Global Potash Market Size, Share, Trends & Growth Forecast Report – Segmented By Product (Potassium Chloride, Potassium Sulphate, Potassium Nitrate), End-user (Agricultural, Non-Agricultural) And By Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) – Industry Analysis From (2025 to 2033)

Global Potash Market Size

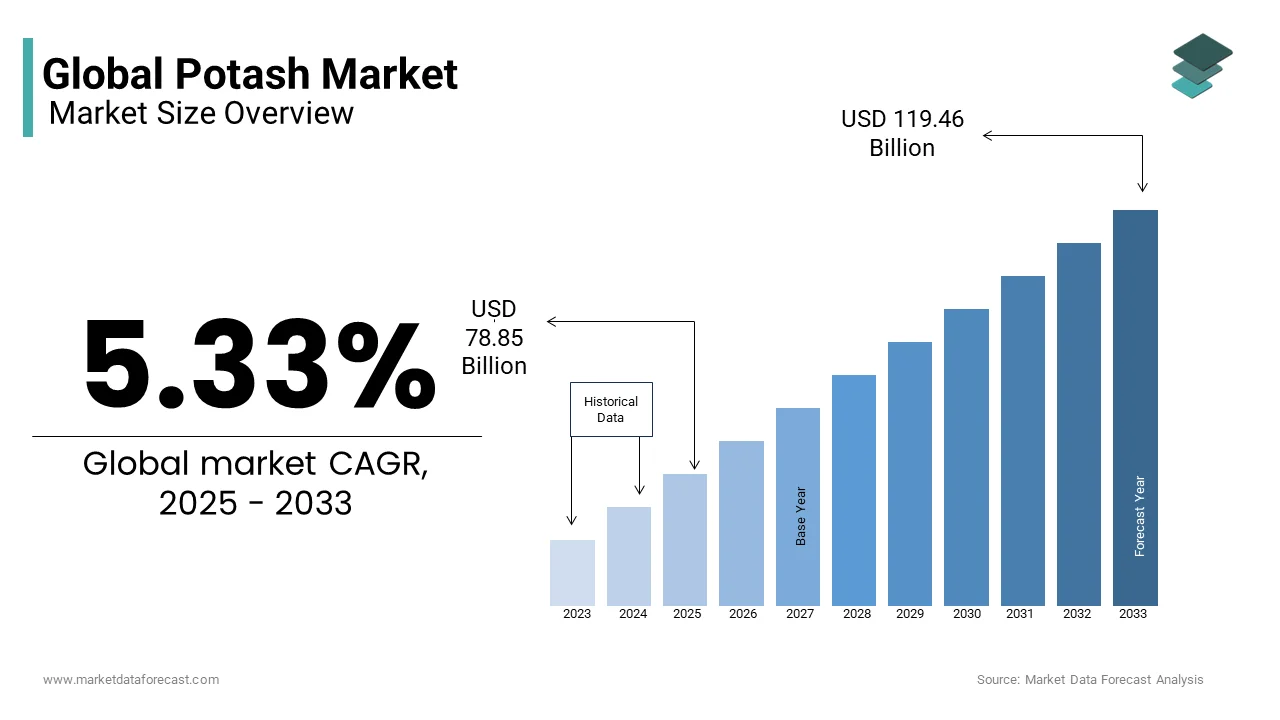

The global potash market size was valued at USD 74.86 billion in 2024 and is anticipated to reach USD 78.85 billion in 2025 from USD 119.46 billion by 2033, growing at a CAGR of 5.33% during the forecast period from 2025 to 2033.

Potash is a potassium-rich mineral that is a critical component in the production of fertilizers that plays a vital role in enhancing plant growth to improve crop yields and increase agricultural resilience against diseases and environmental stress. Global potash production is heavily concentrated in a few key regions. Canada is the world’s largest potash producer, accounting for over 30% of global production with primarily sourced from the vast reserves in Saskatchewan. Other major producers include Russia and Belarus, which together contribute nearly 40% of global supply. According to the United States Geological Survey, global potash production reached approximately 70 million metric tons in 2022 by reflecting a steady increase in response to rising agricultural demands.

