Global Pregnancy Testing Market Size, Share, Trends and Growth Forecast Report By Product Type, Test Type (HCG Blood Test, HCG Urine Test, LH Urine Test and FSH Urine Test), Distribution Channels and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2025 to 2033

Global Pregnancy Testing Market Size

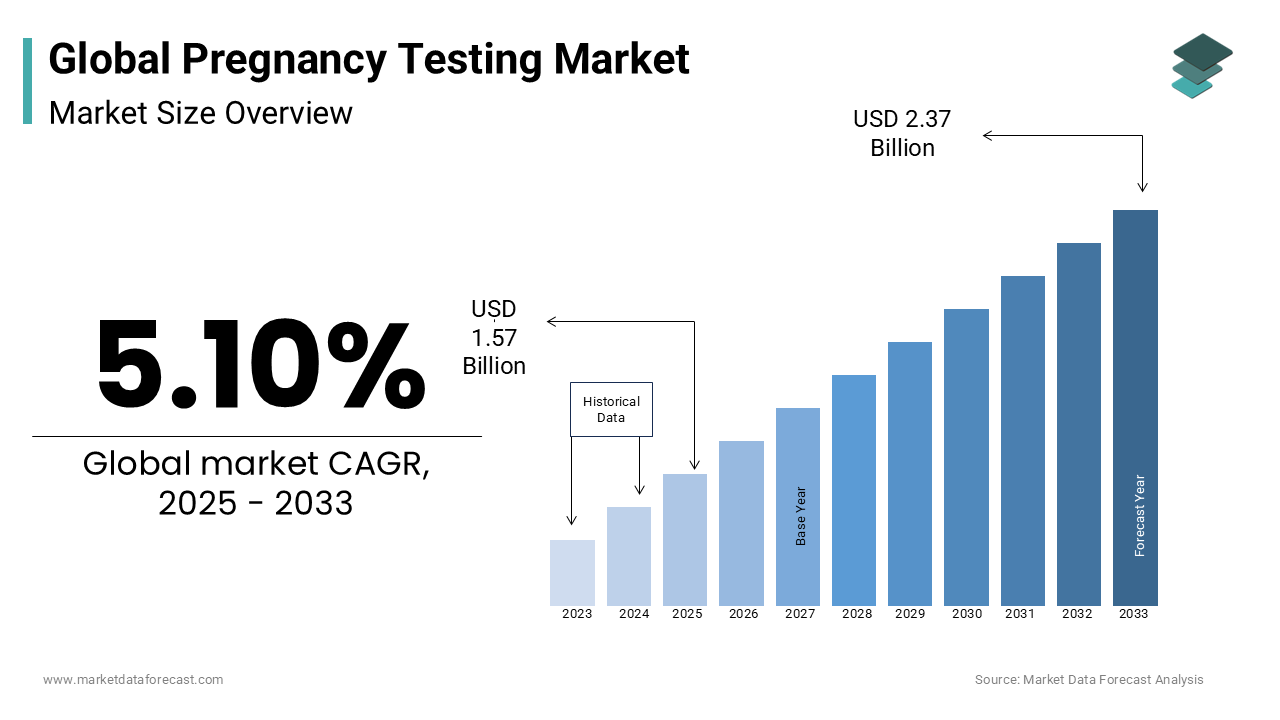

The global pregnancy testing market was valued at USD 1.49 billion in 2024. The global market size is expected to reach USD 2.34 billion by 2033 from USD 1.57 billion in 2025, growing at a CAGR of 5.10% during the forecast period.

Pregnancy testing kits are medical devices that identify early signs of pregnancy in women. The device detects a little HCG (Human Chorionic Gonadotropin; female pregnancy hormone), which grows within the human body during the early weeks of development. The level of HCG in the blood doubles every 2 to 3 days in the early days of pregnancy, indicating that the pregnancy is progressing. Thus, the presence of HCG over a certain level indicates pregnancy. For instance, Clearblue's digital bioassay kits may estimate the number of weeks a person has been pregnant and are widely used in families, gynecological clinics, and hospitals.

MARKET DRIVERS

Rising Awareness

The growing awareness about early pregnancy detection, increasing advancements in pregnancy test technologies and rising trend of home pregnancy testing kits are primarily propelling the global market growth. Manufacturers focus on new product launches, expansions of their markets, mergers, and collaborations, positively influencing the pregnancy testing market. Planned or meant pregnancies have increased awareness among women, offering immense growth opportunities to the key players. Qualitative analysis enables stakeholders to profit from market opportunities at a particular time. The increasing working population worldwide, the rise in disposable income and supportive government initiatives are further estimated to promote the growth of the global pregnancy testing market in the coming years.

