Global Orthopedic Implants Market Size, Share, Trends & Growth Forecast Report By Product Type, Application, End-users and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Orthopedic Implants Market Size

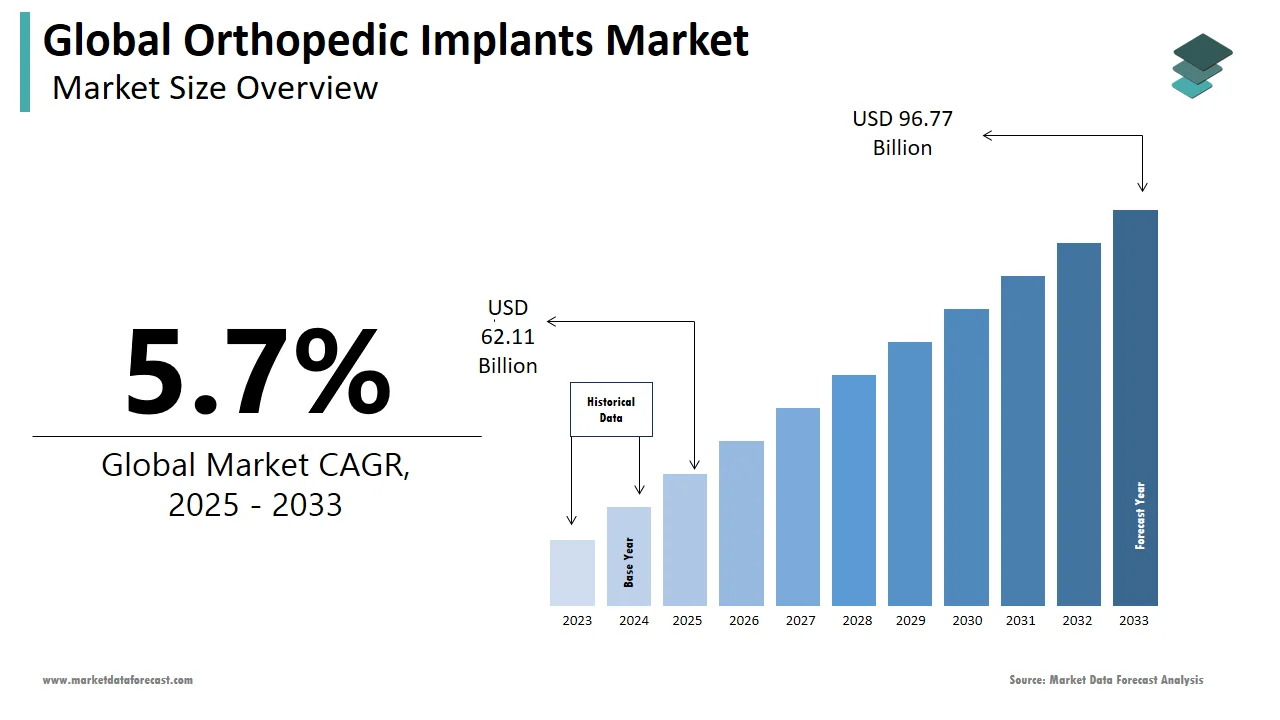

The global orthopedic implants market was worth US$ 58.76 billion in 2024 and is anticipated to reach a valuation of US$ 96.77 billion by 2033 from US$ 62.11 billion in 2025, and it is predicted to register a CAGR of 5.7% during the forecast period 2025-2033.

MARKET DRIVERS

The growing patient population suffering from orthopedic injuries, increasing awareness among people regarding the importance of fitness and physical activities, and the rising geriatric population worldwide are primarily driving the growth of the orthopedic implants market.

The high acceptance of patients for integrating implants with image techniques is the primary driving factor of the orthopedic implants market. Additionally, the adoption of various treatments, such as shifting from conventional invasive surgical procedures to a dramatic paradigm shift toward minimally invasive procedures for various orthopedic diseases or disabilities, is expected to favor the market growth during the forecast period. Furthermore, the rise of 3D-print orthopedic implants integration with image techniques, including MRI and CT, and a wide range of applications across various applications like oncology and traumatology, and spine surgeries, propel the orthopedic implants market growth.

The rise in the aging population majorly accelerates the growth of the orthopedic implants market. The senior population accounts for a high rise in orthopedic surgeries, and increased replacement surgeries for various reasons such as emergence and accidents are major contributing factors for market growth. Lifestyle issues such as obesity, excess fat depositions, and lack of physical activity lead to joint and knee pains, whereas most patients opt for replacement surgeries. Athletic injuries are a significant concern and are reported high every year. Around 1.2 million football players and various athletes face injuries, estimated by the reports from NASA neuroscience and spine associates in 2017. Other augmenting factors for market growth are the rise in chronic orthopedic diseases such as osteoporosis, characterized by structural de modification of bone tissues and low bone mass density. Increasing adoption of technological developments in manufacturing orthopedic implants, research activities, implementation procedures, the adaption of sedentary lifestyle changes, and awareness of physical health and fitness activities are also significant growth driving factors.

