Global Printers Market Size, Share, Trends & Growth Forecast Report By Type (Multi-functional Printers, Standalone Printers), Technology (Dot Matrix, Inkjet) Connectivity (Wired, Wireless) Output (Colour Printers, Monochrome Printers) End Use (Industrial, Residential) and Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 to 2033

Global Printers Market Size

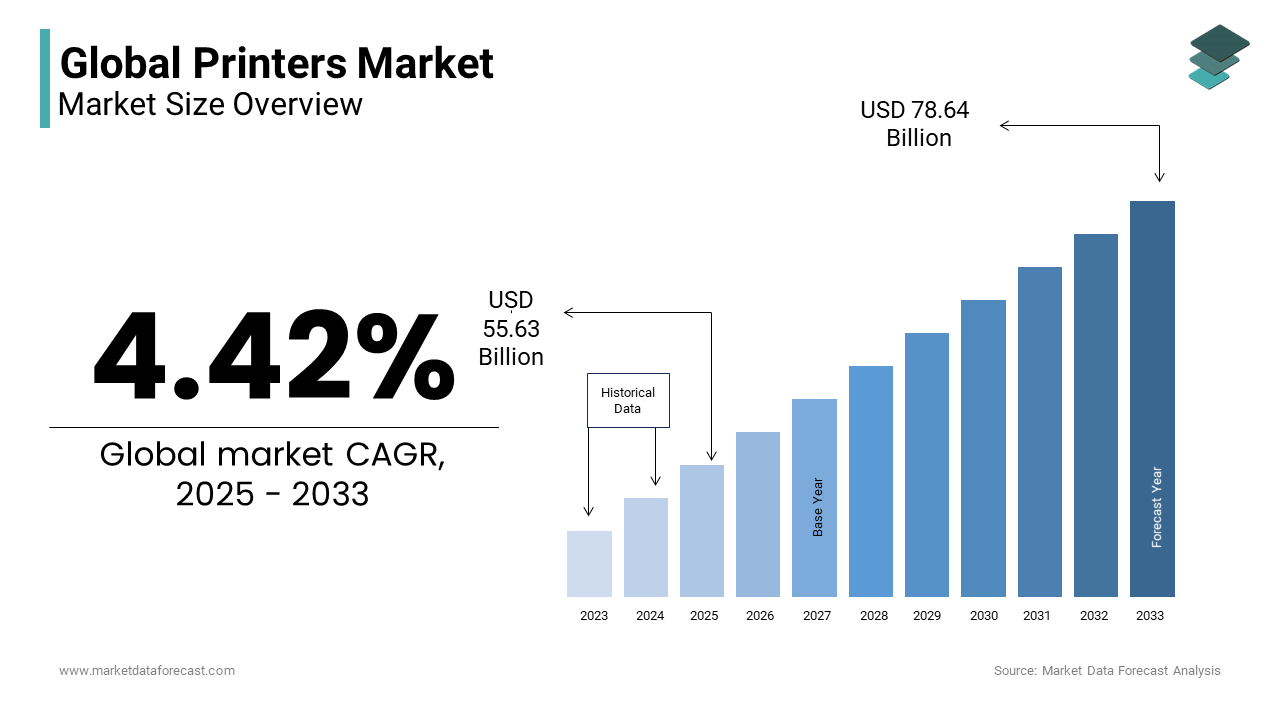

The global printers market size was valued at USD 53.28 billion in 2024. The printers market size is expected to have 4.42% CAGR from 2025 to 2033 and be worth USD 78.64 billion by 2033 from USD 55.63 billion in 2025.

Employing technologies like inkjet, laser, thermal, and 3D printing, printers cater to the varied requirements of consumers, businesses, and industrial sectors. Modern printers have evolved into intelligent, multifunctional systems that support digital workflows and automation, integrating advancements in artificial intelligence (AI), cloud computing, and wireless connectivity. Despite the global shift towards digitalization, printing remains integral across educational, corporate, healthcare, and governmental sectors. According to International Data Corporation (IDC), approximately 2.8 trillion pages were printed worldwide in 2020, underscoring the sustained demand for physical documentation. In the corporate realm, a report by Quocirca indicates that 72% of businesses continue to rely on print, though its significance is diminishing as digitization initiatives gain momentum.

