Global Packaged Vegan Food Market Size, Share, Trends & Growth Forecast Report By Product (Dairy Alternatives, Packaged Meals, Meat Alternatives, Bakery and Confectionery), Distribution Channel and Region(North America, Europe, Asia-Pacific, Latin America, Middle East And Africa), Industry Analysis (2025 to 2033)

Global Packaged Vegan Food Market Size

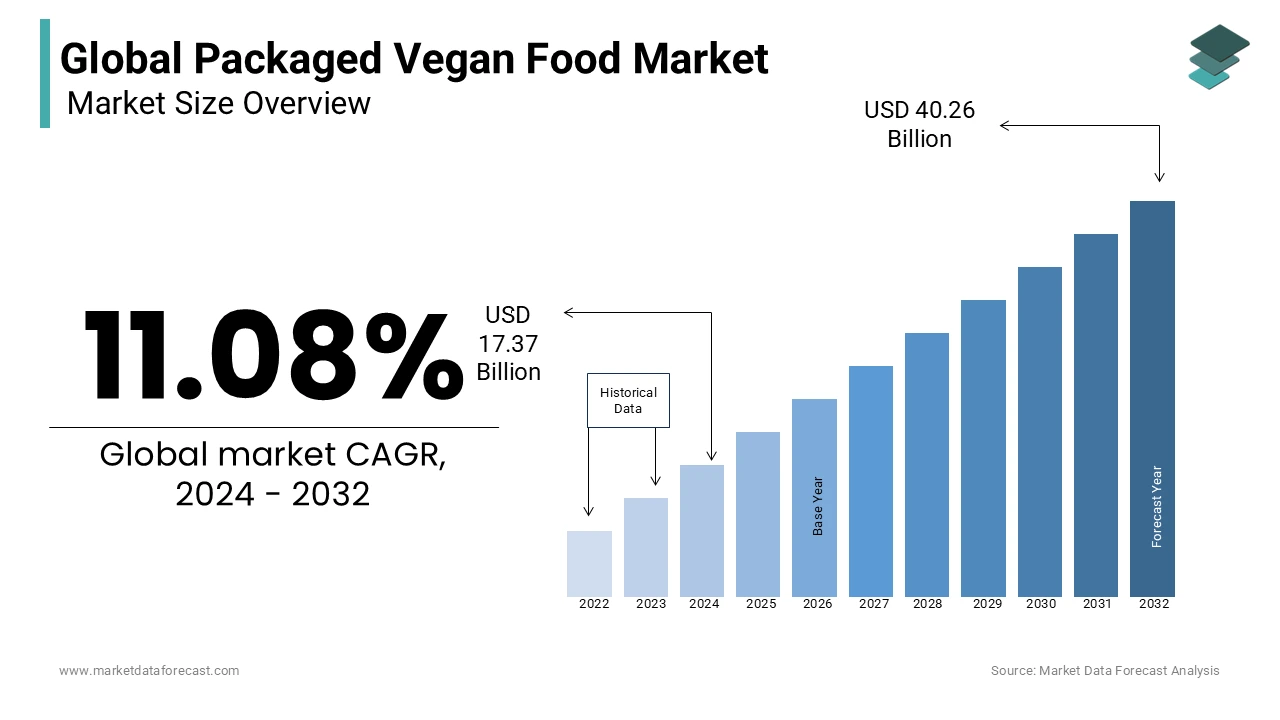

The size of the global packaged vegan food market was valued at USD 17.37 billion in 2024. The global market is further estimated to grow from USD 19.29 billion in 2025 to USD 44.71 billion by 2033, experiencing a CAGR of 11.08% from 2025 to 2033.

