Global Private 5G Network Market Size, Share, Trends & Growth Forecast Report By Component (Hardware, Software And Services), Spectrum (Licensed, Unlicensed/Shared), Frequency (Sub 6 Ghz, Mmwave), Vertical (Manufacturing, Energy And Utilities, Transportation & Logistics, Defense, Enterprises And Campus, Mining, Healthcare/Hospital, Oil & Gas, Retail, And Agriculture), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Private 5G Network Market Size

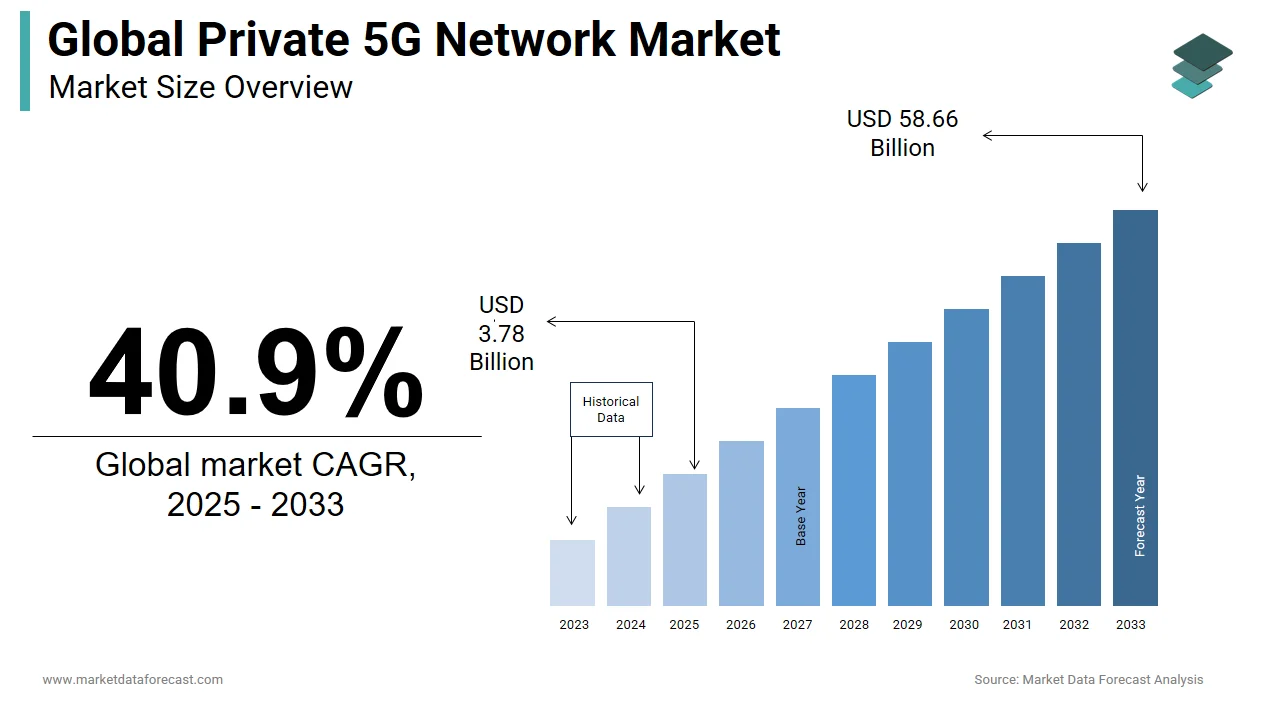

The global Private 5G Network market was worth USD 2.68 billion in 2024. The global market is predicted to reach USD 3.78 billion in 2025, and it is estimated to reach USD 58.66 billion by 2033, registering a CAGR of about 40.9% during the forecast period.

The global private 5G network market has been growing at a promising pace over the last few years and is predicted to accelerate further during the forecast period. The rising need for secure, high-performance connectivity in various industries such as manufacturing, logistics, healthcare, and energy is majorly fueling the demand for private 5G network services. Currently, countries such as the United States, Germany, China, and Japan have the highest demand for private 5G network services as industrial sectors and large enterprises are increasingly using private 5G network services in these countries. For instance, the automotive and manufacturing sectors in Germany have been deploying private 5G networks to improve their automation and IoT integration.

