Global Polypropylene Market Size, Share, Trends, & Growth Forecast Report Segmented By Polymer Type (Homopolymer, Copolyme), Process, Application, End-use, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Polypropylene Market Size

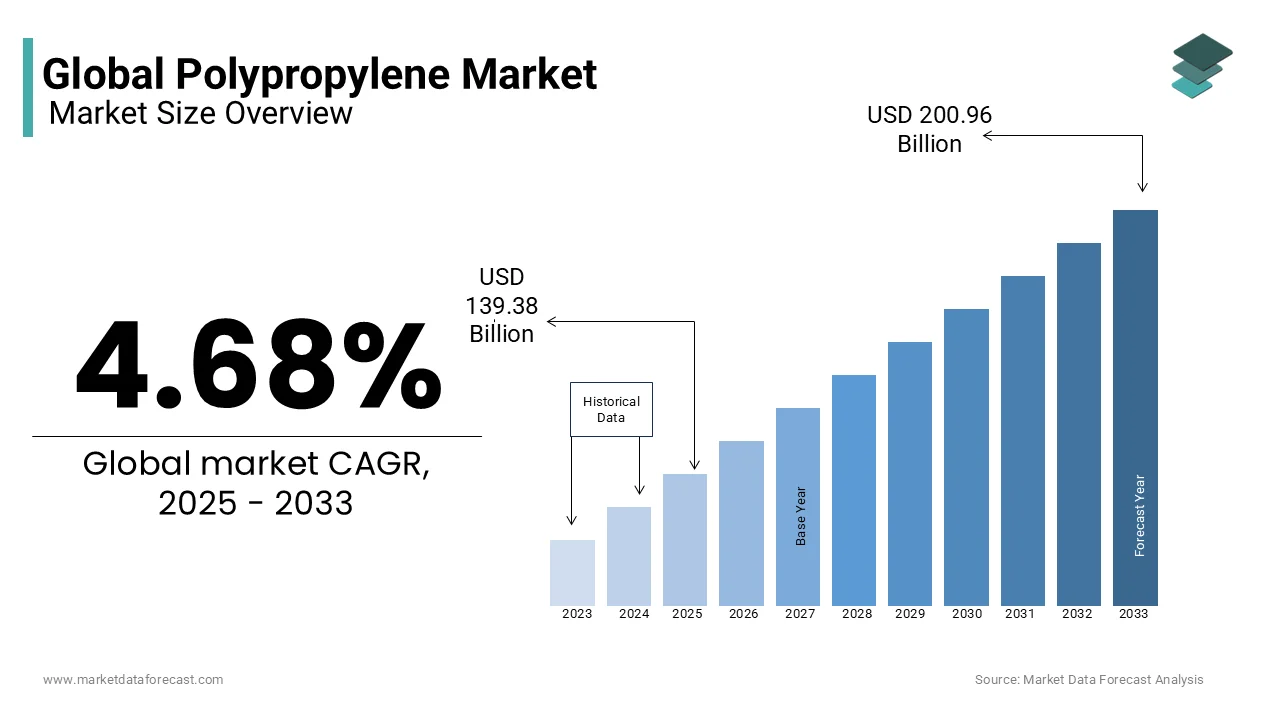

The global polypropylene market size was valued at USD 133.15 billion in 2024 and is expected to reach USD 200.96 billion by 2033 from USD 139.38 billion in 2025. The market is projected to grow at a CAGR of 4.68%.

Polypropylene (PP) is a thermoplastic polymer derived from propylene monomers that is prized for its versatility, durability, and cost-effectiveness. Its unique properties, including high chemical resistance, thermal stability, and lightweight characteristics which make it indispensable in modern manufacturing processes. Beyond its industrial applications, polypropylene plays a pivotal role in addressing global challenges in sustainability and resource efficiency. For instance, the U.S. Environmental Protection Agency has emphasized the growing importance of recyclable materials with polypropylene being widely regarded as one of the most recyclable plastics available. In 2022, it was reported that over 30% of plastic waste collected in Europe was composed of polypropylene with its significance in circular economy initiatives. Additionally, the material’s use in the automotive sector has been transformative, with the National Highway Traffic Safety Administration noting that vehicles incorporating lightweight materials like polypropylene have achieved an average fuel efficiency improvement of 12% over the past decade.

