Global Radiotherapy Market Size, Share, Trends & Growth Forecast Report – Segmented By Type (External Beam Radiation Therapy (IMRT, IGRT, Tomotherapy, Stereotactic Radiosurgery, Stereotactic body Radiation Therapy and Proton Therapy), Internal Beam Radiation Therapy and Systemic Radiation Therapy), Application (Skin & Lip Cancer, Head & Neck Cancer, Breast Cancer, Prostate Cancer, Cervical Cancer, Lung Cancer and Spine Cancer), Equipment Type and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2024 to 2032)

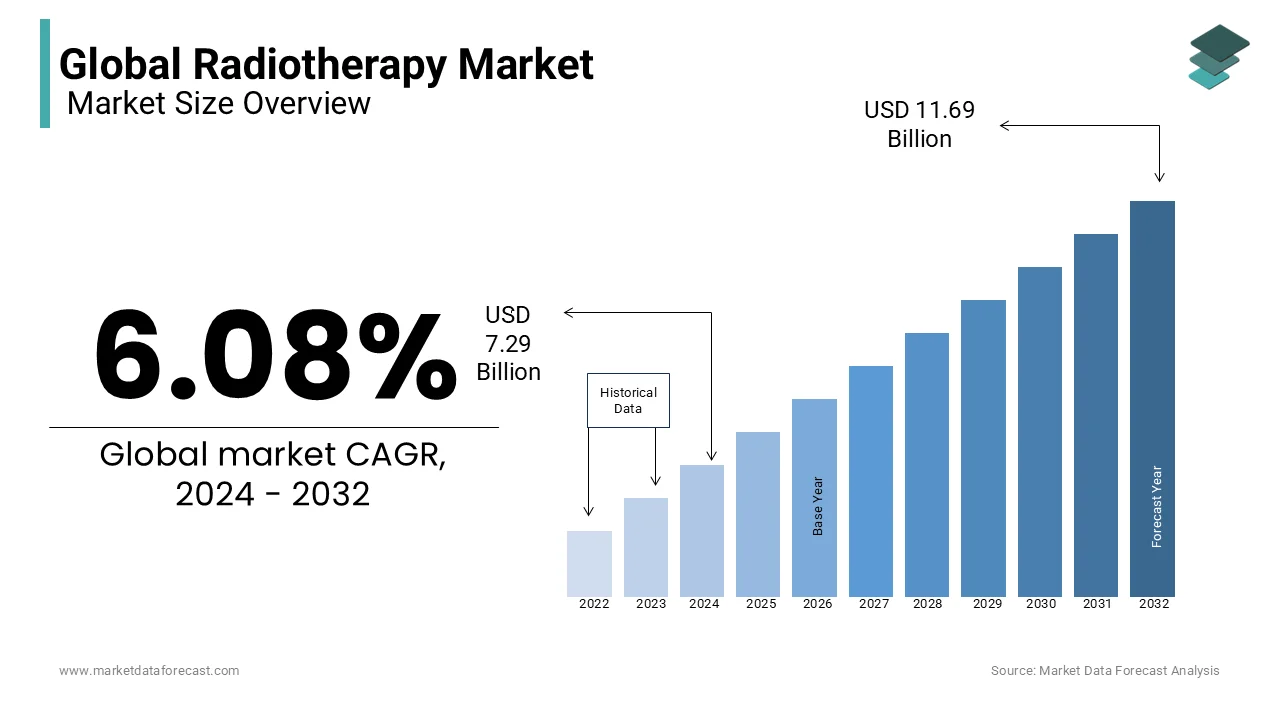

Global Radiotherapy Market Size (2024 to 2032)

In 2023, the global radiotherapy market was valued at USD 6.87 billion and it is expected to reach USD 11.69 billion by 2032 from USD 7.29 billion in 2024, growing at a CAGR of 6.08% during the forecast period.

