Global Process Analytical Technology Market Size, Share, Trends & Growth Forecast Report By Product (Analyzers, Sensors & Probes, Samplers, Software & Services), Technique (Spectroscopy, Chromatography, Particle Size Analysis, Electrophoresis), Monitoring Method (On-line, In-line, At-line, Off-line), Application (Small Molecules, Large Molecules, Manufacturing Applications), End Use (Pharmaceutical & Biotechnology Companies, CROs,CMOs & CDMOs), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Process Analytical Technology Market Size

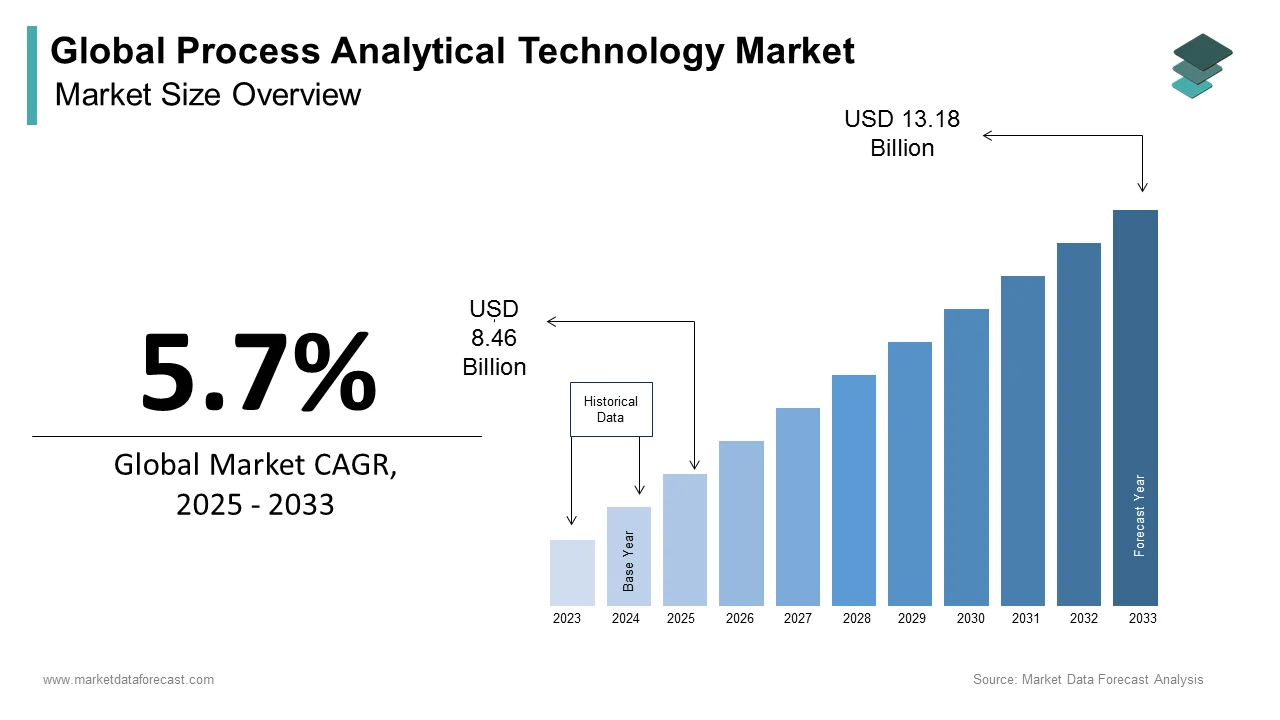

The size of the global process analytical technology market was worth USD 8 billion in 2024. The global market is anticipated to grow at a CAGR of 5.7% from 2025 to 2033 and be worth USD 13.18 billion by 2033 from USD 8.46 billion in 2025.

Process Analytical Technology (PAT) is a systematic framework for designing, analyzing, and controlling manufacturing processes through real-time measurements of critical quality parameters. It includes a suite of tools, techniques, and methodologies aimed at improving process understanding by making sure of product quality, and optimizing operational efficiency. The U.S. Food and Drug Administration (FDA) defines PAT as a mechanism to design and control manufacturing processes by measuring critical process parameters and quality attributes and thereby fostering innovation and compliance in industries such as pharmaceuticals, biotechnology, and food processing.

