Global Safety Syringes Market Size, Share, Trends, Growth Forecast Report By Technology (Retractable Safety Syringes and Non-Retractable Safety Syringes), Therapy (Insulin, Glucagon-like peptide-1 (GLP-1), Tuberculosis and Growth Hormones), End-Users (Home care and Hospitals) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2025 to 2033

Global Safety Syringes Market Size

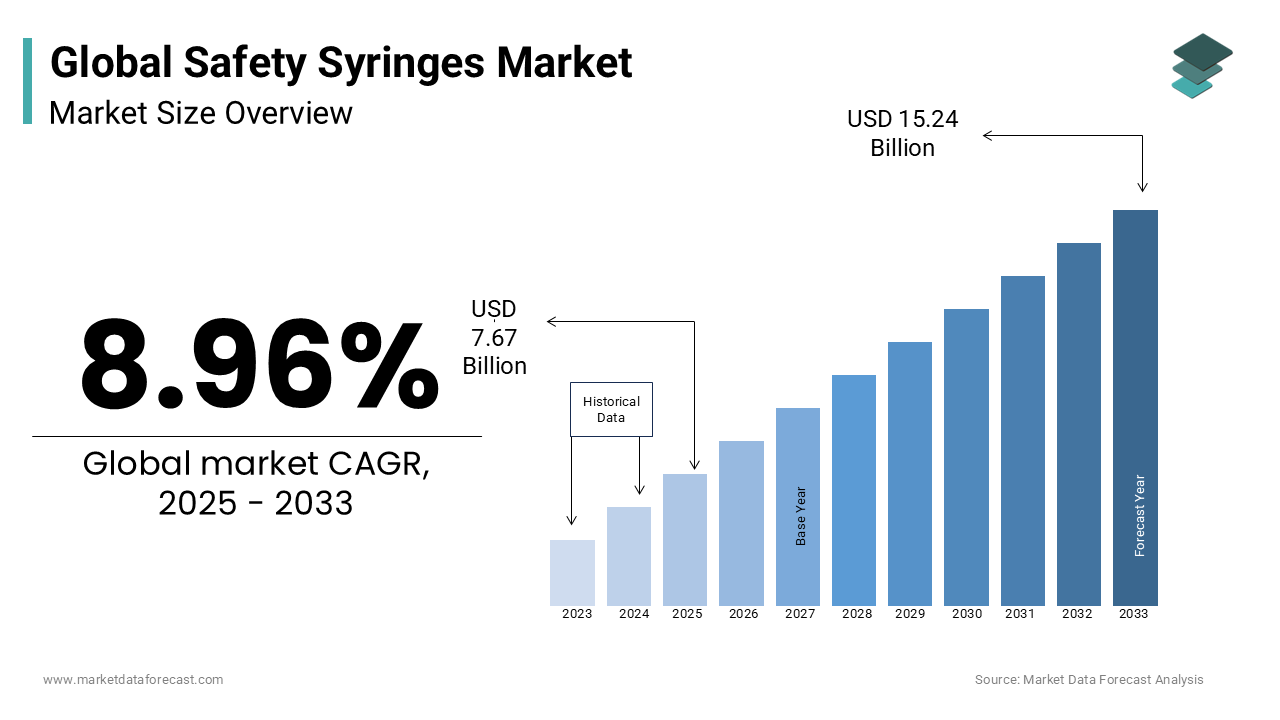

The global safety syringes market size was valued at USD 7.04 billion in 2024. The global market size is forecasted to be worth USD 15.24 billion by 2033 from USD 7.67 billion in 2024, growing at a CAGR of 8.96% during the forecast period.

Over the past decade, there has been considerable growth in using safe syringes over conventional syringes. Safety syringes consist of an integrated safety that helps to guard healthcare workers against accidental needle stick injuries.

Market Drivers

Rising Prevalence of Needlestick Injuries

The growing incidence of needlestick injuries, rising demand for injectables, and increasing demand for safety mechanisms in syringes are propelling the global safety syringe market growth. The global safety syringes market is expected to be driven by the growing prevalence of chronic diseases such as diabetes, the increasing incidence of needle stick injuries, and the growing demand for safety mechanisms in syringes. According to the Centers for Disease Control and Prevention (CDC), 6 in 10 Americans have at least one chronic disease. According to International Diabetes Federation (IDF), an estimated 537 million had diabetes in 2021, which is expected to be 643 million by 2030. The growing patient population is anticipated to fuel the demand for safe syringes. Also, other factors, such as the rising prevalence of blood-borne diseases and increasing preference for delivery methods, further boost the market growth. For instance, according to the WHO, 3 million unintentional needlestick injuries were recorded, with 37% new hepatitis B cases in healthcare professionals, 39% new hepatitis C cases, and about 5.59% new HIV infections. Furthermore, around 422 million people worldwide developed diabetes in the recent period.