Growing Births and Adolescent Pregnancies

For instance, according to the Centers for Disease Prevention and Control (CDC), the birth rate was 11.0 per 1000 people in the United States in 2020. Furthermore, the growing number of cases of adolescent pregnancies and the need for sexual awareness and wellness push the pregnancy testing market. For instance, according to the National Library of Medicine, in low- and middle-income (LMIC) nations as of 2019, girls between the ages of 15 and 19 had an estimated 21 million pregnancies annually, of which nearly 50% were unplanned and gave birth to an estimated 12 million children. Therefore, the market's growth is driven by the need to raise awareness about the significance of sex education and proper pregnancy protocols.

Rising Need to Find Pregnancy in the Early Stages to Opt for Abortions

The time limit to abort an unwanted pregnancy is between 13-24 weeks; therefore, it is essential to test and find pregnancy in the early stages if you are not ready for a baby yet. The rising cases of abortions support the need for proper pregnancy tests. For example, Three out of ten pregnancies (29% of all pregnancies) and six out of ten (61%) of all unplanned pregnancies result in induced abortion (1). The WHO produced a list of essential health services in 2020, including comprehensive abortion treatment. Therefore, the need for efficient and accurate pregnancy tests is rising worldwide.

MARKET RESTRAINTS

Low Adaptation Rate of Pregnancy Test Kits

Lack of minimum knowledge of pregnancy test kits in a woman is a significant restraint to the growth of the pregnancy testing market during the forecast period. Women suffering from PCOS and having less ovulation confirmation using kits for ovulation prediction are the factors that are expected to limit the expansion of the global pregnancy testing market over the forecast period. There are many challenges in perinatology in this modern era, such as heart conditions, malfunction of kidneys, and abnormalities, and to overcome these risks during pregnancy, testing is being done. Immunotherapy treatment occurs when the immune system starts attacking the patient's body.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Test Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Abbott Laboratories, Cardinal Health, Church & Dwight, Germaine Laboratories, Kent Pharmaceuticals, Piramal Enterprises, Prestige Brands Holdings, Procter & Gamble Co., Quidel Corporation, and SPD Swiss Precision Diagnostics. |

SEGMENTAL ANALYSIS

By Product Insights

The line indicator test is anticipated to account for a promising share of the worldwide market during the forecast period. The increase in the female population, growing awareness, and ease of use are the major factors driving the line indicator tests.

On the other hand, the pregnancy test kits segment is expected to propel the global pregnancy testing market throughout the forecast. It is due to the growing number of product approvals and various products in the market. In addition, the rise of technological advancements, increasing research and development activities, ease of availability, and accessibility of home-based pregnancy test kits are other reasons that will drive this sub-segment.

By Test Type Insights

Based on the test type, the HCG Urine test is anticipated to have a considerable share of value in the global pregnancy testing market during the forecast period. The HCG blood test is a quantitative test that measures the level of HCG hormone produced in the female body during pregnancy. The increased number of intended and unintended pregnancies fosters the doctors to recommend the HCG Blood test to test for pregnancy. Entering new market players has played a significant role in increasing the market share. The HCG Urine segment is expected to progress at a healthy rate during the forecast period. The increased number of household HCG pregnancy test kits is the primary factor for its highest growth.

The LH urine test and FSH urine test segments are predicted to hike at a decent rate and are expected to have positive growth. These tests are relatively new and help detect pregnancy at highly early stages, like 1 -1 1/2 days before ovulation. These tests can be performed at the patients' homes easily. The FSH test is also helpful in indicating menopause, thus making pregnancy testing more effective.

By Distribution Channel Insights

The online segment is expected to account for the leading share based on the distribution channel during the forecast period. The increase in internet usage and the variety of online products are significant reasons. In addition, the easy availability and accessibility of various pregnancy test kits in the online domain further drive the market.

Easy accessibility of pregnancy test kits across hypermarkets and supermarkets is expected to foster market growth. In addition, overall increased awareness of the brand has resulted in improved marketing and promotional activities, which are expected to increase the demand for pregnancy test kits.

REGIONAL ANALYSIS

Geographically, the North American pregnancy testing market is predicted to dominate the global market during the forecast period owing to the region's advanced techniques in pregnancy testing. In addition, the increased awareness among women leading to the increased demand for self-detecting pregnancy kits, growing fertility disorders, and increased unplanned pregnancy rate are the major factors that have helped the market's growth in this region.

