Global Planters Market Size, Share, Trends & Growth Forecast Report – Segmented By Product Type, Mechanism, End-User, And By Region (North America, Europe, Latin America, Asia-Pacific, Middle East and Africa) - Industry Analysis From 2025 to 2033

Global Planters Market Size

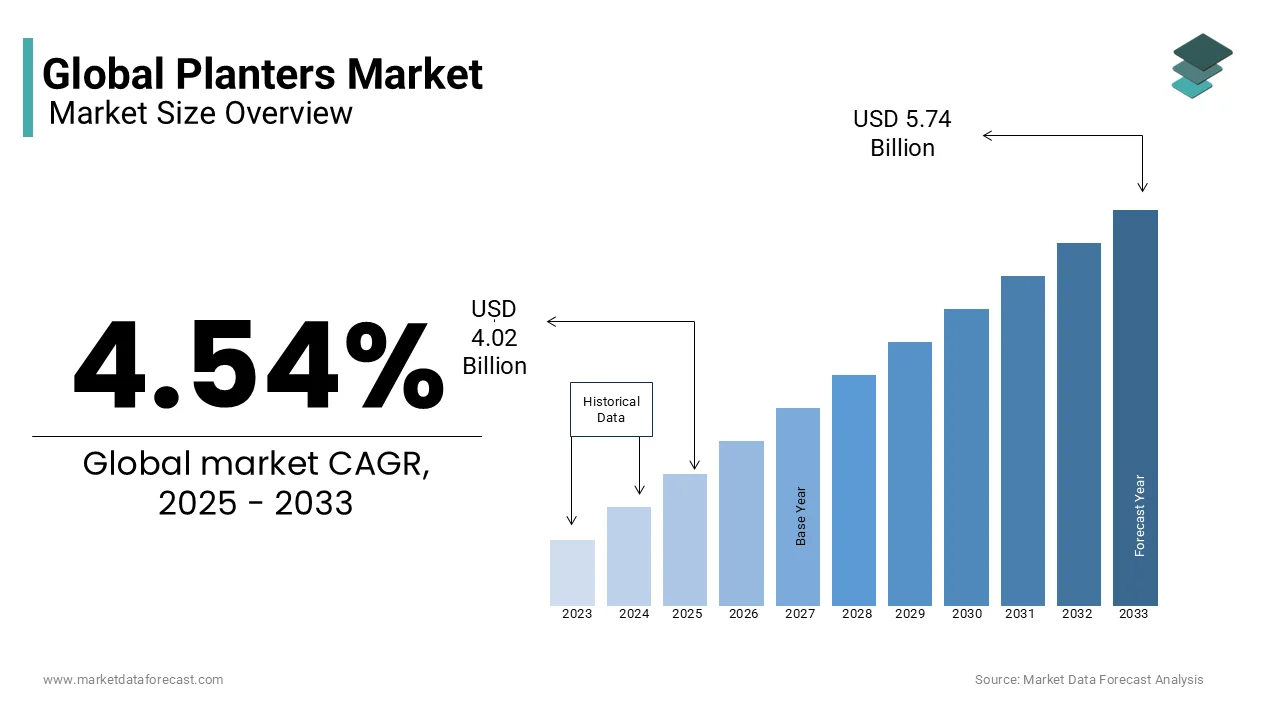

The global planters market size was valued at USD 3.85 billion in 2024 and is anticipated to reach USD 4.02 billion in 2025 from USD 5.74 billion by 2033, growing at a CAGR of 4.54% during the forecast period from 2025 to 2033.

Current Scenario of The Global Planters Market

Planters are indispensable tools for nurturing plants in diverse settings, from urban apartments to suburban gardens and commercial spaces. Available in various designs, materials, and sizes, they cater to both practical gardening needs and modern design sensibilities. Beyond their utilitarian purpose, planters have become emblematic of broader societal trends such as urbanization, wellness, and environmental consciousness. The World Health Organization (WHO) shows that urban populations account for over 55% of the global population, with projections indicating this figure will reach 68% by 2050. This urban migration has driven demand for space-efficient gardening solutions, with planters enabling city residents to cultivate greenery in compact areas like balconies, rooftops, and windowsills.

