Global Poultry Healthcare Market Size, Share, Trends & Growth Forecast Report By Product Type, Test Type and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Poultry Healthcare Market Size

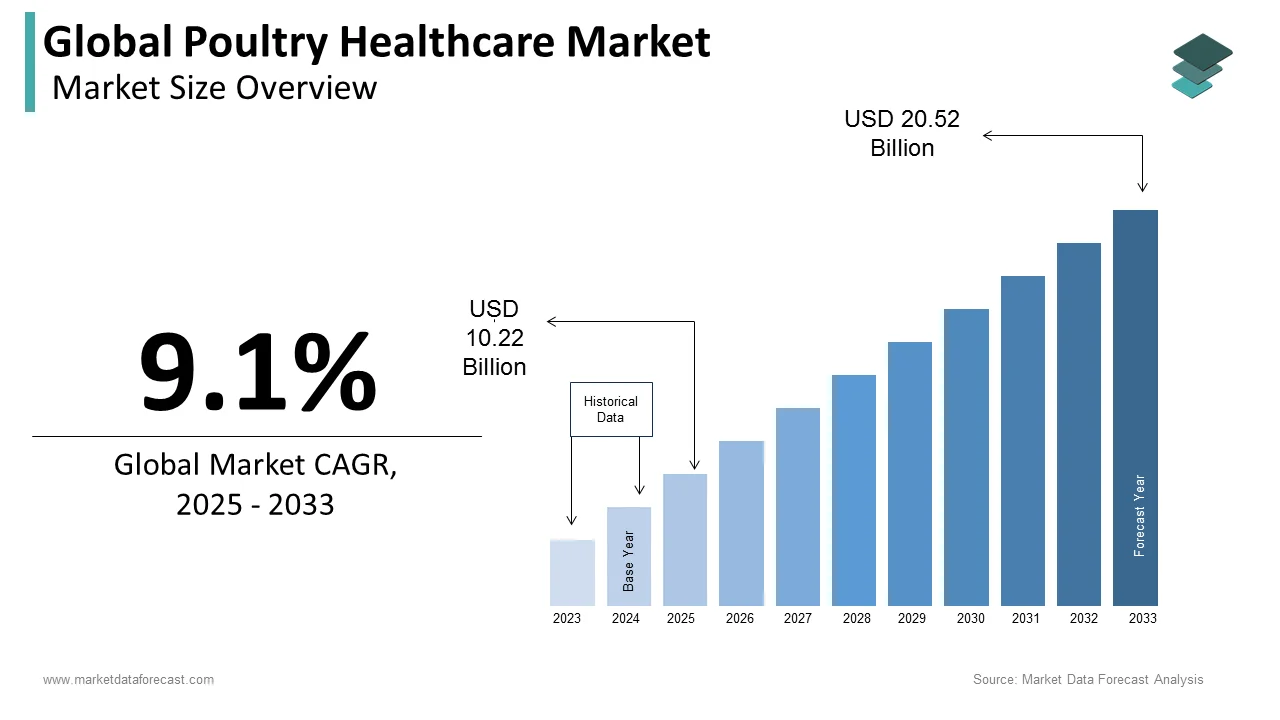

The size of the global poultry healthcare market was worth USD 9.37 billion in 2024. The global market is anticipated to grow at a CAGR of 9.1% from 2025 to 2033 and be worth USD 20.52 billion by 2033 from USD 10.22 billion in 2025.

Poultry is a type of animal husbandry in which birds are grown for meat, eggs, and feathers, either commercially or domestically. Chickens, ducks, turkeys, and geese are commercially important poultry, although guinea fowl and squabs are only of local significance. The health of these birds is managed and maintained through poultry healthcare. Poultry eggs and meat are vital sources of high-quality proteins, minerals, and vitamins that help to keep the human diet balanced. Egg-type chicken breeds with rapid growth and excellent feed conversion efficiency are available. As a result, poultry health has become a crucial part of animal farming. Poultry farming is not only a valuable source of secondary income, but it also ensures people's nutritional security. It is a primary protein source in the human diet. Increased demand for protein-rich animal items, particularly chicken products, results from changing lifestyles and diets. According to the International Food Policy Research Institute, by 2020, developing countries will produce around 40% more meat and 60% more milk per capita than in 1990. To accomplish this goal, poultry healthcare plays an important role.

MARKET DRIVERS

The growing prevalence of poultry illnesses and the growing need for vaccinations propels the global poultry healthcare market.

