Global PVC Market Size, Share, Trends, & Growth Forecast Report Segmented By Application (Construction, Consumer Goods, Packaging, Electrical &Electronics., Transportation), , and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Polyvinyl chloride (PVC) Market Size

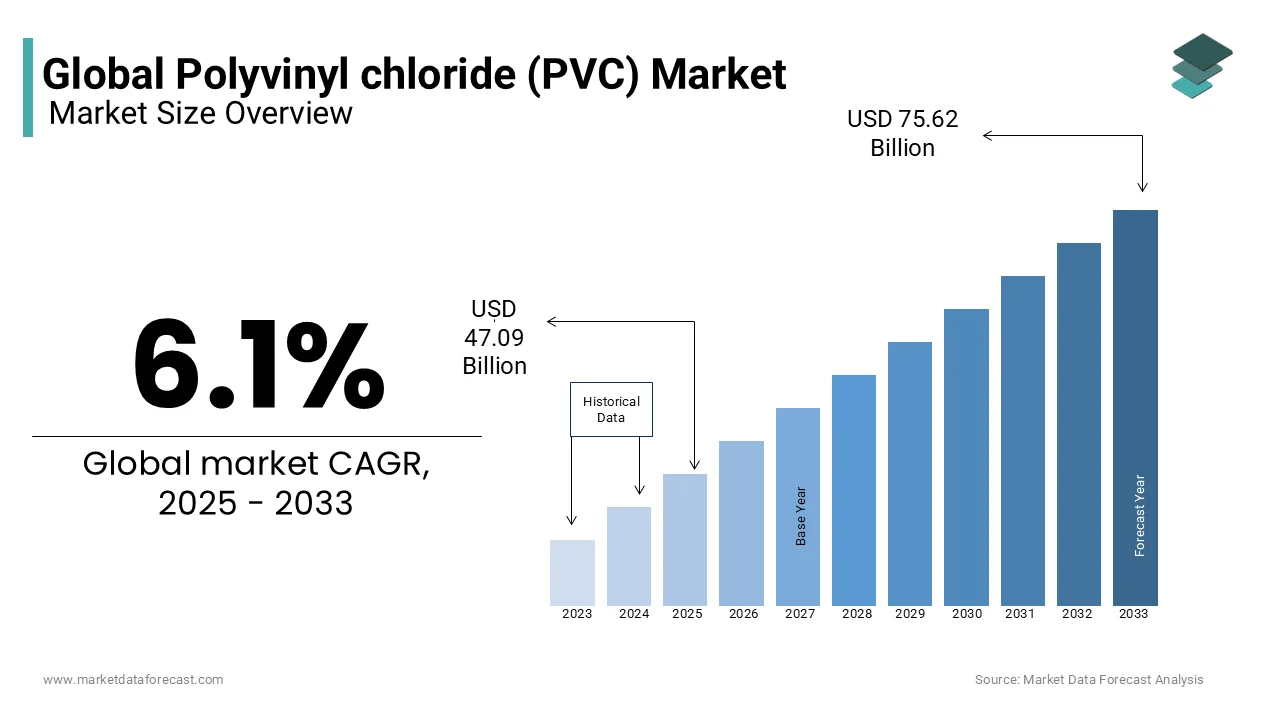

The Global Polyvinyl chloride (PVC) market size was valued at USD 44.38 billion in 2024 and is expected to reach USD 75.62 billion by 2033 from USD 47.09 billion in 2025. The market is projected to grow at a CAGR of 6.1%.

Polyvinyl chloride (PVC) is a versatile thermoplastic polymer extensively utilized across various industries due to its durability, chemical resistance, and cost-effectiveness. The global production of PVC has seen substantial growth over the past decades. In 2018, the production volume was approximately 44.3 million metric tons, and it is projected to reach nearly 60 million metric tons by 2025. This increase is primarily driven by rising demand in the building and construction sector, particularly in rapidly urbanizing regions.

Regionally, Asia-Pacific holds a dominant position in the PVC market by accounting for a substantial share of global consumption. This control over the market is attributed to large-scale infrastructure projects and a burgeoning automotive industry in countries like China and India. Furthermore, advancements in PVC production technologies and the development of bio-based plasticizers are anticipated to open new avenues for market growth which is aligning with the global shift towards sustainable and environmentally friendly materials.