The current scenario gives emphasis to the pivotal role of PAT in allowing real-time monitoring and data-driven decision-making. For instance, 65% of pharmaceutical manufacturers have integrated PAT tools into their operations to meet stringent regulatory standards and enhance production efficiency. Furthermore, the European Medicines Agency highlights that the adoption of PAT has contributed to a notable reduction in batch failures which is underscoring its importance in minimizing waste and improving yield. PAT systems are becoming increasingly sophisticated due to advancements in artificial intelligence and machine learning and is allowing predictive analytics and process optimization. The growing demand for personalized medicine when coupled with the rise of continuous manufacturing practices further propels the adoption of PAT. PAT emerges as a cornerstone technology because industries strive to balance innovation with sustainability are driving transformation across manufacturing ecosystems while aligning with global regulatory frameworks and industrial digitization trends.

MARKET DRIVERS

Regulatory Support and Frameworks

Government agencies have established frameworks to encourage the adoption of Process Analytical Technology (PAT) in pharmaceutical manufacturing. The U.S. Food and Drug Administration (FDA) introduced a guidance document titled "PAT — A Framework for Innovative Pharmaceutical Development, Manufacturing, and Quality Assurance," which outlines a regulatory framework to support innovation and efficiency in pharmaceutical development, manufacturing, and quality assurance. This framework is designed to facilitate the implementation of PAT by providing a clear regulatory pathway and thereby encouraging manufacturers to adopt these technologies to enhance product quality and process efficiency.

Advancements in Analytical Technologies

The development of advanced analytical tools has significantly contributed to the growth of the PAT market. For instance, the FDA has explored the use of water proton Nuclear Magnetic Resonance (wNMR) as a noninvasive PAT tool for manufacturing automation. This technology allows for the quantitative and noninvasive evaluation of drug products which is providing rapid and automatable data collection without compromising product integrity. Such advancements enable more precise monitoring and control of manufacturing processes and are leading to improved product quality and consistency.

MARKET RESTRAINTS

High Implementation Costs

Implementing Process Analytical Technology (PAT) involves substantial financial investment which can be a significant barrier for many organizations. The U.S. Food and Drug Administration (FDA) acknowledges that the adoption of PAT requires considerable resources for the development and validation of new analytical methods as well as for the integration of advanced technologies into existing manufacturing processes. These costs encompass not only the procurement of sophisticated analytical instruments but also expenses related to staff training and process re-engineering. The FDA's guidance on PAT highlights that the financial burden associated with these implementations can deter companies and especially small and medium-sized enterprises from adopting these advanced technologies and consequently limiting the widespread utilization of PAT in the industry.

Complexity of Integration

Integrating PAT into existing manufacturing workflows presents grave challenges owing to the complexity of aligning new analytical technologies with established processes. The FDA notes that successful PAT implementation requires a thorough understanding of both the manufacturing process and the analytical methods employed. This necessitates extensive process redesign and validation efforts to ensure that the integration does not disrupt production or compromise product quality. The complexity of this integration process can be a deterrent for companies, as it demands substantial time and expertise to achieve seamless incorporation of PAT into current manufacturing systems.

MARKET OPPORTUNITIES

Regulatory Support for Quality by Design (QbD) Initiatives

Regulatory agencies have been actively promoting Quality by Design (QbD) approaches, which integrate Process Analytical Technology (PAT) to enhance pharmaceutical development and manufacturing. The European Medicines Agency (EMA) established a PAT team in 2003 to support QbD activities within the European Union that is emphasizing the importance of timely measurements of critical quality attributes during processing. This initiative underscores the regulatory commitment to encouraging the adoption of PAT is providing a structured framework that facilitates innovation and efficiency in pharmaceutical manufacturing.

Advancements in Noninvasive Analytical Technologies

Recent developments in noninvasive analytical methods have opened new avenues for PAT applications. The U.S. Food and Drug Administration (FDA) has explored the use of water proton Nuclear Magnetic Resonance (wNMR) as a PAT tool capable of quantitatively and noninvasively evaluating drug products. This technology allows for rapid as well as automatable assessments without compromising product integrity and is offering potential improvements in manufacturing automation and product quality surveillance. Such advancements present significant opportunities for integrating innovative analytical technologies into PAT frameworks which is enhancing process control and efficiency.

