Global Phosphatic Fertilizers Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Diammonium Phosphate (DAP), Monoammonium Phosphate (MAP), Superphosphate And Others), Application (Grains & Oil seeds, Fruits & Vegetables And Others), And Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis (2025 to 2033)

Global Phosphatic Fertilizers Market Size

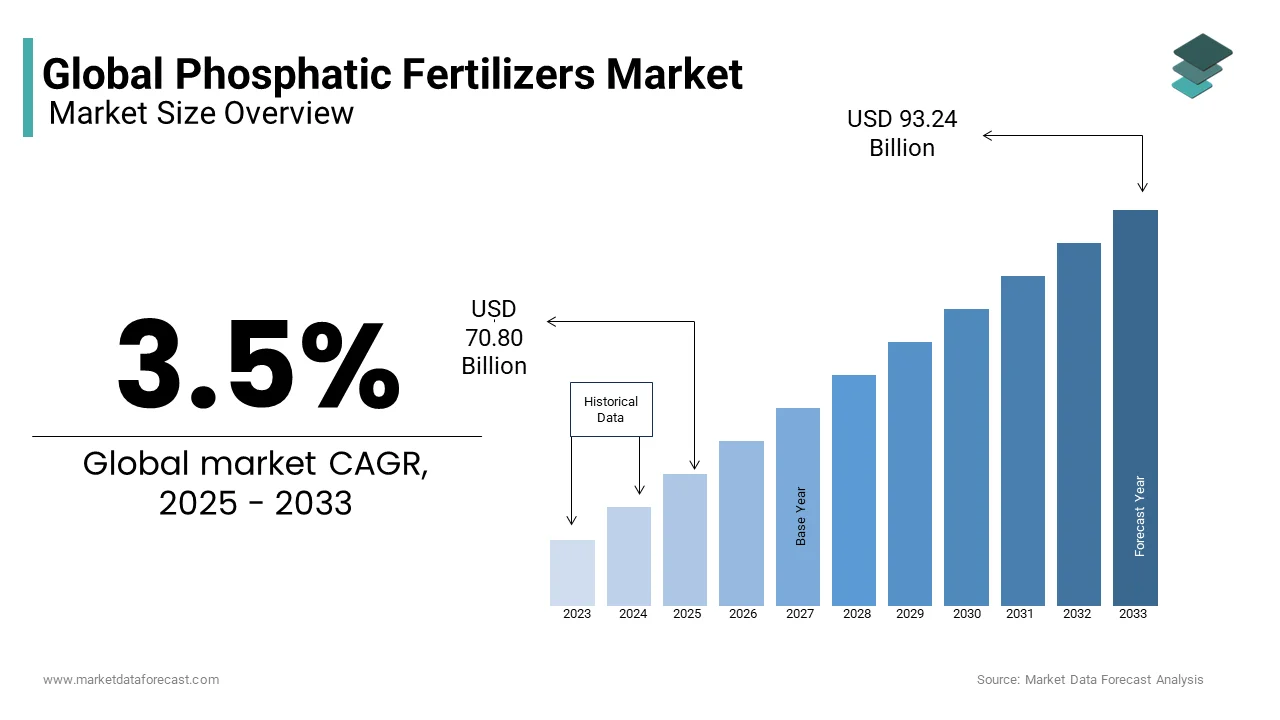

The global phosphatic fertilizers market was valued at USD 68.41 billion in 2024 and is anticipated to reach USD 70.80 billion in 2025 from USD 93.24 billion by 2033, growing at a CAGR of 3.5% from 2025 to 2033.

The phosphatic fertilizers market is essential for supporting global food security, given phosphorus's role in root development and crop yield. The phosphatic fertilizers market is expected to grow steadily. This demand is fueled by rising global food requirements, especially as population growth and shifting dietary trends place greater pressure on agricultural productivity. Key fertilizers like diammonium phosphate (DAP) and monoammonium phosphate (MAP) remain central to the market, with DAP being particularly favored due to its high phosphorus content and adaptability across various soil types.

Asia-Pacific dominates, led by agricultural giants China and India, which collectively consume over half of the world’s phosphatic fertilizers. Their growing focus on maximizing yields for staple crops underscores the demand in this region. Sustainability is also becoming crucial: as environmental concerns mount, there’s an industry shift toward controlled-release and environmentally friendly fertilizers to mitigate nutrient runoff and reduce ecological impact. Companies such as Nutrien, OCP Group, and Mosaic are actively innovating in this space, developing products that align with sustainable agricultural practices.

