Global OTR Tires Market Size, Share, Trends & Growth Forecast Report – Segmented By Product Type (Radial Tires, Bias Tires, Non-Pneumatic Tires), Vehicle Type (Earthmovers, Loaders and Dozers, Graders, Material Handling Equipment, Tractors and Agricultural Equipment), End-Users (Construction, Industrial, Mining, Agriculture, Ports, Others), Target (OEMs, Aftermarket) And By Region (North America, Europe, Asia Pacific, Latin America, and Middle East and Africa) – Industry Analysis From (2025 to 2033)

Global OTR Tires Market Size

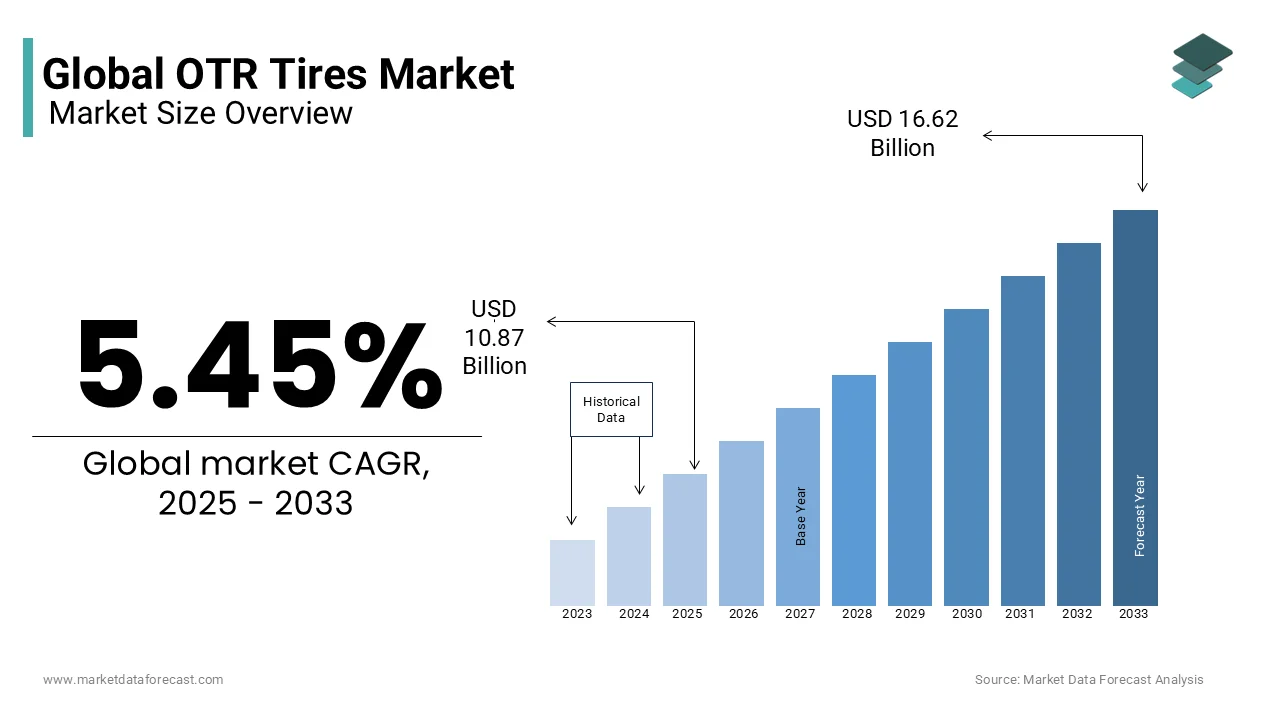

The global OTR tires market was valued at USD 10.31 billion in 2024 and is anticipated to reach a valuation of USD 10.87 billion in 2025 from USD 16.62 billion by 2033, growing at a CAGR of 5.45% during the forecast period from 2025 to 2033.

Current Scenario of The Global OTR Tires Market

OTR tires are meticulously designed to withstand extreme conditions, offering exceptional durability, load-bearing capacity, and superior traction on challenging terrains. These tires are integral to machinery such as dump trucks, bulldozers, loaders, and agricultural tractors, which operate under demanding conditions. The importance of OTR tires is underscored by their role in ensuring operational efficiency, safety, and productivity across critical industries.

