Global Patient Engagement Solutions Market Size, Share, Trends & Growth Forecast Report By Delivery (Web-based and Cloud-based, On-premises), Components (Software, Hardware and Services), End-Users (Health Management, Social Management, Financial Health Management and Home Healthcare Management), Application, Therapeutic Area and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033

Global Patient Engagement Solutions Market Size

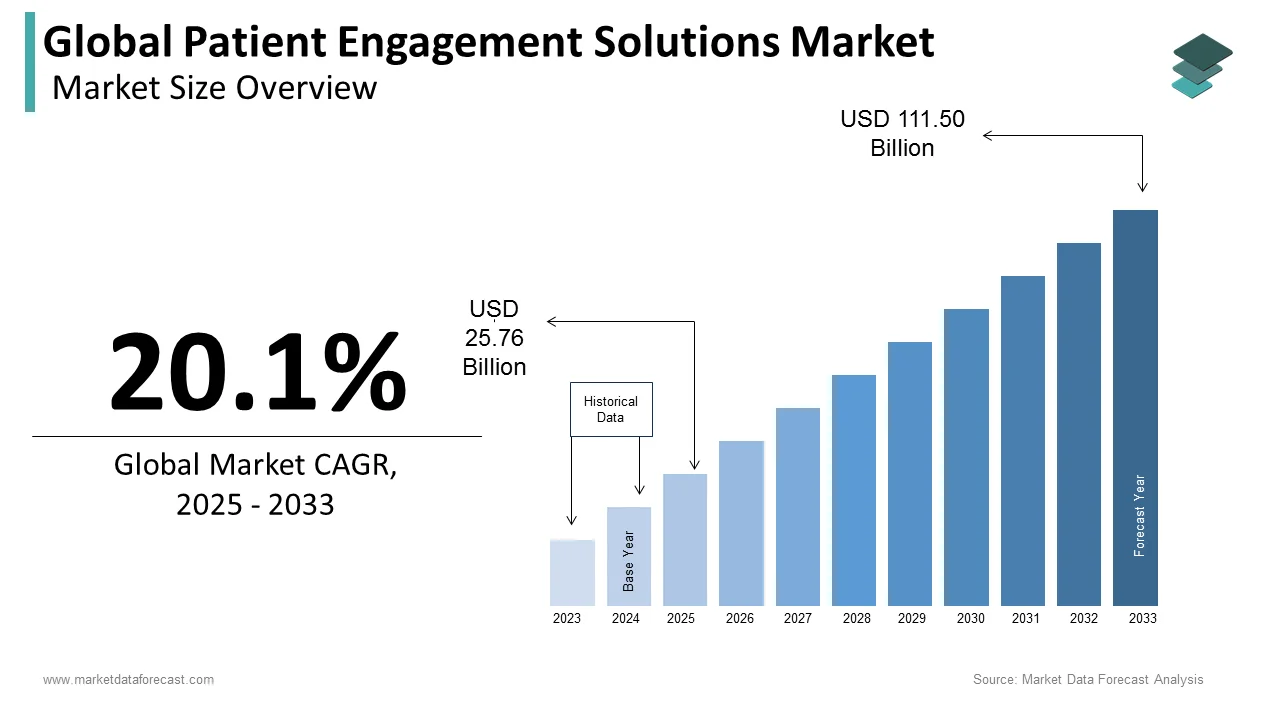

The size of the global patient engagement solutions market was worth USD 21.45 billion in 2024. The global market is anticipated to grow at a CAGR of 20.1% from 2025 to 2033 and be worth USD 111.50 billion by 2033 from USD 25.76 billion in 2025.

MARKET DRIVERS

Growing Demand for Patient-centered Healthcare

The governments of several countries and hospitals have been putting increased focus on delivering patient-centered healthcare over the last few years and the trend is expected to continue further in the coming years. The growing emphasis and adoption of a patient-centered healthcare approach are fuelling the usage of patient engagement technologies and solutions. Using patient engagement solutions, patients can communicate with their healthcare providers and patients can share health information with healthcare providers and patients can also be involved in the treatment procedures. As per the findings of a study conducted by HealthIT.gov, an estimated 88% of U.S. adults agreed that using patient engagement solutions such as patient portals, mobile apps and wearable medical devices has helped them manage their health effectively.

