Global Recreational Vehicles Market Size, Share, Trends & Growth Forecast Report By Type (Class A, Class B, Class C, and Towable), Propulsion Type (Motorized and Non-motorized), Application (Commercial Use and Personal Use), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Recreational Vehicles Market Size

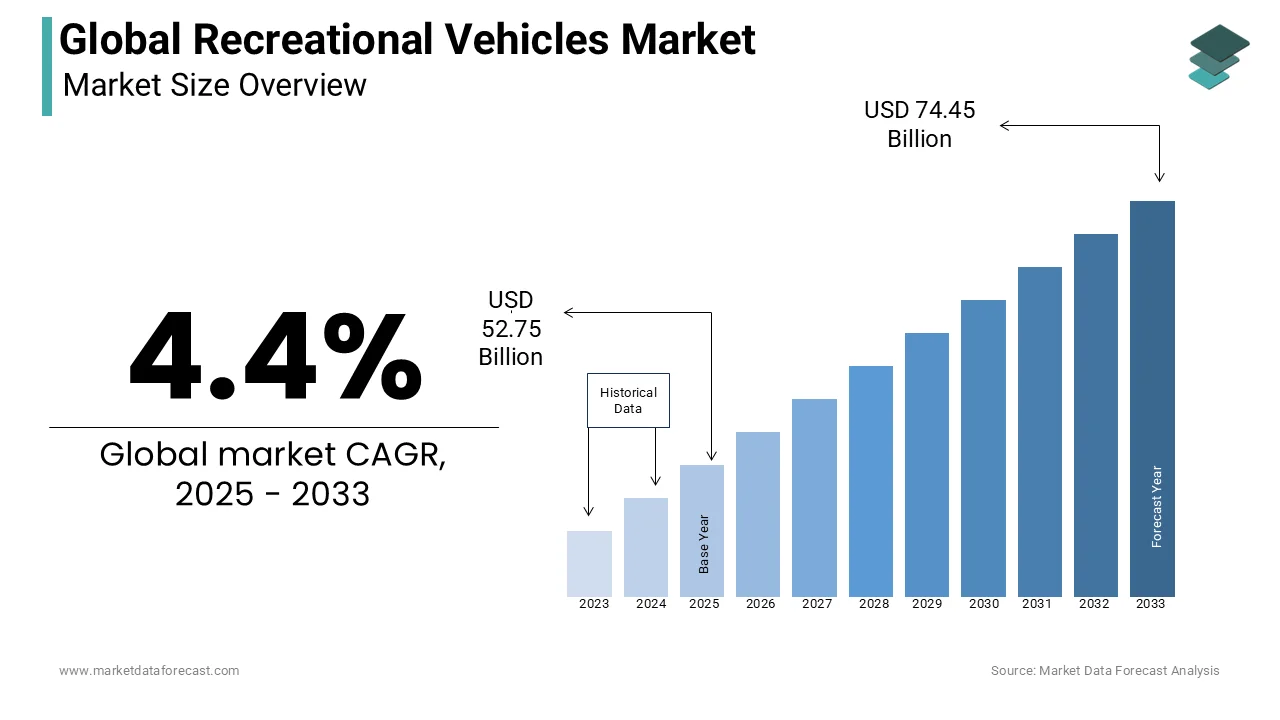

The size of the global recreational vehicles market was worth USD 50.53 billion in 2024. The global market is anticipated to grow at a CAGR of 4.4% from 2025 to 2033 and be worth USD 74.45 billion by 2033 from USD 52.75 billion in 2025.

Recreational Vehicles (RV) provide travelers with mobile living spaces equipped with essential amenities such as sleeping areas, kitchens, and bathrooms which is making them a popular choice for individuals and families seeking adventure and convenience. The demand for RVs has surged in recent years owing to increasing consumer interest in road trips, outdoor recreation, and off-grid living. According to the Recreational Vehicle Industry Association (RVIA), approximately 11.2 million households in the United States own an RV with ownership expanding beyond traditional demographics to include younger consumers such as millennials and Gen Z travelers. Furthermore, the average RV owner spends around 3 to 4 weeks per year traveling in their vehicle, highlighting the lifestyle shift towards flexible and mobile living.