Newcastle disease, avian influenza, bird flu, fowl pox, infectious bronchitis, and aspergillosis are all causing a rise in the need for poultry healthcare. These illnesses not only affect birds but may also spread to people. For example, since 2003, 239 instances of human infection with the avian influenza A (H5N1) virus have been recorded from four countries: Cambodia, China, Vietnam, and Lao PDR as of December 17, 2020. Likewise, according to WHO, persons who come into close contact with infected living or dead birds are more likely to develop H5N1 bird flu. Further, Between 15th January to 4th February of 2021, 9,065,680 animals were reported as losses in loss, and new outbreaks of pathogenic avian influenza in Africa, Asia, and Europe. These increasing diseases raise the demand for vaccines. Several groups are developing vaccinations, parasiticides, anti-infectives, and feed additives to cure these illnesses.

Government initiatives further propel the global poultry healthcare market.

Governments are making efforts to improve the market because poultry health has become crucial for human people, and poultry healthcare plays a significant role in creating higher income and productivity in poultry farming. In India, for example, the National Livestock Mission (NLM) is intended to include all actions necessary to guarantee quantitative and qualitative improvements in livestock production systems and capacity building among all stakeholders. Governments are also attempting to increase poultry product output and address the issues that arise during poultry production. As production grows, so does the demand for good animal healthcare. As a result, governments worldwide are investing in developing improved animal healthcare systems and expanding the poultry healthcare market.

MARKET RESTRAINTS

Counterfeit products and lack of awareness limit the poultry healthcare market growth.

However, the poultry healthcare business is constrained by the prevalence of counterfeit products and a lack of awareness. As poultry becomes a more appealing target for market players, counterfeit products are rising. As a result, counterfeit products are readily available, especially in rural markets. Furthermore, many farmers are unfamiliar with the processes involved in poultry healthcare management. Many birds die due to this lack of understanding, and money is lost. As a result, growth in the poultry healthcare industry has slowed.

Impact Of Covid-19 On The Global Poultry Healthcare Market

COVID-19 acts as a challenge for the poultry healthcare market. COVID-19 caused chaos in the human healthcare industry. The coronavirus epidemic has also disrupted the poultry healthcare business. Chickens and other poultry animals are not vulnerable to SARS-CoV-2 (COVID-19) virus intranasal infection. Nonetheless, COVID-19 demonstrates the effects on poultry consumption, transportation, and poultry agricultural economics. It has also considered the economic, ethical, and social components and the maintenance of high environmental security. In the current circumstances, stockholders, veterinarians, farmers, and all other players in the chicken production chain face hurdles. During the COVID-19 pandemic, antibiotics were used more often in feed-producing animals to boost animal immunity and health and raise animal agricultural earnings. However, its use increases the risk of antibiotic-resistant microorganisms and the harmful effects of antibiotics on the environment, such as cross-resistance and carryover effects.The ongoing pandemic also results in a labor shortage for everyday animal care and farming and limits on free-range and backyard husbandry, putting a strain on poultry nutrition and disease treatments. Poultry meat production has also fallen because of the epidemic. In 2020, worldwide chicken meat output decreased by 2%, and worldwide chicken meat commerce decreased by 1%. Increased feeding costs, raw ingredient prices, and availability also negatively impact the industry's growth and customers' purchasing power, especially in the aftermath of the COVID-19 epidemic. As a result of the COVID-19 pandemic, it is now more important than ever to recognize the severe threat that existing viruses and future microbes might cause pandemics to represent animal health.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.1% |

|

Segments Covered |

By Product Type, Test Type, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bayer AG, Boehringer Ingelheim GmbH, Ceva Sante Animale, Merck & Co. Inc., IDEXX Laboratories, Inc., Megacor Diagnostik GmbH, Thermo Fisher Scientific Inc., Virbac and Zoetis Inc, and Others. |