The growing patient population suffering from chronic diseases such as diabetes and hypertension is boosting the growth of the patient engagement solutions market. As per the data published by Accenture, the usage of patient engagement solutions among the chronic disease patient population ranges between 52% and 76%. Patients suffering from chronic diseases require ongoing care and disease management. To such patients, patient engagement solutions have been helping significantly in communicating with healthcare providers and participating in treatment procedures. Patient engagement tools such as mobile apps, patient portals, remote monitoring devices, and other digital platforms help patients to actively participate in treatment procedures and address their needs.

Many governments, patients, and healthcare providers have realized the importance of patient engagement solutions in delivering improved healthcare outcomes and reducing healthcare costs. As a result, several governments made regulations and have brought initiatives in favor of patient engagement solutions. The Medicare Access and CHIP Reauthorization Act (MACRA) and the Affordable Care Act (ACA) in the United States were announced to provide rewards to healthcare providers to boost the adoption of patient engagement solutions to further deliver improved healthcare outcomes and reduce healthcare costs to patients. In addition, the Centers for Medicare and Medicaid Services (CMS) announced rewarding programs to healthcare providers to use patient engagement solutions. Likewise, the Digital Single Market initiative in Europe by the European Commission has been encouraging healthcare professionals to adopt digital health technologies, including patient engagement solutions. Similarly, other regions, such as the Asia-Pacific and Latin America, are introducing initiatives and regulations to boost the adoption of patient engagement solutions in the respective healthcare systems.

In addition, an increasing number of advancements in healthcare technologies, rising adoption of mHealth and telemedicine, growing usage of social media and digital channels in the healthcare industry and increasing adoption of electronic health records (EHR) are fuelling the growth rate of the patient engagement solutions market. The growing healthcare costs, the rising need for cost-effective healthcare solutions, the increasing aging population worldwide and the growing focus on population health management are supporting the growth of the patient engagement solutions market.

Furthermore, the growing adoption of cloud-based solutions, rising penetration of artificial intelligence and machine learning in the healthcare industry, and increasing awareness among people regarding the benefits of patient engagement solutions and technologies are supporting the market's growth rate. Factors such as rising emphasis on patient feedback and experience by the hospitals, increasing adoption of personalized medicine, the growing shift from fee-for-service to value-based reimbursement models, increasing importance of patient data analytics and insights and rising prevalence of mental health and behavioral health conditions are sharing favorable impact on the growth of the patient engagement solutions market.

MARKET RESTRAINTS

Poor awareness levels among people and healthcare providers regarding the benefits of patient engagement solutions and technologies in some countries are hampering the growth rate of the overall market. Privacy and security concerns associated with the usage of patient engagement solutions are another significant attribute hindering market growth. High costs associated with the implementation and training of patient engagement solutions are notable factors impeding market growth. Due to these high costs, the adoption of patient engagement solutions is being limited among the smaller healthcare providers. In addition, the complexities that patients are facing when using patient engagement technologies, interoperability issues, and the stringent regulatory environment for these solutions are inhibiting the market’s growth rate.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Delivery, Components, End-Users, Application, Therapeutic Area, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Market Leaders Profiled |

Allscripts Healthcare Solutions, Inc., Athenahealth, Inc., Cerner Corporation, IBM, Lincor Solutions, Mckesson Corporation, Medecision, Inc., Orion Health Ltd., Yourcareuniverse, Inc., and Welvu. |

SEGMENTAL ANALYSIS

By Delivery Insights

The web and cloud-based segment had the largest share of the global patient engagement solutions market in 2024 and the domination of the segment is likely to continue throughout the forecast period. The web and cloud-based segment is also expected to register the highest CAGR during the forecast period. The growth of the segment is majorly driven by the increasing adoption of cloud computing technology and the growing preference for web-based solutions among healthcare providers. The benefits of cloud-based delivery, such as scalability, flexibility, and cost-effectiveness, are another notable factor contributing to the segment’s growth rate. The rising adoption of telemedicine and remote patient monitoring are favoring segmental growth as these cloud-based solutions can be accessed at any time and from anywhere. According to a recent HIMSS Analytics Survey in 2018 in the United States, an estimated 83% of healthcare organizations use cloud-based solutions.

On the other hand, the on-premises segment accounted for a considerable share of the global patient engagement solutions market in 2022 and is expected to grow at a steady CAGR during the forecast period. On-premises solutions offer better data security and privacy concerns, which is majorly driving segmental growth. On-premises solutions offer greater flexibility and customization options compared to cloud-based solutions, which is further favoring the growth rate of the segment.