MARKET DRIVERS

Rising Demand from the Packaging Industry

The polypropylene market is significantly driven by the growing demand in the packaging industry for food and beverage products. Polypropylene's lightweight, high chemical resistance, and moisture barrier properties make it ideal for flexible and rigid packaging. According to data from the U.S. Census Bureau, the packaging industry in the United States alone saw a 4.2% annual growth rate in 2023, with plastics, including polypropylene, comprising nearly 36% of the total packaging materials used. Similarly, the European Plastics Converters (EuPC) reported that 19 million tonnes of plastic packaging were produced in Europe in 2022 with polypropylene accounting for a large portion due to its recyclability and cost-effectiveness. This upward trend is expected to continue as sustainability initiatives encourage the use of recyclable polymers.

Expansion of the Automotive Sector

Another major driver of the polypropylene market is its expanding application in the automotive industry. Polypropylene is widely used for manufacturing automotive components such as bumpers, interior trims, and battery cases due to its lightweight, durability, and cost-efficiency, contributing to overall vehicle weight reduction and improved fuel efficiency. The International Organization of Motor Vehicle Manufacturers (OICA) reported that global vehicle production increased by 6% in 2023, reaching over 93 million units. Additionally, the U.S. Department of Energy highlighted that lightweight materials like polypropylene could enhance fuel economy by 6-8% for every 10% reduction in vehicle weight. This rising production and the automotive sector’s shift toward lightweight materials significantly boost polypropylene demand.

MARKET RESTRAINTS

Environmental Concerns and Regulatory Restrictions

One of the key restraints facing the polypropylene market is the growing environmental concerns related to plastic waste and stringent government regulations. Polypropylene, being a non-biodegradable plastic shall contributes significantly to global plastic pollution. The U.S. Environmental Protection Agency (EPA) reported that in 2019, only 3% of polypropylene waste was recycled while the majority ended up in landfills is contributing to environmental degradation. In response, many governments are implementing stricter regulations on single-use plastics and encouraging alternatives. The European Union’s directive on single-use plastics aims to reduce plastic consumption by 50% by 2026 which will directly affect polypropylene demand especially in packaging applications. These environmental pressures and regulations are pushing industries to explore biodegradable or alternative materials which is restraining market growth.

Volatility in Raw Material Prices

Fluctuations in raw material prices, particularly crude oil and natural gas pose a significant restraint to the polypropylene market. Polypropylene is derived from propylene, a byproduct of petroleum refining and natural gas processing by making its production costs highly sensitive to oil price volatility. According to the U.S. Energy Information Administration (EIA), crude oil prices surged by nearly 40% in 2022 due to geopolitical tensions and supply chain disruptions. This spike led to increased production costs for polypropylene manufacturers by reducing profit margins and affecting product pricing. Furthermore, the unpredictability in raw material prices can cause supply chain instability by making it difficult for manufacturers to maintain consistent pricing strategies, thus impacting overall market growth.

MARKET OPPORTUNITIES

Growth in the Medical and Healthcare Sector

The expanding medical and healthcare sector presents a significant opportunity for the polypropylene market. Polypropylene is increasingly used in medical applications due to its chemical resistance, sterilization compatibility, and non-toxicity. It is widely utilized in the production of syringes, medical vials, surgical instruments, and personal protective equipment (PPE). According to the U.S. Food and Drug Administration (FDA), the demand for medical-grade plastics, including polypropylene, rose by over 20% between 2020 and 2022 which is driven by heightened healthcare activities and pandemic-related needs. Additionally, the World Health Organization (WHO) highlighted that global healthcare spending reached $9 trillion in 2022 which is emphasizing the growing demand for durable and cost-effective medical materials. This trend is expected to continue is offering a robust growth avenue for polypropylene manufacturers.

Rising Demand for Electric Vehicles (EVs)

The global shift toward electric vehicles (EVs) offers a promising opportunity for the polypropylene market. Polypropylene is used in EVs for lightweight components such as battery casings, interior panels, and cable insulation is contributing to improved vehicle efficiency. The International Energy Agency (IEA) reported that global EV sales surpassed 10 million units in 2022, a 55% increase from the previous year, with projections indicating further growth due to supportive government policies and sustainability goals. Additionally, the U.S. Department of Energy noted that using lightweight materials like polypropylene can extend EV battery range by reducing overall vehicle weight. The demand for polypropylene in automotive applications is expected to rise significantly as the EV market expands which is creating new growth opportunities.