Planters also play a pivotal role in promoting mental well-being and biophilic design, which emphasizes the integration of natural elements into living spaces. Research published in the Journal of Environmental Psychology demonstrates that exposure to indoor plants reduces stress and enhances cognitive performance, reinforcing the psychological benefits of incorporating greenery into daily life. Additionally, data from the Royal Horticultural Society (RHS) indicates that gardening activities, including the use of planters for growing herbs and vegetables, have surged in popularity, particularly among younger demographics. The RHS reports that over 30% of UK households now engage in food gardening, with many adopting sustainable practices such as composting and water conservation. These trends underscore the planters market's alignment with evolving consumer values, offering innovative solutions that blend eco-consciousness with aesthetic appeal and functional utility.

Market Drivers

Rising Urbanization and Limited Outdoor Spaces

The rapid pace of urbanization has significantly driven the demand for planters, as city dwellers seek ways to incorporate greenery into their compact living spaces. The United Nations Department of Economic and Social Affairs states that 56% of the global population resides in urban areas, with projections indicating this will rise to 68% by 2050. This trend has led to a surge in indoor gardening, where planters serve as essential tools for cultivating plants on balconies, terraces, and windowsills. As per the Royal Horticultural Society (RHS), over 30% of households in urban areas engage in some form of gardening, with many relying on portable planters. These statistics underscore how urbanization fuels the need for space-efficient gardening solutions, making planters indispensable for modern lifestyles.

Growing Awareness of Mental Health Benefits

The increasing awareness of mental health benefits associated with gardening has become a major driver of the planters market. A study published in the Journal of Environmental Psychology reveals that interaction with indoor plants reduces stress levels by up to 15% and improves overall mood. This has encouraged individuals, particularly millennials and Gen Z, to adopt gardening as a therapeutic activity. Furthermore, the American Psychological Association states that gardening can reduce symptoms of anxiety and depression by promoting mindfulness and physical activity. With over 40 million adults in the United States alone experiencing mental health challenges annually, according to the National Institute of Mental Health, the demand for accessible gardening tools like planters is rising. This trend highlights the role of planters in fostering well-being through accessible green spaces.

Market Restraints

High Costs of Sustainable Materials

One significant restraint in the planters market is the high cost associated with sustainable materials such as biodegradable plastics, bamboo, and recycled composites. The World Bank reports that eco-friendly materials can increase production costs by up to 25%, making these products less affordable for price-sensitive consumers. While sustainability is a growing priority, many manufacturers face challenges in balancing affordability with environmental responsibility. Additionally, a survey conducted by McKinsey & Company found that while 60% of consumers are willing to change their consumption habits to reduce environmental impact, only 30% are willing to pay a premium for sustainable products. This discrepancy limits the adoption of eco-friendly planters, particularly in developing regions where budget constraints dominate purchasing decisions.

Environmental Concerns Over Plastic Planters

The widespread use of plastic in planters presents another restraint, as it raises environmental concerns due to non-biodegradability and pollution. The Ellen MacArthur Foundation states that approximately 79% of all plastic ever produced still exists in landfills or the natural environment, contributing to ecological damage. Although plastic planters remain popular due to their durability and affordability, stricter regulations on single-use plastics are pushing manufacturers to explore alternatives. However, transitioning to greener options poses logistical and financial hurdles. For instance, the International Energy Agency notes that producing biodegradable alternatives requires advanced technologies, which can increase manufacturing costs by up to 40%. This challenge underscores the tension between meeting consumer demands and adhering to environmental standards.

Market Opportunities

Expansion of Smart Planter Technology

A major opportunity in the planters market lies in the development of smart planter technology, which integrates IoT-enabled sensors to monitor soil moisture, nutrient levels, and light exposure. These innovations appeal to tech-savvy consumers seeking convenience and precision in gardening. Additionally, the Consumer Electronics Association stresses that over 65% of millennials are interested in smart home devices, including those related to gardening. Smart planters not only enhance user experience but also cater to urban professionals who lack time for traditional gardening. As urbanization accelerates, the demand for automated, efficient gardening solutions is expected to drive significant growth in this segment.

Growing Popularity of Vertical Gardening

Another promising opportunity is the rising popularity of vertical gardening, which relies heavily on specialized planters designed for vertical arrangements. The Food and Agriculture Organization (FAO) estimates that vertical farming could reduce water usage by up to 90% compared to traditional methods, making it an attractive option for sustainable urban agriculture. Vertical gardening systems, often incorporating modular planters, enable efficient use of limited space while enhancing aesthetic appeal. This trend aligns with increasing urbanization and the need for innovative gardening solutions.

