Global Pesticide Inert Ingredients Market Size, Share, Trends & Growth Forecast Report By Type (Emulsifiers, Solvents and Carriers), Source (Synthetic and Bio-Based), Form (Dry and Liquid), Pesticide Type (Herbicides, Insecticides, Fungicides and Rodenticides) and Region (North America, Europe, Latin America, Asia Pacific, Middle East and Africa), Industry Analysis From 2025 To 2033

Global Pesticide Inert Ingredients Market Size

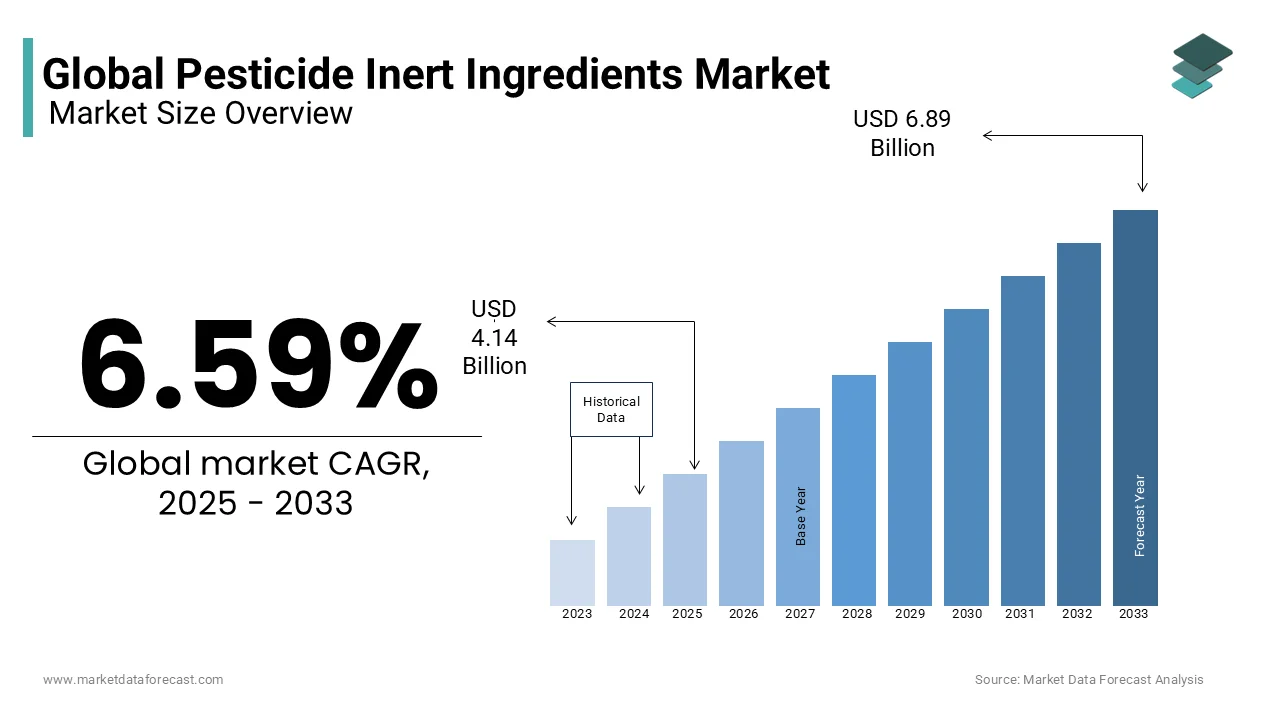

The global pesticide inert ingredients market was valued at USD 3.88 billion in 2024 and is anticipated to reach USD 4.14 billion in 2025 from USD 6.89 billion by 2033, growing at a CAGR of 6.59% during the forecast period from 2025 to 2033.

The pesticide inert ingredients are responsible for targeting pests, inert ingredients such as emulsifiers, solvents, and carriers to ensure that these formulations are applied uniformly, remain stable during storage, and minimize environmental impact. According to the United Nations Food and Agriculture Organization, global agricultural output must increase by 70% by 2050 to meet the demands of a growing population by amplifying the need for advanced crop protection solutions. Inert ingredients are indispensable in this context, as they enable the development of high-performance pesticides that address challenges such as pest resistance, environmental degradation, and regulatory compliance.

