Global Risk Management Market Size, Share, Trends & Growth Forecast Report Segmented By Risk Type (Compliance Risk, Financial and Credit Risk, Security Risk, Operational Risk, Strategic Risk, and Legal Risk), Enterprise Size, and Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Risk Management Market Size

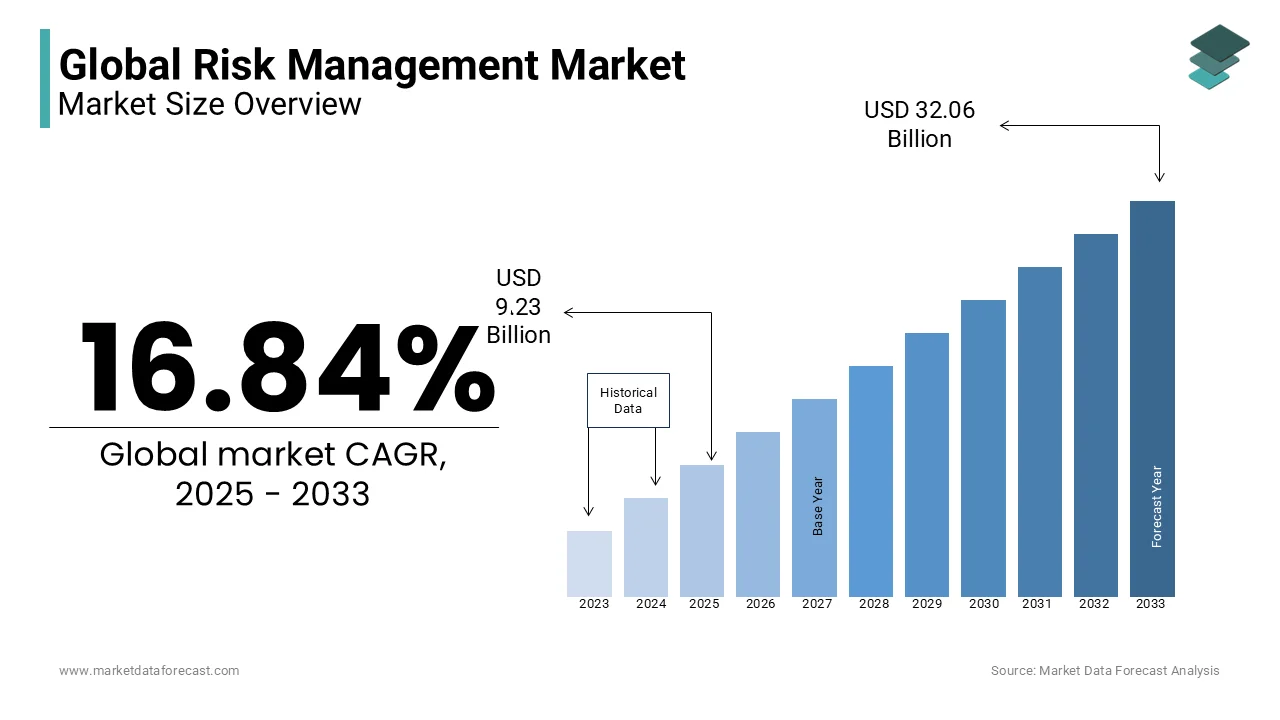

The global risk management market was worth USD 7.90 billion in 2024. The global market is projected to reach USD 32.06 billion by 2033 from USD 9.23 billion in 2025, growing at a CAGR of 16.84% from 2025 to 2033.

Risk management helps organizations mitigate and manage a wide spectrum of risks, including financial, operational, cyber, compliance, and reputational risks. As industries face increasing levels of complexity, interconnectivity, and emerging risks, effective risk management has become indispensable for maintaining business continuity and safeguarding long-term success.

