Global Reclaimed Lumber Market Size, Share, Trends, & Growth Forecast Report Segmented By Application (Flooring, Paneling, Beams & Boards, Furniture, and Others), End-use, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Reclaimed Lumber Market Size

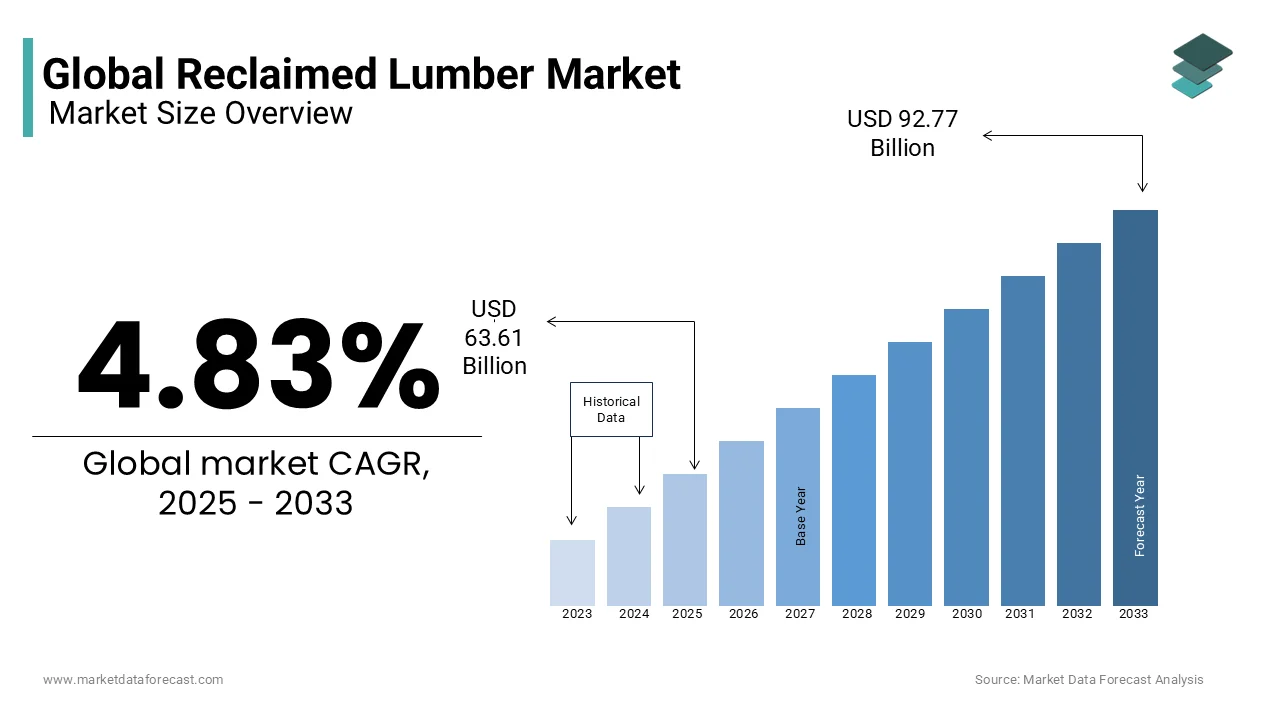

The global Reclaimed Lumber market size was valued at USD 60.68 billion in 2024 and is expected to reach USD 92.77 billion by 2033 from USD 63.61 billion in 2025. The market is projected to grow at a CAGR of 4.83%.