Key factors propelling growth include the rising demand for sustainable agricultural practices and the stringent regulatory frameworks governing pesticide safety. However, the market faces significant hurdles, such as the high costs associated with product development and growing environmental concerns surrounding synthetic inert ingredients. At the same time, emerging opportunities in bio-based formulations and untapped markets in developing regions offer promising avenues for expansion. Understanding these dynamics is essential for stakeholders seeking to navigate the evolving landscape of the pesticide inert ingredients market.

MARKET DRIVERS

Growing Demand for High-Performance Crop Protection Solutions

The escalating need for high-performance crop protection solutions is a pivotal force propelling the pesticide inert ingredients market. As per the Food and Agriculture Organization, global agricultural production must increase by 70% by 2050 to meet the demands of a growing population. This surge in demand has necessitated the use of advanced pesticide formulations, where inert ingredients play a critical role in enhancing efficacy. For instance, emulsifiers and solvents improve the stability and dispersibility of active ingredients by ensuring uniform application. The United Nations projects that nearly 40% of global crop losses occur due to pests, underscoring the importance of optimized pesticide formulations. Furthermore, according to the International Fertilizer Association, the global fertilizer and pesticide market was valued at over $180 billion in 2022, with inert ingredients contributing significantly to this figure. The ability of inert ingredients to mitigate environmental degradation while maintaining potency has made them indispensable in modern agriculture.

Stringent Regulatory Frameworks Driving Innovation

Stringent regulatory frameworks governing pesticide safety have catalyzed innovation in inert ingredient development. The European Chemicals Agency mandates rigorous testing of all pesticide components, including inert substances, to ensure minimal ecological impact. This has spurred manufacturers to invest in research and development by leading to the creation of eco-friendly inert ingredients. According to the Environmental Protection Agency, approximately 30% of registered pesticides in the U.S. underwent reformulation between 2018 and 2022 to comply with updated regulations. According to a report by the World Health Organization, regulatory compliance has increased market transparency, fostering consumer trust. The global pesticide inert ingredients market is projected to grow at a compound annual growth rate (CAGR) of 6.5% from 2023 to 2030, as per Grand View Research.

MARKET RESTRAINTS

High Costs Associated with Development and Registration

The prohibitive costs linked to the development and registration of pesticide inert ingredients pose a significant barrier to market growth. According to the U.S. Department of Agriculture, the average cost of bringing a new pesticide formulation to market exceeds $286 million, with inert ingredients accounting for a substantial portion of this expenditure. The complexity of ensuring compliance with diverse international standards further exacerbates these costs. For instance, the European Union’s REACH regulation requires extensive toxicity and environmental impact assessments, which can take up to five years and cost millions of dollars. A study by the Pesticide Action Network reveals that small and medium-sized enterprises often struggle to meet these financial demands, limiting their participation in the market. Consequently, the high entry barriers stifle innovation and constrain market expansion, particularly in developing regions where funding is scarce.

Environmental Concerns Surrounding Synthetic Inert Ingredients

Environmental concerns surrounding synthetic inert ingredients are increasingly impeding market progress. The National Oceanic and Atmospheric Administration reports that synthetic carriers and solvents contribute to soil and water contamination, affecting biodiversity. For example, nonylphenol ethoxylates, commonly used as emulsifiers, have been identified as endocrine disruptors by prompting bans in several countries. The Stockholm Convention on Persistent Organic Pollutants estimates that over 10% of inert ingredients currently in use are classified as hazardous. Moreover, public awareness campaigns led by organizations like Greenpeace have heightened consumer scrutiny, pressuring manufacturers to adopt sustainable alternatives. However, the transition to bio-based options is slow due to technological and economic challenges. These environmental concerns not only threaten regulatory approvals but also erode consumer confidence, thereby restraining market growth.

MARKET OPPORTUNITIES

Rising Adoption of Bio-Based Inert Ingredients

The increasing adoption of bio-based inert ingredients presents a lucrative opportunity for market players. The Bio-based Products Market Outlook by the Organisation for Economic Co-operation and Development forecasts that bio-based chemicals will capture 22% of the global chemical market by 2030. This shift is driven by consumer demand for environmentally friendly products and government incentives promoting green chemistry. For instance, the U.S. Department of Energy offers grants exceeding $100 million annually to support the development of sustainable agricultural inputs. Bio-based carriers, such as plant-derived oils, are gaining traction due to their biodegradability and low toxicity. According to the International Biocontrol Manufacturers’ Association, the use of bio-based inert ingredients in pesticides has grown by 15% annually since 2019.