Furthermore, favorable reimbursement policies in developed countries such as the United States and the U.K., the availability of advanced healthcare infrastructure, and stringent regulations on the compulsory use of safety syringes are projected to fuel the market growth. On the other hand, several countries have enacted legislation mandating the use of safety syringes to reduce needlestick injuries and prevent needle re-use. As a result, safe syringes are expected to be used more frequently than regular syringes due to these regulations. Other factors, such as increasing healthcare spending and initiatives taken by the government and private organizations to create awareness programs about safe syringes, positively influence market growth. In addition, the growing awareness among the people regarding the benefits of safety syringes is expected to accelerate the market growth during the forecast period.

Most healthcare personnel prefer safety needle technology over conventional devices for accuracy, operation time, and rapid usage design. Various varieties of safety needles are on the market, each with its own mechanism. Technological advancements in the healthcare sector and surging R&D activities have provided lucrative growth opportunities for the market players to introduce advanced safety syringes, which is likely to expand the market growth. Increasing self-administration in non-hospital settings drives the safety syringe market during the forecast period. In the U.S., nearly 8 billion syringes are used in hospital settings. Using these syringes in the home environment increases the safety of needlesticks in healthcare settings. These self-administer syringes are used mainly by people who are taking their treatment. Prefilled safety syringes are used most for needle protection and reducing dosage errors. These are helpful for older people to hold and operate the device securely without any help. These syringes give patients the independence that comes with self-administration and reduce the risks associated with unsupervised self-care.

Market Restraints

Safety syringes should be addressed in emerging countries due to a need for more awareness about healthcare and safety issues. A rise in government initiatives and healthcare and safety awareness could improve the adaptability of safety syringes. However, the availability of alternative drug delivery methods and the high costs of surgical staplers impede the growth of this market. In addition, the lack of awareness regarding healthcare and safety issues in emerging economies is restraining market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2023 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Technology, Therapy, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Covidien plc, Retractable Technologies Inc., Becton, Dickinson & Company, Terumo Corporation, Unilife Corporation, and Revolutions Medical, Smiths Medical, Sol-Millennium, Ultimed Inc., and Axel Bio Corporation. |

SEGMENTAL ANALYSIS

By Technology Insights

The retractable safety syringes segment is expected to register a significant share during the forecast period. The segment growth is attributed to the increasing utilization of safety syringes in many applications and the growing preference for automatic retractable safety syringes over manual syringes. They are safer and easy to handle. Manual and automated retractable syringes are two types of retractable safety syringes. The manual retractable safety syringes sub-segment led to the retractable safety syringes sector due to lower prices than automated retractable syringes during the forecast period.

By Therapy Insights

The insulin segment is projected to account for a significant share of the global safety syringes market in the coming years. The growth of this segment is projected to be fueled by the growing number of patients with diabetes and the rising demand for proper glucose levels management by checking regularly.

On the other hand, the tuberculosis segment is projected to witness a significant share owing to the increasing prevalence of diabetes and tuberculosis across the globe.

By End-User Insights

The hospital segment is anticipated to account for an enormous share during the forecast period. The senior population largely contributes to the segment growth due to the rising prevalence of diabetes and Tuberculosis. Also, the growth of the hospital segment is expanded due to the increasing investment in developing hospital sectors and the growing number of hospital admissions.

