Global Platinum Market Size, Share, Trends, & Growth Forecast Report Segmented By Source (Primary, Secondary), Form, End-use, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Platinum Market Size

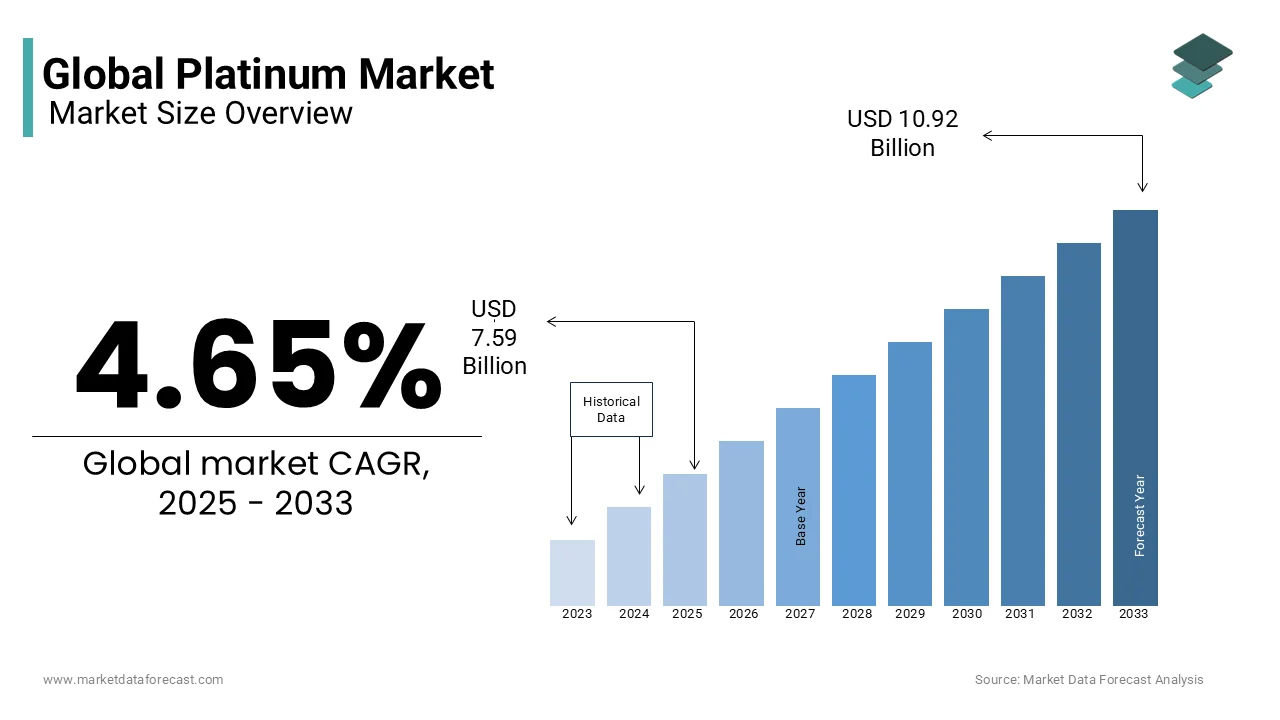

The global platinum market size was valued at USD 7.25 billion in 2024 and is expected to reach USD 10.92 billion by 2033 from USD 7.59 billion in 2025. The market is projected to grow at a CAGR of 4.65%.

Platinum is a precious metal renowned for its exceptional resistance to corrosion and remarkable catalytic properties and plays a pivotal role in various industries, notably automotive, jewelry, and industrial applications. In recent years, the platinum market has experienced significant shifts in supply and demand dynamics. According to the World Platinum Investment Council (WPIC), the global platinum market recorded a deficit of approximately 878,000 ounces in 2023 and is marking one of the most substantial shortfalls in recent history. This trend is anticipated to persist, with a projected deficit of around 418,000 ounces in 2024, as reported by the WPIC.

South Africa remains the dominant player in platinum production by contributing nearly 70% of the global supply. However, the market faces challenges such as labor strikes, power supply issues, and regulatory hurdles which can disrupt production and affect global supply chains.

