Global Plastics Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Polyethylene, Polypropylene, Polyethylene Terephthalate, Polyvinyl Chloride, Acrylonitrile Butadiene Styrene, Polyamide, Polycarbonate, Polyurethane, Polystyrene, and Others), End-use Industry, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Plastics Market Size

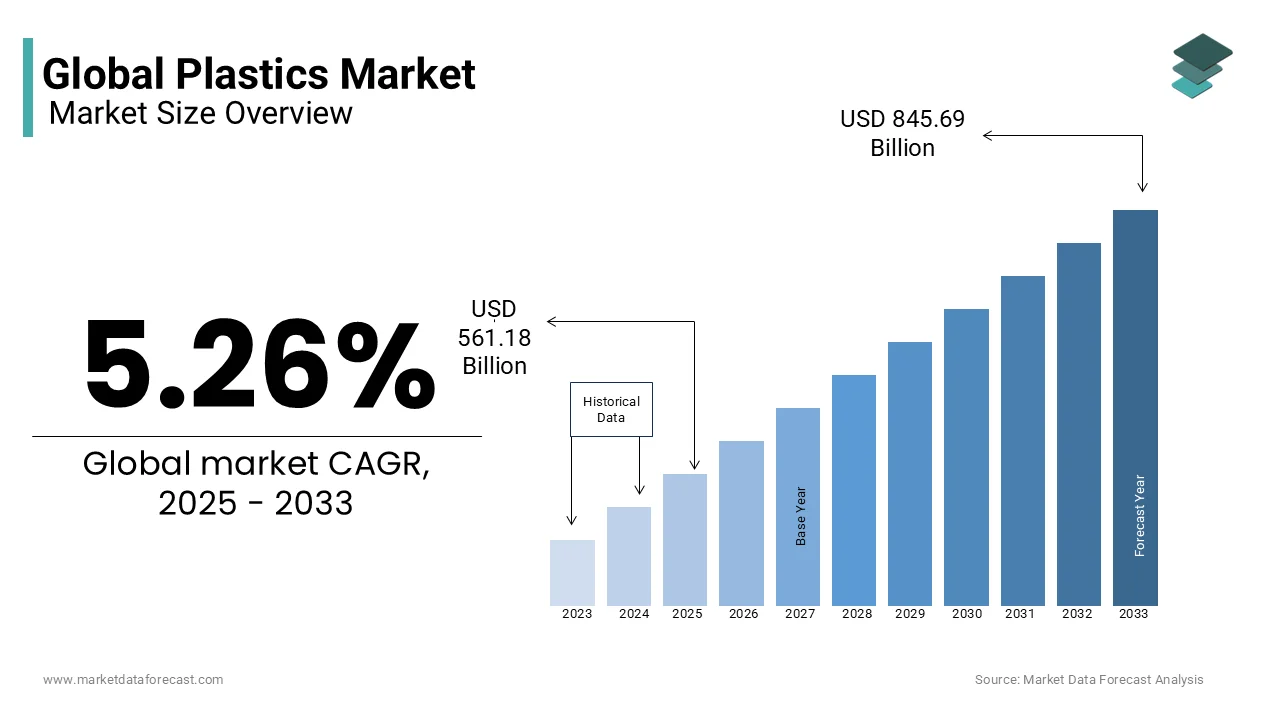

The global plastics market size was valued at USD 533.14 billion in 2024 and is expected to reach USD 845.69 billion by 2033 from USD 561.18 billion in 2025. The market is projected to grow at a CAGR of 5.26%.

In 2023, global plastic production reached approximately 413.8 million metric tons with China accounting for 33% of this output. The environmental implications of such extensive production are profound. According to the Organisation for Economic Co-operation and Development (OECD), without policy interventions, global plastic production is projected to triple by 2060, potentially reaching 1.23 billion metric tons annually. This surge in production correlates with increased waste generation and the OECD also notes that in 2019 alone approximately 6.1 million metric tons of plastic waste entered aquatic ecosystems, exacerbating pollution levels.

