Global Perfumes Market Size, Share, Trends, & Growth Forecast Report Segmented By Product (Mass, Premium), End-User, Distribution Channel, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Perfumes Market Size

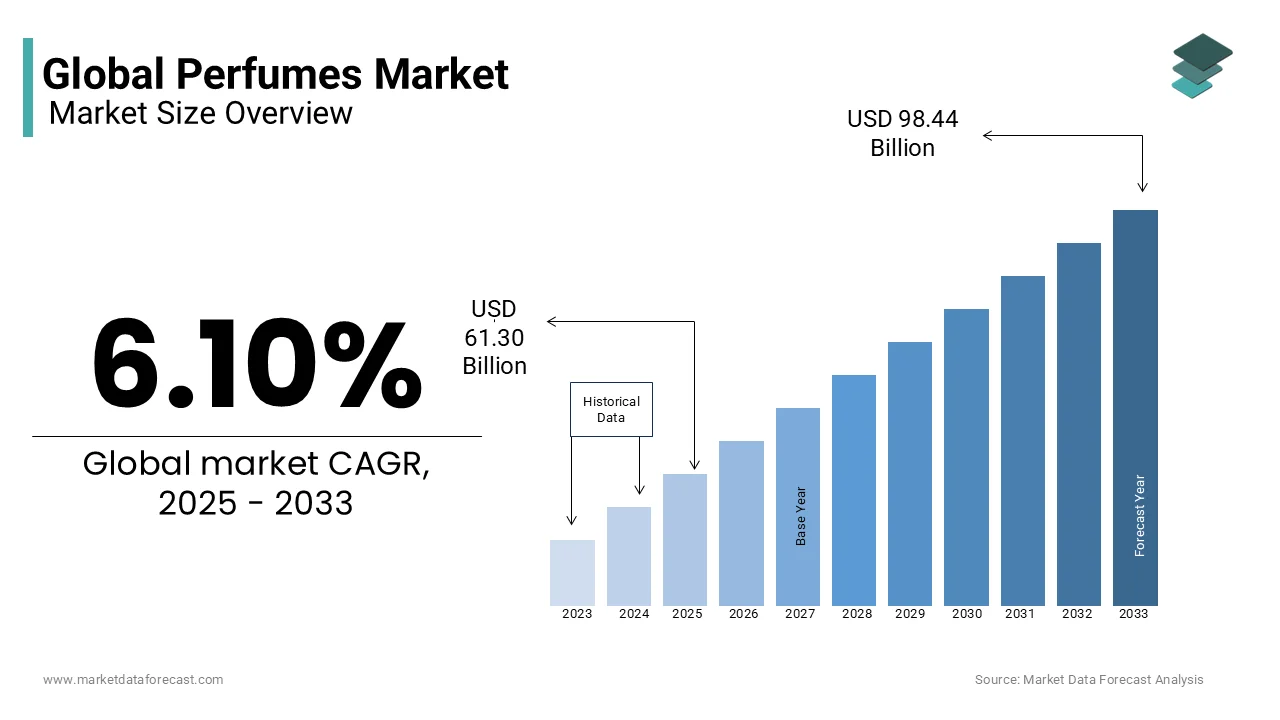

The global perfumes market size was valued at USD 57.78 billion in 2024 and is expected to reach USD 98.44 billion by 2033 from USD 61.30 billion in 2025. The market is projected to grow at a CAGR of 6.10%.

Perfumes are crafted from a delicate balance of essential oils, aroma compounds, and fixatives and have transcended their traditional role as mere scent enhancers to become symbols of identity, status, and even memory. In 2023, the perfumes market continues to evolve and shaped by shifting societal norms, technological advancements, and consumer behavior. For instance, studies indicate that the human sense of smell is intricately linked to memory and emotion, with research published in the journal Chemical Senses suggesting that individuals can recall smells with an accuracy of 65% after one year, compared to only 50% for visual stimuli. This underscores the profound impact fragrances have on personal experiences and their enduring appeal.

