Global PET Preforms Market Size, Share, Trends & Growth Forecast Report - Segmentation By Type (Type 1, Type 2, Type 3, Type 4, Type 5), By Application (Carbonated Soft Drinks, Water, Food, Non-Carbonated Drinks, Cosmetics & Chemicals, Pharma & Liquor) & By Region (North America, Latin America, Europe, Asia Pacific, Middle East & Africa) - Industry Analysis (2024 to 2032)

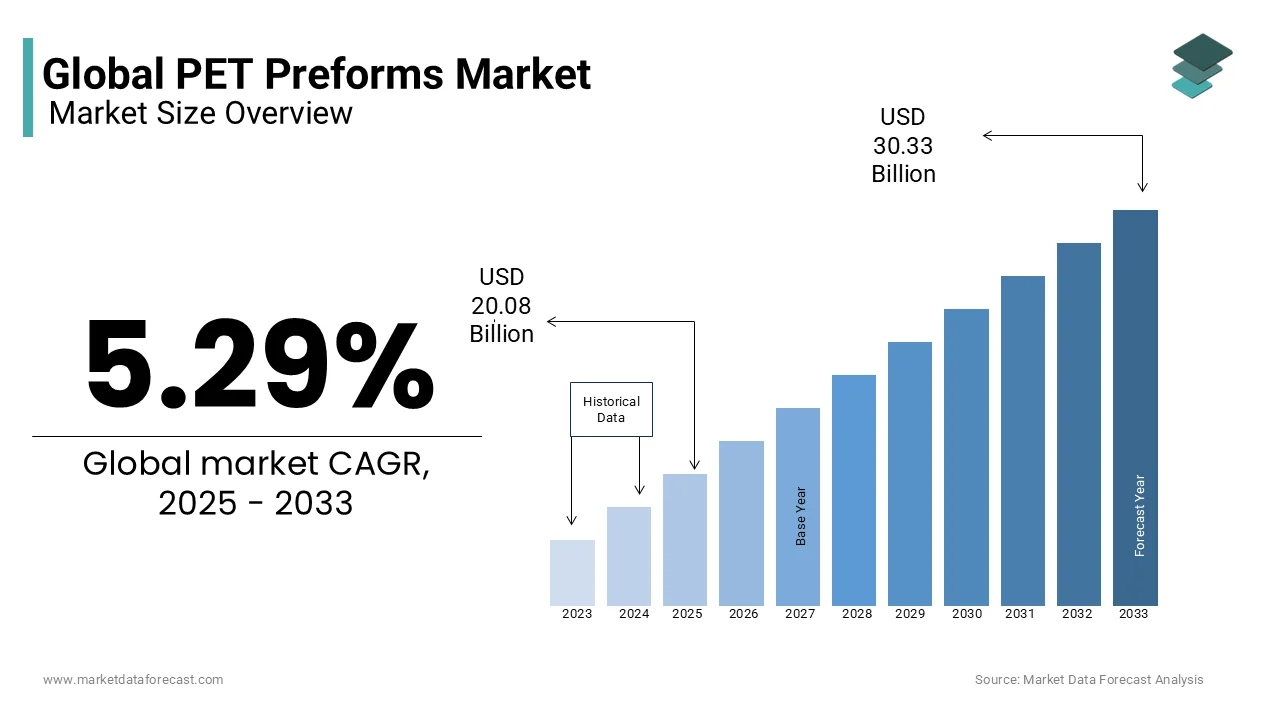

Global PET Preforms Market Size (2024 to 2032)

The global PET preforms market is expected to grow at a CAGR of 5.29% from 2024 to 2032 and was valued at USD 18.11 billion in 2023. The global market size is further expected to reach USD 28.80 billion by 2032 from USD 19.07 billion in 2024.

PET preforms are unfinished PET bottles with various neck sizes. They are made with PET resins, which are linear, white, but bluish thermoplastic resins based on terephthalic acid and ethylene glycol through a polycondensation process. The latter is a widely available thermoplastic polyester. The worldwide market for PET preforms is growing steadily and is predicted to maintain momentum over the next two years. One of the reasons behind this is the various perceived advantages of PET. It is rigid, strong, dimensionally stable, and resistant to water and chemicals. Therefore, it is highly replacing glass and metal bottles.

