Global Scaffolding Market Size, Share, Trends, & Growth Forecast Report By Type (Supported Scaffolding, Suspended Scaffolding, and Rolling Scaffolding), Material, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Scaffolding Market Size

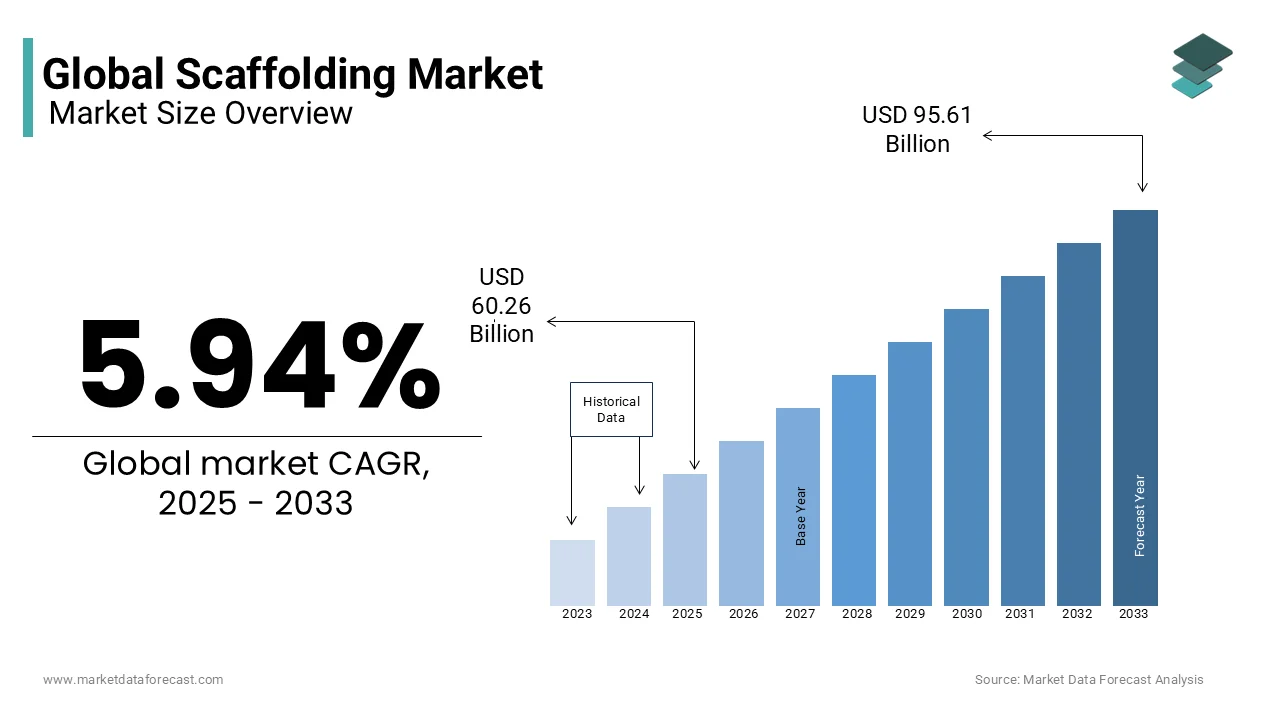

The global scaffolding market was worth USD 56.88 billion in 2024. The global market is projected to reach USD 95.61 billion by 2033 from USD 60.26 billion in 2025, growing at a CAGR of 5.94% from 2025 to 2033.

Scaffolding is also called staging and a temporary structure used in construction, maintenance, and repair projects. It helps workers reach high places and provides a stable platform for materials. Scaffolding ensures safety and efficiency in various construction activities. It is made from strong materials like steel, aluminum, or wood, which makes it reliable and adaptable for different types of projects. The construction industry employs millions of people worldwide. The International Labour Organization (ILO) estimated that before the COVID-19 pandemic, about 7.7% of all workers were employed in construction. This highlights how crucial scaffolding is in supporting building projects everywhere.

Worker safety is a major concern in the construction sector. In the United Kingdom, the Health and Safety Executive (HSE) recorded 138 worker deaths in 2023/24, with 51 happening in the construction industry. Falls from height were the most common cause of these deaths, leading to 50 fatalities across different industries, which made up 36% of all workplace deaths. These numbers show why scaffolding is so important for preventing falls and protecting workers. To reduce such accidents, governments and organizations have introduced strict safety rules for scaffolding. Groups like the Occupational Safety and Health Administration (OSHA) in the United States, the International Organization for Standardization (ISO), and the European Committee for Standardization (CEN) have created detailed guidelines. Following these rules helps prevent workplace injuries and encourages safer working conditions in construction.