MARKET CHALLENGES

Limited Recycling Infrastructure

A major challenge facing the polypropylene market is the limited global recycling infrastructure for this polymer. While polypropylene is technically recyclable, the lack of efficient collection, sorting, and processing facilities hampers its widespread recycling. According to the U.S. Environmental Protection Agency (EPA), only about 1% of polypropylene packaging was recycled in the United States in 2019, compared to higher rates for other plastics like PET. The fragmented recycling systems in many countries make it difficult to achieve high recovery rates, contributing to environmental waste and reducing the appeal of polypropylene in sustainability-focused industries. Furthermore, the high cost of recycling polypropylene compared to virgin material discourages companies from investing in recycling initiatives, thereby posing a challenge to market growth.

Substitution by Biodegradable Alternatives

The increasing adoption of biodegradable plastics poses a significant challenge to the polypropylene market. Industries are shifting toward eco-friendly where biodegradable alternatives such as polylactic acid (PLA) and polyhydroxyalkanoates (PHA) due to rising environmental concerns over plastic pollution. The European Bioplastics Association reported that global bioplastics production capacity is expected to grow from 2.4 million tonnes in 2021 to 7.5 million tonnes by 2026 is driven by regulatory policies favoring sustainable materials. Similarly, the U.S. Department of Agriculture (USDA) has promoted bio-based products through initiatives like the BioPreferred Program by encouraging industries to reduce reliance on conventional plastics. This transition toward biodegradable materials threatens polypropylene’s dominance, particularly in packaging and consumer goods sectors is posing a long-term challenge to its market share.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.68% |

|

Segments Covered |

By Polymer Type, Process, Application, End-use, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

SABIC, Exxon Mobil Corporation, Borealis AG, BASF SE, INEOS Group, Reliance Industries Limited, LG Chem, LyondellBasell Industries Holdings B.V., DuPont, Braskem, and others |

SEGMENTAL ANALYSIS

By Polymer Type Insights

The homopolymer segment dominated the market by holding 65.6% of the global polypropylene market share in 2024. The dominance of homopolymer segment is primarily attributed to its superior mechanical properties, such as high tensile strength and rigidity by making it ideal for applications like packaging films, textiles, and automotive components. The U.S. Census Bureau indicated that the packaging industry alone consumes over 40% of homopolymer polypropylene due to its cost-effectiveness and versatility. Its widespread use in both rigid and flexible packaging, coupled with growing demand in consumer goods and automotive sectors with reinforces its position as the leading polymer type in the market.

The copolymer polypropylene segment is anticipated to register a CAGR of 6.8% during the forecast period owing to its enhanced impact resistance and flexibility compared to homopolymers by making it suitable for demanding applications such as automotive parts, medical devices, and industrial containers. The International Organization of Motor Vehicle Manufacturers (OICA) reported a 6% increase in global vehicle production in 2023 which is boosting demand for durable copolymer materials in automotive applications. Additionally, its expanding use in medical applications, such as syringes and diagnostic devices, due to its chemical resistance, contributes to its rapid market growth.

By Process Insights

The injection molding segment had 40.9% of the global market share in 2024. The growth of the injection molding segment is majorly driven by its versatility in producing complex, high-precision parts for industries such as automotive, packaging, and consumer goods. According to the U.S. Census Bureau's Annual Survey of Manufactures, the plastics product manufacturing sector, heavily reliant on injection molding that contributed over $100 billion to the U.S. economy in 2022. Injection molding’s efficiency, cost-effectiveness, and ability to produce lightweight, durable products make it the preferred process in the automotive sector, where reducing vehicle weight enhances fuel efficiency and meets regulatory standards for emissions.

The blow molding segment is estimated to expand at a CAGR of 6.8% from 2025 to 2033 due to the increasing demand for lightweight, durable packaging solutions in the food, beverage, and pharmaceutical industries. The U.S. Food and Drug Administration reported a 5% annual increase in demand for plastic bottles and containers, particularly for safe, hygienic storage solutions. Additionally, the surge in demand for bottled water and personal care products, combined with the recyclability of polypropylene in blow-molded products that further fuels this growth. The ability to create hollow, lightweight containers with minimal material waste positions blow molding as a critical process in sustainable packaging initiatives globally.