The global market for risk management is experiencing robust growth due to several factors. According to a report from the U.S. Department of Homeland Security, the rise of cyber threats, such as data breaches and ransomware, has significantly heightened the need for comprehensive risk management solutions. A 2020 survey by the National Institute of Standards and Technology (NIST) revealed that 62% of organizations identified cyber risks as their top concern, further underscoring the importance of addressing cybersecurity risks through proactive risk management practices.

Additionally, the expanding complexity of global regulatory requirements is driving demand for integrated risk management systems. For example, the U.S. Securities and Exchange Commission (SEC) has increased its focus on corporate governance, prompting organizations to adopt more sophisticated frameworks for regulatory compliance. As of 2021, the SEC emphasized that companies must disclose material risks, including environmental, social, and governance (ESG) factors, leading to increased market demand for risk management solutions that can effectively assess and mitigate these emerging risks. The risk management market is projected to continue growing rapidly. The U.S. Bureau of Labor Statistics (BLS) projects a 6% growth rate in risk management and insurance employment through 2029 which is leveraging the demand for professionals and technologies that can navigate evolving risk landscapes.

MARKET DRIVERS

Cybersecurity Surge: The Digital Defense Imperative

The escalating frequency and complexity of cyber threats are propelling the demand for advanced risk management solutions. According to the U.S. Department of Homeland Security (DHS), cyber-attacks have become one of the leading security threats to organizations globally. In 2021 alone, there were over 65,000 reported cybersecurity incidents in the U.S., as reported by the FBI's Internet Crime Complaint Center (IC3). These incidents resulted in over USD 6.9 billion in damages. As businesses transition to digital operations, the need for cybersecurity frameworks that can effectively manage and mitigate risks grows. Consequently, risk management solutions incorporating advanced cybersecurity measures are in high demand across industries such as finance, healthcare, and retail.

Regulatory Pressure: Compliance Driving Risk Management Investments

The increasing complexity of regulatory frameworks is another major driver of the risk management market. Governments are enacting more stringent regulations across multiple industries that enables businesses to strengthen their risk management processes. For example, the U.S. Securities and Exchange Commission (SEC) has mandated that publicly traded companies disclose material risks with those related to environmental, social, and governance (ESG) factors. As of 2021, the SEC stated that ESG disclosures are essential for investors to make informed decisions. This has spurred businesses to invest in integrated risk management solutions to ensure they comply with the evolving regulatory landscape. The U.S. Government Accountability Office (GAO) has also emphasized the need for effective risk management systems to navigate the growing number of compliance requirements.

MARKET RESTRAINTS

High Implementation Costs: A Barrier to Entry

One significant restraint for the risk management market is the high cost of implementing comprehensive risk management systems. Small and medium-sized enterprises (SMEs) often struggle with the initial and ongoing costs of adopting advanced risk management solutions. The U.S. Small Business Administration (SBA) reports that 50% of small businesses face financial constraints when investing in cybersecurity and risk mitigation technologies, which can limit their ability to compete with larger organizations. Furthermore, businesses must also allocate resources for employee training, system updates, and compliance measures, adding to the overall expense. This financial burden deters many companies from fully integrating risk management practices, especially when they face limited budgets.

Lack of Skilled Professionals: A Growing Talent Gap

Another significant challenge in the risk management market is the shortage of qualified professionals to manage complex risk management frameworks effectively. According to the U.S. Bureau of Labor Statistics (BLS), the demand for risk management professionals, especially in cybersecurity, has outpaced the supply of skilled workers, with job openings in the sector growing by over 15% annually. The National Institute of Standards and Technology (NIST) highlights that this talent gap poses a considerable challenge, as organizations struggle to implement and maintain effective risk management strategies without adequate expertise. The shortage of skilled professionals leads to inefficiencies and vulnerabilities in risk management systems, potentially exposing businesses to greater risks.