According to the Fragrance Foundation, over 75% of consumers associate specific scents with positive memories or emotions that is driving the demand for personalized and evocative fragrances. Furthermore, gender-neutral and unisex perfumes are gaining prominence, reflecting broader societal movements toward inclusivity and fluidity. According to a study conducted by the NPD Group, sales of unisex fragrances have grown by nearly 20% in the past two years, signaling a shift away from traditional gendered marketing. Additionally, the rise of digital platforms has transformed how consumers interact with perfumes, with virtual fragrance consultations and AI-driven scent recommendations becoming increasingly popular. These innovations highlight the industry’s adaptability and its ability to resonate with modern sensibilities.

MARKET DRIVERS

Rising Disposable Incomes and Urbanization

The growth of the perfumes market is significantly propelled by rising disposable incomes and rapid urbanization, particularly in emerging economies. As per the World Bank, the global middle class is expanding, with over 140 million people moving out of poverty annually in developing nations. This economic shift has led to increased spending on luxury and lifestyle products, including fragrances. Urbanization further amplifies this trend, as city dwellers are more exposed to global trends and branded goods. The United Nations Department of Economic and Social Affairs reports that 56% of the global population resides in urban areas, a figure expected to rise to 68% by 2050. Urban consumers prioritize personal grooming, driving demand for premium perfumes. These demographic and economic transformations create a fertile ground for the perfumes market to thrive, particularly in regions like Asia-Pacific and Africa.

Growing Emphasis on Personal Grooming and Self-Care

The increasing focus on personal grooming and self-care practices is another key driver of the perfumes market. A report by the Centers for Disease Control and Prevention highlights that mental health awareness has surged globally, with self-care becoming a priority for millions. Fragrances play a pivotal role in enhancing mood and confidence, making them integral to self-care routines. Additionally, the International Labour Organization notes that workplace grooming standards have become more stringent, encouraging individuals to invest in personal care products. Data from the U.S. Census Bureau reveals that Americans spend enormous amount of money annually on personal care and beauty products, with perfumes accounting for a significant share. This growing cultural emphasis on appearance and well-being underscores the sustained demand for fragrances across diverse demographics.

MARKET RESTRAINTS

Stringent Regulations on Chemical Ingredients

Stringent regulations governing the use of chemical ingredients in perfumes pose a significant restraint on the market. Regulatory bodies such as the European Chemicals Agency (ECHA) have imposed restrictions on allergenic substances like phthalates and synthetic musks, which are commonly used in fragrance formulations. According to the U.S. Food and Drug Administration, a significant number of cosmetic-related complaints involve adverse reactions to fragrance ingredients, prompting stricter compliance measures. These regulations increase production costs and limit innovation, as manufacturers must reformulate products to meet safety standards. Furthermore, the Environmental Protection Agency highlights that improper disposal of perfume chemicals contributes to environmental pollution, leading to additional scrutiny. Such regulatory pressures challenge smaller brands with limited resources, potentially stifling market growth and diversification.

High Production Costs and Supply Chain Disruptions

High production costs and supply chain disruptions are major restraints impacting the perfumes market. The International Trade Administration reports that the cost of essential oils and raw materials, such as sandalwood and jasmine, has risen by up in recent years due to climate change and geopolitical instability. These factors disrupt the availability of key ingredients, forcing manufacturers to seek alternatives or absorb higher costs. Additionally, the COVID-19 pandemic highlighted vulnerabilities in global supply chains, with the World Trade Organization estimating a 5.3% decline in global trade during its peak. Although recovery efforts are underway, logistical challenges persist, affecting production timelines and profit margins. For small and medium-sized enterprises, these financial burdens can be particularly crippling, limiting their ability to compete with larger players and innovate within the market.

