Global Recycled Plastics Market Size, Share, Trends & Growth Forecast Report – Segmented By Source (Bottles, Films, Fibers and Foams), Type (PET, PE, PP, PVC and PS), End-Use Industry (Packaging, Building & Construction, Textiles, Automotive, Electrical & Electronics), and Region -(North America, Europe, Asia Pacific, Latin America, Middle east and Africa) – Industry Analysis (2024 to 2032)

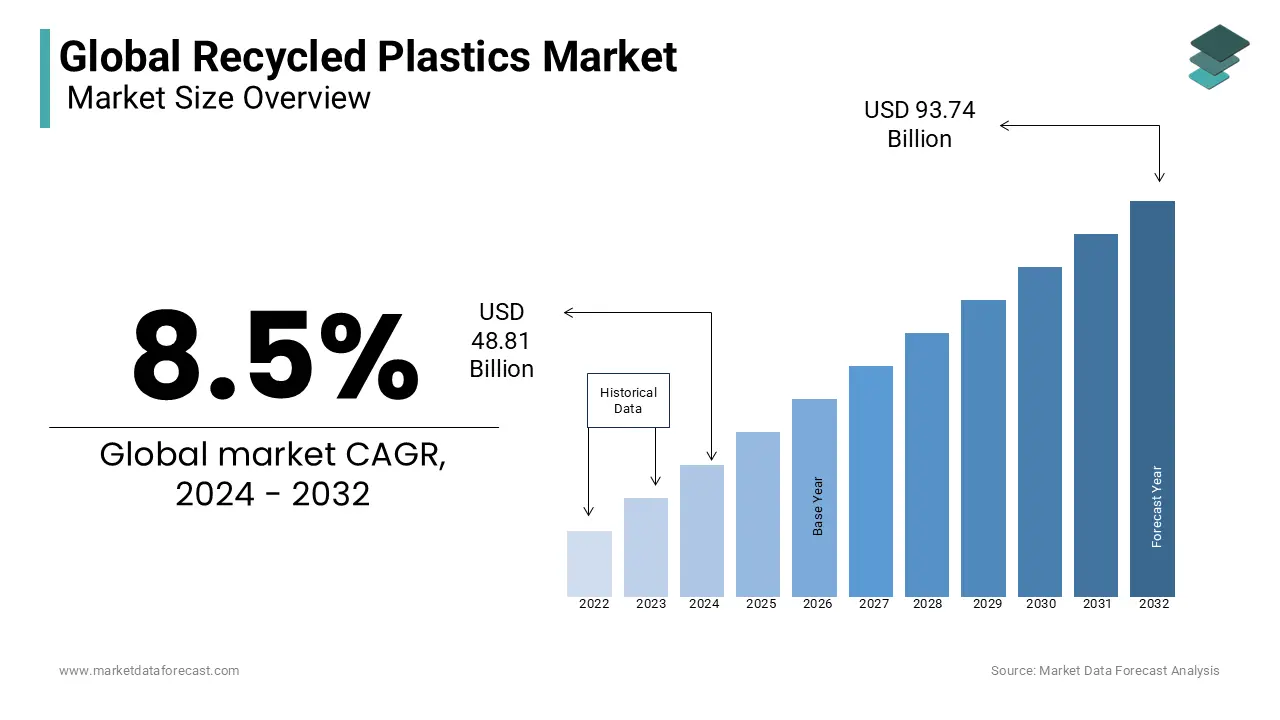

Global Recycled Plastics Market Size (2024 to 2032)

The global recycled plastics market size is expected to be worth USD 48.81 billion in 2024 and USD 93.74 billion by 2032, growing at a CAGR of approximately 8.5% during the forecast period.

Current Scenario of the Global Recycled Plastics Market

Recycled plastic is the plastic that is reprocessed from waste or scrap plastic into new essential products. The recycling process involves various steps such as sorting, cleaning, melting, and reforming the plastic into new products. The plastics which can be highly recyclable are polyethylene terephthalate (PET), High-density polyethylene (HDPE), low-density polyethylene (LDPE), Polyvinyl chloride (PVC), Polypropylene and Polystyrene. In recent years, most of the plastic being used in packaging has been recycled plastic. Making a plastic bottle from recycled plastic is energy-efficient as it takes 75% less energy. The global recycled plastics market has accounted for significant growth in the past years and is anticipated to have notable growth during the forecast period. The increased applications of recycled plastics in various industries escalating the market growth opportunities.