MARKET DRIVERS

Increasing Demand for High-Quality Printing in Education and Corporate Sectors

The education and corporate sectors are significant drivers of the printers market due to their reliance on high-quality printed materials. According to a 2021 report by the National Center for Education Statistics (NCES), U.S. educational institutions spend approximately $8 billion annually on instructional materials, including printed textbooks and classroom resources. Similarly, a study by Keypoint Intelligence reveals that 57% of businesses still depend on printed documents for critical operations like contracts, invoices, and internal reports. The hybrid work model, accelerated by the COVID-19 pandemic, has further increased printer demand, with Statista reporting a 4% growth in global office printer shipments in 2022. As organizations prioritize professional-grade outputs, laser and inkjet printers remain essential tools, particularly in North America and Europe, where industries balance digital transformation with the need for physical documentation.

Growing Adoption of 3D Printing Technology Across Industries

The rapid adoption of 3D printing technology is reshaping the printers market, driven by its transformative applications across healthcare, automotive, and aerospace sectors. According to the U.S. Department of Commerce, the global 3D printing market grew by 17% in 2021, reaching a value of $15.1 billion, as reported by the International Trade Administration (ITA). Innovations in additive manufacturing have enabled industries to produce complex prototypes and end-use parts efficiently. For instance, the Food and Drug Administration (FDA) has approved a 3D-prsizeable number of inted medical devices, including prosthetics and surgical guides, showcasing the healthcare sector's reliance on this technology. Additionally, automakers using 3D printing can reduce production costs by up to 50% for certain components. With governments investing heavily in advanced manufacturing, 3D printing continues to gain momentum globally.

MARKET RESTRAINTS

Environmental Concerns and Regulatory Pressures on Printer Manufacturing

The printers market is significantly impacted by environmental concerns and stricter regulations on manufacturing practices. According to the Global E-waste Monitor 2020, a report published by the United Nations University (UNU), global electronic waste reached 53.6 million metric tons in 2019, with printers contributing to this growing issue. HP estimates that only 38% of ink cartridges are recycled annually, leaving millions of cartridges to end up in landfills, where they can take up to 1,000 years to decompose. To address these issues, governments are enforcing stricter environmental regulations. For instance, the European Union’s Restriction of Hazardous Substances Directive (RoHS) limits the use of hazardous materials like lead and mercury in electronics, increasing compliance costs for manufacturers. These pressures force companies to invest in sustainable alternatives, which often require higher upfront investments and may slow market growth.

Declining Demand Due to Digitalization and Paperless Trends

The shift toward digital solutions is a major restraint for the printers market as businesses and consumers increasingly adopt paperless practices. Over 60% of organizations have implemented digital document management systems, reducing their reliance on printed materials. Additionally, industries such as banking and insurance have notably reduced paper usage over the past decade due to e-signature platforms and cloud-based storage solutions. Educational institutions are also transitioning to digital formats, with a study by the National Center for Education Statistics (NCES) showing a 20% decline in textbook printing in U.S. schools since 2017. This trend is driven by cost efficiency and environmental awareness, further shrinking the demand for traditional printers and challenging the market to adapt to evolving consumer preferences.

MARKET OPPORTUNITIES

Expansion of 3D Printing in Healthcare and Custom Manufacturing

The printers market has a significant opportunity in the expansion of 3D printing, particularly in healthcare and custom manufacturing. Over 200,000 patients globally have benefited from 3D-printed medical devices, including prosthetics, implants, and surgical guides, as of 2022. The FDA also emphasizes that 3D printing enables personalized solutions, reducing surgery preparation times considerably. Governments are investing in additive manufacturing research, with the National Institutes of Health (NIH) funding projects to explore 3D printing applications in regenerative medicine, creating new revenue streams for the printers market.

Growing Demand for Eco-Friendly and Sustainable Printing Solutions

The increasing demand for eco-friendly printing solutions presents a major opportunity for the printers market. The U.S. Environmental Protection Agency (EPA) reports that paper and cardboard recycling rates reached 66% in 2020, reflecting growing consumer awareness about sustainability. To meet this demand, manufacturers are developing energy-efficient printers and recyclable ink cartridges. For instance, the EPA’s ENERGY STAR program certifies printers that consume less energy than standard models, driving their adoption in offices and homes. Additionally, governments worldwide are incentivizing green technologies, with the European Union offering subsidies under its Circular Economy Action Plan for companies adopting eco-friendly practices. These trends create opportunities for printer manufacturers to innovate and capture emerging markets focused on sustainability.

