Global Research Antibodies Market Size, Share, Trends & Growth Forecast Report By Product (Primary Antibodies, Secondary Antibodies), Type (Monoclonal Antibodies, Polyclonal Antibodies), Technology (Western Blotting, Immunohistochemistry, Immunofluorescence, Flow Cytometry, Immunoprecipitation), Source (Mouse, Rabbit, Goat, Others), Application (Infectious Diseases, Immunology, Oncology, Stem Cells, Others), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033.

Global Research Antibodies Market Size

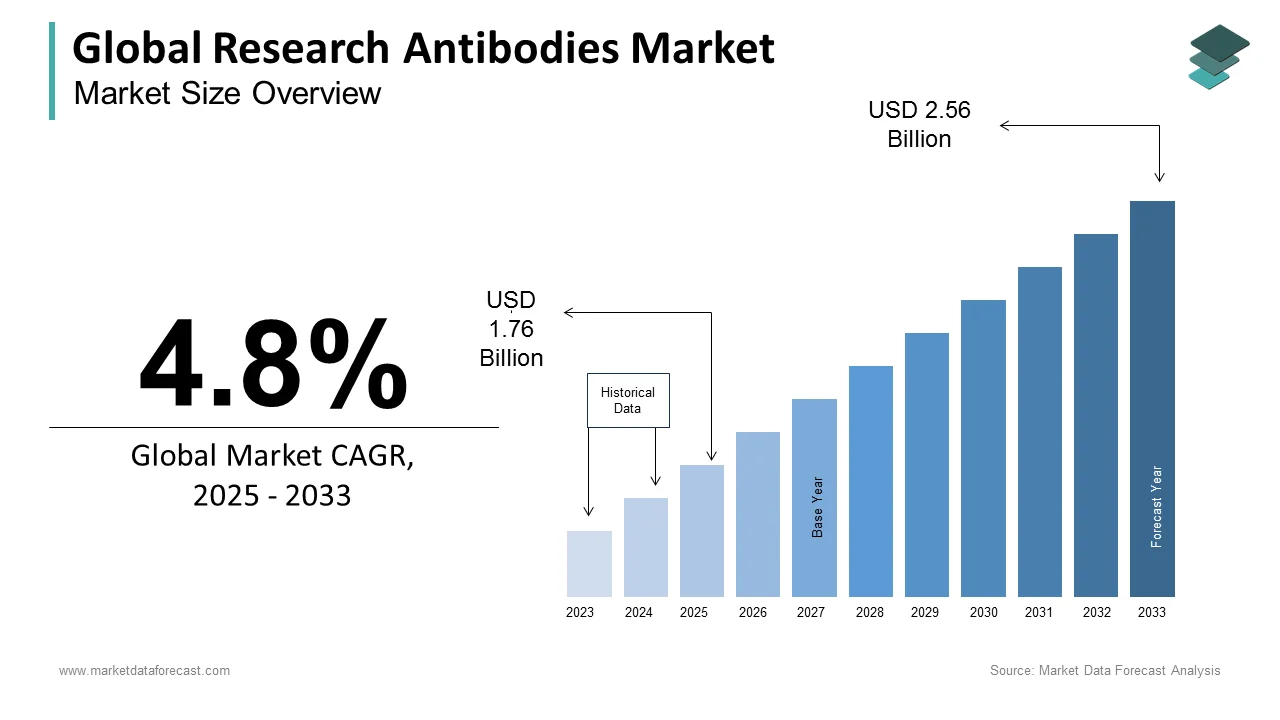

The size of the global research antibodies market was worth USD 1.68 billion in 2024. The global market is anticipated to grow at a CAGR of 4.8% from 2025 to 2033 and be worth USD 2.56 billion by 2033 from USD 1.76 billion in 2025.

