Global Peptide Therapeutics Market Size, Share, Trends & Growth Forecast Report By Type, Application, Type of Manufacturers, Route of Administration, Synthesis Technology and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Peptide Therapeutics Market Size

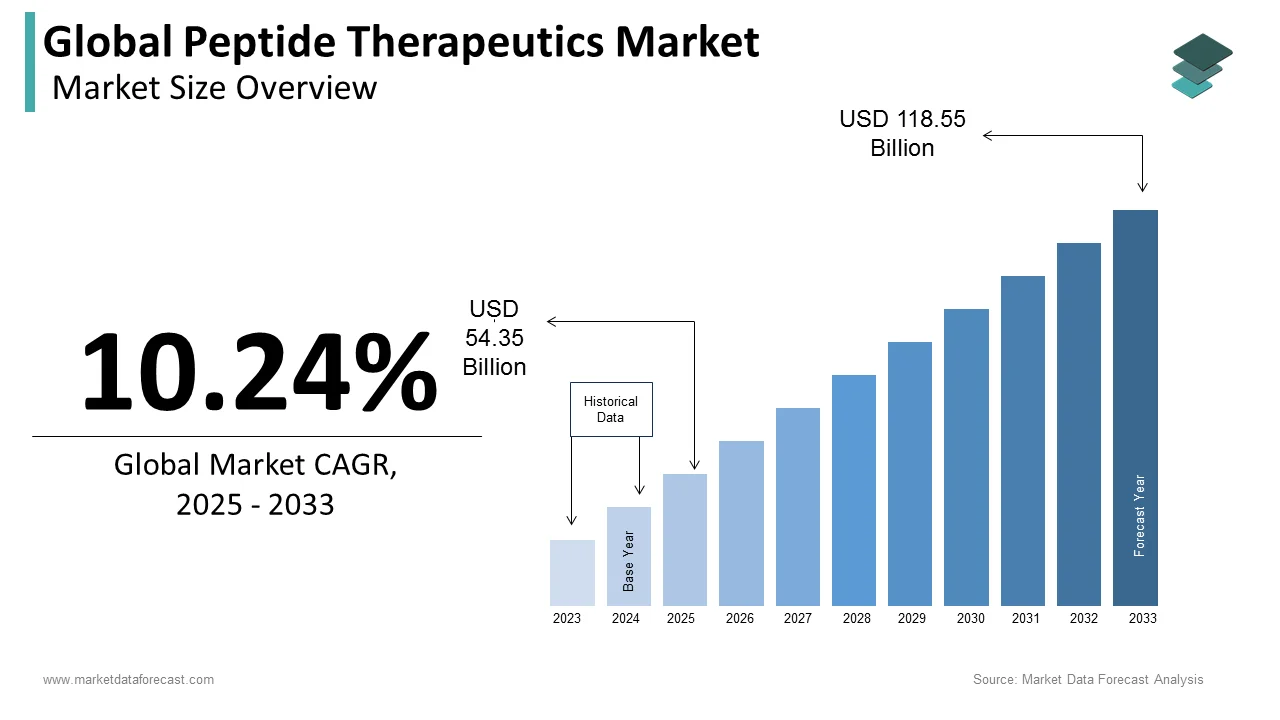

The size of the global peptide therapeutics market was worth USD 49.3 billion in 2024. The global market is anticipated to grow at a CAGR of 10.24% from 2025 to 2033 and be worth USD 118.55 billion by 2033 from USD 54.35 billion in 2025.

MARKET DRIVERS

The growing developments in peptide therapeutics and the rising prevalence of metabolic disorders and infectious diseases drive the global peptide therapeutics market growth.

Peptide processing requires a low cost of production, and the demand for peptide therapeutics is expected to expand over the projected period due to increased clinical applications. Other factors increasing the market expansion are rising advances in research and production of new medicines and technical developments in peptide therapeutics. In addition, increased healthcare spending is also expected to help the peptide therapeutics market to expand. Peptides are effective precursors in developing new therapeutics due to their inherent properties of specificity, safety, tolerability, and ability to produce expected human results. The global peptide therapeutics market is expected to develop if more hybrid technologies are introduced to achieve economies of scale. Furthermore, compared to traditional pharmaceutics, peptide therapeutics have greater effectiveness and clinical results with fewer side effects, increasing their popularity among patients and prescribers.

MARKET RESTRAINTS

Natural peptides' poor chemical and physical stability and low circulating plasma half-life hinder the global peptide therapeutics market growth. In addition, the low oral bioavailability of peptide drugs due to injection administration and poor intestinal mucosa penetration will likely limit demand development shortly.