On the demand side, the automotive sector continues to be a significant consumer of platinum, accounting for approximately 44% of total demand as of 2024. The rise in hybrid vehicle sales has provided a lifeline to platinum group metals, as these vehicles require catalytic converters to curb emissions a function not necessary in pure electric vehicles. Investment interest in platinum has also seen a resurgence. Retail giants like Costco have introduced platinum bars to their product offerings and is reflecting growing consumer interest in the metal as an investment asset. Despite its price volatility, platinum's rarity and diverse industrial applications continue to bolster its market appeal.

MARKET DRIVERS

Automotive Industry Demand

The automotive sector significantly drives platinum demand due to its essential role in catalytic converters which reduce vehicle emissions. As of 2024, automotive applications account for approximately 44% of global platinum consumption, highlighting the metal's critical function in meeting stringent emission standards. The World Platinum Investment Council emphasizes platinum's centrality in reducing vehicle emissions, noting its increasing use in gasoline autocatalysts as a substitute for more costly palladium. Additionally, the rise of hybrid vehicles which require catalytic converters and has further bolstered platinum demand. This sustained need underscores the automotive industry's pivotal role in shaping the platinum market's dynamics.

Industrial Applications

Beyond the automotive sector, platinum's unique properties such as high resistance to corrosion and excellent catalytic capabilities make it indispensable in various industrial applications. The World Platinum Investment Council reports that industrial uses constitute between 27% to 36% of total platinum demand over the past five years. Notably, platinum is utilized in the production of nitric acid for fertilizers and in the petrochemical industry to achieve higher yields of high-octane fuel per barrel of oil. Its high melting point and stability are vital in the glass-making industry and is particularly in producing LED screens and glass fiber. These diverse applications underscore platinum's integral role in multiple industrial processes which is driving consistent demand in the market.

MARKET RESTRAINTS

Supply Constraints

The global platinum market faces significant supply constraints due to its concentrated production in specific regions. According to the U.S. Geological Survey (USGS), South Africa is the world's leading producer of platinum-group metals (PGMs) and is accounting for approximately 74% of the world's platinum mine production in 2011. This heavy reliance on a single country makes the supply chain vulnerable to disruptions from labour strikes, power shortages and political instability. For instance, labor strikes in South African mines have historically led to substantial decreases in platinum production and is affecting global availability. Additionally, the USGS notes that in 2022, the United States produced only about 3,300 kilograms of platinum, underscoring its limited contribution to global supply. These factors collectively constrain the market's ability to meet growing demand.

Price Volatility

Platinum prices are notably volatile is influenced by fluctuations in supply and demand, geopolitical tensions, and changes in industrial usage. The USGS reported that the average annual price of platinum decreased from $1,094.31 per troy ounce in 2021 to $980 per troy ounce in 2022. Such volatility poses challenges for industries that depend on platinum because unpredictable costs can disrupt budgeting and financial planning. Moreover, price instability can deter investment in platinum mining and processing infrastructure, further exacerbating supply issues. This volatility underscores the need for stakeholders to develop strategies to mitigate financial risks associated with platinum procurement.

MARKET OPPORTUNITIES

Hydrogen Economy Expansion

The expanding hydrogen economy presents a significant opportunity for the platinum market. Platinum serves as a critical catalyst in proton-exchange membrane (PEM) fuel cells which are integral to hydrogen-powered vehicles and energy systems. The U.S. Department of Energy stated that PEM fuel cells utilize platinum-based catalysts to facilitate the electrochemical reactions necessary for energy production. As global efforts intensify to reduce carbon emissions, the demand for hydrogen fuel cells is expected to rise, thereby increasing the need for platinum. This trend underscores the metal's strategic importance in future energy infrastructures.

Advancements in Medical Technologies

Platinum's unique properties including biocompatibility and resistance to corrosion makes it invaluable in medical applications such as pacemakers, catheters, and implantable defibrillators. The U.S. Geological Survey notes that platinum's stable electrical properties are essential for medical devices. As the global population ages and healthcare technologies advance, the demand for such medical devices is projected to increase, thereby bolstering the platinum market. This growth trajectory highlights the expanding role of platinum in the medical sector.

MARKET CHALLENGES

Environmental Regulations and Substitution

Stringent environmental regulations have led to the development of advanced catalytic converters that may utilize alternative materials, potentially reducing platinum demand. The U.S. Environmental Protection Agency's Tier 3 Motor Vehicle Emission and Fuel Standards program, implemented in 2017, sets new vehicle emissions standards and a new gasoline sulfur standard, aiming to reduce the impacts of motor vehicles on air quality and public health. These regulations have prompted the exploration of alternative materials and technologies in catalytic converters which could affect platinum usage.