The global private 5G network market has high competition. The key telecom operators, large-sized technology companies, and several network equipment providers are actively participating in the global private 5G network market and applying various strategies to strengthen their position in the global market. Companies such as Ericsson, Nokia, Huawei, and Cisco play a dominating role in the global market, as these companies hold extensive knowledge and technology portfolios. The market participants are keen to develop end-to-end solutions that include network infrastructure, management software, and cybersecurity measures to stabilize and increase their occupancy in the global market. An increase in partnerships and collaborations has been noticed in the global private 5G network market in recent years. The market participants are open to partnering and collaborating to combine their strengths to offer comprehensive and scalable private 5G solutions. As discussed, Y-o-Y growth in the demand for high-performance connectivity in various sectors and increasing efforts from the market participants to stay competitive in the global market are likely to aid the global private 5G network market to register promising growth during the forecast period.

MARKET DRIVERS

The growing demand for high-speed internet connectivity is primarily propelling the private 5G network market growth.

Companies now require robust and reliable network solutions to support their operations as the usage of data-intensive applications and services has increased significantly. As per the statistics of Statista, the global average internet speed reached 55 Mbps in 2021. However, the demand for higher-speed internet connectivity has been growing continuously, and the impact of this trend is comparatively greater in the manufacturing, healthcare, and logistics industries. The private 5G network can offer ultra-low latency and higher bandwidth, and further provide seamless connectivity and efficient data transfer, which is extremely important to support advanced applications such as real-time video streaming, telemedicine, and cloud computing. This particular factor stood at the forefront in fueling the adoption of private 5G networks by several companies from various sectors and contributing significantly to the global market growth.

The rapid adoption of Industry 4.0 is another key factor driving the private 5G network market growth.

The adoption of Industry 4.0 and digital technologies in the manufacturing processes has been growing increasing in the past few years and resulting in the increasing need for high-speed internet connectivity to ensure smoother workflows. Industry 4.0 heavily depends on interconnected devices, automation, and data exchange in manufacturing environments and hence requires reliable and high-speed communication networks. Private 5G networks provide the necessary infrastructure to support Industry 4.0 in smart factories and offer real-time monitoring, predictive maintenance, and efficient resource management. As the number of Industry 4.0 initiatives increases in the coming years, the demand for private 5G networks will increase and propel the global market growth.

The expansion of smart factories globally is also boosting the global private 5G network market growth.

In the modern era, smart factories have been increasingly leveraging the latest technologies, such as IoT, AI, and robotics, to optimize manufacturing processes and thereby boost productivity and reduce operational costs. According to the Global Digital Operations Study by PwC, a whopping 72% of the manufacturers plan to implement smart factory initiatives by 2025. Smart factories operate with a large number of connected devices and systems and require high-speed and low-latency connectivity that private 5G networks provide. An increase in the adoption of smart factory solutions directly fuels the demand for private 5G networks and contributes to the expansion of the global market.

Furthermore, Y-o-Y growth in IoT devices and applications, rising need for improved network security, growing demand for reliable and low-latency communication, rapid adoption of autonomous vehicles, and increasing demand for real-time data analytics are favoring the growth of the private 5G network market. The growing use of augmented and virtual reality, increasing number of initiatives and funding from the governments of several countries in favor of private 5G networks, rising number of advancements in 5G technology, increasing need for remote monitoring and control, and rapid expansion of edge computing are supporting the expansion of the global market.

MARKET RESTRAINTS

High initial costs associated with the deployment of private 5G networks are a key restraint to the global market growth.

The entire setup of a private 5G network demands substantial investment in infrastructure, including base stations, core networks, and specialized equipment. In addition to that, the high costs associated with the acquisition of a 5G spectrum license are adding to the initial costs of private 5G networks and making them very expensive. As per a report by McKinsey, the setup cost for a 5% network to deploy is two to three times higher than that of a 4G network. Due to the significant costs, the small and medium-sized enterprises (SMEs) are hesitant to adopt private 5G networks as these companies hold limited financial resources.