MARKET OPPORTUNITIES

Advancement in Artificial Intelligence: Revolutionizing Risk Management

One significant opportunity in the risk management market is the increasing integration of artificial intelligence (AI) and machine learning (ML) technologies. AI is revolutionizing the way businesses assess and mitigate risks by providing predictive analytics, automating decision-making, and enhancing real-time monitoring capabilities. According to the U.S. Department of Commerce, AI adoption in risk management could reduce operational losses and improve decision-making speed by up to 30%. The National Institute of Standards and Technology (NIST) also emphasizes AI's potential to identify emerging risks by analyzing vast amounts of data quickly, enabling organizations to make more informed, proactive risk management decisions. Businesses are expected to invest more in these innovations to gain a competitive advantage in managing risks as AI technologies continue to evolve,.

Expansion of Regulatory Requirements: Driving Demand for Risk Management Solutions

The growing complexity of regulatory frameworks across industries presents another opportunity for the risk management market. Governments around the world are introducing more stringent regulations, especially in areas such as data privacy, environmental impact, and cybersecurity. As organizations strive to remain compliant, there is a rising demand for integrated risk management solutions. According to the U.S. Government Accountability Office (GAO), the need for such systems is expected to increase significantly as more businesses face stringent regulatory audits and compliance checks in the coming years. This creates an opportunity for companies offering advanced risk management solutions to cater to these evolving regulatory demands.

MARKET CHALLENGES

Data Privacy Concerns: Navigating Privacy Laws and Security Threats

A major challenge in the risk management market is the growing concern surrounding data privacy and the complexity of adhering to evolving privacy laws. With the rapid digitalization of businesses, organizations are increasingly handling vast amounts of sensitive customer and employee data, making them prime targets for cyberattacks. The U.S. Federal Trade Commission (FTC) reports that data privacy violations in 2022 led to over USD 16 billion in consumer harm due to fraudulent practices. Additionally, regulatory frameworks such as the General Data Protection Regulation (GDPR) in the EU and the California Consumer Privacy Act (CCPA) in the U.S. impose stringent requirements on data handling, increasing the risk of non-compliance. Organizations face the challenge of balancing innovation with the need for robust privacy safeguards, which complicates risk management efforts.

Integration of Risk Management Systems: Overcoming Legacy Challenges

Another significant challenge in the risk management market is the integration of modern risk management solutions with legacy systems. Many organizations still rely on outdated infrastructure, which creates difficulties when attempting to adopt new technologies. According to the U.S. Government Accountability Office (GAO), over 60% of federal agencies report significant challenges in modernizing legacy IT systems which also applies to risk management platforms. The lack of interoperability between legacy systems and new risk management technologies increases implementation complexity and costs which leads to delays and inefficiencies in identifying and mitigating risks. This issue is particularly acute for government agencies and large enterprises with established but outdated infrastructures by making it a persistent hurdle in the adoption of comprehensive risk management solutions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

16.84% |

|

Segments Covered |

By Risk Type, Enterprise Size, Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

The major players in the global risk management market include IBM Corporation, Oracle Corporation, SAP SE, Deloitte, PwC (PricewaterhouseCoopers), KPMG, Thomson Reuters, RiskWatch International, MetricStream, and SAS Institute Inc. |

SEGMENTAL ANALYSIS

By Risk Type Insights

The financial and credit risk segment held the leading share of the global risk management market in 2024 and is likely to continue its domination in the global market throughout the forecast period owing to the critical role of finance and credit risk in safeguarding organizations from financial losses. This segment is particularly important in sectors such as banking and finance, where managing credit exposure is vital for operational stability. According to the U.S. Federal Reserve, financial institutions have seen a surge in non-performing loans, leading to heightened concerns over credit risks. In 2022, financial risks represented over 35% of the total risk management market share is primarily driven by the increasing focus on credit default risk and market volatility. This is compounded by regulatory requirements, such as Basel III, which emphasize risk-based capital adequacy standards.