The versatility of OTR tires is evident in their widespread use across diverse sectors. For instance, the mining industry relies heavily on OTR tires, with large haul trucks often requiring tires capable of supporting payloads exceeding 300 tons per trip. According to the International Council on Mining and Metals (ICMM), mining operations account for nearly 60% of global OTR tire consumption, reflecting their centrality to resource extraction. In agriculture, tractors equipped with OTR tires play a vital role in sustaining global food production systems. The Food and Agriculture Organization (FAO) estimates that modern agricultural practices cover approximately 1.4 billion hectares of arable land globally, much of which depends on mechanized equipment utilizing OTR tires. Additionally, the World Road Association states that over 50% of construction projects in developing regions rely on heavy machinery fitted with OTR tires, underscoring their significance in infrastructure development.

Market Drivers

Infrastructure Development and Urbanization

The rapid pace of infrastructure development and urbanization is a key driver of the OTR tires market. As global populations shift toward urban areas, governments are investing heavily in construction projects such as roads, bridges, and housing complexes. The United Nations Department of Economic and Social Affairs projects that 68% of the world’s population will live in urban areas by 2050, necessitating significant infrastructure expansion. This trend fuels demand for heavy machinery equipped with OTR tires, particularly in emerging economies like India and China. According to the Global Infrastructure Hub, global infrastructure investment needs are estimated at USD 94 trillion by 2040, with Asia accounting for over 50% of this demand. These investments create a robust demand for durable tires capable of handling the rigors of construction sites. Furthermore, advancements in tire technology, such as improved tread designs and heat resistance, align with the needs of modern infrastructure projects, further propelling market growth.

Growth in Mining Activities

The expansion of mining activities worldwide is another major driver of the OTR tires market. Mining operations rely heavily on large haul trucks and excavators, which require specialized tires to handle extreme loads and harsh terrains. The International Energy Agency reports that global mineral production has increased by 30% over the past decade, driven by rising demand for resources like coal, iron ore, and rare earth elements. Countries like Australia, Brazil, and South Africa are leading contributors to this growth, driving demand for high-performance OTR tires. Additionally, the World Mining Congress reports that mining companies are investing heavily in fleet expansions, with capital expenditures on equipment expected to grow by 15% annually through 2030. Innovations in tire materials, such as reinforced compounds, further enhance their suitability for mining applications. As mining operators prioritize efficiency and safety, the demand for durable and reliable OTR tires continues to rise.

Market Restraints

High Production Costs

High production costs pose a significant restraint to the OTR tires market. Manufacturing these tires involves advanced technologies and high-quality raw materials, such as synthetic rubber and steel belts, which contribute to elevated costs. The International Rubber Study Group states that raw material costs account for approximately 60% of total tire production expenses, making it a critical factor affecting profitability. Moreover, fluctuations in natural rubber prices, driven by geopolitical tensions and climate-related disruptions, exacerbate cost volatility. For instance, the International Monetary Fund reports that adverse weather conditions in Southeast Asia caused natural rubber prices to spike by 25% in 2022. These challenges limit manufacturers' ability to offer competitive pricing, particularly in price-sensitive markets. Additionally, the energy-intensive nature of tire production further escalates costs, as highlighted by the International Energy Agency, which notes that industrial energy consumption has risen by 15% over the past decade.

Environmental Regulations

Stringent environmental regulations present another major restraint for the OTR tires market. Governments worldwide are implementing policies to reduce carbon emissions and promote sustainable practices, impacting tire manufacturing and usage. The European Tyre and Rubber Manufacturers' Association reports that the tire industry contributes approximately 5% of global CO2 emissions during production and end-of-life disposal. Regulations such as the European Union’s Tire Labeling Act mandate improved fuel efficiency, reduced noise levels, and enhanced wet grip performance, increasing compliance costs for manufacturers. Additionally, the United Nations Environment Programme emphasizes that improper disposal of used tires contributes to environmental pollution, with an estimated 1 billion tires discarded annually. These factors force manufacturers to invest in eco-friendly alternatives, such as bio-based materials, which often come at a premium. While these measures aim to mitigate environmental impact, they also impose financial and operational burdens on the OTR tires market.

Market Opportunities

Adoption of Smart Tire Technologies

The adoption of smart tire technologies presents a significant opportunity for the OTR tires market. Smart tires, equipped with sensors and IoT-enabled systems, provide real-time data on tire pressure, temperature, and tread wear, enhancing operational efficiency and safety. In industries like mining and construction, where downtime can result in substantial financial losses, smart tires offer a competitive advantage by reducing unplanned repairs. For example, Caterpillar Inc. has integrated smart tire systems into its heavy machinery, achieving a 20% reduction in maintenance costs. Furthermore, the National Institute of Standards and Technology highlights that IoT-enabled systems improve resource utilization by up to 30%, underscoring their potential to revolutionize the OTR tires market.

