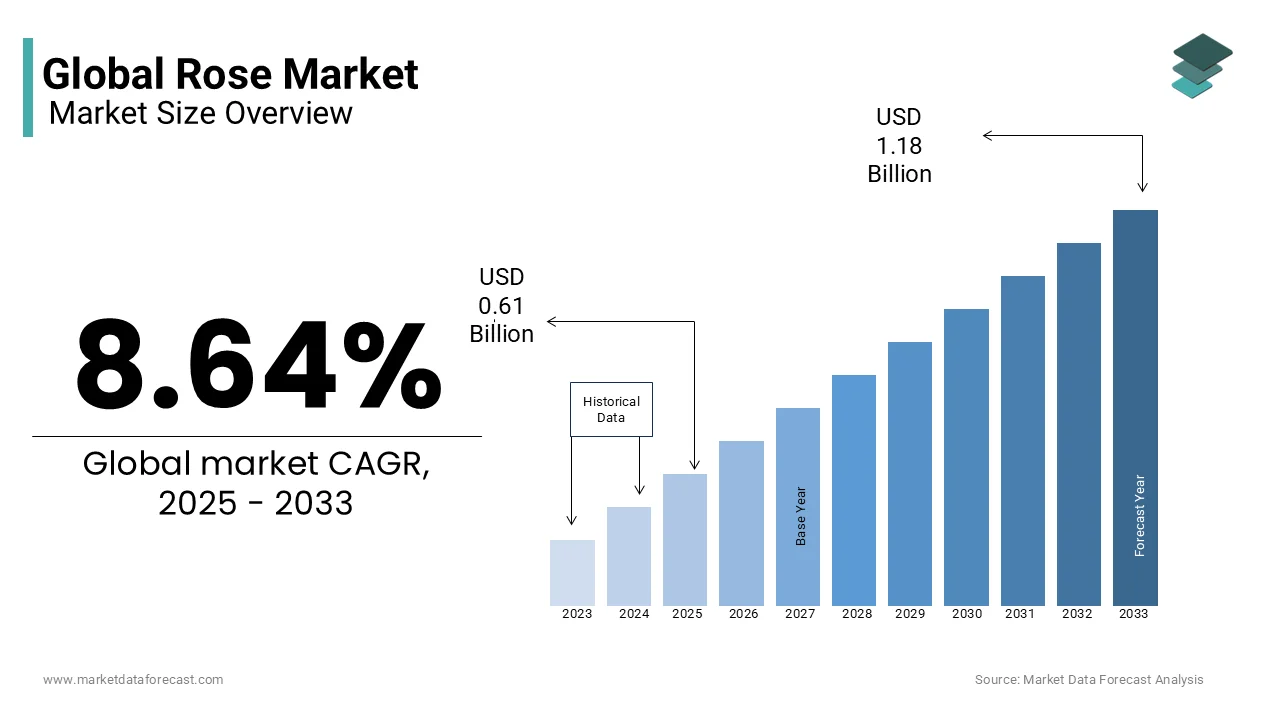

Global Rose Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Hybrid Tea Roses, Floribunda Roses, Climbing Roses, Others), Application, Distribution Channel, And Region (Latin America, North America, Asia Pacific, Europe, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Rose Market Size

The global rose market size was valued at USD 0.56 billion in 2024 and is expected to reach USD 1.18 billion by 2033 from USD 0.61 billion in 2025. The market is projected to grow at a CAGR of 8.64%.

Roses are not merely ornamental flowers as they hold cultural, emotional, and economic significance across the globe. The global fascination with roses is deeply rooted in their symbolism by representing love, beauty, and passion, which has sustained their demand for centuries. According to the Society of American Florists, approximately 250 million roses are produced annually for Valentine’s Day alone due to their enduring popularity in celebratory and sentimental contexts. Furthermore, the International Union for Conservation of Nature states that there are over 150 species of roses, with countless hybrids cultivated worldwide is reflecting both biodiversity and human ingenuity.