Expansion into Emerging Markets

Emerging markets offer untapped potential for the pesticide inert ingredients industry. The World Bank estimates that agricultural output in Sub-Saharan Africa and South Asia will grow by 3.5% annually over the next decade with the investments in infrastructure and technology. This growth is expected to boost demand for advanced pesticide formulations by including inert ingredients. According to the India’s Ministry of Agriculture, pesticide consumption in the country has risen by 10% annually since 2020, with inert ingredients playing a crucial role in enhancing product performance. Similarly, Brazil’s agrochemicals companies relies heavily on imported inert ingredients that creates opportunities for global suppliers. According to the International Trade Centre, trade agreements and reduced tariffs are facilitating market entry for foreign companies.

MARKET CHALLENGES

Limited Awareness Among End-Users

Limited awareness among end-users regarding the benefits of inert ingredients remains a pressing challenge. A survey conducted by the International Federation of Agricultural Producers reveals that only 30% of farmers in developing countries understand the role of inert ingredients in pesticide formulations. This knowledge gap often leads to improper application by reducing the effectiveness of pest control measures. For instance, incorrect mixing ratios of emulsifiers can result in uneven spray coverage by causing crop damage. The United Nations Development Programme notes that educational initiatives aimed at bridging this awareness deficit are underfunded in rural areas. Furthermore, misinformation spread through unverified sources exacerbates the problem by deterring farmers from adopting advanced formulations. Addressing this challenge requires collaborative efforts between governments, NGOs, and private entities to promote awareness and training programs by ensuring optimal utilization of inert ingredients.

Supply Chain Disruptions and Raw Material Scarcity

Supply chain disruptions and raw material scarcity present significant hurdles for the pesticide inert ingredients market. According to the Global Supply Chain Institute, the COVID-19 pandemic caused a 20% decline in the availability of key raw materials, such as petroleum derivatives used in synthetic carriers. Geopolitical tensions, exemplified by the Russia-Ukraine conflict, have further exacerbated shortages is driving up costs. According to the International Energy Agency, crude oil prices surged by 40% in 2022 by impacting the production of solvent-based inert ingredients. Additionally, climate change-induced natural disasters, such as floods and droughts, have disrupted supply chains in major manufacturing hubs like China and India. The World Trade Organization emphasizes that diversifying sourcing strategies and investing in local production capabilities are critical to mitigating these risks. However, implementing these solutions requires substantial investment and time by posing a persistent challenge to market stability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.59% |

|

Segments Covered |

By Type, Source, Form, Pesticide Type, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BASF SE, Clariant, Croda International Plc., DuPont., Eastman Chemical Company, Huntsman International LLC., LyondellBasell Industries Holdings B.V., Solvay, Stepan Company, Evonik Industries, Akzo Nobel N.V., and Royal Dutch Shell among other domestic and global players. |

SEGMENTAL ANALYSIS

By Type Insights

The emulsifiers segment dominated the pesticide inert ingredients market by accounting for 40.3% of the share in 2024 due to their ability to stabilize pesticide formulations by ensuring even distribution of active ingredients. The global demand for emulsifiers is projected to reach $12 billion by 2025 that is driven by their widespread use in herbicides and insecticides. According to the American Chemistry Council, emulsifiers enhance the shelf life of pesticides, reducing waste and operational costs. Their versatility across various pesticide types, coupled with advancements in surfactant technology. For instance, non-ionic emulsifiers are increasingly preferred due to their compatibility with sensitive crops.

The solvents segment is anticipated to register a CAGR of 7.8% from 2025 to 2033. This growth is fueled by the rising demand for water-based pesticides, which rely on solvents to dissolve active ingredients effectively. The International Water Management Institute states that water scarcity has prompted manufacturers to develop formulations requiring minimal water that is boosting solvent usage. Additionally, the shift toward eco-friendly solvents, such as glycerin and ethanol, aligns with regulatory trends favoring sustainability. According to the Renewable Fuels Association, bio-based solvents accounted for 25% of the global solvent market in 2022. Their rapid adoption is driven by their biodegradability and low environmental impact. As manufacturers prioritize green chemistry, solvents are poised to play an increasingly vital role in the evolution of pesticide formulations.