Expansion in Emerging Markets

Emerging markets represent a lucrative opportunity for the OTR tires market, driven by rapid industrialization and infrastructure development. Countries in Asia-Pacific, Latin America, and Africa are witnessing significant investments in sectors such as mining, agriculture, and construction. The Asian Development Bank estimates that infrastructure investments in the Asia-Pacific region will reach USD 1.7 trillion annually by 2030, creating a robust demand for OTR tires. Similarly, the African Development Bank shows that infrastructure projects across Africa are expected to grow by 10% annually over the next decade, fueled by initiatives like the African Continental Free Trade Area. These developments are complemented by government policies promoting mechanization in agriculture, with the Food and Agriculture Organization reporting a 25% increase in tractor usage in Sub-Saharan Africa since 2015. As emerging markets continue to industrialize, the demand for durable and high-performance OTR tires is set to surge, offering manufacturers a chance to expand their global footprint.

Market Challenges

Fluctuating Raw Material Prices

Fluctuating raw material prices present a significant challenge for the OTR tires market, impacting production stability and profitability. Natural rubber, a primary component of OTR tires, is subject to price volatility due to factors such as weather conditions, geopolitical tensions, and supply chain disruptions. The International Rubber Study Group notes that natural rubber prices have experienced fluctuations exceeding 40% in recent years, driven by adverse weather events in key producing regions like Thailand and Indonesia. Synthetic rubber, another critical material, is derived from petrochemicals, whose prices are influenced by global oil market dynamics. The International Energy Agency states that crude oil prices surged by over 60% in 2022, directly affecting synthetic rubber costs. These price instabilities create uncertainty for manufacturers, who must balance cost management with maintaining product quality. Additionally, the reliance on imported raw materials in regions like Europe and North America further complicates supply chain logistics, exacerbating the challenge.

Limited Recycling Infrastructure

The limited availability of recycling infrastructure for OTR tires poses a significant challenge to the market. End-of-life tires are difficult to dispose of due to their size, weight, and composition, often leading to environmental concerns. The World Business Council for Sustainable Development estimates that only 15% of OTR tires are recycled globally, with the remainder being incinerated or dumped in landfills. This inefficiency is exacerbated by the lack of specialized facilities capable of handling large-scale OTR tire recycling. For instance, the Environmental Protection Agency stresses that the U.S. recycles less than 10% of its OTR tires, despite generating over 300 million waste tires annually. The absence of standardized recycling processes further complicates efforts to address this issue. Additionally, the high costs associated with transporting and processing OTR tires deter investment in recycling technologies. As regulatory pressures mount, manufacturers face the dual challenge of developing sustainable solutions while managing the logistical and financial hurdles of recycling.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.45% |

|

Segments Covered |

By Product Type, Vehicle Type, End-Users, Target Market, And Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Generale des Etablissements Michelin (CGEM), Bridgestone Corporation, The Goodyear Tire & Rubber Company, The Yokohama Rubber Co., Ltd., Continental Aktiengesellschaft, Balkrishna Industries Limited, Toyo Tire & Rubber Company, Apollo Tyres Ltd., Hankook Tire Co. Ltd. and Cooper Tire & Rubber Company, and Others. |

SEGMENTAL ANALYSIS

OTR Tires Market Analysis By Product Type

The Radial tires segment dominated the OTR tires market by holding 65.8% of the total market share in 2024 due to superior performance characteristics such as better fuel efficiency, longer lifespan, and enhanced traction on rough terrains. According to the U.S. Department of Energy, radial tires reduce rolling resistance by up to 30%, improving fuel economy for heavy machinery by an estimated 5-10%. Additionally, the International Rubber Study Group emphasizes that radial tires last 20-30% longer than bias tires, making them cost-effective for industries like mining and construction. Their ability to handle heavy loads under extreme conditions ensures their widespread adoption. As industries increasingly prioritize operational efficiency, radial tires remain the preferred choice for demanding applications.

The Non-pneumatic tires segment is the fastest-growing segment, with a CAGR of 12.3% during the forecast period. These tires are gaining traction due to their puncture-proof design and low maintenance requirements. The National Institute of Standards and Technology states that non-pneumatic tires reduce downtime by 25% compared to traditional pneumatic tires, making them ideal for remote operations like mining. Furthermore, the Environmental Protection Agency reports that non-pneumatic tires generate 40% less waste during production, aligning with global sustainability goals. As industries adopt advanced technologies, the demand for innovative solutions like non-pneumatic tires is expected to rise significantly, driven by their durability and eco-friendly composition.