MARKET CHALLENGES

Data Security and Integrity Concerns

Implementing Process Analytical Technology (PAT) necessitates the integration of advanced data acquisition and analysis systems within manufacturing processes. The U.S. Food and Drug Administration (FDA) emphasizes the importance of maintaining data integrity as outlined in their guidance on current good manufacturing practices. Maintaining the security and integrity of data collected through PAT systems is crucial because any compromise can lead to big regulatory and compliance issues. The FDA's guidance on PAT highlights the need for robust data management practices to uphold data integrity throughout the manufacturing process.

Limited Standardization Across the Industry

The adoption of PAT is hindered by a lack of standardized methodologies and practices across the pharmaceutical industry. The European Medicines Agency (EMA) has recognized this challenge and is noting that the variability in PAT applications can cause inconsistencies in process monitoring and control. This lack of standardization complicates the implementation of PAT, as companies must navigate differing approaches and technologies, potentially leading to inefficiencies and increased costs. The EMA's discussions on PAT underscore the need for harmonized standards to facilitate broader adoption and effective utilization of these technologies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Technique, Monitoring Method, Application, End-use, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Thermo Fisher Scientific Inc., Repligen Corporation, Bruker Corporation, Agilent Technologies, Inc., ABB Ltd., Danaher Corporation (Ab Sciex LLC), PerkinElmer, Inc., Emerson Electric Co., Sartorius AG, Mettler-Toledo, and Others. |

SEGMENT ANALYSIS

By Product Insights

The analyzers segment held 30.7% of the global market share in 2024. The growth of the analyzers segment is majorly driven by their essential role in monitoring critical process parameters such as temperature, pressure and pH across various industries including pharmaceuticals, oil and gas, and chemicals. The U.S. Food and Drug Administration (FDA) emphasizes the importance of analyzers in ensuring product quality and process efficiency which is focuses on their role in real-time monitoring and control during manufacturing.

The sensors and probes segment is projected to witness the fastest CAGR of 5.5% over the forecast period owing to the increasing demand for real-time, precise monitoring of critical process parameters in manufacturing. The National Institute of Standards and Technology (NIST) throws light on the advancements in sensor technology and is observing their improved sensitivity and accuracy in detecting chemical and physical changes during production. These improvements facilitate better process control, reduce variability, and ensure higher product quality that is making sensors and probes indispensable in modern manufacturing environments.

By Technique Insights

The spectroscopy segment dominated the PAT market by holding 36.3% of the global market share in 2024. The domination of spectroscopy segment in the global market is credited to its comprehensive usage in real-time monitoring and control of manufacturing processes across industries such as pharmaceuticals and biotechnology. Techniques like Near-Infrared (NIR) and Raman spectroscopy are widely utilized for their non-destructive analysis capabilities which is enabling the assessment of critical quality attributes without compromising product integrity. The U.S. Food and Drug Administration (FDA) recognizes the importance of these techniques in ensuring product quality and process efficiency and is highlighting their role in facilitating real-time release testing and enhancing manufacturing control strategies.

The chromatography segment is growing rapidly and is predicted to exhibit a CAGR of 7.6% during the forecast period due to the increasing demand for high-precision analytical techniques in the pharmaceutical and chemical industries. Liquid Chromatography (LC) and Gas Chromatography (GC) are pivotal in separating and analyzing complex mixtures which is ensuring the purity and potency of products. The National Institutes of Health (NIH) stresses on the critical role of chromatography in drug development, particularly in the identification and quantification of active pharmaceutical ingredients and impurities and thereby supporting stringent regulatory compliance and quality assurance measures.

By Monitoring Method Insights

The on-line monitoring segment led the market by occupying 47.8% of the global market share in 2024. The on-line monitoring method involves continuous real-time analysis of critical process parameters which is allowing immediate adjustments to maintain optimal manufacturing conditions. The U.S. Food and Drug Administration (FDA) gives special the importance of on-line monitoring in its guidance on PAT, highlighting its role in enhancing process understanding and control. The FDA notes that on-line analysis allows for timely decision-making, reducing variability and ensuring consistent product quality. This approach is particularly vital in industries such as pharmaceuticals, where maintaining stringent quality standards is essential.