MARKET CHALLENGES

Rising Costs of Raw Materials and Supply Chain Disruptions

The printers market faces significant challenges due to rising costs of raw materials and ongoing supply chain disruptions. According to the U.S. Bureau of Labor Statistics, the Producer Price Index (PPI) for semiconductors, a critical component in printer manufacturing, increased by 20% in 2022 due to global shortages. The International Trade Administration (ITA) highlights that disruptions caused by the COVID-19 pandemic and geopolitical tensions, such as those between the U.S. and China, have delayed shipments of essential components like ink cartridges and printer heads, leading to a 10% decline in production efficiency. Additionally, the U.S. Department of Commerce reports that logistics costs surged by over 20% in 2021, further straining manufacturers. These challenges force companies to raise product prices, impacting consumer demand. As supply chains remain volatile, manufacturers must explore alternative sourcing strategies or risk losing market share. Addressing these issues is crucial for sustaining growth in an increasingly competitive market.

Intense Competition from Substitute Technologies

The printers market is challenged by intense competition from substitute technologies such as digital displays and mobile devices. The National Center for Education Statistics (NCES) notes that notable percentage of schools in the U.S. now use digital textbooks, reducing demand for traditional printing solutions. Furthermore, this trend leaves printer manufacturers struggling to innovate and compete. As digital alternatives become more accessible and affordable, the printers market must adapt to retain relevance and address evolving consumer preferences.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.42 % |

|

Segments Covered |

By Type, Technology, Connectivity, Output ,End Use and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

HP Development Company, L.P., Canon, Inc. Seiko Epson Corporation, Brother Industries Ltd, Xerox Holdings Corporation. |

SEGMENTAL ANALYSIS

By Type Insights

The multi-functional printers (MFPs) segment dominated the printers market by accounting for 60.7% of the global market share in 2024. The versatility, combining printing, scanning, copying, and faxing capabilities of multi-functional printers into a single device that appeal to both businesses and households is majorly driving the expansion of segment in the global market. The U.S. Environmental Protection Agency (EPA) highlights that ENERGY STAR-certified MFPs consume 25% less energy than standalone printers, making them a cost-effective and eco-friendly choice. Additionally, the rise of hybrid work models has increased demand for compact, all-in-one solutions that save space and enhance productivity. Their importance lies in meeting diverse operational needs while reducing energy and infrastructure costs, solidifying their position as the largest and most preferred segment.

On the contrary, the standalone printers segment is predicted to register a CAGR of 4.7% over the forecast period owing to the increasing demand for specialized printing solutions, such as high-resolution photo printers, label printers, and large-format printers used in industries like retail, healthcare, and graphic design. The U.S. Department of Commerce notes that small businesses and creative professionals are driving this trend, as they require precise outputs for marketing materials, product packaging, and professional-grade prints. Furthermore, advancements in inkjet and laser technologies have improved print quality while reducing operational costs. Standalone printers are critical for niche applications where multi-functional devices fall short, making them indispensable for specific consumer needs. Their rapid growth underscores their role in addressing targeted market demands.

By Technology Insights

The inkjet printers segment led the market by holding 40.1% of the global market share in 2024. Their leadership stems from affordability, versatility, and high-quality outputs, making them ideal for households, small businesses, and creative professionals. The U.S. Environmental Protection Agency (EPA) highlights that ENERGY STAR-certified inkjet printers consume 30% less energy compared to non-certified models, enhancing their appeal as eco-friendly solutions. Additionally, advancements in ink formulations, such as pigment-based inks, have improved print durability and color accuracy, driving demand for photo and document printing. Inkjet printers are particularly important due to their ability to cater to diverse needs, from casual home use to specialized applications like marketing materials, solidifying their position as the largest segment.

Whereas, the 3D printers segment is projected to witness a CAGR of 18.9% over the forecast period due to the increasing adoption across industries such as healthcare, automotive, and aerospace. The U.S. Department of Commerce notes that innovations in additive manufacturing have enabled cost-effective production of complex prototypes and end-use parts, reducing material waste significantly. For instance, the healthcare sector utilizes 3D printers for prosthetics and surgical models, with sizeable number of FDA-approved devices in use as of 2022. 3D printers are critical for enabling customization and innovation, making them indispensable in advanced manufacturing. Their importance lies in transforming traditional production methods, positioning them as a key driver of future industrial growth.

