Global Personal Luxury Goods Market Size, Share, Trends, & Growth Forecast Report Segmented By Product (Luxury Fashion, Jewelry & Watches Leather Goods, Fragrances & Cosmetics, Other Luxury Goods), Distribution Channel, Demographic and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Personal Luxury Goods Market Size

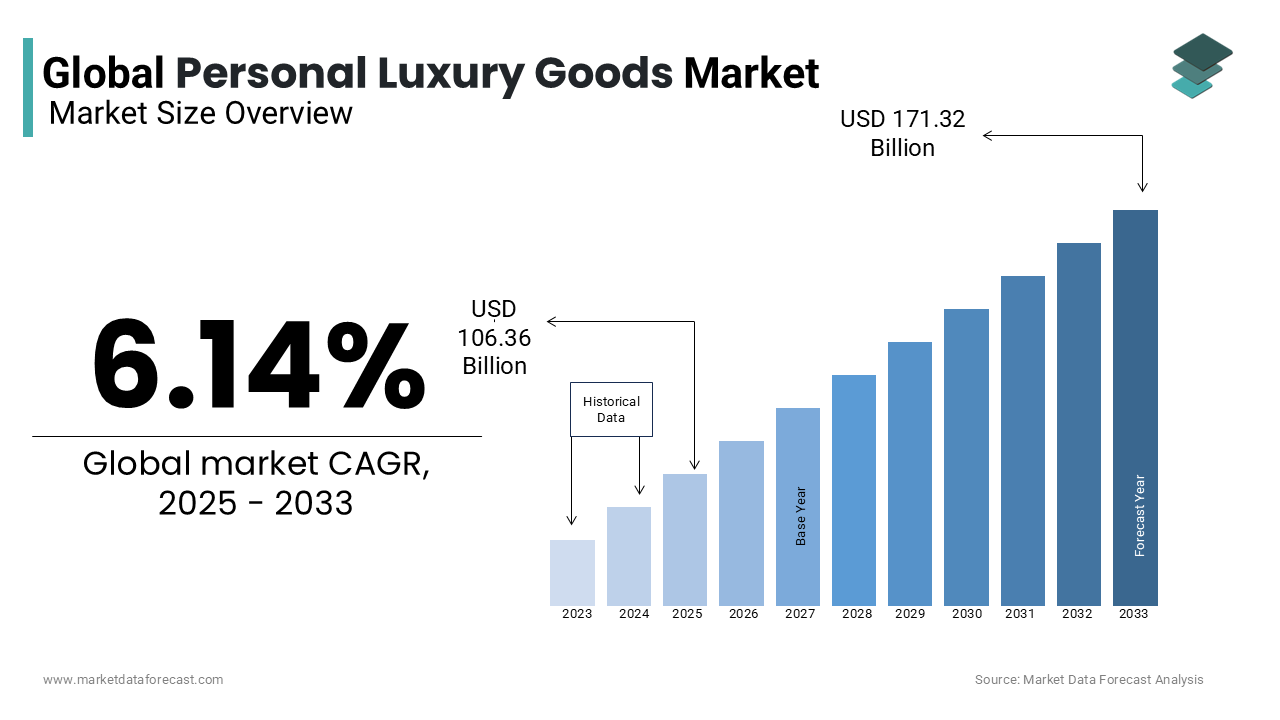

The global Personal Luxury Goods market size was valued at USD 100.21 billion in 2024 and is projected to grow from USD 106.36 billion in 2025 to USD 171.32 billion by 2033, the market is expected to grow at a CAGR of 6.14% during the forecast period.

Personal luxury goods are adapting to changing consumer preferences, technological advancements, and sustainability concerns. A key trend is the increasing significance of digital channels with 60% of luxury purchases influenced by online experiences and consumers engaging with brands through social media, e-commerce platforms and virtual storefronts. Additionally, 70% of luxury shoppers now use smartphones to research products before making a purchase which is reflecting the growing reliance on mobile technology for shopping decisions.

MARKET DRIVERS

Rising Disposable Income in Emerging Markets

Luxury goods are increasingly accessible because the global middle class continues to expand and is especially witnessed in emerging markets such as China, India, and the Middle East. According to the World Bank, global GDP growth in developing economies was 4.6% in 2023 which is boosting disposable income. In China, personal income rose by 6.1% in 2023, driving demand for high-end products. This growing affluence is expected to fuel luxury consumption with China alone projected to account for 40% of global luxury sales by 2025, as stated by the World Bank.