Research antibodies are essential tools in various fields, including molecular biology, immunology, neuroscience, and cancer research. They are widely used for detecting, identifying, and quantifying proteins, making them crucial in applications such as Western blotting, immunohistochemistry, flow cytometry, and ELISA. Oncology research remains a primary application area, generating more than 33% of the revenue share in 2023.

MARKET DRIVERS

Rising Prevalence of Chronic Diseases

Chronic diseases such as cancer, autoimmune disorders, and neurological conditions are on the rise globally, driving demand for advanced research and therapeutic antibodies. The World Health Organization (WHO) estimates that cancer is the second leading cause of death worldwide, with over 9.6 million deaths in 2020 alone. Antibodies play a critical role in targeted therapies, making them essential in clinical trials and research for new treatments. This increasing burden of chronic diseases is a significant driver for antibody research, propelling growth in the market.

Technological Advancements in Antibody Discovery

Advances in biotechnology, such as CRISPR gene editing and phage display technology, have revolutionized antibody discovery, enhancing the efficiency and specificity of antibody production. According to a 2024 report by the U.S. National Institutes of Health (NIH), the CRISPR/Cas9 gene-editing technology has revolutionized antibody discovery by allowing for precise modification of immune cells to produce more targeted and efficient antibodies. The NIH has allocated over $1.3 billion in its 2024 budget to support gene-editing technologies, including those for antibody-based therapies. Additionally, AI-powered drug discovery platforms are increasing the speed and success rate of antibody development and is further contributing to the market's expansion.

MARKET RESTRAINTS

High Cost of Antibody Development

The development of research antibodies and particularly monoclonal antibodies, is a capital-intensive process involving extensive research, trials, and regulatory approvals. According to the U.S. National Institutes of Health (NIH), the cost of developing a single monoclonal antibody can exceed $1 billion. This high cost highits accessibility for many research organizations, especially smaller biotech firms, and may delay the availability of new therapies. Moreover, production costs related to scale-up manufacturing also contribute to the pricing challenges in the market, restricting wider adoption and growth.

Regulatory Challenges and Approval Delays

Navigating the regulatory landscape is a significant challenge for antibody-based therapeutics. The U.S. Food and Drug Administration (FDA) and other regulatory agencies require extensive preclinical and clinical trial data before granting approval. According to a 2024 FDA report, only 10 to 20% of all therapeutic antibodies entering clinical trials receive regulatory approval after extensive trials. The lengthy approval timelines, often taking 10-15 years, and stringent requirements for safety and efficacy increase the time to market, which can deter investment in antibody development. This regulatory burden remains a major restraint on market growth.

MARKET OPPORTUNITIES

Expansion of Immuno-Oncology Therapies

Immuno-oncology which uses antibodies to stimulate the immune system to target cancer cells, represents a significant opportunity in the research antibodies market. The National Cancer Institute (NCI) estimates that approximately 1.9 million new cancer cases were diagnosed in the U.S. in 2024 alone with immuno-oncology therapies accounting for an increasing share of treatment options. Antibody-based therapies, such as checkpoint inhibitors and monoclonal antibodies are proving to be effective in treating various cancers, fueling the demand for new antibody research and driving market growth in this segment.

Rising Demand for Personalized Medicine

Personalized medicine which tailors treatments to individual genetic profiles, is rapidly gaining traction in the healthcare industry. The U.S. National Institutes of Health (NIH) supports this trend with significant funding, estimating that personalized medicine could reduce healthcare costs by $200 billion annually by improving treatment outcomes and reducing adverse drug reactions. Antibodies play a pivotal role in this sector, as they can be customized to target specific biomarkers. The increasing use of personalized medicine, particularly in oncology and rare diseases, presents a lucrative opportunity for the growth of the research antibodies market.

