Global Permanent Magnets Market Size, Share, Trends, & Growth Forecast Report Segmented By Material (Ferrite, Neodymium Iron Boron (NdFeB), Aluminum Nickel Cobalt (Alnico), and Samarium Cobalt (SmCo)), Application (Automotive, Consumer goods & electronics, Industrial, Aerospace & Defense, Energy, Medical, and Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Permanent Magnets Market Size

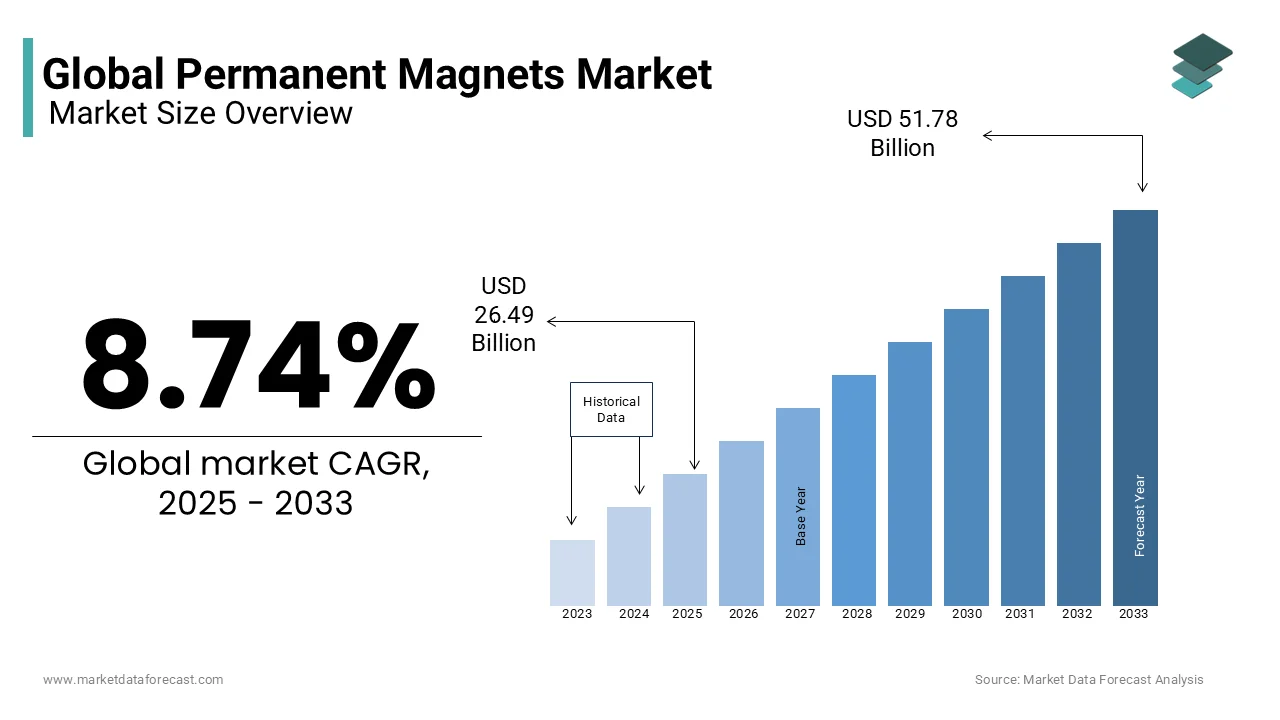

The global permanent magnets market was worth USD 24.36 billion in 2024. The global market is projected to reach USD 51.78 billion by 2033 from USD 26.49 billion in 2025, growing at a CAGR of 8.74% from 2025 to 2033.

Permanent magnets are materials that maintain a consistent magnetic field without requiring an external power source. These magnets function by aligning their atomic structure in a way that retains magnetism over extended periods. They are essential components in various industries including automotive, electronics, healthcare, renewable energy, and industrial automation. The most commonly used types of permanent magnets include neodymium iron boron (NdFeB), samarium cobalt (SmCo), alnico, and ferrite magnets and each offers distinct properties suited for specific applications.