The PET preforms are tube-shaped intermediate products made using polyethylene terephthalate (PET) plastic, which is widely used to prepare plastic bottles and containers. The global PET preforms market has accounted for notable growth from the past years and is anticipated to have significant growth with a prominent growth rate during the forecast period. The PET preforms are developed by injecting molten PET plastic into the mold, then cooling and storing it, making it ready for manufacturing. The extensive use of PETs in the production of containers for a variety of products, which includes water, soft drinks, alcohol, oils, detergents, and personal care products, is contributing to the market revenue. The PET preforms can be single-layered or multilayer, and in a few cases, they involve barrier layers, which improves beverage shelf-life.

MARKET DRIVERS

YoY rise in demand for weight reduction in packaging and continuous innovation with PET preforms propels the market growth.

PET products have various properties, such as being lightweight, long service life, and easy to handle. Due to these advantages, PET products are widely employed in packaged food and beverage industries. They are widely employed in the health and cosmetic industries due to innovations in the packaging industry. In the short term, the world market for PET performs is predicted to grow due to the many advantages of PET products. The most important of them is their long service life and lightweight. They are also easy to handle. This made them extremely popular in the food and beverage industry. The products are also finding mass adoption in the cosmetic and healthcare industries, which are constantly in search of innovative packaging.

The rising consumption of carbonated beverages also boosts the PET preforms market growth.

Another factor that is believed to fuel the market is the continued drive for product development. Manufacturers and independent research organizations propose better techniques to produce more advanced products. Thanks to these initiatives, PET bottles find use in many fields. Despite these challenges, the worldwide market for PET forms is predicted to increase due to the massive call for PET bottles from different end-use industries. This is due to increased urbanization, disposable income, and consumerism.

MARKET RESTRAINTS

Strict government regulations on the use of plastic products and the unavailability of recycling facilities are major limitations in the PET preform market. The strict rules restricting the use of plastic represent a challenge for the worldwide market for PET preforms. This is because plastic is considered non-biodegradable. Not only government agencies but also NGOs and other organizations are raising awareness about the need to recycle plastic or limit its use, these initiatives may hinder the market growth rate. Various drawbacks of utilizing polyethylene terephthalate (PET) preforms are cases of oxidization, lower heat resistance compared to polymers, and rising concerns regarding the oxygen permeability into the packaging, which are estimated to impede the market revenue growth due to limited adoption rate. The increased recycled rate may hinder the production of virgin polymers, limiting the market expansion.

- For Instance, according to the European Union's directive, new PET bottles that are produced from 2025 should contain at least 25% recycled materials.

MARKET OPPORTUNITIES

The increased adoption of PET preforms across the medical and pharmaceutical industries significantly escalates the market growth opportunities. The material of the PET preforms consists of ethylene glycol, which is extensively used for packaging medicine products, which range from tablets to syrups, which is fueling the market revenue owing to the expansion of the medical industry. Another factor creating growth opportunities for the PET preforms market is the enlarging demand for PET packaging in the cosmetics and personal care industry. As these reforms have longer shelf-life and can be available in a variety of packaging, which can be widely used for creams, lotions, powders, and others, is contributing to the global market revenue expansion.

- According to data from the India Brand Equity Foundation (IBEF), India is estimated to constitute 5% of the total cosmetics market and reach the top five global market revenue.

MARKET CHALLENGES

The major challenging factor limiting the expansion of the PET preforms market is the changing consumer preferences towards biodegradable plastics. People have increasing environmental concerns as ethylene glycol harms the environment. Most of the market players in the food industry are considering this factor and are implementing various initiatives to avoid PET products and switch to biodegradable plastic, which may lead to restricted market growth.

- For Instance, In 2021, Coca-ColaCoca-Cola introduced its first bottle made from entirely plant-based plastic, and it also mentioned its aim to ensure 100% sustainability in bottle production by 2023.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

5.29% |

|

Segments Covered |

By Neck Size, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa. |

|

Market Leaders Profiled |

Retal Industries Ltd. (Cyprus), Plastipak Holdings, Inc. (US), RESILUX NV (Belgium), ALPLA Werke Alwin Lehner GmbH & Co KG (Austria), Zhuhai Zhongfu Enterprise Co. Limited (China), Societe Generale des Techniques (France), Indorama Ventures Public Company Limited (Thailand), KOKSAN Pet Packaging Industry Co. (Turkey), Taiwan Hon Chuan Enterprise Co., Ltd (Taiwan), and Rawasy Al Khaleej Plastic Ind. (UAE), and Others. |

SEGMENTAL ANALYSIS

Global PET Preforms Market By Neck Size

Based on neck size, the 28mm segment led the PET performs market in 2023.

