Global Poultry Processing Equipment Market Size, Share, Trends and Growth Forecasts Report – Segmented By Animal Type (Chicken, Duck, Turkey and Others), Equipment Type (Killing and De-feathering, Cut-ups, Deboning & Skinning, Evisceration, Marinating & Tumbling, and Others), And Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From (2025 to 2033)

Global Poultry Processing Equipment Market Size

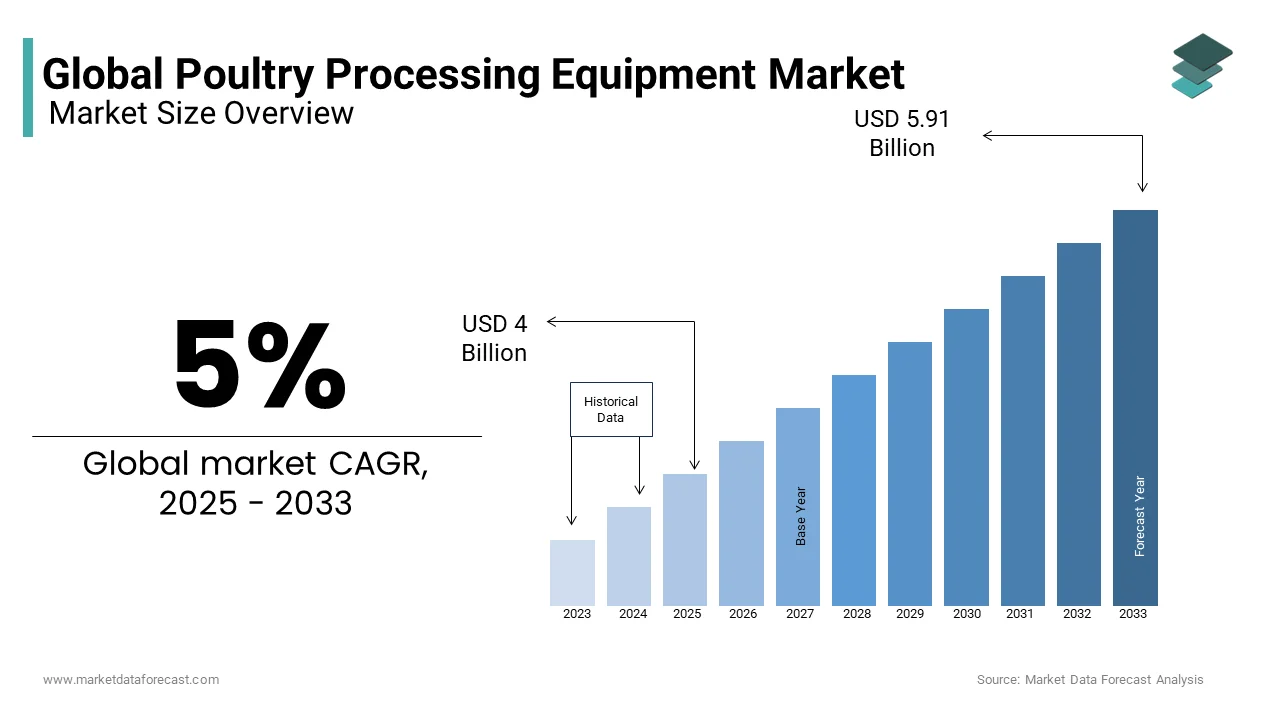

The global poultry processing equipment market was valued USD 3.81 billion in 2024 and is anticipated to reach USD 4.00 billion in 2025 from USD 5.91 billion by 2033, growing at a CAGR of 5% during the forecast period from 2025 to 2033.

Poultry processing equipment converts live poultry into raw products considered fit for human consumption. The poultry processing equipment consists of machines used in poultry plants to process poultry products. This equipment supports the industries in expanding their production capacities by limiting human intervention. The poultry processing equipment is estimated to enhance production quality by reducing contamination. The poultry equipment tools are used for hatching, slaughtering, de-feathering, deboning, and skinning. The global poultry processing equipment market has accounted for significant growth in the past years and is anticipated to have notable growth during the forecast period.

