Global Refrigerators Market Size, Share, Trends & Growth Forecast Report By Product Type (Top Freezer Refrigerator ,Bottom Freezer Refrigerator), Distribution Channel (Online, Offline) and Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 to 2033

Global Refrigerators Market Size

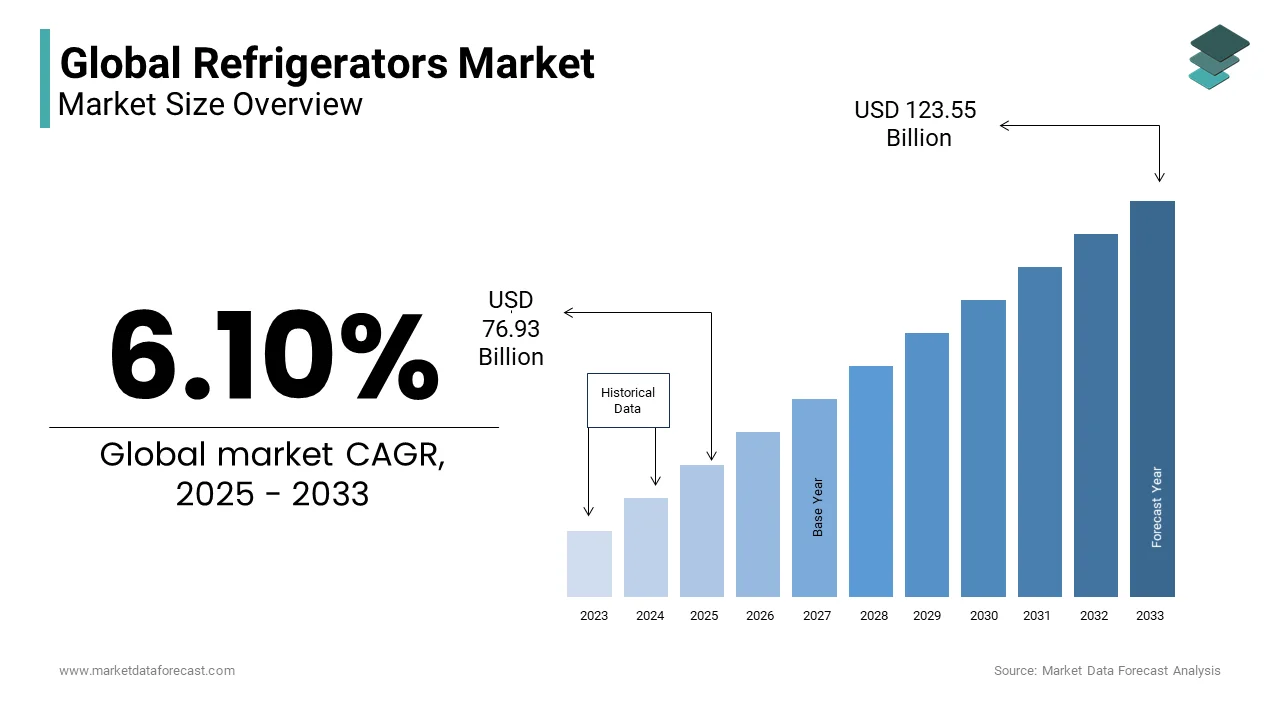

The refrigerators market Size was valued at USD 72.51 billion in 2024. The refrigerators market Size is expected to have 6.10% CAGR from 2025 to 2033 and be worth USD 123.55 billion by 2033 from USD 76.93 billion in 2025.

Refrigerators is a cornerstone of modern consumer appliances and cater to the need for food preservation, safety, and convenience in households and businesses alike. It is one of the most commonly used household appliances globally so refrigerators play a critical role in daily living which helps to maintain food freshness, reduce waste, and enhance food safety. The widespread adoption of refrigerators has transformed food storage practices, reducing reliance on perishable goods and fostering longer shelf lives for numerous products.

According to the International Energy Agency (IEA), refrigeration accounts for approximately 8% of global energy consumption, highlighting its importance not only for food storage but also for its environmental impact. Energy-efficient refrigerators have thus become a focal point for innovation, as manufacturers aim to reduce both operational costs for consumers and the carbon footprint of these essential appliances.