By Components Insights

The software segment captured the leading share of the global patient engagement solutions market in 2024 and the domination of the segment is predicted to continue throughout the forecast period. During the forecast period, the software segment is expected to register the highest CAGR. The growing adoption of technological developments to develop effective and innovative software solutions that can help patients in their healthcare journey and increasing investments by the key market participants to develop advanced software solutions are majorly propelling segmental growth. Factors such as rising demand for patient-centered care, increasing patient population suffering from chronic diseases and a growing number of initiatives from several governments in favor of patient engagement solutions are contributing to the growth rate of the segment. In the sub-segments, the integrated segment is expected to hold the leading share of the global market during the forecast period.

On the other hand, the services segment is estimated to capture a substantial share of the global market during the forecast period. The growing need to provide personalized solutions to patients as per the individual needs and preferences of healthcare providers is promoting the need to tailor patient engagement solutions as per convenience, which is majorly driving segmental growth. In addition, the complexity of healthcare systems and the increasing need to provide education and training to healthcare providers to help them manage patient engagement solutions are contributing to segmental growth.

By End-Users Insights

The provider segment occupied the leading share of the worldwide market in 2024 and is predicted to witness a healthy CAGR during the forecast period. The growing adoption of digital health technologies such as patient portals, mobile apps, and telemedicine platforms to better patient engagement and communication is majorly propelling segmental growth. As per the survey conducted by Accenture, an estimated 63% of patients have shown interest in using digital health technologies in treatment procedures and disease management and 91% of the patients who used digital health technologies felt comfortable and satisfied using patient engagement technologies during the treatment procedures. In recent years, the demand and usage of patient engagement solutions such as telemedicine platforms have increased dramatically due to the COVID-19 pandemic. The rising demand for patient-centered healthcare approach and value-based care by healthcare providers and governments are favoring the segment’s growth rate.

By Application Insights

The health management segment held the major share of the global patient engagement solutions market in 2024 and is expected to grow consistently during the forecast period. Patients have been using patient engagement solutions for a variety of purposes, including disease management, medication management, and remote monitoring. The growing patient population suffering from chronic diseases is primarily boosting segmental growth. As per the data published by the CDC, an estimated six out of ten adults in the U.S. are suffering from at least one chronic disease. The growing need for cost-effective healthcare solutions, the rising adoption of personalized medicine, and the increasing adoption of technological developments are supporting the segment’s growth rate.

On the other side, the social management segment is predicted to grow at a notable CAGR during the forecast period in the global patient engagement solutions market. The growing importance of social determinants of health and the increasing role of patient engagement solutions to address these social determinants of health and improve patient outcomes are primarily promoting the growth of the segment.

By Therapeutic Area Insights

The chronic diseases segment had the largest share of the global patient engagement solutions market in 2024 and is expected to showcase a healthy CAGR during the forecast period. The number of people diagnosed with various chronic diseases is growing significantly with each year passing. The incidence of chronic diseases is higher among developed countries than din eveloping countries. Cancer, diabetes, CVDs and obesity are some of the major chronic diseases. People suffering from chronic diseases require continuous monitoring, treatment, and lifestyle management. The growing prevalence of chronic diseases, the increasing need for patient engagement among the chronic disease patient population, and the growing need to curb the healthcare costs of chronic disease patients are fuelling segmental growth. Furthermore, the increasing adoption of technologically well-developed medical devices and healthcare platforms such as wearables, telemedicine, and remote monitoring to promote patient engagement between healthcare providers and patients is favoring the growth rate of the segment.

On the other side, the fitness segment is expected to grow at a promising CAGR during the forecast period. Factors such as the growing awareness of the importance of physical activity and exercise for health and the rising prevalence of lifestyle-related health conditions such as obesity and diabetes are majorly propelling segmental growth. In addition, factors such as the growing adoption of technological developments such as fitness trackers, wearables, and mobile apps that facilitate patient engagement in fitness and increasing interest in wellness and preventive health by people are fuelling the growth rate of the segment.

REGIONAL ANALYSIS

North America was the largest regional segment in the worldwide patient engagement solutions market in 2024 and the regional domination is predicted to continue throughout the forecast period. The growth of the North American patient engagement solutions market is majorly driven by the presence of well-established healthcare infrastructure, favorable government initiatives, and increasing healthcare expenditure. In addition, the growing prevalence of chronic diseases across North America and the presence of key market participants such as Cerner Corporation, Epic Systems Corporation, and Allscripts Healthcare Solutions, Inc. in North America are contributing to the regional market growth. In addition, the rising adoption of healthcare IT solutions such as electronic health records (EHRs), telehealth, and mHealth are other notable factors fuelling the growth rate of the North American market. Furthermore, the growing demand for patient engagement solutions in chronic disease management and preventive healthcare is promoting the growth rate of the patient engagement solutions market in North America. The U.S. market accounted for the major share of the North American market in 2024, followed by Canada. The growth of the U.S. market can be attributed to the growing adoption of digital health technologies and the increasing usage of smartphones and the Internet for health management.

