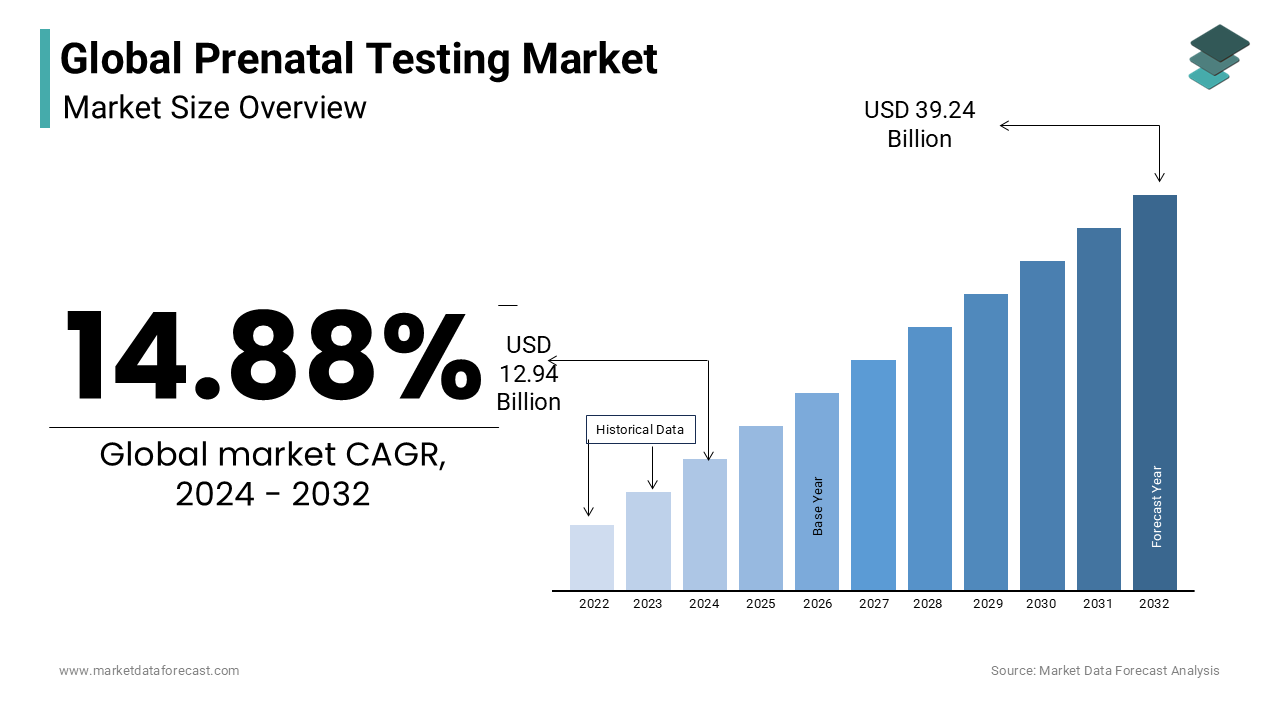

Global Prenatal Testing Market Size, Share, Trends & Growth Forecast Report, Segmented By Technology (Non-Invasive (Non-Invasive Prenatal Testing (NIPT), Maternal Serum Screening and Ultrasound-Based Testing) And Invasive (Amniocentesis, Chorionic Villus Sampling (CVS) and Others), Type, Application, End-Users and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis (2024 to 2032)

Prenatal Testing Market Size

The global prenatal testing market size was valued at USD 11.26 billion in 2023. The global market is expected to expand at a CAGR of 14.88% from 2024 to 2029 and be worth USD 39.24 billion by 2032 from USD 12.94 billion in 2024.

The global prenatal testing market is experiencing robust growth, primarily driven by the rising awareness of genetic disorders and the increasing need for early detection of chromosomal abnormalities. A significant factor contributing to this growth is the advancing maternal age, particularly in developed nations, where older mothers are more susceptible to genetic anomalies during pregnancy. Commonly tested conditions, including Down syndrome, Edwards syndrome, and Patau syndrome, make prenatal testing a crucial component of modern prenatal care protocols.

Non-invasive prenatal testing (NIPT) has emerged as one of the most rapidly expanding segments in the market, given its safety and high accuracy. Unlike traditional invasive procedures such as amniocentesis or chorionic villus sampling (CVS), which carry associated risks, NIPT utilizes cell-free fetal DNA from maternal blood samples to identify chromosomal abnormalities. Its non-invasive nature, combined with the ability to provide results as early as the 10th week of pregnancy, has accelerated its adoption on a global scale.