By Connectivity Insights

The wired printer segment held the largest share of 60.2% of the global market share in 2024. Their leadership is driven by reliability, consistent performance, and lower susceptibility to connectivity issues, making them ideal for offices and industrial environments. The U.S. Department of Commerce highlights that wired printers are often preferred in sectors requiring high-volume printing, such as manufacturing and logistics, due to their stability and compatibility with legacy systems. Additionally, wired connections ensure faster and more secure data transfer speeds compared to wireless options in certain scenarios. Their importance lies in providing a dependable solution for environments where uninterrupted printing is critical, ensuring operational efficiency and minimal downtime.

On the contrary, the wireless printers segment is rapidly growing and is estimated to showcase a CAGR of 8.5% during the forecast period owing to the increasing adoption of hybrid work models and smart home ecosystems, where wireless connectivity enhances convenience and flexibility. The U.S. Environmental Protection Agency (EPA) notes that ENERGY STAR-certified wireless printers consume 15-20% less energy than older models, appealing to eco-conscious consumers. Furthermore, advancements in Wi-Fi 6 and cloud-based printing technologies have improved accessibility, speed, and ease of use. Wireless printers are critical for enabling seamless integration with mobile devices, IoT networks, and remote work setups, making them indispensable in modern workplaces and households. Their rapid growth underscores their role in meeting evolving consumer demands for mobility and connectivity.

By Output Insights

The monochrome printers segment was the largest segment and had 55.4% of the global market share in 2024. Their leadership is driven by cost-effectiveness, faster printing speeds, and lower ink consumption, making them ideal for high-volume text-based printing in offices, educational institutions, and government sectors. The U.S. Environmental Protection Agency (EPA) highlights that ENERGY STAR-certified monochrome printers consume 20% less energy than color printers, enhancing their appeal as eco-friendly solutions. Additionally, their compatibility with legacy systems ensures reliability in industries like legal, logistics, and finance, where text-heavy documents are prevalent. Monochrome printers are particularly important for businesses prioritizing efficiency and cost savings, solidifying their position as the largest segment in the market.

On the other hand, the color printers segment is estimated to grow at a CAGR of 6.5% over the forecast period due to the increasing demand for high-quality color outputs in industries such as marketing, retail, and healthcare. Advancements in inkjet and laser technologies have improved color accuracy while reducing operational costs by up to 15% , making color printers more accessible. Additionally, the rise of digital media, e-commerce, and remote work has driven the need for vibrant packaging, promotional materials, and professional-grade prints. Color printers are critical for enabling creativity, brand differentiation, and visually appealing content, making them indispensable in modern workplaces. Their rapid growth underscores their role in meeting evolving consumer demands for dynamic and engaging printed materials.

By End Use Insights

The commercial segment captured the leading share of 40.3% of the global market share in 2024. Factors such as the high demand for reliable, high-volume printing solutions in corporate environments is majorly fuelling the growth of the commercial segment in the global market. The U.S. Department of Commerce highlights that enterprises require advanced printers for tasks such as document management, marketing materials, and internal communications. Additionally, the rise of hybrid work models has increased the need for secure and efficient printing solutions. Enterprises prioritize multifunctional devices that integrate seamlessly with digital workflows, enhancing productivity. Their importance lies in driving innovation in printer technology, ensuring scalability and efficiency, which solidifies their position as the largest end-use segment.

On the other hand, the industrial segment is forecasted to register a CAGR of 7.5% from 2025 to 2033. This growth is fueled by increasing adoption of 3D printing and advanced manufacturing technologies in sectors like automotive, aerospace, and healthcare. The U.S. Department of Energy notes that additive manufacturing reduces material waste by up to 25%, making it a cost-effective and sustainable solution. For instance, 3D printers are used to create prototypes, tools, and end-use parts, enabling faster production cycles. Industrial printers are critical for enabling customization, reducing lead times, and improving supply chain efficiency. Their rapid growth underscores their role in transforming traditional manufacturing processes, positioning them as a key driver of innovation and industrial growth.