Technological Advancements in Catalysis

Advancements in catalytic technologies present challenges to traditional platinum applications. The U.S. Department of Energy has been actively researching non-platinum group metal (non-PGM) catalysts for fuel cells and industrial processes. These efforts aim to reduce reliance on platinum due to its cost and supply constraints. For instance, scientists at the Department of Energy's Argonne National Laboratory have developed and studied fuel cell catalysts that do not use platinum, providing better understanding of the mechanisms that make these catalysts effective. Such technological progress could diminish platinum's dominance in catalysis and is compelling the market to innovate and explore new applications to maintain demand.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.65% |

|

Segments Covered |

By Source, Form, End-use, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Anglo American Platinum Ltd., Impala Platinum Holdings Limited, Sibanye-Stillwater, Norilsk Nickel, Zimbabwe Platinum Mines Limited, African Rainbow Minerals, Eastern Platinum, Eurasia Mining PLC, Johnson Matthey, Implats Platinum Ltd., and others |

SEGMENTAL ANALYSIS

By Source Insights

Primary platinum is extracted directly from mining operations. The primary segment ruled the global platinum market by holding 80.2% of the global market share in 2024. According to the U.S. Geological Survey's Mineral Commodity Summaries 2023, global mine production of platinum in 2022 was approximately 190 metric tons with South Africa contributing about 140 metric tons and is accounting for nearly 74% of the total production. This dominance is due to the extensive platinum reserves in the Bushveld Complex. The reliance on primary sources is significant because of the metal's critical applications in industries such as automotive catalytic converters and various industrial processes. However, the concentration of production in specific regions can lead to supply vulnerabilities.

The secondary segment is the swiftest growing segment and is estimated to grow at a CAGR of 7.2% over the forecast period. It is obtained through recycling processes and primarily from end-of-life automotive catalytic converters, jewelry, and electronic equipment. The U.S. Geological Survey reports that in 2022, approximately 110 metric tons of palladium and platinum were recovered globally from new and old scrap, with about 11 metric tons of platinum recovered from automobile catalytic converters in the United States. While secondary sources currently supplement the primary supply, advancements in recycling technologies and increasing environmental regulations are expected to enhance the efficiency and volume of platinum recovery. This trend underscores the growing importance of recycling in ensuring a sustainable and stable supply of platinum.

By Form Insights

The metal segment held the largest share of the global market by accounting for 85.5% of the global market in 2024. The growth of the metal segment is primarily driven by its extensive use in automotive catalytic converters which are essential for reducing vehicle emissions. According to the U.S. Environmental Protection Agency, catalytic converters have been instrumental in decreasing harmful emissions from vehicles and thereby contributing to improved air quality. Additionally, platinum's high resistance to corrosion and excellent catalytic properties make it indispensable in various industrial applications, further solidifying its leading position in the market.

The powder segment is estimated to experience the fastest CAGR of 6.12% from 2025 to 2033 owing to its increasing application in the electronics industry where platinum powder is utilized in the manufacturing of high-performance electronic components due to its excellent electrical conductivity and stability. The U.S. Department of Energy stresses on the significance of platinum-based materials in fuel cell technologies, which are gaining traction as clean energy solutions. The rising demand for advanced electronics and sustainable energy systems underscores the importance of platinum powder in modern technological advancements.

By End Use Insights

The automotive segment had the leading share of the global platinum market in 2024 due to platinum's critical role in catalytic converters, which are essential for reducing harmful emissions in internal combustion engine vehicles. According to the U.S. Environmental Protection Agency, catalytic converters have been instrumental in decreasing vehicle emissions, thereby contributing to improved air quality. The continued reliance on internal combustion engines, particularly in regions with stringent emission regulations and underscores the automotive industry's leading position in platinum consumption.

On the other hand, the electronics segment is estimated to register a CAGR of 4.52% over the forecast period owing to the application of platinum in hard disk drives (HDDs) where it is used in the magnetic layers to enhance data storage capacity and reliability. The U.S. Geological Survey notes that platinum's unique properties, such as high conductivity and resistance to corrosion, make it valuable in electronic components. As data storage needs expand with the proliferation of digital technologies and cloud computing, the demand for platinum in the electronics industry is expected to rise, highlighting its growing importance in this sector.

