Global Pneumatic Components Market Size, Share, Trends & Growth Forecast Report By Type (Air Treatment Components, Pneumatic Valves, Pneumatic Cylinders), By Application (Electronics, Chemical Industry, Machinery, Others), and Region, Industry Forecast | 2024 to 2033

Global Pneumatic Components Market Size

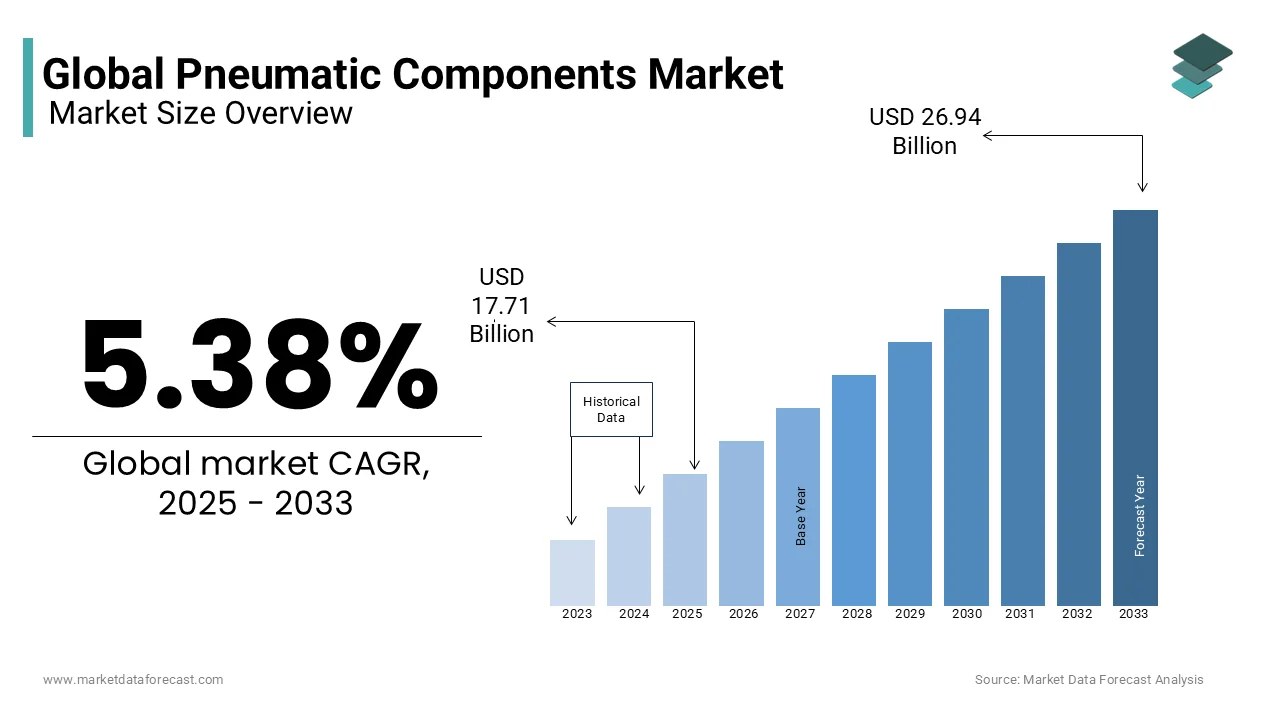

The global pneumatic components market was worth USD 16.81 billion in 2024. The global market is estimated to be USD 17.71 billion in 2025 and is projected to reach USD 26.94 billion by 2033, at a CAGR of 5.38% from 2025 to 2033.

Pneumatic components are the parts that are assembled to make pneumatic devices or pneumatic systems. Pneumatic systems include pneumatic components such as a pneumatic actuator unit, pneumatic control unit, pneumatic filter unit, and other connected parts. Pneumatic components are modules that use compressed air to power mobile parts. Pneumatic components are used to control and transmit energy that utilizes compressed air for functioning. The filters and air dryers are generally employed in pneumatic systems to keep compressed air clean and dry, which helps in the enhancement of the components and increases system reliability and service life. There is a variety of valves that are used in pneumatic systems to control the direction, pressure, and speed of actuators.

MARKET DRIVERS

The rising need for food and beverage industry safety is primarily driving the growth of the pneumatic components market.

The pneumatic components help in controlling. The food and beverage industry has shown a significant rise in the adoption of huge volumes of pneumatic components for a variety of applications. The demand for pneumatic components is increasing in order to enhance machine safety as well as performance. The demand for the pneumatic component is increasing in industries as it provides safe and precise procedures by utilizing compressed and energy-efficient automation. Several manufacturers are making efficient use of pneumatic components for the manufacturing and development of other products.