The packaged vegan food market is rapidly gaining traction, with Europe and North America leading the way. According to Packaging Gateway, over 1610 new vegan menus and products alone were introduced in 2023 and discovered that customers are searching for simple and less processed foodstuffs that pitch in sustainability and value. Veganism is quickly spreading around the world. As per the World Population Review, the United Kingdom has the maximum number of vegans among all the nations globally, followed by the USA. Moreover, the market growth is primarily fueled by the rising consciousness about its health benefits. In India, the intake of wholesome, organic, and vegan foods is trending upward, which has surged the availability and accessibility of plant-derived food choices in prominent supermarkets. Considering the country’s growing economy, urbanization, consumer spending power and cardiovascular patients, this market is expected to thrive in the coming years. Health is also the biggest factor in European people's consumption of less meat. According to ProVeg International, more than 51% of people in Europe are lowering their meat consumption, with Germany and Italy witnessing a maximum decline at 59%, and well-being is the main reason (47%). Animal welfare is the second reason for eating less meat. Therefore, the market is rapidly growing with Europe and North America in the command.

MARKET DRIVERS

Rising Trend of Veganism

The growing trend of veganism and increasing awareness among people regarding the health benefits associated with consuming vegan food boosts market growth. The number of people turning vegan is exponentially growing owing to their love and consideration toward animals and the environment. One of the main drivers of processed vegan food is the health benefits it provides, such as helping to prevent diseases such as heart attack and diabetes. According to various studies, the incidence rate of cancer in vegans is only 40% than that of meat eaters. Besides type 2 diabetes and heart disease, studies recommended that these people are less prone to certain cancers. Likewise, in another study on 65000 postmenopausal women published by the American Society for Nutrition in 2022, a healthy plant-derived diet was associated with a 14% reduced danger of breast cancer. At the same time, an unhealthy vegetarian diet is related to a 20% greater risk of breast cancer. The vegan diet does not include anything of the animal product and is therefore considered to be safer and consequently favored over meat. Packaged vegan food is prepared using plant-based ingredients that provide phytochemicals. Such phytochemicals help to boost the body's defensive enzyme. Since a vegan diet favours animal rights, as a result, people are adopting it because of their ethical concerns toward the environment and animals. The concern for animal welfare has led more people to prefer vegan food. The consumption of vegan food also promotes the development of essential enzymes in the body.

Growing Concern About Animal Welfare and Cruelty

According to the Good Food Institute, animal welfare is the second most primary cause, as stated by 21% of vegetarians and 17% of pescetarians in Brazil. It also found that 76% of people had a positive attitude toward decreasing the consumption of animal products, followed by 21% who said they had a senseless attitude and 3% who had a negative attitude. The growing consumption of environmentally friendly products and ethical concerns regarding the consumption of meat are further fuelling the growth of the packaged vegan food market. Constant product development and experimentation are fuelling the market forward. Problems regarding the preservation of packaged food can be a little restrained. Competitive and crowded market, with constant new developments.

MARKET RESTRAINTS

Lack of Definitive Regulations

The lack of definitive regulations associated with vegan food labeling hinders market growth. For instance, as per the European Union regulations, only items made from the milking procedure of animals can be allowed to have designations like “dairy” or “milk,” and such types of designated regulations are not present in many countries. Moreover, presently, no federal regulations deal with vegan food labeling in the USA. Though certain states, such as New York and California, have enforced their labeling requirements, they are specifically crafted for themselves. Another issue is the presence of private standards (e.g., Vegan Society and Vegetarian Resource Group offer voluntary certification schemes) and international guidelines (e.g., The Codex Alimentarius Commission's draft guidelines), but these are not compulsory. According to the research conducted by the Food Standards Agency (FSA), it was discovered that 62% of individuals who respond to animal-derived food items or who purchase for another person who is confident and certain that goods labeled ‘vegan’ are fit for human consumption, is “false and can be putting them at danger.