MARKET OPPORTUNITIES

Growing Demand for Personalized Fragrances

The demand for personalized fragrances presents a significant opportunity for the perfumes market, driven by advancements in technology and shifting consumer preferences. Customization is a growing trend across industries with 30% of consumers willing to pay a premium for personalized products. In the fragrance sector, innovations such as AI-driven scent profiling and bespoke perfume creation are gaining traction. For instance, a report by the International Fragrance Association notes that niche perfumery, which often includes personalized options, has grown notably annually over the past five years. Furthermore, the rise of e-commerce platforms enables brands to offer tailored experiences directly to consumers, enhancing engagement. By leveraging data analytics and digital tools, companies can cater to individual preferences, fostering brand loyalty and expanding their customer base. This trend underscores the potential for growth in the luxury and artisanal segments of the perfumes market.

Expansion of E-Commerce and Digital Marketing

The rapid expansion of e-commerce and digital marketing offers another major opportunity for the perfumes market. According to the United Nations Conference on Trade and Development, global e-commerce sales reached $4.9 trillion in 2021, with beauty and personal care products accounting for a significant share. The U.S. Department of Commerce reports that online retail sales grew by 8.3% in 2022, driven by increased internet penetration and smartphone usage. Perfume brands are capitalizing on this trend by investing in virtual try-on tools, influencer collaborations, and targeted social media campaigns. Additionally, the World Trade Organization highlights that cross-border e-commerce enables brands to access untapped markets, particularly in regions with limited physical retail infrastructure. By embracing digital strategies, companies can enhance visibility, engage younger demographics, and boost sales, positioning themselves for sustained growth in an increasingly digital world.

MARKET CHALLENGES

Increasing Prevalence of Fragrance Sensitivities

The rising prevalence of fragrance sensitivities poses a significant challenge to the perfumes market, as regulatory bodies and consumer advocacy groups push for stricter ingredient transparency. Approximately 1 in 3 people of the population experiences adverse reactions to fragranced products, ranging from headaches to respiratory issues. This has led to increased scrutiny of synthetic chemicals commonly used in perfumes, such as phthalates and parabens. The European Chemicals Agency has already restricted over 26 allergenic substances in cosmetics, impacting formulation practices globally. Additionally, a study by the U.S. Food and Drug Administration highlights that fragrance-related complaints account for a considerable share of all cosmetic product concerns. These health concerns not only drive regulatory changes but also influence consumer preferences, compelling brands to reformulate products or risk losing market share.

Economic Uncertainty and Inflationary Pressures

Economic uncertainty and inflationary pressures present another major challenge for the perfumes market, particularly in luxury and premium segments. The International Monetary Fund warns that global inflation rates reached an average of 8.7% in 2022, significantly impacting consumer spending patterns. The U.S. Bureau of Labor Statistics notes that discretionary spending on non-essential items, including perfumes, declines during periods of economic downturn. Rising raw material costs, such as essential oils and packaging materials, further exacerbate the issue, with the World Trade Organization reporting a 20% increase in commodity prices due to supply chain disruptions. For smaller brands, these financial pressures can limit innovation and marketing budgets, while larger companies face challenges in maintaining profitability. As consumers prioritize affordability, brands must adapt by offering value-driven options without compromising quality.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.10% |

|

Segments Covered |

By Product, End-User, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

The Avon Company, CHANEL, Coty Inc., LVMH Moet Hennessy-Louis Vuitton, The Estée Lauder Companies, Revlon, Puig, L'Oréal Groupe, Shiseido Company, Ltd., Givaudan, Hermès, KERING, and others |

SEGMENTAL ANALYSIS

By Product Insights

The mass perfumes segment was the major segment in the global perfumes market and held 60.4% of the global market share in 2024. The domination of mass perfumes segment is attributed to its affordability and accessibility, particularly in emerging markets such as India, Brazil, and Southeast Asia. The United Nations Industrial Development Organization notes that mass fragrances are widely distributed through retail channels like supermarkets and drugstores, making them accessible to a broad consumer base. These products cater to price-sensitive consumers, especially in regions with rising middle-class populations. For instance, in India, over 70% of fragrance sales are from the mass segment, driven by urbanization and increased disposable incomes. The segment's importance lies in its ability to maintain steady demand and serve as an entry point for new consumers, ensuring sustained market stability.