By Source Insights

The synthetic inert ingredients segment was the largest and held 63.2% of the pesticide inert ingredients market share in 2024. Their dominance is attributed to their cost-effectiveness and superior performance in enhancing pesticide stability. According to the American Petroleum Institute, synthetic carriers, derived from petrochemicals, are widely used due to their consistent quality and availability. Their scalability and compatibility with diverse pesticide types make them indispensable despite environmental concerns. For instance, synthetic emulsifiers are integral to glyphosate-based herbicides, which account for 30% of global herbicide sales.

The bio-based inert ingredients segment is ascribed to exhibit a CAGR of 9.2% from 2025 to 2033. This growth is propelled by stringent environmental regulations and consumer preference for sustainable products. According to the European Bioplastics Association, bio-based carriers, such as vegetable oils, reduce carbon footprints by 40% compared to their synthetic counterparts. Additionally, advancements in biotechnology have improved the efficacy of bio-based solvents, making them competitive alternatives. For example, soybean-derived solvents are gaining popularity due to their non-toxic nature and biodegradability. As stakeholders prioritize eco-friendly solutions, bio-based inert ingredients are set to revolutionize the market landscape.

By Pesticides Type Insights

The herbicides segment was the largest by capturing 45.4% of the pesticide inert ingredients market share in 2024. Their dominance is driven by the widespread use of herbicides in controlling weeds, which compete with crops for nutrients. According to the Weed Science Society of America, herbicide-resistant weeds affect over 100 million acres globally by intensifying demand for effective formulations. Inert ingredients, such as emulsifiers and carriers, are crucial in ensuring uniform herbicide application. For instance, glyphosate-based herbicides rely on synthetic carriers to maximize efficacy.

The fungicides segment is likely to experience a CAGR of 8.5% from 2025 to 2033. This growth is fueled by the increasing prevalence of fungal diseases, exacerbated by climate change. According to the International Plant Protection Convention, fungal pathogens cause annual crop losses exceeding $200 billion. Bio-based inert ingredients, such as plant extracts, are gaining traction due to their antifungal properties and environmental safety. For example, neem oil-based carriers are widely used in organic farming. The inert ingredients will play a pivotal role in enhancing formulation performance and sustainability as fungicide demand rises.