Technological advancements, particularly in next-generation sequencing (NGS), have also propelled the market's growth, making prenatal testing more accessible and accurate. These advancements have enabled healthcare providers to detect a broader range of genetic conditions with increased precision. Furthermore, increased government support, along with the integration of prenatal testing into healthcare systems, particularly in North America and Asia-Pacific, is solidifying prenatal testing as a routine practice. The market is expected to maintain steady growth, driven by ongoing innovations in testing methods and the growing demand for early, reliable diagnostics.

Prenatal Testing Market Trends

Rising Adoption of Non-Invasive Prenatal Testing (NIPT)

NIPT has revolutionized prenatal care by offering a safer, highly accurate method for detecting genetic abnormalities such as Down syndrome (trisomy 21), Edwards syndrome (trisomy 18), and Patau syndrome (trisomy 13). Unlike traditional invasive tests, NIPT requires only a blood sample from the mother, eliminating the risk of miscarriage. Recent advancements in next-generation sequencing (NGS) have further enhanced NIPT's accuracy, with detection rates now exceeding 99%. This, coupled with NIPT’s integration into standard prenatal care in countries such as the U.S. and U.K., has driven its widespread adoption. Emerging markets in Asia are also increasingly incorporating this technology into routine care.

Technological Advancements in Genetic Testing

The prenatal testing market is undergoing significant changes due to the rapid development of genetic testing technologies, particularly in next-generation sequencing (NGS) and microarray analysis. These technologies facilitate broader screenings, going beyond common chromosomal disorders to provide more comprehensive genetic analyses. NGS enables genome-wide analysis, supporting early detection of rare genetic mutations. As the focus on precision medicine and personalized healthcare intensifies, demand for advanced testing options is expected to rise. Key market players such as Illumina and Thermo Fisher Scientific are leading innovators in introducing NGS platforms tailored specifically for prenatal applications.

Growing Demand for Early Detection of Genetic Disorders

The growing public awareness of genetic disorders is encouraging more expectant parents to seek early diagnostic solutions. Prenatal testing offers families critical insights, enabling informed medical decisions and, in some cases, early interventions. NIPT, now recommended for all pregnant women in several countries, regardless of age or risk factors, is driving substantial increases in prenatal testing rates. Developed markets such as North America and Europe are witnessing particularly strong growth, as early and accurate testing becomes an essential part of prenatal care guidelines.

MARKET DRIVERS

Increasing Maternal Age

The global rise in maternal age, particularly in developed regions such as the U.S., U.K., and Japan, is a key driver of demand in the prenatal testing market. Older mothers are at greater risk of chromosomal abnormalities, leading to increased prenatal testing for conditions like Down syndrome. As birth rates among women over the age of 35 continue to climb, so too does the demand for prenatal testing.

Advancements in Non-Invasive Testing Methods

The growth of non-invasive prenatal testing (NIPT) is a significant driver of market expansion. NIPT’s ability to detect chromosomal abnormalities early in pregnancy—without posing risks to the fetus—has made it a preferred option for expectant mothers. Continuous advancements in NIPT, particularly through next-generation sequencing (NGS), have improved both accuracy and cost-efficiency, further fueling market growth.

Government Support and Healthcare Reimbursement

Government initiatives and healthcare policies are increasingly promoting prenatal testing as part of routine care. In many countries, particularly across Europe and parts of the U.S., healthcare systems offer full or partial reimbursement for prenatal tests, including NIPT. Public health campaigns have also played a crucial role in raising awareness of the benefits of early detection, driving the adoption of prenatal testing.

MARKET RESTRAINTS

High Costs of Advanced Testing

Despite its clear benefits, the high cost of advanced prenatal tests, particularly NIPT, remains a barrier in lower-income regions. Although technological advancements have brought costs down over time, the average price of an NIPT test ranges between USD 800 and USD 2,000, making it unaffordable for many in countries without robust healthcare coverage. This cost factor limits the market’s penetration in developing areas.