The in-line monitoring segment is projected to be the fastest-growing segment in the PAT market and is anticipated to register a CAGR of 7.61% during the forecast period. The in-line monitoring method integrates analytical instruments directly into the production line allowing for immediate analysis without the need for sample extraction. The National Institute of Standards and Technology (NIST) highlights the advantages of in-line monitoring, noting that it provides real-time data that can be used to control processes more effectively. NIST emphasizes that in-line monitoring enhances process efficiency by reducing delays associated with off-line analysis and minimizing the risk of contamination. This capability is increasingly important in industries aiming to implement continuous manufacturing processes as it supports the seamless operation and real-time quality assurance.

By Application Insights

The small molecules segment captured the largest share of 40.3% in the global market in 2024. The domination of small molecules segment in the global market is attributed to the extensive use of PAT in the development and manufacturing of small-molecule pharmaceuticals. The U.S. Food and Drug Administration (FDA) emphasizes the importance of PAT in ensuring the quality and efficiency of small-molecule drug production which is highlighting its role in real-time monitoring and control of critical process parameters. The FDA's guidance on PAT underscores its significance in enhancing process understanding and ensuring consistent product quality in small-molecule manufacturing.

The large molecules segment is projected to experience the highest CAGR of 12.3% during the forecast period. The growing adoption of PAT in biopharmaceutical manufacturing to produce large molecules such as proteins and monoclonal antibodies is one of the major factors boosting the expansion of the segment in the global market. The National Institutes of Health (NIH) highlights the complexity of large-molecule drugs and is noting that their intricate structures require precise manufacturing processes to ensure efficacy and safety. PAT enables real-time monitoring and control of these complex processes, facilitating higher yields and consistent product quality which is crucial in large-molecule drug production.

By End Use Insights

The pharmaceutical and biotechnology companies segment led the PAT market by accounting for 53.5% of the global market in 2024. The growth of the pharmaceutical and biotechnology companies segment in the global market is attributed to the extensive adoption of PAT frameworks within these industries to enhance manufacturing processes and ensure product quality. The U.S. Food and Drug Administration (FDA) emphasizes the importance of PAT in pharmaceutical manufacturing which is highlighting its role in facilitating real-time monitoring and control of critical process parameters. The FDA's guidance on PAT underscores its significance in improving process understanding and ensuring consistent product quality which are crucial factors in pharmaceutical and biotechnology manufacturing.

The CMOs and CDMOs segment is projected to see the fastest CAGR of 6.54% during the forecast period due to the increasing outsourcing of pharmaceutical manufacturing and development processes to specialized organizations. The U.S. Food and Drug Administration (FDA) acknowledges the growing role of CMOs and CDMOs in the pharmaceutical industry, noting that these organizations are increasingly adopting PAT frameworks to enhance process efficiency and ensure compliance with regulatory standards. The FDA's guidance on PAT highlights the benefits of implementing PAT in outsourced manufacturing processes including improved process control and product quality.