Additionally, refrigeration plays a pivotal role in sectors such as healthcare and pharmaceuticals, where cold storage is critical for the preservation of vaccines, medicines, and other temperature-sensitive products. For instance, the World Health Organization (WHO) has emphasized the importance of reliable refrigeration systems in maintaining the efficacy of vaccines, a key factor in global health initiatives. This highlights the broader utility of refrigerators beyond residential settings, influencing market demand in various industries. Furthermore, as climate change drives global temperature shifts, the importance of robust and reliable refrigeration solutions has never been more apparent in safeguarding food security and public health worldwide.

MARKET DRIVERS

Rising Demand for Energy-Efficient Refrigerators

One of the major drivers of the refrigerators market is the increasing demand for energy-efficient refrigerators. With growing concerns about energy consumption and environmental sustainability, consumers are shifting toward appliances that minimize energy use. According to the U.S. Department of Energy, refrigerators account for nearly 8% of household energy consumption, making energy efficiency a priority for both manufacturers and consumers. The push for greener products is further supported by government regulations such as the Energy Star program, which promotes products that meet energy efficiency standards. Additionally, the global push toward reducing carbon emissions has incentivized consumers to opt for refrigerators with high energy ratings, boosting market demand for energy-efficient models. Manufacturers like Whirlpool and LG are increasingly investing in innovative technologies to meet these consumer demands, with LG reporting that energy-efficient products now account for over 50% of its appliance sales in North America.

Technological Advancements and Smart Refrigeration

Another key driver in the Refrigerators Market is the integration of advanced technologies such as smart refrigeration systems. These refrigerators offer functionalities like Wi-Fi connectivity, touch screens, temperature controls, and automated inventory tracking. According to the International Energy Agency (IEA), smart refrigerators are contributing to the growing market demand as they align with consumer preferences for convenience and automation. In the U.S., for example, nearly 40% of households are projected to have at least one smart appliance by 2025, with the refrigerator being a prominent choice due to its daily use.

MARKET RESTRAINTS

High Initial Cost of Advanced Refrigerators

One of the major restraints in the Refrigerators Market is the high initial cost associated with advanced models, particularly smart and energy-efficient refrigerators. While these products offer long-term savings through reduced energy consumption, the upfront cost can be prohibitive for many consumers. According to the U.S. Department of Energy, energy-efficient refrigerators can cost up to 20-30% more than standard models. This price gap can deter price-sensitive buyers, especially in developing markets, where affordability remains a key consideration. Additionally, the adoption of smart refrigerators, which include advanced features such as Wi-Fi connectivity and touchscreen displays, further increases the price, limiting their market reach.

Regulatory Challenges and Environmental Concerns

Regulatory challenges related to refrigerants and environmental concerns also pose significant restraints to the market. Many traditional refrigeration systems rely on hydrofluorocarbons (HFCs), which are potent greenhouse gases. The global phase-out of HFCs, as mandated by the Kigali Amendment to the Montreal Protocol, has resulted in stricter regulations on the use of these refrigerants. The U.S. Environmental Protection Agency (EPA) indicates that as part of the phase-out, the country will reduce HFC production and consumption by 85% by 2036, with industries expected to shift to alternative refrigerants. This transition to eco-friendly refrigerants, such as hydrocarbons and CO2, may increase production costs and require significant adjustments from manufacturers, slowing down market growth in the short term.

MARKET OPPORTUNITIES

Growth of the Refrigerators Market in Emerging Economies

A significant opportunity for the Refrigerators Market lies in the growing demand for refrigeration in emerging economies. As urbanization and disposable incomes rise in regions like Asia Pacific, Latin America, and Africa, more households are investing in refrigerators. According to the United Nations, nearly 56% of the global population lived in urban areas as of 2020, a number expected to increase to 68% by 2050, primarily in developing countries. This demographic shift is driving the demand for household appliances, including refrigerators. Additionally, increased access to electricity in rural areas is further enabling the widespread adoption of refrigerators in these markets, providing manufacturers with a substantial growth opportunity in these regions.