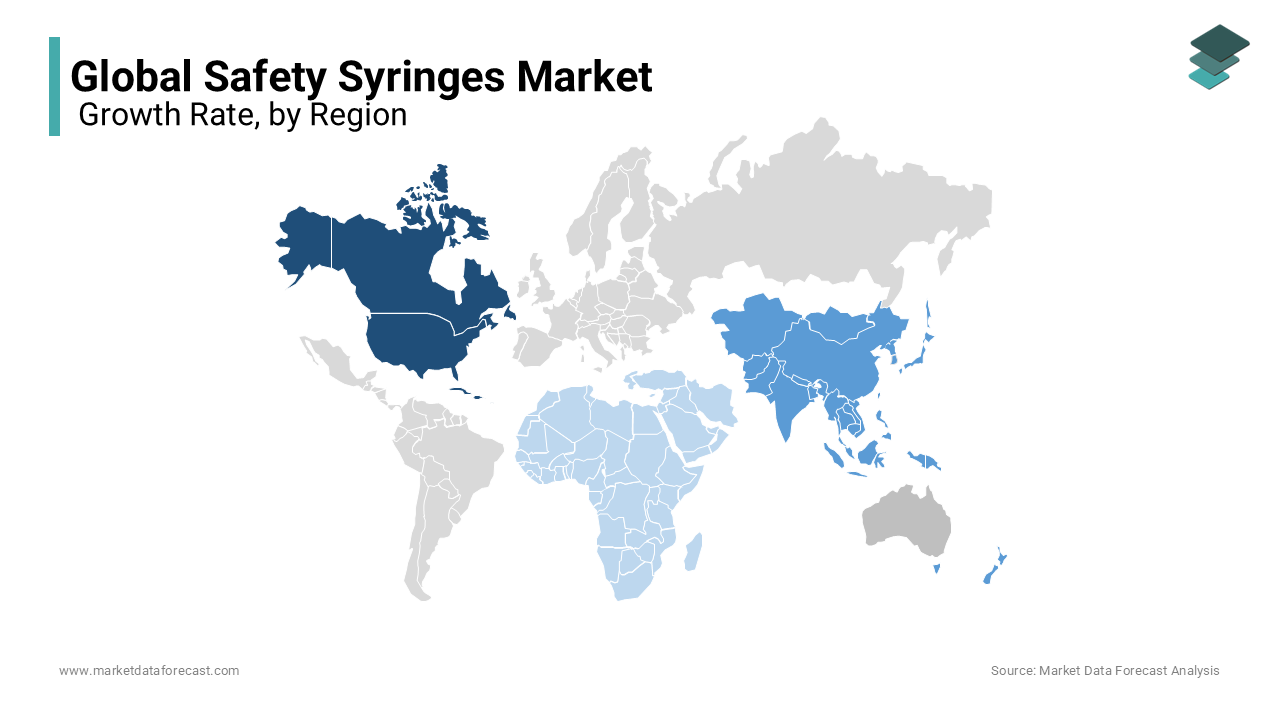

Regional Analysis

North America had the most significant share of the global market in 2024. North America, representing the largest share in revenue and volume, is witnessing a paradigm shift in the usage of safety syringes over traditional syringing additions. The growing demand for prefilled syringes with safety features is also anticipated to drive market growth in the North American Region. Canada's government has encouraged using safety-engineered devices such as protected needles and needle-free systems with self-sealing syringes. In Canada, there is a rule that some regions should use safety devices as per the Public Health Agency of Canada. The main reason for using these devices in this Region is to keep the healthcare workers and patients in a safe zone. Key manufacturers in Canada are working on disposable plastic syringes to reduce the infections caused by syringes and needles. Nearly Every year, 320,000 needlestick incidents happen for healthcare workers in the U.S. in hospital and non-hospital settings. Due to the high demand for safety syringes and needles in the U.S., the market has grown in this Region during the forecast period. Companies providing advanced products for better quality and lower price drives the market forward. Medtronic partnered with Covidien plc, a medical device company focusing on manufacturing safety needles and syringes and increasing its demand in coming years. In 2021, Becton, Dickson, and Company announced the distribution of 800 million syringes and needles to various hospitals for COVID-19 vaccination campaigns in the United States.

The Asia-Pacific safety syringes market is expected to grow due to the ongoing immunization programs supported by the WHO and UNIC and the increased penetration by U.S.-based companies capitalizing on the growing awareness level regarding the consequences of insecure injection practices. Demand for safety syringes is increasing in India due to increasing awareness about using safe medical devices for patient care. Due to the increasing number of needlestick injuries of fingers in India, the market has the largest share in this region. Conducting awareness programs in many regions in India due to the usage of safety syringes, which reduce the needlestick injuries to health care workers and patients, and reducing the prices of these safety syringes drive the market forward. Japan has approved the usage of retractable technology in safety syringes. Due to the fewer syringes during the COVID-19 pandemic, there is a scarcity of syringes in Japan. As a result, the government of Japan has started investing in the manufacturing of safety syringes so that people can take the COVID-19 vaccination. These safety syringes usage has increased since then and production in coming years, which drives the market forward in this Region.

