Global 1,4 Butanediol Market Size, Share, Trends, & Growth Forecast Report Segmented By Application (Tetrahydrofuran (THF), γ-Butyrolactone (GBL), Polybutylene Terephthalate (PBT), Polyurethane, and Other Application), and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global 1,4 Butanediol Market Size

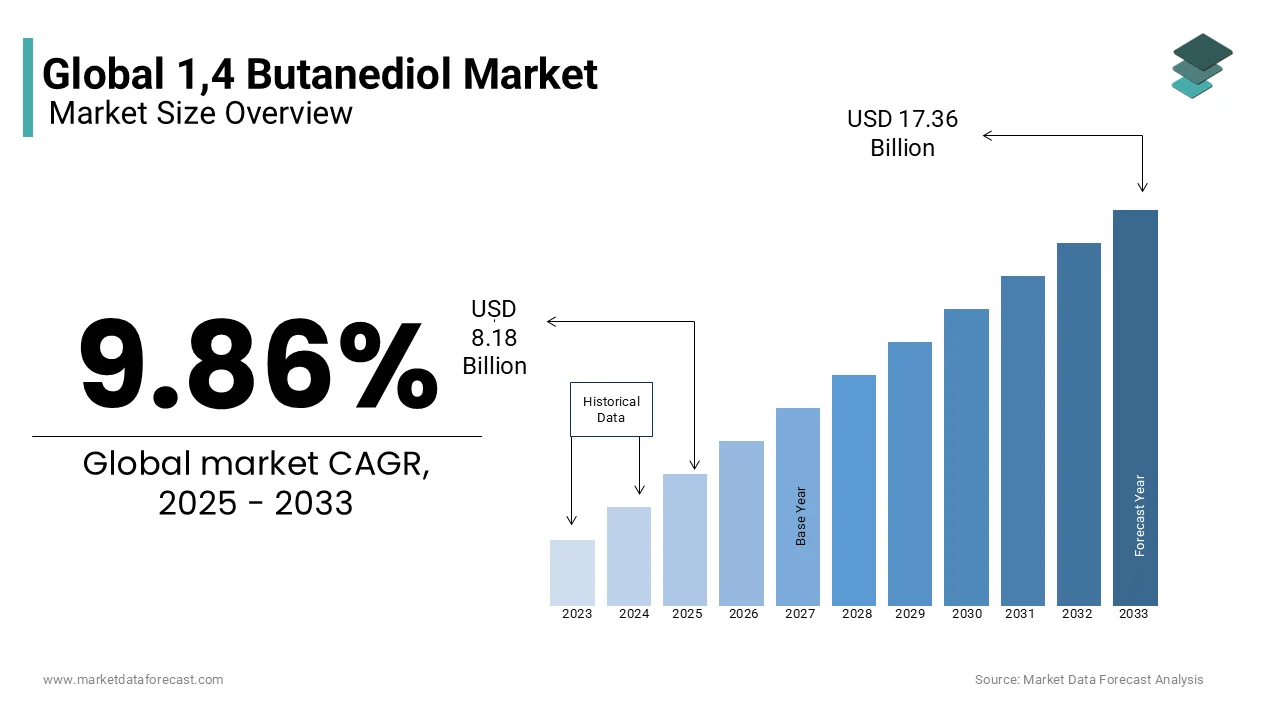

The global 1,4 Butanediol market size was valued at USD 7.45 billion in 2024 and is expected to reach USD 17.36 billion by 2033 from USD 8.18 billion in 2025. The market is projected to grow at a CAGR of 9.86%.

The 1,4-butanediol (BDO) market is experiencing significant developments driven by technological advancements and a shift towards sustainable production methods. A notable trend is the increasing focus on bio-based BDO. Companies are investing in innovative processes to produce BDO from renewable resources such as sugars and biomass and is aiming to reduce environmental impact and reliance on fossil fuels. For instance, in September 2023, BASF SE secured long-term access to bio-based BDO from Qore LLC, a joint venture between Cargill and HELM AG, signaling a strategic move towards sustainable sourcing in the chemical industry.

In terms of production processes, the Reppe process which involves the reaction of acetylene with formaldehyde remains widely utilized due to its efficiency and cost-effectiveness. However, alternative methods like the Davy process, based on the hydrogenation of maleic anhydride, are gaining prominence. These methods offer different advantages in terms of feedstock availability and process economics and is contributing to the diversification of production technologies in the BDO market. The market is also witnessing strategic collaborations aimed at enhancing production capabilities and expanding market reach. For example, in July 2022, LG Chem Ltd. partnered with GS Caltex to develop bio-based BDO using white biotechnology. This initiative focuses on meeting the growing demand for sustainable and bio-based intermediates in various industries.

