Global Organophosphate Pesticides Market Size, Share, Trends, & Growth Forecast Report, Segmented By Ingredients (Malathion, Diazinon, Glyphosate, Methamidophos, Dimethoate, Chloropyriphos, Parathion, Other Organophosphates), Type (Herbicide, Fungicide, Insecticide, Others), Application (Crop Based-Oil Seeds, Fruits & Vegetables, Grains & Cereals, Non-Crop Based-Turf & Ornamental Grass And Others) And Region (North America, Europe, Asia – Pacific, Latin America, Middle East And Africa), Industry Analysis From (2025 to 2033)

Global Organophosphate Pesticides Market Size

The global organophosphate pesticides market was valued at USD 9.40 billion in 2024 and is anticipated to reach USD 9.90 billion in 2025 from USD 14.92 billion by 2033, growing at a CAGR of 5.27% from 2025 to 2033.

Organophosphate pesticides are a class of chemicals primarily used as insecticides. These pesticides play an integral role in the global agricultural industry as they are effective in controlling a wide range of pests. The demand for organophosphate pesticides has been gradually growing from the last few years owing to the increasing agricultural productivity and rapid adoption of effective pest management practices. In terms of total pesticide usage, Brazil leads globally and applied an estimated 719,507 tons of pesticides in 2021. The United States follows with 457,400 tons and Indonesia ranks third with 283,300 tons in the leading consumers of pesticides worldwide. When considering per capita usage, Paraguay stands out at 3.72 kilograms per person, with Brazil at 3.36 kg per capita.

Organophosphate pesticides are effective yet they also impose potential health risks. Due to this, these pesticides are putting under increased scrutiny. For instance, in the United States, the Environmental Protection Agency (EPA) has expedited actions to mitigate risks associated with certain organophosphates by implementing measures to protect farmworkers and communities.

MARKET DRIVERS

The growing agricultural productivity needs is one of the key factors propelling the global market growth. The global population is expected to reach 9.7 billion by 2050 and this growth in the population will intensify the food demand to a great level in the coming future. Organophosphate pesticides are effective to fight against pests such as aphids, thrips and caterpillars that are critical to maintain high yields in staple crops such as rice, wheat and corn. According to the Food and Agriculture Organization (FAO), pest infestations destroy nearly 20–40% of global crops annually. Developing countries such as India and Indonesia, agriculture contributes significantly to GDP and these countries rely on these pesticides to secure their food supply and this dependency on organophosphate pesticides to mitigate crop losses is a primary driver of the global market growth.

Cost-effectiveness and efficiency are further boosting the organophosphate pesticides market growth. Organophosphate pesticides are highly economical compared to bio-based alternatives. This affordability makes them particularly attractive to cost-conscious farmers in developing countries. For instance, a report by the National Pesticide Information Center, common organophosphates such as malathion and chlorpyrifos control a wide range of pests at a fraction of the cost of synthetic or biological alternatives. The low-cost structure and broad-spectrum efficacy contribute to their demand in countries such as Brazil, which applied over 720,000 tons of pesticides in 2021.

The growing horticultural and ornamental crop cultivation is aiding the market growth. The global horticulture market is experiencing rapid growth. Fruits and vegetables accounts for a significant portion of global agricultural trade. Organophosphate pesticides are essential in horticultural and ornamental crop cultivation to control pests that impact crop quality. For example, China is the largest producer of horticultural crops and accounts for 55% of the vegetable production globally. Similarly, the Spanish fruit export market depends on pesticides to maintain product standards. According to the International Trade Centre, global fruit exports were valued at over USD 100 billion in 2023, which confirms the role of these pesticides in protecting premium crops from economic losses.

MARKET RESTRAINTS

Regulatory restrictions are a major restraint to the organophosphate pesticides market. Governments and international agencies have implemented stringent regulations due to health and environmental concerns. The European Union banned chlorpyrifos and chlorpyrifos-methyl in 2020 as these are linked to developmental neurotoxicity. Similarly, the U.S. Environmental Protection Agency (EPA) has restricted several organophosphates to protect farmworkers and communities. This strict regulatory landscape for organophosphate pesticides is limiting the accessibility of these pesticides in developed regions. For instance, as per the CropLife International report, bans and restrictions have decreased organophosphate usage by over 15% in North America and Europe.