The premium perfumes segment is at the high acceleration phase and is predicted to register the highest CAGR of 8.2% over the forecast period owing to the rising disposable incomes and a shift toward luxury consumption, particularly in developed regions like North America and Europe. The U.S. Department of Commerce reports that premium fragrances are increasingly associated with personalization and exclusivity, appealing to affluent consumers seeking unique experiences. Additionally, the rise of niche perfumery and sustainable luxury practices has attracted environmentally conscious buyers. A study by the European Consumer Organisation (BEUC) highlights that over 40% of European consumers are increasingly prioritizing products with sustainable and eco-friendly packaging, including premium fragrances. As millennials and Gen Z prioritize quality and brand storytelling, premium perfumes are becoming a status symbol, driving their rapid expansion and underscoring their strategic importance in the global market.

By End-user Insights

The women segment was at the driving seat in the perfumes market with 55.3% of the global market share in 2024. The cultural association of fragrances with femininity, self-care, and personal expression is majorly driving the female segment in the global market. Likewise, the U.S. Department of Commerce notes that women are more likely to purchase multiple fragrances for different occasions, contributing to sustained demand. Additionally, marketing campaigns targeting women have historically been more extensive, reinforcing their prominence in the market. The segment's importance lies in its ability to generate consistent revenue and influence fragrance trends globally. With rising disposable incomes and urbanization, particularly in regions like Asia-Pacific, the women’s segment remains a cornerstone of the perfumes market, ensuring steady growth and innovation.

The unisex perfumes segment is predicted to achieve the fastest CAGR of 9.3% over the forecast period. Evolving societal norms toward gender fluidity and inclusivity and particularly among younger demographics such as Millennials and Gen Z are all fuelling this growth. A report by the United Nations Department of Economic and Social Affairs highlights that a significant share of Gen Z consumers prioritize products that challenge traditional gender boundaries. Brands are capitalizing on this trend by launching versatile fragrances with minimalist and eco-friendly branding, appealing to a broader audience. The rise of digital platforms has further amplified awareness and accessibility of unisex perfumes. As inclusivity becomes a key consumer value, this segment’s rapid expansion underscores its strategic importance in shaping the future of the perfumes market.

By Distribution Channel Insights

The offline segment held the leading share of the global market share in 2024 owing to the tactile and experiential nature of fragrance shopping, where consumers often prefer testing scents in-store before purchasing. The U.S. Department of Commerce highlights that brick-and-mortar stores, including department stores and specialty retailers, remain critical for luxury and premium perfumes, which benefit from personalized customer service. Moreover, emerging markets such as India and Brazil also rely heavily on offline channels due to limited e-commerce penetration in rural areas. The segment's importance lies in its ability to build brand trust and provide immersive experiences and thereby ensuring it remains a cornerstone of the perfumes market despite the rise of digital alternatives.

The online segment is growing at rapid pace and is estimated to grow at a promising CAGR of 12.4% during the forecast period. Factors such as increasing internet penetration, smartphone usage, and the convenience of e-commerce platforms are primarily boosting the growth of the online segment in the global market. A report by the U.S. Census Bureau notes that global e-commerce sales reached $4.9 trillion in 2021, with beauty and personal care products, including perfumes, showing significant growth. Virtual try-on tools, AI-driven scent recommendations, and influencer marketing have further enhanced online engagement. Additionally, cross-border e-commerce enables brands to reach untapped markets in regions like Asia-Pacific and Africa. The online segment’s rapid expansion underscores its strategic importance in driving accessibility and innovation in the perfumes market as digital adoption accelerates.