- According to data provided by the OECD, only 9% of plastic waste is recycled worldwide, while 79% ends up in landfills or nature, and 12% is incinerated.

MARKET DRIVERS

The increased pace of formulation or enforcement of laws and regulations by several countries and international bodies on the prohibition or elimination of polymer waste is fuelling the recycled plastics market.

Economies like Taiwan and France are actively promoting reusable substitutes by making regulations for banning or imposing fines on single-use plastic bags. In addition, the European Union, through the Packaging and Packaging Waste Directive (PPWD), has set a target for all packaging to compulsorily incorporate during production at least 30 percent of recycled materials by 2030. As a result, these legal requirements and consequences make it mandatory instead of an option.

Also, reprocessing plastic can lower emissions of greenhouse gasses by about 70 percent against the newly made ones from oil, as per research by the University of California. It further concluded that shifting to recycled plastics can conserve up to 50 percent of the energy utilized to manufacture virgin plastics. Furthermore, high-density polyethylene (HDPE) and polyethylene terephthalate (PET/PETE) are the most frequently reprocessed polymers that find their use their application in milk and soft drink bottles.

MARKET RESTRAINTS

Capital-intensive and costly operation of recycling factories or facilities, contamination, complex composition, and misleading customers by fake or falsely labeled are derailing the recycled plastics market.

The recycling ability is compromised and it even becomes costly and difficult to separate because of several coated layers and plastic types. Different plastic grades are often mixed, or multiple layers are applied to make the product strong, lightweight, and attractive. This complex formation prolongs the reprocessing. Moreover, polymers, most of the times, gets polluted and contaminated with microorganisms, food, and other matters, causing the resin to be incapable of cleaning for reapplication. Furthermore, the heavy investment requirement in the initial stages and high functional cost are other factors decreasing the growth rate of the recycled plastics market. So, considerable financial support and machinery are required for building factories or facilities, collection, aggregation, washing, and final processing.

Interestingly, in the United States, as per the Department of Energy, around 48 million tons of garbage is generated annually but in reality, only 5 to 6 percent of that gets recycled and all the remaining is either burned or ends up in landfills.

MARKET OPPORTUNITIES

The increasing adoption of recycled plastics in the packaging industry is a significant factor contributing to the market growth in the coming years. The growing government stringent regulations regarding the recycling of plastics and healthy initiatives by public organizations are enhancing the adoption of recycled plastics in the food and beverages industry and are providing market growth opportunities. The escalating awareness among the people regarding saving energy is augmenting the market expansion. Recycled plastics production involves the elimination of various processing steps compared to conventional plastics production which saves more energy is creates opportunities for market revenue.

MARKET CHALLENGES

The rising preference for virgin plastics over recycled substitutes is a major challenging factor for the expansion of the global recycled plastics market. Various challenges such as the leaching of toxic substances, a decline in quality, microplastics, and environmental concerns are estimated to impede the global market expansion. The high costs of recycled plastics compared to virgin plastics will act as a major restraining factor for market growth. Various government initiatives and regulations banning certain types of plastic are predicted to hinder global market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

8.5% |

|

Segments Covered |

By Material, Recycling Process, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

B & B Plastics Incorporation, B. Schoenberg & Corporation, PARC Corporation, Omni Resource Recovery, Custom Polymers Incorporation, United Plastic Recycling, Coll Materials/Nicos Polymers, Maine Plastics Incorporation, Norwich Plastics, APC recycling, NAM polymers, and Others. |

SEGMENTAL ANALYSIS

Global Recycled Plastics Market Analysis By Material

The polyethylene terephthalate segment has a most significant share in the recycled plastic market by resin type and is estimated to rise at a high rate throughout the foreseen period. This sector is predicted to gain 180 BPS in the coming years, making it a brilliant opportunity in this segment of this market. Moreover, the year-on-year expansion for this sector could be in the range of 2 to 5 percent, with the most increase showcased in PET.