During the forecast period, the 28mm segment is expected to register the highest CAGR of more than 5%. This can be attributed to the rising consumption of bottled beverages, technological advancements, the growing urban population, favorable regulatory initiatives encouraging recyclable materials, and reducing environmental impact. Likewise, in May 2024, a new 0.75-liter recyclable wine bottle made of PET was introduced by Alpla which is a plastic packing expert. It lowers carbon emissions by up to 50 percent and helps in saving costs of up to 30 percent. It can be produced completely of recycled PET and has already been used in Austria by the pilot consumer and Wegenstein, its development partner.

Global PET Preforms Market By Application

Based on application, the carbonated beverage segment is predicted to register a promising CAGR during the forecast period.

This can be attributed to the increase in the consumption of carbonated soft drinks due to the growing young population and the rise in the disposable income of consumers. As per industry experts, the consumption of soft beverages is propelled by demographics and consumer tastes. The revenue is predicted to cross over 600 billion dollars in this period. Moreover, the United States soft drink-producing industry consists of around 550 companies with yearly sales of over 40 billion dollars. This makes the US market extremely concentrated. On the other hand, the share of carbonated drinks has sharply risen in the emerging countries in Asia Pacific; therefore,

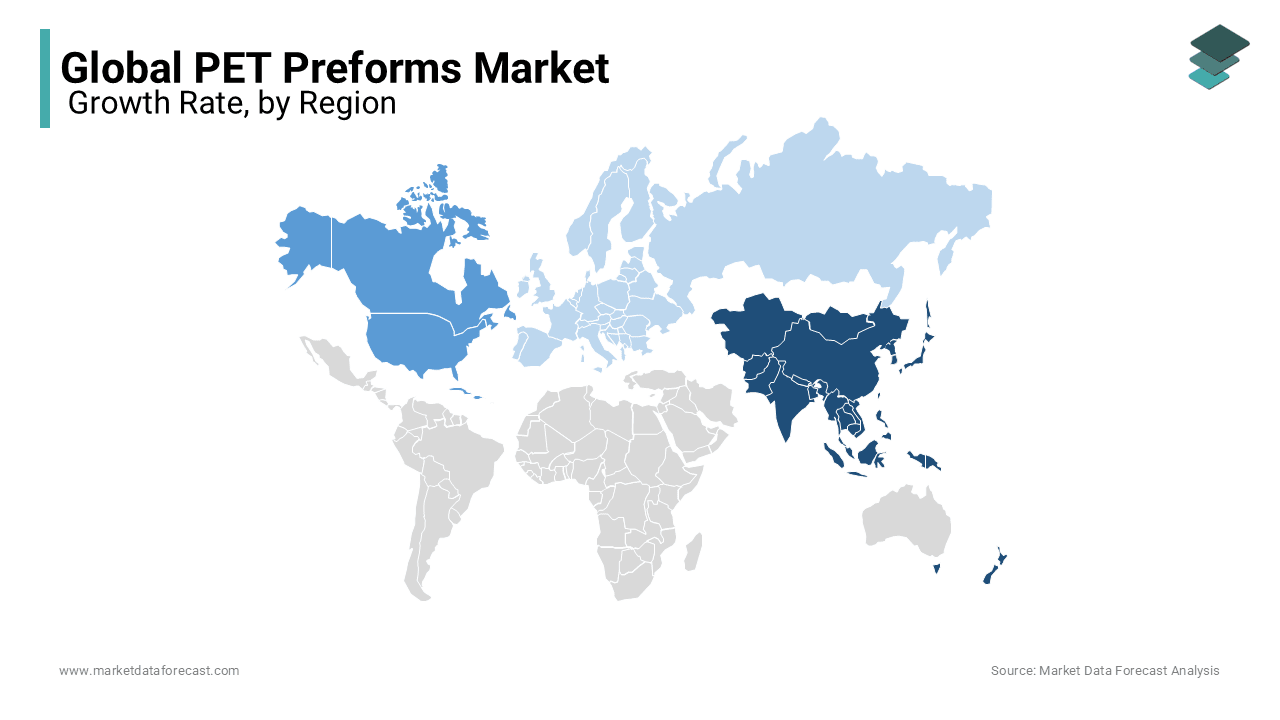

REGIONAL ANALYSIS

Asia-Pacific is considered the most lucrative region worldwide for PET preforms.

