Global Salt Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Rock Salt, Salt in Brine, Solar Salt, Vacuum Pan Salt), Source, Application, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Salt Market Size

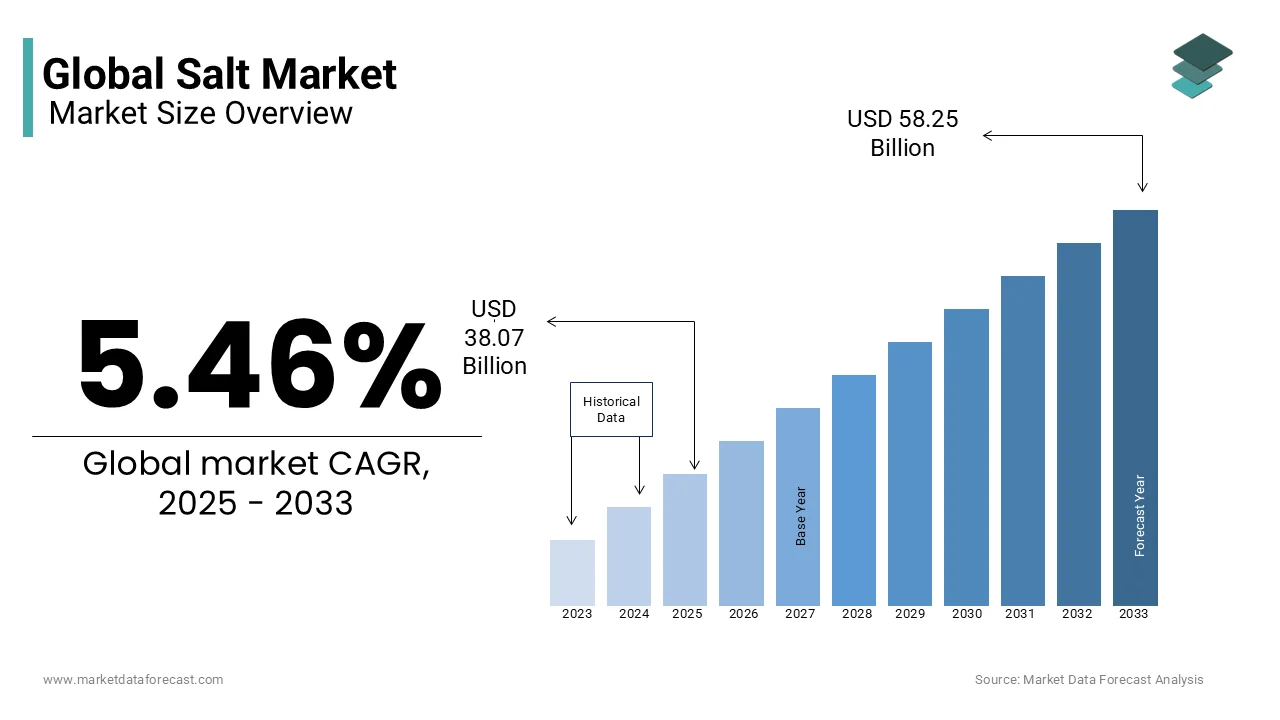

The global salt market size was valued at USD 36.10 billion in 2024 and is expected to reach USD 58.25 billion by 2033 from USD 38.07 billion in 2025. The market is projected to grow at a CAGR of 5.46%.

Salt is a naturally occurring mineral primarily composed of sodium chloride (NaCl). Salt is indispensable not only for human consumption, where it enhances flavor and preserves food, but also in various industrial applications including chemical manufacturing, water treatment, de-icing, and agriculture. Salt plays a critical role in human health by regulating fluid balance by supporting nerve transmission, and aiding muscle function. The World Health Organization (WHO) recommends a daily salt intake of less than 5 grams to reduce the risk of cardiovascular diseases with a global consumption average around 9-12 grams per day by highlighting a significant public health concern.

MARKET DRIVERS

Rising Demand in the Chemical Industry

The chemical industry is a significant driver of the global salt market, particularly due to its role in chlor-alkali production, which yields essential chemicals like chlorine, caustic soda, and soda ash. These chemicals are foundational in manufacturing products such as plastics, glass, detergents, and paper. According to the United States Geological Survey (USGS), nearly 43% of salt consumed globally is directed toward chemical production. The growing demand for polyvinyl chloride (PVC) in construction and automotive industries has further fueled salt consumption as chlorine derived from salt is a critical component in PVC manufacturing. Additionally, the increasing focus on water treatment chemicals, particularly in rapidly industrializing regions has amplified the demand for industrial-grade salt is cementing its role in the chemical sector's expansion.