The security risk segment is growing rapidly and is estimated to register a CAGR of 18.3% during the forecast period. This rapid growth is driven by the rising prevalence of cyber threats, including data breaches, ransomware attacks, and phishing scams, which are becoming increasingly sophisticated. According to the U.S. Department of Homeland Security (DHS), the number of reported cyber incidents grew by over 30% in 2021 compared to the previous year. The demand for security risk management solutions is expected to accelerate as businesses continue to digitize operations, necessitating advanced threat detection, prevention, and recovery systems. This rapid increase is reflected in the growing adoption of cybersecurity measures, which is contributing significantly to the expansion of the market.

By Enterprise Size Insights

The large enterprises segment held 70.7% of the global market share in 2024 due to their scale and the complexity of risks they face. Large enterprises often operate across multiple geographies and industries by leading to diversified risk exposures, including financial, operational, cybersecurity, and regulatory risks. These enterprises are particularly sensitive to compliance risks, as seen in the rising global regulatory landscape, including the General Data Protection Regulation (GDPR) in Europe. The U.S. Government Accountability Office (GAO) highlights that large enterprises face increased regulatory scrutiny, further driving the demand for comprehensive risk management systems. Additionally, large organizations have the financial resources to invest in advanced tools, ensuring their continued dominance in the market.

The small & medium enterprises (SMEs) segment is anticipated to register a CAGR of 15.7% during the forecast period in the risk management market. The increasing awareness of emerging risks and the need for effective risk mitigation strategies is augmented in leveraging the growth rate of the market. SMEs are more vulnerable to cybersecurity threats, with the U.S. Cybersecurity and Infrastructure Security Agency (CISA) reporting that 43% of cyberattacks target small businesses. Furthermore, the rise in regulatory compliance requirements, such as the California Consumer Privacy Act (CCPA) is expelling SMEs to invest in risk management solutions. This rapid growth reflects a broader trend of SMEs adopting digital tools to safeguard against operational, financial, and reputational risks while ensuring compliance with evolving regulatory standards.

By Vertical Insights

The BFSI segment leads the risk management market by accounting for 38% of the global market share in 2024. This dominance is attributed to the complex and highly regulated nature of the financial industry, where operational, financial, and cybersecurity risks are pervasive. In 2021, the U.S. Federal Deposit Insurance Corporation (FDIC) reported that financial institutions faced significant challenges with rising fraud and cyber threats which underscored the need for robust risk management systems. Moreover, regulatory frameworks such as the Dodd-Frank Act and Basel III drive continuous investments in risk management solutions within the BFSI sector to ensure compliance and protect against financial volatility.

The healthcare segment is estimated to witness the highest CAGR of 19.1% in the forecast period. The U.S. Department of Health and Human Services (HHS) reported that healthcare data breaches compromised over 45 million patient records in 2020 with the growing threat of cyber risks in the sector. The need to protect patient data and ensure compliance with regulations like the Health Insurance Portability and Accountability Act (HIPAA) is critical as healthcare providers increasingly adopt electronic health records and telemedicine. Additionally, the COVID-19 pandemic has led to heightened awareness of operational and regulatory risks is driving the fast adoption of risk management solutions in healthcare.

REGIONAL ANALYSIS

North America was the largest regional segment for risk management globally and accounted for 45.9% of the global market share in 2024. The region’s dominance is driven by a high concentration of industries in finance, healthcare, and technology, all of which have complex risk management needs. The U.S. Federal Reserve reports that financial institutions in the U.S. have increasingly focused on mitigating operational and cybersecurity risks with the rising number of cyberattacks targeting the sector. Furthermore, North America benefits from a strong regulatory environment, such as the Sarbanes-Oxley Act and regulations from the U.S. Securities and Exchange Commission (SEC), which further propel the need for risk management solutions.