Radiation is used in radiation therapy, commonly known as radiotherapy, as a cancer treatment to eradicate cancer cells and reduce tumor size. As with X-rays of your teeth or broken bones, radiation is utilized at low doses in X-rays to see inside your body. Radiation therapy damages cancer cells' DNA, which either kills them or limits their growth at high dosages. Cancer cells that have DNA damage that cannot be repaired either cease proliferating or die. When the injured cells expire, the body degrades and eliminates them. Radiation therapy does not instantly eradicate cancer cells. Before cancer cells experience enough DNA damage to cause them to die, days or weeks of treatment are required. After radiation therapy is finished, cancer cells continue to perish for a few weeks or months.

MARKET DRIVERS

The growing cancer patient population worldwide and an increasing number of awareness initiatives are propelling the growth of the global radiotherapy market.

By 2040, it is anticipated that there will be more than 30 million new cases of cancer annually, up from less than 20 million in 2020. In terms of the annual number of new cases, breast cancer surpassed lung cancer in 2020. The National Cancer Registry Programme (ICMR-NCRP) of the Indian Council of Medical Research (ICMR) predicts that there will be 1.57 million cancer cases in India by 2025, up from 1.46 million in 2022. By the end of 2022, global oncology spending will exceed USD 200 billion. The need for radiotherapy will rise as there are more cancer patients worldwide.

The rising demand for radiation therapy is fuelling the growth rate of the global radiotherapy market.

There is a critical need for advancements in treatment technology that can lower the cost and increase the accessibility of radiotherapy services given the rising incidence of cancer worldwide and significant discrepancies in radiotherapy treatments. Megavoltage treatment units, simulators (X-ray or computed tomography), brachytherapy treatment units, dosimetry equipment for QA, shielding blocks, port films, and immobilization devices are a few examples of the equipment required for radiation. Millions of people in underdeveloped nations could have their lives changed by less expensive technologies. Physics, engineering, and other scientists must now concentrate on creating such technologies or adapting existing technologies so that radiotherapy might be more reasonably priced and accessible in developing nations in order to keep up with the growing global radiation oncology movement.

The growing funding by the governments of various countries in the development of the healthcare sector for cancer treatments is boosting the global radiotherapy market growth.

The Global Breast Cancer Initiative (GBCI) was launched by the WHO (World Health Organisation) in 2023 with the goal of evaluating, bolstering, and expanding services for the early diagnosis and management of breast cancer. The Department of Atomic Energy and its grant-in-aid organization, the Tata Memorial Centre, spearheaded the establishment of the National Cancer Grid (NCG), a network of cancer treatment facilities, research facilities, patient organizations, and charitable organizations with the aim of establishing uniform standards of patient care for cancer prevention, detection, and treatment throughout India. These might act as market catalysts for radiotherapy.

MARKET RESTRAINTS

high cost of operation, the requirement of a skilled or trained workforce that is human resources and the maintenance of equipment are primarily hindering the growth of the radiotherapy market.

The expense of setting up new radiotherapy facilities or updating outdated equipment continues to be a significant impediment to expanding access to cancer treatment in low- and middle-income nations (Developing countries). In fact, due to financial constraints, radiotherapy has not been included in the construction of cancer centers in Rwanda and Kenya (Africa). It is difficult to estimate the cost of providing safe and effective radiation since it involves so many factors, such as building infrastructure and purchasing equipment, hiring staff, managing patient throughput, maintaining equipment, and paying for individual patients. The costs of opening and operating a radiation center fluctuate greatly between nations due to a variety of reasons, including political unrest and geographic location. A sizable portion of the cost of administering radiotherapy goes towards equipment, such as teletherapy machines, brachytherapy after loaders, and the necessary ancillary elements, such as planning software, radioactive isotopes, and staffing, such as doctors, medical physicists, radiation therapists, and nurses. Perhaps even more difficult than paying employees is financing equipment in developing nations. In low-income nations, the cost of capital equipment can be as high as 81%, while in high-income nations, salaries make up most costs while equipment only makes up 30% of them. Without competent labor, cancer control programs meant to lower cancer-related morbidity and death cannot be effectively carried out. In underdeveloped nations, particularly in Africa, and particularly in the sub-Saharan region, the availability of human resources for the delivery of radiation presents a significant difficulty.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