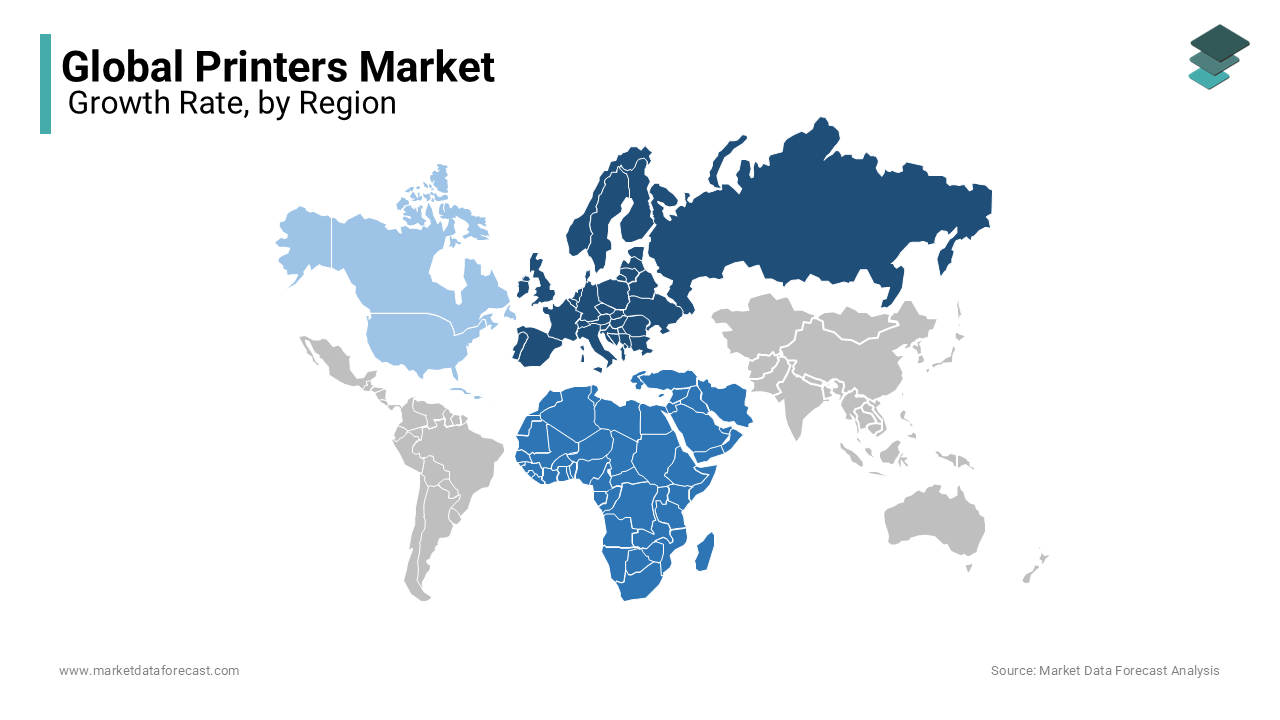

REGIONAL ANALYSIS

The Asia-Pacific region led the printers market by accounting for 40.2% of the global market share in 2024. This leadership is driven by rapid industrialization, urbanization, and high demand for consumer electronics in countries like China, Japan, and India. According to the U.S. Department of Commerce, China remains the largest producer of printers globally, contributing approximately 25% to worldwide production due to its advanced manufacturing capabilities. The increasing adoption of 3D printing in industries such as automotive and healthcare further accelerates growth. The region's importance lies in its role as a global manufacturing hub and its expanding middle-class population, which drives demand for both traditional and advanced printing technologies.

The Middle East and Africa (MEA) region is the fastest-growing segment in the printers market with a CAGR of 6.5% from 2025 to 2033. This growth is fueled by rising investments in digital transformation, education, and small businesses across countries like the UAE, Saudi Arabia, and South Africa. The African Development Bank highlights that SMEs in Africa are adopting affordable printing solutions to meet operational needs. Additionally, government initiatives such as Saudi Arabia’s Vision 2030 emphasize digitization while maintaining reliance on printed documentation, creating hybrid opportunities. The MEA region's growth underscores its potential as an emerging market, attracting global manufacturers to develop localized solutions tailored to regional demands.