MARKET DRIVERS

Infrastructure Development and Urbanization

The rapid pace of urbanization and infrastructure development globally has significantly bolstered the demand for polyvinyl chloride (PVC). Its durability, cost-effectiveness, and resistance to environmental degradation make it a preferred material in construction applications such as pipes, window frames, and flooring. According to the United Nations, by 2050, approximately 68% of the world's population is projected to reside in urban areas, up from 55% in 2018. This urban expansion necessitates extensive construction and infrastructure projects and thereby driving the increased utilization of PVC materials. The material's adaptability to various construction needs underscores its integral role in supporting global urbanization efforts.

Advancements in Medical Applications

PVC's unique properties including flexibility, chemical stability, and transparency have led to its widespread adoption in the healthcare sector. It is extensively used in medical devices such as intravenous (IV) bags, blood bags, and tubing. The U.S. Food and Drug Administration (FDA) recognizes PVC as a safe material for medical device manufacturing and that is contributing to its prevalent use in healthcare settings. The material's ability to be easily sterilized and its compatibility with various medical applications have been pivotal in enhancing patient care and safety. As medical technologies advance, the reliance on PVC-based devices is expected to grow, further driving demand in this sector.

MARKET RESTRAINTS

Environmental and Health Concerns

Polyvinyl chloride (PVC) production and disposal raise significant environmental and health issues. According to the UK's Environment Agency, additives in PVC such as plasticizers and stabilizers can leach into the environment and is posing risks to ecosystems and human health. Additionally, the U.S. Environmental Protection Agency (EPA) identifies vinyl chloride, the primary monomer in PVC production, as a known human carcinogen is linked to liver cancer and other serious health conditions. These concerns have led to increased scrutiny and calls for stricter regulations on PVC use and manufacturing processes.

Regulatory Pressures and Potential Bans

Growing awareness of PVC's environmental impact has prompted regulatory bodies to consider stringent measures. In June 2024, environmental organizations, including ClientEarth and the European Environmental Bureau, urged the European Commission to phase out PVC by 2030 which is citing legal obligations to protect health and the environment. The European Chemicals Agency (ECHA) has also reported that certain substances added to PVC pose risks, leading to discussions on potential restrictions under the REACH regulation. Such regulatory pressures could limit PVC production and application and is compelling industries to seek alternative materials.

MARKET OPPORTUNITIES

Advancements in Recycling Technologies

Innovations in recycling technologies present significant opportunities for the polyvinyl chloride (PVC) market. The British Plastics Federation projects that by 2035, a 70% rate for recycling and reuse of plastics is achievable with an additional 23% of total plastic waste being mechanically recycled within the UK and an extra 6% being chemically recycled. This advancement not only addresses environmental concerns associated with PVC disposal but also aligns with governmental objectives to reduce landfill waste and promote a circular economy. The development of efficient recycling processes enhances the sustainability profile of PVC, potentially increasing its acceptance and application across various industries.

Integration into Renewable Energy Applications

PVC's unique properties such as durability and versatility makes it integral to renewable energy technologies. The National Policy Statement for Renewable Energy Infrastructure (EN-3) said that PVC products are not only energy-efficient during use but also essential components in renewable energy systems. Examples include transparent pipes for photo-bioreactors, photovoltaic cells on reflective PVC roofing membranes and pressure pipes in geothermal projects. As the global focus shifts towards sustainable energy solutions, the demand for PVC in these applications is poised to grow and is offering substantial market expansion opportunities.

MARKET CHALLENGES

Volatility in Raw Material Prices

The polyvinyl chloride (PVC) industry is significantly impacted by fluctuations in the costs of key raw materials, particularly ethylene and chlorine. Ethylene, primarily derived from crude oil or natural gas, is subject to price volatility influenced by geopolitical tensions, supply chain disruptions, and market demand. For instance, the U.S. Energy Information Administration (EIA) reported that crude oil prices experienced substantial fluctuations in recent years, affecting downstream products like ethylene. Such instability in raw material costs poses challenges for PVC manufacturers in maintaining consistent production expenses and pricing strategies. Additionally, the reliance on fossil fuels for these raw materials raises concerns about long-term sustainability and exposure to regulatory changes aimed at reducing carbon emissions.

