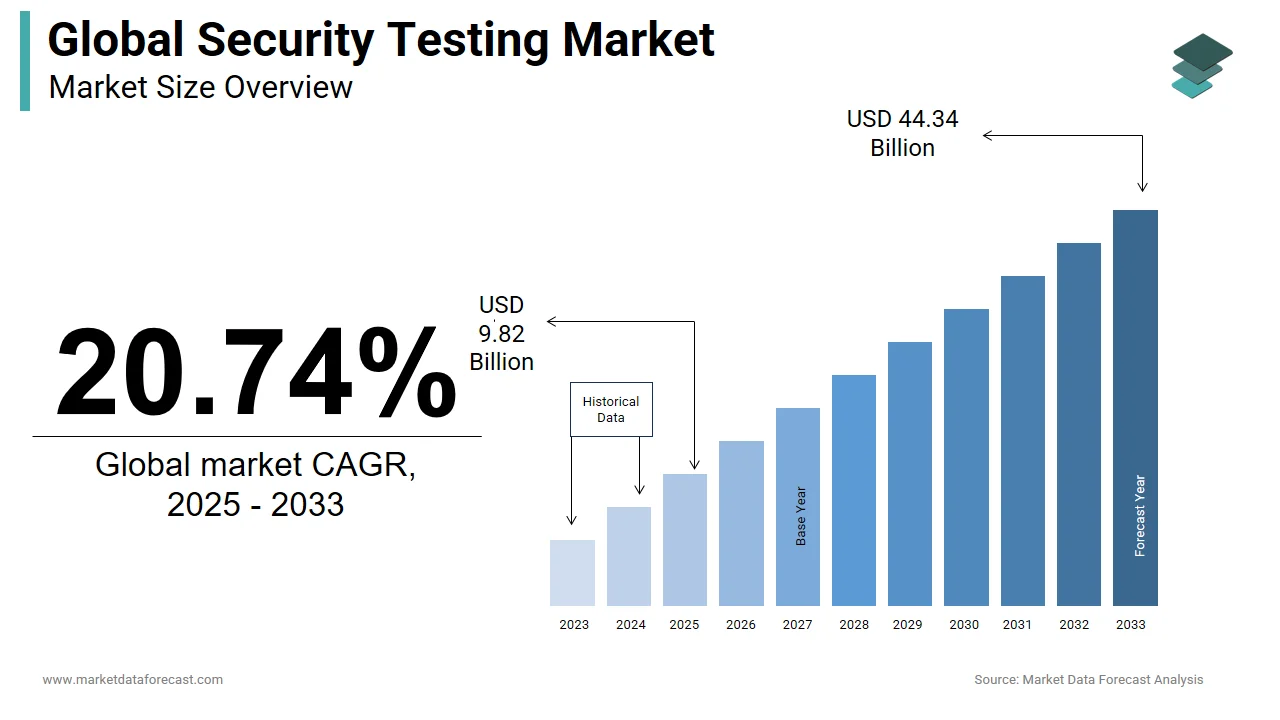

The global security testing market was worth USD 8.13 billion in 2024. The global market is predicted to reach USD 9.82 billion in 2025 and USD 44.34 billion by 2033, growing at a CAGR of 20.74% during the forecast period.

MARKET DRIVERS

The strict and mandatory rules from the governments of different countries that regulate compulsory testing are a significant driver of the market's growth.

Also, the increased adoption of cloud-based web and mobile applications, which call for the need for improving security due to the interference of third parties, is considered to be a major driving factor in the security testing market.