REGIONAL ANALYSIS

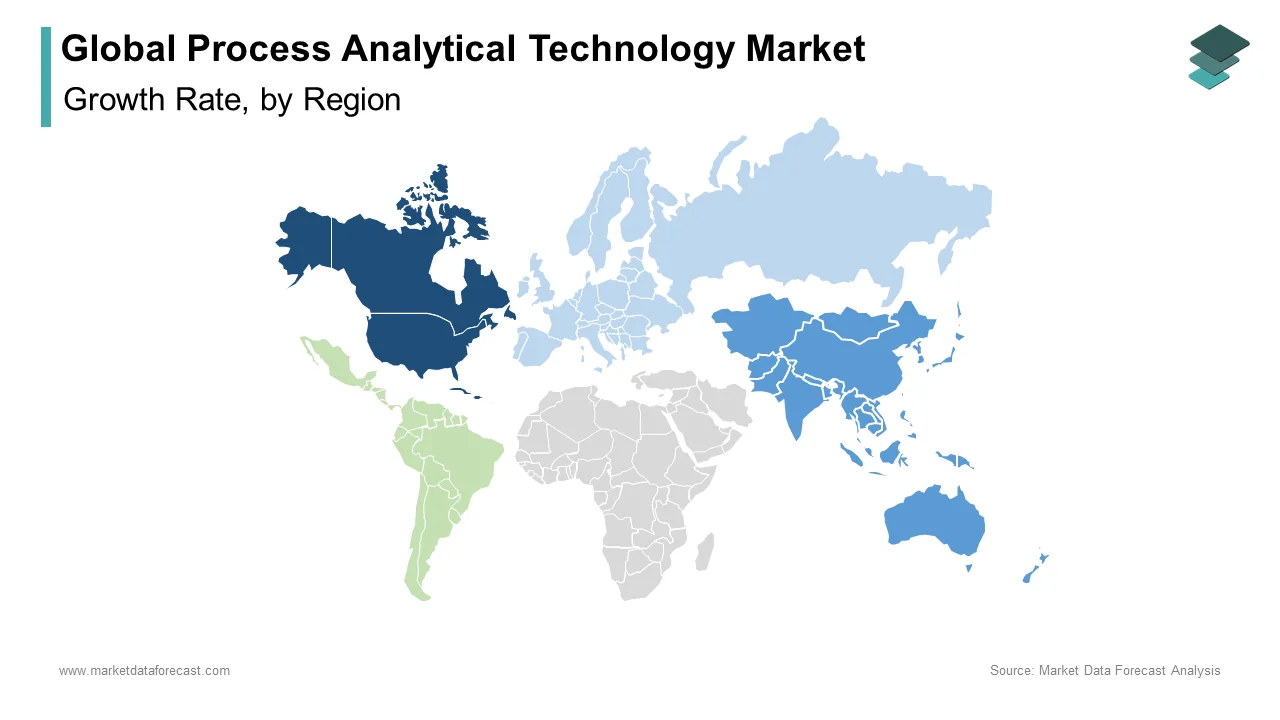

North America dominated the Process Analytical Technology (PAT) market by accounting for 35.1% of the global market share in 2024. The region’s dominance is driven by robust pharmaceutical manufacturing and is supported by the FDA's push for real-time quality monitoring systems. The U.S. pharmaceutical industry in 2022 contributed over $1 trillion to the economy, according to the Pharmaceutical Research and Manufacturers of America (PhRMA). High R&D spending is exceeding $95 billion annually and further cements North America's leading position. The region's advanced technological infrastructure and regulatory frameworks make it a critical hub for PAT innovation.

The Asia-Pacific region is the fastest-growing in the PAT market with a projected CAGR of 11.7% over the forecast period owing to the rapidly growing expanding pharmaceutical industries in China and India that are reinforced by government initiatives like "Made in China 2025" and India’s National Biopharma Mission. According to the Indian Ministry of Commerce, pharmaceutical exports from India reached $24.6 billion in FY 2022-23 . Additionally, China’s National Bureau of Statistics highlights that biotech investments exceeded $20 billion in 2022 that is underscoring the region’s pivotal role in scaling PAT adoption globally.

Europe holds a significant share of the Process Analytical Technology (PAT) market. The region benefits from stringent regulatory frameworks enforced by the European Medicines Agency (EMA) which mandate advanced quality control systems. In 2022, the European Federation of Pharmaceutical Industries and Associations (EFPIA) reported that the pharmaceutical industry contributed €84 billion in R&D spending across Europe. Germany, France, and Switzerland lead the market, supported by robust investments in biotech and pharmaceutical manufacturing. Europe’s focus on sustainability and innovation ensures its continued prominence in the PAT market.

Latin America is poised for steady growth in the PAT market and is driven by rising healthcare expenditure and expanding pharmaceutical manufacturing. According to the World Health Organization (WHO), healthcare spending in the region is projected to grow at a CAGR of 5.9% through 2030 . Brazil and Mexico are key contributors. While infrastructure challenges persist, government initiatives like Mexico’s National Development Plan aim to enhance domestic drug production. These factors position Latin America as a growing contributor to global PAT adoption.

The Middle East and Africa are expected to witness gradual growth in the PAT market, fueled by initiatives like Saudi Vision 2030 and UAE Vision 2030, which emphasize local pharmaceutical manufacturing. South Africa leads the African region with pharmaceutical sales reaching $4.3 billion in 2022, as per the Department of Trade, Industry, and Competition. However, Sub-Saharan Africa faces challenges due to limited infrastructure which may hinder rapid expansion. Despite slower growth, increasing healthcare investments will drive incremental PAT adoption.

KEY MARKET PLAYERS

Some of the notable companies dominating the global process analytical technology market profiled in this report are Thermo Fisher Scientific Inc., Repligen Corporation, Bruker Corporation, Agilent Technologies, Inc., ABB Ltd., Danaher Corporation (Ab Sciex LLC), PerkinElmer, Inc., Emerson Electric Co., Sartorius AG, Mettler-Toledo, and Others.