North America holds a significant share of the printers market. The region's growth is driven by the increasing adoption of eco-friendly printing solutions and high-quality laser printers, particularly in the U.S. ENERGY STAR-certified printers now account for a large percentage of all printers sold in the U.S., reflecting a strong push toward energy efficiency. Additionally, the demand for 3D printing in healthcare and aerospace sectors, supported by initiatives like America Makes (a public-private partnership focused on additive manufacturing), the region remains a leader in innovation and sustainability, focusing on reducing electronic waste and promoting recyclable printing technologies.

Europe represents a growing market. The region’s growth is fueled by stringent environmental regulations, such as the EU’s Restriction of Hazardous Substances Directive (RoHS) and the Waste Electrical and Electronic Equipment Directive (WEEE), which mandate sustainable manufacturing practices. The EEA highlights that paper recycling rates in Europe reached a significant mark in 2021, driving demand for eco-friendly printers. Countries like Germany and the UK lead in adopting advanced printing technologies, including 3D printing for industrial applications. The region’s emphasis on sustainability and innovation positions it as a key player in the global printers market.

Latin America is an emerging market for printers, with Brazil leading due to its growing manufacturing sector and increasing adoption of 3D printing technologies. The region benefits from rising investments in education and small businesses, particularly in Mexico and Argentina, where affordable printing solutions are in high demand. However, challenges such as economic instability and supply chain disruptions persist. Despite these hurdles, Latin America’s urbanization and industrialization trends present opportunities for growth. As the region adopts hybrid work models and digital transformation, demand for both traditional and advanced printers is likely to increase steadily in the coming years.

Top 3 Players in the market

HP Inc. (Hewlett-Packard)

HP Inc. is the global leader in the printer market, commanding approximately 40% of the total market share. The company is known for its Inkjet, LaserJet, and enterprise-grade multifunction printers (MFPs), catering to both consumer and commercial users. HP has been at the forefront of sustainable printing, introducing recyclable ink cartridges, energy-efficient printers, and Instant Ink subscription services that automate ink deliveries. Additionally, HP is a key player in 3D printing, leveraging Multi Jet Fusion (MJF) technology for industrial applications. The company continuously innovates with cloud-based printing, AI-powered print management, and security features, making it a dominant force in the printing industry.

Canon Inc.

Canon is one of the most well-established companies in the imaging and printing industry, holding around 20%-25% of the global market share. It is renowned for its PIXMA inkjet printers, imageRUNNER ADVANCE series for enterprises, and high-speed production printers. Canon has a strong presence in the photo printing and office solutions market, providing high-quality prints with its advanced laser and inkjet technologies. Additionally, Canon is a leader in commercial and industrial printing, investing heavily in large-format and production printing solutions, such as the Colorado UVgel printers. The company integrates AI-driven workflow automation, cloud printing, and security enhancements, ensuring efficiency and reliability for businesses and consumers alike.

Epson (Seiko Epson Corporation)

Epson holds approximately 15%-18% of the global printer market and is a pioneer in inkjet and sustainable printing solutions. The company's EcoTank technology, featuring cartridge-free, refillable ink tanks, has disrupted the industry by significantly reducing printing costs and environmental waste. Epson is also at the forefront of heat-free printing, with its PrecisionCore technology, which lowers energy consumption by up to 85% compared to traditional laser printers. Beyond home and office printing, Epson is a leader in digital textile and sublimation printing, serving industries such as fashion, signage, and commercial printing. With a strong focus on enterprise printing, AI-powered workflow solutions, and cloud integration, Epson continues to shape the future of the global printer market.

Top strategies used by the key market participants

HP Inc.: Innovation & Subscription-Based Printing

HP’s primary strategy revolves around continuous technological innovation and a shift towards a subscription-based model. The company has heavily invested in smart printers, AI-powered print security, and cloud-integrated printing to enhance efficiency. HP's Instant Ink subscription service ensures automated ink deliveries, locking customers into its ecosystem and guaranteeing recurring revenue. Additionally, HP is focusing on 3D printing with its Multi Jet Fusion (MJF) technology, positioning itself as a leader in industrial and commercial printing solutions. The company also promotes sustainability by introducing recycled ink cartridges and energy-efficient printers, reinforcing its commitment to eco-friendly printing.

Canon Inc.: Expansion in Commercial & Industrial Printing

Canon has been strengthening its position by diversifying into commercial and industrial printing solutions. The company is aggressively expanding its large-format and high-speed production printing segment, catering to businesses, publishing industries, and textile printing markets. Canon has introduced advanced automation, AI-driven workflow solutions, and high-resolution imaging technologies to improve print quality and efficiency. Furthermore, Canon has leveraged its expertise in imaging and optics to enhance its photo printing and document scanning capabilities. Its focus on cloud printing, secure enterprise solutions, and AI-based print management allows businesses to optimize their printing operations while reducing costs.