Reclaimed lumber is type of lumber that is often sourced from timber harvested decades or even centuries ago, is prized for its superior durability, unique aesthetic qualities, and environmental benefits. Reclaimed wood typically features characteristics such as tighter grain patterns, rich patinas, and historical charm that are difficult to replicate in newly harvested timber. The growing demand for sustainable building materials is combined with the rising popularity of rustic and vintage interior design has significantly bolstered the reclaimed lumber market in recent years. Environmental consciousness plays a key role in driving the global market expansion. According to the U.S. Environmental Protection Agency (EPA), construction and demolition activities in the United States generate approximately 600 million tons of waste annually, nearly double the amount of municipal solid waste. By repurposing existing wood, the reclaimed lumber helps reduce landfill waste and lowers the demand for freshly harvested timber, contributing to forest conservation efforts. Additionally, reclaimed wood is increasingly being utilized in green building projects, with the U.S. Green Building Council (USGBC) recognizing its role in earning LEED (Leadership in Energy and Environmental Design) certification credits. The reclaimed lumber market is expected to witness sustained growth which is driven by both environmental imperatives and aesthetic preferences.

MARKET DRIVERS

Growing Demand for Sustainable and Eco-Friendly Building Materials

The increasing global emphasis on sustainability and environmental conservation is a major driver of the reclaimed lumber market. The demand for eco-friendly construction materials has surged as industries and consumers become more conscious of their environmental footprint. Reclaimed lumber significantly reduces the need for deforestation is contributing to resource conservation and lowering carbon emissions. According to the U.S. Forest Service, the U.S. loses approximately 6,000 acres of forested land daily due to logging and development. The U.S. Green Building Council highlights that incorporating reclaimed materials can contribute toward LEED certification which further incentivizing sustainable construction practices across residential, commercial, and industrial sectors.

Increasing Popularity of Rustic and Vintage Aesthetic Trends

The growing preference for rustic, vintage, and industrial aesthetics in interior design and architecture is fueling the demand for reclaimed lumber. This wood offers unique visual appeal with its weathered textures, rich patinas, and historical character with qualities that are difficult to achieve with newly milled timber. The National Association of Home Builders reports that over 30% of custom home builders in the U.S. incorporate reclaimed wood into their projects, reflecting consumer demand for distinctive and authentic design elements. Additionally, reclaimed lumber is widely used in furniture manufacturing, flooring, and decorative features is aligning with trends that emphasize natural, sustainable, and historically rich materials. This aesthetic appeal, combined with its environmental benefits, positions reclaimed lumber as a versatile and highly sought-after product in both residential and commercial applications.

MARKET RESTRAINTS

High Processing and Labor Costs

One of the primary restraints in the reclaimed lumber market is the high cost associated with processing and labor. Salvaging wood from old structures requires significant manual effort, including deconstruction, removal of nails and contaminants, and refinishing to meet safety and aesthetic standards. This process is both time-consuming and costly compared to sourcing new timber. The U.S. Department of Labor reports that skilled labor costs in construction and material recovery have risen by approximately 4.7% annually, further increasing the overall expense of reclaimed wood. Additionally, specialized equipment and treatments are often necessary to ensure the wood is free from pests, lead paint, or other hazardous materials, which adds to the total cost and limits its affordability for some consumers.

Inconsistent Supply and Quality Variations

The reclaimed lumber market faces challenges related to inconsistent supply and quality variations. Unlike newly manufactured timber is reclaimed wood availability depends on the demolition of old structures which is unpredictable and region-specific. This irregular supply chain can lead to delays and increased costs for projects requiring large or uniform quantities of reclaimed materials. According to the U.S. Environmental Protection Agency, only a fraction of the 600 million tons of construction and demolition waste generated annually is wood suitable for reuse, limiting access to high-quality materials. Additionally, reclaimed lumber often varies in size, grade, and structural integrity which is requiring additional inspection and processing to meet modern building codes that further complicating its widespread adoption in construction projects.