MARKET DRIVERS

Urbanization and Infrastructure Development

Cities around the world are growing rapidly, leading to a high demand for new buildings, roads, and bridges. The United Nations' 2024 World Population Prospects states that the global population reached around 8.09 billion in mid-2023, with a large number of people living in cities. As more people move to urban areas, there is an increasing need for construction projects, including homes, offices, and transportation systems. To build these safely and efficiently, scaffolding is required. Scaffolding ensures that workers can access high areas while keeping construction sites organized and secure. As cities expand further, scaffolding will continue to play a key role in supporting urban development.

Safety Regulations and Compliance

Governments and organizations enforce strict safety rules in the construction industry to prevent accidents. The Health and Safety Executive (HSE) in the United Kingdom recorded 138 worker deaths in 2023/24, with 51 of them in construction. The most common cause was falling from heights, resulting in 50 fatalities, which made up 36% of all workplace deaths. Due to such alarming statistics, authorities have introduced strict guidelines for scaffolding use. Companies must follow safety rules when setting up, inspecting, and using scaffolding. To meet these regulations, businesses invest in high-quality scaffolding and provide proper worker training. These efforts not only make workplaces safer but also increase the demand for advanced scaffolding solutions.

MARKET RESTRAINTS

Safety Concerns and Compliance Costs

Although scaffolding improves worker safety, there are still risks associated with improper setup and maintenance. The Occupational Safety and Health Administration (OSHA) states that scaffolding-related accidents lead to around 4,500 injuries and over 60 deaths in the United States each year. To ensure safety, companies must conduct regular inspections, provide worker training, and maintain scaffolding systems properly. These safety measures, while essential, come with high costs. Small and medium-sized businesses often struggle to afford these expenses, which can impact their profitability. While safety regulations are necessary, the financial burden on companies remains a significant challenge in the scaffolding market.

Limited Availability of Skilled Workers

The construction industry depends on skilled workers to operate scaffolding safely and effectively. However, there is currently a shortage of trained professionals. The U.S. Bureau of Labor Statistics reported that as of December 2024, there were 7.6 million unfilled job positions across different industries, with construction facing severe shortages. Many experienced workers are retiring, and fewer young professionals are entering the field. This lack of skilled labor makes it difficult for companies to complete projects on time, increasing costs and reducing efficiency. As a result, some construction projects face delays, leading to a lower demand for scaffolding. Finding and training more workers is essential to address this issue.

MARKET OPPORTUNITIES

Technological Advancements in Scaffolding Systems

New technology is helping to improve scaffolding safety and efficiency. The Occupational Safety and Health Administration (OSHA) estimates that using proper scaffolding safety measures can prevent around 4,500 injuries and 50 deaths each year in the United States. Companies are now developing scaffolding with advanced safety features, such as fall protection systems, real-time monitoring sensors, and automated guardrails. These innovations make scaffolding easier and safer to use. In addition, Building Information Modeling (BIM) allows companies to plan scaffolding structures digitally, reducing mistakes and saving time. As the construction industry adopts more technology, the demand for modern, high-tech scaffolding will continue to rise.

Emphasis on Worker Training and Certification

Training programs are becoming more important in the scaffolding market. The Occupational Safety and Health Administration (OSHA) requires that all workers using scaffolding be trained by a qualified expert. Training helps workers recognize risks and follow safety procedures. With proper training, workers can set up and use scaffolding correctly, reducing accidents. Certified workers are also more likely to meet safety regulations, preventing legal and financial issues for companies. Investing in worker training improves safety and efficiency, making it an important opportunity for businesses in the scaffolding market. As more organizations focus on proper certification, the demand for trained scaffolding professionals will increase.

MARKET CHALLENGES

Material Cost Fluctuations

The cost of materials used for scaffolding, such as steel and timber, can vary greatly, making it difficult for companies to plan budgets. In 2021, the United Kingdom saw an increase of 113% in softwood lumber prices, as reported by the Royal Institution of Chartered Surveyors (RICS). These price changes were caused by disruptions in supply and demand. Similarly, the cost of steel reached its highest level since the 2007-2008 financial crisis, increasing expenses for scaffolding companies. When material prices rise unexpectedly, businesses may delay projects or raise their prices, making scaffolding less affordable for clients. Managing these costs remains a major challenge for the market.