Ethical and Legal Concerns

The increasing availability of prenatal genetic testing has raised ethical and legal concerns, particularly regarding selective abortion and genetic privacy. The ability to detect a wide range of genetic conditions, some of which may be less severe, has prompted societal debates. Additionally, evolving legal frameworks around genetic data privacy could impact the adoption rates of prenatal testing, particularly in countries with stringent regulations.

Lack of Awareness in Emerging Markets

In emerging markets, awareness of prenatal testing remains low, particularly for non-invasive prenatal testing (NIPT). Many regions, especially in Africa and parts of Asia, still rely on traditional screening methods such as ultrasounds, with genetic testing limited to high-risk pregnancies. This lack of awareness, coupled with inadequate healthcare infrastructure, continues to hamper the growth of prenatal testing in these areas.

MARKET OPPORTUNITIES

Expansion in Emerging Markets

The prenatal testing market presents significant untapped potential in emerging economies, particularly across Asia-Pacific and Latin America. With improving healthcare infrastructure and growing awareness of early genetic screening, the demand for prenatal testing in countries such as China, India, and Brazil is expected to rise. Governments in these regions are heavily investing in healthcare technologies, fostering market growth. The expansion of private healthcare providers and the rise of the middle class further create promising opportunities for companies offering prenatal testing services.

Technological Integration with AI and Big Data

The integration of artificial intelligence (AI) and big data analytics into prenatal testing is poised to drive substantial growth in the market. AI can enhance the accuracy of genetic tests, providing predictive insights that help healthcare providers make more informed decisions. Additionally, big data enables the analysis of large datasets from prenatal tests, identifying patterns and refining diagnostic algorithms. Companies that invest in AI and data-driven solutions are expected to benefit from the growing demand for more accurate and personalized prenatal care.

Growing Focus on Personalized Medicine

As personalized medicine continues to gain traction in the healthcare sector, prenatal testing is becoming a critical component of individualized care. By identifying genetic risks early, prenatal tests allow for tailored healthcare plans, enabling doctors to provide more targeted interventions. The increasing emphasis on personalized medicine is expected to drive demand for advanced prenatal testing, creating significant market opportunities for companies offering detailed genetic insights.

MARKET CHALLENGES

Regulatory Hurdles

The prenatal testing market faces regulatory challenges, particularly in obtaining approvals for new genetic testing technologies. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) enforce strict requirements for genetic tests, making the approval process both time-consuming and costly. Additionally, regulatory frameworks in many countries are still evolving, creating uncertainty for companies looking to introduce new products.

Infrastructure Limitations in Low-Income Regions

In low- and middle-income regions, limited healthcare infrastructure presents a significant barrier to the widespread adoption of prenatal testing. Access to advanced laboratories, skilled healthcare professionals, and diagnostic equipment is often lacking in these areas, restricting the availability of advanced tests like NIPT. Without significant investments in healthcare infrastructure, expanding prenatal testing in these regions will be challenging, thereby limiting overall market growth.

High Competition and Price Pressures

The prenatal testing market is becoming increasingly competitive, with numerous companies offering similar products. This competition has led to price pressures, particularly in established regions such as North America and Europe. As companies vie for market share, there is a risk that price competition could erode profit margins, especially as the cost of genetic testing technologies continues to decrease.

IMPACT OF COVID-19 ON THE PRENATAL TESTING MARKET

Surge in Demand for Non-Invasive Prenatal Testing (NIPT)

The COVID-19 pandemic significantly reshaped the prenatal testing landscape, with a noticeable shift toward non-invasive prenatal testing (NIPT). To minimize patient visits and reduce exposure risks, demand for NIPT surged, as the test only requires a maternal blood sample. NIPT became an attractive option for early detection of chromosomal abnormalities without the risks associated with invasive procedures. Global adoption of NIPT increased by an estimated 10-15% during the pandemic, as healthcare providers in regions such as North America, Europe, and Asia-Pacific prioritized non-invasive testing to limit physical contact.

Rise of Telemedicine and Home-Based Diagnostics

The pandemic also accelerated the integration of telemedicine into prenatal care. With lockdowns and travel restrictions in place, virtual consultations became a key method of delivering prenatal care, allowing doctors to recommend and follow up on prenatal tests remotely. This shift led to the introduction of at-home sample collection kits for NIPT, with companies like Myriad Genetics offering these services. The trend toward telemedicine and home-based diagnostics is expected to continue, driving long-term changes in prenatal care delivery.