Market Challenges

Fluctuating Raw Material Prices

One significant challenge facing the planters market is the volatility in raw material prices, particularly for metals, ceramics, and plastics. The International Monetary Fund (IMF) reports that global commodity prices have experienced fluctuations of up to 20% annually due to geopolitical tensions and supply chain disruptions. These price swings directly impact production costs, forcing manufacturers to either absorb the additional expenses or pass them on to consumers. For instance, a report by the World Trade Organization emphasizes that rising petroleum prices have increased the cost of producing plastic-based planters by nearly 12% in recent years. Such instability creates uncertainty for businesses and complicates long-term planning, ultimately affecting profitability and market competitiveness.

Intense Competition and Market Saturation

Another challenge is the intense competition and market saturation within the planters industry, driven by the low barriers to entry and the proliferation of generic products. This fragmentation leads to price wars and reduced profit margins, particularly for companies lacking strong brand differentiation. Additionally, online retail platforms have intensified competition by enabling smaller players to reach global audiences without significant marketing investments. As a result, established brands must continuously innovate and invest in marketing strategies to maintain their position, while new entrants struggle to carve out a niche in an already crowded marketplace.

SEGMENT ANALYSIS

Planters Market Analysis By Product Type

The Broadcast planters segment held the largest market share of 40.7% in 2024. This segment leads because broadcast planters are versatile, cost-effective, and widely used for large-scale farming. The FAO states that over 60% of global cropland relies on traditional planting methods, where broadcast planters play a key role. These planters are especially important in developing regions like Asia and Africa, where smallholder farmers dominate agriculture. With the global agricultural land area estimated at 4.8 billion hectares, broadcast planters remain critical for efficient seed distribution, ensuring food security for growing populations.

The Precision planters segment is the fastest-growing segment, with a CAGR of 7.5% due to the rising adoption of advanced farming technologies. The USDA states that precision agriculture can increase crop yields by up to 20% while reducing seed wastage by 15%. Farmers are increasingly investing in precision planters due to their ability to optimize planting depth, spacing, and seed placement. Additionally, the International Institute for Sustainable Development reports that precision tools reduce input costs by 10%, further boosting profitability.

Planters Market Analysis By Mechanism

The Mechanically driven planters accounted for 50.1% of the market in 2024 because these planters are affordable, easy to maintain, and suitable for small-scale farmers. The World Bank reports that over 80% of farms in developing countries rely on manual or mechanical tools due to limited access to advanced machinery. Mechanically driven planters are particularly important in regions like South Asia and Sub-Saharan Africa, where agriculture employs more than 60% of the workforce. Their simplicity and reliability make them indispensable for traditional farming systems, contributing significantly to global food production.

The Electrical driven planters segment is predicted to advance at a CAGR of 8.3%. This growth is fueled by the increasing availability of renewable energy sources and advancements in battery technology. The IEA states that the global adoption of electric-powered agricultural equipment is expected to rise by 15% annually, driven by government incentives for sustainable farming. Additionally, the U.S. Environmental Protection Agency shows that electric machinery reduces greenhouse gas emissions by up to 30% compared to traditional fuel-powered tools.

Planters Market Analysis By End Use

The Grains segment represented the largest end-use segment by holding a market share of 45.5% in 2024. This dominance is due to grains being staple crops globally, with wheat, rice, and maize covering over 70% of farmland worldwide. The FAO estimates that grain production must increase by 50% by 2050 to meet the needs of a growing population. Grains require efficient planting methods, making planters crucial for achieving high yields. This segment's importance lies in its role in ensuring global food security, as grains provide over 50% of the world’s caloric intake, particularly in developing nations.

The Commercial crops are the rapidly growing segment, with a CAGR of 9.2% in the coming years due to the rising global demand for cash crops like cotton, sugarcane, and coffee. UNCTAD states that the global trade value of commercial crops exceeded USD 1.5 trillion in 2022, reflecting their economic significance. Additionally, the World Trade Organization highlights that emerging markets in Asia and Latin America are expanding their commercial crop production by 12% annually.