Competition from Alternative Materials

The polyvinyl chloride (PVC) market faces increasing competition from alternative materials, such as polyethylene (PE), polypropylene (PP), and newer bio-based plastics, which are often perceived as more sustainable or cost-effective. In particular, the growing adoption of sustainable materials in construction, packaging, and automotive sectors is posing a challenge for PVC. The International Energy Agency (IEA) reports that alternative materials, like bio-based plastics, are gaining traction as part of efforts to reduce carbon footprints and improve recyclability. For instance, the use of biodegradable plastics and recycled materials in construction and consumer goods is increasing which may diminish PVC's market share and especially in environmentally conscious markets. The shift towards these alternatives also adds pressure on PVC producers to innovate and adopt sustainable practices to retain competitiveness.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.1% |

|

Segments Covered |

By Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Arkema S.A., China National Bluestar (Group) Co. Ltd., INEOS Group Ltd., KEM ONE, LG Chem Ltd., Mitsubishi Chemical Corporation, Occidental Petroleum Corporation, Shin-Etsu Chemical Co. Ltd., Westlake Chemical Corporation, Xinjiang Zhongtai Chemical Co., and others |

SEGMENTAL ANALYSIS

By Application Insights

The construction segment led the polyvinyl chloride (PVC) market by accounting for 54.1% of the global market share in 2024. The extensive application of PVC in building materials such as pipes, window frames, and flooring owing to its durability, cost-effectiveness, and resistance to environmental degradation is primarily driving the domination of construction segment in the global market. According to the reports of the National Bureau of Statistics of China, in 2020, the construction industry contributed about CNY 7.3 trillion to the national economy, underscoring the significant demand for PVC in infrastructure projects. Similarly, the U.S. Census Bureau noted a 21.8% increase in the total value of residential dwellings in April 2021 compared to the previous year which is reflecting the material's critical role in supporting global construction activities.

The electrical and electronics sector is another major segment and is expected to register a CAGR of 5.2% over the forecast period. Factors such as PVC's excellent insulating properties, flexibility, and flame retardancy that are making it ideal for use in cable insulation, connectors, and electronic device components is majorly boosting the growth of the electrical and electronics segment in the global market. The U.S. Energy Information Administration reported that electricity consumption in the United States reached approximately 3.8 trillion kilowatt-hours in 2020 which is highlighting the escalating need for efficient electrical infrastructure. As the demand for advanced electronic devices and robust power distribution networks continues to rise, PVC's role in ensuring safety and performance in electrical applications becomes increasingly vital.