According to a study by a group of experts from Poland, Kazakhstan, Iran, Qatar, and India, the re-usage of plastics is advantageous only if it is extensively applied in the manufacturing of several concrete items and wood-polymer boards. But, this is possible only if separating and cleaning are not especially focused on while producing polymer goods. It also states that polyethylene is a perfect base material for garbage bins, plastic panels, and all types of household utensils. This opens potential opportunities for the segment’s market growth.

Global Recycled Plastics Market By Recycling Process

The chemical segment is an emerging category of the recycled plastics market and is believed to move forward with an upward growth trajectory in the coming years. Whereas, the mechanical segment is a well-known and traditional reprocessing type. This does not change the chemical structure compared to the other category which alters the basic chemical formation of polymers.

Considering the different uses of plastics, a combination of reprocessing solutions with efforts intended for expanding reuse and waste minimization will be required. This demands a regulatory framework that allows all recycling choices and ensures a level playing field for chemical and mechanical segments. Since it’s a new approach, clarification is required on the chemical reprocessing technology’s way forward in achieving this industry environment.

Global Recycled Plastics Market Analysis By Application

The packaging sector in the recycled plastics market is estimated to rise at the highest CAGR based on value and volume during the foreseen period. Several advantages of recycled plastics, such as the reduction of pollution and lesser dependence on fossil fuels, and its broad application in sustainable packaging solutions like containers, bottles, bags, films, and other protective packaging products, drive its demand. This is causing a shift to fully recycled plastic packaging which can again be reprocessed. In addition, the Plastic Treaty 2024, under which governments worldwide will meet in Busan, Republic of Korea, for the fifth and final round of discussions for an international agreement to stop plastic pollution. Furthermore, the trend of growing emphasis on raising the post-consumer recycled (PCR) substance or matter in packing materials is influencing the demand for recycled packaging products.