Shift Toward Digital and Online Shopping

Digital transformation is a significant driver since more luxury brands are investing in e-commerce and digital marketing. A McKinsey report reveals that 70% of luxury consumers now use the internet for product research and 30% of purchases are made online. As of 2023, 40% of global luxury sales were through digital channels. This shift allows brands to connect with younger, tech-savvy consumers and particularly millennials and Gen Z who prefer the convenience of online shopping while seeking exclusivity in digital experiences.

MARKET RESTRAINTS

Economic Uncertainty and Global Recessions

Economic downturns and global uncertainties can greatly affect luxury goods consumption. The International Monetary Fund (IMF) projects global growth to slow to 2.8% in 2024 due to inflation, geopolitical tensions and supply chain issues. During economic stress, luxury goods are considered discretionary and that is leading to reduced sales. For instance, the COVID-19 pandemic caused a 23% drop in global luxury sales in 2020 and that is illustrating the impact of economic shocks on the sector.

Counterfeit Products and Brand Integrity

Counterfeit goods are a significant challenge which is supported by the Organization for Economic Cooperation and Development (OECD) by estimating that counterfeit products account for 3.3% of global trade and valued at about $509 billion annually. These fake goods undermine brand integrity and dilute the value of authentic luxury items. Consumers may question the exclusivity and authenticity of luxury brands, potentially reducing brand loyalty and market share for legitimate companies because counterfeiting has become more sophisticated these days. This has prompted luxury brands to invest in anti-counterfeit technologies.

MARKET OPPORTUNITIES

Growth in Middle-Class Consumer Base

The expanding middle class in emerging markets presents a substantial growth opportunity for the Personal Luxury Goods Market. The World Bank estimates that the global middle class will reach 5.5 billion people by 2030 with a major concentration in Asia and Africa. The demand for luxury goods will rise owing to the populations gaining more disposable income. In particular, China and India are expected to see their middle-class populations grow by over 20% by 2025 and consequently providing a strong foundation for luxury brands to expand their consumer base.

Increased Demand for Sustainable Luxury Products

The demand for sustainable luxury goods is on the rise as consumers become more eco-conscious. A McKinsey & Company report reveals that 60% of luxury consumers in 2023 considered sustainability a key purchasing factor with a preference for ethically sourced and environmentally friendly products. The European Commission found that 66% of European consumers are willing to pay more for sustainable items. Luxury brands that adopt sustainable practices are well-positioned to capture this growing market segment and build stronger brand loyalty among eco-conscious consumers.

MARKET CHALLENGES

Supply Chain Disruptions

The luxury goods market faces vulnerabilities due to supply chain disruptions, which affect product availability and quality. The World Economic Forum (WEF) reports that 75% of global companies experienced supply chain disruptions in 2023, caused by factors like natural disasters, geopolitical tensions and labor shortages. In Europe, 40% of manufacturers reported delays due to logistics and transportation issues. These disruptions can affect the luxury market as brands rely on high-quality, exclusive materials, making it more difficult to maintain consistent product availability.

Intense Competition from New Entrants

New entrants and especially in the online space pose a growing challenge to established luxury brands. A global survey by Accenture found that 63% of consumers are more likely to shop with smaller and independent luxury brands for their unique offerings and personalized services. The rise in preference for boutique brands when combined with the expansion of established players forces luxury companies to innovate continuously. Additionally, 42% of luxury consumers are attracted to niche brands offering specific customizations, which is fragmenting the market and increasing competitive pressures for larger traditional luxury brands.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.14% |

|

Segments Covered |

By Product, Distribution Channel, Demographic, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

LVMH (Moet Hennessy Louis Vuitton, Kering, Richemont, Prada, Chanel, Hermes, Burberry, Rolex, Tiffany & Co., Valentino, and others. |

SEGMENTAL ANALYSIS

By Product Insights

The luxury fashion segment held 40.4% of global personal luxury goods share in 2024. This dominance is due to the consistent demand for high-end fashion brand, including apparel, footwear and accessories. The growing appeal of luxury fashion among consumers particularly in regions like Europe and North America reinforces its position as the top segment. A report from Bain & Company estimates that the luxury fashion market is valued at $200 billion globally with key players such as LVMH Gucci and Chanel leading this growth. The constant innovation and exclusivity associated with luxury fashion drive this segment's sustained leadership in the market.