Toxicological concerns associated with organophosphate pesticides is also impeding the market growth. Organophosphates have been linked to acute and chronic health risks such as neurotoxicity, cancer and respiratory issues. According to the reports of World Health Organization (WHO), pesticide exposure contributes to 200,000 deaths annually and organophosphates is considered as the significant contributor to these deaths due to their neurotoxic effects. Public awareness and advocacy for safer alternatives have reduced organophosphate usage in countries like the U.S. In these countries, integrated pest management (IPM) systems are replacing chemical-intensive methods and this shift is primarily due to the increasing consumer demand for chemical-free produce and stringent safety regulations.

MARKET OPPORTUNITIES

Emerging Markets in Asia-Pacific is a significant opportunity to the market. Developing countries such as India, Indonesia and Vietnam present significant growth opportunities due to their expanding agricultural activities. Asia-Pacific accounted for over 30% of global pesticide usage in 2023 due to their high reliance on agriculture for economic development. With increasing food demand and insufficient adoption of alternative solutions, these countries continue to rely heavily on organophosphate pesticides to combat pests. The growing cultivation of rice and vegetables, government initiatives to improve food security are likely to provide substantial demand for organophosphate pesticides in the Asia-Pacific region over the forecast period.

Advancements in formulation technologies are providing growth opportunities. Innovations in pesticide formulations, such as slow-release and microencapsulation technologies have enhanced the safety and efficacy of organophosphate pesticides. These advancements reduce environmental impact and mitigate health risks and promoting wider acceptance. For instance, Dow AgroSciences introduced encapsulated formulations for organophosphates such as Lorsban to improve target delivery while reducing toxicity. According to a report by the International Pesticide Application Research Centre, such innovations can increase application efficiency by 20–30% and provide opportunities for manufacturers to meet evolving regulatory standards.

Adoption of precision agriculture is likely to offer new growth avenues. The integration of organophosphate pesticides with precision agriculture technologies represents a promising opportunity. GPS-enabled systems and drones optimize pesticide application reduces waste and increases effectiveness. Over the forecast period, the adoption of precision agriculture is anticipated to increase exponentially and create synergies for pesticide manufacturers and this trend is particularly strong in developed countries such as the U.S. and Australia, in which, farmers adopt smart farming methods to improve yield and sustainability.

MARKET CHALLENGES

The growing competition from bio-based alternatives is the major challenge to the market. The rising popularity of bio-based pesticides such as neem oil and microbial solutions presents a major challenge. These alternatives are environmentally friendly and match with consumer demand for sustainable farming practices. The demand for bio-based pesticides is growing significantly and outpacing the demand for synthetic pesticides. For instance, India is a major organophosphate market and is witnessing increased adoption of bio-based solutions due to government subsidies for organic farming.

The growing costs of compliance is further hindering the growth of the global market. The cost of adhering to regulatory standards is increasing, particularly for organophosphate manufacturers. Compliance with safety protocols, environmental testing, and licensing requirements adds financial pressure. According to the study of Pesticide Action Network, companies that spend approximately 20% of their revenue on regulatory compliance in developed markets such as the EU and the U.S. This reduces profit margins and discourages new companies from investing in organophosphate products.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.27% |

|

Segments Covered |

By Ingredients, Type, Crop Based, and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Monsanto, DOW Agriscience LLC, Bayer CropScience, Syngenta AG, BASF, Dupont, American Vanguard Corp, FMC Corporation, Adama Agricultural Solutions Ltd, Nufarm. |