MARKET OPPORTUNITIES

Expansion of Green Building Certifications and Government Incentives

The increasing adoption of green building certifications and government-backed sustainability initiatives presents significant growth opportunities for the reclaimed lumber market. Programs such as LEED (Leadership in Energy and Environmental Design) and the WELL Building Standard prioritize the use of sustainable materials, including reclaimed wood, in construction projects. The U.S. Green Building Council reports that LEED-certified buildings whereas 105,000 projects have been already certified in 185 countries as of 2023 which is indicating strong momentum in sustainable construction. Additionally, government incentives, such as tax credits and grants for eco-friendly building practices that further encourage the use of reclaimed materials. For example, the U.S. Environmental Protection Agency offers various programs supporting material reuse and waste reduction is positioning reclaimed lumber as a key component in achieving compliance with these standards.

Rising Demand in Commercial and Hospitality Sectors

The commercial and hospitality sectors are increasingly incorporating reclaimed lumber to enhance brand image and meet consumer demand for sustainable environments. Hotels, restaurants, and retail spaces are leveraging the aesthetic and eco-friendly appeal of reclaimed wood in their interior designs is aligning with the growing trend of environmentally responsible business practices. According to the U.S. Department of Commerce, the commercial construction sector experienced a 6.2% growth rate in 2022, with sustainable materials playing a significant role in new developments. Major hospitality chains, including Marriott and Hilton, have incorporated reclaimed wood in their design frameworks to align with corporate sustainability goals. This trend not only enhances the market potential for reclaimed lumber but also establishes it as a preferred material in high-visibility and brand-focused projects.

MARKET CHALLENGES

Complex Regulatory Compliance and Building Code Restrictions

Navigating regulatory compliance and building code restrictions presents a significant challenge in the reclaimed lumber market. Many municipalities have stringent guidelines concerning the structural use of reclaimed wood regarding safety, fire resistance, and pest contamination. The U.S. Department of Housing and Urban Development notes that reclaimed materials often require additional certification or grading to meet modern building standards, adding complexity and cost to projects. Moreover, variability in local codes can deter builders from using reclaimed lumber in structural applications where uniformity and certified strength are critical. This challenge can limit the material's use in large-scale construction by confining its applications primarily to non-structural or decorative purposes.

Limited Consumer Awareness and Market Fragmentation

Limited consumer awareness about the benefits and availability of reclaimed lumber remains a major barrier to market growth. While sustainability is a growing trend, many consumers and even industry professionals are unfamiliar with reclaimed wood's environmental advantages, durability, and unique aesthetic appeal. According to a report from the U.S. Environmental Protection Agency, less than 30% of construction and demolition materials are diverted for reuse by indicating a significant knowledge gap about reclamation practices. Additionally, the reclaimed lumber market is highly fragmented, with numerous small-scale suppliers lacking the resources for large-scale marketing or distribution. This fragmentation hinders market consolidation and makes it difficult for consumers to access consistent, reliable sources of reclaimed wood by slowing broader adoption.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.83% |

|

Segments Covered |

By Application, End-use, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Vintage Timberworks, Inc., Carpentier Hardwood Solutions, NV, Imondi Flooring, TerraMai, Jarmak Corporation, Elemental Republic, Olde Wood Ltd., Trestlewood, True American Grain Reclaimed Wood, Beam and Board, LLC, Altruwood , and others |

SEGMENTAL ANALYSIS

By Application Insights

The furniture segment dominated the market by accounting for 40.7% of the global market share in 2024. The growth of the furniture segment in the global market is driven by the growing consumer preference for sustainable and artisanal furniture which aligns with the rising demand for eco-friendly home decor. The USDA highlights that reclaimed lumber is highly valued for its unique aesthetic appeal, durability, and historical charm by making it a popular choice for crafting high-end furniture pieces. Additionally, the Environmental Protection Agency (EPA) notes that using reclaimed wood in furniture reduces deforestation and minimizes construction waste by up to 25%. The furniture segment's prominence underscores its critical role in promoting environmentally responsible consumption while meeting modern design trends.