SEGMENTAL ANALYSIS

By Product Type Insights

- Vaccines

- Parasiticides

- Anti-Infectives

- Medical Feed Additives

- Others

By Test Type Insights

- ELISA (Enzyme-Linked Immunosorbent Assay) Test

- PCR (Polymerase Chain Reaction) Test

- Molecular Diagnostic Test

- Other Test Types

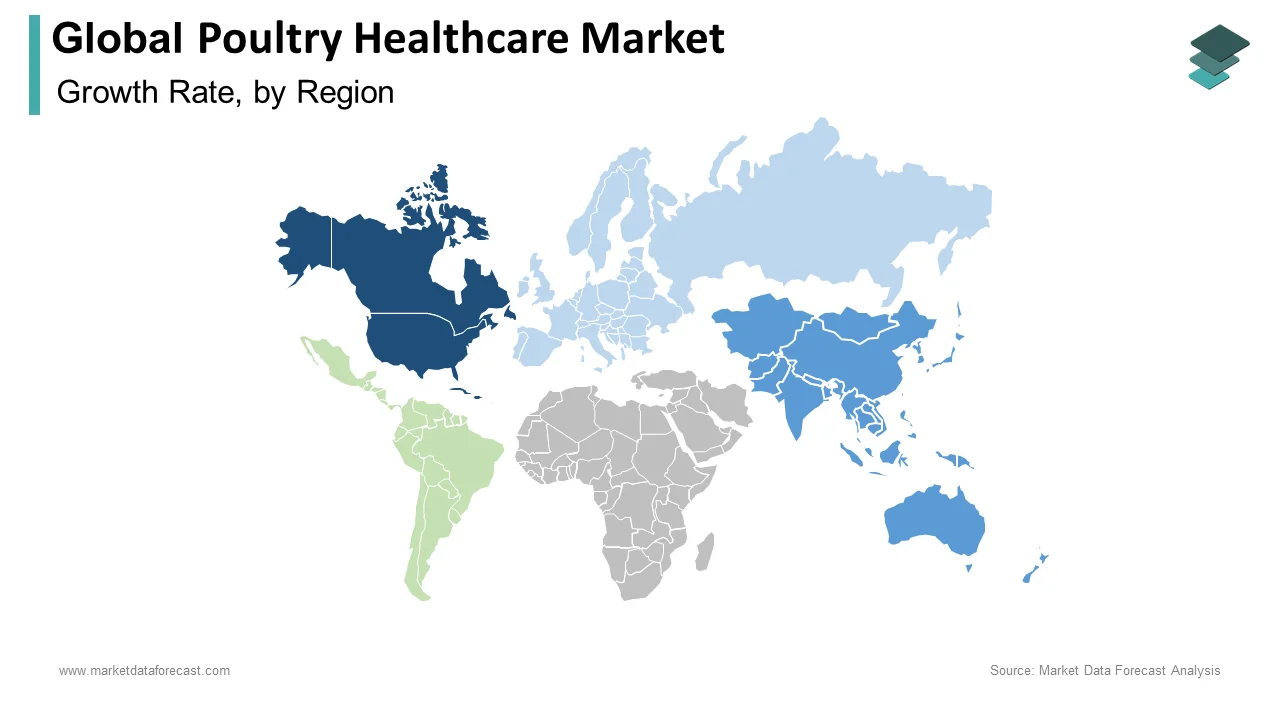

REGIONAL ANALYSIS

- North America

- The United States

- Canada

- Rest of North America

- Europe

- UK

- Germany

- France

- Spain

- Italy

- Rest of Europe

- APAC

- India

- China

- Japan

- Australia

- South Korea

- Rest of APAC

- Latin America

- Mexico

- Brazil

- Chile

- Argentina

- Rest of Europe

- Middle East and Africa

KEY MARKET PLAYERS

Some of the notable companies operating in the global poultry healthcare market profiled in this report are Bayer AG, Boehringer Ingelheim GmbH, Ceva Sante Animale, Merck & Co. Inc., IDEXX Laboratories, Inc., Megacor Diagnostik GmbH, Thermo Fisher Scientific Inc., Virbac and Zoetis Inc.These players concentrate on strategies like product launches, partnerships or collaborations, acquisitions, and mergers.

RECENT MARKET DEVELOPMENTS

-

In February 2021, Merck Animal Health, a part of Merck & Co. known as MSD Animal Health outside of the United States and Canada, completed its acquisition of PrognostiX Poultry Limited d/b/a Poultry Sense Ltd. from its founding stockholders. Poultry Sense Ltd. is a leader in the poultry industry's health and environmental monitoring systems.

-

In October 2020, Kemin Industries inked an exclusive partnership with Pacific GeneTech (PGT) to license PGT's TMH001 Eimeria vaccine for poultry through its subsidiary Kemin Biologics. PGT is a biologics firm that develops and commercializes next-generation vaccines for animal health and food safety applications with significant unmet or underserved requirements.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]