The Asia-Pacific pregnancy testing market is the fastest-growing region due to its vast population base and more significant opportunity for market penetration. YOY growth in the population and easy accessibility of pregnancy test kits are primarily fuelling the market’s growth rate. In addition, online retailers' presence is anticipated to impact market growth positively. Awareness regarding pregnancy test kits is growing significantly among the APAC region, accelerating the adoption and usage of these devices and resulting in market growth.

The European pregnancy testing market accounted for the third highest share of the market and is expected to register profitable growth mainly due to technological advancements and increased public awareness. According to Eurostat, an estimated 4.1 million childbirths happened in Europe in 2020.

The Latin American pregnancy testing market and MEA pregnancy testing market are anticipated to grow at a CAGR of 5.26% and 5.35%, respectively, during the forecast period. Countries, where the employment rate among women is increasing, are anticipated to see considerable growth for pregnancy test kits in these regions.

KEY MARKET PLAYERS

Some of the promising companies playing a leading role in the global pregnancy testing market profiled in this report are Abbott Laboratories, Cardinal Health, Church & Dwight, Germaine Laboratories, Kent Pharmaceuticals, Piramal Enterprises, Prestige Brands Holdings, Procter & Gamble Co., Quidel Corporation, and SPD Swiss Precision Diagnostics.

RECENT HAPPENINGS IN THE MARKET

- In November 2022, Israel, Europe, South Africa, and the United Arab Emirates will soon have pharmacies and other retail establishments carrying the first saliva-based pregnancy tests created by a company from Jerusalem. The SaliStick test kits will be accessible in these areas in the first few months of 2019, according to Salignostics. This Israeli biotech company created the pregnancy test using the same technology to create COVID-19 testing kits.

- In October 2022, the CARE ProgramTM (Comprehensive Assessment Risk and Education), a digital platform that improves the patient and provider experience by facilitating access to genetic education, testing, reporting, and counseling, was recently launched by Ambry Genetics (Ambry), a pioneer in clinical diagnostic testing and a subsidiary of REALM IDx. By increasing access to non-invasive prenatal testing (NIPT), also known as non-invasive prenatal screening (NIPS), and assisting patients in making informed decisions, this end-to-end program enhances family planning and prenatal care. The goal of NIPT is screening, not a diagnosis.

- In November 2022, at the 41st Annual National Society of Genetic Counselors Meeting, Nov. 16–19 in Nashville, Tenn., Myriad Genetics, Inc., a leader in genomic testing and precision medicine, will highlight efforts to extend access to prenatal and hereditary cancer genetic insights. Genetic counselors play a crucial role in today's patient-centered healthcare system by providing patients and doctors with data-driven genetic insights and individualized medical information to support vital healthcare decisions.

- In November 2022, Maven Clinic, a startup, defied market trends by obtaining $90 million in new funding to increase its family and women's healthcare offerings. Shah stated that Maven intends to increase family building and its worldwide service offerings with additional cash. In addition, he stated, "We're delighted to continue filling gaps [in women's health], and we're aiming to expand our menopause services and enter Medicaid." Maven will also use the additional funds to maintain its platform-wide customization investment.

- In December 2017, Lia Diagnostics Inc., an American Company, developed the first biodegradable pregnancy kits.

- In March 2017, the failed batches of the Genesis Biotech PregSure digital test were the subject of an urgent recall. As a result, Minco Import and Export’s One Step Pregnancy TesExport'smoved from the register, and the sponsor ceased supply.

MARKET SEGMENTATION

This research report on the global pregnancy testing market has been segmented and sub-segmented based on the product, test type, distribution channel, and region.

By Product

- Pregnancy Test Kits

- Strip Tests

- Midstream Kits

- Cassette Tests

- Digital Tests

- Fertility/Ovulation Tests

- Line Indicator Tests

- Digital Tests

By Test Type

- HCG Blood Test

- HCG Urine Test

- LH Urine Test

- FSH Urine Test

By Distribution Channel

- Hospitals & Specialty Clinics

- Pharmacies

- Online Retail

- Others (Supermarkets and Specialty Retail)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the pregnancy testing market?

The global pregnancy testing market size is anticipated to be worth USD 1.49 billion in 2024.

What is the growth of the pregnancy testing market?

The global pregnancy testing market is anticipated to grow at a CAGR of 5.1% during the forecast period.

Which region dominated the pregnancy testing market worldwide in 2024?

North America accounted for the leading share of the worldwide market in 2024.

Who are the key players in the pregnancy testing market?

Abbott Laboratories, Cardinal Health, Church & Dwight, Germaine Laboratories, Kent Pharmaceuticals, Piramal Enterprises, Prestige Brands Holdings, Procter & Gamble Co., Quidel Corporation, and SPD Swiss Precision Diagnostics are a few of the notable players in the pregnancy testing market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]