REGIONAL ANALYSIS

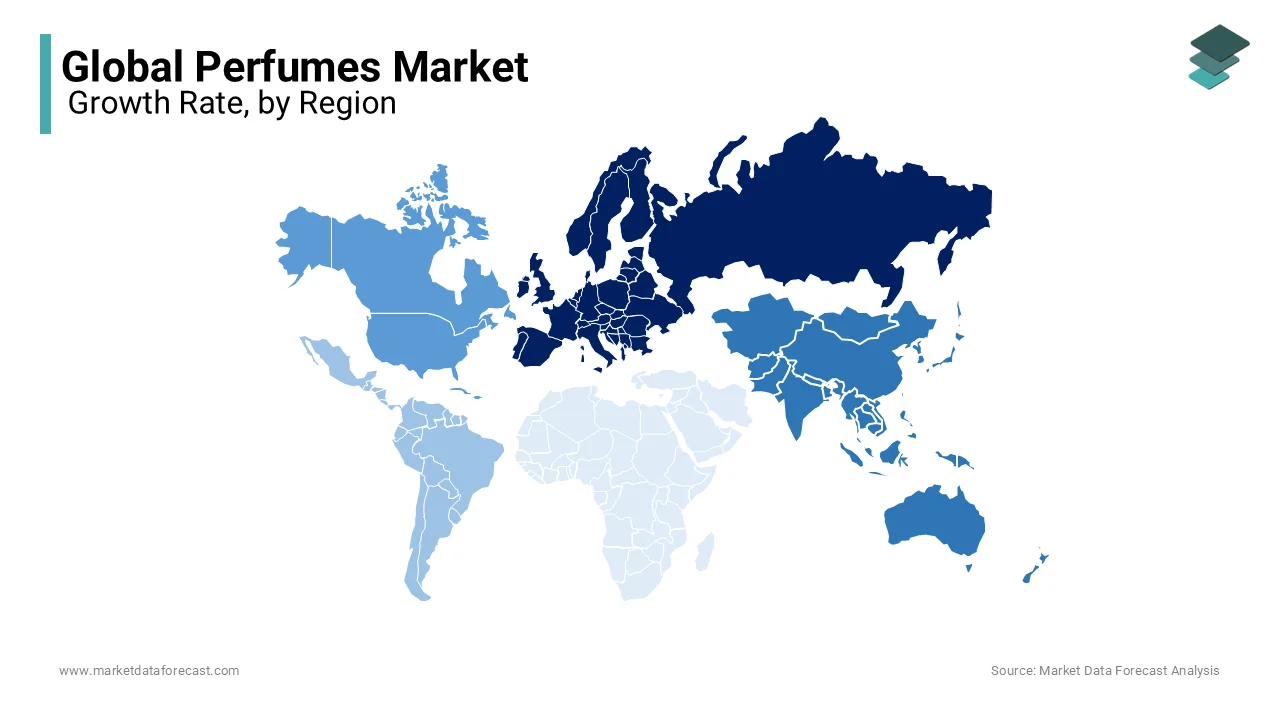

Europe was the most dominating region for perfumes and captured 35.3% of the global market share in 2024. The rich heritage in perfumery in Europe, high disposable incomes, and strong consumer affinity for luxury fragrances are propelling the European market growth. France is often regarded as the global hub of perfumery and contributes significantly to this dominance. The United Nations Industrial Development Organization highlights that Europe’s stringent quality standards and innovation in sustainable practices further solidify its position. With a well-established retail infrastructure and a thriving niche perfumery segment, Europe remains pivotal in shaping global trends and maintaining its leadership in the industry.