The increasing demand for industrial safety and the increasing investment by key industrialists further boost the pneumatic components market growth. Additionally, strict government regulation toward safe operations within the industries and growing industrial automation are some of the factors that support market growth. Furthermore, with the rapid adoption of advanced technologies such as the Industrial Internet of Things (IIoT), artificial intelligence, etc., pneumatic technology is gaining a lot of traction and becoming popular for functional and commercial use due to its monitoring and measurement capabilities. It also provides meaningful information on machine operation and enhances the performance of the devices.

The factors driving the call for pneumatic components are the requirements to enhance machine safety and performance. Pneumatic components are a significant part of making and other end-use businesses owing to the escalating call for safe and precise procedures, including the employment of compressed air and energy-efficient automation. Many manufacturers dedicated to the supply of pneumatic systems focus on the development of technologies that ensure the safety of machines. Manufacturers also aim to optimize power consumption and connectivity, as well as monitor factory automation, as this helps improve maintenance planning and increases operational efficiency. There are several features and benefits associated with pneumatic components that make them the preferred choice for various end applications. With the rapid adoption of the Industrial Internet of Things (IIoT), pneumatic technology is gaining a lot of ground and becoming functional and commercial with its monitoring and measurement capabilities, providing meaningful information on machine operation and performance of the devices.

MARKET RESTRAINTS

The increasing financing costs like bank interest and high initial investment are hampering the growing trajectory of the pneumatic components market.

Moreover, the operating pressure issue is the most frequently occurring problem for the industry players as optimal air pressure is important for a sufficiently powered pneumatic system. Furthermore, the increasing necessity of large investments along with the lack of government policies is behaving as market restraints for pneumatic components and systems in the foreseen period. Apart from this, intense competition from electromechanical valves is decreasing the industry’s development. The breakthroughs in electromechanical systems have resulted in some industries transitioning away from pneumatic products. Another key obstacle in complex integration. Organisations are finding it difficult to incorporate sophisticated solutions into the current systems which consume significant time and cost of technicians or professionals.

Further, it has adverse effects on the environment if the gas or air inside is polluted, harmful or contaminated. This is hindering the market expansion. For instance, sulfur hexafluoride, fluorinated gases, etc. are harmful gases which increase global warming and deplete ozone layers. Also, it leads to health problems and air pollution involving gases like nitrogen oxides and carbon monoxide. Ammonia or chlorine results in corrosion or damage to animals or plants. Various countries have also introduced heavy carbon tariffs or pollution fines, increasing the cost of final products and may also attract legal action by state authorities.

MARKET OPPORTUNITIES

During the design and development phase, machine safety and improved operation are critical steps. The most important aspect of machine safety and integration is not integration but the proper handling of all kinds of shutdowns and restarts, creating a need for properly designed programs, including systems tires that help restart machines when restarting a predetermined safety position and automatic restart of the cycle with minimal operator intervention. Hence, the need to improve the safety and operation of machinery is predicted to drive the expansion of the global pneumatic components market during the foreseen period. In addition, increased investment in industrial automation is predicted to drive the demand for pneumatic components, as many devices employed in industrial automation operate on compressed air. Industrial automation has seen innovations in the field of robotics. For example, in 2018, Amazon delivered nearly five billion items in 2 days, which was the result of advanced robotic capabilities in industrial automation and artificial intelligence. In addition, pneumatic components, such as pneumatic actuators, find various applications in industrial automation. Advanced pneumatic actuators feature wireless sensors and valve controls, providing predictive maintenance functions. One of the recent innovations in industrial automation is the development of air-driven manufacturing cells for low-cost automation applications. These cells can be utilized in applications as low-cost alternatives to escalate production and improve output quality. Therefore, it is predicted that the gradual use of pneumatic components in industrial automation will create expansion opportunities for the players operating in the global pneumatic components market during the conjecture period.

MARKET CHALLENGES

Pneumatic equipment requires the installation of expensive air production equipment. The increased reliance on pneumatic equipment on air tends to create more complications in handling and monitoring equipment compared to electrical or hydraulic systems since air is a compressible gas. In addition, the risk when handling pneumatic equipment due to air pressure leakage can lead to fatal injuries. In addition, end users find substitutes such as electrical and hydraulic equipment which are more attractive than pneumatic equipment in terms of use. These are the factors that are hindering the expansion of the pneumatic equipment market in the world.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.38% |

|

Segments Covered |

By Component Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Festo SE & Co. KG, Bosch Rexroth AG, SMC Corporation, Airtac International Group, Norgren, Inc., Ckd Corp., Parker Hannifin Corporation, JELPC (Ningbo Jiaerling Pneumatic Machinery Co., Ltd.), Fenghua Yaguang Pneumatic Element Co, Ltd., Zhaoqing Fangda pneumatic Co. Ltd., Camozzi Group, Wuxi Huatong Pneumatic Manufacture Co. Ltd., Easun Pneumatic Science & Technology, and CNSNS, and Others. |

SEGMENTAL ANALYSIS

By Component Type Insights

The pneumatic valves segment holds the top position and is projected to expand further during the forecast period for the pneumatic components market. The demand for smart pneumatic systems with software for advanced data collection and analysis abilities. As per a study, the application of pneumatic-driven automatic valves can enhance pipeline fault or error detection processes by fast transient tests.

