Global Portable Ultrasound Market Size, Share, Trends & Growth Forecast Report By Device Type (Mobile Ultrasound and Hand-Held Ultrasound), Application (Cardiovascular, Obstetrics and Gynecology, Gastric and Musculoskeletal), End-Users (Hospitals and Diagnostics Centers) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2025 to 2033

Global Portable Ultrasound Market Size

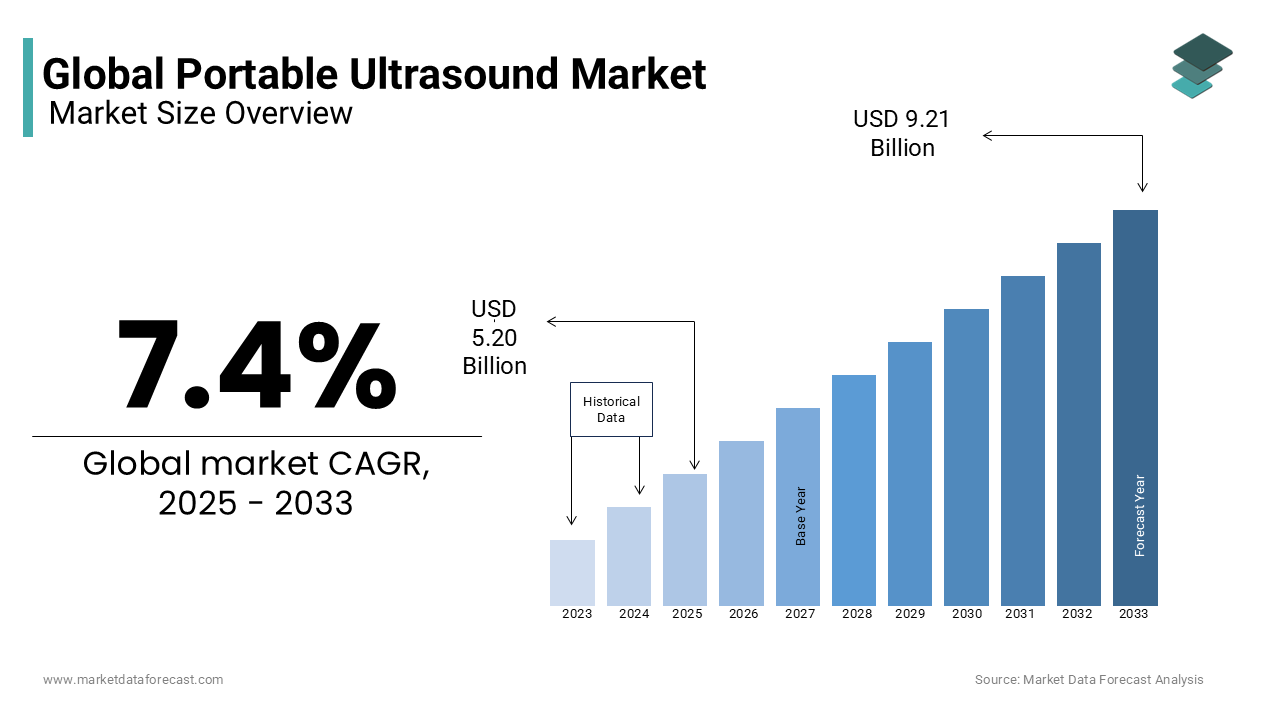

The global portable ultrasound market size was valued at USD 4.84 billion in 2024. The global portable ultrasound market is estimated to be worth USD 9.21 billion by 2033 from USD 5.20 billion in 2025, growing at a CAGR of 7.4% during the forecast period.