The Asia-Pacific region is the emerging region in the global perfumes market with a projected CAGR of 7.5% over the forecast period. This rapid growth is fueled by rising urbanization, increasing disposable incomes, and a growing middle class in countries like China and India. The United Nations Department of Economic and Social Affairs reports that the Asia-Pacific region will account for 60% of the global middle-class population by 2030, propelling demand for premium and personalized fragrances. Additionally, the adoption of digital platforms for e-commerce has expanded market access, particularly among younger demographics. This region’s dynamism underscores its importance as a future growth engine for the global perfumes market.

North America is a mature and stable segment of the perfumes market and is characterized by high consumer spending on luxury goods and a strong e-commerce presence. The region accounts for a notable portion of the global perfumes market. The country is the largest contributor which is driven by urbanization, technological advancements in digital marketing, and a growing preference for personalized fragrances. Additionally, the rise of gender-neutral perfumes aligns with cultural shifts toward inclusivity. While growth may be slower compared to emerging markets, North America remains crucial due to its innovation-driven environment and established retail networks, ensuring steady demand in the coming years.

Latin America is an emerging player in the perfumes market with Brazil leading as one of the top fragrance-consuming countries globally. This growth is fueled by cultural preferences for fragrances, increasing disposable incomes, and urbanization and particularly in countries like Mexico and Argentina. The Brazilian Toiletry, Perfumery, and Cosmetic Association highlights that Brazil alone accounts for a substantial share of Latin America’s beauty and personal care business. Despite economic volatility in some areas, the region’s youthful population and rising adoption of e-commerce platforms present significant opportunities for expansion, making it an attractive market for international brands.

The Middle East and Africa region possesses substantial potential in the perfumes market. It’s progress is influenced by cultural traditions that stresses on the use of fragrances and religious practices favouring scents. The African Development Bank projects steady growth, with the Middle East adding significantly due to its high per capita spending on luxury perfumes. Countries like the UAE and Saudi Arabia are key markets, supported by affluent consumers and robust retail infrastructure. Further, in Africa, urbanization and rising disposable incomes are expected to drive demand, particularly in South Africa and Nigeria. The World Trade Organization notes that cross-border trade and investments in retail channels will further boost accessibility. While challenges like economic disparities persist, this region’s cultural affinity for fragrances ensures sustained growth in the foreseeable future.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

The Avon Company, CHANEL, Coty Inc., LVMH Moet Hennessy-Louis Vuitton, The Estée Lauder Companies, Revlon, Puig, L'Oréal Groupe, Shiseido Company, Ltd., Givaudan, Hermès, KERING are playing the dominating role in the global perfumes market.

The global perfumes market is highly competitive and driven by luxury branding, product innovation, celebrity endorsements, and digital transformation. Major players like LVMH, Estée Lauder, and Coty dominate by expanding their brand portfolios, acquiring new businesses, and reaching customers worldwide. These companies stay ahead by launching new fragrances, premium editions, and sustainable products to match changing consumer preferences.

Smaller niche and indie fragrance brands are also gaining popularity with their unique scents, handmade quality, and personalized experiences. Brands like Le Labo, Byredo, and Maison Francis Kurkdjian are competing with luxury giants by offering high-priced exclusive perfumes with simple branding and natural ingredients.

Online shopping and direct-to-consumer (DTC) sales have changed the industry by helping smaller brands reach global customers without relying on traditional stores. New markets in Asia, the Middle East, and Latin America are becoming major areas of growth as more people can afford luxury perfumes.

As customers look for sustainable and ethical products, brands are competing by offering eco-friendly production, recyclable packaging, and cruelty-free perfumes, shaping the future of the perfume industry.

TOP 3 PLAYERS IN THE MARKET

LVMH Moët Hennessy Louis Vuitton (LVMH)

LVMH is a French multinational conglomerate renowned for its diverse portfolio of luxury brands. In the fragrance sector, LVMH boasts iconic names such as Dior, Givenchy, and Guerlain. Dior's Sauvage, for instance, has achieved remarkable success, becoming the world's best-selling perfume and selling a bottle every three seconds. LVMH's strategy of combining heritage brands with innovative marketing has solidified its leading position in the global perfumes market.