Beyond their aesthetic appeal, roses contribute significantly to ecological balance. A study published by the Royal Horticultural Society reveals that rose gardens support pollinators such as bees and butterflies is playing a vital role in maintaining ecosystem health. Interestingly, roses also have historical ties to wellness practices along with the University of Maryland Medical Center notes that rose petals contain antioxidants and anti-inflammatory properties by making them a staple in herbal remedies. Additionally, UNESCO reports that rose water production in regions like Bulgaria and Iran, dates back thousands of years, preserving ancient traditions while adapting to modern demands. These elements collectively shape the contemporary rose market, which thrives at the intersection of tradition, innovation, and sustainability.

MARKET DRIVERS

Cultural and Emotional Significance of Roses

The cultural and emotional symbolism of roses serves as a major driver for the rose market growth with their association with love, celebration, and remembrance. According to the United States Department of Agriculture, floral purchases in the U.S. spike by over 30% during holidays like Valentine’s Day and Mother’s Day, with roses accounting for nearly 60% of these sales. This trend is mirrored globally, as noted by the Food and Agriculture Organization, roses dominate international flower trade routes from Kenya and Ecuador to Europe and North America. Furthermore, a report by the National Retail Federation reveals that consumers spent approximately $2 billion on fresh flowers in 2022, with roses being the top choice for gifting. The universal appeal of roses transcends borders, making them indispensable in ceremonies, festivals, and rituals worldwide, thereby sustaining their market relevance.

Economic Contributions and Export Opportunities

The economic impact of rose cultivation and trade significantly drives the global rose market in developing nations where floriculture is a key agricultural export. The International Trade Centre reports that Ethiopia alone exported over 400,000 tons of cut flowers in 2021, with roses constituting more than 85% of this volume. Similarly, the Kenya Flower Council states that the country’s floriculture industry generates over $1 billion annually with roses leading the sector and providing employment to over two million people. The Indian Ministry of Agriculture notes that India produces over 2.5 billion rose stems annually are catering to both local consumption and religious ceremonies. These figures underscore how roses contribute to national economies, foster rural development, and enhance trade balances by positioning the flower as a critical agricultural commodity with far-reaching socioeconomic benefit

MARKET RESTRAINTS

Environmental Challenges and Climate Vulnerability

The rose market faces significant restraints due to environmental challenges due to the impact of climate change on cultivation. The United Nations Framework Convention on Climate Change studies showcased that erratic weather patterns by including droughts and unseasonal rainfall that have disrupted rose farming in key producing regions like Kenya and Ecuador. For instance, the Kenyan Meteorological Department studies have seen a 15% decline in flower yields during prolonged dry spells in 2022, primarily affecting rose crops. Additionally, the World Bank notes that water scarcity is a growing concern, with rose farms requiring up to 10 liters of water per stem is straining local resources in water-scarce areas. These environmental pressures not only increase production costs but also threaten the sustainability of rose farming. As climate-related disruptions intensify, growers face mounting challenges in maintaining consistent supply chains, which could lead to price volatility and reduced market accessibility.

Stringent Regulatory Standards and Trade Barriers

Stringent regulatory standards and trade barriers pose another major restraint for the rose market. The European Commission enforces strict phytosanitary and chemical residue limits, with non-compliance leading to rejected shipments. In 2021, the European Union reported that over 5% of imported flowers, including roses, were rejected due to excessive pesticide residues. Similarly, the United States Department of Agriculture mandates rigorous inspections, which can delay shipments and increase costs for exporters. These regulations disproportionately affect small-scale growers in developing nations who lack the infrastructure to meet such standards. Furthermore, tariffs and trade restrictions are documented by the International Trade Centre, add financial burdens for countries exporting to high-demand markets like the U.S. and Europe. These barriers limit market access and profitability, especially for emerging players striving to compete in the global rose market.