The global demand for permanent magnets is driven by advancements in technology and industrial applications. In electric vehicles (EVs), permanent magnets improve motor efficiency is reducing energy consumption and extending battery life. According to the International Energy Agency (IEA), global electric car sales reached nearly 14 million units in 2023, marking a 35% increase from the previous year. This rapid growth has brought the total number of electric cars on the road to 40 million and thereby emphasizing the increasing reliance on rare earth magnets for propulsion systems.

Similarly, in wind power generation, offshore wind turbines rely on high-performance magnets to enhance energy conversion efficiency. The Global Wind Energy Council (GWEC) reported that 117 gigawatts (GW) of new wind capacity were installed in 2023 which is making it the best year ever for wind energy expansion.

In consumer electronics, permanent magnets are present in approximately 90% of modern devices including smartphones, speakers, and hard disk drives as estimated by the Consumer Technology Association (CTA). Additionally, magnetic resonance imaging (MRI) machines, which heavily depend on high-strength magnets, conduct over 40 million scans annually worldwide, as reported by the World Health Organization (WHO).

MARKET DRIVERS

Government Policies and Initiatives

Government policies aimed at reducing carbon emissions and promoting renewable energy adoption are majorly driving the permanent magnets market. At the COP28 UN Climate Change Conference, nearly 200 countries agreed to work towards ambitious global energy objectives, including tripling renewable energy capacity by 2030, as reported by the International Energy Agency (IEA). This collective commitment has led to increased investments in renewable technologies such as wind turbines and electric vehicles and both of which rely heavily on permanent magnets for efficient operation. For instance, the IEA's Renewables 2024 report highlights that global renewable electricity capacity is expected to reach almost 11,000 gigawatts by 2030, nearly tripling the capacity from 2022 levels. Such policies and targets are propelling the demand for permanent magnets essential in these applications.

Technological Advancements in Consumer Electronics

The rapid evolution of consumer electronics has significantly increased the demand for permanent magnets. Devices such as smartphones, laptops, and wearable technology rely on compact and efficient components and many of which utilize permanent magnets. The global demand for rare earths for permanent magnets in consumer electronics was approximately 7,500 metric tons in 2015 and is projected to increase to 12,500 metric tons by 2025. This substantial growth underscores the critical role permanent magnets play in the functionality and miniaturization of contemporary electronic devices.

MARKET RESTRAINTS

Supply Chain Concentration and Geopolitical Risks

The permanent magnets market is heavily reliant on rare earth elements (REEs), with China accounting for approximately 80% of the global REE production. This concentration poses substantial supply chain risks as geopolitical tensions or policy changes can disrupt the availability of these critical materials. For instance, in 2010, China temporarily reduced its REE exports and that led to a global supply shortage and price volatility. Such events underscore the vulnerability of the permanent magnets market to geopolitical dynamics and therby prompting concerns over supply security and the need for diversification.

Environmental and Health Concerns in Rare Earth Mining

The extraction and processing of rare earth elements used in permanent magnets raise noteworthy environmental and health concerns. The U.S. Environmental Protection Agency (EPA) highlights that rare earth mining can lead to the release of harmful substances including radioactive materials and heavy metals which are contaminating soil and water resources. Additionally, the energy-intensive nature of REE processing contributes to greenhouse gas emissions. These environmental and health challenges not only pose regulatory hurdles but also increase operational costs for companies, potentially restraining the growth of the permanent magnets market.

MARKET OPPORTUNITIES

Development of Rare Earth Element Recycling Technologies

Advancements in recycling technologies for rare earth elements (REEs) present a significant opportunity for the permanent magnets market. The U.S. Department of Energy emphasizes that enhancing REE recycling can mitigate supply chain risks and reduce environmental impacts associated with mining. Innovative processes are being developed to efficiently recover REEs from end-of-life products such as electric vehicle motors and wind turbine generators. Implementing these recycling methods can decrease reliance on primary extraction, promote resource sustainability, and stabilize the supply of critical materials necessary for permanent magnet production.