The jewelry and watches segment is forecasted to witness a CAGR of 7.6% during the forecast period. This growth is largely fueled by increasing consumer interest in high-end accessories and investment in luxury timepieces. According to Richemont's 2023 financial results, the group's jewelry division including brands like Cartier and Van Cleef & Arpels that recorded a 14% increase in sales and significantly contributed to global market growth. Also, the rising demand for luxury watches and jewelry in emerging markets and mainly in Asia and the Middle East is helping to elevate the rapid expansion of this segment.

By Distribution Channel Insights

The exclusive brand boutiques segment held the largest share of 62.8% in the personal luxury goods market in 2024. These outlets are critical for maintaining brand exclusivity and providing consumers with a personalized shopping experience. As of 2023, exclusive brand boutiques accounted for 45% of global luxury sales with flagship stores in major cities like Paris, Milan and New York. The experience and customer service at these locations are significant drivers for high-net-worth individuals who prefer an immersive and bespoke shopping journey.

The online retail segment has gained immense traction in the recent years and is predicted to register the fastest CAGR of 12.6% during the forecast period. According to the McKinsey & Company report, 40% of global luxury goods sales were completed through digital channels in 2023 and this number is expected to rise. This growth is propelled by younger generations who choose the convenience of e-commerce while still desiring exclusivity. Digital platforms are those adding exclusivity with virtual experiences are gaining traction and thereby allowing brands to reach global consumers efficiently and effectively.

By Demographic Insight

The High-Net-Worth Individuals (HNWIs) segment held 70.2% of total luxury market consumption. According to Knight Frank's 2023 Wealth Report, the global population of HNWIs has increased by 5% annually and is leading to greater luxury consumption. Their wealth and purchasing power make them the key drivers of the market that is especially for high-end items such as rare jewelry, luxury cars, and fine art. These individuals continue to dominate the consumption of luxury goods due to their significant disposable income and desire for exclusivity.

The young affluent consumers segment is gaining huge traction and is expected to grow at a CAGR of 6.14% during the forecast period. This growth is largely attributed to their increasing purchasing power and the influence of digital platforms. According to a report by the World Economic Forum, millennials and Gen Z, who have an affinity for luxury brands and value experiences, are expected to account for 40% of global luxury consumption by 2030. These younger consumers are shaping the market by demanding more personalized, digital-first shopping experiences that blend exclusivity with convenience.

REGIONAL ANALYSIS

North America is the most dominating region in the global market currently and accounted for 76.6% of global market share in 2024. Luxury spending in the U.S. represents 25 to 30% of global consumption despite contributing just 0.4% to GDP. In 2023, U.S. luxury sales saw significant gains with companies such as Richemont reporting a 22% increase in U.S. sales contributing to a 10% rise in global sales. According to the U.S. Bureau of Economic Analysis, consumer spending has been a key factor in this growth by having personal consumption expenditures rising by 0.4% in November 2024 after a 0.3% increase in October. Also, in 2023, average annual consumer expenditures in the U.S. rose by 5.9% reaching $77,280 and further demonstrating the robust economic position of U.S. consumers.

Europe is expected to grow at a CAGR of 4.6% during the forecast period. European luxury items account for 74% of the global market by covering sectors like fashion accessories, watches, jewelry and perfumes and reinforcing it’s role in shaping global trends. In 2023, high-end exports from Europe were valued at €260 billion and represented 10% of total EU exports. This highlights the significant role luxury goods play in Europe’s export economy and solidifies region’s position as a dominant force in the global luxury sector.

The Asia-Pacific is estimated to showcase the highest growth among regions over the forecast period. In 2023, consumer expenditure in Asia-Pacific countries rose steadily, with China and India experiencing notable increases in luxury goods spending. According to the World Bank, China’s middle class grew by over 10% annually from 2020 to 2023, fueling greater demand for high-end products. The trend of online shopping is also gaining momentum in the region, with 80% of Asian consumers using the internet for product research, a significant portion of whom purchase luxury goods online, as reported by the OECD.