By Application Insights

The film & sheet segment led the market by accounting for 35.3% of the global market share in 2024. The high demand in food packaging, labeling, and protective films due to properties like moisture resistance, durability, and flexibility are driving the growth of the film & sheet segment in the global market. The European Plastics Converters (EuPC) reported that flexible packaging using polypropylene films constituted nearly 40% of the plastic packaging market in Europe. Its importance is further amplified by the rising demand for lightweight, cost-effective, and recyclable packaging solutions across various industries.

The fiber segment is likely to progress at a prominent CAGR of 6.5% during the forecast period in the polypropylene market over the forecast period due to the increasing use in the textile, automotive, and medical sectors. The U.S. Department of Commerce highlighted that demand for polypropylene-based nonwoven fabrics surged by 25% between 2020 and 2022 primarily due to heightened use in personal protective equipment (PPE), such as masks and gowns during the pandemic. Additionally, polypropylene fibers are favored in automotive interiors for their lightweight and durable properties, contributing to fuel efficiency. The Textile Exchange reported a rising trend in synthetic fiber consumption, with polypropylene playing a key role due to its cost-effectiveness, strength, and resistance to moisture and chemicals which is fueling its rapid market expansion.

By End-use Insights

The packaging segment led the market and held 35.1% of the global polypropylene market share in 2024. The lightweight, chemical resistance, and flexibility of Polypropylene make it ideal for both rigid and flexible packaging solutions, which is one of the key factors propelling the growth of the packaging segment in the global market. The U.S. Census Bureau reported that the packaging industry grew by 4.2% in 2023 with polypropylene contributing significantly due to its cost-effectiveness and recyclability. Additionally, the European Plastics Converters (EuPC) noted that nearly 40% of all plastic packaging materials produced in Europe are polypropylene-based. Its role in food safety, extended shelf life, and sustainable packaging solutions underscores its dominance in this sector.

The medical segment is estimated to grow at a promising CAGR of 8.5% over the forecast period owing to the increasing demand for disposable medical supplies, such as syringes, vials, masks, and surgical instruments due to polypropylene’s biocompatibility and sterilization capabilities. According to the U.S. Food and Drug Administration (FDA), the use of medical-grade plastics surged by 20% between 2020 and 2022 is largely attributed to pandemic-related healthcare needs. Furthermore, the World Health Organization (WHO) reported that global healthcare expenditures reached $9 trillion in 2022 which is emphasizing the growing demand for reliable, cost-effective materials like polypropylene in medical applications. This trend is expected to continue with advancements in medical technologies and rising healthcare infrastructure investments globally.