Research into Alternative Materials for Permanent Magnets

Exploring alternative materials that can replace or reduce the use of traditional rare earth elements in permanent magnets offers a promising avenue for market growth. The U.S. Department of Energy is investing in research to develop new magnet compositions such as iron-nitride compounds which exhibit strong magnetic properties without relying on scarce REEs. These efforts aim to create cost-effective and sustainable magnet solutions and is potentially reducing dependence on geopolitically sensitive materials and fostering innovation in various applications, including renewable energy technologies and electric vehicles.

MARKET CHALLENGES

Price Volatility of Rare Earth Elements

The permanent magnets market struggles with serious issues caused by the price volatility of rare earth elements (REEs). According to the U.S. Department of Energy, the global supply chain for rare earth metals and magnets is almost completely dominated by China which controlled a major portion of rare earth mining and 92% of magnet manufacturing in 2020. This concentration can lead to substantial price fluctuations and is impacting the cost structure and profitability of industries reliant on permanent magnets. Such volatility poses a considerable challenge for manufacturers in maintaining stable production costs and planning long-term investments.

Limited Recycling and Reusability

The recycling and reusability of rare earth elements in permanent magnets remain limited. The U.S. Geological Survey indicates that only minimal quantities of rare earths are recovered from end-of-life products like batteries, permanent magnets and fluorescent lamps. This limited recycling capability exacerbates supply constraints and environmental concerns because the extraction and processing of REEs are resource-intensive and environmentally taxing. Enhancing recycling processes is essential to mitigate supply risks and reduce the environmental footprint associated with rare earth mining and processing.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.74% |

|

Segments Covered |

By Material, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Adams Magnetic Products Co., Earth-Panda Advance Magnetic Material Co., Ltd., Arnold Magnetic Technologies, Daido Steel Co., Ltd., Eclipse Magnetics Ltd., Electron Energy Corp., Goudsmit Magnetics Group, Hangzhou Permanent Magnet Group, Magnequench International, LLC, and Ningbo Yunsheng Co., Ltd. |

SEGMENTAL ANALYSIS

By Material Insights

The neodymium Iron Boron (NdFeB) segment dominated the market by holding 45.4% of the global permanent magnet market share in 2024. NdFeB magnets are favored due to their exceptional magnetic strength and energy efficiency which is making them indispensable for electric vehicles (EVs), wind turbines, and consumer electronics. The International Energy Agency (IEA) reports that global EV sales surpassed 10 million units in 2022 with each vehicle requiring up to 2 kg of rare-earth magnets like NdFeB. Additionally, the Global Wind Energy Council (GWEC) states that wind power installations reached 837 GW globally in 2022 which is further driving demand. NdFeB’s superior performance ensures its critical role in advancing green technologies.

The ferrite magnets segment is estimated to witness a CAGR of 6.2% over the forecast period owing to their cost-effectiveness, corrosion resistance and widespread use in automotive, industrial, and consumer electronics sectors. According to the International Organization of Motor Vehicle Manufacturers (OICA) , global automotive production exceeded 85.4 million units in 2022 with ferrite magnets being integral to motors, sensors, and actuators. Furthermore, the U.S. Department of Energy (DOE) highlights that ferrites are increasingly used in renewable energy systems, such as solar inverters, due to their affordability and reliability. Their versatility and lower raw material costs make ferrite magnets a key solution for scalable and budget-friendly applications.

By Application Insights

The automotive segment dominated the permanent magnets market by accounting for 28.3% of the global market share in 2024. This leading position of automotive segment in the global market is fueled by the soaring demand for electric vehicles (EVs). The International Energy Agency (IEA) noted a remarkable 108% increase in global EV sales in 2021 with sales reaching 6.6 million units. Permanent magnets are essential for EV traction motors which require high efficiency and compact designs. Additionally, traditional internal combustion engine vehicles rely on magnets for components like sensors, actuators, and alternators. The Organization of Motor Vehicle Manufacturers states that global vehicle production in 2021 was approximately 80 million units and thereby further amplifying demand. The automotive segment’s prominence underscores its pivotal role in both conventional and sustainable mobility solutions.