MARKET OPPORTUNITIES

Expansion into Sustainable and Eco-Friendly Products

The growing global emphasis on sustainability presents a significant opportunity for the rose market to innovate and diversify its offerings. The United Nations Environment Programme reports that eco-conscious consumers are driving demand for sustainable products, including biodegradable floral packaging and organic rose-based goods. For instance, the European Union’s Green Deal initiative encourages the adoption of environmentally friendly practices, with projections indicating a 20% increase in demand for organic flowers by 2025. Additionally, the Indian Ministry of Commerce studies reveal that India’s organic rose farming sector has grown by 12% annually over the past five years, fueled by rising exports of chemical-free roses. This shift not only aligns with global sustainability goals but also opens new revenue streams for growers. The rose market can tap into premium segments by attracting environmentally aware consumers and enhancing brand loyalty.

Integration of Roses in Wellness and Cosmetic Industries

The integration of roses into wellness and cosmetic industries offers another promising avenue for market growth. The World Health Organization acknowledges the therapeutic benefits of natural ingredients with rose extracts increasingly used in skincare, aromatherapy, and herbal remedies. According to the U.S. Department of Health and Human Services, the global natural cosmetics market is projected to reach $54 billion by 2027, with rose-based products is accounting for a significant share due to their anti-inflammatory and hydrating properties. Furthermore, the Australian Government’s Department of Industry notes that rose water production has seen a compound annual growth rate (CAGR) of 8% over the past decade is driven by consumer demand for clean-label beauty products. Roses can serve as a key ingredient by enabling growers and manufacturers to explore high-margin markets while addressing the rising preference for natural and holistic solutions.

MARKET CHALLENGES

Labor Dependency and Workforce Challenges

The rose market is heavily reliant on manual labor, making it vulnerable to workforce-related challenges. The International Labour Organization reports that floriculture employs over 2 million people globally, with women constituting nearly 70% of the workforce in countries like Kenya and Colombia. However, labor shortages and rising wages are becoming significant concerns. For instance, the Colombian Ministry of Labor notes that labor costs in the floriculture sector have increased by 15% over the past five years due to stricter labor laws and higher minimum wages. Additionally, as per the Ethiopian Horticulture Producer Exporters Association, seasonal labor migration has led to a 10% drop in productivity during peak harvest periods. These challenges are compounded by the physically demanding nature of rose farming, which often leads to high turnover rates. Addressing these issues requires investment in mechanization and improved working conditions to sustain long-term growth.

Pests, Diseases, and Crop Loss Risks

Pests and diseases pose a persistent threat to rose cultivation, significantly impacting yields and profitability. The Food and Agriculture Organization states that fungal infections like powdery mildew and botrytis affect up to 30% of rose crops annually, particularly in humid climates. In India, the Ministry of Agriculture reports that pest infestations, such as aphids and thrips, cause an estimated $50 million in losses each year. Furthermore, the United States Department of Agriculture studies showed that the spread of plant pathogens through global trade has intensified, with quarantine measures often disrupting supply chains. These biological threats not only reduce crop quality but also increase dependency on chemical pesticides, raising production costs and environmental concerns. To mitigate these risks, growers must adopt integrated pest management strategies and invest in disease-resistant rose varieties, ensuring resilience against these recurring challenges while maintaining market competitiveness.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.64% |

|

Segments Covered |

By Type, Application, Distribution, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

David Austin Roses, Dümmen Orange, Interplant Roses, Kordes Roses, Meilland International, Parfum Flower Company, Robertet Group, Rose Story Farm, Select Roses, Star Roses & Plants, and Weeks Roses |

SEGMENTAL ANALYSIS

By Type Insights

The hybrid tea roses segment dominated the market by holding the leading share of the global rose market in 2024. The domination of hybrid tea roses segment is attributed to their unmatched aesthetic appeal, characterized by large, solitary blooms and a wide variety of colors that cater to diverse consumer preferences. The United States Department of Agriculture emphasizes that Hybrid Tea Roses are the preferred choice for gifting during peak seasons like Valentine’s Day, where they represent over 60% of total rose sales. Their long vase life, often lasting up to 10-12 days, makes them highly desirable in both retail and event floristry. Additionally, their adaptability to hybridization allows breeders to introduce new varieties with enhanced fragrance, disease resistance, and climatic resilience. These factors not only sustain their market leadership but also reinforce their cultural and economic importance globally.