TOP 3 PLAYERS IN THE MARKET

Thermo Fisher Scientific Inc.

Thermo Fisher Scientific is a global leader in providing cutting-edge analytical instrumentation and solutions for the Process Analytical Technology (PAT) Market. The company specializes in real-time process monitoring, spectroscopy, and chromatography solutions, which are widely used in the pharmaceutical, biotechnology, and food industries. With technologies like Raman spectroscopy, Fourier-transform infrared (FTIR) spectroscopy, and mass spectrometry, Thermo Fisher enables manufacturers to achieve real-time release testing (RTRT) and improve product quality. The company is also at the forefront of AI-powered PAT solutions, integrating cloud-based analytics and automation for predictive quality control and continuous manufacturing. By focusing on regulatory compliance and efficiency, Thermo Fisher Scientific plays a crucial role in reducing production downtime, ensuring batch-to-batch consistency, and enhancing process optimization across multiple industries.

Agilent Technologies Inc.

Agilent Technologies is a major player in the PAT market, providing industry-leading liquid chromatography (HPLC), mass spectrometry (MS), and spectroscopy solutions for real-time quality assurance. The company's analytical instruments help manufacturers comply with stringent FDA, EMA, and ICH Q14 regulatory guidelines for pharmaceutical and biologics production. Agilent's software solutions, such as Agilent OpenLab, offer AI-powered process automation and data-driven decision-making, ensuring consistent product quality and operational efficiency. The company is particularly strong in biopharmaceutical process control, offering advanced monitoring systems for cell culture, fermentation, and continuous manufacturing processes. With its focus on innovation and automation, Agilent Technologies continues to enhance real-time process monitoring, minimizing variability, and improving bioprocess efficiency.

Sartorius AG

Sartorius AG is a leading provider of bioprocess solutions and PAT technologies, focusing on real-time monitoring for biopharmaceutical and vaccine manufacturing. The company excels in single-use bioprocessing, spectroscopy-based process monitoring, and automation, making it a crucial partner for pharmaceutical and biotech firms. Sartorius’ Ambr® Bioprocess Systems integrate Raman and Near-Infrared (NIR) spectroscopy for continuous monitoring of critical process parameters (CPPs) and critical quality attributes (CQAs), allowing for better process control and higher product yields. Additionally, Sartorius plays a significant role in continuous biomanufacturing, providing real-time analytical solutions that improve scalability, cost-effectiveness, and compliance with Good Manufacturing Practices (GMP). Through its focus on digitalization, single-use technologies, and real-time analytics, Sartorius is driving the future of smart biomanufacturing and process efficiency in the PAT market.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Technological Innovation & Product Development

Leading PAT companies continuously invest in cutting-edge analytical tools and real-time process monitoring technologies to stay ahead of the competition. Thermo Fisher Scientific has developed advanced Raman, Near-Infrared (NIR), and Fourier Transform Infrared (FTIR) spectrometry solutions that enhance process precision in pharmaceutical and biopharmaceutical manufacturing. Agilent Technologies focuses on automation in liquid chromatography (HPLC) and mass spectrometry (MS) solutions, allowing manufacturers to achieve real-time quality control and process optimization. Sartorius AG integrates PAT-enabled bioprocess systems, improving continuous manufacturing and ensuring higher yields in biologics and vaccine production. Additionally, companies are introducing AI-powered PAT software and cloud-based analytics, making process monitoring more efficient and ensuring compliance with regulatory standards.

Mergers, Acquisitions & Strategic Investments

Acquiring innovative companies and investing in emerging PAT technologies allow key players to expand their market presence and strengthen their expertise. Thermo Fisher Scientific has pursued acquisitions such as MarqMetrix, a company specializing in in-line PAT solutions, to enhance its real-time process monitoring capabilities. Agilent Technologies has engaged in strategic acquisitions and collaborations with biotechnology firms, expanding its PAT-driven bioprocess monitoring solutions. Sartorius AG has acquired companies offering spectroscopy and real-time analytical solutions to integrate them into its biomanufacturing PAT ecosystem. These acquisitions enable companies to diversify their product portfolios, expand their customer base, and accelerate innovation in the PAT sector.

