Global PET Scanners Market Size, Share, Trends & Growth Forecast Report By Product Type (Partial Ring PET Scanners & Full Ring PET Scanners), Application, Detector Type, End Users, and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global PET Scanners Market Size

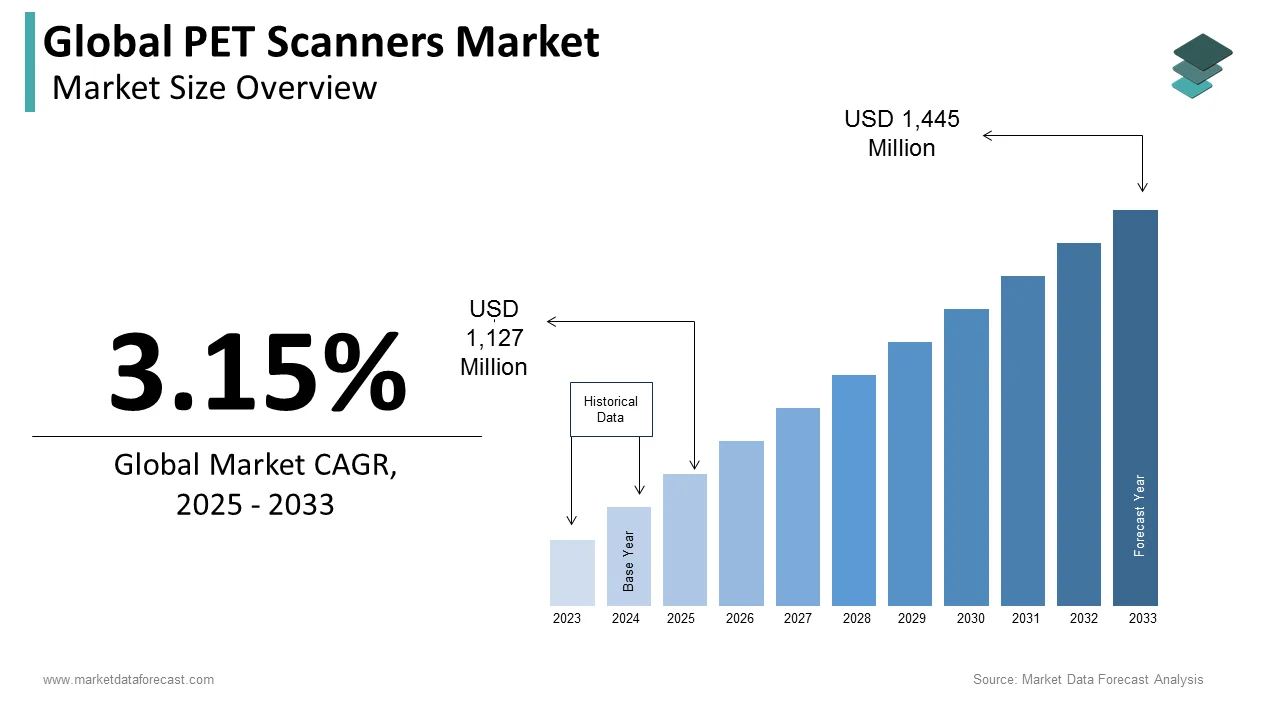

The size of the global PET scanners market was worth USD 1,093 million in 2024. The global market is anticipated to grow at a CAGR of 3.15% from 2025 to 2033 and be worth USD 1,445 million by 2033 from USD 1,127 million in 2025.

Positron Emission Tomography (PET) is a clinical imaging technique that uses radioactive substances for imaging the functions of tissues and organs. The radioactive substances present biological activity in the human body and are called tracers. By detecting the radiation emitted by the radioactive substances injected into the body, Positron Emission Tomography (PET) provides an image of the body. The substances cast into the body are radioactive atoms like nitrogen-13, carbon-11, fluorine-18, or oxygen-15. Positron Emission Tomography was basically used to diagnose several diseases like cancer and Alzheimer’s disease. PET/CT imaging helps the physician evaluate the disease's extent, know whether the treatment is working, and identify any reoccurring tumors. PET was applicable in both medical and research fields. Moreover, PET is popularly used in oncology diagnosis, mapping the functions of the human brain and heart, and supporting drug development.

MARKET DRIVERS

Growing Prevalence of Chronic Diseases

For instance, According to the World Health Organisation (WHO), around 9.6 million people died due to cancer in 2018, which is the second-leading cause of death globally. The growing Pet acceptance all over the world is boosting the growth of the market. The increasing aging population has led to a rise in heart diseases globally, propelling the global PET Scanners Market. Moreover, the growing awareness regarding the advantages of positron emission tomography scanning is fueling the market during the forecast period. The rise in the prevalence of chronic illnesses throughout the world, growth in demand for effective diagnostic systems, and increased coverage for PET-CT scanning under Medicare drive the market. PET procedures involve applications for cancer diagnosis and monitoring, but the impending commercial release of several novel radiotracers that aid in diagnosing prevalent neurodegenerative conditions, such as Alzheimer’s disease, has encouraged further PET adoption in neurology.