REGIONAL ANALYSIS

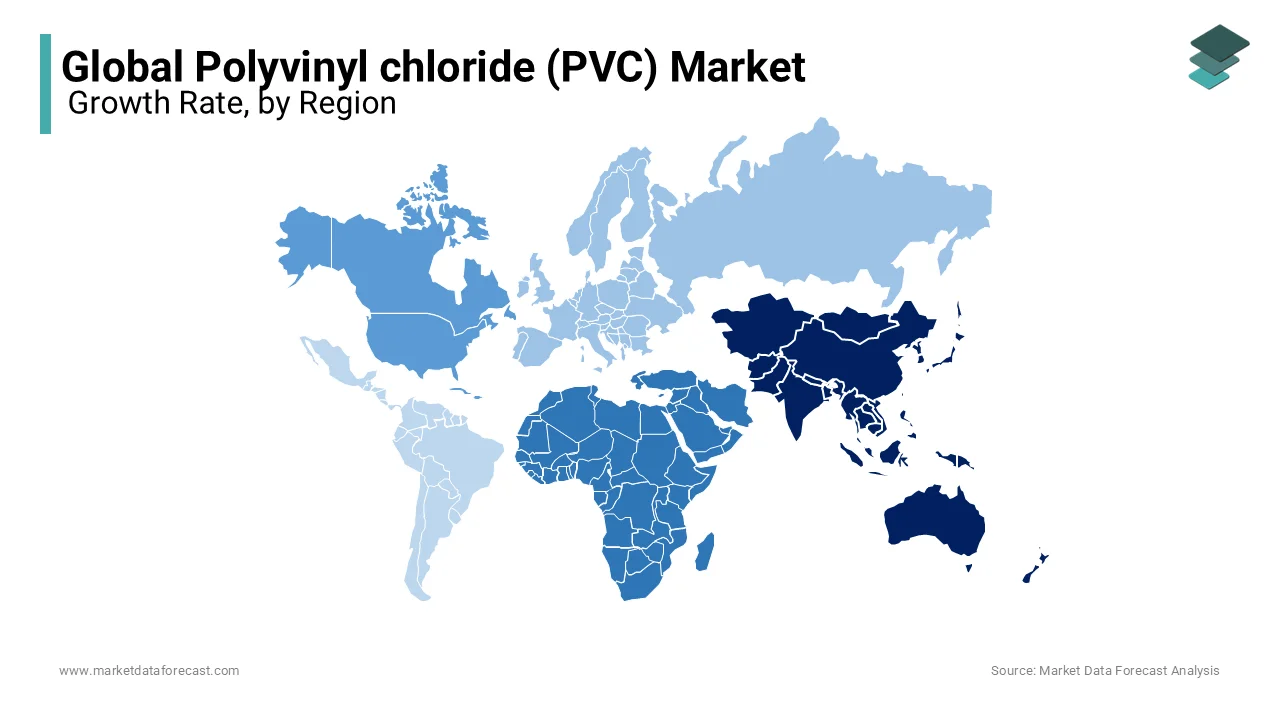

Asia-Pacific held the dominant position in the global PVC market by accounting for 56.1% of the market share in 2024. The dominating position of Asia-Pacific in the global market is primarily driven by the rapid industrialization and urbanization in countries like China and India. For instance, China has experienced significant growth in construction activities which is leading to a high demand for durable and cost-effective construction materials. The National Bureau of Statistics of China reported that in 2021, the construction industry in China generated an added value of approximately USD 1.5 trillion. Additionally, the region's expanding automotive and electronics industries contribute to the substantial consumption of PVC products.

The Middle East and Africa is projected to grow at a noteworthy CAGR of 5.5% during the forecast period. Factors such as significant investments in infrastructure and construction projects and is particularly in countries like Saudi Arabia, the United Arab Emirates and South Africa are fuelling the PVC market expansion in this region. For example, Saudi Vision 2030 outlines plans for numerous large-scale infrastructure developments which is increasing the demand for PVC in construction materials. Additionally, the region's growing population and urbanization trends are driving the need for residential and commercial buildings, further bolstering PVC consumption.

North America PVC market is expected to witness steady growth and is supported by the ongoing recovery in the construction sector and increased spending in consumer goods and electronics. The U.S. Census Bureau noted a 21.8% increase in the total value of residential housing in 2021 compared to the previous year, indicating a resurgence in construction activities. Furthermore, advancements in PVC recycling technologies and a growing emphasis on sustainable building materials contribute to the market's positive outlook in this region.

Europe holds a significant share in the global PVC market. The region is anticipated to experience moderate growth due to robust demand from the construction sector. Countries like Germany and France are witnessing significant infrastructure development, contributing to the sustained demand for PVC products. Additionally, stringent environmental regulations in Europe are encouraging the adoption of sustainable and recyclable PVC materials, further influencing market dynamics.

Latin America is projected to exhibit stable growth in the PVC market. Countries such as Brazil and Mexico are experiencing profitable growth owing to increased activities in the construction industry. The region's expanding manufacturing sector and rising urbanization rates are also contributing to the demand for PVC in various applications including packaging and automotive industries. Government initiatives aimed at infrastructure development are expected to further drive PVC consumption in the coming years.

KEY MARKET PARTICIPANTS

Arkema S.A., China National Bluestar (Group) Co. Ltd. (China National Chemical Corporation), Formosa Plastics Corporation, INEOS Group Ltd., KEM ONE, LG Chem Ltd., Mitsubishi Chemical Corporation, Occidental Petroleum Corporation, Saudi Basic Industries Corporation (Saudi Arabian Oil Co.), Shin-Etsu Chemical Co. Ltd., Westlake Chemical Corporation, Xinjiang Zhongtai Chemical Co. Ltd. are playing dominating role in the global polyvinyl chloride (PVC) market

TOP 3 PLAYERS IN THE MARKET

Shin-Etsu Chemical Co., Ltd.