OTR Tires Market Analysis By Vehicle Type

The Earthmovers account for the largest market share of 40.6% in 2024 in the OTR tires market. This dominance is driven by their extensive use in mining and large-scale construction projects. The World Mining Congress reports that over 60% of mining operations rely on earthmovers, which require specialized tires to handle heavy loads and harsh terrains. Additionally, the Global Infrastructure Hub estimates that infrastructure spending will reach USD 94 trillion globally by 2040, boosting demand for earthmovers. Their importance lies in their ability to operate efficiently in extreme conditions, ensuring uninterrupted project timelines.

The Tractors and agricultural equipment segment represented the quickest rising category, with a CAGR of 8.7%. This growth is fueled by increasing mechanization in agriculture, particularly in emerging markets. The Food and Agriculture Organization states that tractor usage in Sub-Saharan Africa has risen by 20% since 2015, driven by government initiatives promoting modern farming practices. Additionally, the United Nations projects that global food demand will increase by 50% by 2050, necessitating efficient farming methods. OTR tires for tractors are designed to withstand heavy loads and diverse terrains, making them essential for large-scale farming.

OTR Tires Market Analysis By End-Users

The mining sector held the biggest market share i.e. 35.4% in 2024 in the OTR tires market. This prominance is attributed to the heavy reliance on machinery like haul trucks and excavators, which require specialized tires to operate in harsh environments. The International Council on Mining and Metals reports that the global mining industry produces over 17 billion metric tons of minerals annually, driving demand for durable OTR tires. Additionally, the World Mining Congress reveals that mining companies plan to increase capital expenditures on equipment by 15% annually through 2030. OTR tires play a crucial role in ensuring safety and efficiency in mining operations, making them indispensable for this sector.

The construction sector is the fastest expanding end-user category, with a CAGR of 9.5%. This rise is propelled by rapid urbanization and infrastructure development worldwide. The Global Infrastructure Hub estimates that global infrastructure investment needs will reach USD 94 trillion by 2040, with Asia accounting for over 50% of this demand. Additionally, the United Nations Department of Economic and Social Affairs projects that 68% of the world’s population will live in urban areas by 2050, necessitating significant construction activities. OTR tires for construction equipment are designed to handle heavy loads and challenging terrains, ensuring smooth project execution.

REGIONAL ANALYSIS

North America was the leading region in the OTR tires market with a substantial market share that is driven by its robust mining and construction industries. The U.S. Geological Survey reports that the U.S. mining sector contributes over USD 800 billion annually to the economy, creating significant demand for durable OTR tires. Additionally, infrastructure spending in the U.S. reached USD 1.3 trillion in 2022, according to the American Society of Civil Engineers, further boosting demand. Technological advancements, such as smart tire systems, are widely adopted in this region, enhancing operational efficiency. North America's leadership stems from its strong industrial base, stringent safety regulations, and focus on sustainability, making it a critical hub for OTR tire manufacturers.

Asia Pacific OTR tires market is expected to grow at a CAGR of 7.8%. Rapid urbanization and industrialization, particularly in China and India, drive this growth. The Asian Development Bank estimates infrastructure investments in the region will reach USD 1.7 trillion annually by 2030. Additionally, the Food and Agriculture Organization stresses that Asia accounts for 55% of global agricultural production, increasing demand for tractors and agricultural equipment. This region's growth is supported by government initiatives promoting mechanization and mining activities.

Europe holds a significant position in the OTR tires market due to its advanced mining technologies and stringent environmental regulations. The European Tyre and Rubber Manufacturers' Association reports that the region produces over 5 million metric tons of rubber products annually. Europe's focus on sustainable practices has led to innovations like eco-friendly tires, aligning with the European Green Deal's goals. Additionally, the European Commission shows that infrastructure spending in the EU exceeds USD 600 billion annually, supporting demand for construction machinery.

Latin America is a key player in the OTR tires market, primarily due to its thriving mining sector. The World Mining Congress states that Chile and Peru are among the top global copper producers, driving demand for heavy machinery and OTR tires. Additionally, the Inter-American Development Bank reports that infrastructure investments in Latin America are expected to grow by 5% annually through 2030. Agricultural expansion, particularly in Brazil and Argentina, further boosts demand for tractors and farming equipment.