The energy segment is anticipated to progress at a promising CAGR of 8.3% over the forecast period due to the increasing adoption of renewable energy technologies like wind turbines and solar inverters. The Global Wind Energy Council (GWEC) reports that global wind power capacity reached 837 GW in 2022 with each turbine requiring up to 600 kg of permanent magnets. Government initiatives, such as the European Green Deal, aim to achieve carbon neutrality by 2050, further accelerating investments in clean energy. The energy segment’s rapid growth reflects its critical role in advancing global sustainability goals.

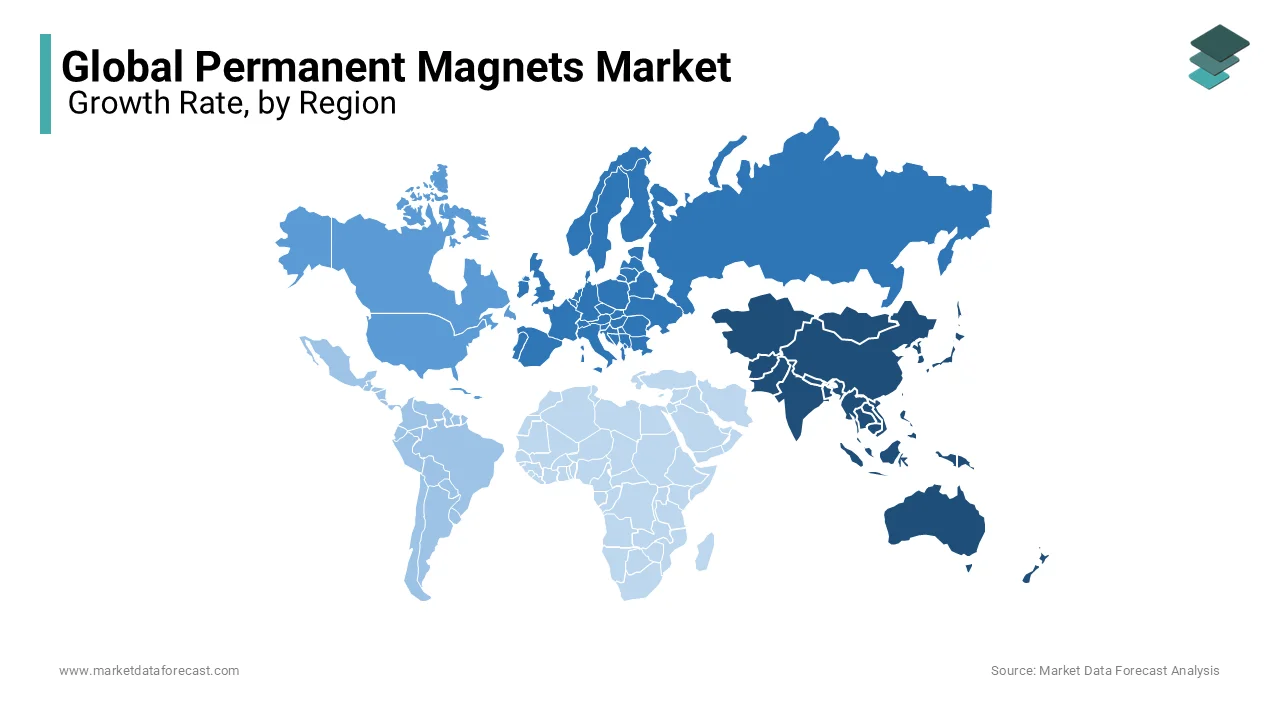

REGIONAL ANALYSIS

Asia-Pacific held the dominating position in the global permanent magnets market in 2024 by accounting for 69.5% of the global market share. The lead of Asia-Pacific in the global market is primarily due to China's significant role in the industry because it is the leading producer of rare earth elements essential for manufacturing permanent magnets. The region's robust manufacturing sector particularly in electronics and automotive industries further bolsters its leading position. According to the U.S. Geological Survey, China produced 140,000 metric tons of rare earth oxides in 2020 which is representing about 60% of the world's total production. This substantial output underscores the region's pivotal role in the global supply chain for permanent magnets.