In addition to the above, the complexities associated with the network integration, limited availability of 5G spectrum, and regulatory and compliance challenges are impeding the global private 5G network market. The shortage of skilled workforce, concerns associated with security and privacy, competition from existing network technologies, slow adoption rate by small and medium enterprises, and issues associated with interference and compatibility are further hampering the growth of the private 5G network market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

40.9% |

|

Segments Covered |

By Component, Frequency, Spectrum, Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Altiostar, Nokia Corporation, Qualcomm Technologies, Inc., Telefonaktiebolaget LM Ericsson, T-Systems International GmbH, AT&T Inc., Broadcom Inc., Cisco Systems, Deutsche Telekom, Huawei Technologies Co., Verizon Communications, ZTE Corporation, Microsoft, Amazon, Google, Samsung, Vodafone Limite,d and Others. |

SEGMENTAL ANALYSIS

By Component Insights

The hardware segment dominated the market by accounting for 42.9% of the global market share in 2023 and is expected to grow at a notable CAGR during the forecast period. Hardware components such as small cells, routers, and base stations are essential to build and maintain the network infrastructure. The domination of the hardware segment in the global market is primarily attributed to the increasing demand for robust and reliable network infrastructure, advancements in 5G technology, and growing investments in private 5G deployments by enterprises. According to Gartner, more than 50% of the companies that employed private 5G networks give more importance to hardware upgrades to ensure connectivity and reliability.

The software segment had a substantial share of the global market in 2023 and is predicted to grow at a healthy CAGR during the forecast period. The growing number of cyber threats and the increasing need for robust security measures are propelling the growth of the software segment in the global market. For instance, as per the data of Cybersecurity Ventures, approximately 60% of the investments in private 5G network investments in software are primarily to gain improved security and threat detection capabilities. The rising need for advanced network management solutions and increasing demand for real-time analytics to optimize network performance are further fueling the growth of the software segment in the global market.

The services segment is also a major segment in the global market and is predicted to grow at the fastest CAGR during the forecast period. Factors such as the increasing complexity of 5G networks that require expert support, the growing trend of outsourcing network management, and the rising need for continuous monitoring and maintenance services are driving the growth of the services segment in the global market.

By Frequency Insights

The Sub 6 GHz segment dominated the global private 5G network market in 2023, accounting for 68.8% of the global market share, and is predicted to register a healthy CAGR during the forecast period. The advantages of sub-6 GHz, such as wider coverage, better penetration capabilities, and suitability for a range of industrial applications, are primarily responsible for the domination of the sub-6 GHz segment in the global market. As per GSMA, 65% of the private 5G networks deployed worldwide utilized Sub 6 GHz frequencies in 2023. The rising need for robust and reliable network performance in challenging environments and the growing adoption of 5 G-enabled IoT devices are further propelling segmental growth in the global market.

However, the mmWave segment is predicted to witness the fastest CAGR in the global market during the forecast period. The adoption of mmWave is growing exponentially as this technology offers high bandwidth and low latency that are ideal for applications requiring ultra-fast data transmission and minimal delay. Factors such as advancements in mmWave technology, rising demand for high-speed data applications, and the growing deployment of 5G networks in urban and densely populated areas are driving the growth of the mmWave segment in the global market. As per Ericsson, mmWave frequencies were used in more than 35% of new private 5G networks deployed in 2023. This ratio is further expected to increase and contribute to the growth of the mmWave segment in the global market.

By Spectrum Insights

The licensed segment accounted for 60.9% of the global market share in 2023 and is anticipated to witness a prominent CAGR during the forecast period. Licenses for private 5G networks provide guaranteed service quality, lower interference, and improved security features. The rising need for reliable connectivity in industries such as manufacturing, healthcare, and transportation, in which uninterrupted service and data security are extremely important, is one of the major factors propelling the growth of the licensed segment in the global market. According to GSMA, more than 70% of the private 5G networks deployed worldwide are of licensed spectrum deployments.

The unlicensed/shared segment held a considerable share of the worldwide market in 2023 and is estimated to grow at the highest CAGR during the forecast period. The adoption of unlicensed spectrum private 5G network deployments is high among the small and medium-sized enterprises (SMEs), which is primarily driving the segmental expansion. The flexibility and lower entry barriers of unlicensed/shared spectrum are notable factors supporting the expansion of the unlicensed segment in the global market.