This is due to the growing call from the developing economies of Japan, China, and India. The organic expansion of end-use industries, such as purified water, soft drinks, pharmaceutical alcoholic beverages, and food and beverage, has greatly influenced the plastics industries in the region. This has led to the expansion of the PET preform market. Europe and North America could be other leading markets in the race for first place in the worldwide PET preform market. The Asia-Pacific region is considered to be the fastest-growing region in the PET preforms market.

The consumption of PET preforms is high in the region's developing economies. The growing call for purified water, food, carbonated beverages, pharmaceutical alcohols, and beverages due to population expansion in countries such as China and India had increased the call for plastic products, resulting in the market for preforms of PET.

- According to the Council for Scientific and Industrial Research (CSIR), around 900 kilograms of PET are produced in India, 90% of which is employed in the manufacture of PET products. 65% is recycled in recycling facilities, 15% is employed in the unorganized sector and the remaining 10% is reemployed for domestic purposes. India has the highest recycling rate of PET products, which is driving the expansion of the PET preforms market during the foreseen period.

The North American region is projected to grow notably during the forecast period by registering the highest CAGR.

The presence of an enlarged food and beverages industry and significant regional market players is the primary factor contributing to the regional market growth. The North American region accounted for the most significant share of the packaging industry, where plastic packaging production comprised a volume of 22.4 million in 2022.

- According to data from a report published in 2023 by the Beverage Marketing Corporation and the International Bottled Water Association, bottled water in the United States held the most significant share, accounting for 25% of overall beverage consumption.

Europe is predicted to record considerable growth during the forecast period.

The expanding demand for packaging products in various industries, such as pharmaceuticals, food and beverages, cosmetics and cosmetics, and personal care, is driving the regional market growth. Germany and the United Kingdom held the most significant European market share.

- For Instance, In 2023, Germany and Finland accounted for the highest collection of PET bottles across the European region. These countries implemented deposit-return schemes.

KEY PLAYERS IN THE GLOBAL PET PREFORMS MARKET

Companies playing a prominent role in the global PET preforms market include

- Retal Industries Ltd. (Cyprus)

- Plastipak Holdings, Inc. (US)

- RESILUX NV (Belgium)

- ALPLA Werke Alwin Lehner GmbH & Co KG (Austria)

- Zhuhai Zhongfu Enterprise Co. Limited (China)

- Societe Generale des Techniques (France)

- Indorama Ventures Public Company Limited (Thailand)

- KOKSAN Pet Packaging Industry Co. (Turkey)

- Taiwan Hon Chuan Enterprise Co., Ltd (Taiwan)

- Rawasy Al Khaleej Plastic Ind. (UAE)

RECENT HAPPENINGS IN THE MARKET

- In May 2024, Krones Group finished its entire system for the manufacturing, filling, and packing of PET containers by combining the plastics cycle and the line concept. This positions Krones as the only vendor with the capability of having the complete PET beverage industry's value chain in its portfolio.

- In August 2023, Husky Technologies and Origin Materials Inc. reported they had integrated the sustainable chemical furan dicarboxylic acid (FDCA) for advanced packing and other uses. Also, Origin effectively polymerized the bio-based sustainable chemical FDCA into polyethylene terephthalate (PET), a regular recyclable plastic. Husky also shaped the final PET/F hybrid polymer into preforms to convert it into bottles.

DETAILED SEGMENTATION OF THE PET PREFORMS MARKET INCLUDED IN THIS REPORT

This research report on the global PET preforms market has been segmented and sub-segmented based on neck size, application, and region.

By Neck Size

- 25mm

- 28mm

- 29mm

- 30mm

By Application

- Carbonated drinks

- Bottled water

- Other drinks

- Edible oil

- Food items

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]