Expansion of Road De-Icing Applications

Salt's use in road de-icing is a major factor driving market growth in regions experiencing harsh winter conditions. Road salt effectively lowers the freezing point of water, preventing ice formation and enhancing vehicular safety. In the United States alone, over 20 million tons of salt are used annually for de-icing purposes, as reported by the Federal Highway Administration (FHWA). This application has become increasingly vital due to unpredictable weather patterns linked to climate change, which have intensified winter storms in many regions. As urban infrastructure expands and transportation safety remains a priority, the consistent demand for de-icing salt is expected to sustain market growth in North America and Europe.

MARKET RESTRAINTS

Health Concerns Over Excessive Sodium Consumption

Growing awareness of the health risks associated with high sodium intake is a significant restraint on the salt market in the food sector. Excessive salt consumption is linked to hypertension, cardiovascular diseases, and stroke. The World Health Organization (WHO) reports that approximately 1.13 billion people globally suffer from hypertension with high sodium intake being a primary contributor. WHO recommends reducing daily salt intake to less than 5 grams per day with the global average ranges from 9 to 12 grams. Public health initiatives and stricter regulations in many countries, including mandatory sodium reduction targets in processed foods, are curbing the demand for food-grade salt as manufacturers seek alternative flavoring and preservation methods.

Environmental Impact of Salt Mining and Usage

Environmental concerns related to salt extraction and application for de-icing shall pose a restraint on market growth. The extensive use of road salt leads to soil degradation, freshwater contamination, and adverse effects on aquatic ecosystems. The U.S. Environmental Protection Agency (EPA) highlights that road salt runoff contributes to elevated chloride levels in freshwater bodies, affecting nearly 40% of urban streams in the United States. Additionally, large-scale salt mining can disrupt local ecosystems and groundwater balances. The environmental impact of traditional salt usage may limit market expansion in certain regions.

MARKET OPPORTUNITIES

Growth in Renewable Energy Storage Solutions

An emerging opportunity in the salt market is its application in renewable energy storage in molten salt technology for concentrated solar power (CSP) plants. Molten salt is used as a heat transfer and storage medium by enabling energy retention for electricity generation even when sunlight is unavailable. According to the International Renewable Energy Agency (IRENA), CSP installations with molten salt storage increased by over 10% globally between 2020 and 2023. This growth is driven by the global push for sustainable energy solutions and the need for efficient storage technologies. The demand for high-purity salt in CSP plants is expected to rise by presenting a lucrative avenue for salt producers.

Rising Demand for Gourmet and Specialty Salts

The increasing popularity of gourmet and specialty salts, such as Himalayan pink salt, sea salt, and fleur de sel, offers a significant growth opportunity within the food and beverage sector. These salts are valued for their unique flavors, textures, and trace mineral content by appealing to health-conscious consumers and culinary professionals. The U.S. Department of Agriculture (USDA) notes a steady increase in consumer spending on premium food products by including specialty salts, with a growth rate of 6% annually in the organic and natural food segments. This trend is further fueled by the expanding global culinary tourism industry and the rising interest in artisanal and natural food products is creating new markets for premium salt varieties.

MARKET CHALLENGES

Fluctuating Raw Material and Transportation Costs

One of the key challenges facing the salt market is the volatility in raw material and transportation costs. While salt itself is abundant, the costs associated with extraction, processing, and distribution are subject to fluctuations due to fuel price changes and labor costs. According to the U.S. Energy Information Administration (EIA), global diesel prices increased by over 20% between 2021 and 2023 which is significantly impacting transportation expenses for bulk commodities like salt. Additionally, supply chain disruptions, such as those experienced during the COVID-19 pandemic, have further strained logistics, leading to increased costs and delivery delays. These fluctuations can reduce profit margins and create pricing instability for manufacturers and suppliers in the salt industry.