By Vertical Insights

The manufacturing segment led the market and captured 30.7% of the worldwide market share in 2023 and is predicted to continue to be the major segment in the global market throughout the forecast period. An increasing need for real-time monitoring, automation, and improved connectivity for smart factories in the manufacturing sector is fueling the adoption of private 5G networks in manufacturing facilities and boosting the expansion of the manufacturing segment in the global market. According to the estimations of GSMA, more than 40% of the manufacturers worldwide will adopt private 5G networks by 2025. The rising awareness among manufacturing facilities of how private 5G networks can boost productivity is further promoting the segmental growth in the worldwide market. As per McKinsey & Company, the usage of private 5G networks can bring at least a 20% increase in productivity in the manufacturing facilities.

REGIONAL ANALYSIS

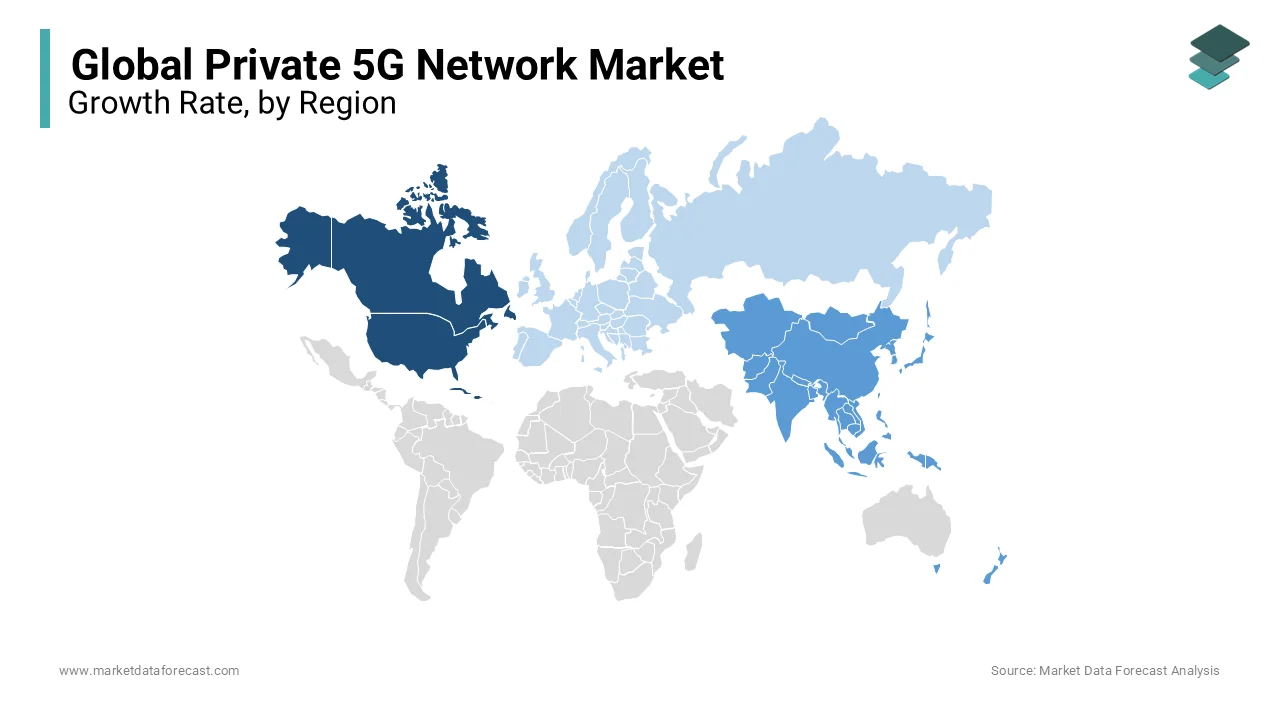

North America is the most prominent region in the global private 5G network market and accounted for 36.1% of the global market share in 2023. During the forecast period, the North American region is expected to grow at a notable CAGR. The dominance of North America in the global market is primarily credited to the presence of advanced technological infrastructure, early adoption of 5G technology, and significant investments in R&D. The U.S. is currently holding the largest share of the North American market due to the presence of major tech hubs and increasing adoption of private 5G networks.

