Global PV Inverter Market Research Report – Segmentation By Product (Central PV inverter, String PV inverter, Micro PV inverter, Other), By Application (Utilities, Commercial, Residential & Industrial), By Type (On-grid, and Off-grid), By Region (North America, Europe, Asia Pacific, Latin America, Middle East - Africa) – Industry Forecast 2024 to 2032.

Global PV Inverter Market Size (2024-2032):

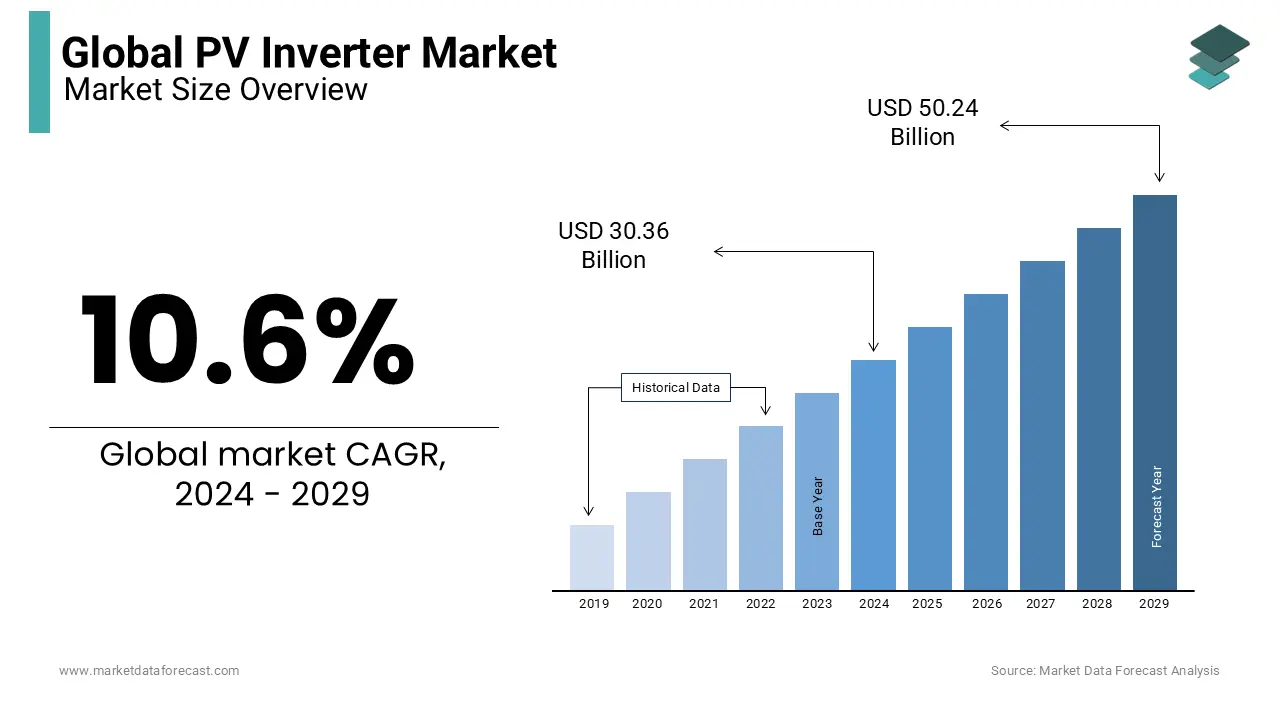

The Global PV Inverter Market was worth US$ 27.45 billion in 2023 and is anticipated to reach a valuation of US$ 67.97 billion by 2032 from US$ 30.36 billion in 2024 and is predicted to register a CAGR of 10.6% during 2024-2032.

MARKET DRIVERS

The PV inverter optimizes the performance of solar power systems, ensuring that maximum electricity is generated from sunlight. This enhanced efficiency not only reduces energy waste but also leads to cost savings for solar system owners. Therefore, consumers and businesses seek ways to reduce their energy bills and environmental impact; the value of PV inverters in maximizing the benefits of solar installations is driving the growth of these systems.