The flooring segment is the fastest-growing application in the global reclaimed lumber market. Factors such as the increasing adoption of reclaimed wood flooring in both residential and commercial spaces due to its eco-friendly attributes and timeless aesthetic appeal are propelling the growth of the flooring segment in the global market. The ITA reports that the global demand for sustainable building materials is rising at an annual rate of 10% with reclaimed flooring being a preferred choice for green building certifications like LEED. The United Nations Environment Programme (UNEP) emphasizes that reclaimed wood flooring significantly reduces carbon footprints compared to conventional materials. Additionally, advancements in restoration technologies have improved the durability and finish of reclaimed wood will further boost its popularity. This segment’s rapid expansion highlights its importance in driving sustainable construction practices and meeting evolving consumer preferences.

By End-use

The residential segment had 50.7% of the global market share in 2024. Homeowners increasingly favor reclaimed wood for its aesthetic appeal, sustainability, and historical value. It is widely used in flooring, paneling, beams, and custom furniture which is aligning with the growing trend towards rustic and vintage interior design. Additionally, reclaimed wood contributes to LEED certification is making it attractive in sustainable home construction. The National Association of Home Builders reports that sustainable materials like reclaimed lumber are incorporated in over 35% of new residential builds which is emphasizing the sector's leading role in market growth.

The commercial segment is projected to register the highest CAGR of 8.2% over the forecast period. Businesses in retail, hospitality, and office spaces are increasingly adopting reclaimed wood to enhance brand image and meet sustainability goals. Major hotel chains, restaurants, and corporate offices integrate reclaimed lumber into their interior designs to appeal to environmentally conscious consumers and align with corporate sustainability initiatives. According to the U.S. Environmental Protection Agency, commercial buildings account for nearly 12% of total U.S. greenhouse gas emissions by prompting many companies to adopt eco-friendly materials like reclaimed wood to reduce their environmental footprint. This trend is bolstered by green building certifications and government incentives promoting sustainable construction in the commercial sector.

REGIONAL ANALYSIS

North America was the largest regional segment for reclaimed lumber globally in 2024 by occupying 40.7% of global market share. The dominance of North America in the worldwide market is attributed to the strong emphasis on sustainable construction practices, abundant sources of reclaimable wood from old barns, factories, and warehouses, and widespread adoption of green building certifications like LEED. The National Association of Home Builders reports that over 35% of residential and commercial projects in the U.S. incorporate reclaimed materials. Additionally, the region's well-established infrastructure for demolition and salvage operations supports consistent supply, while rising consumer demand for rustic and vintage aesthetics further propels market growth.

Asia-Pacific is the fastest-growing regional segment in the global reclaimed lumber market and is predicted to showcase a CAGR of 9% over the forecast period. Rapid urbanization, rising disposable incomes, and increasing awareness of sustainable construction practices are majorly boosting the Asia-Pacific market growth. Countries like China, Japan, and Australia are integrating reclaimed wood into both residential and commercial projects which is driven by environmental policies promoting sustainable resource use. The United Nations Environment Programme highlights that Asia-Pacific accounts for over 50% of global construction activity by presenting significant opportunities for reclaimed materials. Additionally, the growing popularity of eco-friendly interior design trends and government initiatives focused on reducing construction waste contribute to the region’s rapid expansion in the reclaimed lumber market.

Europe is expected to see steady growth in the reclaimed lumber market due to stringent environmental regulations and high consumer awareness of sustainability. The European Commission’s Circular Economy Action Plan encourages material reuse is boosting demand for reclaimed wood in both residential and commercial sectors. Latin America, particularly Brazil and Argentina is witnessing moderate growth as reclaimed wood becomes more popular in luxury residential projects and boutique hotels. In the Middle East and Africa, growth is emerging as sustainable building practices gain traction, though infrastructural challenges and limited supply chains may slow progress. However, as green building standards expand globally, these regions are poised to increasingly adopt reclaimed materials in future construction projects.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

Vintage Timberworks, Inc., Carpentier Hardwood Solutions, NV, Imondi Flooring, TerraMai, Jarmak Corporation, Elemental Republic, Olde Wood Ltd., Trestlewood, True American Grain Reclaimed Wood, Beam and Board, LLC, Altruwood are playing dominating role in the global market.