MARKET CHALLENGES

Immunogenicity Issues

One major challenge in the development of research antibodies is their potential to cause immune responses in patients which is a phenomenon known as immunogenicity. According to the U.S. Food and Drug Administration (FDA), nearly 20-30% of patients treated with therapeutic antibodies experience immune reactions, which can lead to reduced efficacy or severe side effects. This issue is particularly prevalent with non-human or chimeric antibodies. Immunogenicity concerns require extensive preclinical and clinical testing, adding time and cost to the development process and limiting the rapid deployment of new antibody therapies.

Supply Chain and Manufacturing Limitations

The complexity of producing high-quality research antibodies at scale presents significant challenges, particularly with the supply chain and manufacturing processes. The global COVID-19 pandemic highlighted the fragility of the biotechnology supply chain, with the U.S. Food and Drug Administration (FDA) reporting that more than 60% of biologics experienced some form of supply chain disruption. This includes issues related to raw material availability, production capacity, and regulatory compliance. These manufacturing bottlenecks can lead to delays in research and development, increased production costs, and limited access to necessary antibodies for research and thereby hindering market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.8% |

|

Segments Covered |

By Product, Type, Technology, Source, Application, End-Use, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Abcam Plc., Merck KGaA, Thermo Fischer Scientific, Inc., Cell Signalling Technology, Inc., Santa Cruz Biotechnology Inc., Bio-Techne Corporation, PerkinElmer, Inc., Jackson ImmunoResearch Inc., Proteintech Group, Inc., Becton, Dickinson, and Others. |

SEGMENTAL ANALYSIS

By Product Insights

The primary antibodies segment held 74.46% of the global market share in 2024. The domination of the primary antibodies segment is attributed to their high specificity and direct detection capabilities, making them essential for various laboratory procedures such as staining and imaging. It is also driven by increasing demand for innovative research-use only (RUO) antibodies and advancements in antibody production methods. According to a 2023 report by the American Association of Immunologists, primary antibodies are used in over 50,000 immunohistochemistry applications annually across global research institutions.

Conversely, the secondary antibodies segment is estimated to witness the fastest CAGR of 8.2% from 2025 to 2033. This growth is attributed to their cost-effectiveness and convenience in development, as well as the availability of ready-to-use conjugated antibodies that enhance product development activities. Secondary antibodies are anticipated to play a crucial role in improving experimental flexibility and accuracy, thereby contributing to the overall expansion of the research antibodies market. The availability of conjugated secondary antibodies has led to a 25% increase in immunofluorescence applications over the last five years and especially in clinical laboratories and cancer research.

By Type Insights

The monoclonal antibodies segment occupied 68.6% of the global market share in 2024. These antibodies (mAbs) are highly specific, binding to a single site on the target antigen. The mAbs segment plays a central role in drug development, with over 50 monoclonal antibody therapies approved by the FDA for clinical use in various diseases, including cancer, autoimmune diseases, and chronic diseases like rheumatoid arthritis. According to the World Health Organization (WHO), mAbs are used in more than 80% of global oncology clinical trials and is reflecting their dominance in cancer research.

The polyclonal antibodies segment is predicted to grow at a CAGR of 5.1% over the forecast period owing to their cost-effectiveness, versatility in detecting a wide range of antigens, and increasing demand for diagnostic and research applications in immunology, infectious diseases, and vaccine development. According to the American Association of Immunologists (AAI), polyclonal antibodies are used in over 100,000 ELISA assays per year, making them a crucial tool in research and clinical diagnostics.

By Technology Insights

The western blotting segment commanded for 51.3% of the global market share in 2024. The importance of western blotting in detecting specific proteins in complex samples is propelling the expansion of the wester blotting segment in the global market. Western Blotting is recognized by regulatory bodies like the U.S. Food and Drug Administration (FDA) as a standard method for protein analysis, further solidifying its importance in research. It is applicable across various research fields, including oncology, immunology, and neurology, contributing to its widespread adoption. Western blotting is used in over 70% of protein analysis studies published globally each year.