Portable ultrasound is a device that uses ultrasound technology and is a type of medical ultrasound equipment with a portable benefit over more giant ultrasound machines found in hospitals. Portable ultrasound equipment can be used in various disciplines, including emergency medical, critical care medicine, and musculoskeletal health. Sound waves are used in ultrasound imaging to create images of the inside of the body. It's used to find out what's causing discomfort, swelling, and infection in the body's internal organs and inspect a baby in pregnant women's and newborns' brains and hips. It's also used to guide biopsies, detect cardiac problems, and measure heart attack damage. Because of their portability, portable ultrasound devices are being modified to satisfy growing commercial demands. These machines have several advantages, including decreasing the burden of patients waiting hours for a check-up or transferring from one area to another where devices are accessible. Portable ultrasound equipment is frequently transferred from one procedure location to another.

MARKET DRIVERS

Growing Patient Population With Lung Diseases and Lifestyle-based Disorders

Asthma, COPD, lung cancer, acute lower respiratory tract infections, and tuberculosis are a few of the major lung-related diseases. According to the American Lung Association, 24.8 million Americans suffer from asthma, 12.5 million adults in the United States are living with COPD, and 541000 people have lung cancer in the United States. In addition, the increase in accident cases and tumors, common targeted diseases, high risk of surgical procedures for older adults, YOY rise in the geriatric population, and growing demand for minimum invasive diagnostics drive the portable ultrasound market. According to the Insurance Institute for Highway Safety, a total of 35766 fatal motor vehicle crashes happened in the United States in 2020. According to the United Nations, one in six people will be more than 65 years of age.

Technological Advancements in Portable Ultrasound

Furthermore, increasing awareness about portable ultrasound is a big plus to the market's growth rate. In addition, the upcoming consumption of low-power and charging technologies will likely push the market boom. In addition, reducing the cost of portable ultrasound devices can further fuel growth opportunities. The growth events like training programs and the rise in ambulatory and remote patient care infrastructure also boost the market's growth rate. Strengthening healthcare expertise by focusing on the healthcare business through divestment strategies and expanding companies' capabilities through acquisitions focusing on innovations of products and technologies will support market growth in the coming years.

MARKET RESTRAINTS

Strict government regulations, insufficient well-trained and skilled personnel, and equipment costs are majorly hampering the growth of the portable ultrasound market. In addition, the rise in interest rates and insufficient public health coverage hinder market growth. The high price also prevents the market from reaching its true potential. The availability of handheld or portable ultrasound poses a significant problem for the manufacturers who make the devices. However, these challenges can be addressed by training new users and continuing the training support until the initial sale is made.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Device Type, Application, End-User, Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Fujifilm Holdings Corporation Japan), Analogic Corporation (U.S.), Esaote S.p.A. (Italy), Koninklijke Philips N.V. (Netherlands), Toshiba Corporation (Japan), Siemens AG (Germany) |

SEGMENTAL ANALYSIS

By Device Type Insights

The mobile ultrasound devices segment accounted for the largest share of the market in 2024. It is expected to grow rapidly during the forecast period. Factors such as rising demand for ambulatory, growing preference for these devices in the developed regions, and increasing popularity favor the growth of the mobile ultrasound devices segment to register the lead. Due to advanced technology, ultrasounds are performed on mobile phones. This scanning process is easy and can be done anywhere and anytime. Scanbooster is the first realistic Ultrasound Simulator app available for iPhone, iPad, and Android. These ultrasound machines are used to generate two-dimensional images.

On the other hand, handheld ultrasound devices are small, lightweight, and designed for diagnostic usage. As a result, the handheld ultrasound devices segment is anticipated to grow with a high CAGR rate. This handheld ultrasound imaging is performed at the bedside. It is easy to use, and its information is used for early detection and treatment. It takes less time to produce the images through ultrasound imaging. It is safe to use and can be done repeated times on their own. It only needs a few basic controls to do the imaging and store the images in JPEG format. These handheld and portable ultrasound devices are used mainly during the COVID-19 pandemic to treat patients due to imaging capabilities and reduce the spread of infection.