REGIONAL ANALYSIS

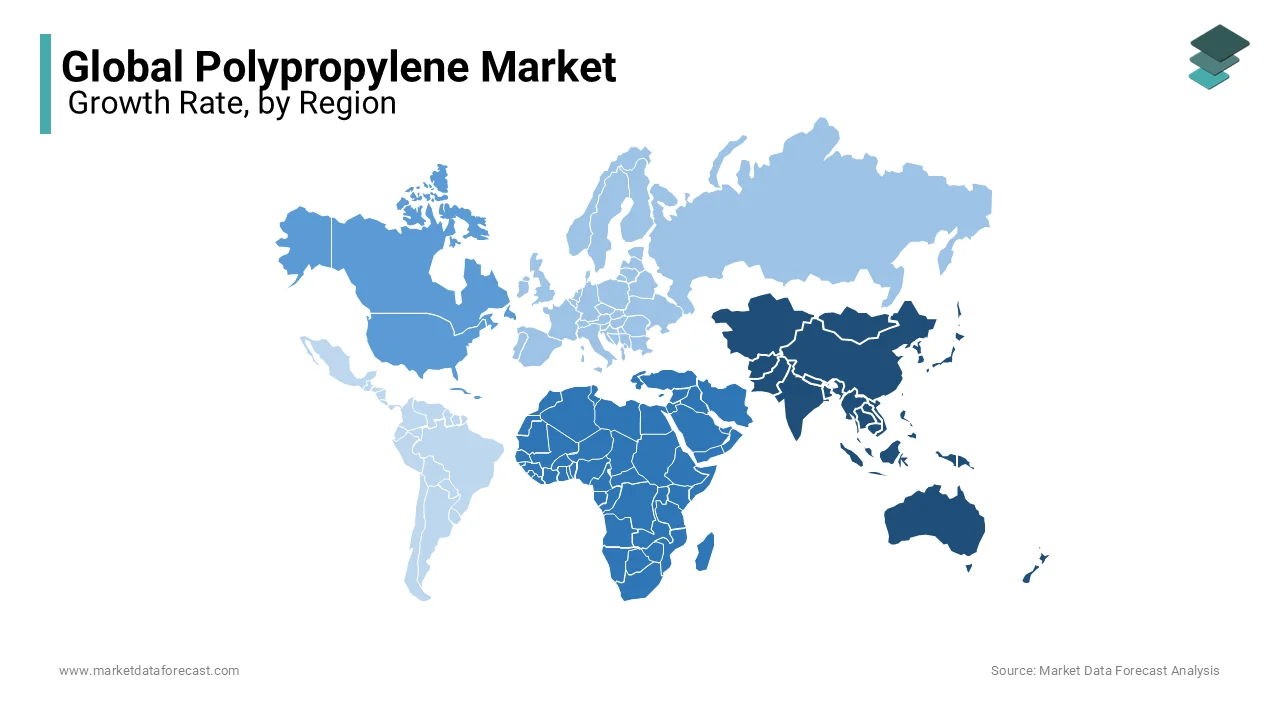

Asia-Pacific dominated the polypropylene market with 55.8% of global market share in 2024 due to its booming manufacturing and industrial sectors. According to the China Petroleum and Chemical Industry Federation, China alone produced over 35 million metric tons of polypropylene in 2022 by making it the world’s largest producer and consumer. The region’s leadership is driven by rapid urbanization, rising automotive production, and growing demand in packaging and construction sectors. India’s packaging industry, as reported by the Indian Ministry of Commerce is growing at 15% annually which further fueling polypropylene demand. The combination of industrial growth and favorable government policies cements Asia-Pacific's leading position in this market.

The Middle East and Africa region is projected to expand at a CAGR of 7.2% from2025 to 2033. This growth is driven by rising investments in petrochemical industries and expanding infrastructure projects. According to the Gulf Petrochemicals and Chemicals Association (GPCA), the Middle East accounted for 13% of global polypropylene production in 2022 with significant growth expected due to increased production capacity in countries like Saudi Arabia and the UAE. Moreover, large-scale infrastructure developments, including the Saudi Vision 2030 initiative are spurring demand for polypropylene in construction and automotive applications. The region's access to low-cost raw materials further supports this rapid growth trajectory.

North America is expected to witness steady growth in the polypropylene market which is driven by technological advancements and increased recycling efforts. The U.S. Energy Information Administration reported that polypropylene production in the U.S. increased by 5% in 2022 due to rising demand in automotive and healthcare sectors. Europe’s market is stabilizing as stringent environmental regulations promote recyclable and sustainable polypropylene products. The European Commission’s Plastics Strategy aims to recycle 50% of plastic packaging by 2025 is boosting demand for recyclable polypropylene. Latin America is anticipated to grow moderately which is driven by expanding industrialization in countries like Brazil and Mexico. According to Brazil’s National Confederation of Industry, the country’s plastic consumption rose by 4.5% in 2022 with a steady rise in polypropylene demand.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

SABIC, Exxon Mobil Corporation, Borealis AG, BASF SE, INEOS Group, Reliance Industries Limited, LG Chem, LyondellBasell Industries Holdings B.V., DuPont, Braskem are playing dominating role in the global polypropylene market.

The global polypropylene market is highly competitive, characterized by the presence of several key players, including SABIC, Exxon Mobil Corporation, LyondellBasell Industries, Borealis AG, and Reliance Industries Limited. These companies compete on factors such as production capacity, technological innovation, sustainability initiatives, and geographic reach. The market is dominated by large-scale producers with vertically integrated operations, enabling them to control the supply chain from raw material sourcing to final product distribution.

Technological advancements, particularly in process optimization and product diversification, play a crucial role in maintaining competitive advantage. Companies like LyondellBasell leverage proprietary technologies such as Spheripol to produce high-performance polypropylene grades, while Exxon Mobil focuses on Exxpol™ technology for specialized applications. Sustainability has emerged as a key competitive factor, with firms like SABIC and Borealis investing in circular economy initiatives and recycled polypropylene products to meet environmental regulations and growing consumer demand for eco-friendly materials.