Technological Innovation and Eco-Friendly Refrigeration

Technological innovation presents another promising opportunity for the Refrigerators Market, particularly in the development of eco-friendly refrigeration systems. As governments worldwide tighten environmental regulations, the demand for low-GWP (Global Warming Potential) refrigerants and energy-efficient appliances is growing. The U.S. Environmental Protection Agency (EPA) supports the adoption of alternative refrigerants such as R-32 and natural refrigerants like propane and CO2. The EPA has invested $15 million in funding for research to advance refrigeration technology that supports these sustainable alternatives. Additionally, the European Union has allocated €200 million toward initiatives to encourage energy-efficient appliance adoption across member states, focusing on reducing carbon footprints in the home appliance sector.

MARKET CHALLENGES

Supply Chain Disruptions

A significant challenge faced by the Refrigerators Market is supply chain disruptions, which have been exacerbated by factors such as the COVID-19 pandemic and geopolitical tensions. According to the U.S. Department of Commerce, supply chain delays have led to increased raw material costs and extended lead times for manufacturing, particularly in the semiconductor and steel sectors, both critical for refrigerator production. This has impacted the timely delivery of products, with some manufacturers reporting up to a 20% delay in shipments. Such disruptions affect manufacturers' ability to meet growing consumer demand, leading to potential revenue losses and increased costs, which ultimately affect product pricing and market penetration.

Raw Material Price Volatility

Another challenge in the Refrigerators Market is the volatility of raw material prices, particularly for metals such as steel, aluminum, and copper, which are essential for manufacturing refrigeration units. The U.S. Bureau of Labor Statistics reports that metal prices have experienced significant fluctuations in recent years, with steel prices rising by 130% from 2020 to 2021 due to supply shortages and trade policies. This price instability puts pressure on manufacturers, forcing them to either absorb the cost increase or pass it on to consumers, which can reduce demand. Additionally, the reliance on rare earth metals for certain components adds another layer of vulnerability to the market’s stability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.10 % |

|

Segments Covered |

By Product Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Samsung ,LG Electronics Inc., Whirlpool Corporation, Panasonic Corporation, Hitachi, Ltd. |

SEGMENT ANALYSIS

By Product Type Insights

The top freezer refrigerator segment occupied the major share of 35.7% in the global market in 2024 due to its affordability, energy efficiency, and traditional design. In the U.S., for example, approximately 60% of households still prefer top freezer models due to their price-point and energy-saving features, as reported by the National Energy Efficiency Alliance. Additionally, top freezer refrigerators are often the go-to option for rental properties and small businesses, where budget constraints are a significant factor. In 2023 alone, retailers reported a 12% increase in sales of top freezer models in lower-income regions.

The French door refrigerator segment is on the rise and is expected to exhibit a CAGR of 7.3% over the forecast period. The premium features of French door refrigerators such as energy-efficient cooling systems, flexible storage options, and modern design that are appealing to affluent consumers is one of the key factors propelling the growth of the French door refrigerator segment in the global market. According to the National Kitchen and Bath Association, French door refrigerators account for over 25% of all refrigerator sales in North America in 2023, a significant increase from 17% in 2020.

By Distribution Channel Insights

The Offline segment held the major share of 70.2% in the global market in 2024. The dominance of offline segment in the worldwide market is largely due to consumer preference for experiencing the product firsthand before purchase. According to the National Retail Federation, approximately 60% of appliance buyers in the U.S. visit physical stores to inspect large appliances like refrigerators before making a decision. Brick-and-mortar stores offer the opportunity for customers to assess the size, design, and features of refrigerators, which plays a significant role in decision-making.

The online segment is growing rapidly and is projected to express a CAGR of 11.2% from 2025 to 2033. This rapid growth is driven by increasing consumer preference for convenience and the expanding reach of e-commerce platforms. In 2023, online sales of large appliances like refrigerators increased by 22% in the U.S., according to the National Retail Federation. Online retailers offer advantages such as competitive pricing, home delivery, and a broader selection of models, which have made online shopping more attractive to tech-savvy and time-conscious consumers.