Stringent Environmental Regulations

The salt industry faces mounting challenges due to stringent environmental regulations aimed at mitigating the ecological impacts of salt production and usage. Regulatory bodies are increasingly enforcing guidelines to limit saline discharge into water bodies and reduce the environmental footprint of mining operations. The European Environment Agency (EEA) has reported a 15% increase in regulatory actions against excessive chloride contamination in European freshwater bodies over the past five years. Compliance with these regulations often requires significant investment in environmentally friendly extraction and waste management technologies, increasing operational costs. Salt producers must adapt to more sustainable practices which can be financially and logistically challenging.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.46% |

|

Segments Covered |

By Type, Source, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Akzo Nobel (Netherlands), Cargill Salt (U.S.), Compass Minerals International, Inc. (U.S.), INEOS Enterprises Salt (U.K.), Solvay (Belgium), K+S (Germany), China National Salt Industry (China), CIECH GROUP (Poland), Hunan Salt Industry Co., Ltd. (China), Salins Group (France), and others |

SEGMENTAL ANALYSIS

By Type Insights

The rock salt segment held the largest share of 45.4% in the global market in 2024. The widespread use of rock salt in de-icing roads during winter months is a primary factor driving the domination of the segment in the global market. The Federal Highway Administration reports that over 20 million tons of rock salt are utilized annually in the United States alone for highway maintenance by ensuring safe transportation during icy conditions. Additionally, its cost-effectiveness and abundant availability make it a preferred choice for industrial and municipal applications. Rock salt's importance extends beyond de-icing, as it is also used in chemical production and water softening.

The salt in brine segment is a lucrative segment and is estimated to register the fastest CAGR of 6.8% during the forecast period owing to its increasing application in renewable energy storage in solar power plants. The IEA notes that concentrated solar power (CSP) systems utilize salt brine for thermal energy storage by enabling efficient electricity generation even during non-sunny periods. Furthermore, the World Health Organization highlights the rising demand for salt brine in water treatment processes as it effectively removes impurities and ensures safe drinking water. Salt in brine is poised to play a pivotal role in addressing these global challenges by making it a key focus for future innovations.

By Source Insights

The salt mines segment held 65.7% of the global market share in 2024. The domination of the salt mines segment is majorly driven by the widespread use of rock salt in critical applications such as de-icing roads during harsh winters, particularly in North America and Europe. The Federal Highway Administration highlights that over 40% of mined salt is used for de-icing purposes with consumption increasing by 15% in regions experiencing severe weather conditions. Additionally, salt mines are favored for their ability to produce high-purity salt suitable for industrial applications like chlor-alkali production and water softening. The USGS emphasizes that mining operations are highly scalable and cost-effectiveness will further solidifying the dominance of salt mines in the global market.

The brine segment is another major segment in the global market and is estimated to grow at a CAGR of 5.66% over the forecast period. The growing demand for brine-derived salt in sustainable and eco-friendly applications, such as solar evaporation processes that minimize environmental impact is majorly driving the expansion of the brine segment in the global market. The World Trade Organization notes that brine extraction is gaining traction due to its lower energy requirements and suitability for food-grade salt production. Additionally, advancements in desalination technologies have expanded the availability of brine as a raw material, particularly in arid regions. The IEA highlights that brine-derived salt is increasingly being adopted in emerging economies for chemical manufacturing and water treatment, underscoring its importance in addressing global sustainability goals while supporting industrial growth.

By Application Insights

The chemical processing segment held the leading share of 41.2% of the global market share in 2024. The lead of chemical processing segment in the global market is majorly attributed to the chlor-alkali industry, where salt is used to produce essential chemicals like chlorine, caustic soda, and soda ash. These chemicals are integral to the manufacturing of products such as PVC plastics, paper, textiles, detergents, and glass. The International Energy Agency (IEA) notes that global demand for PVC has increased by 5% annually due to its widespread use in construction, automotive, and packaging industries. The scalability of chemical processing and the irreplaceable role of salt in these processes underscore its dominance in the salt market.

The water treatment segment is the fastest-growing application segment in the salt market and is projected to register a CAGR of 5.2% over the forecast period. Salt is essential in water softening processes, where it helps reduce hardness by removing calcium and magnesium ions, thus preventing scale buildup in industrial equipment and household appliances. The rising demand for clean, potable water and stricter government regulations on water quality are driving this growth. The United Nations reports that by 2030, nearly 50% of the global population will face water stress which further increasing the demand for effective water treatment solutions where salt plays a pivotal role. Industrial sectors and municipalities are investing heavily in water purification infrastructure by amplifying the market potential for salt in this application.