MARKET DRIVERS

The growing global food demand and population growth are propelling the global phosphatic fertilizers market growth. As global population surges toward an expected 9.7 billion by 2050, agricultural output must increase substantially to meet food demand. Phosphorus is essential for crop growth, making phosphatic fertilizers critical for enhancing yield. The FAO estimates that food production needs to rise by 60% from current levels to support population growth. Phosphatic fertilizers like DAP and MAP are widely used in intensive farming for cereals, oilseeds, and pulses, especially in food-dependent regions like Asia and Africa. This sustained demand drives the market, as efficient phosphorus application directly correlates to better yield and crop quality.

Soil degradation and nutrient deficiency is further boosting the global market growth. Widespread soil degradation has led to phosphorus deficiencies in many agricultural regions, reducing natural fertility and crop productivity. About 30% of global arable land is deficient in phosphorus, making phosphatic fertilizers crucial for replenishing essential nutrients. Phosphorus is particularly important for root development and energy transfer in plants, making it a go-to supplement for nutrient-poor soils. With 10 million hectares of arable land lost annually to degradation, farmers increasingly rely on fertilizers to sustain crop yields, boosting demand for phosphorus-based products.

Government initiatives and subsidies are favoring the phosphatic fertilizers market. Governments worldwide are actively supporting phosphatic fertilizers to ensure food security and agricultural stability. Countries like India offer substantial subsidies for DAP and MAP fertilizers, making them more accessible to farmers. India's government, for example, allocated nearly USD 27 billion for fertilizer subsidies in 2022-23, largely directed toward phosphatic fertilizers. Similar programs across Asia and Africa incentivize farmers to increase fertilizer use, ensuring more reliable food production. These policies play a significant role in driving the market, as affordability and accessibility allow broader adoption of phosphatic fertilizers in emerging economies.

MARKET RESTRAINTS

Environmental concerns and regulatory pressure are hindering the growth of the global market. Phosphatic fertilizers contribute to environmental issues like nutrient runoff, which can lead to water pollution and eutrophication in nearby water bodies. Excess phosphorus runoff creates "dead zones" by depleting oxygen, which severely impacts aquatic ecosystems. According to the EPA, nutrient pollution is one of America’s most widespread, costly environmental issues. As awareness grows, governments are imposing stricter regulations on fertilizer application. In Europe, the EU’s Nitrates Directive and the Water Framework Directive regulate fertilizer use to prevent pollution. These restrictions and growing environmental concerns are pushing the industry toward eco-friendly alternatives, potentially limiting traditional phosphatic fertilizer demand.

Volatility in raw material prices is impacting the market negatively. Phosphatic fertilizers rely on phosphate rock as a key raw material, and price volatility in this commodity can impact production costs and availability. Countries like Morocco and China dominate phosphate rock production, making the supply chain vulnerable to geopolitical issues and export restrictions. For instance, China's restrictions on phosphate exports in recent years have led to price spikes, impacting global supply and costs for manufacturers. With raw material prices fluctuating, phosphatic fertilizer prices can become unaffordable for farmers in emerging markets, which impacts adoption rates and overall market growth potential.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.5% |

|

Segments Covered |

By Type, Application, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

CF Industries Holdings Inc. (U.S.), OCP (Morocco), Agrium Inc. (Canada), Potash Corp. of Saskatchewan (Canada), Mosaic (U.S.), Eurochem (Russia), ICL (Israel), Yara International ASA (Norway), Coromandel International Ltd. (India), Phosagro (Russia) |

SEGMENTAL ANALYSIS

By Type Insights

The diammonium phosphate (DAP) segment accounted for 38.8% of the global market share in 2023. The high phosphorus content of DAP (18% nitrogen and 46% phosphorus) makes it particularly effective for intensive agricultural applications, especially in staple crops like cereals, which require substantial nutrient inputs. DAP’s versatility in various soil types, coupled with its affordability and nutrient-dense formulation, makes it highly favored by farmers worldwide. It is especially popular in major agricultural economies like India, where DAP accounts for the majority of phosphate fertilizer usage. The Indian government’s substantial subsidies on DAP to ensure food security further strengthen its leading position in the global market.