REGIONAL ANALYSIS

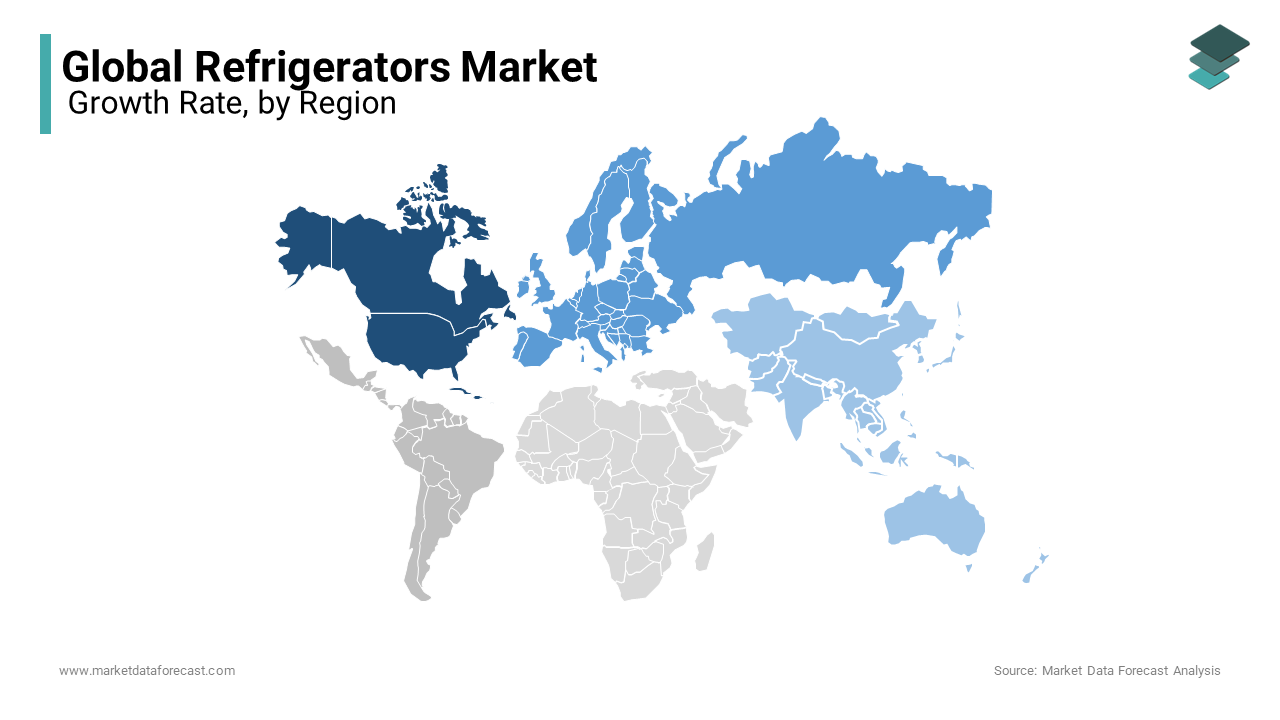

North America dominated the refrigerators market in 2024 by accounting for 30.7% of the global market share in 2024. The domination of North America is majorly driven by the high per capita income, advanced infrastructure, and increasing demand for energy-efficient and smart refrigerators. In 2023, U.S. consumers spent an estimated $7.5 billion on refrigerators, with a significant portion allocated to energy-efficient models, according to the National Kitchen and Bath Association. The region's strong focus on sustainability, driven by stringent environmental regulations, further contributes to its leading position.

The Asia-Pacific region is expected to grow at the fastest rate in the Refrigerators Market with a projected CAGR of 8.5% from 2025 to 2033. This rapid growth can be attributed to factors such as increasing urbanization, rising disposable incomes, and the expanding middle class in countries like China, India, and Southeast Asia. According to the Asian Development Bank, Asia’s middle class is expected to expand by over 1.3 billion people by 2030, a key driver of demand for home appliances, including refrigerators.

Europe’s Refrigerators Market is poised to experience steady growth in the coming years. Driven by stringent energy regulations and a strong shift towards sustainability, the region is focused on increasing the adoption of energy-efficient appliances. The European Union’s Ecodesign regulations and Energy Labeling program are pushing consumers and manufacturers towards energy-efficient solutions. In fact, the EU's Ecodesign regulations alone have contributed to a 30% increase in the sale of energy-efficient appliances since their implementation in 2009, according to the European Commission.