COVID-19 Impact On The Global Peptide Therapeutics Market

COVID-19 is a worldwide pandemic caused by the coronavirus (SARS-CoV-2), a severe acute respiratory syndrome (SARS). People who had covid had respiratory issues. The use of peptide molecules in developing the COVID-19 vaccine is expected to increase, boosting market growth. Peptides are attractive to pharmaceutical producers because they are simple to manufacture. Compared to the old trial-and-error method, today's approach begins with a thorough understanding of the disorder on a molecular basis. Then, experimental medicines are developed based on drug result predictions. Furthermore, extensive government support for the use of peptides in the formulation of the COVID-19 vaccine is expected to provide a potential catalyst for peptide adoption, potentially stimulating the growth of the peptide therapeutics industry.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.24% |

|

Segments Covered |

By Type, Application, Type of Manufacturers, Route of Administration, Synthesis Technology, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Eli Lilly and Company, Amgen, Inc., Pfizer, Inc., Bristol-Myers Squibb Company, Ever Neuro Pharma GmbH, Takeda Pharmaceutical Company Limited, AstraZeneca PLC, GlaxoSmithKline plc, Novo Nordisk A/S., Novartis AG, Zealand Pharma AG, AmbioPharm Inc., Bachem Holding AG, PolyPeptide Group, Sanofi SA, Amylin Pharmaceuticals, CirclePharma, Inc., PeptiDream Inc., Apitope Technology, Arch NioPartners, and Galena Biopharmaceuticals, and Others. |

SEGMENTAL ANALYSIS

By Type Insights

Based on the type, Due to increased investments by large pharmaceutical companies in R&D for developing novel drugs and high prescription rates, Innovative peptides dominated and had the highest share. The rising investments in the innovation of new drugs and products support the segment's growth.However, the generic segment is also expected to have significant growth during the forecast period due to a need to curb healthcare medicinal costs and rising investments from federal governments. Additionally, there has been a loss of patents for several branded drugs, creating an opportunity for the generic market players, which provide drugs at a lower cost.

By Route of Administration Insights

Based on the route of administration, in 2020, the Parenteral route segment had the largest market share; however, the oral segment is expected to grow at the fastest rate over the forecast period. The parenteral route is the most commonly used mode of administration as it is the most tested and safely performed function leading to segment growth. However, there has been continuous research on other routes of administration and their efficiency, like the pulmonary route of administration, even though several drawbacks obstruct the pulmonary route, like causing inflammation and the lack of availability of low-weighing molecules which would be able to cross the alveolar epithelium.

By Synthesis Technology Insights

Based on Synthesis Technology, Because of the growing need for pure peptides to develop effective medicines, the Liquid Phase Peptide Synthesis (LPPS) segment led in 2020. However, the SPPS segment is expected to exceed the LPPS segment due to its advantages like faster synthesis time, more efficiency, durability, scalability, and a grip over peptides' physical and chemical characteristics. The hybris segment is also expected to grow as it is an intermediate between LPPS and SPPS and can benefit from both processes. Due to this dual property system, many market players opt for hybrid systems.