The Middle East & Africa is a rapidly emerging region in the OTR tires market, driven by large-scale infrastructure and mining projects. The African Development Bank states that infrastructure investments in Africa are projected to grow by 10% annually over the next decade. Additionally, Saudi Arabia’s Vision 2030 initiative, as reported by the Ministry of Investment of Saudi Arabia, includes mega-projects worth USD 1 trillion, increasing demand for construction machinery. South Africa, a major producer of platinum and gold, requires specialized OTR tires, according to the World Mining Congress. This region's importance lies in its resource-rich landscapes, growing urbanization, and government-led initiatives, positioning it as a promising market for OTR tire manufacturers.

Top 3 Players in the market

Bridgestone Corporation

Bridgestone is the largest player in the global OTR tires market, holding a significant market share of approximately 20%. The company’s position is due to its focus on innovation, sustainability, and a wide product portfolio catering to industries like mining, construction, and agriculture. Bridgestone has invested heavily in advanced technologies, such as smart tire systems that monitor pressure and temperature in real-time, enhancing operational efficiency. According to the International Rubber Study Group, Bridgestone accounts for over 30% of global radial tire production, which are preferred for their durability and fuel efficiency. Additionally, the company’s commitment to sustainability is evident through its use of eco-friendly materials, aligning with global environmental regulations. Bridgestone’s strong distribution network and partnerships with major mining and construction companies further solidify its position. By driving innovation and promoting sustainable practices, Bridgestone contributes significantly to the global OTR tires market, ensuring the availability of high-performance tires that meet the demands of modern industries.

Michelin Group

Michelin ranks second in the global OTR tires market, contributing approximately 15% to the industry. Known for its high-performance tires, Michelin has established itself as a leader in providing solutions for extreme terrains and heavy-duty applications. The company’s innovations, such as the XDR series for mining trucks, have set benchmarks in load-bearing capacity and heat resistance. According to the European Tyre and Rubber Manufacturers' Association, Michelin holds a 25% share in the premium OTR tire segment, driven by its focus on quality and safety. Michelin’s growth is fueled by strategic investments in research and development, particularly in sustainable tire manufacturing. The company’s emphasis on reducing carbon emissions aligns with global sustainability goals, making it a preferred choice for environmentally conscious industries. Through its cutting-edge technologies and eco-friendly initiatives, Michelin plays a pivotal role in advancing the global OTR tires market, offering durable and efficient solutions that enhance industrial productivity.

Goodyear Tire & Rubber Company

Goodyear is the third-largest player in the OTR tires market, with a market share of around 12%. The company’s strength lies in its diverse product range, including radial, bias, and specialized tires for mining and construction equipment. Goodyear’s robust presence in North America and Europe is supported by its partnerships with leading OEMs (Original Equipment Manufacturers) and fleet operators. According to the U.S. Department of Transportation, Goodyear supplies over 20% of the OTR tires used in the U.S. mining sector, leveraging its expertise in designing durable tires for harsh conditions. The company has also made significant strides in adopting advanced materials, such as silica-based compounds, to improve tire performance and reduce environmental impact. Goodyear’s focus on expanding its footprint in emerging markets, particularly Asia-Pacific, ensures steady growth in the global OTR tires market. By addressing the specific needs of end-users and promoting sustainable manufacturing practices, Goodyear contributes to the advancement of the global OTR tires market, ensuring reliable and high-performance solutions for demanding applications.

Top Strategies Used By The Key Market Participants

Innovation and Technological Advancements

Leading companies like Bridgestone, Michelin, and Goodyear prioritize research and development (R&D) to introduce cutting-edge technologies and innovative products. For instance, Bridgestone has developed IoT-enabled smart tires that provide real-time data on pressure, temperature, and tread wear, enhancing operational efficiency for mining and construction industries. Similarly, Michelin’s XDR series for mining trucks incorporates advanced heat-resistant materials, setting benchmarks in durability and performance. According to the International Rubber Study Group, investments in R&D account for over 5% of revenues for top tire manufacturers. By focusing on technological advancements, these companies cater to the growing demand for high-performance and eco-friendly tires, solidifying their leadership in the market.

Sustainability and Eco-Friendly Initiatives

Sustainability has become a cornerstone strategy for key players aiming to align with global environmental regulations and consumer preferences. Michelin has committed to achieving carbon neutrality by 2050, as outlined in its sustainability roadmap, by adopting renewable materials and reducing emissions during production. Goodyear has introduced silica-based compounds to improve fuel efficiency and reduce environmental impact. Additionally, Bridgestone emphasizes circular economy practices, such as recycling end-of-life tires, which the Environmental Protection Agency highlights as critical for reducing waste. These initiatives not only enhance brand reputation but also meet the increasing demand for sustainable solutions in industries like mining and agriculture.