Supply Chain Disruptions and Adaptations

While demand for prenatal testing increased during the pandemic, supply chain disruptions initially affected the availability of testing reagents and kits. Companies responded by reconfiguring their logistics and manufacturing processes to meet rising demand. For instance, manufacturers scaled up production capacities and secured local supply chains, particularly in regions such as North America and Europe. Laboratories and diagnostic centers adapted by optimizing turnaround times and enhancing digital infrastructure to ensure continued service delivery.

Long-Term Impact and Industry Transformation

The COVID-19 pandemic has had a lasting impact on the prenatal testing market. Non-invasive methods such as NIPT have now been integrated into routine prenatal care for both high-risk and average-risk pregnancies. As patients increasingly prefer safer and more convenient testing options, the demand for non-invasive diagnostics is expected to grow. Additionally, the advancements in digital healthcare and remote monitoring that gained traction during the pandemic are likely to remain key drivers of market growth in the years to come.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

14.88% |

|

Segments Covered |

Type, Technology, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Qiagen, Medicover Genetics, 10X Genomics, Yourgene Health, F. Hoffmann-la Roche Ltd., Laboratory Corporation of America Holdings, Agilent Technologies Inc., Thermo Fisher Scientific Inc., Natera Inc., BGI, Eurofins Scientific, Illumina Inc., Quest Diagnostics Inc. and Revvity.

|

SEGMENTAL INSIGHTS

Global Prenatal Testing Market By Type

In 2023, the consumables segment dominated the global prenatal testing market, capturing 70.8% of the market share. Consumables, including reagents, kits, and other materials used in testing processes, are essential for conducting prenatal tests in laboratories and hospitals. The growing demand for consumables, particularly for non-invasive prenatal testing (NIPT) and biochemical screenings, is driven by the increasing adoption of NIPT and rising awareness of early genetic disorder diagnosis. Leading companies such as Illumina and Thermo Fisher Scientific continue to innovate in reagents and kits, making prenatal testing more accessible and cost-effective, further driving market growth.

The instruments market is projected to grow at a CAGR of 15% from 2024 to 2032. This growth is fueled by the development of new testing technologies and the adoption of AI-based platforms, enhancing the accuracy and efficiency of prenatal diagnostics. Instruments such as next-generation sequencers and ultrasound devices are increasingly in demand for early detection of genetic anomalies. Companies like Agilent Technologies and PerkinElmer are developing tools to meet the rising need for precision in prenatal testing.

Global Prenatal Testing Market by Technology

In 2023, non-invasive prenatal testing (NIPT) accounted for 60.2% of the global market share, making it the preferred method due to its high accuracy, minimal risk, and ability to detect chromosomal abnormalities through a simple maternal blood sample. The widespread adoption of NIPT is driven by the growing demand for safe and reliable prenatal screening. Companies such as Natera and Illumina are at the forefront of the global NIPT market. Other non-invasive methods, including maternal serum screening and ultrasound, continue to support market growth.

The invasive prenatal testing segment is projected to grow at a CAGR of 13.98% from 2024 to 2032. Although non-invasive methods dominate, invasive procedures like amniocentesis and chorionic villus sampling (CVS) remain critical for high-risk pregnancies requiring comprehensive genetic information. Innovations in imaging techniques and needle guidance systems have enhanced the safety and accuracy of these procedures, maintaining their significance in the market.

Global Prenatal Testing Market by Application

The Down syndrome (trisomy 21) testing segment held the largest market share at 40.9% in 2023. Screening for Down syndrome is prioritized in prenatal care due to the condition’s prevalence and the rising maternal age in developed regions, which increases the risk of chromosomal abnormalities. NIPT has become the standard method for early detection, with companies like Natera and Roche Diagnostics continuously advancing detection technologies.

The detection of rare genetic disorders represents the fastest-growing application segment, with a projected CAGR of 17%. Advances in genetic sequencing technologies have made it possible to identify a wide range of rare conditions, including microdeletion syndromes and single-gene disorders, early in pregnancy. Companies like BGI and Eurofins Scientific are driving this trend by developing expanded genetic panels for early and comprehensive prenatal diagnostics.

Global Prenatal Testing Market by End-Users

Diagnostic laboratories held the largest market share in the prenatal testing market in 2023, capturing 60.7%. These laboratories serve as the primary setting for advanced prenatal tests, such as NIPT, genetic sequencing, and biochemical screenings. The increasing demand for prenatal diagnostics, particularly in regions like North America and Europe, has strengthened the role of diagnostic labs, which are equipped with state-of-the-art technology and specialized staff to handle large volumes of tests.