REGIONAL ANALYSIS

North America

North America led the planters market with 22.2% market share in 2024 due to its advanced agricultural technologies and high mechanization levels. The United States Department of Agriculture (USDA) states that 85% of U.S. farms use mechanized equipment, including planters, to maximize efficiency. With 914 million acres of farmland, North America contributes significantly to global food production. The USDA also states that investments in precision agriculture grew by 20% in 2022, driven by government incentives and private sector funding. Canada and the U.S. dominate the region, with their focus on sustainable practices like no-till farming boosting planter adoption.

Europe

Europe excels in the planters market owing to its strong emphasis on sustainability and eco-friendly farming practices. The European Environment Agency reports that over 35% of farms in Europe have adopted green technologies, including advanced planters. With 174 million hectares of arable land, Europe plays a key role in global grain and oilseed production. Germany and France lead the region, accounting for 28% of Europe’s agricultural machinery market. The European Commission notes that subsidies for sustainable farming increased by 15% in 2022, encouraging planter adoption. Europe’s commitment to reducing carbon footprints ensures its prominence in the global planters market.

Asia Pacific

Asia Pacific dominated the planters market due to its vast agricultural base and growing population. The Food and Agriculture Organization (FAO) estimates that Asia accounts for 50% of global agricultural output, with China and India leading the way. Over 60% of smallholder farmers worldwide are based in this region, driving demand for affordable planting solutions. The Asian Development Bank states that agricultural investments in the region grew by 10% annually over the past decade. With 2.2 billion hectares of arable land, Asia Pacific’s importance lies in meeting food demands while adopting modern tools to enhance productivity and sustainability.

Latin America

Latin America is a top performer in the planters market, driven by its focus on commercial crops like soybeans, sugarcane, and coffee. The United Nations Conference on Trade and Development (UNCTAD) states that Latin America accounts for 13% of global agricultural exports, with Brazil being the largest contributor. The Inter-American Development Bank reports that agricultural GDP in the region grew by 3% in 2022, supported by technological advancements. With 570 million hectares of arable land, Latin America’s tropical climate and fertile soil make it ideal for large-scale farming.

Middle East & Africa

The Middle East & Africa is emerging as a significant player in the planters market, driven by efforts to combat food insecurity and desertification. The African Development Bank reports that agricultural investments in Sub-Saharan Africa grew by 8% annually over the past five years, with governments prioritizing mechanization. Egypt and South Africa lead the region, accounting for 22% of agricultural machinery adoption. The World Bank highlights that over 60% of Africa’s population depends on agriculture for livelihoods, creating demand for efficient planting tools.

Top 3 Players in the market

John Deere

John Deere holds a leading position in the global planters market, commanding a significant market share of approximately 25%. The company’s dominance stems from its cutting-edge innovations and extensive product portfolio, including precision planters and smart farming solutions. According to the U.S. Department of Agriculture (USDA), John Deere’s advanced planters have contributed to a 15% increase in crop yields for farmers adopting their technologies. The company invests heavily in research and development, with over $4 billion annually dedicated to improving agricultural machinery. John Deere’s commitment to sustainability, such as reducing emissions by 20% in its equipment, further strengthens its leadership. Its global presence and strong distribution network make it a key contributor to modernizing agriculture worldwide.

AGCO Corporation

AGCO Corporation is another major player, holding an estimated 20% share of the global planters market. Known for its flagship brands like Massey Ferguson and Challenger, AGCO focuses on providing versatile and efficient planting solutions tailored to diverse farming needs. The Food and Agriculture Organization (FAO) shows that AGCO’s mechanized planters have improved planting efficiency by up to 30% in developing regions. AGCO’s recent investments in digital farming tools, such as GPS-enabled planters, align with the growing demand for precision agriculture. With operations in over 140 countries, AGCO plays a pivotal role in supporting smallholder and commercial farmers globally. Its emphasis on affordability and durability ensures widespread adoption, particularly in emerging markets.

CNH Industrial

CNH Industrial ranks among the top players, with a market share of approximately 18%. The company’s brands, including Case IH and New Holland, are renowned for their high-performance planters designed for large-scale farming. The International Institute for Sustainable Development reports that CNH Industrial’s advanced planting technologies have reduced seed wastage by 12%, enhancing resource efficiency. CNH Industrial has also prioritized sustainability, committing to reduce greenhouse gas emissions from its machinery by 25% by 2030. Its strong foothold in North America and Europe, coupled with strategic partnerships in Asia Pacific, positions it as a key driver of innovation in the planters market. CNH Industrial’s focus on integrating IoT and automation into its products ensures its continued growth and influence in the industry.