The climbing roses segment is anticipated to showcase a notable CAGR of 8.5% over the forecast period owing to the increasing adoption of vertical gardening solutions, particularly in urban areas facing space constraints. The European Environment Agency notes that cities across Europe have witnessed a 15% annual rise in green infrastructure projects, including the use of climbing roses to beautify walls, fences, and pergolas. These roses are prized for their ability to cover large vertical spaces efficiently while providing environmental benefits such as reducing urban heat islands and improving air quality. Moreover, advancements in breeding have introduced drought-resistant and low-maintenance varieties, aligning with the growing consumer preference for sustainable landscaping options. As urbanization accelerates globally, Climbing Roses are poised to play a pivotal role in blending aesthetics with ecological sustainability, making this segment a key driver of innovation and growth in the rose market.

By Application Insights

The ornamental segment held the leading share of 65.1% of the global market share in 2024. The growth of the ornamental segment in the global market is driven by the universal appeal of roses in celebrations, weddings, and gifting, with the United States Department of Agriculture estimating that ornamental roses generate $10 billion annually. Roses are integral to the floral industry, particularly during peak seasons like Valentine’s Day, when demand surges by 40%. Their aesthetic versatility and cultural symbolism make them irreplaceable in decorative applications. The segment's leadership is further reinforced by its widespread adoption in both household and commercial settings, ensuring consistent demand and profitability.

The food and beverage segment is projected to grow at the highest CAGR of 9.5% over the forecast period. The growing interest from consumers in natural ingredients and gourmet products, such as rose-flavored teas, jams, and desserts is boosting the growth of the F&B segment in the global market. The World Health Organization reports that edible flowers, including roses, are gaining traction due to their antioxidant properties and health benefits. Additionally, the Australian Government’s Department of Agriculture notes that rose-based beverages have seen a 25% increase in sales over the past three years. Urbanization and premiumization trends further drive this growth, as consumers seek unique, artisanal flavors. This segment’s dynamism underscores its potential to redefine culinary innovation while contributing significantly to the rose market’s diversification.

By Distribution Channel Insights

The supermarkets and hypermarkets segment had the leading share of 45.4% of the global market share in 2024. The prominence of supermarkets and hypermarkets segment in the global market is driven from convenience, wide product availability, and strong supply chain networks that ensure fresh roses year-round. The Food and Agriculture Organization reports that over 60% of consumers prefer purchasing flowers from these outlets due to bundled deals and proximity to household essentials. This channel's importance lies in its ability to cater to both impulse buyers and bulk purchasers, particularly during peak seasons like Valentine’s Day. With established logistics and consistent footfall, supermarkets/hypermarkets remain pivotal in sustaining steady demand and accessibility for roses globally.

The online segment is predicted to register a prominent CAGR of 18.3% over the forecast period due to the increasing penetration of e-commerce platforms and shifting consumer preferences toward digital shopping. The U.S. Census Bureau notes that online floral sales surged by 25% in 2022, with roses accounting for nearly 70% of these purchases. Millennials and Gen Z consumers, who prioritize convenience and customization, are key contributors to this trend. Additionally, the Indian Ministry of Electronics and Information Technology reports that mobile commerce has further accelerated this growth, with 40% of online flower orders placed via smartphones. The ability to offer personalized gifting options, doorstep delivery, and competitive pricing makes online retail a transformative force in the rose market, ensuring its continued dominance in the coming years.