- For Instance, the top producers of chicken meat are the United States with 20% of the global production, which is 21.08 million metric tons in 2024 and is followed by Brazil with 14%, then China with 14% with 14.8 million metric tons.

MARKET DRIVERS

Increased consumer preference for protein-rich foods and increased consumption of processed foods, such as meal preparation and meat dish preparation, drive the global poultry processing equipment market. As the health problems associated with meat consumption grow, the demand for poultry products worldwide will increase further. Additionally, increased adoption of safety measures for poultry processing equipment will ensure nutritional benefits, accelerating market growth during the forecast period. As the demand for poultry products increases and the technological development of poultry processing equipment increases, the global market for poultry processing equipment will be further strengthened.

- For Instance, in 2024, Japan topped globally with the largest share of broiler meat importers. Brazil and the United States are the two top exporters of broiler meat globally.

As people around the world have an increasing preference for meat consumption, the demand for processing machinery has increased. Many other developments in meat processing technology can be deciding factors in the growth of the global poultry processing equipment market. Furthermore, mechanization of the meat production method reduced labor costs and improved meat quality and safety. Meat comprises different contents such as water, protein, and fat. Meat processing techniques are used to preserve food for a long time, refine the preparation process, and improve its flavor. Many industries have entered the market to meet the demand for processed meat worldwide, creating a need for meat processing equipment. Poultry processing equipment is used to treat turkeys, ducks, and primarily chicken. Poultry is a rich source of protein and is easily digestible by consumers. It is derived from a rich source of essential amino acids, vitamins, phosphorus, fats, and minerals in the skeletal muscle overdose diet of various algae. In addition, poultry processing equipment is used to prepare Meat using multiple types of poultry consumed by humans. Different methods included in poultry processing equipment include killing and slaughtering, fighting, cutting, boning and skinning, pickling and tumbling, and more.

The global market for poultry meat processing equipment is supposed to increase consumer preference for protein-rich foods and expand growth due to technological advances in food processing equipment.

The demand for processed poultry meat has grown exponentially with the rapid development of consumer food preferences and increased interest in health, leading to a high-protein, fat-free diet. Meat processing equipment is essential in the meat production process. The development of various meat processing technologies is also assumed to promote the growth of the global market. Mechanization in the production process has contributed positively to reduced labor and meat safety. The increase in disposable income for middle-class consumers has positively impacted the global poultry processing equipment market.

MARKET RESTRAINTS

Developing countries where expensive processing equipment cannot be easily purchased can act as market limitations. Lack of knowledge of technological advances in the local market is anticipated to hamper the development of the poultry processing equipment market. Specific factors related to meat intake, such as the risk of obesity and health problems, can have a negative impact on the market. Furthermore, rising raw material prices and high capital investments may hamper the global market for poultry processing equipment. Various factors, such as the high risk of contamination to salmonella bacteria and other pathogens and bruising during transportation slaughter, may lead to birds' downgrading and hinder market growth. The higher chances of exposure to various diseases and infections and the requirement of high maintenance of the equipment may impede the market growth rate.

MARKET OPPORTUNITIES

The growing initiatives to improve global food security are escalating the demand for efficient automated systems and advanced processing equipment, which provides market growth opportunities during the forecast period. The escalation in technological advancements across the food industry, the continuous adoption of machinery, and the growing innovations in product development are estimated to create market growth opportunities in the coming years.