Moreover, the growing demand for improved productivity and automation in industries comprising healthcare, automotive and food and beverages is fuelling the segment’s market share. Also, the extensive use of automated systems and equipment in production operations is propelling the need for accurate airflow and pressure control for industrial automation. In addition, the high fuel prices and volatile economic situation worldwide are forcing companies to invest in advanced as well as energy-efficient pneumatic valves to lower functional expenses.

Region-wise, North America is the biggest marker for pneumatic valves owing to its developed manufacturing industry and high industrialization. It is followed by Europe and then the Asia Pacific which is rapidly advancements in industrialization.

By Application Insights

The machinery segment captured the maximum portion of the pneumatic components market share. Traditional older machines required more maintenance and power to work. The demand for compact and lightweight machines is growing and pneumatic components are perfect for such applications. It provides a better force-to-weight ratio, quick response and resistance against harsh environments. Besides this industry players are investing in the development of sustainable and eco-friendly products to comply with the environmental protection laws and regulations. Like, the European Union has implemented several policies and laws for green manufacturing and reducing carbon emissions.

In addition, technological advancements like Industry 4.0 and 5.0 and the Internet of Things (IoT) and subsequent integration are projected to drive the segment forward. The use of collaborative robots and other robotic solutions to optimise and streamline manufacturing procedures is influencing pneumatic usage in several industries.

REGIONAL ANALYSIS

The Asia-Pacific region is estimated to hold the largest market share during the foreseen period, owing to escalation investments being made by manufacturers towards electronics and other significant applications.

Moreover, with the regional government bodies focusing on infrastructural developments, there is immense scope for expanding the pneumatic components market in Asia-Pacific during the foreseen period. With the rapid escalation of commercial development and favorable government policies regarding FDI, the region is poised for significant investments from major manufacturers in the forthcoming years. Additionally, with the escalation of government initiatives in India, the scope of expansion and development of pneumatic components in emerging markets is predicted to be immense during the foreseen period. The manufacturing costs in the Asia-Pacific countries of China and India are lower than those in the developed nations, which would drive the expansion of the pneumatic components market in this region during the foreseen period. North America will dominate the pneumatic components market due to the rising demand for automation. At the same time, Asia-Pacific will expect to grow in the foreseen period due to the prevalence of market players in China.

KEY PLAYERS IN THE MARKET

Companies playing a prominent role in the global pneumatic components market include Festo SE & Co. KG, Bosch Rexroth AG, SMC Corporation, Airtac International Group, Norgren, Inc., Ckd Corp., Parker Hannifin Corporation, JELPC (Ningbo Jiaerling Pneumatic Machinery Co., Ltd.), Fenghua Yaguang Pneumatic Element Co, Ltd., Zhaoqing Fangda pneumatic Co. Ltd., Camozzi Group, Wuxi Huatong Pneumatic Manufacture Co. Ltd., Easun Pneumatic Science & Technology, and CNSNS, and Others.

RECENT HAPPENINGS IN THE MARKET

- In May 2024, Emerson introduced the new AVENTICS Series 625 AVENTICS Series 625 Sentronic proportional pressure control valves and data acquisition software. It provides greater control accuracy and helps in surveillance, direct PC control and quick setup. Also, it offers better productivity, precision, adaptability and flexibility in producing systems based on pneumatic power.

- In May 2024, Bosch Rexroth announced SMC Deutschland as the first pneumatic supplier, boosting its ctrlX World partner network. This enables the integrators and machine builders to have the capability to link SMC actuators and sensors for pneumatic use cases via EtherCAT or IO-Link into their ctrlX automation systems.

- In April 2024, Festo collaborated with Phoenix Contact to add Phoenix’s PLCnext technology into the networking and end device catalogue to provide advanced automation products to users demanding connectivity in electric and pneumatic systems.

MARKET SEGMENTATION

This research report on the global pneumatic components market has been segmented and sub-segmented based on component type, application, and region.

By Component Type

- Air Treatment Components

- Pneumatic Valves

- Pneumatic Cylinders

By Application

- Electronics

- Chemical Industry

- Machinery

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the Pneumatic Components Market growth rate during the projection period?

The Global Pneumatic Components Market is expected to grow with a CAGR of 5.38% between 2024-2032.

What can be the total Pneumatic Components Market value?

The Global Pneumatic Components Market size is expected to reach a revised size of USD 25.56 billion by 2032.

Name any three Pneumatic Components Market key players?

JELPC (Ningbo Jiaerling Pneumatic Machinery Co., Ltd, Fenghua Yaguang Pneumatic Element Co, Ltd, Zhaoqing Fangda pneumatic Co. Ltd are the three Pneumatic Components Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]