Ensuring Scaffold Stability and Safety

Keeping scaffolding stable and safe is one of the biggest challenges in construction. The Health and Safety Executive (HSE) states that scaffolding must be set up on firm, level ground with proper support to prevent collapse. If scaffolding is not secure, workers face a serious risk of injury or death. To avoid such dangers, companies must follow strict inspection procedures and ensure scaffolding is built according to safety standards. Regular safety checks are required to find and fix any weaknesses in the structure. Proper inspections and adherence to regulations help protect workers and ensure that scaffolding remains a reliable tool in construction projects.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.94% |

|

Segments Covered |

By Type, Material, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ADTO Industrial Group Co.Ltd., Altar Group LLC, Wilhelm Layher Holding GmbH, Step up Scaffold, KHK Scaffolding & Formwork LLC, Waco Kwikform Limited, Safway Group Holding LLC, and PERI GmbH. |

SEGMENTAL ANALYSIS

By Type Insights

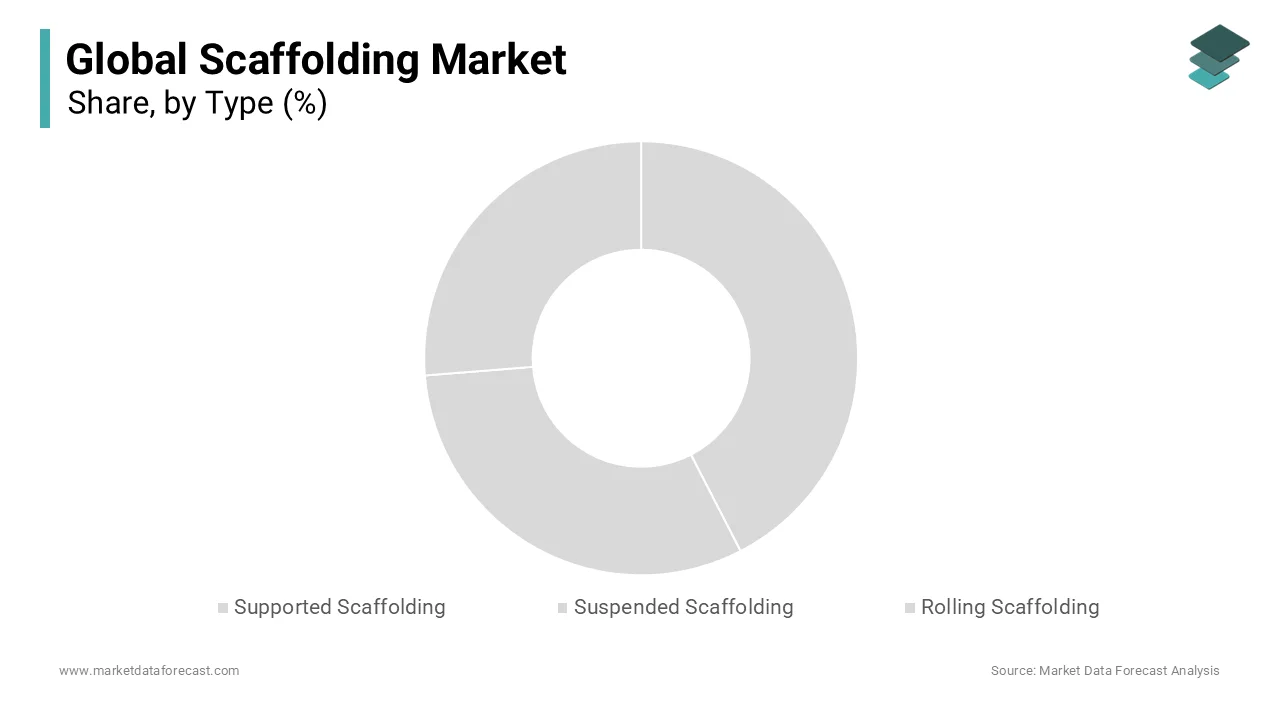

The supported scaffolding segment dominated the market by capturing 65.8% share in 2024. Its dominance is attributed to its cost-effectiveness, stability, and widespread use in both residential and commercial construction. According to the U.S. Occupational Safety and Health Administration (OSHA) , supported scaffolding is used in over 65% of construction projects due to its ease of installation and compliance with safety standards. The National Institute for Occupational Safety and Health (NIOSH) highlights that scaffolding-related accidents account for nearly 4,500 workplace injuries annually, emphasizing the importance of reliable systems like supported scaffolding. This segment's affordability, combined with its ability to support heavy loads, makes it indispensable in large-scale infrastructure projects.