Potash reserves are abundant but geographically concentrated. The global estimated reserves stand at around 3.6 billion metric tons by ensuring long-term supply stability. However, geopolitical tensions, particularly involving Russia and Belarus have periodically disrupted supply chains with leading to volatility in global potash availability. Beyond agriculture, potash is used in industrial applications such as glass manufacturing, soap production, and water softening, although these sectors account for a smaller share of total consumption.

Market Drivers

Rising Global Food Demand and Agricultural Intensification

The escalating global population, projected to reach 9.7 billion by 2050, according to the United Nations, has intensified the demand for food production and is driving the need for fertilizers like potash to enhance crop yields. Farmers are turning to potash to boost soil fertility and maximize productivity. The Food and Agriculture Organization reports that global cereal production alone reached 2.8 billion metric tons in 2022, a figure that continues to rise annually to meet growing consumption needs. Potash is vital for key crops such as corn, wheat, and rice, contributing to improved resistance against drought and diseases. This agricultural intensification directly correlates with increased potash consumption worldwide.

Expansion of Potash-Intensive Crops in Emerging Economies

The rapid agricultural development in emerging economies in Asia and Latin America is a significant driver of potash demand. Countries like India and Brazil are expanding the cultivation of potash-intensive crops such as sugarcane, soybeans, and palm oil. According to the United States Department of Agriculture, Brazil’s soybean production reached 153 million metric tons in 2023 by positioning it as the world's largest exporter. Potash application is essential in maintaining soil health and ensuring high yields for these crops. Additionally, India’s government subsidies on potash-based fertilizers have encouraged greater use among farmers that further boosting demand in these regions.

Market Restraints

Geopolitical Instability Affecting Supply Chains

The potash market is highly vulnerable to geopolitical tensions, especially given the concentration of production in a few key countries. Russia and Belarus together account for nearly 40% of global potash supply, according to the United States Geological Survey. Political instability and international sanctions against Belarus, coupled with trade restrictions on Russian exports due to ongoing conflicts, have disrupted global supply chains is leading to price volatility and supply shortages. For instance, in 2022, sanctions on Belarusian potash exports resulted in a sharp decline in global availability by causing prices to spike by over 60% within months. Such geopolitical disruptions create uncertainty for import-dependent countries and hinder the stable growth of the potash market.

High Production and Transportation Costs

Potash extraction and distribution involve significant operational expenses is acting as a restraint on market expansion. The mining process is energy-intensive, requiring substantial investments in infrastructure, equipment, and labor. Additionally, potash deposits are often located in remote regions, increasing transportation costs. For example, Canadian potash, primarily mined in Saskatchewan, must be transported over long distances to reach international markets which is contributing to higher final prices. The U.S. Geological Survey reports that fluctuations in fuel prices and increased freight charges have further strained supply chains is impacting profitability for producers and affordability for consumers. These cost challenges limit the accessibility of potash in developing regions with limited financial resources.

Market Opportunities

Growing Demand for Sustainable and Precision Agriculture

The increasing emphasis on sustainable agricultural practices presents a significant opportunity for the potash market. Precision agriculture relies on data-driven techniques to optimize fertilizer use, which enhances the efficiency of potash application is reducing environmental impacts while maximizing crop yields. According to the U.S. Department of Agriculture, precision farming has grown drastically since 2020, with more farmers adopting technologies that require customized fertilizer solutions. Potash’s role in improving nutrient efficiency aligns with these trends, positioning it as a key input for environmentally conscious farming. The demand for potash tailored to precision agriculture is expected to rise significantly as sustainability regulations tighten worldwide in Europe and North America.

Expansion of Potash Use in Non-Agricultural Sectors

Potash is gaining traction in various industrial sectors, offering new avenues for market growth. Potash is increasingly used in water treatment, pharmaceuticals, and the production of specialty glass and soaps. The U.S. Geological Survey notes that industrial use accounts for approximately 15% of total potash consumption, a figure that is steadily rising. The growing demand for eco-friendly de-icing solutions is due to the rising utilization of potassium-based compounds. Additionally, potash derivatives are being explored in battery technologies and biofuels is creating opportunities for diversification in the potash market as industries seek sustainable raw materials.