PET is increasingly utilized in cardiology for myocardial perfusion imaging, and thus rosining cases of cardiovascular diseases will contribute to the growth of the market. The development of healthcare facilities in countries like India and China will drive market growth majorly regionally. The availability of Medicare coverage for PET scanning is a significant opportunity for the PET Scanners Market. The increase in government and private funds to provide the best treatment for patients is estimated to fuel the market in the coming years. Moreover, the development of healthcare facilities in emerging nations like India and China will drive market growth.

MARKET RESTRAINTS

High Costs

The short half-life of radioisotopes is restricting the growth of the PET Scanners Market. Moreover, stringent regulatory rules for the usage of PET scanners are hammering the market. Further, the low supply of radiopharmaceuticals is another that is impeding market growth. The countries with less technology available for PTE scanning are a significant challenge for the market. PET scanning is a costly procedure; making it affordable for all patients is also a challenge for the market to overcome. Purchase and investment value have become top priorities for buyers who recognize the ongoing uncertainties in the economy and healthcare and have become acutely conscious of system characteristics related to configuration scalability, clinical versatility, and potential profitability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Application, Product Type, Detector Type, End Users, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Market Leader Profiled |

Siemens AG, Hitachi, Ltd., General Electric Co., Toshiba Corporation |

SEGMENTAL ANALYSIS

By Product Type Insights

The full-ring PET scanners accounted for the most extensive share based on product type, and the oncology application is considered the most lucrative segment. The full-ring PET scanner dominates the product type segment; the full-ring PET scanner is expected to grow at 5.1% annually. A full-ring PET scanner has no gaps and is impractical when the patient is scanned while lying on the proton therapy bed. The improved timing resolution (such as 300ps) reduces error even in a full-ring scanner.

The partial ring PET scanner is second in the market share and is expected to grow at the same rate during the forecast period. The partial ring, unlike the full ring, can again be used, and thus, there is a low requirement in quantity.

By Application Insights

Based on the application, the oncology segment accounted for the largest market share in 2024 and is expected to grow at a healthy rate during the forecast period. PET scanning is an effective nuclear imaging technique used to confirm the presence of various cancers. With the rising incidence of cancer globally, the demand for advanced imaging techniques is growing, resulting in the market's growth. Oncology accounts for more than 80% of the PET and PET/CT procedures performed.

The neurology segment had a 5% market share among other sub-segments. The increased cases of neurological disorders have contributed to the growth of the market.

The cardiology segment is another prominent segment and is predicted to grow at a reasonable rate during the forecast period. The primary reason for the rise in cardiovascular disease cases is the prevalence of unhealthy lifestyles and an increase in the geriatric population.

By End Users Insights

Based on end-users, the diagnostic centers had the largest market share among others in 2019 and are expected to grow at the fastest rate. The increased adaption of PET technology has improved its market share. The centers specialize in PET scanning, and thus, people are more aware of them.

Hospitals have the second-largest market share. PET scanners are expensive and can be afforded by Hospitals. These scanners are used to identify problems in body functions and are very useful for hospitals.

Research Institutes use PET scanners for research purposes; therefore, they have less market share. The increase in research will further boost the market.