Latin America is projected to experience moderate growth in the Refrigerators Market over the next few years. With the rise in disposable income and urbanization, countries like Brazil and Mexico are witnessing increased refrigerator adoption. According to the World Bank, the middle class in Latin America grew from 21% of the population in 2000 to 35% in 2020, increasing purchasing power for household appliances like refrigerators. Additionally, electricity access in the region has improved, with 97% of the population having access to electricity as of 2022, facilitating greater adoption of modern appliances. However, the region’s growth is tempered by economic volatility and inflationary pressures.

The Middle East and Africa (MEA) region is expected to experience gradual growth in the Refrigerators Market. This growth is driven by increasing urbanization and rising demand for consumer goods in countries like Saudi Arabia, UAE, and South Africa. In Sub-Saharan Africa, electricity access has improved from 33% in 2010 to nearly 50% in 2022, expanding the potential consumer base for refrigerators. However, economic challenges, political instability, and the lack of infrastructure in certain regions may slow down market growth. The growing preference for energy-efficient and durable refrigerators in urban centers is expected to be the key driver for the MEA market’s expansion in the coming years, according to the World Bank.

Top 3 Players in the market

Whirlpool Corporation

Whirlpool Corporation is one of the leading players in the global Refrigerators Market, holding a significant share due to its diverse product offerings and extensive distribution network. The company is renowned for producing high-quality and energy-efficient refrigerators that cater to both residential and commercial sectors. Whirlpool has pioneered innovation in smart refrigerators, incorporating advanced technologies like Wi-Fi connectivity, touchscreens, and voice control in their products. According to the company’s annual report, Whirlpool maintains a strong market presence in North America and Europe, contributing to its robust position globally. Additionally, its commitment to sustainability, demonstrated through the development of energy-efficient models, has further bolstered its competitive advantage.

Samsung Electronics

Samsung Electronics is a key player in the Refrigerators Market, known for its technological innovations and premium product offerings. The company has made substantial contributions through its range of smart refrigerators, featuring cutting-edge technologies such as Family Hub, which integrates Wi-Fi, touchscreen interfaces, and voice-activated controls. Samsung has capitalized on the growing demand for smart home appliances, positioning itself as a leader in the segment. According to Statista, Samsung held a market share of approximately 20% in the global refrigerator market as of 2023. The company’s continuous focus on advanced refrigeration technology, energy efficiency, and user-centric design makes it a dominant force in the global market.

LG Electronics

LG Electronics is another major player with a strong footprint in the global Refrigerators Market. LG’s refrigerators are highly regarded for their innovative features such as the InstaView door-in-door technology, smart inverter compressors, and energy-efficient systems. The company has invested heavily in sustainable technologies, aligning with global efforts to reduce carbon footprints. LG’s commitment to quality and design excellence has helped it secure a significant share of the global market, particularly in North America and Asia. According to a report from GlobalData, LG was among the top three refrigerator manufacturers, contributing substantially to the market's growth, especially in the premium and smart refrigerator segments.

Top strategies used by the key market participants

Product Innovation and Technological Advancements

One of the major strategies employed by key players in the Refrigerators Market is continuous product innovation and the integration of advanced technologies. Companies like Samsung and LG have been at the forefront of introducing smart refrigerators with features such as Wi-Fi connectivity, touchscreens, and voice control. These innovations cater to the growing consumer demand for convenience and enhanced functionality in home appliances. For instance, Samsung’s Family Hub refrigerator, which includes a touchscreen interface that allows users to control home devices, check the weather, and even stream music, has significantly contributed to the company's market leadership. By adopting cutting-edge technologies, these companies aim to appeal to tech-savvy consumers and differentiate themselves in a highly competitive market.