The reclaimed lumber market is characterized by moderate to high competition, driven by the growing global demand for sustainable building materials and unique architectural aesthetics. The market comprises a mix of established players and small, specialized firms, each leveraging unique strategies to differentiate their offerings. Key players such as Vintage Timberworks, Inc., Carpentier Hardwood Solutions, NV, and Imondi Flooring dominate the landscape through extensive product portfolios, sustainable sourcing practices, and global distribution networks.

Competition in this market is largely influenced by the ability to source high-quality, authentic reclaimed wood, maintain consistent supply chains, and offer innovative products tailored to diverse applications, including flooring, furniture, and paneling. Firms that integrate advanced processing technologies and adhere to environmental certifications, such as FSC and LEED compliance, gain a competitive edge, appealing to environmentally conscious consumers and commercial developers.

Regional players often capitalize on local sourcing opportunities, offering unique wood types with historical significance, while global companies expand through strategic partnerships and entry into emerging markets, particularly in Asia-Pacific and Latin America. Additionally, the rise in eco-conscious consumer behavior and green building initiatives continues to intensify competition, with companies investing in marketing strategies that emphasize the environmental and historical value of reclaimed lumber products.

STRATEGIES USED BY THE MARKET PLAYERS

Sustainable Sourcing and Environmental Stewardship

Leading companies prioritize sourcing high-quality reclaimed wood from sustainable and ethical channels. By salvaging wood from old barns, factories, and warehouses, they reduce environmental impact while preserving historical materials. Companies like Vintage Timberworks and Trestlewood emphasize environmental stewardship in their branding, appealing to eco-conscious consumers and aligning with green building certifications like LEED.

Product Diversification and Customization

Firms such as Imondi Flooring and Olde Wood Ltd. diversify their product offerings by expanding into flooring, paneling, beams, and custom-made furniture. They also provide bespoke solutions tailored to specific architectural and design needs, catering to both residential and commercial sectors. This customization enhances customer satisfaction and differentiates their products from mass-produced alternatives.

Technological Integration and Innovation

Adoption of advanced processing techniques and technology integration is a key strategy. Companies like Carpentier Hardwood Solutions incorporate thermally modified wood technologies to enhance product durability and resistance. Others invest in precision milling and finishing equipment to maintain consistency and quality in reclaimed products.

Strategic Partnerships and Collaborations

Forming partnerships with construction firms, architects, and interior designers helps companies expand their market reach. TerraMai collaborates with commercial developers to incorporate reclaimed wood into high-profile projects, including corporate offices and hospitality spaces, boosting brand visibility and credibility.

Expansion into Emerging Markets

To capture new growth opportunities, companies are expanding their operations into emerging markets in Asia-Pacific and Latin America. Firms like Imondi Flooring leverage global sourcing networks and expand distribution channels to meet rising demand in these rapidly urbanizing regions.

Emphasis on Marketing and Storytelling

Many reclaimed lumber companies focus on storytelling to highlight the history and uniqueness of their wood. True American Grain Reclaimed Wood emphasizes the historical significance of their products, which resonates with consumers seeking authenticity and a connection to the past. This emotional appeal enhances brand loyalty and drives sales.

Commitment to Certifications and Quality Assurance

To meet growing demand for sustainable building materials, key players pursue certifications like FSC (Forest Stewardship Council) and LEED compliance. This not only ensures product quality and environmental responsibility but also appeals to institutional buyers and environmentally conscious consumers.

TOP 3 PLAYERS IN THE MARKET

Vintage Timberworks, Inc.

Based in California, Vintage Timberworks specializes in sourcing and supplying reclaimed wood from dismantled structures across North America. Their extensive inventory includes beams, flooring, and paneling materials, catering to both residential and commercial projects. By salvaging high-quality timber, they contribute to environmental conservation efforts and provide clients with unique, historically rich materials that add character to various architectural designs.