The European patient engagement solutions market was the second biggest regional market globally in 2024 and is anticipated to witness a healthy CAGR during the forecast period. Factors such as rising demand for improved patient care and increasing adoption of advanced technologies in healthcare are primarily driving the European market growth. The growing number of government initiatives and funding for healthcare IT solutions are further favoring the growth rate of the European market. Furthermore, the rising aging population across Europe, the increasing burden of chronic diseases, such as cancer, diabetes, and cardiovascular diseases, and growing healthcare expenditure in countries such as Germany, France, and the UK are driving the patient engagement solutions market in the European region. The UK market held the leading share of the European market in 2024, followed by Germany and France.

The APAC patient engagement solutions market is estimated to showcase the fastest CAGR during the forecast period. The growth of the APAC market can be attributed to the favorable government initiatives of China, India, and Japan, as well as the rapid adoption of digital healthcare technologies. In addition, the growing adoption of telemedicine and mHealth solutions in rural areas with limited access to healthcare services is another notable factor contributing to the market growth in the Asia-Pacific region. China occupied the leading share of the APAC market in 2021, followed by India and Japan.

The Latin American patient engagement solutions market is anticipated to hold a considerable share of the worldwide market during the forecast period. The growing number of improvements in the healthcare infrastructure among Latin American countries and rising funding from governmental and non-governmental organizations are promoting market growth in Latin America. The growing demand for healthcare IT solutions in countries such as Brazil and Mexico and the rising number of people suffering from diabetes, obesity, and hypertension are contributing to the Latin American market growth. Brazil accounted for the major share of the Latin American market in 2024, followed by Mexico and Argentina.

The MEA patient engagement solutions market is forecasted to hold a moderate share of the worldwide market in the coming years. The UAE accounted for the major share of the MEA market in 2021, followed by Saudi Arabia and South Africa.

KEY MARKET PLAYERS

Notable companies leading the global patient engagement solutions market profiled in this report are Allscripts Healthcare Solutions, Inc., Athenahealth, Inc., Cerner Corporation, IBM, Lincor Solutions, Mckesson Corporation, Medecision, Inc., Orion Health Ltd., Yourcareuniverse, Inc., and Welvu.

RECENT MARKET DEVELOPMENTS

- In March 2020, Allscripts Inc. assisted U.S. healthcare organizations in executing telehealth support for virtual patient visits within a short period. In addition, the industry has generated comprehensive strategies for clients to implement telehealth at their organizations over its agnostic-patient engagement platform.

- In June 2020, Athenahealth, Inc. introduced Athena Telehealth, a new embedded healthcare provider to conduct telemedicine visits with their patients correctly, allowing the providers to improve patient care.

- In December 2019, Cerner Corporation made a public statement incorporating Change Healthcare solutions to automate acute case management and improve patient care.

MARKET SEGMENTATION

This market research report on the global patient engagement solutions market has been segmented and sub-segmented into the following categories.

By Delivery

- Web-based and Cloud-based

- On-premises

By Components

- Software

- Standalone

- Integrated

- Services

- Consulting

- Education

- Others

- Hardware

By End-Users

- Payers

- Providers

- Individual Users

By Application

- Health Management

- Social Management

- Financial Health Management

- Home Healthcare Management

By Therapeutic Area

- Chronic diseases

- Diabetes

- Obesity

- Cardiovascular

- Others

- Fitness

- Mental Health

- Women's Health

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How much is the global patient engagement solutions market going to be worth?

As per our research report, the global patient engagement solutions market size is forecasted to be worth USD 92.85 billion by 2032.

Which segment by delivery is predicted to dominate the patient engagement solutions market in the coming years?

Based on delivery, the cloud-based segment is forecasted to be growing at the fastest CAGR in the global patient engagement solutions market from 2024 to 2032.

Which are the top market participants in the patient engagement solutions market?

Allscripts Healthcare Solutions, Inc., Athenahealth, Inc., Cerner Corporation, IBM, Lincor Solutions, Mckesson Corporation, Medecision, Inc., Orion Health Ltd., Yourcareuniverse, Inc., and Welvu are some of the noteworthy companies operating in the global patient engagement solutions market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]