Europe is the growing at a rapid pace in the permanent magnets market and is projected to have a CAGR of 11.5% in the coming years. This rapid expansion is driven by the increasing production of electric vehicles (EVs) and the development of renewable energy projects within the region. The European Union's commitment to reducing carbon emissions has led to substantial investments in wind energy and EV infrastructure. For instance, the European Environment Agency reported that the share of newly registered electric cars in the EU increased from 3.5% in 2019 to 11% in 2020 which is highlighting the region's accelerating transition to sustainable transportation.

The permanent magnets market in North America is anticipated to grow steadily and is supported by advancements in the automotive and electronics sectors. The U.S. Department of Energy has been investing in research to develop alternative materials and recycling methods to reduce dependence on imported rare earth elements and is aiming to strengthen domestic supply chains. The region's focus on technological innovation and sustainable practices is expected to drive moderate growth in the permanent magnets market.

Latin America is expected to witness moderate growth in the permanent magnets market in the coming years. The region currently has limited production and application of permanent magnets so increasing industrialization and investments in renewable energy projects may drive future demand. For example, Brazil has been expanding its wind energy capacity which could lead to a higher demand for permanent magnets used in wind turbine generators.

The Middle East & Africa region is projected to experience modest growth in the permanent magnets market. The region's focus on diversifying energy sources and developing renewable energy projects, such as solar and wind power, may contribute to increased demand for permanent magnets. However, the market's growth may be constrained by limited industrial infrastructure and reliance on imports for raw materials.

KEY MARKET PLAYERS

The major players in the global permanent magnets market include Adams Magnetic Products Co., Earth-Panda Advance Magnetic Material Co., Ltd., Arnold Magnetic Technologies, Daido Steel Co., Ltd., Eclipse Magnetics Ltd., Electron Energy Corp., Goudsmit Magnetics Group, Hangzhou Permanent Magnet Group, Magnequench International, LLC, and Ningbo Yunsheng Co., Ltd.

COMPETITIVE LANDSCAPE

The permanent magnets market is highly competitive, driven by increasing demand from industries such as automotive, consumer electronics, renewable energy, and industrial automation. The competition is shaped by technological advancements, supply chain strategies, and geopolitical factors affecting raw material availability.

Key players such as Proterial, Ltd. (formerly Hitachi Metals), Arnold Magnetic Technologies, and TDK Corporation dominate the market, leveraging their expertise in rare earth magnet production and innovation. These companies compete by developing high-performance, cost-effective, and sustainable magnet solutions, particularly for electric vehicles (EVs) and wind turbines.

A major competitive challenge is the supply of rare earth elements (REEs), which are primarily controlled by China. To counter this, many companies are investing in alternative magnet technologies and forming strategic partnerships with non-Chinese suppliers. Additionally, advancements in rare earth-free magnets are intensifying competition, as companies seek more sustainable and geopolitically stable solutions.

New entrants, especially startups and research-driven firms, are focusing on innovative magnet compositions and recycling technologies to disrupt the market. Overall, competition in the permanent magnets industry is fueled by technological innovation, supply chain security, sustainability efforts, and global market expansion, making it a dynamic and evolving sector.

Top 3 Players in the Market

Proterial, Ltd. (formerly Hitachi Metals, Ltd.)

Proterial, Ltd., a Japanese company, is renowned for its advanced magnetic materials. The company offers a wide range of magnets, including Neomax rare earth magnets and ferrite magnets, which are utilized in various fields such as automobiles, electronics, and home appliances. Their commitment to research and development has led to innovations that enhance the performance and efficiency of permanent magnets, solidifying their position as a market leader.

Arnold Magnetic Technologies

Arnold Magnetic Technologies, based in the United States, specializes in high-performance permanent magnets, including RECOMA samarium cobalt magnets. These magnets are known for their exceptional magnetic strength and performance, making them suitable for demanding applications in aerospace, automotive, and energy sectors. Arnold's global reach and state-of-the-art technology center enable them to collaborate closely with clients to optimize designs and achieve superior system performance.