REGIONAL ANALYSIS

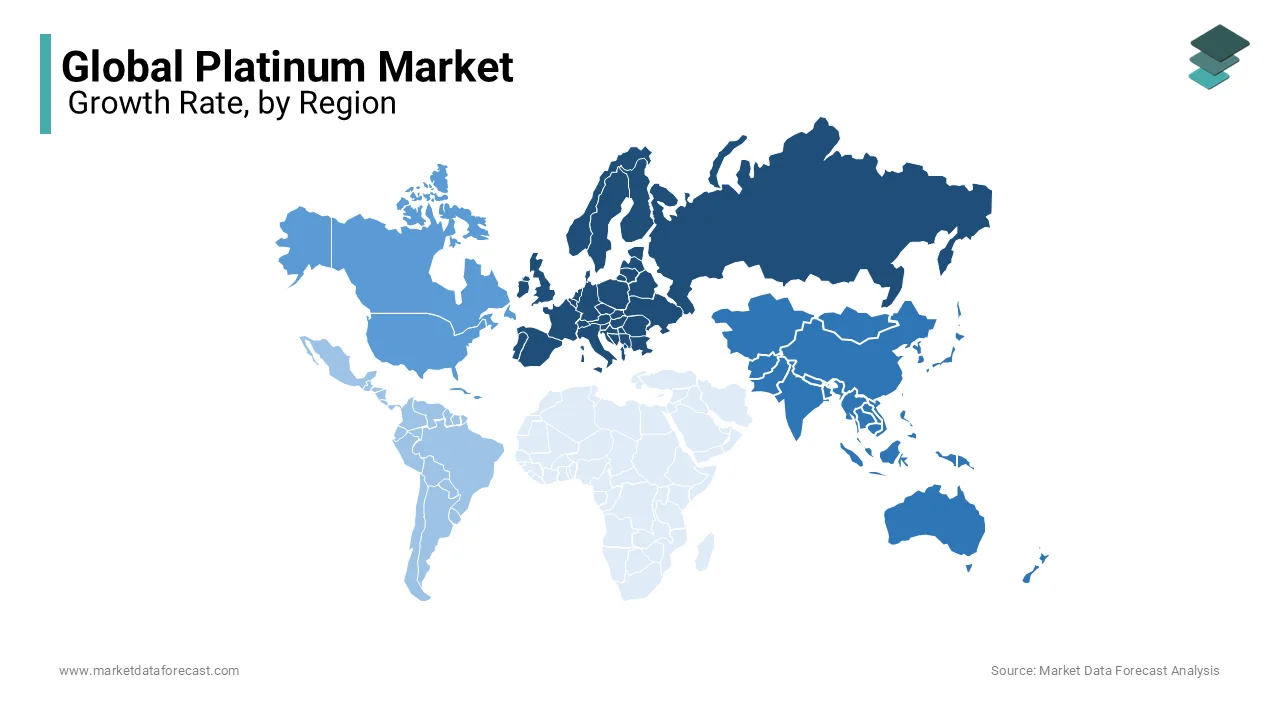

Europe stood as the largest market for platinum by capturing 34.2% of the global market share in 2024. The growth of the European region in the global market is majorly driven by its stringent environmental regulations and a robust automotive industry. The region's commitment to reducing vehicle emissions has led to increased demand for platinum-based catalytic converters. According to the European Automobile Manufacturers Association, Europe produced over 16 million passenger cars in 2022 which is underscoring the significant role of the automotive sector in platinum consumption. Additionally, Europe's focus on hydrogen fuel cell technology, which utilizes platinum as a catalyst, further bolsters its market position.

The platinum market in the Asia-Pacific region is growing at a brisk pace and is estimated to register a CAGR of 6.2% over the forecast period due to the accelerated industrialization, rising disposable incomes, and a burgeoning automotive sector in countries such as China, Japan, and South Korea. The U.S. Geological Survey notes that platinum's unique properties, including resistance to chemical attack and stable electrical characteristics, make it indispensable in various industrial applications prevalent in this region. Furthermore, the Asia-Pacific's focus on environmental regulations and the adoption of clean energy technologies, such as hydrogen fuel cells, are driving increased demand for platinum which is solidifying its position as the fastest-growing market.