The rolling scaffolding segment is predicted to witness the highest CAGR of 6.8% from 2025 to 2033 due to factors such as the increasing demand in industrial maintenance, warehousing, and logistics sectors, where mobility is essential. The International Labour Organization (ILO) states that mobile scaffolds improve labour efficiency by up to 25-30%, making them ideal for dynamic work environments. Furthermore, the rise of e-commerce has spurred warehouse automation. Rolling scaffolding’s adaptability aligns perfectly with these trends, ensuring its rapid adoption. The U.S. Department of Commerce also notes increased investments in smart warehouses, further boosting demand for flexible equipment like rolling scaffolding.

By Material Insights

The steel segment dominated the scaffolding market by holding 53.5% share in 2024. It is due to its exceptional strength, durability, and ability to support heavy loads in demanding construction environments. According to the American Iron and Steel Institute (AISI), steel scaffolding can withstand loads up to 5 times greater than aluminum, making it ideal for industrial and high-rise projects. The U.S. Occupational Safety and Health Administration (OSHA) reported that steel scaffolding reduces structural failures by 30%, ensuring worker safety. Additionally, the World Steel Association reports that steel is 100% recyclable, with over 70% of steel products being recycled globally, aligning with sustainability goals. Its cost-effectiveness and reliability make it indispensable in large-scale infrastructure projects.

The aluminum scaffolding segment is estimated to register the fastest CAGR of 6.9% from 2025 to 2033. Its growth is driven by increasing demand for lightweight, corrosion-resistant materials in maintenance, renovation, and residential projects. The International Aluminium Institute states that aluminum is 40% lighter than steel, reducing labour fatigue and improving portability. Furthermore, the rise in green building initiatives, boosts aluminum adoption due to its recyclability and energy efficiency. The U.S. Green Building Council (USGBC) emphasizes that aluminum scaffolding supports LEED-certified projects, enhancing its appeal. According to the National Institute of Standards and Technology (NIST), aluminium’s resistance to rust extends its lifespan by 20-30% compared to wood or steel in harsh environments, further driving its popularity.

By Application Insights

The construction industry held the largest share of the scaffolding market at 65.7% share in 2024. Its dominance is driven by the global surge in infrastructure development, with the World Bank estimating that urbanization will require $94 trillion in infrastructure investments by 2040. Scaffolding is essential for worker safety and project efficiency, with the Occupational Safety and Health Administration (OSHA) reporting that proper scaffolding reduces fall-related accidents by up to 40%. The International Labour Organization (ILO) highlights that over 60% of construction projects globally rely on scaffolding for structural support. Additionally, the U.S. Census Bureau reports a steady annual growth rate of 8-10% in construction spending, particularly in emerging markets like Asia-Pacific, where urbanization is driving demand.

The electrical maintenance segment is anticipated to witness the fastest CAGR of 7.8% from 2025 to 2033 owing to the increasing investments in power infrastructure, with the International Energy Agency (IEA) projecting global energy investment to reach $2.8 trillion annually by 2030, including upgrades to aging grids. Scaffolding is critical for safe access during electrical repairs, reducing downtime by 25-30%, as per the U.S. Department of Energy. The rise of renewable energy projects further drives demand. The National Institute for Occupational Safety and Health (NIOSH) emphasizes that scaffolding enhances safety compliance in high-risk environments, making it vital for modernizing power systems and supporting green energy transitions.