TDK Corporation

TDK Corporation, also based in Japan, is a prominent player in the permanent magnets market. The company specializes in electronic components and materials, including a variety of permanent magnets used in applications like motors, sensors, and actuators. TDK's products are integral to consumer electronics, automotive systems, and industrial equipment, contributing significantly to the global supply of high-quality permanent magnets.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Technological Innovation and R&D Investments

Leading companies in the permanent magnets market focus on continuous research and development (R&D) to enhance their product performance and efficiency. Innovations in material composition and manufacturing techniques help companies develop stronger, more durable, and heat-resistant magnets. Proterial, Ltd. (formerly Hitachi Metals, Ltd.) has pioneered Neomax rare earth magnets, which offer superior performance for electric vehicles (EVs) and wind turbines. Arnold Magnetic Technologies invests heavily in RECOMA samarium cobalt magnets, known for their high-temperature stability, making them ideal for aerospace and military applications. Meanwhile, TDK Corporation continues to advance ferrite magnets and sensor-integrated magnetic components, catering to consumer electronics and automotive industries. By leading technological innovation, these companies maintain their competitive edge in high-performance magnet applications.

Strategic Acquisitions and Partnerships

Acquisitions and strategic collaborations are essential for companies looking to expand their capabilities and product offerings. Proterial, Ltd. collaborates with automotive manufacturers to develop advanced motor technologies, securing its role in the growing EV market. Arnold Magnetic Technologies strengthens its presence in aerospace and defense by partnering with key players to develop specialized magnets for satellites and military systems. On the other hand, TDK Corporation acquired Micronas Semiconductor, allowing it to integrate magnetic sensors into its product portfolio. These strategic moves enable companies to stay ahead in an increasingly competitive market by gaining access to new technologies, customer bases, and manufacturing capabilities.

Supply Chain Control and Rare Earth Material Sourcing

Since rare earth elements (REEs) are critical for permanent magnet production, companies adopt strategies to secure a stable supply chain and reduce dependency on China, the dominant global supplier. Proterial, Ltd. has developed partnerships with Japanese and Australian rare earth suppliers, ensuring a diversified supply chain. Arnold Magnetic Technologies works closely with North American suppliers to mitigate geopolitical risks associated with rare earth procurement. TDK Corporation takes a different approach by investing in alternative magnetic materials, aiming to reduce reliance on neodymium and samarium. By strengthening supply chains, these companies ensure production stability and cost control, which are crucial for long-term success.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Hancock Prospecting, an Australian mining firm owned by Gina Rinehart, disclosed a 5.3% stake in MP Materials and a 5.8% stake in Lynas. This move indicates Hancock's strategic interest in the rare earths sector, which is integral to the permanent magnets market.

- In May 2024, the European Patent Office announced Dr. Masato Sagawa as a finalist for the European Inventor Award 2024 in the 'Non-EPO Countries' category. This recognition highlights his invention of the neodymium magnet, the most powerful permanent magnet, which is crucial in electric vehicles and wind turbines.

- In January 2024, Niron Magnetics announced plans to establish its first large-scale production facility in the United States. The 10,000-ton facility, expected to be operational by 2027, will produce rare earth-free permanent magnets using abundant materials like iron and nitrogen, aiming to enhance supply chain security and sustainability.

MARKET SEGMENTATION

This research report on the global permanent magnets market is segmented and sub-segmented into the following categories.

By Material

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminum Nickel Cobalt (Alnico)

- Samarium Cobalt (SmCo)

By Application

- Automotive

- Consumer goods & electronics

- Industrial

- Aerospace & Defense

- Energy

- Medical

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is driving the growth of the global permanent magnets market?

The increasing demand for permanent magnets in electric vehicles, renewable energy applications, and consumer electronics is a major growth driver. Technological advancements and government initiatives promoting clean energy further boost the market.

Which industries are the major consumers of permanent magnets?

The key industries using permanent magnets include automotive (for electric motors and hybrid vehicles), electronics (in smartphones, speakers, and hard drives), energy (for wind turbines and generators), and medical (for MRI machines and medical devices).

How are technological advancements influencing the permanent magnets market?

Innovations in magnet composition, enhanced production techniques, and new applications in robotics and aerospace are driving market growth, improving efficiency, and expanding the use of permanent magnets in emerging technologies.

What is the future outlook for the global permanent magnets market?

The market is expected to grow steadily, driven by increasing applications in energy, transportation, and consumer electronics. Ongoing research into material efficiency and recycling will shape its long-term sustainability.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]