North America is anticipated to account for a prominent share of the global market over the forecast period. In North America, the platinum market is driven by the automotive industry's demand for catalytic converters and the jewelry sector's preference for high-quality platinum pieces. The region's advanced industrial base and technological innovations also contribute to the utilization of platinum in various applications, including electronics and chemical processing. The United States and Canada are significant consumers, with ongoing investments in sustainable technologies potentially bolstering future demand.

Latin America is experiencing moderate growth in the platinum market and is supported by emerging automotive and industrial sectors. Countries like Brazil and Mexico are witnessing increased demand for platinum in automotive applications due to rising vehicle production and the implementation of stricter emission standards. Furthermore, the region's developing economies and expanding middle class contribute to a growing market for platinum jewelry.

The Middle East and Africa region, particularly South Africa, play a crucial role in the global platinum market. South Africa is the world's largest producer of platinum and is accounting for approximately 74% of global production, as reported by the U.S. Geological Survey. The region's mining activities significantly influence global supply dynamics. However, factors such as labor strikes, regulatory challenges, and infrastructure issues can impact production levels. On the consumption side, the Middle East's luxury market drives demand for platinum jewelry, while industrial applications are also contributing to the market's development.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

Anglo American Platinum Ltd., Impala Platinum Holdings Limited, Sibanye-Stillwater, Norilsk Nickel, Zimbabwe Platinum Mines Limited, African Rainbow Minerals, Eastern Platinum, Eurasia Mining PLC, Johnson Matthey, Implats Platinum Ltd. are playing dominating role in the global platinum market.

The global platinum market is highly competitive, dominated by a few key players, including Anglo American Platinum, Impala Platinum (Implats), and Norilsk Nickel (Nornickel). These companies control the majority of global platinum production, with South Africa being the largest supplier, accounting for nearly 75% of the world’s platinum reserves.

Competition in the market is driven by production efficiency, technological innovation, and market diversification. As platinum demand shifts from traditional applications like automotive catalytic converters to green technologies such as hydrogen fuel cells and renewable energy, companies are racing to invest in sustainable mining and new industrial applications. Additionally, mergers and acquisitions (M&A) play a crucial role in consolidating market power, as seen in Implats’ acquisition of Royal Bafokeng Platinum.

The price volatility of platinum adds another layer of competition, as companies must optimize costs while maintaining profitability. External factors such as government policies, environmental regulations, and supply chain disruptions also impact market dynamics. With increasing emphasis on ESG (Environmental, Social, and Governance) compliance, companies that implement sustainable mining practices gain a competitive edge.

As the market evolves, competition will intensify among established miners, emerging players, and technology firms investing in platinum-based clean energy solutions.

TOP 3 PLAYERS IN THE MARKET

Anglo American Platinum

Anglo American Platinum is the world's largest producer of platinum, responsible for nearly 40% of the global supply. Headquartered in Johannesburg, South Africa, the company operates extensive mining and refining facilities in the Bushveld Igneous Complex, one of the richest platinum deposits in the world. Its production supports key industries, including automotive catalytic converters, hydrogen fuel cells, jewelry, and industrial applications. As a subsidiary of Anglo American plc, it benefits from a strong financial backing and a well-integrated supply chain. Given its dominant market share, Anglo American Platinum significantly influences global platinum prices and supply trends, making it a key driver of the market.

Impala Platinum Holdings Limited (Implats)

Impala Platinum Holdings Limited, known as Implats, is the second-largest producer of platinum, accounting for about 20% of the global market supply. The company is also headquartered in Johannesburg, South Africa, and operates major platinum mines in the Bushveld Complex in South Africa and the Great Dyke in Zimbabwe. Implats is well known for its integrated mining-to-refining approach, ensuring a consistent supply of high-quality platinum. Its platinum output is crucial for the automotive, jewelry, and industrial sectors, particularly in emission-reducing catalytic converters. The company’s strategic investments in expanding its operations and improving efficiency keep it competitive in the evolving platinum market.