Asia Pacific is projected to be the fastest-growing regional segment in the global private 5G network market. The rapid industrialization, the presence of extensive 5G rollouts, and strong support from the governments of Asia-Pacific countries in favor of private 5G networks are boosting the Asia-Pacific market growth. The Asia-Pacific region is experiencing a significant increase in investments for the deployment of private 5G networks, which is expected to promote the regional market. In this region, notable companies that operate in manufacturing and healthcare have been increasingly adopting private 5G networks, and this trend is likely to accelerate further during the forecast period and fuel the growth rate of the Asia-Pacific market. China and Japan are predicted to hold the major share of the Asia-Pacific market during the forecast period.

Europe is a noteworthy regional segment in the global market and accounted for a substantial share of the worldwide market in 2023. Europe is expected to witness a healthy CAGR during the forecast period. Factors such as an increasing number of initiatives from the governments of Europe in favor of private 5G networks and a growing number of partnerships between telecom operators are boosting the European market growth. For instance, the European Commission announced a “5G Action Plan” to boost the 5G deployment across all the member states by 2025. According to the predictions of Deloitte, more than 35% of European companies are likely to have private 5G networks by 2025.

KEY MARKET PLAYERS

The main players in the market are Altiostar, Nokia Corporation, Qualcomm Technologies, Inc., Telefonaktiebolaget LM Ericsson, T-Systems International GmbH, AT&T Inc., Broadcom Inc., Cisco Systems, Deutsche Telekom, Huawei Technologies Co., Verizon Communications, ZTE Corporation, Microsoft, Amazon, Google, Samsung, Vodafone Limited.

RECENT MARKET HAPPENINGS

- In June 2025, Deutsche Telekom launched private 5G network for RTL Deutschland, which is the first media company in Germany to have their own 5G SA network. With this initiation, Deutsche Telekom hopes to get greater flexibility for live productions.

- In June 2025, Samsung Electronics collaborated with NAVER Cloud to launch first-ever private 5G network in Korea.

- In June 2025, the government of Malaysia announced their plans to setup 40 private 5G network use cases across various industries by 2025.

MARKET SEGMENTATION

This research report on the global private 5G network market is segmented based on the component, frequency, spectrum, vertical, and region

By Component

-

Hardware

-

Rradio Access

-

Core and Backhaul

-

Transport

-

-

Software

-

Services

By Frequency

- Sub 6 GHz

- mmWave

By Spectrum

- Licensed

- Unlicensed/Shared

By Vertical

- Manufacturing

- Energy and Uilities

- Transportation & Logistics

- Defense

- Enterprises and Campus

- Mining

- Healthcare/Hospital

- Oil & Gas

- Retail

- Agriculture

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is a private 5G network, and how does it differ from public 5G networks?

Private 5G networks are dedicated cellular networks deployed by an organization for its exclusive use, offering high-speed, low-latency connectivity tailored to their specific needs. Unlike public 5G networks, which are operated by telecommunications companies and serve a wide range of users, private 5G networks are localized and provide control over coverage, capacity, and security.

How are private 5G networks regulated on a global scale?

Regulation of private 5G networks varies from country to country, but most regulatory frameworks focus on spectrum allocation, licensing requirements, and compliance with security and privacy standards. Regulatory authorities typically work with industry stakeholders to ensure that private 5G deployments adhere to local laws and regulations while promoting innovation and competition.

What are the anticipated growth prospects for the global private 5G network market in the coming years?

The global private 5G network market is expected to experience significant growth in the coming years, driven by increasing demand from industries such as manufacturing, healthcare, and transportation. Factors such as advancements in technology, the proliferation of IoT devices, and the need for reliable and high-speed connectivity are expected to fuel market expansion.

How does the deployment of private 5G networks contribute to digital transformation initiatives globally?

Deploying private 5G networks is a key enabler of digital transformation initiatives, providing organizations with the connectivity and infrastructure needed to leverage emerging technologies such as AI, IoT, augmented reality, and robotics. By enhancing communication, automation, and data exchange capabilities, private 5G networks accelerate innovation and drive competitive advantage in the digital economy.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]