MARKET RESTRAINTS

High costs associated with the treatment procedures of the orthopedic implants market are key factors hindering market growth. In addition, unfavorable reimbursement policies and an increasing number of product calls are showcasing a negative impact on the growth rate of the orthopedic implants market.

Impact Of COVID-19 on The Global Orthopedic Implants Market

COVID-19's spread infection rate is high that all the countries have fallen prey to it. During this, every medical market has a negatively impacted orthopedic implant. In addition, the government has implemented stringent regulations, such as lockdown rules and travel ban issues. During the travel ban issues, international communications and meetings were not progressed. Hence this impacted the business scenario for the orthopedic implants market.Furthermore, achieving hospitality goals, such as surgeries for orthopedic patients, has been more challenging. As a result, imports and exports have been halted, due to which the needed medical devices could not reach customers. Along with end-users, manufacturers and production units faced severe losses because of the many countries' bans on imports and exports. However, during the forecast period, the orthopedic implants market is anticipated to showcase a healthy CAGR considering the declining impact of COVID-19, growing habituation towards new normalization, and resuming business activities worldwide.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.7% |

|

Segments Covered |

By Product Type, Application, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Johnson & Johnson (DePuy Synthes), Zimmer Biomet Holdings, Inc., Stryker Corporation, Medtronic Plc, Smith and Nephew Plc., Wright Medical Group N.V., CONMED Corporation, Arthrex, Inc, DJO Finance LLC, and Globus Medical Inc., and Others. |

REGIONAL ANALYSIS

Geographically, North America was the global market leader in accounting for most of the share in 2024. With the increased number of senior people and the number of orthopedic surgeries performed, many orthopedic clinics are observed in North America. As a result, North America is expected to account for the largest share of the worldwide orthopedic implants market during the forecast period. Furthermore, North America is estimated to grow at a robust CAGR during the forecast period due to the presence of developing economic countries such as the USA, Canada, etc., with the coupling of the rise of activities by market key players.

Followed by Europe, European countries are the second largest for witnessing market shares and growth due to increased chronic illnesses after North America. Furthermore, the European orthopedic implants market is forecasted to hike steadily during the forecast period due to rigorous activities like merging and joint ventures by establishing key market players in European countries.

The Asia-Pacific orthopedic implants market also witnesses the highest growth in the forecast period due to its healthcare and infrastructure, medical tourism, and physical health and fitness awareness. In addition, an increasing number of initiative steps taken by private and public organizations and the rise of the acceptance rate of various applications of orthopedic implants by patients strongly support the market in this region.

The Middle East and Africa expect slow growth after the forecast period due to a lack of knowledge and awareness in physical and fitness orthopedic health services.

KEY MARKET PLAYERS

Some of the top companies leading the global orthopedic implants market profiled in this report are Johnson & Johnson (DePuy Synthes), Zimmer Biomet Holdings, Inc., Stryker Corporation, Medtronic Plc, Smith and Nephew Plc., Wright Medical Group N.V., CONMED Corporation, Arthrex, Inc, DJO Finance LLC, and Globus Medical Inc.

RECENT MARKET HAPPENINGS

- In 2019, Implant, a medical technology company (specializing in vertebral and knee-surgery implants), received a patent in Japan for its JAZZ Lock® technology, an integral part of its JAZZ™ solutions platform.

- In 2019, a Wide range of helix lock plate systems (including small and large implants for different bones) was launched by siora surgical Pvt ltd.

- In 2017, General Electric made a partnership agreement with Stryker, a leading medical technology company.

MARKET SEGMENTATION

The global orthopedic implants market research report has been segmented by product type, application, end-user, and region.

By Product Type

- Joint reconstruction

- Spinal implants

- Trauma implants

- Ortho biologics

By Application

- Knee

- Spinal

- Hip

- Dental

- S.E.T (sports medicine, Extremities, Trauma)

By End-user

- Hospitals

- Orthopedic clinics

- Ambulatory services

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What was the size of the orthopedic implants market?

The global orthopedic implants market size was valued at USD 58.76 billion in 2024.

What factors are driving the growth of the orthopedic implants market?

The growth of the orthopedic implants market is primarily driven by the increasing incidence of musculoskeletal disorders such as arthritis, osteoporosis, and bone fractures, along with the growing aging population.

Who are the key players in the orthopedic implants market?

Johnson & Johnson, Stryker Corporation, Zimmer Biomet Holdings Inc., Smith & Nephew Plc, Medtronic Plc, B. Braun Melsungen AG, Conmed Corporation, DJO Global Inc., Wright Medical Group N.V., and NuVasive Inc. are some of the notable companies in the orthopedic implants market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]