Norilsk Nickel (Nornickel)

Norilsk Nickel, commonly referred to as Nornickel, is a Russian mining giant that is primarily known for its production of nickel and palladium but also ranks among the top platinum producers globally. Based in Moscow, Russia, Nornickel operates some of the world’s richest nickel-copper-palladium-platinum ore deposits, primarily in Norilsk and the Kola Peninsula. While its platinum output is smaller than that of Anglo American Platinum and Implats, it plays a vital role in the supply of refined platinum for industrial applications, electronics, and the automotive sector. Nornickel’s diversified metal portfolio gives it an edge in global commodity markets, and its continued investment in sustainable mining practices ensures a steady platinum supply for years to come.

STRATEGIES USED BY THE MARKET PLAYERS

Production Efficiency and Cost Optimization

To maintain profitability in the highly competitive platinum market, leading companies focus on cost reduction and operational efficiency. Anglo American Platinum has invested in automation, mechanization, and digital mining technologies to improve productivity while cutting operational costs. By streamlining processes, the company ensures sustainable mining practices with minimal waste. Implats has implemented lean manufacturing principles and optimized logistics to enhance efficiency, while also investing in modernized processing plants to improve metal recovery rates. Nornickel, benefiting from its low-cost Russian mining operations, has leveraged byproduct extraction, refining platinum alongside its primary nickel and palladium production, which significantly reduces overall costs. These efficiency-driven strategies help companies stay profitable despite volatile platinum prices.

Expansion through Mergers, Acquisitions, and Partnerships

To strengthen their market positions, platinum producers pursue strategic acquisitions, mergers, and partnerships. Anglo American Platinum has expanded its resource base by acquiring stakes in junior mining companies, securing long-term platinum supply. Implats, in one of the most significant deals in recent years, acquired Royal Bafokeng Platinum (RBPlat), enhancing its production capacity and reserves. Nornickel, known for its international collaborations, has formed joint ventures with global partners, allowing it to expand its refining capabilities and access new markets. Through these strategic expansions, companies consolidate their market presence, increase production, and secure their long-term dominance in the platinum market.

Diversification into Platinum-Based Technologies

As demand shifts from traditional automotive catalysts to emerging green technologies, platinum companies are diversifying into hydrogen fuel cells, electronics, and medical applications. Anglo American Platinum is a pioneer in fuel cell technology, actively investing in hydrogen-powered solutions that use platinum as a key catalyst. Implats is researching new industrial applications for platinum, including medical implants and chemical catalysts, to reduce dependency on automotive demand. Nornickel, leveraging its expertise in battery metals, has integrated platinum into electric vehicle (EV) technologies, ensuring long-term market relevance. By investing in these high-growth sectors, companies are future-proofing their operations and positioning themselves as leaders in next-generation platinum applications.

RECENT HAPPENINGS IN THE MARKET

- In November 26, 2024, the World Platinum Investment Council (WPIC) announced a revised forecast, projecting a platinum market deficit of 539,000 ounces for 2025. This adjustment reflects ongoing supply constraints and sustained demand across various sectors.

- In August 15, 2024, the WPIC reported that clear policy frameworks and increased government funding have expedited the approval of large-scale hydrogen electrolyser projects in Europe. Over the past month, four significant projects, each exceeding 100 MW, reached their final investment decisions, increasing European electrolysis capacity by approximately 33%. This development is anticipated to boost platinum demand, given its critical role in hydrogen production technologies.

MARKET SEGMENTATION

This research report on the global platinum market has been segmented and sub-segmented based on source, form, end-use, and region.

By Source

- Primary

- Secondary

By Form

- Metal

- Powder

- Alloys

By End Use

- Automotive

- Jewellery

- Chemical

- Electronics

- Industrial

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the current size of the global platinum market, and what is its projected growth?

The global platinum market was valued at USD 7.25 billion in 2024 and is expected to grow at a CAGR of 4.65%, reaching USD 7.59 billion in 2025 and USD 10.92 billion by 2033.

2. What are the key market opportunities driving platinum demand?

Two significant market opportunities for platinum include the expanding hydrogen economy and advancements in medical technologies.

3. What is the growth outlook for the Asia-Pacific platinum market?

The Asia-Pacific region is projected to register a CAGR of 6.2% over the forecast period. This growth is fueled by accelerated industrialization, rising disposable incomes, and a rapidly expanding automotive sector in countries like China, Japan, and South Korea, alongside a heightened focus on environmental regulations and clean energy technologies such as hydrogen fuel cells.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com