MARKET OPPORTUNITIES

Emerging Markets

Asia Pacific presents a potential opportunity for the expansion of the packaged vegan food market. Among the plant-based foods, cell-derived, cultivated, and plant-based meat continues to be relevant and has made headlines throughout the world. These categories have demonstrated steady growth in recent years by handling a few important sustainability and environmental factors. One of the major causes for the tremendous growth of plant-derived meat in Asian countries is the easier availability of raw materials like oats, peas, soy, etc. The promising markets are Singapore, China and India. Singapore maintains a robust position in the meat sector of APAC. The combination of several specialized local producers and the government’s support makes it a lucrative market for in-house consumption as well as for exports. Besides this, Middle Eastern countries have started to prefer vegan foods, which provides a good opportunity for market expansion. This is because of the rising worry regarding the health effects of consuming excess animal-derived food and beverage items and the acceptance of veganism in light of COVID-19, which were projected to fuel the progress of dairy and meat substitutes in the market.

MARKET CHALLENGES

Rise in Price and Inflation

Production setups, government aid, taxes, packaging, scale and demand all play an important role in cost increase. Moreover, the vegan industry has just begun to take off during the last few years. This shows that it is significantly lagging behind the animal agriculture industry regarding the research and development conducted for their product, and manufacturing of vegan items is energy, technology, and labor-intensive in comparison to the animal agriculture industry. Apart from this, inflation is a major factor affecting the customer’s shopping behavior. In 2023, prices of food at home in the United States increased by 5% from the previous year, which has doubled the average of 20 years for food cost inflation in retail. That increase was in addition to an 11% rise in grocery prices in 2022, meaning customers expend considerably more on foodstuffs in 2023 in contrast to what they spent barely years ago. This pattern was evident in the data on plant-derived and traditional retail. The average cost of plant-based foods climbed up 8% and 18% against those in 2021. Therefore, price remains a barrier to the packaged vegan food market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

11.08% |

|

Segments Covered |

By Product, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Beyond Meat, Amy’s Kitchen, Plamil Foods, Tofutti Brands, White Wave Foods, Annie's Homegrown, Barbara's Bakery, Dr. Mcdougall's Right Foods, Edward & Sons, Galaxy Nutritional Foods, Pacific Foods, The Bridge and Vegan Made Delight |

SEGMENTAL ANALYSIS

By Product Type Insights

Based on product type, the dairy alternative segment led the market in 2023. Vegan dairy alternatives are readily available in supermarkets and specialty food stores in a wide range of blending styles and labels. When buying traditional vegetarian dairy alternatives, customers prefer a non-sweetened option over other dairy products. This is attributed to the fact that the sweetened version not only contains added sugar but is also relatively high in both carbohydrates and calories. Demand for flavored vegetarian dairy alternatives is increasing due to the growing demand for delicious, nutritious, blended, and lactose-free products among the millennial populace worldwide. According to a study by ProVeg International, plant-derived dairy is the most common category in the field of substitutes. When concerning alt-milk, 12 percent of European people eat these products routinely, and 36 percent consume them weekly. Similar figures show up for vegan yogurt (33 percent) and cheese (31 percent).

By Distribution Channel Insights

Based on the distribution channel, the hypermarket segment had the largest share of the global market in 2023. The availability of a broad range of products under one roof, discount coupons, advertising, and the existence of major players such as Wal-Mart are primary factors for driving the segment. Consumers prefer to taste new types before buying them, increasing the demand for hypermarkets over other channels. Convenience stores also have an essential share of the sector. On the other side, the digital retailer segment is the fastest growing and is increasing at a high CAGR in the forecast period. Expanding the use and penetration of the Internet in rural regions of developing nations is a primary driver of the segment. In addition, the growing young working population demands easier access, and an increasing number of online retailers and discounts will drive the online retailer segment in the forecast period.