The monoammonium phosphate (MAP) is the fastest-growing segment and is estimated to grow at a CAGR of 5.34% during the forecast period. MAP contains a balanced nutrient profile (11% nitrogen and 52% phosphorus), making it particularly suitable for specialty crops and precision farming practices. The demand for MAP is rising as it provides efficient phosphorus uptake without altering soil pH as much as other fertilizers, making it suitable for areas where soil management is critical. MAP’s efficiency in high-value crops and its compatibility with sustainable farming methods drive its popularity, especially in developed markets such as North America and Europe, where environmentally conscious farming practices are expanding rapidly.

By Application Insights

The grains and oilseeds segment captured 53.7% of the global market share in 2023. Grains such as wheat, rice, and maize are staple foods globally, driving continuous demand for fertilizers to maximize yield. Phosphorus is critical for root development and energy transfer in these crops, and it is essential for achieving high productivity. With rising global food requirements, especially in regions like Asia and Africa, where grains are primary food sources, phosphatic fertilizers are vital. The FAO reports that demand for grains is expected to increase by 30% by 2030, further reinforcing the need for phosphorus-based fertilizers in this segment.

The fruits and vegetables segment is the fastest-growing application and is projected to grow a CAGR of 6.12% over the forecast period. This growth is driven by the rising consumer demand for fresh produce, along with an increasing focus on health and nutrition. Phosphorus is essential in fruits and vegetables for improving root structure, enhancing flowering, and boosting nutrient absorption, which directly impacts crop quality. The expansion of horticulture and organic farming, particularly in developed markets like North America and Europe, has increased reliance on phosphatic fertilizers for high-value crops. The focus on sustainable agriculture and nutrient-rich diets makes this segment a focal point for future growth.