However, the high costs associated with innovation and deployment that affect budgets are the primary restraining factors in the security testing market in the forecast period. Also, the lack of awareness about cybersecurity and increased adoption of freeware security applications may pose some friction to the growth of the security testing market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

20.74% |

|

Segments Covered |

By Type, Tool, Deployment Mode, Organization Size, Vertical, Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Capgemini SE, Cisco Systems Inc., Wipro Limited, Hewlett Packard Enterprise, Valency Networks Pvt Ltd, IBM Corporation, Hexaware Technologies Limited, Qualys Inc., Symetrics, WhiteHat Security, Beyond Security, TraceSecurity, Applause App Quality Inc., Accenture, Cognizant Technology Solutions Corp, Rohde & Schwarz UK Ltd, Infosys Limited, CloudBees, Tata Consultancy Services Limited, McAfee, Veracode, Zensar Technologies Limited, Checkmarx, PortSwigger, UL LLC, Cenzic, and Intertek Group Plc, and others. |

SEGMENTAL ANALYSIS

By Type Insights

The application testing segment is the fastest growing and has accounted for the highest share of the market. This progress is attributed to the increased number of web and mobile applications susceptible to vulnerabilities and threats.

By Tool Insights

As mentioned earlier, the web penetration testing segment of security testing tools was the largest in terms of value and volume in 2018 and is calculated to have the fastest growth rate in the forecast. The growth is assisted by the growing cyberattacks on organizations' critical hardware and software applications.

By Deployment Mode Insights

The cloud segment of deployment mode is the fastest growing in the forecast period due to its convenience to both sides of the users.

By Organization Size Insights

The SME segment is anticipated to lead the market for security testing.

By Industry Insights

BFSI and IT& Telecom sectors are estimated to be the top-leading segments in the security testing market. This is attributed to the implementation of technology in the banking and financial sectors worldwide.