Market Challenges

Environmental Concerns and Regulatory Pressures

The environmental impact of potash mining presents a significant challenge to the market. Potash extraction often leads to land degradation, water contamination, and ecosystem disruption, particularly in regions with intensive mining operations like Canada and Russia. The U.S. Environmental Protection Agency highlights that mining activities contribute to increased salinity in surrounding water bodies, adversely affecting local biodiversity. Additionally, stricter environmental regulations aimed at minimizing mining’s ecological footprint are being implemented worldwide. For instance, Canada has introduced stringent guidelines on waste management and water usage in potash mining is increasing compliance costs for producers. These environmental concerns and regulatory pressures can limit production expansion, delay new projects, and raise operational expenses, hindering market growth.

Volatility in Global Fertilizer Prices and Market Competition

Fluctuations in global fertilizer prices and increased competition from alternative fertilizers pose a challenge to the potash market. Potash prices are highly sensitive to changes in global supply-demand dynamics, currency fluctuations, and input costs such as energy and transportation. According to the World Bank, global fertilizer prices saw a sharp increase of over 70% in 2022 due to supply chain disruptions and rising energy costs. Furthermore, competition from nitrogen and phosphate-based fertilizers which are often more readily available and cost-effective that affects potash’s market share. Farmers in cost-sensitive regions may opt for these alternatives is reducing the demand for potash-based products and impacting the profitability of potash producers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.33% |

|

Segments Covered |

By Product, End-user Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

JSC Belaruskali, Compass Minerals Intl. Ltd., Mosaic Company, Uralkali, Rio Tinto Ltd., BHP Billiton Ltd., Eurochem, Red Metal Ltd., Encanto Potash Corp. (EPC), Intrepid Potash Inc, K+S Aktiengesellschaft, Nutrien. |

SEGMENT ANALYSIS

Global Potash Market By Product

The Potassium Chloride (KCl) segment accounted for the largest share of the global potash market in 2024. The widespread use is primarily due to its high potassium content (typically around 60% K2O) and cost-effectiveness by making it the preferred choice for staple crops like corn, wheat, and rice is majorly propelling the growth of the potassium chloride segment in the global market. In 2024, global production of Potassium Chloride exceeded 1 million metric tons, with major agricultural economies like China and India accounting for significant portions of this demand. The affordability and availability of KCl, combined with its proven effectiveness in enhancing crop yields and drought resistance with its leadership in the potash market.

The potassium sulfate (K2SO4) segment is emerging as the fastest-growing segment in the potash market and is expected to exhibit a CAGR of 5.8% over the forecast period. The suitability of potassium sulphate for chloride-sensitive crops, such as fruits, vegetables, and tobacco, where chloride-free fertilizers are essential for optimal plant health and soil quality are boosting the expansion of the segment in the global market. In 2022, the global production of Potassium Sulphate was estimated at 7 million metric tons with demand steadily increasing in regions like Europe and the Middle East. The growing emphasis on sustainable agriculture and organic farming, where K2SO4 is preferred due to its environmental benefits that further accelerates its market expansion.

Global Potash Market By End-use

The agricultural segment dominated the market by holding 88.5% of the global market share in 2024. The agriculture sector accounted for 90% of global potash consumption in 2024. Potash is a critical nutrient for crop growth is enhancing water retention, nutrient absorption, and resistance to diseases. Its primary use in fertilizers for staple crops like corn, wheat, and rice drives this dominance. According to the Food and Agriculture Organization, global fertilizer use reached over 200 million metric tons in 2024 with potash-based fertilizers constituting a significant portion due to their role in improving crop yields in regions facing soil degradation and food security challenges.

The non-agricultural segment is thriving and is predicted to register a CAGR of 5.8% during the forecast period owing to the potash’s expanding applications in industries such as water treatment, pharmaceuticals, de-icing, and glass manufacturing. The demand for environmentally friendly de-icing solutions, for instance, is increasing in colder regions, with potassium-based alternatives preferred over traditional salts due to reduced environmental impact. Additionally, the rising need for potash in specialty glass and soap production is coupled with its role in emerging technologies like biofuels and energy storage is propelling growth in this segment.