Epson: Sustainable & Heat-Free Printing Technology

Epson has positioned itself as a leader in eco-friendly and cost-effective printing solutions, focusing on heat-free printing technology to differentiate itself from competitors. The company’s EcoTank series, which eliminates the need for traditional ink cartridges, has gained massive traction, reducing both printing costs and environmental impact. Additionally, Epson’s PrecisionCore technology allows for energy-efficient inkjet printing, cutting energy consumption by up to 85% compared to laser printers. The company is also expanding its presence in digital textile, signage, and industrial printing, targeting industries beyond consumer and office printing. Epson continues to enhance its AI-driven automation and cloud-based printing solutions, ensuring seamless connectivity and efficiency in modern workplaces.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the global printers market include HP Development Company, L.P., Canon, Inc. Seiko Epson Corporation, Brother Industries Ltd,Xerox HoldingsCorporation,FUJIFILM Corporation, Roland DGCorporation,Ricoh Company Ltd,Panasonic Corporation, Toshiba Corporation

The global printers market is highly competitive, driven by technological advancements, changing consumer preferences, and sustainability initiatives. The market is dominated by three key players—HP Inc., Canon Inc., and Epson—which collectively hold a significant share. However, Brother, Ricoh, Xerox, Kyocera, and Lexmark also maintain strong positions, particularly in enterprise and commercial printing.

Technological innovation is a major battleground, with companies competing on print speed, quality, security, and cloud integration. HP leads in 3D printing and subscription-based ink services, Canon dominates photo and high-volume production printing, while Epson is disrupting the market with EcoTank technology and heat-free inkjet solutions. Meanwhile, Brother and Kyocera specialize in cost-effective business laser printers, and Xerox and Ricoh focus on managed print services (MPS).

Sustainability is another key differentiator, with companies investing in energy-efficient printers, recyclable ink cartridges, and low-waste printing technologies. Additionally, the shift towards AI-driven automation, IoT connectivity, and cloud-based printing solutions is reshaping market dynamics.

Price competition remains intense, especially in the home and small business printer segments, while enterprise and industrial printing markets see more focus on customization and service contracts. As digital transformation accelerates, companies must continuously innovate to maintain their market positions.

RECENT HAPPENINGS IN THE MARKET

- In December 2024, Xerox announced its agreement to acquire Lexmark International for $1.5 billion, including debt. This move aims to strengthen Xerox's core printing portfolio and expand its services globally, particularly in the Asia-Pacific region.

- In January 2025, investment funds controlled by financier Edi Truell made a £245 million conditional offer for De La Rue, a 200-year-old British banknote printer. The offer is contingent upon the completion of De La Rue's £300 million sale of its authentication division to Crane NXT.

- In September 2024, Epson agreed to acquire Fiery, LLC, a leading innovator of digital front ends and workflow software, from Siris Capital Group, LLC, in a transaction valued at approximately $591 million. This acquisition is expected to enhance Epson's digital printing capabilities.

MARKET SEGMENTATION

This research report on the Printers Market is segmented and sub-segmented into the following categories.

By Type

-

-

Multi-functional Printers

-

Standalone Printers

-

By Technology

-

-

Dot Matrix

-

Inkjet

-

LED

-

Thermal

-

Laser

-

3D

-

Others

-

By Connectivity

-

-

Wired

-

Wireless

-

By Output

-

-

Color Printers

-

Monochrome Printers

-

By End Use

-

-

Industrial

-

Residential

-

Commercial

-

Educational Institutions

-

Enterprises

-

Government

-

Others

-

-

By Region

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East and Africa

Frequently Asked Questions

What are the main types of printers available?

Inkjet, Laser, All-in-One, Dot Matrix, 3D, Thermal, and Sublimation printers.

What is the difference between inkjet and laser printers?

Inkjet uses liquid ink (better for high-quality images), Laser uses toner (faster and cheaper for bulk printing).

What are common printer issues and how to fix them?

Paper jams (align paper), poor print quality (clean heads), connectivity issues (restart printer, check Wi-Fi).

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]