Top strategies used by the key market participants

Sustainability Initiatives and Eco-Friendly Solutions

Sustainability is a core focus for leading players aiming to align with global environmental goals. John Deere has committed to reducing emissions from its machinery by 20%, while CNH Industrial aims to cut greenhouse gas emissions by 25% by 2030. The World Bank reports that eco-friendly farming practices, supported by sustainable equipment, can reduce input costs by 10%. Companies are also developing planters made from recycled materials or designed for minimal soil disturbance. These initiatives not only enhance brand reputation but also cater to the rising consumer demand for environmentally responsible products, solidifying their competitive edge.

Geographic Expansion and Market Penetration

To strengthen their global presence, key players are expanding into high-growth regions like Asia Pacific, Latin America, and Africa. For instance, AGCO Corporation has established manufacturing hubs in India and Brazil to serve local markets more effectively. The African Development Bank notes that investments in Sub-Saharan Africa’s agricultural sector grew by 8% annually over the past five years, driven by such expansions. Similarly, John Deere’s strategic focus on North America and Europe ensures dominance in developed markets while tapping into emerging economies. This dual approach enables companies to diversify revenue streams and capture untapped opportunities.

Product Diversification and Customization

Diversifying product portfolios to meet varied customer needs is another critical strategy. CNH Industrial offers specialized planters for grains, oilseeds, and commercial crops, catering to different farming requirements. The Food and Agriculture Organization (FAO) states that tailored solutions have increased planter adoption by 25% in regions with diverse cropping patterns. Additionally, companies like John Deere provide customizable features, such as adjustable row spacing and variable seed depth settings, to enhance usability. By addressing specific farmer needs, these players ensure higher customer satisfaction and long-term loyalty, further strengthening their market position.

COMPETITIVE LANDSCAPE

The planters market is a highly dynamic space with numerous companies striving to gain an edge. Industry giants like John Deere, AGCO Corporation, and CNH Industrial dominate due to their cutting-edge and dependable products. These leaders invest heavily in innovation to design planters that boost efficiency and crop yields for farmers. At the same time, smaller firms compete by offering budget-friendly options or catering to niche demands such as small-scale farms or specialty crops, adding to the competitive landscape.

To maintain their position, major players adopt clever tactics. They collaborate with tech companies to integrate features like GPS and smart sensors into their equipment, enabling precise planting. Sustainability is another focus, with many brands developing eco-conscious solutions like low-waste seed systems or energy-efficient designs.

Growth opportunities in regions like Asia and Africa are also heating up the competition. Many companies are targeting these areas because of the large number of small-scale farmers who need affordable tools. Meanwhile, advanced markets such as North America and Europe demand high-tech solutions, keeping big brands on their toes. This intense rivalry drives constant improvements, benefiting farmers worldwide and ensuring the planters market remains vibrant and innovative.

KEY MARKET PLAYERS

Amop Synergies, Bracke Group, Dawn Equipment Company, Deere & Company, East Jorden Plastics, HC Companies, Holland Transplanter, Inter IKEA Systems, Keter, Khedut Agro, Kinze Manufacturing, Mahindra and Mahindra, Monosem Inc., Poppelmann, Schlagei Manufacturing, Van Horlick Forestry. Are the market players that are dominating the global planters market.

RECENT HAPPENINGS IN THIS MARKET

- In August 2024, Planters reintroduced its fall-flavored nut varieties, including Apple Cider Donut Cashews and Pumpkin Spice Almonds. These seasonal snacks are now available in stores and online, including on Amazon.

- In September 2024, Planters launched PLANTERS Special Reserve, a premium line of Virginia peanuts, in celebration of National Peanut Day. These specially selected peanuts are larger than standard ones and are hand-cooked and roasted to perfection.

MARKET SEGMENTATION

This research report on the global planters market is segmented and sub-segmented into the following categories.

By Product Type

- Broadcast

- Drill

- Precision

- Dibble

- Specialised

By Mechanism

- Mechanically Driven

- Hydraulic

- Electrical Driven

By End Use

- Grains

- Oilseeds & Pulses

- Commercial Crops

- Tress

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]