Global Poultry Feed Premix Market Size, Share, Trends, COVID-19 Impact and Growth Forecasts Report, Segmented By Ingredient Type (Minerals, Antibiotics, Vitamins, Amino Acid, other Ingredients), End User (Large-scale Poultry Farms, Small and Medium-sized Poultry Farms, and Home-based Poultry Keepers) and Region (North America, Europe, Asia Pacific, Latin America, Middle East And Africa), Industry Analysis From 2025 to 2033

Global Poultry Feed Premix Market Size

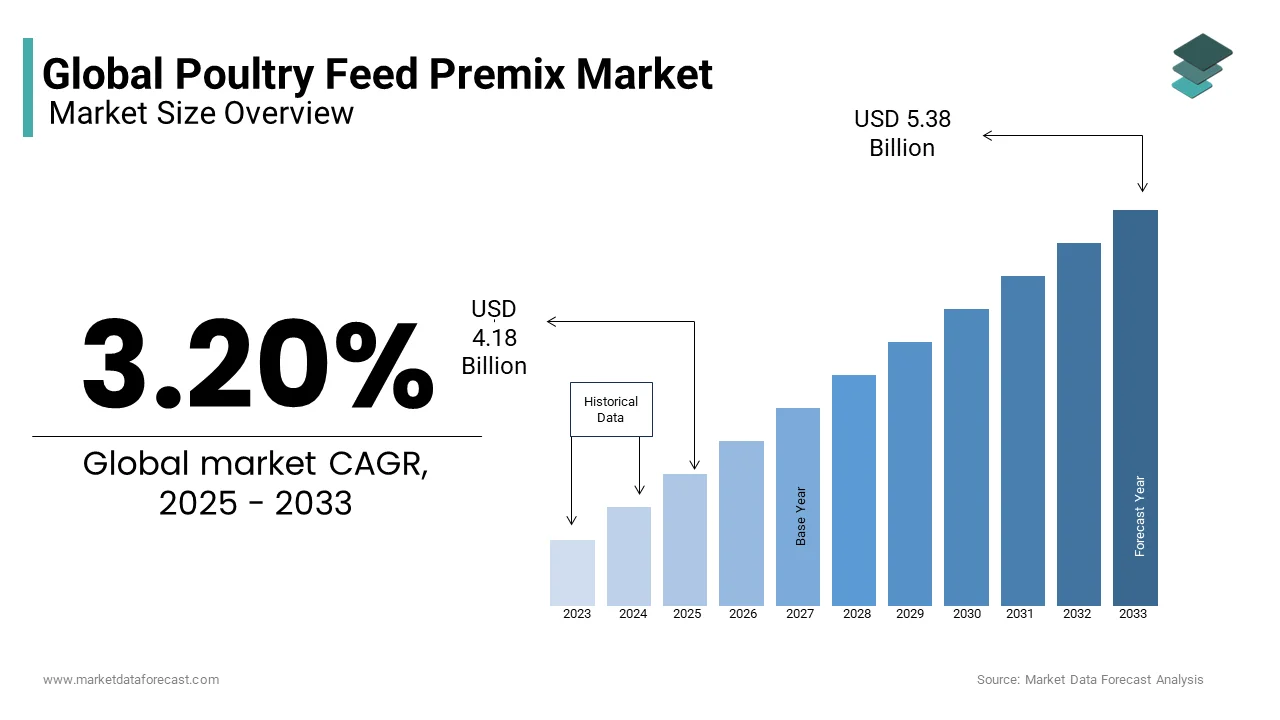

The global poultry feed premium market was valued at USD 4.05 billion in 2024 and is anticipated to reach 4.18 billion in 2025 from USD 5.38 billion by 2033, growing at a compound annual growth rate (CAGR) of 3.20% during the forecast period from 2025 to 2033.

MARKET DRIVERS

The surging global demand for poultry products is propelling the growth of the global poultry feed premix market.

This increase results from population expansion and shifting dietary preferences, with poultry meat and eggs becoming staples in many diets. As the world's population continues to grow, the need for poultry production also rises. Poultry feed premixes play an important role in meeting this demand by ensuring that poultry receives the essential nutrients necessary for healthy growth and optimal performance. Poultry farmers rely on these premixes to provide precise nutritional formulations, enhancing the overall health and productivity of their flocks. With advancements in feed technology and the industrialization of poultry farming, the market is witnessing a surge in demand. Moreover, regulatory standards for animal feed safety and quality, coupled with the growing emphasis on sustainability and organic production, further amplify the market's growth prospects. In this dynamic landscape, the poultry feed premix market is poised for continued expansion as it adapts to meet the evolving needs of the poultry industry.