The safety syringes market in the European Region also has a moderate share in the growth due to factors such as increasing blood-borne diseases and increasing needle stick injuries. European Parliament has adopted a decision to promote health and safety in the workplace. Several preventive steps are taken by the European Commission to protect healthcare workers from injuries caused by needlesticks, given the risk of infection from blood-borne severe infections, such as Hepatitis B and C and HIV. Several large companies are working together to manufacture safety syringes to prevent needlestick injuries in the healthcare sector. In the United Kingdom, these safety syringes are used for administering local anesthesia in dental surgeries.

The safety syringes market in Latin America had a moderate share of the global market in 2023. Brazil holds the largest market share among others. Increasing government investment in the manufacturing of safety medical devices and reducing reusable syringes are the factors that drive the market forward in this Region. Most of the hospitals in this Region focus on advanced infrastructure and use advanced devices in their hospitals for patient safety. Furthermore, after the pandemic, most hospitals are more aware of treating patients, mainly in drug delivery. In addition, this government has started manufacturing safety syringes that are helpful to healthcare workers from needle stick injuries.

The safety syringes market in the Middle East and Africa has moderate growth in manufacturing safety syringes due to increasing pandemic diseases and chronic diseases such as cancer, diabetes, and cardiovascular diseases. In addition, the increasing number of diabetes patients in this Region also drives the safety syringe market forward.

KEY MARKET PARTICIPANTS

Companies playing a noteworthy role in the global safety syringes market are Covidien plc, Retractable Technologies Inc., Becton, Dickinson & Company, Terumo Corporation, Unilife Corporation, and Revolutions Medical, Smiths Medical, Sol-Millennium, Ultimed Inc., and Axel Bio Corporation.

RECENT MARKET HAPPENINGS

- In 2021, Owen Mumford was approved by the NHS Wales Shared Services for insulin safety pen needles.

- In 2020, DMC MEDICAL launched a SureSafe™ Automatic Retractable Safety Syringe for U.S. people.

- In 2020, Abbott and Insulet Corporation partnered and announced the manufacture of a tubeless insulin pump technology with its Omnipod Insulin Management System. It offers personalized automated insulin delivery and cares for people living with diabetes.

- In 2020, Eli Lilly announced that it had sold two versions of insulin products at half their current U.S. prices.

- In November 2019, QuVa Pharmacy announced that it had launched a new design for its syringe product portfolio of sterile compound products. In addition, Quva Pharma has developed these new labels and has begun to convert all syringes to an enhanced label style.

- In August 2019, Smith Medical announced its partnership with Medline Industries Inc.

- In October 2019, B.D. (Becton and Dickinson and Company), a medical technology company has launched the BD Intevi Imi, a two-step disposable auto-injector push-on-skin device.

- In February 2016, Unilife announced that it would collaborate with Amgen, a leading biotechnology company, on injectable drug delivery systems. This collaboration includes components for development, license, investment, and supply agreement.

- In June 2015, Unilife, a developer, manufacturer, and supplier of injectable drug delivery systems, introduced the Imperium, an instant patch pump for insulin.

MARKET SEGMENTATION

This research report on the global safety syringes market has been segmented and sub-segmented based on technology, therapy, end-user, and Region.

By Technology

- Retractable Safety Syringes

- Automatic Retractable Safety Syringes

- Manual Retractable Safety Syringes

- Non-Retractable Safety Syringes

- Sheathing Tube Syringes

- Sliding Needle Cover Syringes

- Hinged Needle Cover Syringes

By Therapy

- Insulin

- Glucagon-like peptide-1 (GLP-1)

- Tuberculosis

- Growth Hormones

By End-User

- Home care

- Hospitals

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much was the global safety syringes market worth in 2024?

The global safety syringes market was valued at USD 7.04 billion in 2024.

Which segment by therapy dominated the safety syringes market in 2024?

Based on therapy, the insulin segment accounted for the most significant share of the global market in 2024.

Which segment by region accounted for the major share of the global market in 2024?

The North American region had the major share of the global market in 2024.

Which are a few of the companies dominating the safety syringes market?

Covidien plc, Retractable Technologies Inc., Becton, Dickinson & Company, Terumo Corporation, Unilife Corporation, and Revolutions Medical, Smiths Medical, Sol-Millennium, Ultimed Inc., and Axel Bio Corporation are some of the promising players in the safety syringes market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]