REGIONAL ANALYSIS

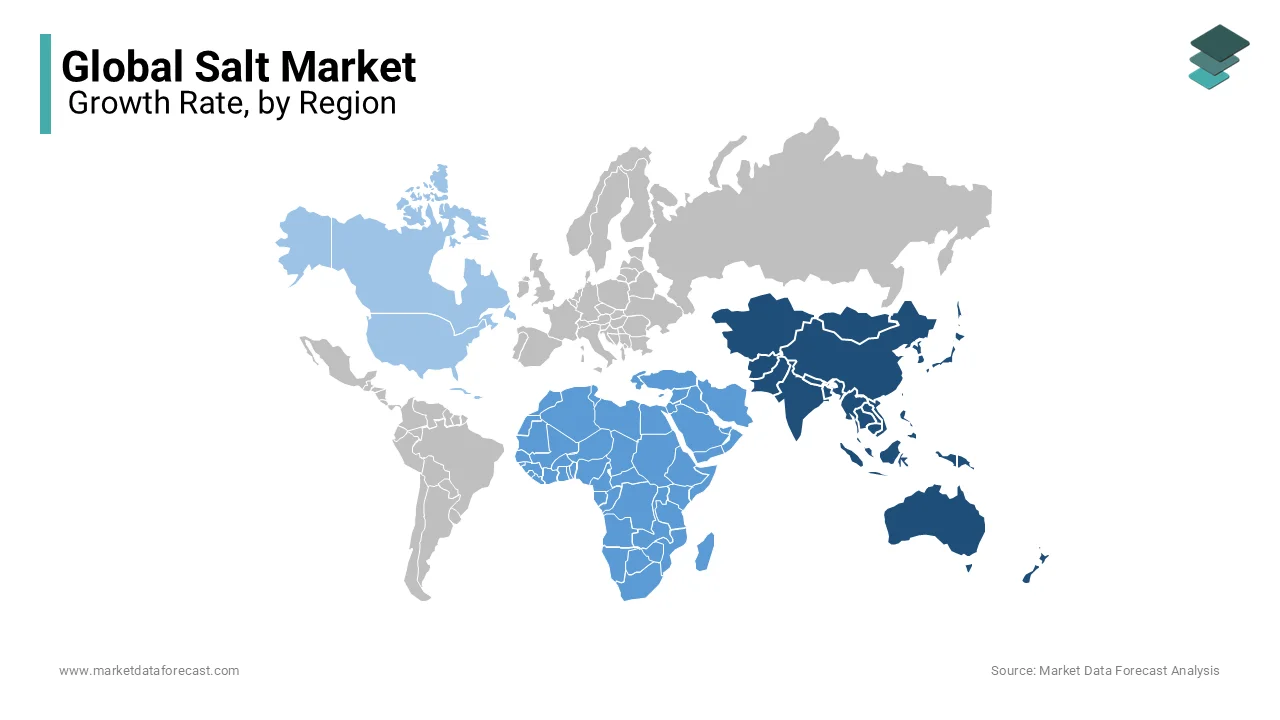

Asia-Pacific led the salt market globally with 45.8% of global market share. The domination of Asia-Pacific in the global market is majorly attributed to the major producers like China and India that are responsible for a significant portion of global salt production. China alone contributes over 60 million metric tons annually by making it the world's largest salt producer. The region’s dominance stems from its large-scale industrial applications, particularly in the chemical processing and food preservation sectors that is driven by rapid industrialization and population growth. Additionally, growing demand for chlor-alkali products and processed foods continues to bolster Asia-Pacific's position in the market.

The Middle East and Africa region is a notable regional segment for salt worldwide and is estimated to progress at a CAGR of 5.5% from 2025 to 2033. Factors such as increasing demand for salt in oil & gas drilling in Gulf countries, where salt is used in drilling fluids to stabilize boreholes is boosting the growth of the MEA salt market. The expansion of desalination plants in countries like Saudi Arabia and the United Arab Emirates which further accelerates demand for industrial-grade salt. The United Nations highlights that MEA countries are investing heavily in water treatment infrastructure to address freshwater scarcity which is driving further salt consumption. Additionally, growing urbanization and industrial development across Africa contribute to the region's rapid growth in the salt market.

In North America, the salt market is expected to experience steady growth due to high demand for de-icing applications, particularly in the United States and Canada, where over 20 million tons of salt are used annually for road safety, according to the Federal Highway Administration (FHWA). Europe is likely to see moderate growth with industrial applications and environmental regulations promoting sustainable salt usage. The European Environment Agency (EEA) reports increased investment in eco-friendly de-icing solutions. Latin America is projected to grow at a stable pace, supported by agricultural applications and rising demand for processed foods in countries like Brazil and Argentina. However, economic fluctuations in the region could slightly temper growth prospects.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

Akzo Nobel (Netherlands), Cargill Salt (U.S.), Compass Minerals International, Inc. (U.S.), INEOS Enterprises Salt (U.K.), Solvay (Belgium), K+S (Germany), China National Salt Industry (China), CIECH GROUP (Poland), Hunan Salt Industry Co., Ltd. (China), Salins Group (France) are playing dominating role in the global salt market.