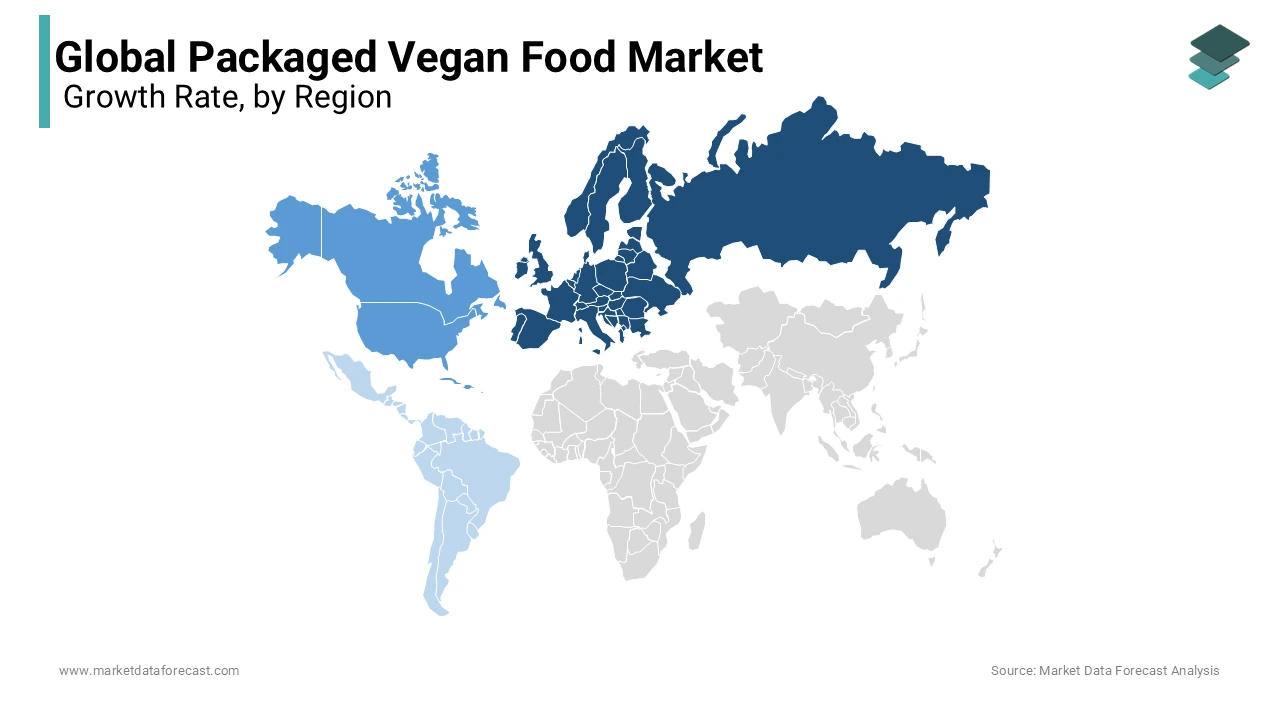

REGIONAL ANALYSIS

Europe is one of the biggest markets for packaged vegan food owing to the significant rise in its sales.

Veganism and vegetarianism are rapidly spreading across the continent, especially in Germany. The country recorded the highest sales. Also, it possesses the most substantial market opportunity for plant-based alternatives due to its robust, innovative capability in this field, which is apparent in several small startup companies. Moreover, according to the acceptance study by the University of Hohenheim, dairy and milk alternatives made from plants are experiencing heightened popularity all over the European market and their revenue surged by 49% between 2020 and 2022. This elevated the market share of the region. Additionally, nutrition-centric eating practices are embedded in the culture of various nations and are another major factor influencing the demand for packaged vegan food.

North America is a growing packaged vegan food market, holding a significant share.

The expansion of this Market is due to an increasing consumer preference for healthy and nutritious food and a substantial rise in the number of people choosing veganism as a lifestyle. Further, as per the study by the Good Food Institute, in the last 10 years, there has been a remarkable increase in the retail sales of plant-based foods from 3.9 billion dollars to 8.1 billion dollars in 2023. This expansion has been propelled by food items that attract a wide consumer base by imitating the functionality, texture and taste of traditional animal products. Moreover, the prominent US states for the vegan population are Oregon, Hawaii, California, New York, Florida, Rhode Island, Maryland, Colorado, West Virginia and Massachusetts. Hence, the growing inclination towards plant-based alternatives and sales is expected to drive the market in the coming years.