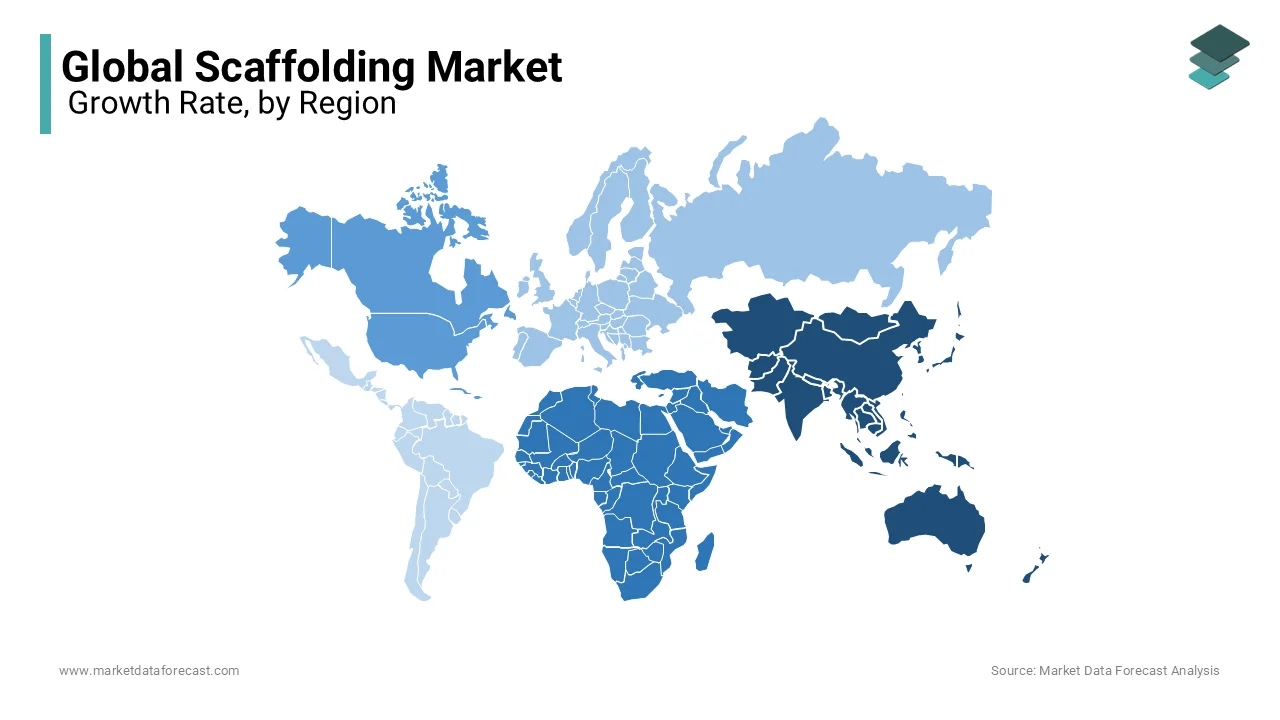

REGIONAL ANALYSIS

Asia-Pacific was the leading region in the scaffolding market by holding 45.9% of the total market share in 2024. This is due to the rapid expansion of cities and increasing construction activities. The United Nations (UN) predicts that by 2030, 54% of Asia’s population will live in urban areas, leading to a higher demand for housing, commercial buildings, and transport systems. The Asian Development Bank (ADB) reports that the region plans to invest $8 trillion in infrastructure projects by 2030. Key countries driving this growth include China and India. The Indian Ministry of Statistics records an 8-10% annual increase in construction spending, reflecting the region’s strong development efforts. Scaffolding is essential for large-scale projects such as highways, metro systems, and skyscrapers, providing necessary support and worker safety. The International Labour Organization (ILO) states that proper scaffolding can reduce workplace accidents by up to 30%, making it crucial for maintaining safety in high-risk construction environments.

The Middle East and Africa is estimated to expand at a CAGR of 7.5% over the forecast period. The demand for scaffolding is driven by massive infrastructure projects in these regions. One major example is Saudi Arabia’s Vision 2030, which includes $1 trillion in planned investments, as reported by the Saudi Ministry of Finance. These projects involve constructing smart cities, transportation networks, and entertainment hubs. In Africa, there is a growing need for infrastructure improvements. The African Development Bank (AfDB) estimates that Africa requires $130-170 billion in annual infrastructure investment to bridge its infrastructure gap. Additionally, renewable energy projects are expanding rapidly. The International Energy Agency (IEA) predicts a 10% annual growth in solar power capacity in the region, increasing demand for scaffolding in solar panel installations. Scaffolding plays a key role in ensuring worker safety and improving efficiency in these large-scale development projects.