SEGMENTAL ANALYSIS

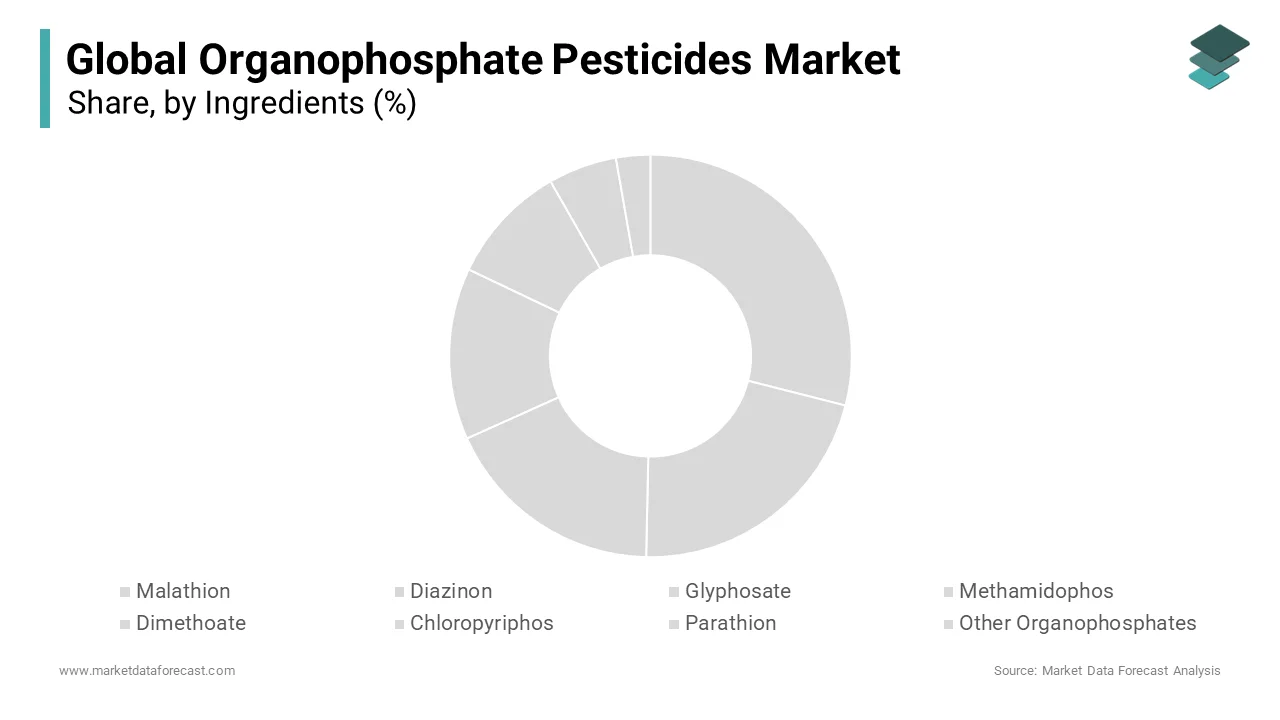

By Ingredients Insights

The glyphosate held 30.6% of the global market share in 2023 and stood as the most dominating segment in the worldwide market. The broad-spectrum herbicidal properties of glyphosate make it indispensable for controlling a wide array of weeds across various crops. The widespread adoption of glyphosate-resistant genetically modified (GM) crops is contributing to the dominance of glyphosate segment in the global market. Companies such as Bayer AG, following its acquisition of Monsanto have heavily invested in glyphosate-based products to reinforce their market position. Despite controversies and legal challenges concerning health implications, the efficacy and cost-effectiveness of glyphosate are expected to continue to drive its extensive application in agriculture.

On the other hand, the chlorpyrifos segment is experiencing rapid growth in the organophosphate segment and is predicted to be the fastest growing segment in the global market. The effectiveness of chlorpyrifos against a broad spectrum of insect pests, including those resistant to other insecticides is boosting the adoption of chlorpyrifos, particularly in developing regions. Companies such as Dow AgroSciences have improved their chlorpyrifos product lines to meet the growing demand for chlorpyrifos. However, regulatory scrutiny in regions such as the European Union and the United States due to environmental and health concerns are posing challenges to the growth of the chlorpyrifos segment.

By Type Insights

The insecticides segment accounted for the largest share of 45.4% of the global market share in 2023 owing to the increasing necessity to protect crops from insect infestations that can significantly reduce yields. Organophosphate insecticides such as malathion and diazinon are favored for their rapid action and broad-spectrum efficacy. Agricultural sectors in countries such as India and Brazil rely heavily on these insecticides to safeguard staple crops. Companies including Syngenta and BASF SE have developed extensive portfolios of organophosphate insecticides to address the demand for insecticides.

The herbicides segment is anticipated to be fastest growing segment and witness a CAGR of 6.22% over the forecast period. Organophosphate herbicides such as glyphosate are integral in no-till farming practices, which are gaining popularity for their soil conservation benefits. Companies such as Bayer AG have been at the forefront and promoting glyphosate-based herbicides as essential tools for modern agriculture.

By Crop Type Insights

The grains and cereals segment led the market by accounting for 40.8% of the worldwide market share in 2023. Staple crops such as wheat, rice, and corn are fundamental to global food security, and their protection from pests is paramount. Organophosphate pesticides are extensively used to manage pest populations in these crops to ensure stable yields. Companies such as Corteva Agriscience provide customized organophosphate solutions to meet the specific needs of grain and cereal farmers.

The fruits and vegetables segment is predicted to witness the fastest CAGR of 5.8% over the forecast period owing to the rising demand for high-quality produce and the susceptibility of these crops to various pests. Horticultural regions in Europe and North America are witnessing increased adoption to meet consumer expectations for blemish-free fruits and vegetables. Companies such as FMC Corporation are investing in research to develop organophosphate formulations that are effective yet minimize residues and match with stringent food safety standards.