Asia Pacific is growing at a notable growth rate.

In comparison to several Western nations, APAC has a small vegan population. However, in recent times, the region has witnessed a surge in the consumption of plant-based meat. According to Nutritional Outlook, in 2022, investment in the Asia Pacific plant-based food industry grew by 30%, arriving at a valuation of around 372 million dollars. These investments are scattered throughout the region instead of being concentrated in one country. With research, development, innovation and legal approvals, major economies such as India, China and Singapore are encouraging investments. Besides these, sales in the rest of Asia also increased, which contributed significantly to the region’s expanding market size. For example, Thailand’s export of plant-based food items was up by 20 percent in 2022, and it is also the sole net exporter. Of these, plant-derived meat held the majority share.

The Middle East and Africa are slowly but consistently emerging as a new hub for vegan and allergen-free products.

Today, veganism is more than just a concept and has been popular in ME and North Africa region for the last few years as a result leading to a huge market revolution. The transition to plant-based meat from meat-based items in the past 5 years is primarily because of the rising consumer awareness about its positive effects on the ecosystem, overall environmental health and carbon footprint. In addition, Saudi Arabia and the United Arab Emirates are expected to lead the region’s market growth. In the UAE particularly, the sales volume of plant-derived items has increased twofold in the last few years as more people keep switching to a greater emphasis on health. For instance, according to UAE-based elGrocer, the market in MENA countries saw an 1152 per cent escalation in sales from 2019 to 2024.

Latin America is gaining traction in the worldwide market.

Latin American packaged vegan food market witnessed notable growth and is gradually accepting the healthy diet and plant-based products. From Argentina to Mexico, the region has also witnessed a respectable rise in demand for plant-derived meat alternatives, which presents a good prospect. Also, Brazil is another major player in the market due to the rising inclination towards protein derived from plants with product introductions in organic food shops, large retailers and even in small corner shops. For instance, a study by Veganuary found that between 2022 and 2023, vegan choices in restaurants rose in Argentina and Chile by 26 percent and 43 percent, respectively.

KEY MARKET PARTICIPANTS

Companies playing a major role in the global packaged vegan food market include Beyond Meat, Amy’s Kitchen, Plamil Foods, Tofutti Brands, White Wave Foods, Annie's Homegrown, Barbara's Bakery, Dr. Mcdougall's Right Foods, Edward & Sons, Galaxy Nutritional Foods, Pacific Foods, The Bridge and Vegan Made Delight.

RECENT MARKET HAPPENINGS

- In September 2024, NOMO introduced a vegan substitute for Bounty chocolate bars. It is a chocolate bar with coconut filling and appears like Mars Bounty Bars. Also, it is made from desiccated coconut and Rainforest Alliance Certified cocoa.

- In September 2024, Flora Press released the introduction of “first-of-its-kind vegan smoked garlic butter, which is expected to be available on supermarket shelves very soon by the year's end and costs 1.75 pounds for 175 grams.

- Beyond Meat, an industry giant and a top competitor in the field of packaged vegan foods, released its new product line of burgers by the name of "Beyond Burgers."

- The idea is that these products have the same taste as actual meat burgers and have almost the same nutrients that meat burgers have, but the subtle twist here is that these are entirely organic and natural.

- Developments of the industry do not just mean the growth of companies in the industry. As mentioned earlier, the industry is heavily led by activism.

- 12,000 animal rights protesters took part in a vegan march in the city of London, holding anti-meat consumption signs such as "meat is murder". These protests are only a considerable upside for the packaged vegan foods market.

MARKET SEGMENTATION

This research report on the global packaged vegan food market has been segmented and sub-segmented based on the product type, distribution channel, and region.

By Product Type

- Dairy Alternatives

- Bakery and confectionery Ingredients

- Packaged Meals

- Meat Alternatives

By Distribution Channel

- Online Retailers

- Hypermarket/Supermarket

- Natural and Organic Stores

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]