By Application Insights

Based on the application, the cardiovascular segment is expected to be the fastest-growing segment during the forecast period. According to the World Health Organization (WHO), in 2017, over 19 million deaths were caused due to a surge in cardiovascular diseases worldwide. Portable cardiac ultrasound devices are used to perform different types of heart examinations. This process is also known as echocardiography. This ultrasound uses noninvasive high-frequency sound waves to image the heart from various angles. It is a cost-effective device that can be bought by ordinary people.

The obstetrics and gynecology portable ultrasound device segment is the second leading segment with the highest CAGR growth rate globally during the forecast period. Vscan Extend™ is a handheld ultrasound device that allows obstetricians/gynecologists to make treatment decisions. It is also used to evaluate the mother's health, including any potential cardiac issues, and to examine the fetus's heart and position. It also measures fluid levels and visualizes uterine fibroids.

By End-Users Insights

The hospital segment is projected to hold the largest share during the forecast period based on the end-users. Factors such as the rising importance of outpatient surgery and the existence of high-end infrastructure are propelling the market demand. In addition, the availability of highly efficient and skilled professionals in the medical field also propels market growth.

The diagnostic center segment is expected to grow the fastest over the forecast period. Ultrasound is one of the most widely used diagnostic techniques in diagnostic centers, used to examine internal body parts.