The environmental impact of RV travel has also become a focal point with studies indicating that an average RV trip can produce notably fewer carbon emissions compared to a traditional fly-and-stay vacation. This has promoted the adoption of electric and solar-powered RVs which are gaining popularity among eco-conscious travelers. Additionally, the RV rental has witnessed a growth of over 30% in the past five years because more travelers seek temporary yet immersive outdoor experiences without committing to full ownership.

MARKET DRIVERS

Growing Popularity of Outdoor Recreation

The increasing enthusiasm for outdoor recreational activities has greatly propelled the demand for recreational vehicles (RVs). According to the National Park Service, in 2022, U.S. national parks experienced over 312 million recreation visits that reflects a substantial rise from previous years. This surge indicates a heightened public interest in nature-centric activities such as camping, hiking, and road trips. RVs offer a unique blend of mobility and comfort which is enabling individuals and families to explore natural landscapes while enjoying the conveniences of home. The flexibility to travel to remote destinations without sacrificing essential amenities makes RVs an attractive option for those seeking immersive outdoor experiences. This trend is further supported by data from the Outdoor Industry Association, which reported that in 2022, approximately 55% of Americans engaged in outdoor recreation at least once and thereby pointing out the growing cultural emphasis on outdoor leisure pursuits.

Advancements in RV Technology and Sustainability

Technological innovations and a focus on sustainability have become key drivers in the RV market. Modern RVs are increasingly equipped with advanced features such as solar power systems, energy-efficient appliances, and smart home integration for enhancing both functionality and environmental friendliness. The U.S. Department of Energy highlights that incorporating solar panels can immensely lower reliance on traditional power sources, promoting cleaner energy consumption. Additionally, the development of lightweight materials and aerodynamic designs contributes to improved fuel efficiency which is aligning with global efforts to reduce carbon emissions. The Environmental Protection Agency notes that advancements in vehicle design and materials can lead to substantial decreases in greenhouse gas emissions. These innovations not only appeal to environmentally conscious consumers but also comply with increasingly stringent environmental regulations and thus broadening the market appeal of RVs.

MARKET RESTRAINTS

High Initial Purchase and Maintenance Costs

The substantial upfront investment required to acquire a recreational vehicle (RV) serves as a major barrier for many potential buyers. The initial cost of an RV can range from tens of thousands to hundreds of thousands of dollars depending on the type and amenities included. Beyond the purchase price, owners must also consider ongoing expenses such as maintenance, insurance, storage, and fuel. The annual maintenance and repair costs for RVs can average between $1,000 and $2,000 which is varying with usage and vehicle condition. These cumulative financial obligations can deter prospective buyers, particularly those with limited disposable income or those weighing the cost-effectiveness of RV ownership against alternative travel options.

Environmental Regulations and Emission Standards

Stringent environmental regulations aimed at reducing vehicle emissions present challenges for the RV market. The Environmental Protection Agency (EPA) enforces rigorous standards to curb greenhouse gas emissions from vehicles, including RVs. Compliance with these regulations often necessitates the adoption of advanced technologies and materials and is leading to increased production costs. Additionally, as many RVs are built on heavy-duty chassis, they are subject to more stringent emission standards that is compelling manufacturers to invest in research and development to meet these requirements. The added costs associated with following of the environmental regulations can result in higher retail prices, potentially limiting market accessibility for cost-sensitive consumers.

MARKET OPPORTUNITIES

Demographic Shifts Favoring RV Adoption

The evolving demographic landscape gives a significant opportunity for the recreational vehicle (RV) market. Notably, younger generations are increasingly embracing RV travel. According to the National Park Service's Campground Industry Trends Report, Millennials and Generation X constitute a substantial portion of new campers which is reflecting a growing inclination among these demographics towards RV-based recreation. As these generations age and their purchasing power increases, the propensity to invest in RVs is expected to rise and is potentially expanding the market base and driving future sales.

Government Support and Infrastructure Development

Government initiatives aimed at promoting tourism and outdoor recreation are creating favourable conditions for the RV market. For instance, the U.S. Department of the Interior has invested in expanding and upgrading national parks and campgrounds, enhancing the appeal of RV travel. The country boasts more than 16,000 campgrounds yet they vary significantly. It is providing huge opportunities for RV enthusiasts. Furthermore, tax incentives and grants are being offered to encourage the development of RV-friendly infrastructure, such as dump stations and electric hookups. These efforts not only improve the accessibility and convenience of RV travel but also stimulate local economies through increased tourism.