Ongoing technological advancements in every industry are driving the PV inverter market growth. Innovations such as microinverters and power optimizers enhance the performance and reliability of solar systems.

Microinverters, for instance, allow for panel-level optimization, ensuring that shaded or underperforming panels do not affect the output of the entire array. Therefore, these advancements improve the overall efficiency and flexibility of solar energy systems, making them more attractive and accessible to a broader range of consumers and industries.

PV Inverter Market value is growing at a faster rate due to Government incentives and policies. Globally, numerous governments are incentivizing solar power adoption through measures like tax credits, rebates, and feed-in tariffs. These financial benefits increased the market growth for PV inverters, as they are essential components for converting solar energy into electricity. As governments worldwide continue to support the adoption of clean energy, the PV inverter market experiences growth, benefiting both manufacturers and consumers seeking affordable and sustainable energy solutions.

MARKET RESTRAINTS

The PV Inverter Market faces significant restraints due to the intermittent nature of solar power generation. Solar energy production relies on sunlight, making it sensitive to factors like weather conditions and daylight hours. Also, PV inverters may not consistently operate at their optimal efficiency levels, leading to variations in energy output. As a result, this intermittent solar generation can impact the overall effectiveness of PV inverters, influencing their adoption and highlighting the need for complementary technologies like energy storage to address the intermittency and ensure a steady power supply.

IMPACT OF COVID-19 ON THE GLOBAL PV INVERTER MARKET

The COVID-19 pandemic had a significant impact on the PV Inverter Market. Initially, as supply chains and manufacturing facilities faced disruptions, there were challenges in the production and distribution of PV inverters. The solar industry experienced delays in project installations and a slowdown in demand due to economic uncertainties. However, the pandemic also underscored the importance of renewable energy and energy resilience. With more people working remotely and a growing emphasis on sustainable practices, there was an increased interest in solar power systems. As economies adapted to the new normal, the PV inverters rebounded, particularly in residential and commercial sectors. In the long term, the PV Inverter Market is expected to recover and continue growing. Advancements in PV inverter technology, declining costs, and evolving regulations supporting clean energy adoption will drive market expansion. The pandemic accelerated the transition to renewable energy solutions, positioning PV inverters as essential components of the global energy landscape.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

10.6% |

|

Segments Covered |

By Product, Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Huawei, SMA Solar Technology, Fronius International, ABB, Enphase Energy, Solaredge Technologies, Delta Electronics, GoodWe, Sungrow Power Supply, Growatt New Energy Technology, and Others. |

SEGMENTAL ANALYSIS

Global PV Inverter Market Analysis By Product

Based on product, the String PV inverters segment holds the largest market share of 45% during the forecast period due to its cost-effective and flexible performance. Designed to work with a string of solar panels, these inverters offer easy scalability by adding more strings. They excel in scenarios with potential shading or panel mismatch issues, as each string operates independently. String inverters are also commonly used in small to medium-scale commercial projects, making them a versatile choice for a range of solar installations.

Central PV inverters will hold the second biggest market during the forecast period, particularly for utility-scale installations. Renowned for their high power capacity and efficiency, they excel in handling large numbers of solar panels. Ideal for grid-tied solar power plants, central inverters offer cost-effective solutions with straightforward installation and maintenance. Their widespread use in utility-scale projects underscores their importance in scenarios where optimizing efficiency and maximizing power output are paramount.

Global PV Inverter Market Analysis By Type

Based on Type, On-grid PV inverters are dominating the market and are expected to grow at a promising CAGR during the forecast period. Their prominence reflects the global shift toward renewable energy and the growing desire to reduce electricity costs through grid connectivity.

Off-grid PV inverters are estimated to showcase a notable CAGR during the forecast period. They are vital for supplying reliable electricity in areas with no grid access, including remote homes, rural electrification initiatives, and standalone solar devices.