The Asia-Pacific region is gaining huge traction and is predicted to be the fastest growing region for risk management worldwide by showcasing a CAGR of 16.3% over the forecast period. According to the Asia-Pacific Economic Cooperation (APEC), digital transformation in countries like China, India, and Japan is leading to an increase in cybersecurity risks. A 2021 report from the Asia-Pacific Computer Emergency Response Team (APCERT) showed that the region experienced a 20% rise in cyber incidents in 2020 alone. Additionally, evolving regulatory frameworks in countries such as India, with the introduction of data privacy regulations are driving businesses to adopt more comprehensive risk management systems.

In Europe, the market for risk management solutions is also growing steadily. The European Union Agency for Cybersecurity (ENISA) reported a 30% increase in cyberattacks across member states in 2021, highlighting the urgency of adopting robust risk management frameworks. In Latin America, digitalization in sectors like finance and healthcare is spurring growth in risk management adoption, with the Latin American Financial Industry Association (ALADI) reporting a 12% increase in cybersecurity investments in 2021. Middle East and Africa are also investing more in risk management, particularly within the energy sector, as reported by the International Energy Agency (IEA) with a focus on securing critical infrastructure against rising security threats. These regions are expected to grow at a stable rate as they continue to face complex regulatory, security, and operational risks.

KEY MARKET PLAYERS

The major players in the global risk management market include IBM Corporation, Oracle Corporation, SAP SE, Deloitte, PwC (PricewaterhouseCoopers), KPMG, Thomson Reuters, RiskWatch International, MetricStream, and SAS Institute Inc.

COMPETITIVE LANDSCAPE

The risk management market is highly competitive, driven by a diverse range of players that offer a variety of solutions to mitigate and manage different types of risks. These players span industries such as technology, consulting, finance, and specialized risk management providers, each aiming to capture market share by providing comprehensive, data-driven solutions.

Large multinational corporations like IBM, Oracle, and SAP lead the market with their integrated risk management platforms, combining advanced technologies such as artificial intelligence (AI), machine learning, and big data analytics to help organizations identify and manage risks effectively. These companies focus on offering end-to-end solutions that cater to diverse industries such as finance, healthcare, and manufacturing. Consulting giants like Deloitte, PwC, and KPMG also play a critical role by providing expert advisory and consulting services, helping organizations navigate complex risk landscapes, including regulatory compliance, financial, and operational risks.

Smaller players, including RiskWatch International and MetricStream, also contribute to the market by focusing on niche risk management solutions, offering specialized tools for industries such as cybersecurity, environmental risk, and governance, risk, and compliance (GRC).

The competition is intensifying as businesses increasingly prioritize risk management to safeguard against cybersecurity threats, regulatory changes, and economic disruptions. As new risks emerge, the market is expected to see continued innovation, with vendors differentiating through technology, service offerings, and industry expertise.

Top 3 Players in the Market

IBM Corporation

IBM is a leading player in the risk management market, particularly known for its AI-powered solutions that help organizations predict, analyze, and mitigate various types of risks, including financial, operational, and cybersecurity threats. Through its IBM OpenPages and IBM Security platforms, IBM provides integrated risk management systems that help businesses address regulatory compliance, manage financial risks, and protect against cyber threats. IBM’s use of advanced data analytics, machine learning, and AI has enabled clients to better identify risks and improve decision-making. IBM’s contribution has been especially prominent in sectors such as finance, healthcare, and government, where it serves large enterprises looking for scalable and secure risk management solutions.

Oracle Corporation

Oracle is another dominant player in the global risk management market, offering a suite of Oracle Risk Management Cloud products. These solutions are designed to assist organizations in automating risk assessments, improving compliance, and managing internal controls. Oracle’s deep integration of financial and risk management tools is especially valuable in industries like banking, insurance, and government, where managing financial and regulatory risks is crucial. Oracle’s advanced analytics and cloud infrastructure enable real-time monitoring and proactive risk mitigation strategies, driving greater business agility and resilience.