REGIONAL ANALYSIS

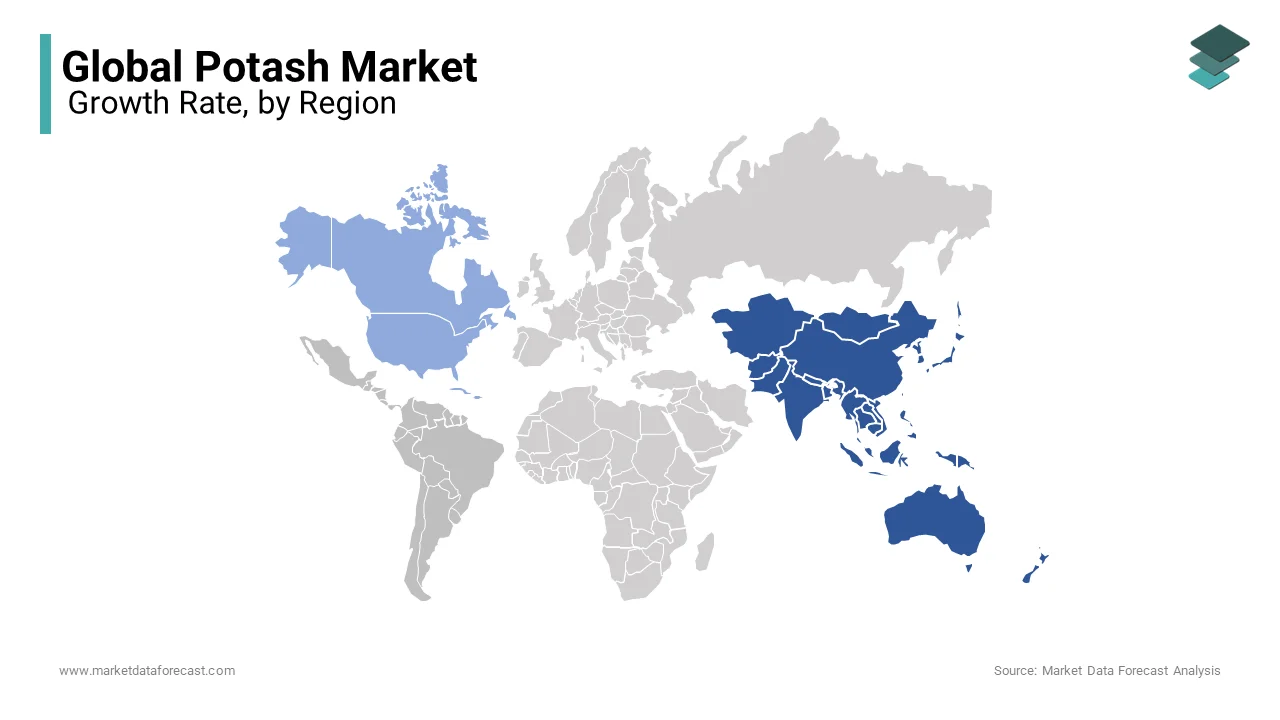

Asia-Pacific dominated the market by capturing 40.4% of global market share in 2024. The growth of the Asia-Pacific region in the global market is primarily attributed to the extensive agricultural activities of Asia-Pacific, particularly in China and India, which are the largest consumers of potash fertilizers worldwide. The FAO highlights that fertilizer consumption in Asia-Pacific grew by over 20% between 2020 and 2022, with potash being essential for improving yields of staple crops like rice, wheat, and vegetables. The Asian Development Bank notes that government subsidies and initiatives to ensure food security have further boosted demand. With over 60% of the global population residing in the region, Asia-Pacific’s leadership underscores its critical role in sustaining global food production while driving the potash market.

North America is expected to have a projected CAGR of 7.2% during the forecast period. This growth is fueled by the region's robust agricultural sector and increasing adoption of precision farming technologies in the United States and Canada. The USGS reports that Canada, the world’s largest potash producer accounts for over 30% of global exports with production exceeding 20 million metric tons annually. Rising demand for high-yield crops like corn and soybeans, coupled with advancements in sustainable farming practices, has amplified potash usage. The U.S. Department of Agriculture emphasizes that North America’s focus on enhancing crop productivity and soil health will continue to drive market expansion with its position as the fastest-growing region.

Europe is expected to grow steadily due to stringent environmental regulations promoting efficient fertilizer use, as highlighted by the European Environment Agency. Latin America, particularly Brazil, will see increased potash demand to support soybean and sugarcane cultivation, with a projected annual growth rate of 5%, per the Inter-American Development Bank. In the Middle East and Africa, rising investments in agriculture and irrigation systems are likely to boost potash usage, with the African Development Bank projecting a 10% increase in fertilizer consumption by 2025. These regions collectively contribute to diversifying global potash demand while addressing regional agricultural challenges.