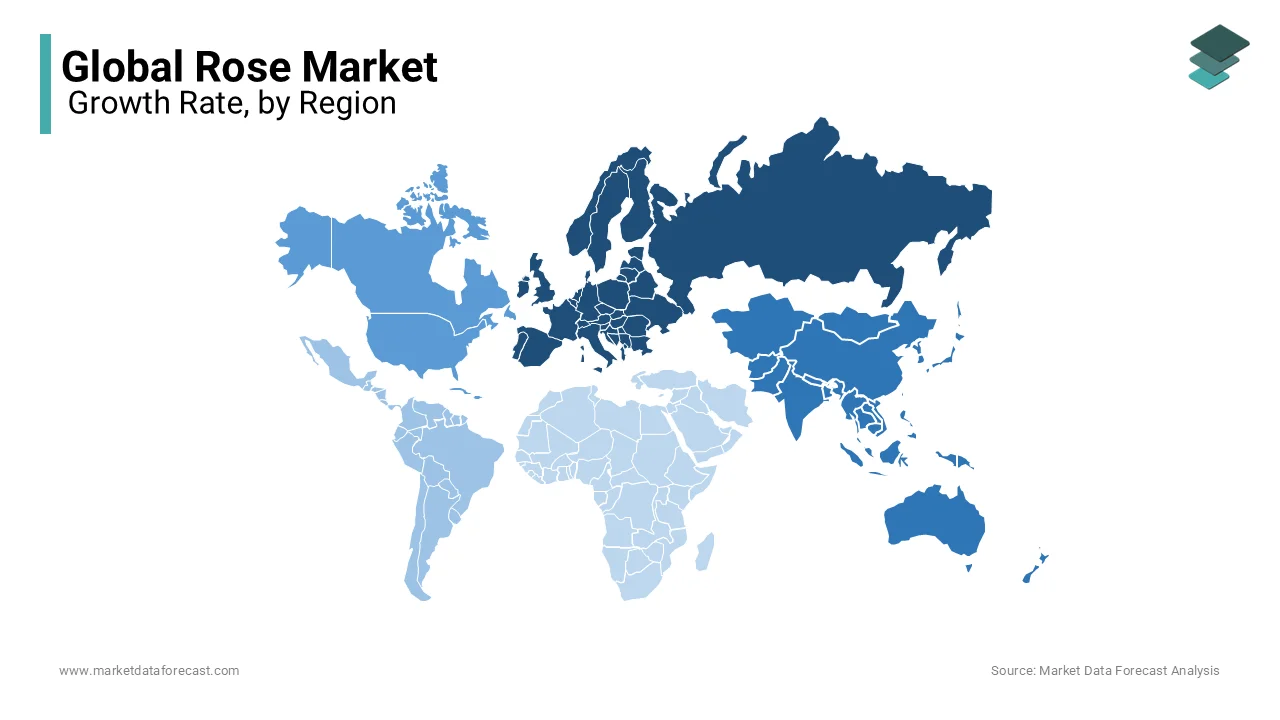

REGIONAL ANALYSIS

Europe dominated the rose market globally by holding 35.3% of the global market share in 2024. The high per capita consumption, particularly in countries like the UK and Germany, where roses are integral to celebrations and gifting traditions, is majorly driving the European rose market growth. The Food and Agriculture Organization reports that Europe imports over 1.2 billion stems annually, primarily from Kenya and Ecuador, underscoring its reliance on international trade. Additionally, the Royal Horticultural Society notes that local cultivation, especially in the Netherlands, contributes significantly to supply chains. Europe’s leadership stems from robust floriculture infrastructure, advanced logistics, and strong consumer awareness of floral aesthetics. This region’s prominence ensures it remains a benchmark for quality and innovation in the global rose market.

The Asia-Pacific region is the fastest-growing market for roses and is likely to register a CAGR of 9.7%, during the forecast period. Rising disposable incomes, urbanization, and increasing adoption of Western gifting traditions are key drivers. The Indian Ministry of Commerce shows a 12% annual rise in domestic rose consumption, while China’s floriculture sector grew by 15% in 2022, fueled by online retail expansion. The Australian Department of Agriculture revealed that demand for roses in weddings and festivals is surging across Southeast Asia. With growing investments in greenhouse farming and export-oriented policies, this region is poised to bridge supply gaps and cater to both local and international markets, making it a critical growth engine for the global rose market.