REGIONAL ANALYSIS

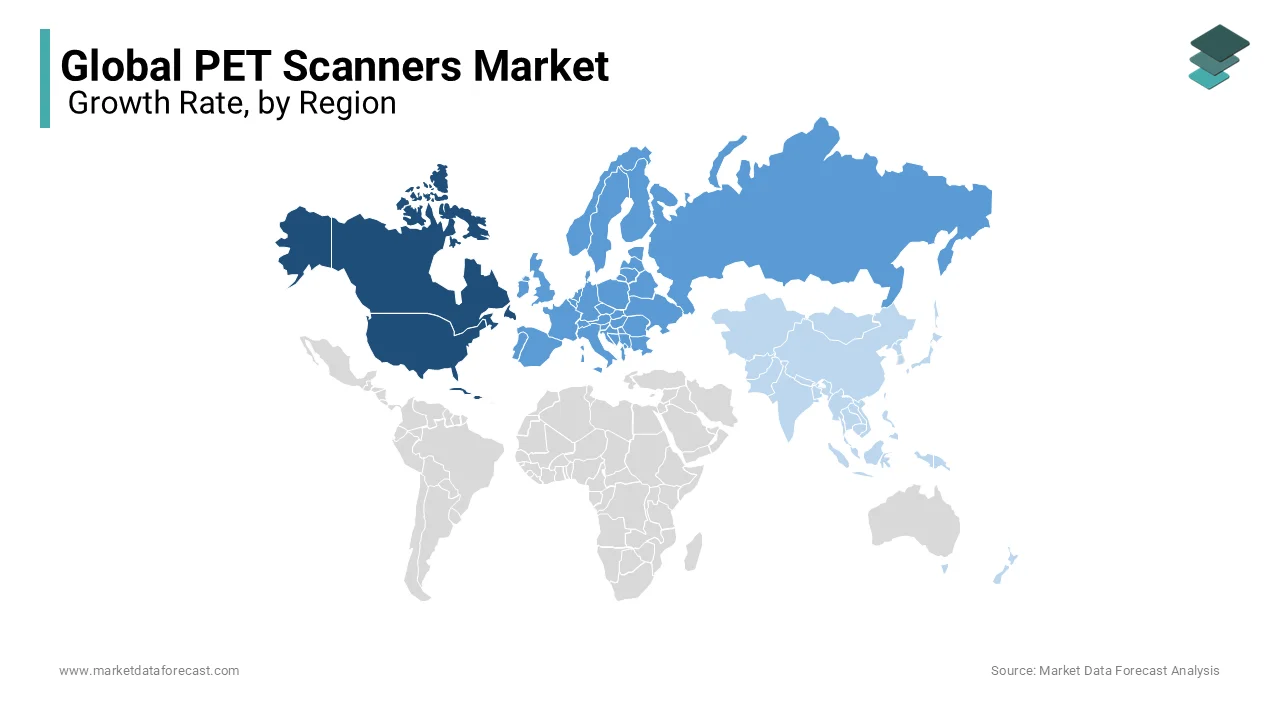

Regionally, North America is the leading market for PET scanners globally, followed by Europe and the Asia Pacific regions. North America held the dominant market share for Positron-Emission Tomography (PET) in 2019 and is expected to maintain growth over the forecast period. Increasing the prevalence of cancer in the United States and the rising number of PET scans are the major factors that will contribute to the development. Manufacturers' introduction of new imaging devices is also contributing to growth.

Europe has the second-largest market share and is expected to grow at a healthy rate. The rise in the geriatric population and the increase in cancer cases will drive market growth. The increase in the quality of healthcare facilities has also helped in market development.

Asia has the third-largest market share and is expected to grow at the fastest rate among other regions. The increase in population and shift towards good quality healthcare facilities in India will drive market growth. Asia Pacific region is expected to have the fastest growth rate during the forecast period, owing to the huge patient base present in the area and booming economies such as China and India.

KEY MARKET PARTICIPANTS

Some of the notable companies leading the Global PET Scanners Market profiled in this report are Positron Corporation, Mediso Ltd., Siemens AG, Hitachi, Ltd., General Electric Co., Toshiba Corporation, Koninklijke Philips N.V., and Yangzhou Kindsway Biotech Co. Ltd., among others.

RECENT MARKET HAPPENINGS

-

QIAGEN N.V., a German provider of sample and assay technologies for molecular diagnostics, applied testing, and academic and pharmaceutical research, has announced the global launch of the QIAcube Connect MDx, which is a flexible platform for automated sample processing. They also mentioned that these devices will now be available for molecular diagnostic laboratories in the U.S., Canada, the European Union, and other worldwide markets.

-

Siemens AG, the multinational conglomerate company, has acquired the clearance for the Siemens Healthineers' Biograph Vision Quadra, a new PET/CT scanner with a large 106-cm axial field of view which is designed for clinical use as well as translational research – or the application of scientific research to create therapies and procedures that improve health outcomes, from US Food and Drug Administration.

MARKET SEGMENTATION

This research report on the global PET scanners market has been segmented and sub-segmented in terms of application, product type, detector type, end-users, and region.

By Application

- Oncology

- Neurology

- Cardiology

- Other Applications

By Product Type

- Partial Ring PET Scanners

- Full Ring PET Scanners

By Detector Type

- Gadolinium Oxyorthosilicate

- Lutetium Fine Silicate

- Bismuth Germanium Oxide

- Lutetium Oxyorthosilicate

- Lutetium Yttrium Orthosilicate

By End Users

- Diagnostic Centres

- Hospitals

- PET Centres

- Research Institutes

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the size of the PET scanners market?

The global PET scanners market size was valued at USD 1060 million in 2023.

What are the key players operating in the PET scanners market?

Siemens Healthineers AG, General Electric Company, Canon Inc., Koninklijke Philips N.V., Hitachi, Ltd., United Imaging Healthcare Co., Ltd., Mediso Medical Imaging Systems Ltd., RayVision Medical Corporation, Cubresa Inc., and Oncovision are some of the notable players in the PET scanners market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]