Sustainability and Energy Efficiency Initiatives

As environmental concerns become more prominent, sustainability has become a key strategy for many companies in the Refrigerators Market. Leading manufacturers such as Whirlpool and LG are focusing on developing energy-efficient models that adhere to global environmental standards. Whirlpool, for example, has integrated environmentally friendly refrigerants and energy-efficient compressors into their products, aligning with regulations set by the U.S. Environmental Protection Agency (EPA). These efforts not only help reduce the carbon footprint but also appeal to eco-conscious consumers who prioritize sustainability in their purchasing decisions. Additionally, the growing demand for energy-efficient appliances driven by regulatory pressures and government incentives for green products has prompted these companies to invest in developing models with high energy ratings, thereby strengthening their market position.

Strategic Acquisitions and Partnerships

Another prominent strategy used by key players is strategic acquisitions and partnerships to expand their market presence and product portfolio. Whirlpool, for instance, has acquired several regional brands to enhance its distribution network and product offerings. This allows the company to cater to diverse consumer needs across various markets. Similarly, Samsung has partnered with various tech companies to integrate advanced smart home capabilities into their refrigerators, such as collaboration with Google for integrating Google Assistant. These partnerships help companies expand their reach, leverage complementary technologies, and offer more value to consumers, thereby enhancing their competitive advantage in the global market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the global refrigerators market include Samsung (South Korea),LG Electronics Inc.(South Korea), Whirlpool Corporation (U.S.),Panasonic Corporation(Japan),Hitachi, Ltd.(Japan),Electrolux AB (Sweden),Godrej Group (India),Haier Group Corporation(China),Midea Group(China),Voltas Limited (India),GE Appliances (U.S.).

The competition in the Refrigerators Market is intense, with a diverse array of global and regional players vying for market share. The market is characterized by a mix of established giants like Whirlpool, Samsung, and LG, alongside emerging brands that are capitalizing on niche segments such as energy-efficient and smart refrigerators. These leading companies dominate the market by leveraging technological innovation, advanced features, and strong brand recognition. For instance, Samsung and LG have pioneered smart refrigerators with integrated Wi-Fi, touchscreens, and voice command functionalities, appealing to consumers seeking convenience and connectivity in their home appliances.

On the other hand, Whirlpool’s focus on sustainability and energy efficiency, along with strategic acquisitions, has helped solidify its position in key regions like North America and Europe. As the demand for energy-efficient and eco-friendly appliances grows, competition has intensified, especially with the introduction of more affordable yet efficient models targeting emerging markets.

Smaller players are also entering the market with competitive pricing strategies, challenging established brands in cost-conscious segments. Additionally, competition is further fueled by regulatory pressures to reduce energy consumption, prompting companies to invest in eco-friendly refrigeration technologies. As such, companies must continuously innovate and adapt to consumer preferences, sustainability concerns, and regulatory changes to maintain a competitive edge in the evolving market landscape.

RECENT HAPPENINGS IN THE MARKET

- In December 2024, Samsung introduced a new line of refrigerators featuring hybrid cooling technology that combines traditional compressors with Peltier modules. This innovation aims to reduce temperature fluctuations and optimize internal space, enhancing energy efficiency. The upcoming RM80F23VM model is expected to be recognized as the most efficient refrigerator by Energy Star in 2025.

- In December 2024, Samsung announced the upcoming release of refrigerators equipped with AI Hybrid Cooling technology. This system integrates a high-efficiency compressor with a Peltier module and utilizes artificial intelligence to adapt cooling methods based on usage patterns and environmental conditions. The AI-driven system is designed to optimize energy efficiency and maintain consistent food freshness.

MARKET SEGMENTATION

This research report on the Refrigerators Market is segmented and sub-segmented into the following categories.

By Product Type

- Top Freezer Refrigerator

- Bottom Freezer Refrigerator

- Side by Side Refrigerator

- French Door Refrigerator

By Distribution Channel

- Online

- Offline

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Who are the leading players in the refrigerator market?

Key players include Whirlpool, Samsung, LG Electronics, Haier, Bosch, Electrolux, Panasonic, Hitachi, and Godrej.

What are the challenges in the refrigerator market?

Challenges include fluctuating raw material prices, high competition, increasing regulatory requirements for energy efficiency, and supply chain disruptions.

What is the current size of the global refrigerator market ?

The global refrigerator market size is valued at several billion dollars and is expected to grow due to increasing urbanization, rising disposable income, and advancements in cooling technology.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]