Furthermore, the plastics market significantly contributes to global oil consumption. The World Economic Forum estimates that plastics production accounts for about 4-8% of annual oil consumption. If current trends persist, this figure could escalate to 20% by 2050. This reliance on fossil fuels not only underscores the environmental challenges associated with plastic production but also highlights the urgency for sustainable alternatives.

MARKET DRIVERS

Technological Advancements in Plastic Recycling

Innovations in plastic recycling technologies are significantly influencing the plastics market. The Organisation for Economic Co-operation and Development (OECD) stated that comprehensive global policies addressing the entire plastics lifecycle including advancements in recycling can reduce plastic leakage into the environment by 96% by 2040. These technological advancements not only mitigate environmental impacts but also promote a circular economy and thereby driving the market toward more sustainable practices.

Government Policies and Regulations

Government interventions are pivotal in shaping the plastics market’s dynamics. The European Union's Directive (EU) 2019/904, known as the Single-Use Plastics Directive which aims to prevent and reduce the impact of certain plastic products on the environment, particularly the aquatic environment, and on human health as well as to promote the transition to a circular economy with innovative and sustainable business models, products, and materials. Such regulations compel manufacturers to innovate and adapt, fostering the development of biodegradable plastics and encouraging investment in sustainable solutions, thereby steering the market toward more responsible production and consumption patterns.

MARKET RESTRAINTS

Environmental Impact and Regulatory Challenges

The plastics market faces significant constraints due to its environmental impact and the resulting regulatory measures. For instance, the United Kingdom's Environmental Improvement Plan 2023 sets a target to reduce residual municipal plastic waste to no more than 42 kilograms per person annually by January 31, 2028 which is representing a 45% decrease from 2019 levels. This initiative reflects a broader global trend of stringent regulations aimed at mitigating plastic pollution. Compliance with such policies necessitates substantial investment in sustainable practices and technologies is posing financial and operational challenges for market stakeholders.

Health Concerns Associated with Plastic Exposure

Growing evidence links exposure to certain chemicals in plastics such as bisphenol A (BPA) and phthalates to adverse health effects. The World Health Organization has shared concerns about exposures to hazardous chemicals used in plastics noting potential health risks at all stages of the plastics lifecycle. These health concerns have led to increased public scrutiny and demand for safer alternatives and is compelling manufacturers to reformulate products and invest in research to mitigate health risks, thereby restraining market growth.

MARKET OPPORTUNITIES

Advancements in Biodegradable Plastics

The development of biodegradable plastics offers a significant opportunity to mitigate environmental pollution. These materials are designed to decompose more readily under specific conditions, reducing their persistence in natural ecosystems. The UK government has emphasized the importance of establishing robust standards for biodegradable plastics to ensure their effective degradation and to prevent potential environmental harm. Implementing such standards can facilitate the adoption of biodegradable plastics which is contributing to waste reduction and environmental sustainability.

Implementation of Deposit Return Schemes (DRS)

Deposit Return Schemes (DRS) have proven effective in enhancing recycling rates and reducing litter. For instance, Ireland's DRS launched in February 2024 and has seen substantial public participation with over 980 million drinks containers returned within its first year. This initiative not only promotes recycling but also fosters community engagement and environmental awareness. The success of such schemes underscores their potential as a model for other regions aiming to improve waste management and promote a circular economy.

MARKET CHALLENGES

Environmental Regulations and Compliance Costs

The plastics market is increasingly challenged by stringent environmental regulations aimed at reducing waste and pollution. For instance, the United Kingdom's Environmental Improvement Plan 2023 sets a target to limit residual municipal plastic waste to no more than 42 kilograms per person annually by January 31, 2028, representing a 45% reduction from 2019 levels. Achieving such targets requires substantial investments in sustainable practices, advanced waste management systems, and the development of alternative materials, thereby escalating operational costs for manufacturers. These financial burdens can impede profitability and deter innovation within the market.