The personal luxury goods market in Latin America is growing steadily and is expected to become a noteworthy regional segment for personal luxury goods globally by the end of the forecast period. This growth is influenced by various factors, including shifting consumer behaviors, economic conditions, and demographics. The World Bank shows that Latin America’s middle class is steadily expanding, with the percentage of middle-class individuals rising from 28% to 34% over the past decade, boosting disposable income and driving demand for luxury goods. Additionally, 72% of Latin American consumers prefer online shopping, as reported by the OECD, influencing how luxury brands approach distribution in the region.

The market in Middle East and Africa is expected to grow at a 5.4% CAGR over the forecast period owing to the rising disposable incomes, evolving consumer preferences, and the growing tourism industry. The region's luxury goods market is gaining traction, particularly in countries like the UAE, Saudi Arabia, and Qat

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

LVMH (Moet Hennessy Louis Vuitton, Kering, Richemont, Prada, Chanel, Hermes, Burberry, Rolex, Tiffany & Co., Valentino are playing dominating role in the global personal luxury goods market.

The Personal Luxury Goods Market is highly competitive, characterized by a handful of leading players vying for dominance. The market is driven by brands with strong heritage, craftsmanship, and a global reputation. Key players such as LVMH, Kering, Richemont, and Prada along with niche high-end luxury brands are fiercely competing to maintain their premium positioning and brand equity.

Competition is intensified by shifting consumer preferences, particularly the growing demand for sustainable and eco-friendly luxury items. As a result, companies are increasingly focusing on incorporating sustainable practices into their supply chains and product offerings. Additionally, there is a rising trend of direct-to-consumer sales models through e-commerce, with companies investing heavily in digital transformation to enhance customer engagement and reach younger demographics.

While established players rely on their prestigious brand value and legacy, newer luxury entrants focus on innovation, customization and niche markets. Additionally, emerging markets such as China, India, and the Middle East are becoming key battlegrounds, as increasing disposable income and changing lifestyles in these regions present new growth opportunities.

Overall, the competition within the Personal Luxury Goods Market remains intense, with brands constantly evolving their strategies to maintain consumer loyalty, attract new buyers, and expand their global presence.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Lacoste launched an aggressive push into the lucrative U.S. sportswear market, aiming to double its U.S. sales from $400 million to $800 million. The strategy involved opening new stores, including a flagship on New York's Fifth Avenue, and emphasizing trends in tennis and golf to attract American consumers.

- In February 2024, LVMH, the world's largest luxury conglomerate, invested heavily in sports, securing substantial deals in Formula One, the Paris Olympics and Paralympics, and soccer. This strategy aims to shift the company's focus from products to emotional and experiential services, aligning with the growing consumer interest in luxury experiences.

MARKET SEGMENTATION

This research report on the global personal luxury goods market has been segmented and sub-segmented based on material, product, distribution channel, demographic, and region.

By Product

- Luxury Fashion

- Jewelry & Watches

- Leather Goods

- Fragrances & Cosmetics

- Other Luxury Goods

By Distribution Channel

- Online Retail

- Exclusive Brand Boutiques

- Department Stores

- Luxury Outlet Stores

By Demographic

- Young Affluent Consumers

- High-Net-Worth Individuals (HNWIs)

- Middle-Class Luxury Shoppers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current size of the global personal luxury goods market?

The global personal luxury goods market is expected to be valued at USD 94.4 bn in 2023.

Which regions are the primary contributors to the global personal luxury goods market share?

Major contributors to the global personal luxury goods market share include North America, Europe, Asia-Pacific, and emerging markets with a growing affluent consumer base.

How has the global personal luxury goods market responded to the impact of the COVID-19 pandemic?

The COVID-19 pandemic initially led to a contraction in the luxury goods market, but the industry has demonstrated resilience, with a gradual recovery as consumer confidence returns.

Who are the major companies in the global personal luxury goods market?

Companies playing a key role in the global personal luxury goods market are LVMH Moët Hennessy Louis Vuitton SE, Kering SA, Richemont, The Estée Lauder Companies Inc., The Swatch Group Ltd., Luxottica Group S.p.A. (Essilor Luxottica), Prada S.p.A., Tiffany & Co., Chanel S.A., Hermès International S.A., Burberry Group PLC, Ralph Lauren Corporation, Cartier (a division of Richemont), Gucci (a brand under Kering), Christian Dior SE, Giorgio Armani S.p.A., Rolex SA, Chopard and Bottega Veneta (a brand under Kering.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]