Global Poultry Feed Market Size, Share, Trends & Growth Forecast Report, Segmented By Type (Turkeys, Broilers, Layers And Others), Feed Additives (Amino Acids, Feed Enzymes, Antioxidants, Vitamins, Antibiotics, And Feed Acidifiers) And By Region (North America, Europe, Latin America, Asia-Pacific, Middle East and Africa), Industry Analysis From 2025 to 2033

Global Poultry Feed Market Size

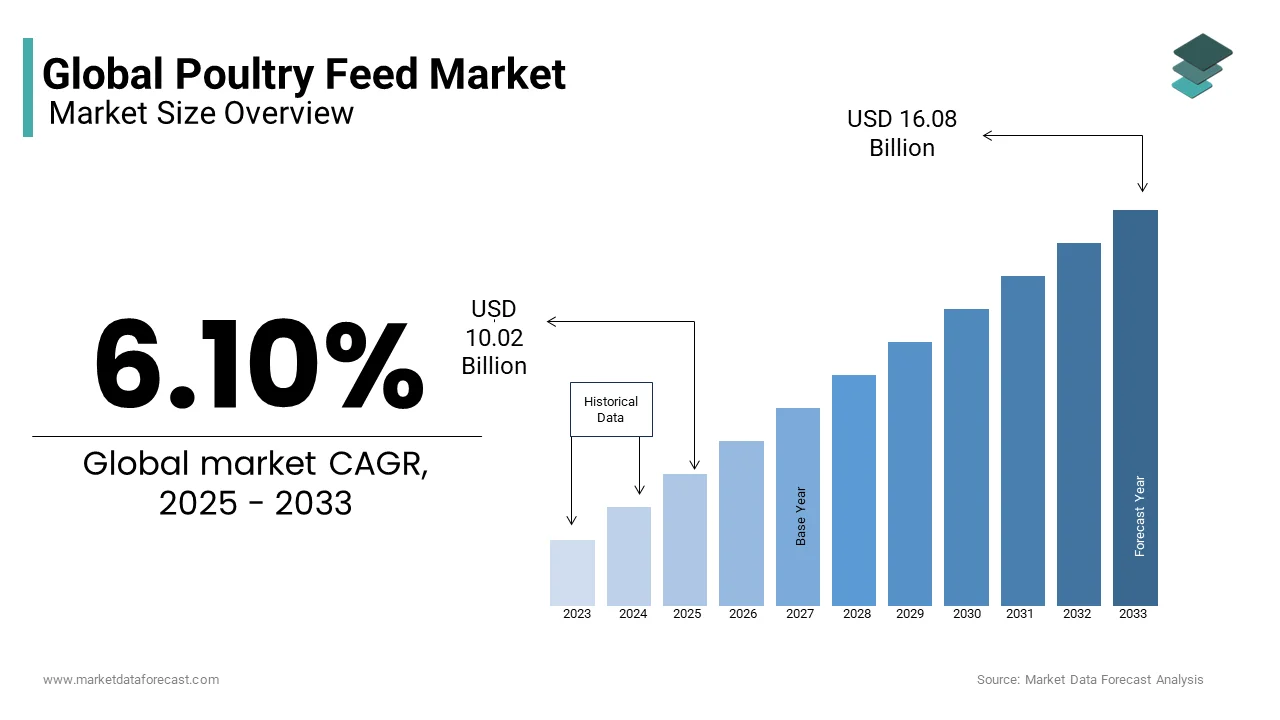

The global poultry feed market was valued at USD 9.44 billion in 2024 and is anticipated to reach USD 10.02 billion in 2025 from USD 16.08 billion by 2033, growing at a CAGR of 6.10% during the forecast period from 2025 to 2033.

Globally, there has been an increase in the poultry feed market and this market is showing great potential in the forecast period. Poultry feed is the food given to farm animals, mainly chickens, turkeys, or any other animals that give meat. The objective of poultry feed is to make the farm animals healthier so that they can provide better meat or other products, like eggs.

For poultry feed to be healthy, it should contain lots of protein and carbohydrates, along with a sufficient amount of vitamins, minerals, and an adequate amount of water. With the increase in demand for meat and eggs, the market has also grown a lot. Hence, the research to make better poultry feed has increased and there have been many developments since the early 2000s. The critical relocation of feed demand from west to east in the 2000s led to increased outputs of formulated compound feed.

MARKET DRIVERS

With the increase in spending capabilities of people due to increased incomes of people, more urbanization, mainly drivers moving to big cities, and increasing population, there has been a huge increase in demand for animal protein, especially meat, and eggs, hence triggering the increase in demand of poultry feed and additives. In addition, people’s increasing fondness for eating outside at fancy restaurants is also driving this market. There has also been an increase in poultry-related diseases in the recent past, so it is the factor that is concerning people and taking away from poultry products that affect the poultry feed market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.10% |

|

Segments Covered |

By Poultry Production, Feed additives, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

JBS S.A. (Brazil), Tyson Foods (U.S.), BRF (Brazil), CP Group (Thailand), Wen’s Food Group (China), Royal DSM N.V. (The Netherlands) |

SEGMENTAL ANALYSIS

By Feed Additives Insights

Feed acidifiers are attributed to the largest share among all other poultry additive segments globally.

REGIONAL ANALYSIS

With the shift in demand for poultry products from west to east, the Asia-Pacific region is the fastest-growing region among all the other regions mentioned while North America is having the largest share of the market.

KEY MARKET PLAYERS

Some of the major companies dominating the market, by their products and services, include JBS S.A. (Brazil), Tyson Foods (U.S.), BRF (Brazil), CP Group (Thailand), Wen’s Food Group (China), Royal DSM N.V. (The Netherlands), Charoen Popkhand Foods (Thailand) and ADM (Archer Daniels Midland Company) (U.S).

MARKET SEGMENTATION

This research report on the global poultry feed market is segmented and sub-segmented into the following categories.

By Poultry Production

- Broilers

- Turkeys

- Layers and others

By Feed additives

- Amino acids

- Feed enzymes

- Antioxidants

- Vitamins

- Antibiotics

- Feed acidifiers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East & Africa

Frequently Asked Questions

What is poultry feed, and why is it critical to the global poultry industry?

Poultry feed is a nutritionally balanced mix of grains, proteins, vitamins, and minerals formulated to support the healthy growth and productivity of birds like broilers, layers, and breeders, making it the backbone of efficient poultry farming.

What’s driving the growth of the global poultry feed market?

Key growth drivers include rising global demand for poultry meat and eggs, increased focus on animal nutrition, growth in commercial farming, and a shift toward high-performance, disease-resistant feed formulations.

What are the major types of poultry feed commonly used worldwide?

The Starter feed (for chicks), Grower feed (for developing birds), Finisher and layer feed (for broilers and egg-laying hens), are the major types of the poultry feed market.

What are the major challenges facing the poultry feed industry globally?

Challenges include fluctuating prices of raw materials like corn and soybeans, pressure to reduce antibiotic use, regulatory restrictions, and sustainability concerns around feed sourcing and production.

What trends are shaping the future of poultry feed worldwide?

The future is driven by demand for organic and non-GMO feed, innovations in feed additives (like probiotics and enzymes), precision feeding technologies, and sustainable sourcing practices that reduce environmental impact.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]