Public Scrutiny and Changing Consumer Preferences

Growing public awareness of plastic pollution has led to increased scrutiny of the plastics market and a shift in consumer preferences toward sustainable products. A report by the UK Parliament revealed that in 2018, the country generated approximately 1.86 million tonnes of overall plastic waste, though official statistics suggest this figure may be higher. This heightened awareness has resulted in consumers favoring products with minimal or biodegradable packaging, pressuring companies to adapt their offerings. Failure to respond to these changing preferences can result in reputational damage and loss of market share, presenting a significant challenge for businesses reliant on traditional plastic products.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.26% |

|

Segments Covered |

By Type, End-use Industry, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BASF SE, SABIC, Dow, Inc., DuPont, Evonik Industries AG, Sumitomo Chemical Co., Ltd., Arkema, Celanese Corporation, Eastman Chemical Company, Chevron Phillips Chemical Co., LLC, and others |

SEGMENTAL ANALYSIS

By Type Insights

The polyethylene segment was the leading segment in the global plastics market and accounted for 24.7% of the global market share in 2024. The widespread use of plastics is attributed to its versatility, durability, and cost-effectiveness, which is majorly propelling the growth of the polyethylene segment in the global market. In the packaging industry, polyethylene is extensively utilized due to its excellent barrier properties and flexibility. Additionally, in the construction sector, it is employed in applications such as pipes and insulation materials, owing to its chemical resistance and mechanical strength. In 2023, global production of polyethylene reached approximately 100 million metric tons, underscoring its critical role in various industries. These diverse applications underscore polyethylene's dominance in the market.

The polypropylene segment is anticipated to register the highest CAGR of 3.2% from 2025 to 2033. Factors such as increasing application in the automotive industry where its lightweight nature contributes to improved fuel efficiency and reduced emissions is boosting the growth of the polypropylene segment in the global market. Furthermore, polypropylene's resistance to fatigue and chemical corrosion makes it ideal for automotive components such as battery housings and bumpers. In the packaging sector, its high melting point and clarity are advantageous for food packaging, ensuring product safety and extending shelf life. These factors collectively contribute to the accelerated adoption of polypropylene in various industries.

By End-Use Industry Insights

The packaging dominated the market by accounting for 40.5% of global market share in 2024. The extensive use of plastics in the packaging industry due to the lightweight, durable, and versatile properties of plastic that are essential for preserving product integrity and extending shelf life is primarily propelling the domination of the packaging segment in the global market. For instance, single-use plastics, predominantly used in packaging, constitute about 40% of the plastic produced annually, as reported by National Geographic. The food and beverage sector significantly contributes to this demand and is utilizing plastic packaging to ensure hygiene and convenience.

The healthcare and pharmaceuticals segment is anticipated to witness a CAGR of 7.5% over the forecast period owing to the increasing demand for disposable medical devices, syringes, and packaging solutions that ensure sterility and safety. Plastics' versatility and compliance with stringent health regulations make them indispensable in manufacturing medical equipment and pharmaceutical packaging. The COVID-19 pandemic has further accelerated this trend with a significant increase in the use of single-use plastic products such as personal protective equipment (PPE), syringes, and test kits. According to the Financial Times, the healthcare sector contributes over 4% of global CO₂ emissions, with single-use plastics being a significant factor.