MARKET CHALLENGES

Economic Sensitivity and Consumer Confidence

The recreational vehicle (RV) market is highly susceptible to economic fluctuations, as RV purchases are often considered discretionary spending. During economic downturns, consumers tend to prioritize essential expenditures which led to a decline in RV sales. For instance, the U.S. Bureau of Economic Analysis reported that in 2022, the outdoor recreation economy contributed substantially to the national GDP. However, this sector is vulnerable to economic cycles and downturns can significantly impact consumer spending on recreational activities. A decrease in consumer confidence can result in postponed or canceled RV purchases is directly affecting the market's revenue streams.

Environmental Concerns and Regulatory Compliance

The RV market faces challenges related to environmental sustainability and adherence to evolving regulations. Recreational vehicles contribute to carbon emissions and environmental degradation, prompting increased scrutiny from regulatory bodies. The U.S. Environmental Protection Agency enforces stringent emission standards that RV manufacturers must comply with, often necessitating costly technological upgrades. Additionally, the U.S. Forest Service stresses that vehicle purchases, including RVs, significantly impact the outdoor recreation economy is emphasizing the need for sustainable practices. Balancing consumer demand for larger as well as more luxurious RVs with the imperative to reduce environmental footprints presents an ongoing challenge for the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Propulsion Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Thor Industries, Inc. (U.S.), Forest River, Inc. (U.S.), Trigano (France), Winnebago Industries, Inc. (U.S.), REV Group (U.S.), Triple E Recreational Vehicles (Canada), The Swift Group (U.K.), Gulf Stream Coach Inc. (U.S.), Pleasure-Way Industries Ltd. (Canada), Groupe Pilote (France), and Others. |

SEGMENT ANALYSIS

By Type Insights

The towable recreational vehicles (RVs) segment held the largest market share of 65.2% in the global market in 2024. The affordability of towable vehicles is majorly propelling the segmental growth in the global market. Towables are priced between $10,000 and $30,000 when compared to motorized RVs that often exceed $100,000. Additionally, this RV type is versatile because they can be pulled by existing vehicles and that is reducing upfront costs. Towables accounted for over 80% of first-time RV buyers which is showing their importance as an entry point into RV ownership.

The Class B segment is anticipated to expand at a promising CAGR of 9.2% from 2025 to 2033 due to the rising fuel prices which averaged $3.90 per gallon in 2023, as reported by the U.S. Energy Information Administration (EIA) . Class B RVs are compact, fuel-efficient, and easier to maneuver, appealing to younger adventurers. Millennials represent a notable share of new RV buyers, driving demand for smaller, flexible options. Furthermore, the rise of remote work has boosted interest in mobile living spaces; a report by Upwork estimates that 36.2 million Americans will work remotely by 2025 up from 16.5 million pre-pandemic. These trends highlight Class B RVs' growing importance in modern travel and lifestyle adaptations.

By Propulsion Type Insights

The non-motorized segment dominated the market by capturing 55.7% of the global market share in 2024 owing to their affordability, with non-motorized RVs costing significantly less than motorized options which is often ranging from $10,000 to $30,000. The U.S. Census Bureau reports that the median household income in 2021 was $70,784, making non-motorized RVs more accessible to middle-income families. Additionally, these RVs can be towed by existing vehicles, reducing upfront costs and enhancing flexibility. Their lightweight design also aligns with fuel efficiency trends, further boosting demand.

The motorized RV segment is the rapidly expanding segment and is predicted to showcase a CAGR of a Compound Annual Growth Rate (CAGR) of 8.3% during the forecast period. The growing disposable incomes that enable consumers to invest in premium motorized RVs is primarily driving the segmental expansion. Additionally, baby boomers account for a significant share of RV owners which is favouring motorized options for comfort during retirement travel. Furthermore, advancements in electric and hybrid propulsion systems are attracting eco-conscious buyers, which projects a 30% rise in electric vehicle adoption by 2030 that is extending to motorized RVs, as noted by the International Energy Agency. These factors emphasize the segment's transformative role in the RV market.