Hospitals represent the fastest-growing end-user segment, with an expected CAGR of 15.88% over the forecast period. Hospitals are increasingly incorporating prenatal testing into routine care, offering both non-invasive and invasive options. The expansion of in-house genetic testing facilities and point-of-care ultrasound devices is enabling hospitals, particularly in emerging markets like India and Brazil, to meet the rising demand for prenatal diagnostics.

REGIONAL INSIGHTS

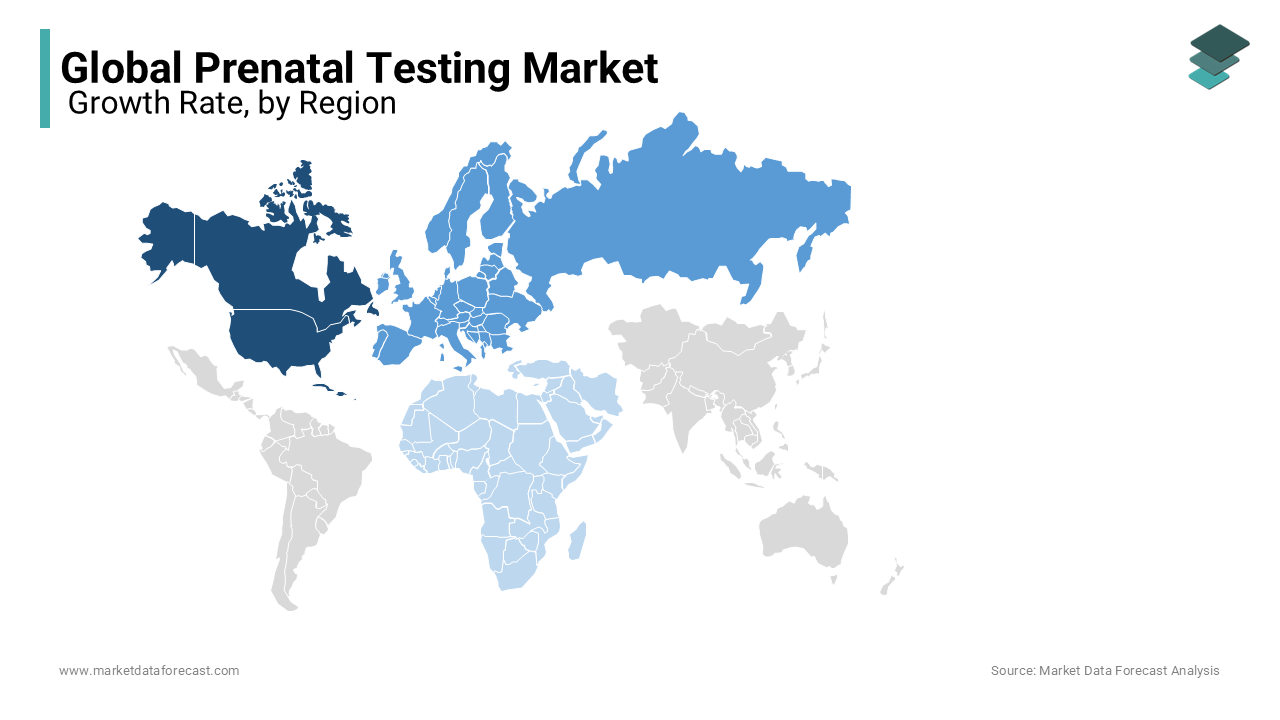

North America Leads in Precision Prenatal Testing

In 2023, North America led the global prenatal testing market, accounting for 40.8% of the total market share. This leadership is driven by the high adoption of NIPT and advanced genetic technologies, particularly in the United States. Favorable policies, such as the American College of Obstetricians and Gynecologists (ACOG) recommendation to offer NIPT to all pregnant women, have significantly increased demand. Companies like Myriad Genetics have introduced home-based NIPT kits, further expanding access to prenatal testing. In Canada, provinces like Ontario are expanding funding for prenatal screening, boosting test adoption.