North America shows steady growth, supported by the United States Department of Agriculture’s forecast of a 5% annual increase in floral spending. Latin America, led by Colombia and Ecuador, remains a vital exporter, supplying 75% of roses to the U.S., as noted by the International Trade Centre. The Middle East and Africa are likely to expand due to rising tourism and events, with Dubai’s flower imports growing by 10% annually, according to the Dubai Chamber of Commerce. These regions benefit from favorable climates for cultivation and strategic trade routes, ensuring their roles as key suppliers and emerging consumer markets in the coming years.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major Players of the global rose market include David Austin Roses, Dümmen Orange, Interplant Roses, Kordes Roses, Meilland International, Parfum Flower Company, Robertet Group, Rose Story Farm, Select Roses, Star Roses & Plants, and Weeks Roses

The global rose market is characterized by intense competition, driven by a mix of established players, emerging regional growers, and shifting consumer preferences. Key participants, such as David Austin Roses, Dümmen Orange, and Kordes Roses, dominate the premium and commercial segments through innovation, sustainability, and strategic expansions. These companies leverage advanced breeding technologies to create unique, disease-resistant varieties that cater to diverse markets, from luxury gardening to mass-market floriculture. Meanwhile, smaller players and regional growers focus on niche markets, offering locally cultivated or organic roses to meet rising demand for eco-friendly products.

Competition is further intensified by the growing influence of online retail platforms, which have lowered entry barriers for smaller brands while enabling larger companies to expand their reach. The rise of e-commerce has also spurred price wars and increased pressure on supply chain efficiency. Additionally, regions like Asia-Pacific and Latin America are emerging as competitive hubs due to favorable climates and lower production costs, challenging traditional exporters like Kenya and Ecuador.

Government regulations and environmental concerns add another layer of complexity, with stricter phytosanitary standards and sustainability requirements shaping competitive dynamics. To stay ahead, companies are investing in sustainable practices, digital marketing, and collaborations with adjacent industries like cosmetics and perfumery. This multifaceted competition underscores the need for continuous innovation, adaptability, and differentiation in the ever-evolving rose market.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Innovation in Breeding and Product Development

Leading companies like Dümmen Orange and Kordes Roses prioritize innovation by investing heavily in breeding programs to develop unique, disease-resistant, and visually appealing rose varieties. By leveraging biotechnology and genetic research, they create roses that cater to specific market demands, such as low-maintenance plants for urban consumers or fragrant blooms for luxury segments. This focus on product differentiation ensures their offerings remain competitive and desirable.

Sustainability and Eco-Friendly Practices

Sustainability has become a cornerstone strategy for key players. Companies like Kordes Roses emphasize eco-friendly practices by developing disease-resistant varieties that reduce the need for pesticides. Similarly, David Austin Roses incorporates sustainable cultivation techniques to appeal to environmentally conscious consumers. These efforts not only align with global sustainability trends but also enhance brand reputation and compliance with stringent international regulations.

Strategic Partnerships and Collaborations

Collaborations with perfumers, designers, and retailers allow players like David Austin Roses and Parfum Flower Company to diversify their revenue streams and enter niche markets. For instance, partnerships with fragrance brands enable these companies to capitalize on the growing demand for natural ingredients in cosmetics and aromatherapy.

Expansion into Emerging Markets

To tap into new growth opportunities, companies are expanding their presence in emerging markets like Asia-Pacific and Latin America. For example, Dümmen Orange has established distribution networks and breeding facilities in regions with favorable climates, ensuring proximity to key consumers and reducing logistical costs.

Digital Marketing and E-Commerce Integration

With the rise of online retail, players like Rose Story Farm and Select Roses have embraced digital platforms to reach broader audiences. By leveraging social media, personalized marketing, and e-commerce channels, they enhance customer engagement and drive sales, particularly among younger demographics.

TOP PLAYERS IN THIS MARKET

David Austin Roses

David Austin Roses is a globally celebrated name in the rose market, known for its iconic English roses that blend the elegance of heritage blooms with the durability of modern hybrids. The company has made a lasting impact on the global market by introducing unique varieties that emphasize fragrance, beauty, and versatility. Its roses are often associated with luxury gardening and high-end floral arrangements, making them a top choice for discerning consumers. David Austin’s collaborations with perfumers and designers have also expanded its influence into the fragrance and lifestyle sectors. By focusing on craftsmanship and innovation, David Austin Roses has set a gold standard for premium floral products, shaping consumer preferences worldwide.