Carpentier Hardwood Solutions, NV

Headquartered in Belgium, Carpentier Hardwood Solutions offers a range of reclaimed wood products, including cladding, decking, and interior applications. They emphasize sustainable practices by repurposing aged timber, thereby reducing the demand for newly harvested wood. Their innovative approach includes combining reclaimed wood with modern technologies, such as thermally modifying timber to enhance durability, which appeals to environmentally conscious consumers seeking both aesthetics and longevity in building materials.

Imondi Flooring

Operating out of China, Imondi Flooring specializes in creating high-end flooring solutions from reclaimed wood sourced globally. Their products are known for their distinctive appearance, derived from the rich history of the salvaged materials used. By transforming reclaimed timber into premium flooring, Imondi contributes to waste reduction and promotes sustainable design practices in the construction industry.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Vintage Timberworks, Inc. expanded its product line by introducing reclaimed old-growth redwood lumber and beams sourced from decommissioned structures in the Port of Oakland. This expansion aims to meet the growing demand for high-quality, sustainable materials in residential and commercial projects.

- In January 2024, Carpentier Hardwood Solutions, NV invested in advanced drying technology to enhance the quality and durability of their reclaimed wood products. This investment is expected to improve product performance and expand their market share in the European construction sector.

- In November 2023, Imondi Flooring launched a new collection of reclaimed oak flooring targeting luxury residential developments in urban centers across Asia. This launch aims to capitalize on the increasing demand for sustainable and aesthetically unique flooring solutions.

- In September 2023, TerraMai partnered with a major U.S. hotel chain to supply reclaimed wood paneling for a nationwide renovation project. This partnership is designed to enhance the hotel’s brand image through sustainable design elements and increase TerraMai’s visibility in the hospitality sector.

- In July 2023, Jarmak Corporation acquired an additional 50,000 square feet of warehouse space to increase its inventory capacity for reclaimed timbers and boards. This expansion is intended to streamline operations and meet the growing demand from commercial clients.

- In May 2023, Elemental Republic introduced a line of reclaimed wood furniture targeting eco-conscious consumers in the North American market. This product diversification is anticipated to capture a share of the growing sustainable furniture market.

- In February 2023, Olde Wood Ltd. received certification from the Forest Stewardship Council (FSC) for its reclaimed wood products. This certification reinforces the company’s commitment to environmental responsibility and appeals to clients seeking certified sustainable materials.

- In December 2022, Trestlewood secured a contract to supply reclaimed wood for a large-scale commercial development in the Midwest United States. This project showcases the company’s capacity to handle high-volume orders and solidifies its reputation in the commercial construction industry.

- In October 2022, True American Grain Reclaimed Wood launched an online platform enabling customers to browse and purchase reclaimed wood products remotely. This digital expansion aims to reach a broader audience and adapt to the increasing trend of online shopping.

- In August 2022, Beam and Board, LLC collaborated with local artisans to create custom reclaimed wood installations for a series of boutique retail stores. This initiative highlights the company’s commitment to community engagement and bespoke craftsmanship.

MARKET SEGMENTATION

This research report on the global reclaimed lumber market has been segmented and sub-segmented based on application, end-use, and region.

By Application

- Flooring

- Paneling

- Beams & Boards

- Furniture

- Others

By End-Use

- Residential

- Commercial

- Industrial

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the current size of the global reclaimed lumber market?

As of 2024, the global reclaimed lumber market was valued at approximately USD 60.68 billion.

2. What is the projected growth of the reclaimed lumber market in the coming years?

The market is expected to reach USD 92.77 billion by 2033, growing at a compound annual growth rate (CAGR) of 4.83% from 2025 to 2033.

3. What challenges does the reclaimed lumber market face?

Challenges include high processing and labor costs associated with sourcing and preparing reclaimed wood for new applications. Additionally, variability in the quality and availability of reclaimed lumber can pose issues for large-scale projects.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]