North America holds a strong position in the scaffolding market due to increased spending on repairing and modernizing aging infrastructure. The American Society of Civil Engineers (ASCE) reports that the United States alone faces a $2.59 trillion infrastructure investment gap by 2029. To address this, the U.S. Census Bureau recorded a 3% annual increase in public construction spending in 2022, with projects such as bridge repairs and highway expansions requiring scaffolding. Additionally, green building initiatives contribute to market growth. The U.S. Green Building Council (USGBC) states that LEED-certified sustainable construction projects have grown by 14% annually over the past decade. Safety remains a priority, with OSHA estimating that proper scaffolding use reduces workplace accidents by up to 25%.

Europe is a well-established market for scaffolding, showing steady growth due to increasing renovation projects and sustainability initiatives. The European Commission has allocated €800 billion under the EU Recovery and Resilience Facility to support energy-efficient and sustainable construction. Renovation projects account for a large portion of construction activities, with the European Construction Industry Federation (FIEC) stating that 35% of construction projects involve renovations. The region’s aging infrastructure also requires continuous investment. For example, the UK government has committed £600 billion to infrastructure projects by 2025. These investments drive demand for scaffolding systems that ensure worker safety and structural support. Improved scaffolding systems have contributed to a 20% reduction in workplace accidents, as noted by the European Agency for Safety and Health at Work.

Latin America’s scaffolding market is growing at a moderate pace, supported by increasing investments in infrastructure and urban expansion. The Inter-American Development Bank (IDB) estimates that the region will see $600 billion in infrastructure investments by 2030. Leading the growth are countries like Brazil and Mexico, which are prioritizing large-scale development projects. Brazil, for instance, has committed $120 billion to infrastructure under its Growth Acceleration Program. Additionally, urbanization is rising steadily. The United Nations (UN) predicts that 81% of Latin America’s population will live in cities by 2030, up from 80% in 2020. However, challenges such as political instability and economic uncertainty may slow progress in some areas. The demand for scaffolding remains strong, particularly for residential, commercial, and industrial projects.

KEY MARKET PLAYERS & COMPETITIVE LANDSCAPE

The major players in the global scaffolding market include ADTO Industrial Group Co.Ltd., Altar Group, LLC, Wilhelm Layher Holding GmbH, Step up Scaffold, KHK Scaffolding & Formwork LLC, Waco Kwikform Limited, Safway Group Holding LLC, and PERI GmbH.

The global scaffolding market is highly competitive, with major companies continuously introducing new technologies and solutions. Leading players like Layher, PERI, and BrandSafway dominate the market because of their strong brand reputation, product innovation, and global presence. They focus on developing lightweight, modular, and high-strength scaffolding to improve efficiency and safety in construction projects.

Mid-sized and regional scaffolding companies also contribute to market growth by offering affordable and locally adapted scaffolding solutions. Many firms in Asia-Pacific, the Middle East, and Latin America are expanding their production and distribution networks to meet the rising demand for construction projects.

Another key factor influencing competition is regulatory compliance. Companies that meet international safety standards like OSHA, ISO, and EN gain an advantage in the market. Sustainability is also becoming more important, with leading firms developing recyclable scaffolding materials and eco-friendly solutions to align with global environmental policies.

Overall, the scaffolding market is constantly evolving, driven by technological advancements, geographical expansions, and strategic partnerships. Companies that focus on innovation, safety, and sustainability will remain competitive and continue to grow in the market.

Top 3 Players in the Scaffolding Market

Layher Holding GmbH & Co. KG

Layher is one of the most well-known companies in the scaffolding market. It is recognized for its high-quality and innovative scaffolding systems that are used worldwide. The company has set a high standard in the market by continuously improving its products to ensure safety and efficiency. Layher’s scaffolding systems are versatile, which means they can be used in many different types of construction and industrial projects. Because of its strong focus on technology and reliability, Layher remains a market leader, helping construction workers complete their tasks more safely and effectively.

PERI SE

PERI is a global leader in scaffolding and formwork solutions. The company is known for its advanced engineering and customer-focused approach. PERI has contributed to large-scale infrastructure projects by improving the way scaffolding is designed and used. Its systems are lightweight, durable, and easy to assemble, making construction work faster and safer. PERI’s focus on engineering excellence allows it to provide modern scaffolding solutions that help reduce costs and improve safety on worksites. The company’s commitment to innovation and efficiency has made it a key player in the global scaffolding market.