Dümmen Orange

Dümmen Orange is a dominant player in the floriculture industry, specializing in breeding and propagating innovative rose varieties alongside other ornamental plants. The company’s commitment to research and development has led to the creation of groundbreaking hybrids that cater to diverse markets, from cut flowers to potted plants. Dümmen Orange’s emphasis on sustainability and disease resistance aligns with global trends toward environmentally friendly practices, enhancing its appeal among growers and consumers alike. Through strategic partnerships and advanced breeding technologies, Dümmen Orange has established itself as a leader in delivering high-quality, resilient roses that meet the demands of modern floriculture.

Kordes Roses

Kordes Roses is a German-based breeder renowned for its dedication to creating resilient and visually striking rose varieties. The company has played a transformative role in the global rose market by developing disease-resistant hybrids that require fewer chemical inputs, addressing growing concerns about environmental sustainability. Kordes’ focus on innovation and quality has earned it a reputation as a trusted supplier for eco-conscious growers and florists. By combining traditional breeding methods with cutting-edge science, Kordes Roses continues to push the boundaries of floriculture, offering varieties that excel in both aesthetics and ecological responsibility. Its contributions have solidified its position as a pioneer in the marketplace which is driving advancements that benefit growers and consumers alike.

RECENT MARKET DEVELOPMENTS

- In March 2023, David Austin Roses launched a new collection of English roses bred for warmer climates. This move is anticipated to expand their market presence in Asia-Pacific and the Middle East by catering to regional growing conditions.

- In June 2022, Dümmen Orange introduced ‘Red Naomi Eco’, a sustainable rose variety requiring minimal chemical inputs. This initiative is expected to strengthen their position as a leader in eco-friendly floriculture solutions.

- In September 2021, Kordes Roses partnered with European florists to promote disease-resistant rose varieties. This collaboration is anticipated to enhance their reputation for sustainability and innovation in the floral industry.

- In January 2023, Parfum Flower Company collaborated with luxury perfume brands to develop rose-based fragrances. This partnership is expected to tap into the growing demand for natural ingredients in the cosmetics sector.

- In July 2022, Meilland International opened a state-of-the-art breeding facility in France. This development is anticipated to accelerate the creation of innovative rose hybrids for both commercial and garden use.

- In November 2021, Robertet Group acquired a stake in an Ethiopian rose farm. This strategic move is expected to secure a reliable supply chain for their fragrance division, ensuring consistent product quality.

- In May 2023, Rose Story Farm expanded its online retail platform to include personalized gifting options and subscription services. This enhancement is anticipated to target younger consumers and boost e-commerce sales.

- In August 2022, Select Roses launched a marketing campaign highlighting heirloom rose varieties. This initiative is expected to appeal to heritage garden enthusiasts and strengthen brand loyalty in North America.

- In February 2023, Star Roses & Plants introduced a line of low-maintenance potted roses tailored for urban consumers. This product line is anticipated to address the rising demand for compact gardening solutions in urban areas.

- In October 2021, Weeks Roses hosted virtual workshops and webinars on rose care and cultivation. This engagement strategy is expected to build customer loyalty and strengthen their global brand presence.

MARKET SEGMENTATION

This research report on the global rose market has been segmented and sub-segmented based on type, application, distribution channel, & region.

By Type

- Hybrid Tea Roses

- Floribunda Roses

- Climbing Roses

- Others

By Application

- Ornamental

- Perfume

- Pharmaceuticals

- Food & Beverage

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Others

By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Frequently Asked Questions

1. Which factors are driving the growth of the rose market?

Rising demand for ornamental flowers, increased use in cosmetics and perfumes, and growing e-commerce flower delivery services.

2. Who are the key players in the global rose market?

Major companies include Afriflora, Kariki, The Karuturi Group, David Austin Roses, and Select Roses.

3. What challenges does the rose market face?

Seasonal supply fluctuations, climate change, transportation costs, and competition from artificial flowers.

4. How is the rose market expected to grow in the coming years?

The market is expected to grow due to increasing consumer demand for luxury floral products and innovations in cultivation techniques.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]