Technological advancements in the poultry industry are promoting global poultry feed premix growth.

Technological advancement is a driving force in the poultry feed premix market due to revolutionized feed formulation, ingredient sourcing, and manufacturing processes. These innovations have had a profound impact on the quality and effectiveness of poultry feed premixes, driving their increased adoption in the poultry industry. Modern feed formulation software and tools enable precise and customized nutrient profiles for different poultry species and growth stages, optimizing bird health and performance. Improved ingredient sourcing involves utilizing high-quality, sustainable, and specialized components to meet the specific nutritional requirements of poultry, contributing to better feed quality. Manufacturing processes have become more efficient and accurate, ensuring the uniform distribution of nutrients in the feed premixes. This results in consistent and balanced diets for poultry, which, in turn, enhances productivity and overall well-being. These technological advancements are propelling the growth of the poultry feed premix market, meeting the evolving needs of the poultry industry with precision and efficiency.

MARKET RESTRAINTS

The fluctuating raw material prices are hampering the growth of the global poultry feed premix market.

This industry relies heavily on a variety of essential components like vitamins, minerals, amino acids, and others to formulate nutritionally balanced feed premixes. These raw materials are important in the market, which can have an effect on production costs and, ultimately, poultry farmers. When prices surge, the cost of premix production increases, potentially straining the budgets of poultry farmers. Such unpredictability can hinder their ability to maintain consistent, cost-effective nutrition for their flocks. To mitigate this restraint, industry participants often employ risk management strategies and work on building resilient supply chains.

Environmental concerns are also a significant restraint on the poultry feed premix market. As the poultry industry is heightened for its environmental impact, there is a rising need for sustainable practices, including the production and use of feed premixes. Embracing sustainable manufacturing processes and sourcing practices can introduce additional costs and complexities to the production of feed premixes. For instance, using environmentally friendly packaging materials and energy-efficient manufacturing facilities may require significant investments. Moreover, the procurement of sustainably sourced raw materials can entail higher expenses. As consumers increasingly demand ethically and sustainably produced poultry products, feed premix producers that embrace sustainable practices can gain a competitive edge in a changing market landscape.

Impact Of COVID-19 On the Global Poultry Feed Premix Market

The COVID-19 pandemic had a notable impact on the Poultry Feed premium market, both in terms of demerits and merits. The disruption in supply chains caused by lockdowns and restrictions led to uncertainties in the availability of raw materials, potentially affecting the production of feed premixes. Fluctuations in global trade also impacted the prices of key ingredients, leading to cost increases. Furthermore, the temporary shutdown of poultry processing plants and food service outlets affected the demand for poultry products, indirectly affecting the need for feed premixes. The economic repercussions of the pandemic also strained the budgets of poultry farmers, potentially leading to reduced purchases of feed premixes. But on the positive side, the pandemic reinforced the importance of safe and efficient food production, driving the adoption of advanced technology in the poultry industry, including in feed formulation and delivery. It also emphasized the need for resilient supply chains, encouraging greater efficiency in the manufacturing and distribution of feed premixes.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.2% |

|

Segments Covered |

Based on the Ingredient Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Cargill, Archer Daniels Midland Company, Nutreco, Charoen Pokphand Foods Public Company Limited, DLG Group, Evonik Industries, Koninklijke DSM N.V., Phibro Animal Health Corporation, Alltech, Zagro, AB Agri, Vilofoss, Biomin, Kent Nutrition Group, Novus International, ForFarmers, Lallemand Animal Nutrition, NWF Group, The Mosaic Company. |

SEGMENTAL ANALYSIS

By Ingredient Type Insights

The vitamins segment had the major share of the global poultry feed premix market in 2024 and is expected to progress at a healthy CAGR during the forecast period. Vitamins are the most dominating vital components in poultry nutrition as they are essential for various physiological functions, including growth, reproduction, and overall health. Vitamins are essential for the proper development and maintenance of poultry.