REGIONAL ANALYSIS

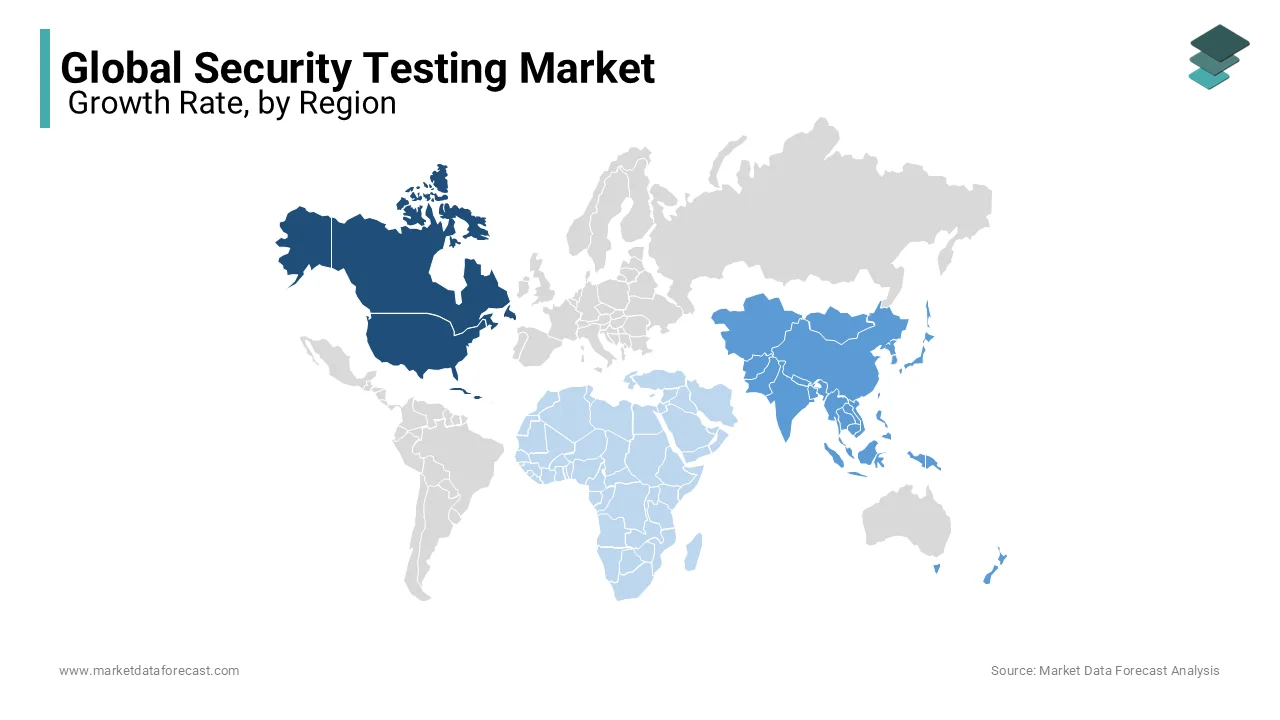

North American region leads the global Security Testing market by value and volume as of 2019. The situation of all the market key players in this region is the main reason for its leading market position. However, this region is the second fastest-growing region in the world, following the Asia Pacific region. Europe was the second lead in the security testing market in 2019. The presence of a vast customer base in and around this region is helping the growth of the security testing market in Europe. Also, the technological supremacy of Europe and North America over the rest of the world is the vital condition that facilitates their development in this emerging field, creating eye-catching performance in the market.

The Asia Pacific region is the next largest market shareholder in 2019 in terms of value and volume. This region is expected to be the fastest growing regional market for Security Testing owing to the future opportunities offered and interest shown by the leading key companies in the Asia Pacific region, mainly India, China, and Japan, which is the cause for such growth rate. The regional advantages offered by this region, such as ease of setup, cheap resources, and a large number of skilled populations, are significant reasons for this region’s advancement in the market.

On the other hand, the Middle East & Africa, and Latin America regions, being in the low developing countries due to the contribution of low GDP countries, have fewer opportunities for market growth. Hence, the Security Testing Market grows at a slow pace in these regions.

KEY MARKET PARTICIPANTS

The major companies operating in the global security testing market include Capgemini SE, Cisco Systems Inc., Wipro Limited, Hewlett Packard Enterprise, Valency Networks Pvt Ltd, IBM Corporation, Hexaware Technologies Limited, Qualys Inc., Symetrics, WhiteHat Security, Beyond Security, TraceSecurity, Applause App Quality Inc., Accenture, Cognizant Technology Solutions Corp, Rohde & Schwarz UK Ltd, Infosys Limited, CloudBees, Tata Consultancy Services Limited, McAfee, Veracode, Zensar Technologies Limited, Checkmarx, PortSwigger, UL LLC, Cenzic, Intertek Group Plc, and others.

RECENT MARKET HAPPENINGS

-

Intel, a key participant in the security testing market, has announced plans to open-source a new firmware security testing tool. The device's name is HBFA, which stands for Host-Based Firmware Analyzer. This project is expected to be formally introduced at the RSA 2019 security conference in San Francisco.

MARKET SEGMENTATION

This research report on the global security testing market has been segmented and sub-segmented based on the type, tool, deployment mode, organization size, industry, and region.

By Type

- Network

- Application

- Device

By Tool

- Penetration Testing

- Web Testing

- Automated Testing

- Code Review

By Deployment Mode

- Cloud

- On-Premises

By Organization Size

- SMEs

- Large Enterprises

By Industry

- Government and Public Utilities

- BFSI

- Healthcare

- IT & Telecom

- Others.

By Region

- Latin America

- Europe

- Asia Pacific

- North America

- Middle East & Africa.

Frequently Asked Questions

How does the increasing adoption of IoT devices impact the demand for security testing services?

The proliferation of IoT (Internet of Things) devices introduces new attack vectors and security challenges. Consequently, the demand for security testing services rises as organizations seek to safeguard IoT ecosystems, mitigate vulnerabilities, and protect sensitive data transmitted through interconnected devices.

What are the emerging trends shaping the future of the security testing market?

Emerging trends in the security testing market include the integration of artificial intelligence (AI) and machine learning (ML) for threat detection, the rise of DevSecOps practices embedding security into the development lifecycle, and the growing emphasis on proactive security measures such as red teaming exercises.

How do advancements in technology such as blockchain and quantum computing impact security testing requirements?

Technologies like blockchain introduce novel security paradigms, while the potential advent of quantum computing poses both opportunities and challenges for security testing. Security testers must adapt their methodologies to address the evolving threat landscape and ensure robust protection against emerging cyber risks.

What are the key challenges faced by organizations in implementing comprehensive security testing strategies?

Challenges include resource constraints, the complexity of modern IT environments, the shortage of skilled security professionals, and the need for continuous monitoring and updates to counter evolving cyber threats effectively.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]