Digital Transformation & AI-Driven Automation

The integration of AI, machine learning, and cloud computing is revolutionizing the PAT market, allowing for predictive analytics and automated process control. Thermo Fisher Scientific has implemented AI-driven predictive analytics in its PAT systems, enabling manufacturers to anticipate deviations, reduce batch failures, and enhance process efficiency. Agilent Technologies is focusing on automated PAT solutions with real-time data processing, reducing human intervention while improving accuracy. Sartorius AG is advancing the digitalization of PAT in bioprocessing, allowing real-time monitoring of Critical Process Parameters (CPPs) and Critical Quality Attributes (CQAs). By leveraging AI and automation, these companies help manufacturers increase production efficiency, ensure product consistency, and reduce operational costs.

COMPETITIVE LANDSCAPE

The Process Analytical Technology (PAT) Market is highly competitive, driven by rapid technological advancements, increasing regulatory requirements, and the growing demand for real-time process monitoring across industries such as pharmaceuticals, biotechnology, chemicals, and food & beverages. The market is dominated by key global players, including Thermo Fisher Scientific, Agilent Technologies, and Sartorius AG, alongside other significant competitors like Bruker Corporation, PerkinElmer, Shimadzu Corporation, and Mettler-Toledo International. These companies compete primarily on technological innovation, automation, regulatory compliance, and digital transformation.

One of the major competitive factors in the PAT market is the adoption of AI-driven automation and cloud-based analytics, allowing for real-time data monitoring and predictive process control. Companies are also focusing on mergers, acquisitions, and partnerships to expand their product portfolios and market reach. Additionally, regulatory compliance with FDA, EMA, and ICH Q14 guidelines plays a crucial role, making it essential for companies to provide validated solutions that meet stringent quality standards.

With increasing adoption of continuous manufacturing and bioprocessing, companies are aggressively investing in advanced spectroscopy, chromatography, and real-time monitoring solutions to maintain a competitive edge. The competition is expected to intensify as newer players enter the market with AI-powered, cost-effective PAT solutions.

RECENT MARKET DEVELOPMENTS

- In June 2024, Thermo Fisher Scientific unveiled a new mass spectrometry platform at the American Society for Mass Spectrometry (ASMS) conference in Anaheim, California. This advancement is expected to set new standards for process efficiency and quality control in the industry.

- In May 2024, Agilent Technologies, Inc. and APC Ltd. announced their partnership to integrate their respective technologies and provide users with specific workflows to assist automated liquid chromatography (LC) process analysis.

- On November 26, 2024, the European Innovation Council (EIC) launched the STEP Scale-up call, a new scheme with a budget of €300 million for 2025, projected to grow to €900 million over 2025-2027. This initiative aims to provide larger investments, ranging from €10 million to €30 million per company, to support the development and market introduction of strategic technologies, including those related to process analytics. The focus areas encompass digital technologies, clean and resource-efficient technologies, and biotechnologies. Companies developing innovative solutions in these domains are encouraged to apply.

MARKET SEGMENTATION

This research report on the global process analytical technology market has been segmented and sub-segmented based on the product, technique, monitoring method, application, end-use, and region.

By Product

- Analyzers

- Sensors & Probes

- Samplers

- Software & Services

By Technique

- Spectroscopy

- NIR Spectroscopy

- Raman Spectroscopy

- NMR Spectroscopy

- Mass Spectroscopy

- Others

- Chromatography

- Liquid Chromatography

- Gas Chromatography

- Particle Size Analysis

- Electrophoresis

- Others

By Monitoring Method

- On-line

- In-line

- At-line

- Off-line

By Application

- Small Molecules

- Large Molecules

- Manufacturing Applications

- Other Applications

By End Use

- Pharmaceutical & Biotechnology Companies

- CROs

- CMOs & CDMOs

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the expected growth of the process analytical technology market?

The process analytical technology market is projected to grow from USD 8.46 billion in 2025 to USD 13.18 billion by 2033, at a CAGR of 5.7%.

2. What factors drive the growth of the process analytical technology market?

Technological advancements, regulatory support, and the increasing adoption of personalized medicine.

3. What challenges does the process analytical technology market face?

High costs of implementation and system integration complexities.

4. How does process analytical technology benefit pharmaceutical manufacturing?

Process analytical technology enhances efficiency, improves product quality, and reduces waste.

5. What opportunities exist in the process analytical technology market?

Innovations in noninvasive methods and focus on Quality by Design (QbD).

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]