The minerals segment is a lucrative segment in the global market. Minerals hold the second largest share in the market as they are essential for bone development, muscle function, and overall metabolic processes. Minerals are included in premixes to maintain the mineral balance in poultry diets, ensuring birds receive the right proportions of each mineral for their growth and productivity.

The amino acids segment is expected to showcase a prominent CAGR during the forecast period. Amino acids are vital for protein synthesis, which is crucial for muscle growth, feather development, and egg production in poultry. Amino acid premixes are formulated to provide the precise balance of amino acids needed by poultry, especially in feed with limited protein sources.

The antibiotics segment is a prominent segment and is predicted to hold a considerable share of the global market during the forecast period. Antibiotics have been used in poultry feed premixes for growth promotion and disease prevention in the past, but their usage is becoming less dominant due to concerns about antimicrobial resistance and changing regulations. Antibiotics are often used under strict veterinary supervision and regulatory guidelines.

By End-User Insights

The large-scale poultry farms segment is expected to account for the major share of the worldwide market over the forecast period. Large-scale poultry farms typically dominate the consumption of feed premixes as these operations are characterized by their extensive production capacity, where they raise a significant number of birds for commercial purposes, often in the thousands or more. Due to the scale and commercial nature of these operations, they have the financial capacity and incentive to invest in high-quality premixes. These farms aim to maximize productivity, reduce mortality rates, and maintain uniform flock growth. Consequently, they often rely heavily on professionally formulated feed premixes to achieve these goals.

The small and medium-sized segment is anticipated to grow at a healthy CAGR during the forecast period. Small and medium-sized poultry farms are the second leading players in the market as they may have more specific production goals. The choice of premixes in this segment often depends on the type of poultry raised and the specific objectives of the farm.

Home-based poultry keepers, including backyard enthusiasts and small-scale hobbyists, form a smaller segment of the market. These keepers typically have a limited number of birds, often for personal consumption or local sales.