The market is also influenced by regional competition, with Asia-Pacific leading in production and consumption due to rapid industrialization and infrastructure development. Additionally, strategic mergers, acquisitions, and partnerships are common, as companies aim to expand their market share, enhance technological capabilities, and penetrate emerging markets. This dynamic environment drives continuous innovation and operational efficiency.

STRATEGIES USED BY THE MARKET PLAYERS

Capacity Expansion and Strategic Investments

Key players in the polypropylene market, such as SABIC, Exxon Mobil Corporation, and LyondellBasell Industries, are heavily investing in expanding their production capacities to meet rising global demand. For instance, SABIC has increased its polypropylene output through new facilities in Saudi Arabia and Asia, while LyondellBasell has expanded its production at its La Porte, Texas plant, adding 500,000 metric tons of annual capacity. These investments help companies secure a larger market share and ensure a stable supply to meet the needs of diverse industries like packaging, automotive, and healthcare.

Technological Innovation and Product Development

Companies are focusing on developing advanced polypropylene grades to meet specific industry requirements, such as lightweight materials for automotive or high-barrier packaging films. Exxon Mobil, for example, utilizes its proprietary Exxpol™ technology to produce performance-enhanced polypropylene, while LyondellBasell’s Spheripol and Spherizone technologies are widely adopted across the industry. These innovations improve product performance, expand application areas, and strengthen brand reputation in the competitive market.

Sustainability and Circular Economy Initiatives

Sustainability has become a core strategy, with companies focusing on recycling initiatives and sustainable production methods. SABIC and LyondellBasell are pioneers in circular polypropylene, producing polymers from recycled feedstock to meet environmental regulations and growing consumer demand for sustainable products. For example, LyondellBasell’s partnership with SUEZ focuses on mechanical recycling, while SABIC has launched certified circular polymers derived from chemical recycling. These initiatives not only reduce environmental impact but also appeal to eco-conscious consumers and industries.

Mergers, Acquisitions, and Strategic Partnerships

Mergers, acquisitions, and collaborations are key strategies to expand market presence and technological capabilities. For instance, Borealis AG, in partnership with ADNOC, expanded its footprint in the Middle East, while Reliance Industries Limited has engaged in multiple joint ventures to strengthen its position in the Asian market. These partnerships allow companies to leverage regional strengths, share resources, and access new markets efficiently.

Geographic Diversification and Market Penetration

Global players like Exxon Mobil and BASF SE are focusing on geographic diversification to reduce dependency on specific markets and mitigate risks from regional economic fluctuations. For example, Exxon Mobil has established polypropylene production facilities across North America, Europe, and Asia, ensuring a balanced global presence. This approach helps companies tap into emerging markets like Asia-Pacific and the Middle East, where industrial growth is fueling polypropylene demand.

TOP 3 PLAYERS IN THE MARKET

SABIC

Saudi Basic Industries Corporation (SABIC) is one of the leading players in the global polypropylene market, contributing significantly to the industry through its large-scale production capabilities and innovative product offerings. Headquartered in Saudi Arabia, SABIC produces over 7 million metric tons of polypropylene annually, making it one of the world’s top suppliers. The company’s focus on sustainable solutions, including the development of certified circular polypropylene, has reinforced its position as an industry leader. SABIC’s global presence, with manufacturing sites across Asia, Europe, and the Americas, allows it to cater to diverse market demands. The company’s efforts in recycling and sustainable manufacturing align with global environmental goals, further strengthening its market position.

Exxon Mobil Corporation

Exxon Mobil Corporation is a major player in the polypropylene market, leveraging its vast petrochemical infrastructure and technological innovations. The company produces millions of tons of polypropylene annually, primarily through its chemical division, ExxonMobil Chemical. With advanced process technologies like its proprietary Exxpol™ technology, ExxonMobil focuses on high-performance polypropylene grades used in packaging, automotive, and consumer goods. The company’s robust supply chain and global manufacturing footprint ensure a consistent market supply. According to the U.S. Energy Information Administration, ExxonMobil is one of the top polypropylene producers in North America, contributing significantly to the region’s market stability and growth.