SAP SE

SAP SE plays a key role in the risk management market, particularly through its SAP GRC (Governance, Risk, and Compliance) solutions. SAP provides enterprises with a comprehensive platform for managing compliance, audit, financial, and operational risks. The company’s strong presence in the enterprise resource planning (ERP) sector has enabled it to integrate risk management into core business processes, offering end-to-end solutions that span across all business functions. SAP’s solutions are widely adopted in industries like manufacturing, energy, and healthcare, where regulatory compliance and operational risk management are critical. The integration of SAP's GRC with its ERP software ensures that organizations can proactively manage risk across their operations, improving transparency and regulatory compliance.

Top Strategies used by the Key Market Participants

Technological Innovation

Key players like IBM, Oracle, and SAP invest heavily in cutting-edge technologies, particularly artificial intelligence (AI), machine learning, and big data analytics, to develop more advanced risk management solutions. For example, IBM leverages AI and machine learning within its IBM OpenPages platform to provide predictive risk insights, enabling businesses to proactively manage risks. Oracle and SAP also incorporate AI and automation in their risk management offerings, helping businesses streamline compliance processes, identify potential financial and operational risks, and improve decision-making.

Strategic Partnerships and Alliances

Collaborations with other technology providers, consulting firms, and industry leaders help expand the reach and capabilities of risk management solutions. SAP has formed various strategic alliances with cloud providers to enhance the scalability of its SAP GRC (Governance, Risk, and Compliance) platform. Similarly, Oracle partners with global banks and insurance companies to tailor its risk management solutions to the unique requirements of the financial services sector. These partnerships enable players to integrate their solutions more effectively across industries, increase customer retention, and gain access to new market opportunities.

Acquisitions and Expanding Product Portfolio

Acquisitions are another common strategy to enhance market share and expand the product portfolio. IBM has been particularly active in acquiring companies with complementary technologies. For instance, IBM acquired Resilient Systems to strengthen its capabilities in incident response and security risk management. Oracle, through its acquisition of Sun Microsystems and NetSuite, has expanded its cloud-based enterprise solutions and risk management capabilities. By acquiring innovative technologies and companies, these players can offer more comprehensive and integrated risk management solutions, catering to a broader range of business needs.

Customization and Industry-Specific Solutions

Tailoring risk management solutions to specific industries and regulatory requirements is a key strategy to ensure product relevance and attract industry-specific clients. Oracle focuses on industries such as financial services and healthcare, offering tailored solutions that address regulatory compliance, financial risks, and cybersecurity issues. SAP customizes its SAP GRC platform for sectors like manufacturing, energy, and pharmaceuticals, where operational and regulatory risk management is a top priority. This customization allows these players to create more value for clients, as businesses are more likely to adopt solutions designed specifically for their sector’s unique needs.

Cloud-Based Risk Management Solutions

The shift toward cloud computing has been a significant driver in the risk management market. Many key players, including IBM, Oracle, and SAP, are increasingly offering cloud-based risk management solutions, which offer benefits such as scalability, cost-effectiveness, and easier integration with existing business systems. Cloud-based platforms allow businesses to access real-time risk analytics, improve collaboration across teams, and scale their risk management efforts as they grow. The adoption of cloud solutions is particularly attractive to small and medium-sized enterprises (SMEs) that are looking for cost-effective risk management tools with minimal upfront investment.

Focus on Cybersecurity and Data Privacy

As cybersecurity threats become more complex, risk management companies have made cybersecurity a central focus of their offerings. For instance, IBM has integrated cybersecurity capabilities into its risk management solutions through its IBM Security platform. This includes threat detection, incident response, and vulnerability management. Similarly, Oracle has expanded its focus on data privacy, providing solutions that help businesses comply with evolving global regulations like the GDPR. As data protection and security risks continue to rise, players in the market are adapting by offering more robust solutions focused on cyber risk mitigation.