Estée Lauder Companies

An American multinational, Estée Lauder has established itself as a powerhouse in the beauty and fragrance industries. With a diverse portfolio that includes brands like Jo Malone, Tom Ford, and its flagship Estée Lauder line, the company appeals to a wide range of consumers. In fiscal year 2023, Estée Lauder reported annual sales of $15.9 billion, underscoring its significant presence in the market. The company's success is driven by strategic acquisitions, high-quality offerings, and a robust global presence.

Coty Inc.

Coty is a global beauty company with a strong focus on fragrances. Its extensive brand portfolio includes Calvin Klein, Marc Jacobs, and Gucci fragrances. Under the leadership of CEO Sue Nabi, Coty has emphasized innovation and quality, aiming to resonate with younger consumers who view fragrance as a form of personal expression. This approach has reinforced Coty's position as a key player in the global perfumes market.

STRATEGIES USED BY THE MARKET PLAYERS

One of the most effective strategies used by top perfume companies is portfolio diversification and brand expansion. By offering a wide range of products, from mass-market to ultra-luxury fragrances, these companies cater to diverse consumer segments. For instance, LVMH ensures that its premium brands such as Dior, Guerlain, and Givenchy appeal to affluent consumers, while Coty reaches a broader audience with Adidas and David Beckham fragrances. This approach allows companies to maximize market penetration and attract both luxury buyers and budget-conscious shoppers.

Luxury positioning and premiumization play a critical role in the dominance of leading perfume brands. These companies emphasize exclusivity, high-quality ingredients, and elegant packaging to position their products as aspirational. LVMH, for example, has ensured that Dior Sauvage remains a global best-seller by associating it with luxury and sophistication. Similarly, Coty’s premium offerings, such as Gucci Bloom and Burberry Hero, capitalize on brand heritage and craftsmanship to maintain strong consumer demand.

Another key strategy is strategic acquisitions and licensing agreements, which allow perfume companies to expand their brand portfolios and market reach. Estée Lauder’s acquisition of Tom Ford Beauty for $2.8 billion reinforced its luxury fragrance sector, while Coty has acquired or partnered with brands like Calvin Klein, Burberry, and Marc Jacobs to strengthen its global presence. These acquisitions ensure that major players maintain control over top-performing brands while continuously expanding their market share.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Monogram Capital Partners, a private equity firm, acquired a majority stake in Tru Fragrance & Beauty, a global beauty brand builder with a portfolio of owned, licensed, and exclusive fragrance and beauty brands. This acquisition is expected to help Monogram expand Tru’s market presence and enhance its product offerings.

- In February 2024, Yellow Wood Partners, a private equity firm, completed the acquisition of Elida Beauty from Unilever. Elida Beauty’s portfolio includes brands such as Q-tips, Caress, Ponds, St. Ives, Impulse, and Noxzema. This acquisition is aimed at revitalizing these heritage brands and strengthening their market positioning.

MARKET SEGMENTATION

This research report on the global perfumes market has been segmented and sub-segmented based on product, end-user, distribution channel, and region.

By Product

- Mass

- Premium

By End-user

- Men

- Women

- Unisex

By Distribution Channel

- Offline

- Online

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the Compound Annual Growth Rate (CAGR) of the perfumes market?

The market is expected to grow at a CAGR of 6.10% during the forecast period.

2. Why is personalized fragrance demand increasing?

Advancements in technology and changing consumer preferences are driving demand for customized fragrances. About 30% of consumers are willing to pay a premium for personalized products.

3. Which segment dominates the global perfumes market?

The mass perfumes segment held 60.4% of the global market share in 2024, driven by affordability and accessibility, especially in emerging markets like India, Brazil, and Southeast Asia.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]