The global salt market is highly competitive, characterized by the presence of numerous multinational corporations and regional producers. Major players like China National Salt Industry, Cargill Salt, K+S AG, INEOS Enterprises, and Compass Minerals dominate the market due to their extensive production capacities, diversified product portfolios, and strong distribution networks. These companies leverage economies of scale to maintain cost advantages, particularly in industrial applications such as chemical processing, de-icing, and water treatment.

Competition is intensified by the commoditized nature of bulk salt, leading to price-based rivalry among producers. However, differentiation is achieved through diversification into specialty salts, such as gourmet, pharmaceutical, and high-purity industrial salts, which offer higher margins. Companies like Salins Group and CIECH Group have capitalized on this trend by introducing premium and health-focused products to meet evolving consumer preferences.

Geographical presence also plays a key role in competitive dynamics. Asia-Pacific, led by China, dominates production, while North America and Europe are significant consumers, particularly in the de-icing sector. Regional producers compete by focusing on logistics efficiency and sustainable practices to comply with environmental regulations.

Technological advancements, sustainability initiatives, and strategic partnerships with key industries are crucial strategies for gaining a competitive edge in this mature yet evolving market.

STRATEGIES USED BY THE MARKET PLAYERS

Expansion through Mergers and Acquisitions

Key players in the salt market are leveraging mergers and acquisitions to expand their global footprint and diversify product offerings. For instance, K+S AG acquired Morton Salt to strengthen its position in North America, expanding its distribution channels and customer base. Similarly, Cargill Salt has pursued strategic acquisitions to enhance its de-icing and industrial salt operations. These acquisitions not only increase production capacity but also provide access to new markets and technologies, helping companies remain competitive in a fragmented market.

Investment in Sustainable and Eco-Friendly Practices

Sustainability has become a crucial strategy for leading salt producers as environmental regulations tighten. Companies like Cargill Salt and INEOS Enterprises are investing in sustainable mining practices and energy-efficient production processes. For example, Cargill has introduced reduced-impact de-icing products to minimize environmental harm from road salt runoff. K+S AG has also prioritized reducing carbon emissions in its mining operations and promoting the use of alternative, environmentally friendly de-icing solutions. These initiatives not only align with regulatory standards but also appeal to environmentally conscious consumers and governments.

Diversification into Specialty and High-Value Salt Products

To enhance profitability, key players are diversifying into specialty salts such as pharmaceutical-grade salt, gourmet salts, and industrial high-purity salts. China National Salt Industry and CIECH Group have expanded their portfolios to include iodized, flavored, and mineral-rich salts catering to health-conscious consumers. This shift towards premium products helps mitigate the impact of declining margins in bulk industrial salt markets, offering higher profit potential and tapping into growing consumer demand for differentiated products.

Geographic Expansion and Infrastructure Development

Expanding into emerging markets, particularly in Asia-Pacific and Africa, is another critical strategy. China National Salt Industry continues to dominate domestically but has also increased its export capacity to neighboring countries. Solvay and Salins Group are investing in infrastructure development in regions with growing demand, such as India and the Middle East, to capitalize on rising industrial and agricultural salt needs. This geographic diversification reduces reliance on saturated markets and positions companies for long-term growth.

Technological Advancements and Process Optimization

Leading companies are adopting advanced technologies to improve production efficiency and product quality. INEOS Enterprises has implemented automated mining technologies and brine extraction optimization to reduce operational costs and increase output. Similarly, K+S AG has introduced digital monitoring systems to streamline logistics and minimize environmental impact. By incorporating technology, these companies can enhance competitiveness, reduce waste, and ensure consistent product quality.

Strategic Partnerships and Long-Term Supply Contracts

Forming alliances with key industrial sectors, such as the chemical and oil & gas industries, is another strategy employed by major players. Cargill Salt and Compass Minerals have established long-term supply agreements with municipal governments and industrial clients for de-icing and chemical processing applications. These partnerships provide stable revenue streams and reinforce market presence, ensuring consistent demand for their products.