Shin-Etsu Chemical, headquartered in Tokyo, Japan, is recognized as the world's largest producer of PVC. The company holds a substantial share of the global market, contributing significantly to the availability of PVC across various industries. Shin-Etsu's extensive production capabilities and commitment to innovation have solidified its leading position in the PVC sector.

Formosa Plastics Corporation

Formosa Plastics, based in Taiwan, is a major player in the PVC market. The company operates large-scale PVC production facilities and supplies a wide range of PVC products globally. Formosa Plastics' significant production capacity and global distribution network make it a key contributor to the PVC industry.

Occidental Petroleum Corporation (OxyChem)

Occidental Petroleum, through its subsidiary OxyChem, is a leading PVC producer in the United States. The company manufactures PVC resins used in various applications, including construction, automotive, and healthcare industries. OxyChem's substantial production capacity and diverse product offerings contribute significantly to the global PVC supply

STRATEGIES USED BY THE MARKET PLAYERS

Capacity Expansion & Vertical Integration

Shin-Etsu Chemical, Formosa Plastics, and OxyChem have all focused on increasing their production capacity to meet the rising global demand for polyvinyl chloride (PVC). Shin-Etsu Chemical has invested heavily in expanding its PVC production facilities, particularly in Asia, Europe, and North America, ensuring a steady supply for industrial applications. Formosa Plastics has integrated its operations by controlling the supply chain from raw material procurement to final product distribution, reducing costs and ensuring product consistency. OxyChem has strengthened its backward integration by securing essential raw materials such as chlorine and ethylene, allowing for more efficient and cost-effective PVC production.

Sustainability and Environmental Initiatives

As environmental concerns over PVC production grow, major players are focusing on sustainability. Shin-Etsu Chemical has implemented energy-efficient production techniques to minimize carbon emissions and waste. Formosa Plastics has been actively working on PVC recycling initiatives and producing lower-emission variants to meet stricter environmental regulations. OxyChem has been developing bio-based and more eco-friendly PVC alternatives, reducing the environmental footprint of its products. These efforts align with increasing regulatory pressures and consumer demands for greener materials.

Strategic Partnerships and Joint Ventures

To strengthen their market position, Shin-Etsu, Formosa Plastics, and OxyChem have engaged in strategic partnerships and joint ventures. Shin-Etsu collaborates with downstream companies to secure long-term supply agreements, ensuring stability in its revenue stream. Formosa Plastics has partnered with distributors and technology firms to enhance its PVC applications in industries such as healthcare and construction. OxyChem has forged alliances with polymer companies to expand its market share and develop specialized PVC products that meet industry-specific needs.

RECENT HAPPENINGS IN THE MARKET

- In June 2024, Environmental organizations, including ClientEarth, the European Environmental Bureau (EEB), and Zero Waste Europe, urged the European Union to ban PVC. This action follows a 2023 report by the European Chemicals Agency (ECHA) highlighting environmental and health risks associated with PVC and its additives.

- In March 2024, the UK's Environment Agency published a scoping review identifying PVC additives relevant to the UK market. The report prioritizes these additives based on available information to assess their potential risks to human health and the environment.

- In November 2023, the European Chemicals Agency (ECHA) released an investigative report confirming that certain substances added to PVC pose risks to health and the environment. Following this report, over 60 environmental NGOs called on the European Commission to phase out PVC by 2030.

MARKET SEGMENTATION

This research report on the global polyvinyl chloride (PVC) market has been segmented and sub-segmented based on application, and region.

By Application

- Construction

- Consumer Goods

- Packaging

- Electrical &Electronics

- Transportation

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the current and projected market size of the global PVC market?

The global Polyvinyl Chloride (PVC) market was valued at USD 44.38 billion in 2024 and is expected to reach USD 75.62 billion by 2033, growing from USD 47.09 billion in 2025 at a CAGR of 6.1%.

2. What are the key challenges affecting the PVC market?

The PVC market faces major challenges like Volatility in raw material prices (ethylene and chlorine).and Competition from alternative materials like bio-based plastics and other polymers.

3. Which region holds the largest share in the global PVC market?

Asia-Pacific dominates the global PVC market, accounting for 56.1% of the market share in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]