By Application Insights

The personal use segment commanded the recreational vehicles (RVs) market by accounting for 80.3% of the global market share in 2024. The dominating position of personal use segment in the global market is majorly attributed to the increasing disposable incomes and a growing preference for outdoor activities. The personal consumption expenditures on recreation services grew by 5.6% in 2022 and that is exhibiting higher demand for leisure travel. Additionally, RVIA data shows that over 11 million households in the U.S. own an RV with personal use being the primary application. The flexibility and affordability of RVs make them ideal for family vacations and road trips, further solidifying their importance in enhancing personal leisure experiences.

The commercial use segment is projected to register the fastest CAGR of 9.5% over the forecast period owing to the rising demand for mobile offices, food trucks, and temporary housing solutions. The remote work adoption increased greatly during the pandemic which drove businesses to explore mobile office solutions. Furthermore, the Federal Emergency Management Agency (FEMA) emphasizes the role of RVs in disaster relief, deploying over 10,000 units annually for temporary housing. These factors underscore the segment's critical role in addressing diverse commercial needs.

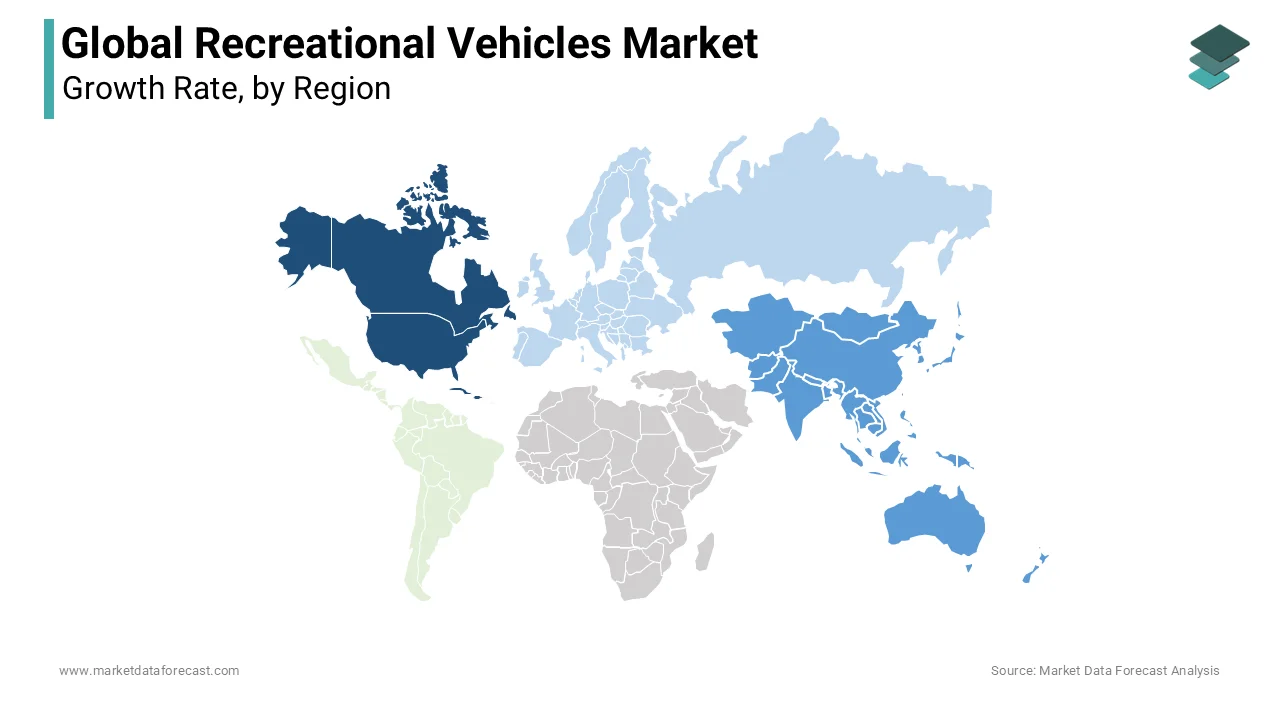

REGIONAL ANALYSIS

North America dominated the recreational vehicles (RV) market by accounting for 57.6% of the global market share in 2024. The growth of the North American region in the global market is primarily credited to the region's well-established RV culture, extensive infrastructure, and a high disposable income among consumers. The U.S. Bureau of Economic Analysis reported that in 2023, the outdoor recreation economy contributed $639.5 billion to the U.S. GDP with RV-related activities being a significant component. The presence of major manufacturers and a robust dealership network further bolster North America's leading position in the RV market.