Europe: A Hub for Government-Supported Testing

Europe is projected to witness a CAGR of 14.48% through 2032, driven by strong healthcare infrastructure, high awareness, and robust government support for prenatal screening. Countries like Germany, France, and the United Kingdom are at the forefront of the region, offering national programs for prenatal screening. In Germany, NIPT has been covered by statutory health insurance for high-risk pregnancies since 2021. Similarly, the U.K. has integrated NIPT into its National Health Service (NHS) for high-risk pregnancies, further driving test adoption.

Asia-Pacific: Rapid Expansion with Growing Awareness

The Asia-Pacific region is the fastest-growing market for prenatal testing, with a projected CAGR of 18.44% through 2032. Rising awareness of genetic disorders and improving healthcare infrastructure are fueling growth in countries like China, India, and Japan. China leads the region with early screening programs, while companies like BGI offer affordable NIPT solutions. In India, government initiatives such as Ayushman Bharat and increased healthcare investment have expanded access to prenatal testing. Japan is experiencing growth in advanced testing methods like NIPT due to innovations in precision medicine.

Latin America: Emerging Market with Untapped Potential

Latin America is an emerging market, with a projected CAGR of 12.42% through 2032. Brazil and Mexico lead the region, driven by increasing healthcare expenditure and rising awareness of prenatal genetic screening. Brazil is gradually integrating advanced screening methods like NIPT into routine care, while private healthcare providers in Mexico are introducing advanced testing technologies. However, limited healthcare infrastructure and the high cost of testing remain barriers to wider adoption.

Middle East & Africa: Steady Growth Driven by Healthcare Investments

The Middle East and Africa (MEA) represent a smaller but steadily growing market, with a projected CAGR of 8-10% through 2032. South Africa leads the region with a focus on improving maternal and child health. Increasing investments in healthcare infrastructure and rising awareness of prenatal testing benefits are driving market growth. Countries like Saudi Arabia and the UAE are adopting advanced testing methods as healthcare access improves, although infrastructure challenges persist in some areas.

COMPETITIVE LANDSCAPE AND KEY PLAYERS IN THE PRENATAL TESTING MARKET

The prenatal testing market is highly competitive, with major players continuously seeking to expand their market presence through product innovations, strategic partnerships, acquisitions, and regional expansions. Leading companies in the market are focusing on advancing technology and improving access to prenatal diagnostics across key regions.

Key Players in the Global Prenatal Testing Market Include

- Qiagen

- Medicover Genetics

- 10X Genomics

- Yourgene Health

- F. Hoffmann-La Roche Ltd.

- Laboratory Corporation of America Holdings (LabCorp)

- Agilent Technologies Inc.

- Thermo Fisher Scientific Inc.

- Natera Inc.

- BGI

- Eurofins Scientific

- Illumina Inc.

- Quest Diagnostics Inc.

- Revvity

These companies play pivotal roles in shaping the global prenatal testing market through continuous innovation and expansion into emerging markets.

Recent Market Developments

- Agilent Technologies launched a new line of prenatal testing reagents in June 2024, aimed at improving the sensitivity and cost-effectiveness of next-generation sequencing (NGS)-based tests for large-scale use in hospitals.

- In May 2024, Revvity introduced a fully automated prenatal screening platform that minimizes manual intervention, providing faster and more accurate results, especially for high-throughput labs.

- Yourgene Health unveiled an upgraded IONA Nx NIPT Workflow in May 2024, enhancing test throughput and reducing processing times, making prenatal testing more accessible in clinical settings.

- BGI launched a low-cost NIPT solution in May 2024, specifically designed for developing countries, making prenatal screening more affordable and accessible in emerging markets.

- F. Hoffmann-La Roche announced the release of its new digital platform in April 2024, which integrates prenatal genetic testing data with clinical records, facilitating seamless information sharing between healthcare providers and laboratories.

- In April 2024, Natera introduced an AI-driven platform that combines genetic data with clinical insights, enhancing the predictive capabilities of its NIPT offerings, especially for detecting rare genetic conditions.

- Quest Diagnostics rolled out an enhanced NIPT service in April 2024, which includes additional screening for microdeletions and other rare genetic disorders, broadening its prenatal testing capabilities.

- Eurofins launched a comprehensive prenatal genetic testing service in March 2024, offering a one-stop solution for NIPT, carrier screening, and single-gene disorder testing.

- In March 2024, Medicover Genetics introduced an NIPT platform integrated with AI algorithms to improve the accuracy of prenatal tests, focusing on high-risk pregnancies across Europe.