Global PV Inverter Market Analysis By Application

Based on application type, the utility sector holds the largest market share, 45%, during the forecast period due to the high-capacity inverters in large-scale solar installations. These large installations typically use central PV inverters to manage and synchronize power production efficiently. Government incentives, renewable energy goals, and environmental considerations have prompted substantial investments in utility-scale solar projects. As a result, utilities represent a significant share of the PV inverter market.

The residential and industrial segment has experienced notable growth, primarily driven by a strong focus on residential applications. Residential users are increasingly adopting solar energy to lower energy costs, attain energy self-sufficiency, and support environmental sustainability. Residential PV inverters, including microinverters, are tailored for smaller-scale installations on rooftops. While industrial applications are relevant, they constitute a smaller proportion of this segment. The predominance of the residential market is attributed to the improving affordability of solar systems, government incentives, and the rising environmental awareness among homeowners.

REGIONAL ANALYSIS

Asia-Pacific is leading the PV inverter market and holds a 44% market share during the forecast period. The region's solar energy capacity has significantly expanded due to government support, incentives, and renewable energy goals. A growing share for clean energy, along with extensive solar installations in countries like China and India, has secured a major share of the PV inverter market size. Additionally, Asia-Pacific's leadership is reinforced by the presence of leading PV inverter manufacturers and a robust manufacturing ecosystem.

North America is the next dominating market, and it has been experiencing substantial growth in the PV inverter market. Federal tax incentives and state-level renewable energy initiatives have generated a surge in solar energy interest. Residential and commercial solar installations are increasing, fueling market expansion. The United States, in particular, is a hub for numerous solar power projects, and the region's PV inverter market share continues to ascend.

Europe is expected to grow at a faster rate during the forecast period. With well-established solar power sectors, the region benefits from supportive regulatory policies, feed-in tariffs, and net-metering programs. Nations such as Germany, Spain, and Italy have made significant solar investments, contributing to Europe's substantial market share in PV inverters. The European Union's dedication to sustainability and renewable energy objectives further propels the adoption of PV inverters for residential and commercial applications in the region.

The Middle East and Africa region is emerging as a growing market for PV inverters.

Latin America is also experiencing a surge in solar energy and PV inverter adoption.

KEY PLAYERS IN THE GLOBAL PV INVERTER MARKET

Companies playing a prominent role in the global PV inverter market include Huawei, SMA Solar Technology, Fronius International, ABB, Enphase Energy, Solaredge Technologies, Delta Electronics, GoodWe, Sungrow Power Supply, Growatt New Energy Technology, and Others.

RECENT HAPPENINGS IN THE GLOBAL PV INVERTER MARKET

- In 2023, Huawei introduced the FusionSolar Smart PV Solution, integrating digital technology to enhance the monitoring and management of solar systems.

- In 2023, SMA launched the Sunny Tripower CORE1, a three-phase inverter designed for commercial solar installations, offering improved energy yield.

- In 2023, SolarEdge continued to develop its DC-optimized inverter technology, offering better energy harvesting and smart energy management features.

DETAILED SEGMENTATION OF THE GLOBAL PV INVERTER MARKET INCLUDED IN THIS REPORT

This global PV inverter market research report has been segmented and sub-segmented based on product, type, application, and region.

By Product

- Central PV inverter

- String PV inverter

- Micro PV inverter

- Other

By Type

- On-grid

- Off-grid

By Application

- Utilities

- Commercial

- Residential & Industrial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. What is the PV Inverter Market growth rate during the projection period?

The Global PV Inverter Market is expected to grow with a CAGR of 10.6% between 2024-2032.

2. What can be the total PV Inverter Market value?

The Global PV Inverter Market size is expected to reach a revised size of USD 67.97 billion by 2032.

3. Name any three PV Inverter Market key players?

ABB, Enphase Energy, and Solaredge Technologies are the three PV Inverter Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]