LyondellBasell Industries Holdings B.V.

LyondellBasell Industries is a global leader in polypropylene production, recognized for its extensive portfolio and technological leadership. The company produces approximately 6 million metric tons of polypropylene annually and operates some of the largest polypropylene manufacturing facilities worldwide. LyondellBasell is known for its Spheripol and Spherizone process technologies, which are widely licensed across the industry, making it not just a major producer but also a technology leader. The company’s focus on circular economy initiatives, including mechanical and advanced recycling, positions it at the forefront of sustainable polypropylene solutions. Its global reach and commitment to innovation significantly contribute to the growth and development of the polypropylene market.

RECENT HAPPENINGS IN THE MARKET

- In 2021, LyondellBasell announced the acquisition of a 50% stake in a new joint venture with China Petroleum & Chemical Corporation (Sinopec) to expand its polypropylene production capacity in China. This strategic move aims to capitalize on the growing demand in the Asia-Pacific region.

- In 2022, SABIC launched a new range of certified circular polypropylene products derived from advanced recycling processes. This initiative aligns with global sustainability trends and caters to increasing consumer demand for eco-friendly materials.

- In December 2023, Exxon Mobil commenced operations at its new polypropylene production unit in Baton Rouge, Louisiana, adding an annual capacity of 450,000 metric tons to meet rising domestic and international demand.

- In June 2023, Borealis completed the acquisition of Rialti S.p.A., a leading European producer of mechanically recycled polypropylene compounds, enhancing its portfolio in sustainable materials.

- In 2022, Reliance Industries expanded its polypropylene production capacity by commissioning a new plant in Jamnagar, India, adding 1 million metric tons per annum to cater to the growing domestic market.

- In October 2024, LG Chem formed a strategic partnership with Lavergne Groupe, a leading North American recycler, to strengthen its presence in the region's polypropylene market. This partnership is a key step in advancing LG Chem’s circular economy goals and enhancing its supply chain efficiency for sustainable materials. The collaboration reflects LG Chem’s commitment to providing eco-friendly solutions and expanding its footprint in the growing North American polypropylene market.

- In March 2024, DuPont introduced a new line of high-performance polypropylene resins designed for demanding industrial and electronic applications. These materials, known for their superior chemical resistance, thermal stability, and mechanical strength, target industries such as aerospace, electronics, and energy. The new polymers, including Kalrez® and Vespel®, significantly enhance equipment longevity and efficiency, especially in extreme environments like chemical vapor deposition (CVD) platforms.

- In June 2023, Braskem expanded its biopolymer production capacity by 30% at its bio-based ethylene plant in Triunfo, Brazil, following an investment of $87 million. This expansion increased the plant's capacity from 200,000 to 260,000 tons per year, reflecting Braskem's commitment to meeting the growing global demand for sustainable products. The bio-based ethylene, derived from sugarcane-based ethanol, helps reduce CO₂ emissions, with the new capacity expected to remove approximately 185,000 tons of CO₂ annually.

- In June 2024, LyondellBasell expanded its polypropylene compounding production in China by starting up an additional production line at its Dalian site. This new line adds 20,000 tonnes of annual capacity, doubling the site’s overall output to 40,000 tonnes per year. The expansion aims to meet the rising demand in the automotive industry, particularly in the rapidly growing new energy vehicle sector in China.

MARKET SEGMENTATION

This research report on the global polypropylene market has been segmented and sub-segmented based on polymer type, process, application, end-use, and region.

By Polymer Type

- Homopolymer

- Copolymer

By Process

- Injection Molding

- Blow Molding

- Extrusion Molding

- Others

By Application

- Fiber

- Film & Sheet

- Raffia

- Others

By End-use

- Automotive

- Building & Construction

- Packaging

- Medical

- Electrical & Electronics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the Polypropylene Market growth rate during the projection period?

The Global Polypropylene Market is expected to grow with a CAGR of 4.68% between 2025 to 2033.

2. What can be the total Polypropylene Market Value?

The Global Polypropylene Market size is expected to reach a revised size of USD 200.96 billion by 2033

3. Name any three Polypropylene Market key players?

SABIC, Exxon Mobil Corporation, Borealis AG, BASF SE, INEOS, Reliance Industries Limited, Braskem are playing dominating role in the global polypropylene market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com