TOP 3 PLAYERS IN THE MARKET

China National Salt Industry (China)

China National Salt Industry (CNSIC) is the largest producer and distributor of salt in China and one of the dominant players globally. The company plays a pivotal role in supplying both industrial and edible salt, contributing significantly to China’s production of over 60 million metric tons annually, as reported by the United States Geological Survey (USGS). CNSIC is critical in supporting China's chlor-alkali industry, one of the largest globally, by supplying high-purity industrial-grade salt. The company's extensive distribution network and government-backed monopoly over salt production in China have ensured its influential role in both domestic and international markets.

Cargill Salt (U.S.)

Cargill Salt, a division of the U.S.-based conglomerate Cargill, Inc., is one of the leading producers of salt in North America. The company produces and markets a wide range of salt products, including industrial, agricultural, de-icing, and food-grade salts. Cargill Salt operates large-scale evaporation and mining facilities, contributing significantly to the U.S. salt production of over 40 million metric tons annually as per USGS data. The company is particularly influential in the de-icing sector, supplying municipalities across North America, and has made strides in sustainable mining practices, further bolstering its market reputation.

K+S (Germany)

K+S AG, headquartered in Germany, is one of Europe’s largest salt producers and a significant player globally. The company operates a wide range of rock salt mines, evaporated salt plants, and brine facilities. K+S holds a strong market position, particularly in the European de-icing salt market, and has expanded into North America with its acquisition of Morton Salt. The company’s annual salt production exceeds 30 million metric tons, contributing to Germany’s role as one of the leading salt producers in Europe, according to Eurostat. K+S is also involved in innovative environmental practices and has diversified into specialty salts for industrial and pharmaceutical applications.

RECENT HAPPENINGS IN THE MARKET

- In April 2021, K+S Aktiengesellschaft divested its North and South American salt business units, including Morton Salt, to Stone Canyon Industries Holdings and partners for $3.2 billion. This move was aimed at streamlining K+S’s operations and focusing on strengthening its core European market presence.

- In August 2023, Atlas Salt released a robust independent Feasibility Study for its Great Atlantic Salt Project. This development marked significant progress toward establishing a highly efficient, low-cost, and scalable salt production operation in North America.

- In January 2024, Atlas Salt appointed Rick LaBelle as CEO. With 40 years of mining sector experience, LaBelle is expected to advance the Great Atlantic Salt Project toward production and strengthen the company’s leadership.

- In February 2024, Atlas Salt entered a non-binding Memorandum of Understanding with Scotwood Industries to establish a strategic offtake and joint venture. This partnership aims to distribute and sell 1.25 to 1.5 million tonnes of salt products annually in the Canadian market.

- In April 2021, Compass Minerals divested its plant micronutrient assets to Koch Agronomic Services. This divestiture allowed Compass Minerals to refocus on its core operations in salt and plant nutrition.

- In May 2022, Atlas Salt reported that drilling at the Great Atlantic Project extended the high-grade salt deposit by approximately half a kilometer in multiple directions. This expansion enhanced the project's potential and long-term viability.

- In 2020, Cargill Incorporated expanded its salt production capabilities by investing in advanced mining technologies. This investment aimed to increase operational efficiency and output to meet the growing global demand for salt.

MARKET SEGMENTATION

This research report on the global salt market has been segmented and sub-segmented based on type, source, application, and region.

By Type

- Rock Salt

- Salt in Brine

- Solar Salt

- Vacuum Pan Salt

By Source

- Brine

- Salt Mines

By Application

- Chemical Processing

- De-icing

- Water Treatment

- Oil & Gas

- Agriculture

- Flavoring Agent

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the current size of the global salt market?

As of 2024, the global salt market was valued at approximately USD 36.10 billion.

2. What is the projected growth of the salt market in the coming years?

The market is expected to reach USD 58.25 billion by 2033, growing at a compound annual growth rate (CAGR) of 5.46% from 2025 to 2033.

3. What factors are driving the growth of the salt market?

Key drivers include increasing demand in the chemical industry, particularly for chlor-alkali production, and the expansion of road de-icing applications in regions with harsh winter conditions.

4. What challenges does the salt market face?

Challenges include health concerns over excessive sodium consumption, leading to reduced demand for food-grade salt, and environmental impacts of salt mining and usage, such as soil degradation and freshwater contamination.

5. Which regions are dominant in the salt market?

The Asia-Pacific region holds a significant share of the salt market, driven by rapid industrialization and urbanization in countries like China and India. North America and Europe also contribute substantially due to robust infrastructure development and automotive production.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]