MARKET CHALLENGES

The increasing veganism worldwide is predicted to negatively impact the expansion of the poultry industry, leading to restricted growth of poultry processing equipment. The growing health awareness among consumers and the significant shift in consumer preferences may challenge the market growth in the coming years.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5% |

|

Segments Covered |

By Animal Type, Equipment Type, and Region |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bayle S.A., Baader Food Processing Machinery, Inc., Marel HF, CTB, Inc., Brower Equipment, Prime Equipment Group, Inc., John Bean Technologies Corporation, CG Manufacturing and Distribution Limited, Cantrell, Meyn and Others. |

SEGMENTAL INSIGHTS

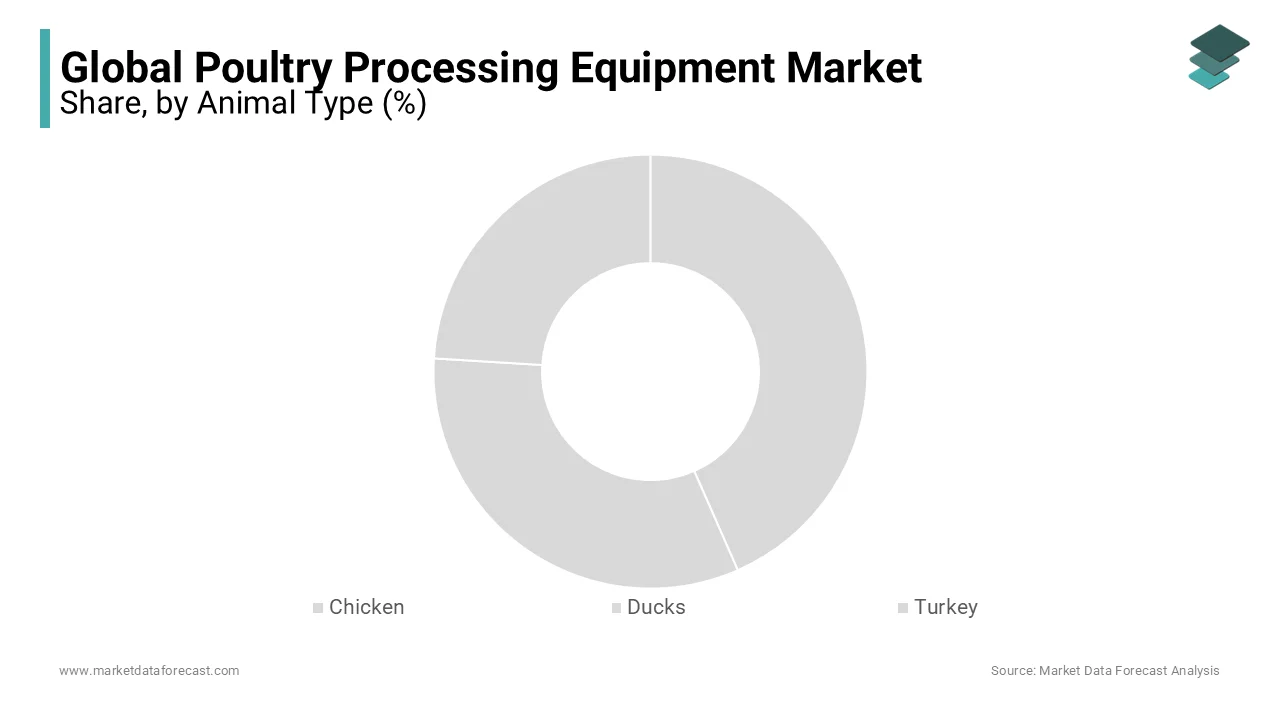

By animal type, the chicken segment holds the most significant share of the global market in 2024.

The dominance of the chicken segment in the global market is expected to continue throughout the forecast period. Chicken is the most common poultry type consumed worldwide and is the primary factor contributing to segment revenue. The increasing population is expanding the global food service, escalating the demand for chicken products, and propelling the market growth in the forecast period. The increased consumption of chickens enhances the requirement for efficient and cost-effective processing equipment, driving the segment growth rate.

- According to the data provided by World Population Review, the United States holds the record as the largest chicken consumer, as every year, the U.S. consumes approximately 15,000 metric tons of chicken, followed by China, which consumes 12,000 metric tons per year.

The turkey segment is estimated to have a steady growth rate during the forecast period owing to its growing consumption worldwide.

- For Instance, the United States consumes most Meat, which accounts for around 41% of the global turkey consumption.