The ELISA segment is projected to grow at a CAGR of 8.6% from 2025 to 2033. It is increasingly favored due to its high throughput, cost-effectiveness, and versatility in detecting a wide array of antigens, antibodies, and other biomarkers. It is widely used in diagnostics, particularly for infectious diseases and autoimmune disorders, and in vaccine development. ELISA is used in over 60% of clinical diagnostic laboratories globally for antibody and antigen detection, making it one of the most widely employed techniques in diagnostics.

By Source Insights

The mouse-derived antibodies segment led the market and held 46.1% of the global market share in 2024. These are known for their high specificity and are relatively easier and more cost-effective to produce than antibodies derived from other animals. This makes them the preferred choice in many research and diagnostic applications. Mouse antibodies account for more than 60% of the antibodies used in ELISA and 55% in flow cytometry applications. In diagnostic kits, the use of mouse-derived antibodies constitutes approximately 50% of the market share due to their affordability and efficiency in various immunoassays.

The rabbit-derived antibodies segment is estimated to grow at a CAGR of 8.9% over the forecast period as these antibodies are preferred for their ability to recognize epitopes that mouse antibodies may not effectively bind to, making them valuable in complex research such as epitope mapping and multi-epitope targeting. Rabbit-derived antibodies are favored in applications requiring higher sensitivity, such as in Western blotting, immunohistochemistry, and immunofluorescence. Rabbit antibodies are used in more than 30% of Western blotting experiments, and their use in IHC and immunofluorescence assays is also expanding rapidly due to their high sensitivity

By Application Insights

The oncology segment occupied for 52.2% of the global market share in 2024. The increasing global burden of cancer is driving substantial research into cancer treatments, biomarkers, and diagnostics. Cancer remains one of the leading causes of death worldwide, leading to increased demand for antibodies in cancer research. The global cancer burden is projected to reach 28.4 million new cases by 2040, indicating a significant demand for cancer research tools, including antibodies.

The stem cells segment is anticipated to record a CAGR of 6.2% from 2025 to 2033. It plays a pivotal role in developing regenerative therapies which is driving the increasing use of antibodies for cell characterization and differentiation. Stem cells are critical in treatments for neurological disorders, heart diseases, and tissue regeneration. Over 40% of stem cell research involves antibodies in areas like differentiation, signaling, and cell surface marker detection.

By End-Use Insights

The pharmaceutical and biotechnology segment dominated the market by accounting for 40.6% of the global research antibodies market in 2024. The increasing demand for biologic drugs, including monoclonal antibodies, has contributed significantly to the growth of this segment. Pharmaceutical companies are extensively using research antibodies for drug discovery, diagnostics, and clinical applications. The pharmaceutical industry alone is responsible for 70% of global antibody sales, reflecting the importance of antibodies in drug development and manufacturing.

The Contract Research Organizations (CROs) segment is likely to expand at the fastest CAGR of 9.1% from 2025 to 2033. Many pharmaceutical and biotech companies are outsourcing their R&D activities to CROs to reduce costs and speed up research timelines. This is driving the demand for research antibodies in outsourced clinical trials, preclinical studies, and drug development. Approximately 30% of pharmaceutical companies now outsource more than half of their R&D processes, increasing the demand for CRO services that include antibody research and development.