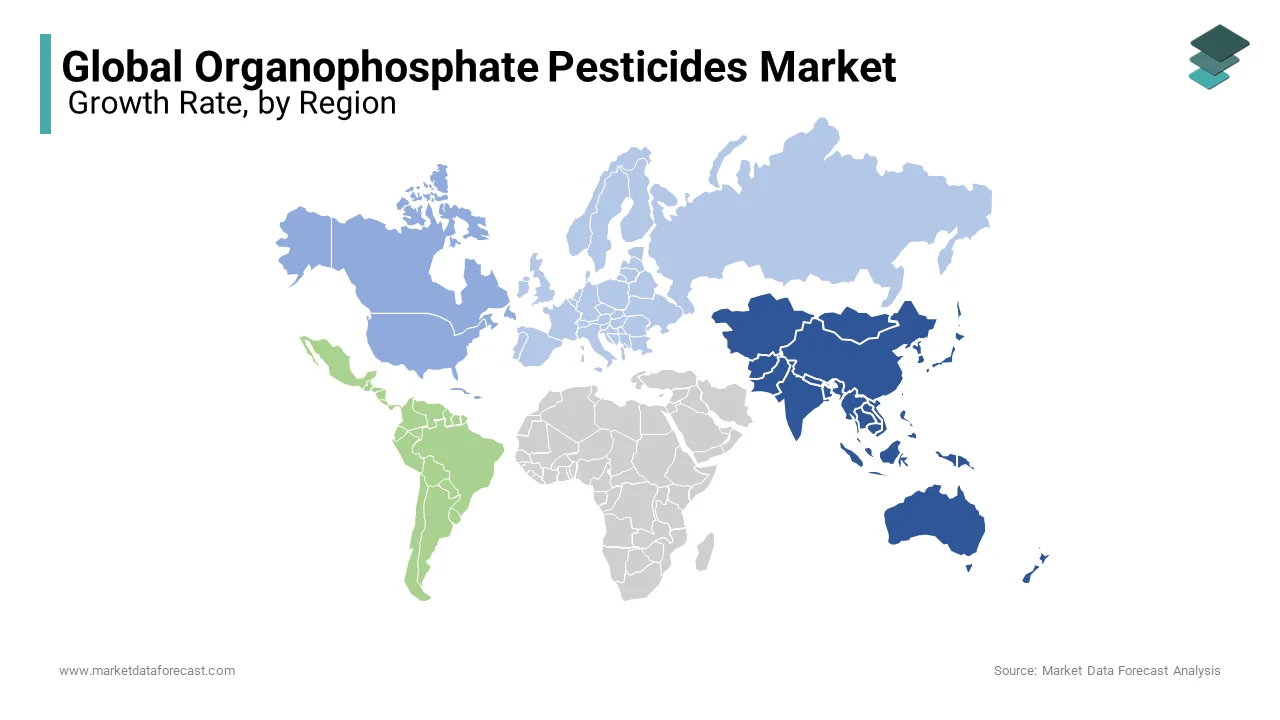

REGIONAL ANALYSIS

The Asia-Pacific region was the most dominant regional market for organophosphate pesticides and captured 36.3% of the global market share in 2023. In this regional market, China and India are the major consumers of organophosphate pesticides due to their vast agricultural landscapes and the need to enhance crop yields to feed growing populations. The growth of the Asia-Pacific market is expected to be fuelled by the prevalence of pest infestations and the cost-effectiveness of organophosphate pesticides. Companies such as UPL Limited and Nufarm are expanding their production capacities and distribution networks in this region to capitalize on the growing demand.

North America is a prominent regional market for organophosphate pesticides. The growth of the North American market is driven by the extensive agricultural activities and increasing need for effective pest control solutions. However, stringent regulatory frameworks by agencies such as the Environmental Protection Agency (EPA) have led to restrictions on certain organophosphates, which is impeding the regional market growth. Companies such as Dow AgroSciences and FMC Corporation are focusing on developing safer formulations and investing in integrated pest management strategies to comply with regulations and maintain market presence. In this regional market, the U.S. is showing dominance and this trend is expected to continue throughout the forecast period.