Segments Covered |

By Type, Application, Equipment Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Key Market Players |

Nordion Inc. (Canada), RaySearch Laboratories AB (Sweden), Ion Beam Applications SA (Belgium), C. R. Bard Inc. (U.S.), Mevion Medical Systems Inc. (U.S.), Varian Medical Systems Inc. (U.S.), IsoRay Medical Inc. (U.S.), Elekta AB (Sweden), Accuray Incorporated (U.S.) and Mitsubishi Electric Corporation (Japan). |

SEGMENTAL ANALYSIS

Global Radiotherapy Market Analysis By Type

The external beam radiation therapy segment had the largest share of the worldwide market in 2023 and is expected to continue ruling the market throughout the forecast period. The domination of the EBRT segment is primarily driven by the growing number of cancer patients and technological developments in radiation therapy. The growing awareness among cancer patients and healthcare professionals regarding the benefits of radiotherapy is further promoting the segmental expansion. Among the sub-segments of EBRT, the IMRT segment is the most popular and is predicted to account for a considerable of the global radiation market during the forecast period. The IGRT sub-segment is also predicted to account for a substantial share of the global market during the forecast period.

Global Radiotherapy Market Analysis By Application

The prostate cancer segment is estimated to hold the largest share of the global radiotherapy market during the forecast period. Prostate cancer is prevalent among men. The American Cancer Society says prostate cancer is the second most common cancer among men in the United States and consumes a significant number of lives every year. External beam radiation therapy is a popular and effective treatment option for cancer. Factors such as the growing prostate cancer population worldwide, increasing awareness among people regarding the treatment options and screening programs for prostate cancer, and the growing aging population are propelling the growth of the prostate cancer segment. In addition, high accuracy and minimal side effects with radiotherapy to treat prostate cancer are boosting the adoption and contributing to segmental growth.

The breast cancer segment is expected to grow at a promising CAGR during the forecast period. The growing prevalence of breast cancer and the increasing usage of radiotherapy to cure breast cancer by healthcare providers are propelling the segment’s growth rate.

The lung cancer segment is estimated to hold a considerable share of the worldwide market during the forecast period.

Global Radiotherapy Market Analysis By Equipment Type

The radiation therapy simulators segment is growing at a higher rate and will keep rising during the forecast period. It is frequently used to lower the danger of radiation exposure for medical professionals. New technologies are aiding segment expansion through innovation and development. The market for linear accelerators, which are frequently employed in radiation procedures, accounted for a substantial share of the global market in 2023. As a result, there is a big market need for it. Radiation therapy treatments are now more accurate and precise thanks in large part to the treatment planning system. Consequently, predicted to rise significantly over the projection period.

REGIONAL ANALYSIS

The North American region held the majority share in the global radiotherapy market in 2023.

The domination of the North American region is expected to continue during the forecast period owing to factors such as an increase in the prevalence of cancer, established radiotherapy system providers, replacement of older therapies with newer ones, and increasing healthcare expenditure. However, improved healthcare infrastructure, the presence of key market players, and a significant increase in research and development activities carried out in radiation oncology are expected to drive the market growth of the radiotherapy market in this region. The United States is contributing the highest shares to the market, owing to increasing investments in developing new devices in healthcare. In addition, the increasing occurrence rate of rare diseases across North America also enhances the market's demand.

Europe was the second-largest regional segment in the global market in 2023.

Europe is expected to hike at a robust CAGR during the forecast period. Improving healthcare infrastructure, rising healthcare expenditure and key market players are propelling the demand for the radiotherapy market over the forecast period. Germany and UK are significant contributors to the market shares in this region. Constant economic growth is one of the significant factors for the market to grow tremendously.