REGIONAL ANALYSIS

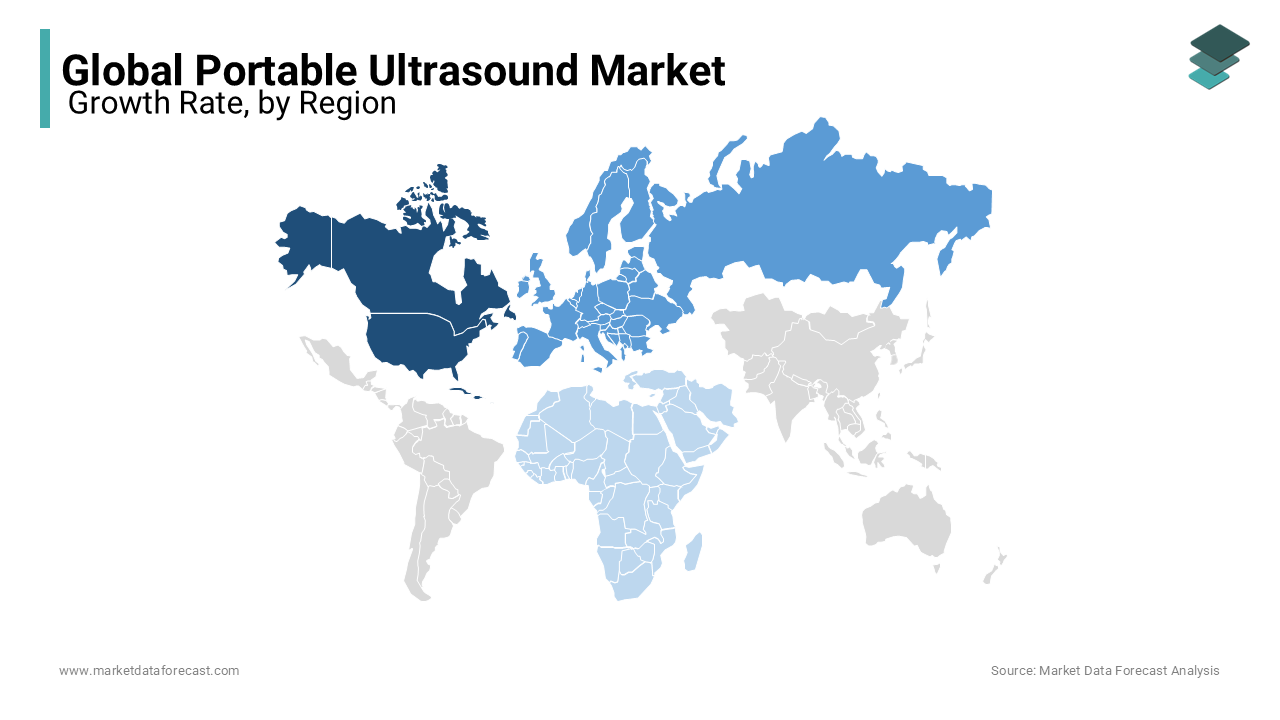

North America is expected to govern the global market share during the forecast period. The market in this region is attributed to developed healthcare infrastructure. The government and increasing support take growing initiatives to develop new technologies and implement reimbursement policies in favor of the ordinary people. The United States dominates the portable ultrasound market in the North American region with the upsurge in advanced health infrastructure and increased diseases and infections. An increasing number of critical players manufacturing portable ultrasound devices boosts the market growth. Canada is predicted to have rapid growth in the Region. Most individuals in Canada use portable ultrasounds connected with artificial intelligence apps that can immediately provide remote diagnostic support after quickly analyzing thousands of previous results. In Canada, ultrasound is one of the most frequently utilized diagnostic technologies. In 2020, Butterfly Network launched Butterfly iQ. Butterfly Network has worked with Health Canada to provide a device that helps people to examine using portable ultrasound. Most Canadians use ultrasound for pregnancy. Due to growing awareness among patients about handheld devices, they are using portable ultrasounds that can be carried in a pocket. This can help most people by knowing the early symptoms of the chronic disease and saving their lives. The Intelligent Network for Point-of-Care Ultrasound project started in Canada to develop and use handheld ultrasound devices that used artificial intelligence. These devices also use machine-learning technology, a cloud-based platform, and an integrated point-of-care network for accurate diagnoses for Canadians.

Europe was the second-largest region in the global portable ultrasound market in 2023. The region accounts for a significant and promising growth rate during the forecast period. Germany is expected to dominate the European portable ultrasound market over the forecast period. Adopting high technology, raising the aging populace, and expanding healthcare expenses are some factors contributing to the market growth in the region. In Europe, it started in 2011, when the European Association of Echocardiography started manufacturing pocket-size imaging devices that are helpful for the cardiac imaging workflow. This technology has advanced technology that can be used by any person easily. Most manufacturers are working on manufacturing ultrasound devices of small sizes with good image quality. As a result, the doctors can bring the ultrasound to the patient and conduct the ultrasound examination immediately. The U.K. holds the highest share of the portable ultrasound market.

Asia-Pacific is expected to grow with a surging CAGR rate during the forecast period. Factors driving the market growth are growing discretionary expenses, an upsurge in patient awareness about the usage, and amplifying utilization of ultrasound in hospitals. Japan is expected to lead the market in the APAC region. The growing older population in China drives the portable ultrasound market forward. People over 65 years have a high risk of rib fractures due to falling from heights. These people can use a portable ultrasound to examine ribs and take further treatment steps. In addition, during the COVID-19 pandemic, ultrasound imaging plays an essential role in the treatment of the virus. In 2020, Royal Philips announced that a handheld tele-ultrasound solution would be available in Japan. Philips get clearance from Japan's healthcare authority to introduce the ultrasound solution for compatible handheld devices. It is a high-quality portable ultrasound available all over the country. The portable ultrasound device market is advancing in this Region due to the increasing aging population and declining birth rate. It also helps older people in Japan avoid traveling long distances.

Latin America is driven by a growing wide range of applications, the adoption of the latest technologies, and the prevalence of quick imaging ability and device efficiency. Brazil is to dominate the market in the LATAM region, followed by Mexico. Key manufacturers in Brazil are more focused on manufacturing portable ultrasound devices for different diseases. Keeping awareness programs about this device's usage and how they can predict the disease and get curable are the main points made evident in this program. In Brazil mostly used ultrasound devices for examination during pregnancy. More women who are pregnant are aware of these ultrasound devices to check the baby's position and growth through this particular interval. Due to increasing cardiac and gastro disease in this Region, related ultrasound device have increased their production, which drives the market forward.