REGIONAL ANALYSIS

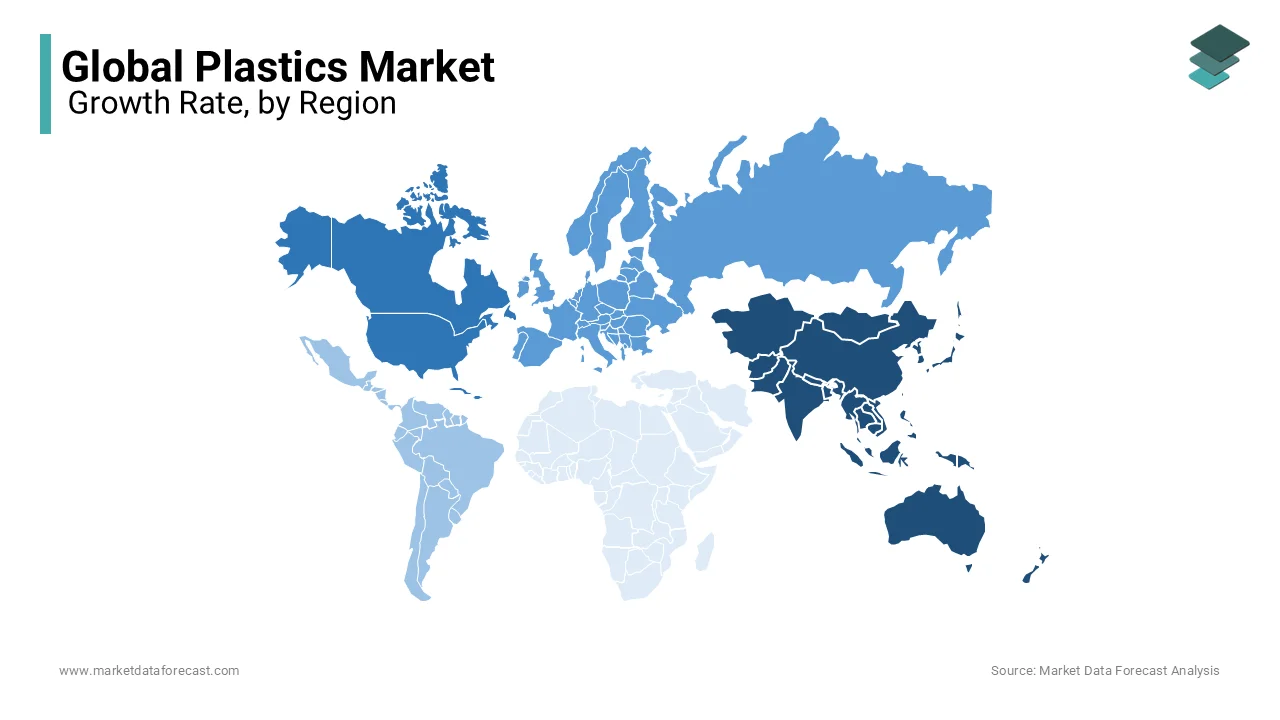

Asia-Pacific was the largest region in the global plastics market and accounted for 43.1% of the global market share in 2024. Factors such as rapid industrialization and urbanization, particularly in countries like China and India are driving the Asia-Pacific plastics market growth. China alone contributes to 31% of global plastic production and is underscoring its significant role in the market. The region's burgeoning middle class has led to increased consumption of plastic products across various sectors, including packaging, construction, and automotive industries. The availability of cost-effective labor and raw materials further bolsters the region's leading position.

North America is the rapidly growing market for plastics with a projected compound annual growth rate (CAGR) of 13.1% from 2025 to 2033. This growth is driven by increasing demand in packaging, automotive, and healthcare industries. The United States, in particular, has a well-established plastics manufacturing sector and is supported by technological advancements and a focus on sustainable practices. Government initiatives promoting recycling and the use of recycled plastics are also contributing to market expansion.

Europe has been a substantial player in the plastics market however, recent trends indicate a decline in production. In 2023, European plastics production decreased by 8.3%, contrasting with a global production increase of 3.4%. This decline is attributed to high energy costs, stringent environmental regulations, and competition from regions with lower production costs. Consequently, Europe's share in the global plastics market has decreased notably in recent years.

Latin America is experiencing moderate growth in the plastics market, driven by urbanization and industrialization. The packaging and construction sectors are significant contributors to the demand for plastics in this region. However, economic volatility and political uncertainties in some countries may pose challenges to market expansion. Efforts towards improving recycling infrastructure and adopting sustainable practices are expected to influence future growth positively.