REGIONAL ANALYSIS

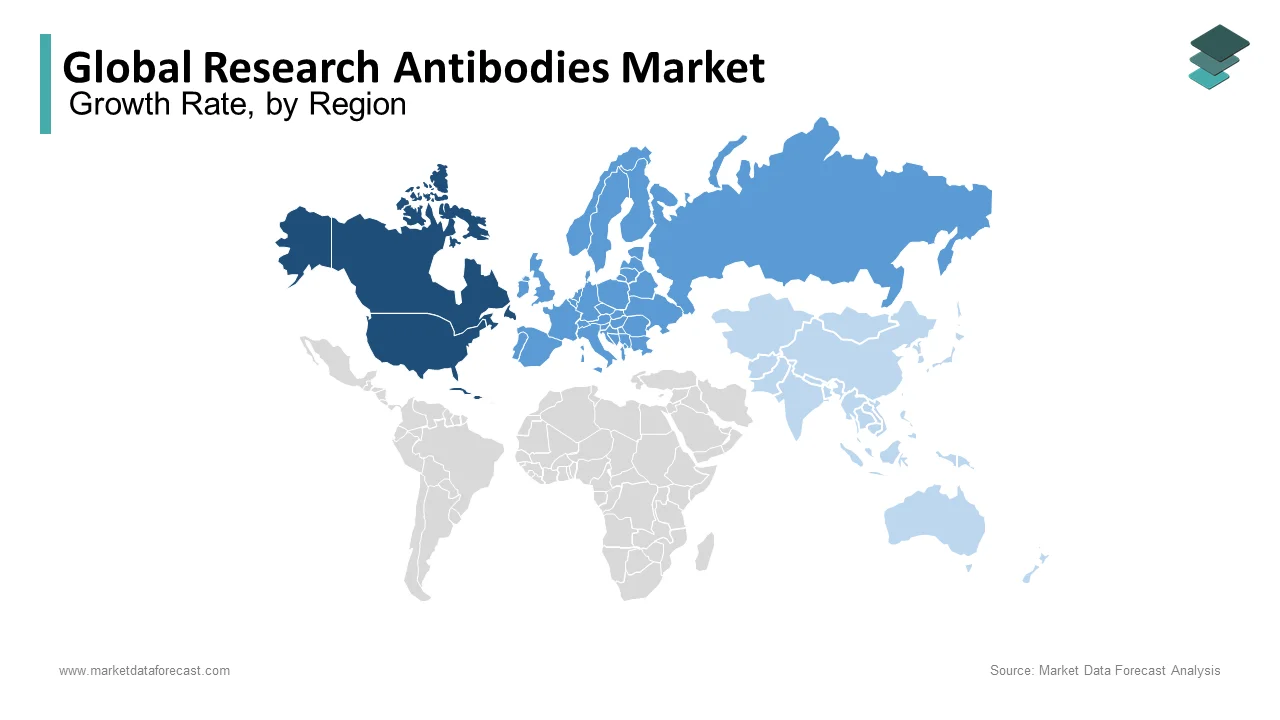

North America holds a dominant position in the global research antibodies market and accounted for 40.8% of the global market share in 2024. The U.S. National Institutes of Health (NIH) allocated approximately USD 47.5 billion to healthcare research in 2024, with a significant portion directed toward antibody-based research, particularly in oncology and immunology. This funding supports both academic and private sector research, boosting market growth.

The European market is a prominent regional segment for research antibodies worldwide. Germany, the United Kingdom, and France are at the forefront, with Germany leading due to its strong pharmaceutical industry and significant research investments. The UK and France also contribute notably, supported by their established biotech sectors and research institutions. The European Union has committed approximately USD 3.6 billion through Horizon Europe to fund life sciences and biotechnology research, which includes a focus on antibody-based therapies.

The research antibodies market in the Asia-Pacific region is expected to witness the fastest growth with a CAGR of 5.05%. The market is anticipated to expand rapidly as the region invests in healthcare and biotechnology. China has become the second-largest publisher of scientific papers on antibodies by contributing nearly 20% of global publications in immunology and antibody research, according to data from Elsevier and Scopus. India is seeing a rapid increase in the number of clinical trials focused on antibodies, especially in areas such as infectious diseases and cancer. The Indian government’s Biotechnology Industry Research Assistance Council (BIRAC) provides grants to research projects, focusing on advancing antibody-based therapies.

Latin America holds a smaller market share in the global market but is expected to grow at a CAGR of 4.2% during the forecast period. Brazil, the leading country in Latin America and invested approximately USD 1 billion in healthcare research in 2023, with a growing portion dedicated to biotechnology and antibody-based therapeutics. Several Latin American countries, including Brazil and Mexico, have established partnerships with European and North American universities for collaborative research on antibody development, particularly in the areas of infectious diseases and cancer immunotherapy.