BrandSafway

BrandSafway is a major player in the scaffolding market, offering a wide range of access and industrial services. With years of experience, the company has built a strong reputation for safety and reliability. BrandSafway’s solutions are used in various sectors, including construction, maintenance, and industrial projects. The company’s extensive service portfolio allows it to meet different project needs efficiently. By focusing on worker safety, high-quality materials, and customized solutions, BrandSafway continues to be a trusted partner for construction companies around the world.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Innovation and Product Development

Major scaffolding companies like Layher, PERI, and BrandSafway invest heavily in research and development to improve their products. They focus on developing modular scaffolding systems that are lightweight and easy to assemble. For example, Layher’s Allround Scaffolding System and PERI’s UP Scaffolding System allow for quick installation and better load-bearing capacity. Many companies are also using digital technology, such as Building Information Modeling (BIM), to make scaffolding safer and more efficient. These advancements help construction projects save time, reduce costs, and improve worker safety.

Strategic Acquisitions and Partnerships

To grow their businesses, top scaffolding companies buy other smaller firms and form partnerships with different organizations. BrandSafway has acquired several regional scaffolding companies, expanding its services to new locations. PERI works closely with construction firms and technology providers to enhance its scaffolding systems. Layher collaborates with training institutions to educate workers on safe scaffolding practices. These strategies help companies increase their market reach and strengthen their expertise.

Geographical Expansion

Large scaffolding companies are expanding their presence worldwide, especially in fast-growing construction markets. Layher and PERI have manufacturing and distribution centers in Asia-Pacific, the Middle East, and Latin America. These locations have high demand for construction projects, including housing, roads, and bridges. By setting up operations closer to these markets, companies can reduce costs, improve logistics, and provide scaffolding services more efficiently.

Emphasis on Safety and Compliance

Scaffolding companies follow strict safety regulations to ensure worker protection. Layher and BrandSafway develop scaffolding solutions that go beyond minimum safety requirements by including anti-slip surfaces, secure locking mechanisms, and improved load-bearing features. Companies also invest in training programs to educate workers on safe scaffolding practices. By following international safety standards such as OSHA, ISO, and EN regulations, scaffolding firms minimize workplace accidents and maintain high industry standards.

RECENT HAPPENINGS IN THE MARKET

- In February 2025, Lyndon SGB, a prominent scaffolding company, announced a rebranding and will now operate under the name Brand Access Solutions. This rebranding aims to strengthen its brand identity and market presence.

- In February 2025, Altrad, a global industrial services group, completed the acquisition of Stork TS Holdings Limited's UK business. This acquisition is expected to expand Altrad's footprint in the UK market and enhance its service offerings.

- In January 2025, HAKI, a Swedish safety solutions company, acquired Trimtec, a distributor of high-tech precision equipment. This acquisition is set to enhance HAKI’s product portfolio and technological capabilities.

MARKET SEGMENTATION

This research report on the global scaffolding market is segmented and sub-segmented into the following categories.

By Type

- Supported Scaffolding

- Suspended Scaffolding

- Rolling Scaffolding

By Material

- Steel

- Aluminum

- Wood

- Others

By Application

- Construction Industry

- Electrical Maintenance

- Temporary Stage

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the primary materials used in scaffolding systems?

Scaffolding systems are primarily constructed using steel, aluminum, and wood, with steel being the most commonly used material due to its strength and durability.

Which region currently leads the global scaffolding market?

The Asia-Pacific region leads the global scaffolding market, driven by rapid urbanization and infrastructure development in countries like China and India.

What are the primary materials used in scaffolding systems?

Scaffolding systems are primarily constructed using steel, aluminum, and wood, with steel being the most commonly used material due to its strength and durability.

What factors are driving the growth of the scaffolding market?

The scaffolding market is growing due to increased construction activities, urbanization, and the need for maintenance of aging infrastructure.

How is technology influencing the scaffolding market?

Technological advancements, including the integration of digital monitoring and automated systems, are enhancing scaffolding safety and efficiency.

What trends are shaping the future of the scaffolding market?

Trends such as the adoption of modular and prefabricated scaffolding systems, focus on worker safety, and the use of eco-friendly materials are shaping the market's future.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]