Based on equipment type, the killing and de-feathering segment led the market in 2024.

The increased adoption of de-feathering and killing machines across the poultry industries involves increased labor work, boosting the segment growth rate. These two pieces of equipment are the primary requirement of every automated poultry processing plant, fueling the segment revenue expansion. These machines primarily support the industry by enhancing productivity and reducing the injury risks to the workforce, which augments the segment growth.

The deboning and skinning segment is estimated to have considerable growth during the forecast period. The growing demand for chicken products from fast-food services is enhancing the demand for higher production, which fuels the segment expansion.

REGIONAL ANALYSIS

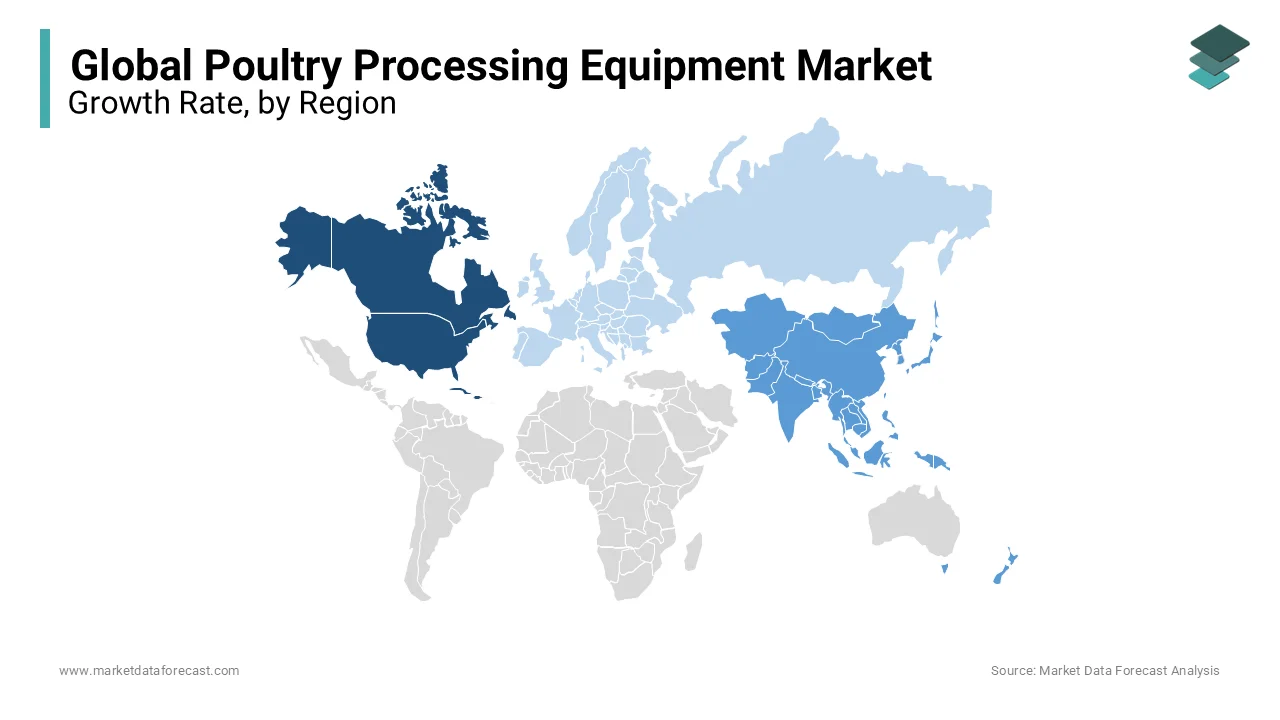

Asia Pacific is expected to be the fastest-growing region in the market, followed by Europe and North America.

North America has the highest demand for poultry processing equipment. The largest market share for poultry processing equipment was obtained in the United States and Canada, considering consumer preferences. The North American poultry processing equipment market is primarily affected by increased government support for the expansion of the poultry processing industry in this region. Also, stringent government regulations to ensure food quality and shift consumer preferences for high-value, protein-rich, fat-free foods have increased the demand for poultry processing equipment in North America. Emerging markets are overcoming technological constraints and currently offer ample growth opportunities, especially in India, Japan, New Zealand, and China.