The Middle East and Africa region is anticipated to witness growth in the plastics market due to increasing investments in infrastructure and construction projects. The availability of petrochemical resources provides a competitive advantage in raw material supply for plastic production. However, the region faces challenges such as political instability and environmental concerns related to plastic waste management. Initiatives to develop recycling facilities and implement regulatory frameworks are expected to shape the market's future trajectory.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

BASF SE, SABIC, Dow, Inc., DuPont, Evonik Industries AG, Sumitomo Chemical Co., Ltd., Arkema, Celanese Corporation, Eastman Chemical Company, Chevron Phillips Chemical Co., LLC are playing dominating role in the global plastics market

The global plastics market is highly competitive, driven by increasing demand, sustainability concerns, and technological advancements. The market is dominated by large multinational corporations such as BASF SE, Dow Inc., and ExxonMobil Chemical, which compete based on product innovation, production capacity, and sustainability efforts. These market leaders benefit from economies of scale, enabling them to invest in advanced materials, recycling technologies, and expansion into emerging markets.

Competition is further intensified by regional manufacturers in Asia, Europe, and North America, which focus on niche markets and cost-effective production. The rise of biodegradable and recycled plastics has also introduced new players, particularly startups and mid-sized companies specializing in sustainable materials. Governments worldwide are enforcing stringent environmental regulations, pushing companies to adopt circular economy models and reduce carbon footprints, increasing competition in recycling technologies and green alternatives.

Additionally, the market faces volatility in raw material prices, especially as petroleum-based plastics are affected by fluctuations in crude oil prices. With growing concerns about plastic pollution and bans on single-use plastics, companies are racing to develop innovative, eco-friendly solutions to maintain their market share. The plastics market remains dynamic and fiercely competitive, shaped by global trends, sustainability demands, and technological advancements.

TOP 3 PLAYERS IN THE MARKET

BASF SE (Germany)

BASF SE, headquartered in Ludwigshafen, Germany, is the world’s largest chemical producer, with an annual revenue of approximately €68 billion. The company plays a critical role in the plastics market by manufacturing a wide range of materials, including engineering plastics, polyurethane, polyamides, and polystyrene, which are used in sectors like automotive, construction, and packaging. BASF is also a pioneer in sustainability, leading initiatives such as ChemCycling™, a project focused on converting plastic waste into new raw materials. With operations in over 80 countries, BASF is actively investing in biodegradable plastics and chemical recycling solutions to promote a circular economy and reduce dependency on fossil-based feedstocks.

Dow Inc. (United States)

Dow Inc., based in Midland, Michigan, is one of the largest players in the global plastics market, with an estimated revenue of $56 billion. The company is the world’s largest producer of polyethylene (PE), which is a key material in packaging, automotive, and industrial applications. Dow has committed to carbon neutrality by 2050 and continues to invest heavily in advanced plastics recycling technologies. The company also collaborates with organizations such as Circulate Capital to address plastic waste challenges, particularly in emerging markets. Through the development of high-performance plastics, Dow contributes to the advancement of energy-efficient construction and electric vehicle (EV) manufacturing.

ExxonMobil Chemical (United States)

ExxonMobil Chemical, a division of ExxonMobil Corporation, is a major force in the global plastics market, with operations spanning multiple continents and contributing to its parent company’s $400 billion+ revenue. The company is the largest producer of polypropylene (PP), a versatile plastic used in automotive, healthcare, and consumer goods. ExxonMobil has invested over $2 billion in innovative plastic waste recycling technologies, including Exxtend™, which converts discarded plastics into reusable materials. The company has also partnered with The Alliance to End Plastic Waste, a global initiative to tackle plastic pollution. With large-scale petrochemical plants in the USA, Singapore, Belgium, and Saudi Arabia, ExxonMobil is not only a key supplier of plastics but also an market leader in advancing circular economy solutions and sustainable practices.