Expanding Global Reach

Global expansion is another strategy for strengthening market position. SAP and Oracle have expanded their risk management services to emerging markets in Asia-Pacific, Latin America, and the Middle East, where increasing digitalization and regulatory complexity are driving demand for risk management solutions. By localizing their offerings and addressing the unique challenges faced by businesses in these regions, these players can tap into new revenue streams and expand their customer base.

RECENT HAPPENINGS IN THE MARKET

- In February 2023, IBM Corporation launched IBM Risk Manager with AI capabilities. This launch leveraged AI and machine learning to automate risk identification, prediction, and mitigation processes, further strengthening IBM's position in the enterprise risk management market.

- In August 2022, Oracle Corporation expanded its Oracle Risk Management Cloud. The expansion added enhanced compliance management features and regulatory automation tools, allowing Oracle to assist enterprises in managing financial, operational, and regulatory risks more effectively.

- In March 2023, SAP SE unveiled a strategic enhancement of SAP GRC solutions. This update integrated advanced data analytics and AI, supporting real-time risk monitoring and compliance, thus providing comprehensive risk management across industries like healthcare, manufacturing, and finance.

- In June 2023, Deloitte acquired a cybersecurity and risk management consultancy firm. This acquisition enabled Deloitte to expand its capabilities in cybersecurity risk management and enhance its service offerings to address the growing digital threat landscape.

- In January 2023, PwC launched the PwC Risk360 Platform. This platform is a comprehensive solution for managing enterprise risk, including financial, operational, cybersecurity, and compliance risks, integrating real-time data and advanced analytics to provide a holistic view of risks.

- In September 2022, KPMG introduced enhanced cyber risk management solutions. These solutions included advanced threat intelligence and automated risk reporting, designed to address the growing cybersecurity needs of businesses worldwide.

- In May 2024, Thomson Reuters partnered with Microsoft for AI-driven risk solutions. This partnership integrated Thomson Reuters' Risk Intelligence platform with Microsoft’s cloud and AI technologies, delivering robust data security and risk management tools for financial institutions and enterprises.

- In November 2023, MetricStream launched MetricStream GRC Cloud. The cloud-native platform provided real-time insights into risks and regulatory changes, with a focus on AI-driven risk analytics and automation, further strengthening MetricStream's market position.

- In April 2024, SAS Institute expanded AI and machine learning features in its risk management solutions. This expansion aimed at helping financial institutions predict market volatility, operational risks, and cybersecurity threats more accurately, bolstering SAS's presence in the risk management sector.

- In January 2025, RiskWatch International launched an enhanced RiskWatch Cloud Platform. The platform offered integrated risk assessment tools, predictive analytics, and compliance automation, catering to businesses in sectors like healthcare, energy, and government, thereby strengthening its competitive position.

MARKET SEGMENTATION

This research report on the global Risk management market is segmented and sub-segmented into the following categories.

By Risk Type

- Compliance Risk

- Financial and Credit Risk

- Security Risk

- Operational Risk

- Strategic Risk

- Legal Risk

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By Vertical

- BFSI

- IT & Telecom

- Healthcare

- Retail

- Manufacturing

- Government & Defense

- Transport & Logistics

- Energy & Utilities

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the key drivers of the risk management market?

The increasing complexity of global regulations, rising cybersecurity threats, economic uncertainties, and the need for operational resilience are major factors driving growth in the risk management market.

What are the emerging trends in the global risk management market?

Key trends include the adoption of AI and machine learning for predictive risk analytics, increased integration of cybersecurity risk management, regulatory technology advancements, and a shift towards cloud-based risk management platforms.

How do geopolitical risks impact the risk management market?

Geopolitical uncertainties such as trade conflicts, economic sanctions, political instability, and regulatory changes increase demand for risk management strategies that help businesses navigate global market volatility.

What is the future outlook for the risk management market?

The market is expected to grow as businesses continue to prioritize risk resilience, regulatory compliance, cybersecurity, and AI-driven risk intelligence solutions to address evolving global challenges.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]