The Asia-Pacific is the rapidly growing regional segment in the global RV market with a CAGR of 7.2% over the forecast period owing to the surging spendable incomes, a growing middle class, and a rising interest in outdoor recreational activities. In China, for instance, the number of registered RVs reached 148,784 by the end of 2019, marking a 48.1% increase from the previous year, as noted by the International Trade Administration. Government initiatives, such as the development of RV-friendly infrastructure and the introduction of the C6 driver's license for towing trailers, are further propelling market growth in the region.

Europe represents a mature market for recreational vehicles (RVs) with countries like Germany, France, and the United Kingdom leading in both production and ownership. The European Caravan Federation reported that in 2015, new registrations of RVs in Europe totalled 151,293 which indicated a 10% increase over the previous year. This growth is caused by a strong culture of outdoor leisure and well-developed camping infrastructure. The region's emphasis on sustainable travel and compact vehicle designs aligns with consumer preferences, supporting steady market expansion.

In Latin America, the RV market is in its nascent stages but shows promising potential. The region's diverse landscapes and growing middle class contribute to an increasing interest in RV travel. Countries like Brazil and Argentina are witnessing a gradual rise in RV ownership and rental services. However, challenges such as limited infrastructure and economic variability may impact rapid growth. As tourism develops and disposable incomes rise, the RV market in Latin America is expected to expand is offering new opportunities for manufacturers and service providers.

The Middle East and Africa currently represent a niche segment of the global RV market. Factors such as extreme climatic conditions and limited camping culture have historically constrained market development. Nonetheless, increasing tourism initiatives and investments in outdoor recreational activities are fostering gradual adoption. Countries like South Africa and the United Arab Emirates are seeing a growing interest in RVs, particularly among expatriates and adventure tourists. As infrastructure improves and awareness of RV travel benefits spreads, the market in these regions is anticipated to grow modestly in the coming years.

KEY MARKET PLAYERS

Some of the notable companies dominating the global recreational vehicles market profiled in this report are Thor Industries, Inc. (U.S.), Forest River, Inc. (U.S.), Trigano (France), Winnebago Industries, Inc. (U.S.), REV Group (U.S.), Triple E Recreational Vehicles (Canada), The Swift Group (U.K.), Gulf Stream Coach Inc. (U.S.), Pleasure-Way Industries Ltd. (Canada), Groupe Pilote (France), and Others.

TOP 3 PLAYERS IN THE MARKET

Thor Industries, Inc.

Thor Industries stands as the world's largest RV manufacturer. Founded in 1980, the company has expanded its portfolio through strategic acquisitions, including prominent brands such as Airstream, Jayco, and Hymer. These acquisitions have enabled Thor to offer a diverse range of RVs, from luxury motorhomes to affordable travel trailers, catering to a broad spectrum of consumer preferences. Thor's extensive dealer network and commitment to innovation have solidified its leading position in both North American and European markets.

Winnebago Industries, Inc.

Winnebago Industries is renowned for its high-quality motorhomes and travel trailers. The company's dedication to craftsmanship and continuous innovation has established it as a trusted name among RV enthusiasts. Winnebago's product lineup includes a variety of motorized and towable RVs, designed to meet the evolving needs of consumers seeking both comfort and adventure. Their focus on integrating advanced technologies and sustainable practices has further enhanced their market appeal.

Forest River, Inc.

As a subsidiary of Berkshire Hathaway, Forest River, Inc. has made a significant impact on the RV market. The company offers a comprehensive range of RVs, including motorhomes, travel trailers, fifth wheels, and more. Forest River's commitment to quality and value has attracted a loyal customer base. Their expansive manufacturing capabilities and diverse product offerings have enabled them to capture a substantial share of the global RV market.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Strategic Acquisitions and Mergers

One of the most effective strategies used by top RV manufacturers is acquiring smaller companies to expand their market presence and diversify their product offerings. Thor Industries has aggressively pursued acquisitions, including Jayco in 2016 and Hymer in 2019, significantly strengthening its position in North America and Europe. Winnebago Industries followed a similar approach by acquiring Grand Design RV in 2016 and Newmar Corporation in 2019, allowing it to cater to a broader range of customers from luxury motorhomes to towable RVs. Forest River, a subsidiary of Berkshire Hathaway, continuously acquires smaller RV brands and suppliers, ensuring a steady supply chain and production capacity. By consolidating smaller competitors, these market leaders have increased their market share, improved operational efficiencies, and reduced direct competition.