The poultry processing equipment market in the Asia Pacific region is presumed to expand rapidly in the near future as the consumption of protein-rich foods such as meat and poultry products increases significantly. Asian countries like China, India, Vietnam, Thailand, and Japan see significant increases in meat consumption. This is anticipated to boost demand for poultry processing equipment, which will be a substantial factor in revitalizing the poultry processing equipment market in the region. The Brazilian and Argentine poultry processing equipment markets are also foreseen to grow during the forecast period. Increased meat consumption in European markets in the UK, France, Germany, and Switzerland is also likely to generate demand for poultry processing equipment during the forecast period.

KEY MARKET PLAYERS

Companies playing the leading role in the global poultry processing equipment market include Bayle S.A., Baader Food Processing Machinery, Inc., Marel HF, CTB, Inc., Brower Equipment, Prime Equipment Group, Inc., John Bean Technologies Corporation, CG Manufacturing and Distribution Limited, Cantrell, Meyn

RECENT HAPPENINGS IN THIS MARKET

- In April 2024, Olymel announced the closure of the Saint-Jean-sur-Richelieu plant, which processes poultry products. The decision was made due to the continued decline in production volumes, which resulted in the 40% capacity of plant operation.

- In March 2023, BADDER, a German-based company known for manufacturing innovative machinery for the food processing industry, announced its partnership with RND automation. The major aim of the partnership is to enhance the production of up to 15.000 birds per hour.

- In 2019, John Bean Technologies Corporation completed the acquisition of Proseal UK Limited and Prime Equipment Group, Inc. With the purchase of Prime Equipment Group, Inc., John Bean Technologies Corporation will expand its full-line solution for poultry consumers.

- In 2018, Cargill acquired Campollo in Colombia, expanding its poultry business and expanding it in Latin America.

- In 2018, Key Technology Inc. and Heat and Control, Inc. entered a strategic partnership for Heat and Control Inc. to expand a wide range of solutions for manufacturers of poultry, meat, seafood, snacks, and other fresh and processed food products in New Zealand, India and Australia.

- In March 2018, Marlen International, Inc. launched new Afoheat, Carruthers, and Unitherm food processing equipment at AnugaFoodTec, Germany.

- In March 2017, Bühler Holding AG launched an advanced grain cleaning solution to help reduce mycotoxin levels.

MARKET SEGMENTATION

This market research report on the global poultry processing equipment market is segmented and sub-segmented into the following categories.

By Animal Type

- Chicken

- Ducks

- Turkey

- Others

By Equipment Type

- Killing & De-Feathering

- Deboning & Skinning

- Cut-Ups

- Evisceration

- Marinating & Tumbling

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. what is the current market size of the global poultry processing equipment market?

The global poultry processing equipment market size is expected to be valued at USD 4 billion in 2024.

2. Which region dominates the Global Poultry Processing Equipment Market in terms of market share?

North America has the highest demand for poultry processing equipment. The largest market share for poultry processing equipment was obtained in the United States and Canada.

3. How is the Poultry Processing Equipment Market evolving in the Asia-Pacific region?

The poultry processing equipment market in the Asia Pacific region is presumed to expand rapidly in the near future as the consumption of protein-rich foods such as meat and poultry products increases significantly.

4. what are the major driving factors for the Poultry Processing Equipment Market?

Increased consumer preference for protein-rich foods and increased consumption of processed foods, such as meal preparation and meat dish preparation, are driving the global market for poultry processing equipment.

5. who are the key market players involved in this market?

Bayle S.A., Baader Food Processing Machinery, Inc., Marel HF, CTB, Inc., Brower Equipment, Prime Equipment Group, Inc., John Bean Technologies Corporation, CG Manufacturing and Distribution Limited, Cantrell, Meyn. Some of the major key players involved in the global poultry processing equipment market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]