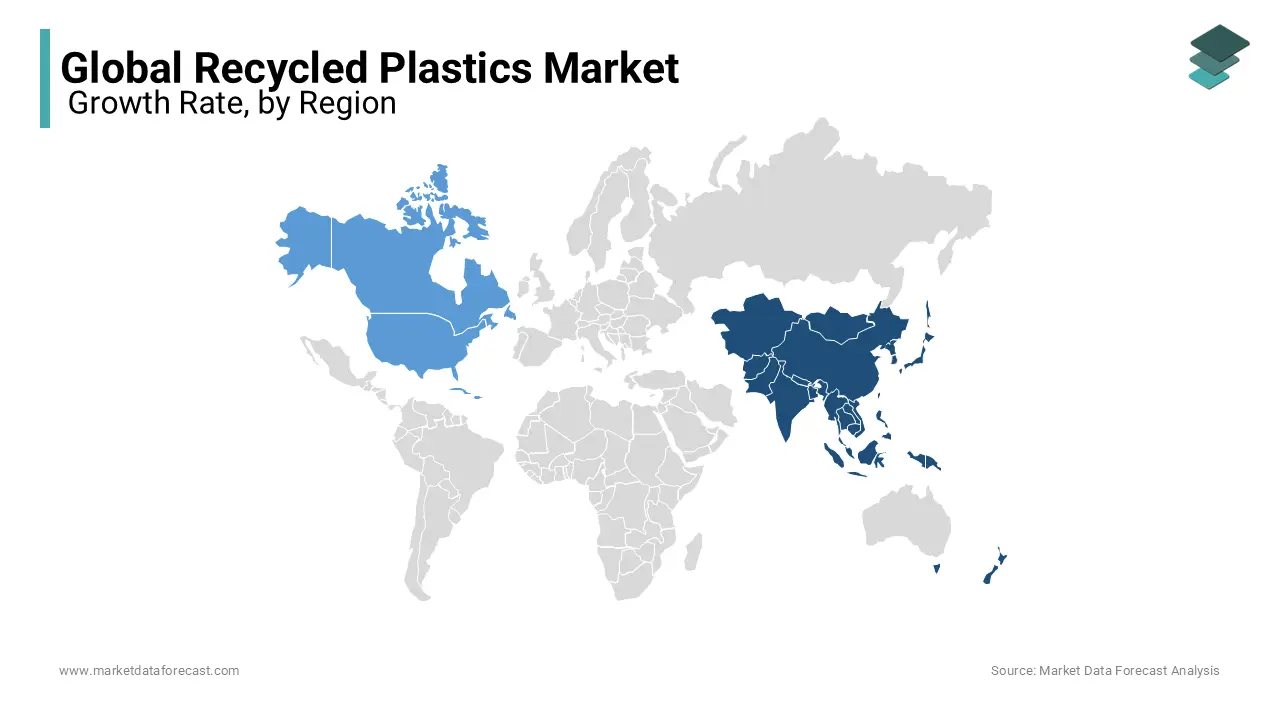

REGIONAL ANALYSIS

The Asia Pacific region is projected to have a rapid growth rate during the forecast period. The region is widely contributed to the packaging industry and the growing technological advancements in packaging, and the expanding food and beverages industry are a few primary factors accelerating the regional market share growth. The rising government initiatives such as “Swatch Bharat” in India are expected to influence positively recycled plastics which creates opportunities for the regional market.

- For Instance, various reports state that South Korea and Germany have the highest recycling rates globally.

The European recycled plastics market is anticipated to have considerable growth during the forecast period owing to rising government support regulations. The presence of advanced recycling technologies in Germany is influencing significantly the market growth in the country.

- For Instance, according to data provided by the Federal Ministry for Environment, Nature Conservation, Nuclear Safety, and Consumer Protection, in 2023, Germany generated 340 million tons of plastic waste per year and had recycling of waste and 50 million tons.

North America dominates the present market for recycled plastics, with the largest per capita plastic consumption offering an opportunity for recyclers. Nevertheless, Europe and China are estimated to dominate the market expansion driven by regulatory changes aimed at escalating domestic recycling rates of post-use plastics. The global recycling rate for plastic is around 10% of the overall plastic consumption yearly, with more than 300 million tons of annual plastic consumption in 2019. The Asia Pacific region is expected to be the quickest developing market for recycled plastics during the foreseen period. The expansion of the recycled plastics market in the Asia Pacific is owing to several initiatives taken in the region to escalate the employment of recycled plastics.

KEY PLAYERS IN THE GLOBAL RECYCLED PLASTICS MARKET

Companies playing a key role in the global recycled plastics market include B & B Plastics Incorporation, B. Schoenberg & Corporation, PARC Corporation, Omni Resource Recovery, Custom Polymers Incorporation, United Plastic Recycling, Coll Materials/Nicos Polymers, Maine Plastics Incorporation, Norwich Plastics, APC recycling and NAM polymers.

RECENT HAPPENINGS IN THE MARKET

- In May 2024, Konica Minolta, Inc. began supplying recycled plastics for external components of an Aterm Home Wifi router produced by NEC Platforms. It was made in collaboration with NEC Platforms from the used polycarbonate (PC) water bottles. The company is targeting 90 percent lower usage of natural resources by 2050 from the 2019 level. For this purpose, they are utilizing outside technologies and are encouraging the application of recycled resources.

- In April 2024, Taranis notified a 10 million investment into Pryme which is a cleantech company. Pryme reportedly made advancements in a new affordable technology for pyrolysis. It provides a high conversion rate for recycling used plastics on a commercial scale with reduced carbon emissions.

- In December 2023, DeepTech Recycling Press released its initial investments of 1 million pounds sterling or 1.26 million dollars to strengthen its plan to deploy solutions to address the problem of inadequate and untenable management of plastic garbage.

DETAILED SEGMENTATION OF THE GLOBAL RECYCLED PLASTICS MARKET INCLUDED IN THIS REPORT

This research report on the global recycled plastics market has been segmented and sub-segmented based on the material, recycling process, application, and region.

By Material

- Polyethylene Terephthalate (PET)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polypropylene (PP)

- Others

By Recycling Process

- Mechanical

- Chemical

By Application

- Packaging

- Construction

- Textile

- Automotive

- Others

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]