REGIONAL ANALYSIS

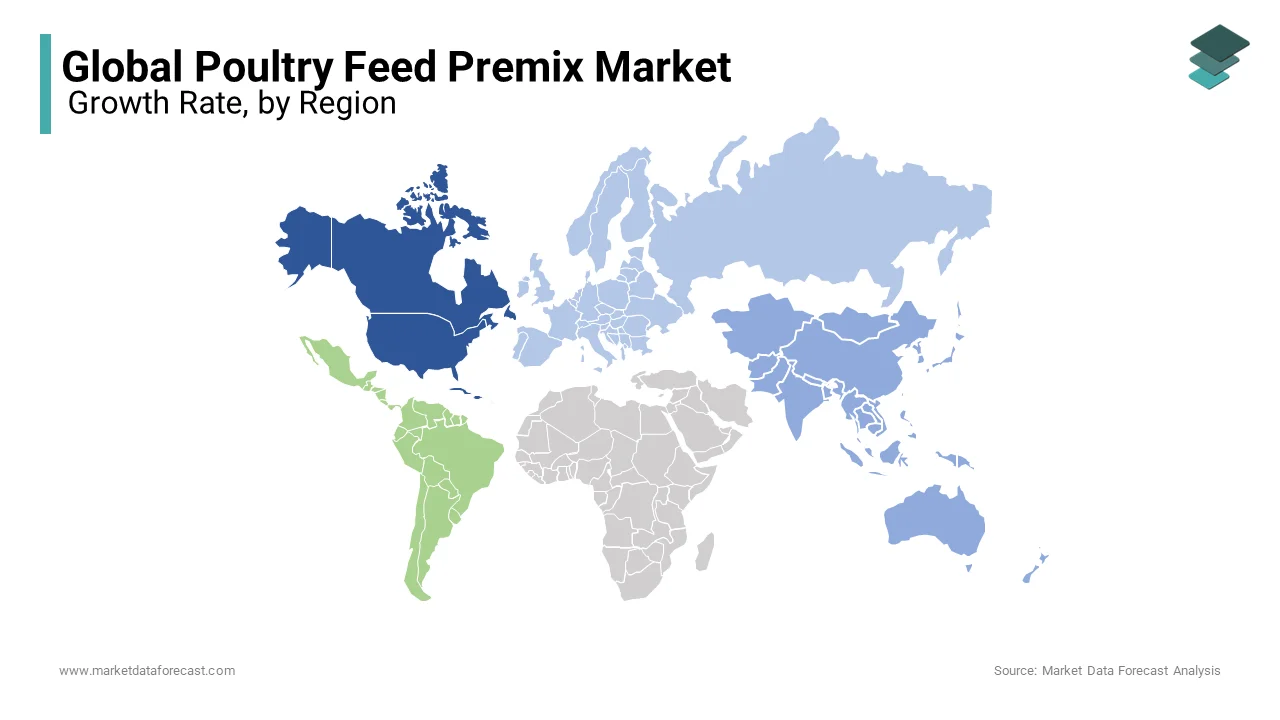

North America is most dominating in the poultry feed premix market as the region boasts advanced poultry production practices, stringent quality standards, and a strong focus on industrial farming. Large-scale poultry farms are prevalent, driving the demand for high-quality feed premixes. Furthermore, consumer demand for specialty poultry products, such as organic and antibiotic-free options, has led to the development of specialized premises.

Asia Pacific is often considered the second-most dominant region in the poultry feed premix market due to the substantial poultry production, large populations, and increasing demand for poultry products. The presence of both extensive commercial poultry operations and numerous small to medium-sized farms contributes to the significant market share. The region's dynamic poultry industry and focus on cost-effective production are key drivers.

Europe has a strong presence in the poultry feed premix market, with advanced and sustainable farming practices. The region's emphasis on animal welfare and organic farming has led to a demand for specialty premixes. While the poultry industry in Europe is not as extensive as in Asia or North America, the focus on quality, safety, and sustainable agriculture ensures a significant market share.

Latin America is likely to have a prominent growth rate in the poultry feed premixes market in the coming years. Countries like Brazil have a growing poultry industry driven by both domestic consumption and exports. The region's diverse poultry farming landscape includes large commercial operations and smaller farms, contributing to the market's growth. Demand for poultry feed premixes in Latin America is increasing as the poultry industry expands.

The Middle East and Africa region exhibits growth potential in the poultry feed premix market. The poultry industry is developing, driven by population growth, urbanization, and changing dietary habits. While the market share in this region may be smaller compared to the aforementioned regions, it is gaining importance as poultry production expands to meet local and export demands.

KEY MARKET PLAYERS

Cargill, Archer Daniels Midland Company, Nutreco, Charoen Pokphand Foods Public Company Limited, DLG Group, Evonik Industries, Koninklijke DSM N.V., Phibro Animal Health Corporation, Alltech, Zagro, AB Agri, Vilofoss, Biomin, Kent Nutrition Group, Novus International, ForFarmers, Lallemand Animal Nutrition, NWF Group, The Mosaic Company. Some major companies are dominating the global poultry feed premix market.

RECENT HAPPENINGS IN THIS MARKET

- In 2022, Cargill continued to invest in research and development, focusing on the development of customized poultry feed premix solutions to meet specific nutritional needs of different poultry species.

- In 2023, Land O'Lakes emphasized the importance of antibiotic-free feed premixes and launched a range of such products to meet consumer preferences for antibiotic-free poultry products.

- In 2023, Invivo Group leveraged data analytics and digital technologies to provide customized and data-driven poultry feed premix solutions for optimizing feed formulations.

MARKET SEGMENTATION

This research report on the global poultry feed premix market is segmented and sub-segmented into the following categories.

By Ingredient Type

- Minerals

- Antibiotics

- Vitamins

- Amino acid

- Others

By End-User

- Large-scale Poultry Farms

- Small and Medium-sized Poultry Farms

- Home-based Poultry Keepers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

what is the size of global poultry feed premix market ?

The global Poultry Feed Premix Market was valued at USD 4.18 billion in 2025 and it is estimated to reach a valuation of USD 5.38 billion by the end of 2033.

what is the CAGR of poultry feed premix market ?

The poultry feed premix market be growing at a CAGR of 3.20% by 2033.

what are the keyplayers involved in polutry feed premix market ?

Some of the major companies dominating this market are Cargill, Koninklijke DSM N.V., Nutreco N.V., Archer Daniels Midland Company, and InVivo Nutrition et Sante Animales.

Which Region Is Dominating in Global poultry feed premix market ?

North America is most dominating in the poultry feed premix market as the region boasts advanced poultry production practices, stringent quality standards, and a strong focus on industrial farming.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]