REGIONAL ANALYSIS

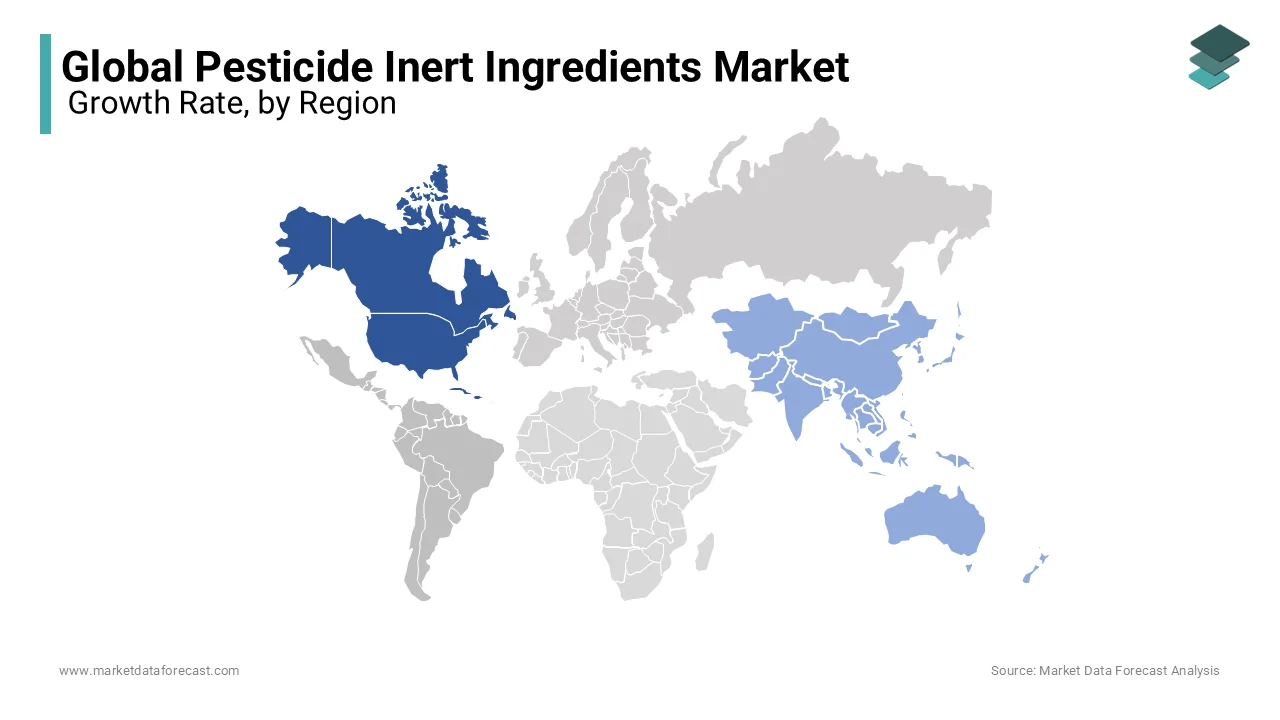

North America led the global pesticide inert ingredients market with 35.4% of the share in 2024. The region's dominance is attributed to advanced agricultural practices and stringent regulatory frameworks. The U.S. Environmental Protection Agency mandates the use of eco-friendly inert ingredients, driving innovation. The region's focus on balancing the agricultural productivity with environmental stewardship and rapid adoption of the advanced technologies are ascribed to boost the growth of the market in North America.

Asia Pacific is esteemed to grow with a CAGR of 10.2% during the forecast period. Rapid urbanization and population growth drive pesticide demand. China and India collectively account for 60% of regional consumption. According to the Asian Development Bank, government subsidies promote the adoption of advanced formulations.

Europe is likely to experience a steady growth pace in the next coming years. The European Union’s REACH regulation promotes the use of bio-based inert ingredients by fostering market growth. Germany, the largest pesticide consumer in Europe, accounts for 20% of regional sales. The European Commission reports that bio-based solvents have reduced pesticide-related emissions by 15%. Europe’s emphasis on sustainability positions it as a key player in the global market.

Latin America and Middle East & Africa are deemed to have lucrative opportunities in the pesticide inert ingredients market in the coming years. Bio-based carriers are gaining popularity due to their environmental benefits, reflecting the region’s focus on sustainable agriculture. South Africa leads in pesticide consumption, with inert ingredients playing a vital role in formulation stability. Investments in agricultural infrastructure are expected to drive future growth of the region’s untapped potential.

KEY MARKET PLAYERS

The major players covered in the global pesticide inert ingredients market report are BASF SE, Clariant, Croda International Plc., DuPont., Eastman Chemical Company, Huntsman International LLC., LyondellBasell Industries Holdings B.V., Solvay, Stepan Company, Evonik Industries, Akzo Nobel N.V., and Royal Dutch Shell among other domestic and global players. Syngenta Crop Protection has introduced the latest insecticidal active ingredient that will assist farmers to protect their crops against sucking pests in an efficient and environmentally sustainable manner.

MARKET SEGMENTATION

This research report on the global pesticide ingredients market is segmented and sub-segmented into the following categories.

By Type

- Emulsifiers

- Solvents

- Carriers

By Source

- Synthetic

- Bio-based

By Form

- Dry

- Liquid

By Pesticide Type

- Herbicides

- Insecticides

- Fungicides

- Rodenticides

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the current market size of the global pest ingredients market?

The current market size of the global pesticide-inert ingredients market was valued at USD 4.14 billion in 2025

What are the market drivers that are driving the global pesticide insert ingredients market?

The growing need to guarantee food quality in the agricultural industry is the key driver of the worldwide market for pesticide-inert ingredients.

Who are the market players that are dominating the global pesticide insert ingredients market?

BASF SE, Clariant, Croda International Plc., DuPont., Eastman Chemical Company, Huntsman International LLC., LyondellBasell Industries Holdings B.V., Solvay, Stepan Company, Evonik Industries, Akzo Nobel N.V., and Royal Dutch Shell among other domestic and global players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]