Innovation and Technology Integration

The RV market is evolving rapidly, and leading companies are investing heavily in new technology to stay ahead of the competition. Thor Industries introduced electric RV concepts, such as the eStream, focusing on energy efficiency and sustainability. Winnebago Industries developed the eRV2, an all-electric motorhome designed to meet the increasing demand for eco-friendly travel solutions. Forest River has integrated smart RV technology, enabling owners to control lighting, climate, and security remotely. These innovations enhance customer convenience and position these brands as pioneers in sustainable and technologically advanced RV solutions. As the demand for environmentally friendly and high-tech RVs grows, these manufacturers are securing their future relevance in the market.

Expansion of Dealer and Service Networks

A strong dealer and service network is crucial for improving accessibility and customer satisfaction in the RV market. Thor Industries has established one of the largest dealership networks across North America and Europe, ensuring customers can easily purchase and service their RVs. Winnebago Industries has expanded its dedicated service centers and strengthened dealer partnerships, making post-purchase support more convenient for customers. Forest River has invested in growing its service and warranty network, ensuring its customers have easy access to maintenance and repair facilities. These efforts enhance brand loyalty, increase repeat customers, and provide consistent revenue streams from service and warranty plans. By expanding their distribution channels and after-sales services, these companies solidify their market leadership and ensure customer satisfaction.

COMPETITIVE LANDSCAPE

The Recreational Vehicles (RV) Market is highly competitive, with several established players and new entrants striving to capture market share. The market is dominated by a few key manufacturers, including Thor Industries, Winnebago Industries, and Forest River, which together account for a significant portion of the global RV market. These companies maintain their competitive edge through strategic acquisitions, technological advancements, and extensive dealership networks.

Product innovation, pricing strategies, and brand reputation drive competition in the RV market. With increasing consumer demand for sustainable and smart RV solutions, companies are investing heavily in electric and hybrid RVs, lightweight materials, and advanced automation. Additionally, customer preferences for luxury and customizable RVs have led manufacturers to diversify their product offerings.

The market also sees competition from regional and niche players who cater to specific segments, such as off-road RVs or compact travel trailers. Furthermore, rising fuel prices, economic fluctuations, and supply chain disruptions pose challenges for all market participants.

As demand for RVs continues to grow, especially with the rise of remote work and outdoor tourism, competition is expected to intensify. Companies that can innovate, expand globally, and enhance customer experience will likely emerge as long-term market leaders.

RECENT MARKET DEVELOPMENTS

- In February 2025, Camping World expanded its footprint into its 44th state by acquiring Hitch RV's locations. This strategic move enhances Camping World's presence and service capabilities across the U.S.

- In February 3, 2025, Patrick Industries announced the acquisition of a sidewall supplier, further strengthening its position in the RV supply chain and broadening its product offerings.

- In January 2025, Astro Shapes, a key supplier in the RV market, was acquired by a new private-equity firm. This transition signals continued investment interest in RV-related manufacturing.

MARKET SEGMENTATION

This research report on the global recreational vehicles market has been segmented and sub-segmented based on the type, propulsion type, application, and region.

By Type

- Class A

- Class B

- Class C

- Towable

By Propulsion Type

- Motorized

- Non-motorized

By Application

- Commercial Use

- Personal Use

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the projected growth of the recreational vehicles market?

The recreational vehicles market is expected to grow from USD 52.75 billion in 2025 to USD 74.45 billion by 2033, at a CAGR of 4.4%.

2. What is driving growth in the recreational vehicles market?

Rising outdoor recreation, advanced RV technologies, and eco-friendly options.

3. What challenges does the recreational vehicles market face?

High initial costs, maintenance expenses, and strict environmental regulations.

4. What demographic trends support recreational vehicles market growth?

Millennials and Gen Z show increasing interest in RV travel and off-grid living.

5. What opportunities exist in the recreational vehicles market?

Government support for tourism, infrastructure improvements, and sustainable RV designs.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]