KEY MARKET PLAYERS

JSC Belaruskali, Compass Minerals Intl. Ltd., Mosaic Company, Uralkali, Rio Tinto Ltd., BHP Billiton Ltd., Eurochem, Red Metal Ltd., Encanto Potash Corp. (EPC), Intrepid Potash Inc, K+S Aktiengesellschaft, Nutrien. These are the market players that are dominating the global potash market.

Top 3 Players in the Market

Nutrien Ltd.

Nutrien Ltd., headquartered in Canada, is the world’s largest potash producer, formed through the merger of PotashCorp and Agrium in 2018. The company operates six potash mines in Saskatchewan, leveraging extensive reserves and efficient production capabilities. Nutrien plays a critical role in the global potash supply chain, serving both domestic and international markets, with a strong focus on North America, Asia, and Latin America. The company emphasizes sustainable mining practices and has a significant presence in agricultural retail, offering a comprehensive portfolio of crop inputs, including potash, nitrogen, and phosphate fertilizers.

The Mosaic Company

The Mosaic Company, based in the United States, is a leading integrated producer of potash and phosphate fertilizers. Mosaic operates three major potash mines in North America and has a strong distribution network that reaches global agricultural markets, particularly in Asia and South America. The company is known for its investment in innovative technologies to improve mining efficiency and reduce environmental impact. Mosaic’s strategic partnerships and long-term supply agreements with key agricultural economies ensure its prominent position in the potash market, catering to the growing demand for high-yield fertilizers.

Uralkali

Uralkali, headquartered in Russia, is one of the largest potash producers globally, with significant mining and processing operations in the Perm region. The company controls substantial potash reserves and operates multiple production facilities, making it a critical supplier to international markets, particularly in Asia and Europe. Uralkali is recognized for its advanced production techniques and cost-efficient mining processes, which help maintain its competitive edge. The company’s strategic export initiatives and logistics infrastructure, including access to key ports, strengthen its global distribution capabilities, ensuring a stable supply to some of the world’s largest agricultural economies.

Top strategies used by the key market participants

Capacity Expansion and Infrastructure Investments

Key players in the potash market, such as Nutrien Ltd. and Uralkali, are heavily investing in expanding their production capacities to meet growing global demand. Nutrien has increased its potash output capacity to over 20 million metric tons annually by optimizing operations across its six mines in Saskatchewan. Similarly, Uralkali has focused on expanding its mining and processing facilities in Russia’s Perm region, targeting production increases to maintain a competitive edge. These capacity expansions ensure a steady supply of potash, allowing companies to meet rising agricultural needs while influencing global pricing dynamics.

Strategic Mergers and Acquisitions

Mergers and acquisitions are critical strategies for market consolidation and growth. The formation of Nutrien Ltd. in 2018, through the merger of PotashCorp and Agrium, created the largest potash producer globally, enhancing its market share and operational efficiencies. The Mosaic Company also pursued strategic acquisitions, including its purchase of Vale Fertilizantes in Brazil, strengthening its presence in Latin America—a key potash-consuming region. These mergers and acquisitions enable companies to expand their geographical reach, streamline operations, and reduce costs.

Diversification and Vertical Integration

To mitigate risks and stabilize revenue, companies like The Mosaic Company and Compass Minerals are diversifying their product portfolios beyond agricultural fertilizers. Mosaic, for instance, integrates potash with phosphate production, offering comprehensive nutrient solutions to farmers. Vertical integration is another key strategy, with companies controlling multiple stages of the supply chain—from mining and processing to distribution—ensuring cost efficiencies and supply chain reliability.

Focus on Sustainability and Innovation

Sustainability is increasingly central to the strategies of major potash producers. Companies such as Nutrien and BHP Billiton are investing in sustainable mining technologies and reducing their environmental footprint. Nutrien has implemented precision agriculture solutions, optimizing potash application to reduce waste and environmental impact. BHP Billiton's Jansen potash project in Canada emphasizes sustainable mining practices and energy efficiency, positioning it as a future leader in responsible potash production.