REGIONAL ANALYSIS

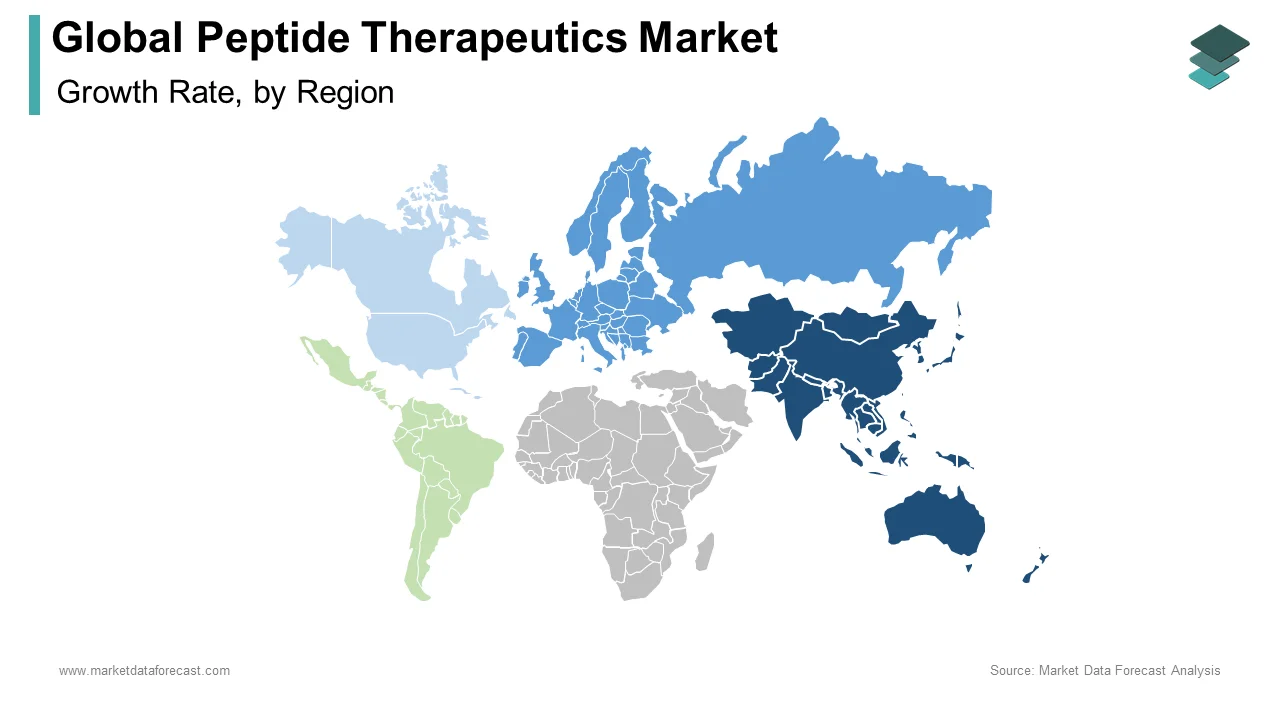

Due to high untapped opportunities, low raw material costs, a rising base of companies offering outsourcing services, a growing biotech industry, and increasing R&D investments, the Asia Pacific peptide therapeutics market is projected to expand significantly. In addition, cheaper raw materials and the expiration of patents on blockbuster products are likely to fuel the generic market shortly, providing significant growth opportunities.

KEY MARKET PLAYERS

Eli Lilly and Company, Amgen, Inc., Pfizer, Inc., Bristol-Myers Squibb Company, Ever Neuro Pharma GmbH, Takeda Pharmaceutical Company Limited, AstraZeneca PLC, GlaxoSmithKline plc, Novo Nordisk A/S., Novartis AG, Zealand Pharma AG, AmbioPharm Inc., Bachem Holding AG, PolyPeptide Group, Sanofi SA, Amylin Pharmaceuticals, CirclePharma, Inc., PeptiDream Inc., Apitope Technology, Arch NioPartners, and Galena Biopharmaceuticals are some of the prominent companies operating in the global peptide therapeutics market.

RECENT MARKET DEVELOPMENTS

- In January 2024, Eli Lilly and Merck & Co. committed more than $1 billion in milestone payments to cooperate with the company because they have determined that PeptiDream's peptides can be used to deliver therapeutic payloads to targets. A Japanese biotech company called PeptiDream has secured several contracts with pharmaceutical companies, including Alnylam and Takeda, thanks to the strength of its peptide discovery platform system.

- In December 2020, Takeda Pharmaceutical Company Limited and PeptiDream Inc. agreed to collaborate on research and produce peptide-drug conjugates (PDCs) for neuromuscular diseases under an exclusive license agreement.

MARKET SEGMENTATION

This research report on the global peptide therapeutics market has been segmented and sub-segmented based on the type, application, type of manufacturers, route of administration, synthesis technology, and region.

By Type

- Generic

- Innovative

By Application

- Metabolic

- Cardiovascular Disorder

- Respiratory

- GIT

- Anti-infection

- Pain

- Dermatology

- CNS

- Renal

- Others

By Type of Manufacturers

- In-house

- Outsourced

By Route of Administration

- Parenteral Route

- Oral Route

- Pulmonary

- Mucosal

- Others

By Synthesis Technology

- Solid Phase Peptide Synthesis (SPPS)

- Liquid Phase Peptide Synthesis (LPPS)

- Hybrid Technology

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

At What CAGR, the global peptide therapeutics market is expected to grow from 2025 to 2033?

The global peptide therapeutics market is estimated to grow at a CAGR of 10.24% from 2025 to 2033.

Which region is growing the fastest in the global peptide therapeutics market?

Geographically, the North American peptide therapeutics market accounted for the largest global market share in 2024.

What was the size of the peptide therapeutics market worldwide in 2024?

The global peptide therapeutics market size was valued at USD 49.30 billion in 2024..

Does this report include the impact of COVID-19 on the peptide therapeutics market?

Yes, we have studied and included the COVID-19 impact on the global peptide therapeutics market in this report.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]