Middle East & Africa is anticipated to hold a moderate share of the global market during the forecast period. Africa is to dominate the portable ultrasound market in the Region. The rising insistence on minimally invasive and noninvasive diagnostic procedures and technological enhancements influences market growth.

KEY MARKET PLAYERS

Some of the key market participants dominating the global portable ultrasound market profiled in this report are Fujifilm Holdings Corporation Japan), Analogic Corporation (U.S.), Esaote S.p.A. (Italy), Koninklijke Philips N.V. (Netherlands), Toshiba Corporation (Japan), Siemens AG (Germany), General Electric Company (U.S.), Samsung Electronics Co., Ltd. (South Korea), Hitachi Ltd. Japan) and Mindray Medical International Ltd. (China).

RECENT HAPPENINGS IN THE MARKET

- In 2022, G.E. Healthcare launched a major digital update for Vscan Air, i.e., a wireless handheld pocket-sized ultrasound device that provides crystal clear image quality. It is also used for whole-body scanning capabilities. These Vscan Air Fleet Solutions are used at hospitals and health systems.

- St. Luke's University Health Network selected G.E. Healthcare for an $11 million ultrasound purchase in 2022.

- In 2022, Clarius Mobile Health launched high-performanc,e handheld wireless ultrasound scanners for all medical specialists. This new version is available in the App Store or Google Store. In addition, new technologies such as artificial intelligence and imaging tools can improve image quality.

- In 2020, At-Home Ultrasounds were launched for pregnant women. It was the World's First Self-Administered Handheld Tele-Ultrasound Device.

- In 2020, Royal Philips received clearance from the U.S. FDA to sell a wide range of ultrasound solutions for managing COVID-

- In October 2019, New Pocket Ultrasound Scanners were smaller, more powerful, and affordable. In addition, Clarius has launched its second-generation wireless ultrasound scanners, making the power and image quality of larger, more expensive systems in a cheap device.

- In May 2019, Clarius Simplified Ultrasound Telemedicine with its Latest Release. In addition, Clarius released a telemedicine solution called Clarius Live.

- In September 2019, Clarius Mobile Health Announced a Partnership with Savvik Buying Group. Clarius recently finalized a partnership, making them the only ultrasound vendor.

- In November 2018, Clarius Mobile Health Announced the Clarius AI Collective Intelligence Ultrasound Platform. The Clarius AI focuses on data and image quality, ease of collection, and a collaborative platform.

- In June 2018, Analogic Introduced Its Newest R.F. Amplifier for 1.5 Tesla MRI Systems.

- In June 2018, Analogic Announced the Completion of the Acquisition by an Affiliate of Altaris Capital Partners.

MARKET SEGMENTATION

This market research report on the global portable ultrasound market has been segmented and sub-segmented based on the device type, application, end-user, and region.

By Device Type

- Mobile Ultrasound

- Hand-Held Ultrasound

By Application

- Cardiovascular

- Obstetrics and Gynecology

- Gastric

- Musculoskeletal

By End-Users

- Hospitals

- Diagnostics Centers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What was the size of the portable ultrasound market worldwide in 2024?

The global portable ultrasound market size was valued at USD 5.20 billion in 2024.

Which region held the major share in the global portable ultrasound market in 2024?

The North American region accounted for the largest share of the market in 2024.

What is the growth rate of the portable ultrasound market in Europe by 2033?

The European market is anticipated to grow at a CAGR of 7.34% from 2025 to 2033.

What are some of the noteworthy players in the portable ultrasound market?

Fujifilm Holdings Corporation (Japan), Analogic Corporation (U.S.), Esaote S.p.A. (Italy), Koninklijke Philips N.V. (Netherlands), Toshiba Corporation (Japan), Siemens AG (Germany), General Electric Company (U.S.), Samsung Electronics Co., Ltd. (South Korea), Hitachi Ltd. (Japan) and Mindray Medical International Ltd. (China) are some of the prominent companies in the portable ultrasound market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]