The market in Middle East and Africa has a small but steadily growing share with a projected CAGR of 4.8%. he United Arab Emirates (UAE) has committed approximately AED 2.5 billion toward healthcare innovation, including biotechnology and antibody research, as part of its Vision 2021 program to enhance medical research and development. South Africa is a leader in the African continent in terms of scientific publications related to antibody research, contributing to around 25% of the region’s total research output on immunology and biotechnology.

KEY MARKET PLAYERS

Abcam Plc., Merck KGaA, Thermo Fischer Scientific, Inc., Cell Signalling Technology, Inc., Santa Cruz Biotechnology Inc., Bio-Techne Corporation, PerkinElmer, Inc., Jackson ImmunoResearch Inc., Proteintech Group, Inc., Becton, Dickinson, and Company

COMPETITIVE ANALYSIS

The Research Antibodies Market is highly competitive, with several global and regional players striving for dominance. Key companies such as Thermo Fisher Scientific, Abcam, Bio-Rad Laboratories, Merck Millipore, and Cell Signaling Technology lead the market by offering a diverse range of antibodies for various applications, including immunohistochemistry, flow cytometry, Western blotting, and ELISA. The competition is driven by factors such as product quality, availability, technological innovations, and customer support.

To remain competitive, companies are heavily investing in R&D to develop novel antibodies that offer increased specificity and reproducibility, addressing the rising demand for precision in life sciences research. The growing popularity of monoclonal and recombinant antibodies has further intensified competition, as these products provide superior performance in areas like drug discovery and diagnostics.

Strategic collaborations, mergers, and acquisitions are common as organizations work to expand their product offerings and reach new markets. There is also a growing demand for custom antibody production services tailored to the needs of research institutions and pharmaceutical firms. This continuous innovation and market activity ensure that the competitive landscape in the research antibodies sector remains dynamic and evolving.

RECENT HAPPENINGS IN THE MARKET

- In October 2024, the UK's Medicines and Healthcare products Regulatory Agency (MHRA) published its business plan for 2024/25, focusing on enabling access to innovative healthcare products while ensuring delivery for all stakeholders. This plan is aimed at improving the approval and regulation process for medical products, including research antibodies.

- In May 2024, Swiss private equity firm Partners Group acquired a majority stake in FairJourney Biologics, a biotechnology company specializing in antibody discovery and development. The deal was valued at approximately €900 million. FairJourney operates laboratories in Porto and Cambridge and has been involved in developing 14 antibody treatments currently in clinical trials, addressing conditions like cancer and autoimmune disorders.

MARKET SEGMENTATION

This research report on the global research antibodies market has been segmented and sub-segmented based on product, type, technology, source, application, end-use, and region.

By Product

- Primary Antibodies

- Secondary Antibodies

By Type

- Monoclonal Antibodies

- Polyclonal Antibodies

By Technology

- Western Blotting

- Immunohistochemistry

- Immunofluorescence

- Immunoprecipitation

- Flow Cytometry

By Source

- Rabbit

- Mouse

- Goat

- Others

By Application

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What factors contribute to the growth of the Research Antibodies Market?

The growth of the Research Antibodies Market is influenced by factors such as increasing investment in life science research, a rise in the prevalence of infectious diseases, and advancements in antibody technologies.

What challenges does the Research Antibodies Market face, and how are they being addressed?

Challenges include issues related to antibody specificity and reproducibility. The industry is addressing these challenges through rigorous validation processes, improved antibody engineering, and collaborations between researchers and manufacturers.

What are the key trends shaping the future of the Research Antibodies Market?

Trends include a growing focus on single-cell analysis, the rise of therapeutic antibodies, increased collaboration between academia and industry, and the integration of artificial intelligence in antibody development processes for improved efficiency.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]