Geographic Expansion and Export Strategies

Key players are expanding into high-growth markets, particularly in Asia-Pacific and Latin America, where agricultural demand is surging. Uralkali and EuroChem focus on exporting to countries like China, India, and Brazil, which are major importers of potash due to their large agricultural sectors. Strategic partnerships and long-term supply agreements with local distributors in these regions help secure market share and stabilize revenue streams.

Technological Advancements and Digital Transformation

Innovation in mining technology and digital solutions is another strategy adopted by key players. Intrepid Potash and K+S Aktiengesellschaft invest in automation and advanced mineral processing technologies to improve efficiency and reduce operational costs. Digital tools, such as precision farming applications, data analytics, and remote monitoring, help optimize potash usage in agriculture, aligning with global trends towards smarter, data-driven farming.

COMPETITIVE LANDSCAPE

The global potash market is highly competitive, characterized by the dominance of a few key players and the concentration of production in specific geographic regions. Major companies such as Nutrien Ltd., The Mosaic Company, and Uralkali control a significant portion of global supply, leveraging their extensive reserves, advanced mining technologies, and established distribution networks. The market operates as an oligopoly, where these leading firms exert considerable influence over pricing, production levels, and global trade dynamics.

Competition is further intensified by the geographical concentration of potash reserves, particularly in Canada, Russia, and Belarus. This limited distribution makes the market vulnerable to geopolitical tensions and trade disruptions, influencing supply chain stability and pricing volatility. For instance, sanctions on Belarusian potash producers have reshaped market dynamics, creating opportunities for other suppliers to fill the gap.

In addition to traditional players, emerging companies like Eurochem and Intrepid Potash are expanding their market presence through strategic investments, technological innovations, and diversification into non-agricultural sectors. Furthermore, environmental regulations and the push for sustainable agriculture are driving competition toward more eco-friendly production methods. The increasing demand for potash in developing regions like Asia-Pacific and Latin America is also encouraging new entrants, fostering a dynamic and evolving competitive landscape.

RECENT HAPPENINGS IN THIS MARKET

In January 2025, Brazil Potash Corp. signed a memorandum of understanding with Keytrade AG for the potential offtake of up to one million tons of potash annually from the Autazes Potash Project. This agreement aims to strengthen Brazil Potash’s position as a leading domestic supplier in Brazil.

In January 2025, American Critical Minerals Corp. obtained essential permits for exploration at their Green River Project in Utah's Paradox Basin. This strategic move positions the company strongly in the potash and lithium sectors, enhancing its market competitiveness.

In August 2024, Intrepid Potash outlined its strategic focus in a new investor presentation, emphasizing increased potash production and potential strategic partnerships. This initiative highlights the company’s efforts to exploit its lithium resources and expand market share.

In December 2021, Uralkali expanded its market presence by acquiring UPI Norte, a major Brazilian fertilizer distributor. This acquisition enhanced Uralkali’s distribution network across South America.

In February 2022, EuroChem acquired the Serra do Salitre phosphate project in Brazil from Yara International for $410 million. This move strengthened EuroChem’s position in the South American fertilizer market.

In December 2021, EuroChem purchased a controlling stake in Brazilian distributor Fertilizantes Heringer S.A. This acquisition expanded EuroChem’s distribution capabilities in Brazil.

MARKET SEGMENTATION

This research report on the global potash market is segmented and sub-segmented into the following categories.

By Product

- Potassium Chloride

- Potassium Sulphate

- Potassium Nitrate

By End-use

- Agricultural

- Non-Agricultural

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current market size of the global potash market?

The current market size of the global potash market size was valued at USD 78.85 billion in 2025

What are the market drivers that are driving the global potash market?

The rising global food demand and agricultural intensification and expansion of potash-intensive crops in emerging economies.

What challenges are faced by the global potash market?

The environmental concerns and regulatory pressures and volatility in global fertilizer prices and market competition

Who are the market players that are dominating the global potash market?

JSC Belaruskali, Compass Minerals Intl. Ltd., Mosaic Company, Uralkali, Rio Tinto Ltd., BHP Billiton Ltd., Eurochem, Red Metal Ltd., Encanto Potash Corp. (EPC), Intrepid Potash Inc, K+S Aktiengesellschaft, Nutrien.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]