Europe captured 20.8% to the global market share in 2023 and is predicted to experience a healthy CAGR over the forecast period. In Europe, France, Germany, and Spain are prominent users of organophosphate pesticides and the market growth in these countries is majorly driven by their extensive agricultural sectors. On the downside, the stringent regulations of the European Union, including bans on specific organophosphates such as chlorpyrifos are negatively impacting the European market growth. Companies operating in the European market such as BASF SE and Syngenta are investing in research and development to create alternative solutions that comply with regulatory standards while meeting the pest control needs of European farmers.

Latin America holds a substantial share of the global organophosphate pesticides market and is expected to grow at a notable CAGR over the forecast period. Brazil and Argentina are the key markets in the Latin American market. The growth of the Latin American market is majorly driven by large-scale cultivation of crops such as soybeans, corn, and sugarcane. The favorable climatic conditions of Latin America and the necessity to control a wide range of pests contribute to the demand for organophosphate pesticides.

The Middle East and Africa region accounts for a smaller share of the global organophosphate pesticides market. However, this regional market is estimated to register a steady CAGR over the forecast period. South Africa and Egypt are the leading consumers of organophosphate pesticides in this region. The growth of the MEA market is likely to be driven by the rising need to improve agricultural productivity and manage pest challenges. The adoption of organophosphate pesticides is influenced by factors such as economic development and agricultural practices. Companies such as ADAMA Agricultural Solutions are focusing on expanding their presence in this region by providing cost-effective and efficient pest control products to support local farmers.

KEY MARKET PLAYERS

Monsanto, DOW Agriscience LLC, Bayer CropScience, Syngenta AG, BASF, Dupont, American Vanguard Corp, FMC Corporation, Adama Agricultural Solutions Ltd, and Nufarm are some of the notable players in the organophosphate pesticides market.

RECENT HAPPENINGS IN THE MARKET

- In October 2024, Bayer CropScience announced plans to launch ten blockbuster agriculture products over the next decade, aiming to generate over €5 billion in annual sales. Bayer intends to leverage these products including advancements in pest-resistant pesticides to solidify its leadership in the agricultural market. This initiative will cater to the rising global demand for crop protection to make sure that Bayer remains competitive amid shifting regulations and evolving farming needs. The planned product pipeline aligns with the market's need for sustainable solutions, bolstering Bayer's global reach and reputation for innovation.

- In June 2024, Syngenta AG’s CEO, Jeff Rowe, addressed geopolitical tensions between the U.S. and China by reaffirming the company’s commitment to U.S. farmers and transparency in data handling. This strategic move aims to mitigate concerns over Chinese ownership and fortify its position in the U.S., which is a key organophosphate pesticides market. By maintaining trust among American farmers and regulators, Syngenta can continue its market operations without disruption, ensuring stability and long-term growth.

- In August 2024, BASF SE launched "XtraCrop," a next-generation organophosphate herbicide for large-scale cereal production in Europe and Asia. The product addresses increasing pest resistance and farmer demands for higher efficiency in weed management. This launch strengthens BASF's portfolio in high-demand regions and demonstrates its commitment to addressing pressing agricultural challenges. With rising herbicide-resistant weeds, "XtraCrop" positions BASF as a solution-driven leader in global pest control.

- In July 2024, Nufarm signed a licensing agreement with Moa Technology to commercialize a novel synthetic herbicide. This collaboration focuses on addressing herbicide resistance in crops, a critical challenge in modern agriculture. By integrating Moa’s innovative technology, Nufarm can differentiate its product offerings and tap into markets demanding next-generation solutions, reinforcing its competitive edge in a rapidly evolving pesticide landscape.

MARKET SEGMENTATION

This market research report on the global organophosphate pesticides market is segmented and sub-segmented into the following categories.

By Ingredients

- Malathion

- Diazinon

- Glyphosate

- Methamidophos

- Dimethoate

- Chloropyriphos

- Parathion

- Other Organophosphates

By Type

- Herbicide

- Fungicide

- Insecticide

- Others

By Crop Based

- Oilseeds

- Fruits & Vegetables

- Grains & Cereals

- Non-Crop

- Turf & Ornamental Grass and others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

what is the size of global of global Organophosphate Pesticides Market?

The global organophosphate pesticides market size was valued at USD 9.90 billion in 2025.

what is the growth of Organophosphate Pesticides Market?

The Organophosphate Pesticides Market is estimated to grow a CAGR of 5.27% to reach USD `14.92 billion by 2033.

what are the key market players of Organophosphate Pesticides Market?

Monsanto, DOW Agriscience LLC, Bayer CropScience, Syngenta AG, BASF, Dupont, American Vanguard Corp, FMC Corporation, Adama Agricultural Solutions Ltd, Nufarm.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]