STRATEGIES USED BY THE MARKET PLAYERS

Sustainability and Circular Economy Initiatives

To address increasing environmental concerns and regulatory pressures, major plastics manufacturers are prioritizing sustainability by investing in recycling technologies and bio-based plastics. BASF launched the ChemCycling™ project, which converts plastic waste into high-quality feedstocks for new materials. Dow is heavily investing in mechanical and chemical recycling, working towards reducing plastic waste in oceans and landfills. Similarly, ExxonMobil has introduced Exxtend™ technology, an advanced recycling solution that breaks down used plastics into their original components for reuse. These sustainability initiatives help plastics companies align with global climate policies, consumer demand for greener products, and corporate social responsibility commitments.

Innovation in Advanced Materials and High-Performance Plastics

Continuous research and development (R&D) allow plastics companies to create stronger, lighter, and more sustainable materials. BASF has been at the forefront of developing lightweight automotive plastics, replacing traditional metals to improve fuel efficiency and reduce emissions in the automotive industry. Dow has focused on high-performance polymers, particularly for electric vehicles (EVs), healthcare, and sustainable packaging applications. Meanwhile, ExxonMobil is innovating in specialty elastomers and advanced polyethylene materials, improving the efficiency and durability of products in construction, industrial, and consumer goods sectors. These advancements in materials ensure companies remain competitive while supporting industries transitioning to greener and more efficient technologies.

Strategic Mergers and Acquisitions (M&A)

To strengthen market positions, plastics companies are actively acquiring smaller competitors and emerging innovators in the market. BASF has expanded its footprint through acquisitions in engineering plastics and specialty additives, particularly for automotive and packaging applications. Dow has strategically acquired companies that enhance its polymer technology and sustainability initiatives, allowing it to remain a leader in the transition towards a circular economy. Similarly, ExxonMobil continues to grow its petrochemical business by forming joint ventures and acquiring facilities in Asia and the Middle East. Through mergers and acquisitions, these corporations increase their technological capabilities, market share, and production capacity, ensuring long-term growth and leadership.

RECENT HAPPENINGS IN THE MARKET

- In November 2024, Amcor announced its plan to acquire Berry Global Group in an all-stock transaction valued at $8.4 billion. This merger positions the combined entity as the world's largest plastic packaging company, with annual sales projected to reach $23.9 billion. The deal is expected to close by mid-2025.

- In April 2024, Borealis AG acquired Integra Plastics AD, a Bulgarian mechanical recycling company, to enhance its portfolio in advanced recycling processes. In Summer 2024, Borealis AG also purchased Rialti S.p.A., an Italian producer of mechanically recycled polypropylene compounds, strengthening its position in the European recycling market.

- In September 2024, Legrand, a French industrial group, acquired Australian Plastic Profiles (APP), significantly expanding its footprint in the Australian market. This move enhances Legrand's capabilities in electrical and digital infrastructure.

MARKET SEGMENTATION

This research report on the global plastics market has been segmented and sub-segmented based on type, end-use industry, and region.

By Type

- Polyethylene

- Polypropylene

- Polyethylene Terephthalate

- Polyvinyl Chloride

- Acrylonitrile Butadiene Styrene

- Polyamide

- Polycarbonate

- Polyurethane

- Polystyrene

- Others

By End-Use Industry

- Packaging

- Automotive & Transportation

- Infrastructure & Construction

- Consumer Goods/Lifestyle

- Healthcare & Pharmaceuticals

- Electrical & Electronics

- Textile

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the current size of the global plastics market?

The global plastics market was valued at USD 533.14 billion in 2024 and is expected to grow to USD 845.69 billion by 2033.

2. What challenges exist in adopting biodegradable plastics?

- Higher production costs compared to traditional plastics.

- Limited industrial composting facilities for effective decomposition.

- Potential contamination of regular plastic recycling streams.

3. Which region has the largest share in the global plastics market?

The Asia-Pacific region is the largest in the global plastics market, accounting for 43.1% of the market share in 2024.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]