Asia-Pacific is projected to witness the highest CAGR during the forecast period.

Introducing new radiation oncology therapy systems in healthcare centers and hospitals in emerging countries like Japan, China, and India drives the market's demand. Many collaborations have been made in this region to provide advanced proton therapies. China is anticipated to dominate the radiotherapy market as it is the leading country with a rapidly increasing diagnosis rate. Rising initiatives by the government to create awareness among the people about the importance of diagnosis are fuelling the demand in the radiotherapy market.

The Middle East and Africa are anticipated to have better growth in the radiotherapy market during the forecast period. The radiotherapy market in MEA is majorly driven by increased healthcare expenditure, advanced radiotherapy systems, and increasing disposable income to improve healthcare infrastructure facilities.

KEY PLAYERS IN THE GLOBAL RADIOTHERAPY MARKET

Nordion Inc. (Canada), RaySearch Laboratories AB (Sweden), Ion Beam Applications SA (Belgium), C. R. Bard Inc. (U.S.), Mevion Medical Systems Inc. (U.S.), Varian Medical Systems Inc. (U.S.), IsoRay Medical Inc. (U.S.), Elekta AB (Sweden), Accuray Incorporated (U.S.) and Mitsubishi Electric Corporation (Japan) are some of the notable companies in the global radiotherapy market.

RECENT HAPPENINGS IN THIS MARKET

- In September 2022, Elekta announced that Karkinos Healthcare, a famous Indian healthcare organization, would buy more than ten linear accelerator (linac) systems and strategically place them around the nation to expand patients' access to cutting-edge precision cancer therapy.

- In June 2021, Elekta (Sweden)'s Elekta Harmony radiation therapy system has been given US FDA 510(k) clearance.

- Accuracy Incorporated (U.S.) introduced The CyberKnife S7 System in June 2020. This cutting-edge tool combines speed, superior precision, and real-time AI-driven motion tracking and synchronization treatment delivery for all stereotactic radiosurgery (SRS) and stereotactic body radiation therapy (SBRT) treatments.

DETAILED SEGMENTATION OF THE GLOBAL RADIOTHERAPY MARKET INCLUDED IN THIS REPORT

This market research report on the global radiotherapy market has been segmented based on the type, application, equipment and region.

By Type

- External Beam Radiation Therapy

- Intensity-Modulated Radiation Therapy (IMRT)

- Image-Guided Radiation Therapy (IGRT)

- Tomotherapy

- Stereotactic Radiosurgery

- Stereotactic body Radiation Therapy

- Proton Therapy

- Internal Beam Radiation Therapy

- Systemic Radiation Therapy

By Application

- Skin & Lip Cancer

- Head & Neck Cancer

- Breast Cancer

- Prostate Cancer

- Cervical Cancer

- Lung Cancer

- Spine Cancer

By Equipment Type

- Linear Accelerators

- Radiation Therapy Simulators

- Treatment Planning Systems

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How much is the global radiotherapy market going to be worth by 2032?

As per our research report, the global radiotherapy market size is projected to be USD 11.69 billion by 2032.

Which region is growing the fastest in the global radiotherapy market?

Geographically, the North American radiotherapy market accounted for the largest share of the global market in 2023.

At What CAGR, the global radiotherapy market is expected to grow from 2024 to 2032?

The global radiotherapy market is estimated to grow at a CAGR of 6.08% from 2024 to 2032.

Which are the significant players operating in the radiotherapy market?

Nordion Inc. (Canada), RaySearch Laboratories AB (Sweden), Ion Beam Applications SA (Belgium), C. R. Bard Inc. (U.S.), Mevion Medical Systems Inc. (U.S.), Varian Medical Systems Inc. (U.S.) are some of the significant players operating radiotherapy market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]