- LabCorp launched an at-home NIPT service in March 2024, allowing expectant mothers to collect samples from home, expanding access to prenatal testing.

Notable Strategic Partnerships and Acquisitions

- Qiagen partnered with a U.S. academic institution in February 2024 to enhance the development of advanced prenatal screening tools using NGS, improving detection rates for genetic abnormalities.

- In February 2024, Illumina launched its latest NGS platform, designed for prenatal diagnostics, offering higher throughput and reduced costs, making it more accessible to hospitals and clinics.

- Thermo Fisher upgraded its Ion Torrent NGS platform in February 2024, increasing the speed and sensitivity of prenatal genetic screening, particularly for rare disorders.

- 10X Genomics introduced a single-cell analysis platform in January 2024, which enhances precision for detecting fetal genetic disorders through advanced sequencing technologies.

- Agilent Technologies formed a strategic partnership with a hospital network in Asia in November 2023, bringing advanced prenatal genetic testing to underserved populations in the region.

- In October 2023, Qiagen expanded its NIPT portfolio by launching liquid biopsy products for early detection of chromosomal disorders.

- Eurofins acquired a leading genetic testing lab in Latin America in October 2023, expanding its presence in the region and strengthening its position in prenatal diagnostics.

- LabCorp acquired a European prenatal testing company in October 2023, enhancing its market share and service offerings, particularly in NIPT and genetic counseling services.

- Revvity expanded its prenatal testing reagents portfolio in October 2023, adding enhanced screening for neural tube defects, improving the accuracy of first-trimester tests.

- In September 2023, Quest Diagnostics partnered with telehealth providers to offer virtual genetic counseling, allowing patients to understand their prenatal testing results from the comfort of their homes.

Focus on Expanding Access to Emerging Markets

- In Southeast Asia, BGI expanded its laboratory network in August 2023, opening new facilities to meet the growing demand for prenatal testing services in the region.

- Yourgene Health received regulatory approval to offer its NIPT services across Southeast Asia in September 2023, expanding its presence in emerging markets with high demand for advanced prenatal diagnostics.

- Medicover Genetics expanded its footprint in Eastern Europe by acquiring a regional genetic testing company in June 2023, tapping into emerging markets where prenatal testing is gaining traction.

- In July 2023, Natera partnered with a major U.S. healthcare provider to integrate NIPT into routine prenatal care, expanding its customer base significantly.

- Technological Advancements and Product Innovation

- In June 2023, Illumina partnered with a national healthcare provider to deliver cutting-edge prenatal testing solutions, including NIPT and microarray-based tests, across multiple European countries.

- Roche Diagnostics expanded its prenatal testing portfolio in August 2023, introducing a more sensitive version of its Harmony Prenatal Test, which detects a broader range of chromosomal abnormalities earlier in pregnancy.

- In July 2023, 10X Genomics partnered with a biotechnology firm to develop prenatal diagnostic solutions, combining single-cell technology with NIPT, enhancing the detection of rare genetic conditions.

REPORT SEGMENTATION

This research report on the global prenatal testing market is segmented and sub-segmented into type, technology, application, end user, and region.

By Type

- Consumables

- Instruments

By Technology

- Non-Invasive

- Non-Invasive Prenatal Testing (NIPT)

- Maternal Serum Screening

- Ultrasound-Based Testing

- invasive

- Amniocentesis

- Chorionic Villus Sampling (CVS)

- Others

By Application

- Neural Tube Defects

- Down Syndrome

- Rare Genetic Disorders

- Others

By End-Users

- Diagnostic Laboratories

- Hospitals

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the prenatal testing market?

The global prenatal testing market size was valued at USD 11.26 billion in 2023.

What are the factors driving the prenatal testing market?

The growing average maternal age and technological advancements are driving the market growth.

Which region dominated the prenatal testing market worldwide in 2023?

North America dominated the market, capturing 40.8% of the worldwide market share in 2023.

Who are the major players in the prenatal testing market?

Qiagen, Medicover Genetics, 10X Genomics, Yourgene Health, F. Hoffmann-la Roche Ltd., Laboratory Corporation of America Holdings, Agilent Technologies Inc., Thermo Fisher Scientific Inc., Natera Inc., BGI, Eurofins Scientific, Illumina Inc., Quest Diagnostics Inc. and Revvity are the major companies in the global market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]