REGIONAL ANALYSIS

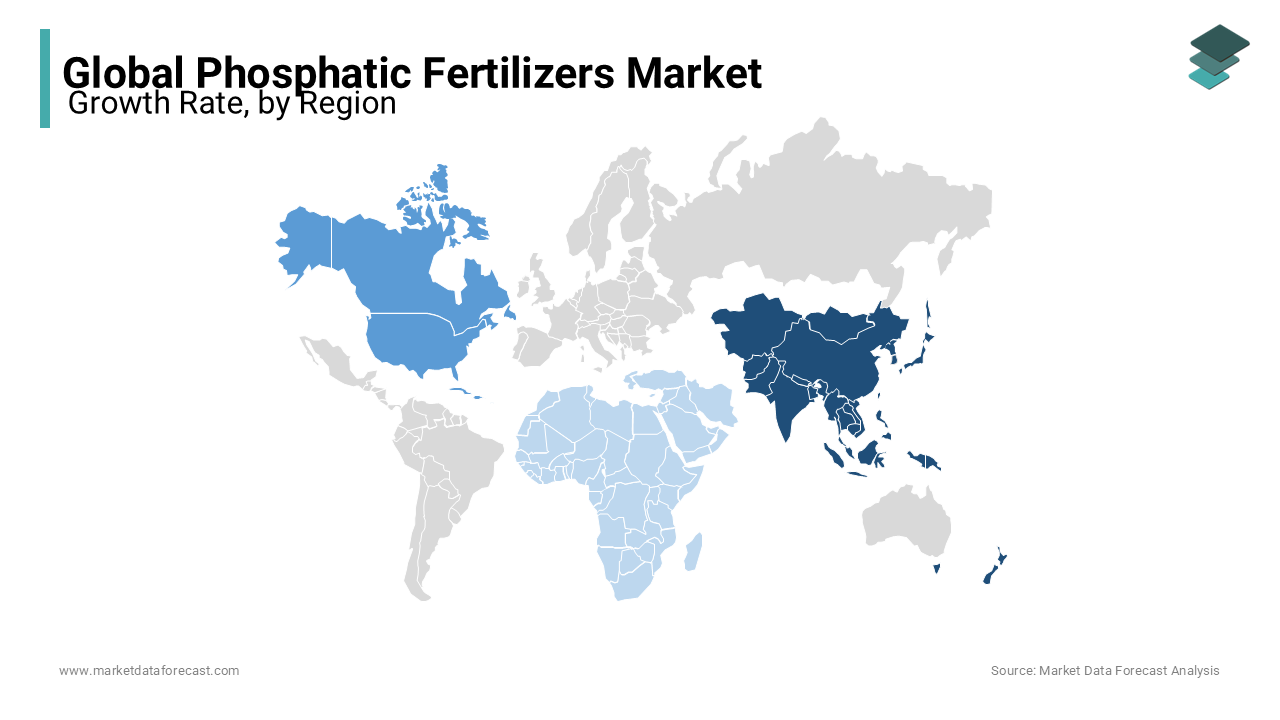

Asia-Pacific is the largest market for phosphatic fertilizers and accounted for 41.8% of the global market share in 2023. The growth of the market in the Asia-Pacific region is primarily attributed to the extensive agricultural activities and food demand in populous countries like China and India. As crop production intensifies to support food security and rising incomes, the APAC market is expected to continue to do well. China and India are the largest consumers, with substantial government subsidies encouraging fertilizer use to maximize yields. As urbanization and income levels increase, Asia-Pacific is set to maintain its leading position, supporting its strong role in the global phosphatic fertilizers market.

North America accounted for 20.5% of the global phosphatic fertilizers market share in 2023. As a mature market, it focuses on high-value crops and sustainable practices. Growth is moderate but stable, supported by the adoption of precision agriculture and controlled-release fertilizers to improve environmental impact. The United States leads the region, prioritizing efficient phosphorus use in major crops like corn and soybeans. With an emphasis on reducing nutrient runoff, North America continues to support environmentally conscious fertilizer practices, sustaining its position in the market.

Europe is expected to witness a healthy CAGR over the forecast period. Europe emphasizes sustainable agriculture and eco-friendly fertilizers, driven by policies like the EU Nitrates Directive. France and Germany lead consumption, particularly for fruits, vegetables, and grains. While growth is limited by regulatory restrictions, Europe’s commitment to high-quality, sustainable crop production keeps the demand for phosphatic fertilizers stable, especially in high-value crops and organic farming.

Latin America is anticipated to account for a considerable share of the global market over the forecast period owing to the expanding agriculture and exports of crops like soybeans and sugarcane. Brazil, the largest consumer in the region, relies on phosphatic fertilizers to enhance productivity for export-oriented crops, followed by Argentina with a focus on grains. Government support for modern farming methods and rising agricultural exports propel growth in Latin America, making it an emerging player with strong future potential in the phosphatic fertilizers market.

The market in the Middle East and Africa is expected to grow at a notable CAGR over the forecast period. The food security needs and agricultural expansion are majorly boosting the regional market expansion. Rising investments in agriculture, particularly in Sub-Saharan Africa, along with improved irrigation practices, are supporting market growth. Key markets like South Africa and Egypt are increasing demand for phosphatic fertilizers to boost yields in horticulture, grains, and vegetables. With its rapidly growing market, the Middle East and Africa are positioned to become increasingly significant in the global phosphatic fertilizers landscape.

KEY MARKET PLAYERS

Companies playing a leading role in the global phosphatic fertilizer market are CF Industries Holdings Inc. (U.S.), OCP (Morocco), Agrium Inc. (Canada), Potash Corp. of Saskatchewan (Canada), Mosaic (U.S.), Eurochem (Russia), ICL (Israel), Yara International ASA (Norway), Coromandel International Ltd. (India), Phosagro (Russia).

MARKET SEGMENTATION

This research report on the global phosphatic fertilizer market has been segmented and sub-segmented based on type, application, and region.

By Type

- Diammonium Phosphate (DAP)

- Monoammonium Phosphate (MAP)

- Superphosphate

- Others

By Application

- Grains & Oilseeds

- Fruits & Vegetables

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle-East and Africa

Frequently Asked Questions

1. What are the benefits of using phosphatic fertilizers?

Phosphatic fertilizers provide essential phosphorus to plants, which is crucial for healthy root growth, energy transfer, and flower and fruit development. They can help increase crop yields and improve overall plant health.

2. What are the key trends in the phosphatic fertilizers market?

Some key trends in the phosphatic fertilizers market include increasing demand for high-analysis phosphatic fertilizers, growing adoption of precision agriculture techniques, and developing innovative phosphatic fertilizer products.

3. What are some challenges facing the phosphatic fertilizers market?

Some challenges facing the phosphatic fertilizers market include environmental concerns related to phosphorus runoff and water pollution, volatility in raw material prices, and regulatory restrictions on fertilizer use.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]