Geographic Expansion and Emerging Market Focus

To capitalize on growth opportunities, leading players are expanding their presence in emerging markets such as Asia-Pacific, Latin America, and Africa. For example, Goodyear has established new manufacturing facilities in Thailand and China to cater to the rising demand for OTR tires in infrastructure and agricultural projects. Similarly, Bridgestone has strengthened its distribution networks in India and Brazil, leveraging government-led mechanization programs. The Asian Development Bank reports that infrastructure investments in Asia-Pacific will exceed USD 1 trillion annually by 2030, making it a lucrative region for expansion. By targeting high-growth markets, these companies ensure sustained revenue growth and enhanced global reach.

COMPETITIVE LANDSCAPE

The OTR tires market is very competitive with many big companies trying to lead the industry. The main players include Bridgestone Michelin and Goodyear. These companies work hard to make the best products and keep customers happy. They focus on making strong and long-lasting tires for mining construction and farming. To stay ahead, they use new technologies like smart tires which help track tire pressure and temperature. This makes work easier and safer for users.

These companies also care about the environment. They are making eco-friendly tires using sustainable materials. This helps them follow rules and meet customer demands for greener products. Another way they compete is by expanding to new places. For example, they build factories in Asia and Africa where there is a growing need for OTR tires due to more construction and farming activities.

Partnerships are also important in this market. Big companies team up with equipment makers to design tires that fit perfectly with machines. This helps them sell more tires and grow their business. Smaller companies also try to compete by offering cheaper options but big brands stay ahead because of their quality and trust. Overall the competition is tough but it pushes companies to improve and give better products to customers.

KEY MARKET PLAYERS

Generale des Etablissements Michelin (CGEM), Bridgestone Corporation, Goodyear Tire & Rubber Company, Yokohama Rubber Co., Ltd., Continental Aktiengesellschaft, Balkrishna Industries Limited, Toyo Tire & Rubber Company, Apollo Tyres Ltd., Hankook Tire Co. Ltd., Cooper Tire & Rubber Company. Are the market players that are dominating the global OTR tires market.

RECENT HAPPENINGS IN THIS MARKET

- In February 2025, Michelin introduced the XTRA LOAD GRIP tire, designed to enhance load capacity and durability for rigid dump trucks in mining and quarry applications.

- In January 2025, Bridgestone announced the release of the VSWAS 23.5R25 V-Steel Snow Wedge All-Season tire, expanding its Off-the-Road (OTR) radial snow tire line. This new size is tailored for grader and loader applications, offering improved performance in deep snow conditions without the need for studs or chains.

- In November 2024, Goodyear launched the RH-4A+ OTR tire, engineered for high-heat environments such as mining operations in hot climates. The tire is designed to provide enhanced tread life and heat resistance, aiming to improve operational efficiency and safety.

- In October 2024, Continental expanded its OTR tire portfolio with the introduction of the RDT-Master CR tire, suitable for rigid dump trucks in construction and mining sectors. The tire offers enhanced cut resistance and durability, reducing downtime and maintenance costs.

- In September 2024, Yokohama introduced the RB42 tire, designed for articulated dump trucks in the OTR segment. The tire features improved traction and wear resistance, aiming to enhance performance in challenging terrains.

MARKET SEGMENTATION

This research report on the global OTR tires market is segmented and sub-segmented into the following categories.

By Product Type

- Radial Tires

- Bias Tires

- Non-Pneumatic Tires

By Vehicle Type

- Earthmovers

- Loader and Dozers

- Graders

- Material Handling Equipment

- Tractors and Agricultural Equipment

By End-Users

- Construction

- Industrial

- Mining

- Agriculture

- Ports

- Other (Defense etc.)

By Region

- North America

- Europe

- Asia-Pacific

- Middle East and Africa

- Latin America

Frequently Asked Questions

1. What is the OTR Tires Market growth rate during the projection period?

The Global OTR Tires Market is expected to grow with a CAGR of 5.45% between 2023-2028.

2. What can be the total OTR Tires Market Value?

The Global OTR Tires Market size is expected to reach a revised size of US$ 12.55 billion by 2028.

3. Name any three OTR Tires Market key players?

Generale des Etablissements Michelin (CGEM), Bridgestone Corporation, and The Goodyear Tire & Rubber Company are the three OTR Tires Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]