MARKET DRIVERS

Advancements in Bio-Based Production Methods

The development of bio-based production methods for 1,4-Butanediol (BDO) is a key market driver. Innovations in genetic engineering have enabled the fermentation of renewable feedstocks to produce BDO. For instance, the U.S. Environmental Protection Agency recognized a process that utilizes genetically modified microbes to ferment sugars into BDO, resulting in substantially less carbon dioxide emissions compared to traditional methods. This approach not only reduces greenhouse gas emissions but also decreases energy consumption considerably which is highlighting the environmental and economic benefits of bio-based BDO production.

Environmental Regulations and Sustainability Initiatives

Stringent environmental regulations and a global shift towards sustainability are propelling the adoption of greener chemical processes in the BDO market. The U.S. Department of Energy's Clean Fuels & Products Shot initiative aims to develop cost-effective fuels and products from sustainable carbon sources by targeting over an 85% reduction in net greenhouse gas emissions by 2035. This initiative stresses on the increasing emphasis on sustainable production methods which is promoting companies to innovate and adopt environmentally friendly technologies in BDO manufacturing.

MARKET RESTRAINTS

Health and Safety Concerns

The potential health risks associated with 1,4-Butanediol (BDO) have major restraint to its market growth. BDO is metabolized into gamma-hydroxybutyric acid (GHB) in the human body, a substance known for its psychoactive effects and potential for abuse. The U.S. Drug Enforcement Administration (DEA) classifies GHB as a Schedule I controlled substance due to its high potential for abuse and lack of accepted medical use. Consequently, the handling and distribution of BDO are subject to stringent regulations to prevent misuse. Additionally, exposure to BDO can lead to adverse health effects such as respiratory depression, dizziness, and nausea, necessitating strict safety protocols in industrial settings. These health and safety concerns may deter manufacturers from utilizing BDO and thereby restraining market expansion.

Environmental Regulations

Stringent environmental regulations concerning the production and disposal of chemical substances like 1,4-Butanediol (BDO) present grave obstacle to market growth. The U.S. Environmental Protection Agency (EPA) enforces regulations under the Toxic Substances Control Act (TSCA) which requires manufacturers to provide detailed data on chemical production, usage, and potential environmental impacts. Compliance with these regulations often necessitates substantial investments in pollution control technologies and sustainable production processes that is increasing operational costs. Furthermore, the European Union's Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation imposes similar stringent requirements on chemical manufacturers including those producing BDO. These regulatory frameworks can act as deterrents for new entrants and may limit the expansion plans of existing manufacturers due to the associated compliance costs and operational constraints.

MARKET OPPORTUNITIES

Increased Demand for Sustainable Materials in Automotive and Electronics Sectors

The rising demand for lightweight and eco-friendly materials in the automotive and electronics industries presents a significant opportunity for the 1,4-Butanediol (BDO) market. As automotive manufacturers seek to reduce vehicle weight and improve fuel efficiency, materials like polyurethane which is derived from BDO are being increasingly used in automotive applications such as seat cushions, dashboards, and insulation. According to the U.S. Department of Energy, the automotive sector accounts for nearly 30% of total global energy consumption is making it a key focus for energy-efficient innovations. Similarly, the growing adoption of electronic devices including smartphones and laptops demands high-performance, durable materials, where BDO plays a crucial role in producing polymers and components. This trend aligns with the overall push towards sustainability because BDO is used to manufacture biodegradable plastics and other green alternatives.

Government Initiatives Promoting Sustainable Chemicals

Government initiatives aimed at promoting sustainable chemical production offer substantial opportunities for the BDO market. The U.S. Department of Energy's Clean Fuels & Products Shot initiative aims to develop cost-effective fuels and products from sustainable carbon sources, targeting over an 85% reduction in net greenhouse gas emissions by 2035. This initiative focuses on the increasing emphasis on sustainable production methods and is encouraging companies to innovate and adopt environmentally friendly technologies in BDO manufacturing.

MARKET CHALLENGES

Health and Safety Concerns

The potential health risks associated with 1,4-Butanediol (BDO) present major challenges to its market expansion. When consumed BDO is rapidly metabolized into gamma-hydroxybutyric acid (GHB) which is a substance with known psychoactive effects and a high potential for abuse. The National Toxicology Program has documented that BDO is swiftly absorbed and converted to GHB in both animals and humans and that is leading to central nervous system depression and other adverse effects. These health concerns necessitate stringent handling and usage regulations, potentially limiting BDO's applications and deterring manufacturers from its adoption.

Environmental Impact of Production Processes

The traditional production methods of BDO involve energy-intensive processes that contribute to environmental pollution. The U.S. Environmental Protection Agency has stated that conventional BDO manufacturing processes are associated with significant greenhouse gas emissions and energy consumption. These environmental challenges are exacerbated by the generation of hazardous byproducts during production, necessitating substantial investments in waste management and pollution control measures. Consequently, the environmental impact of BDO production poses a considerable challenge, prompting the market to seek more sustainable and eco-friendly manufacturing alternatives.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.86% |

|

Segments Covered |

By Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BASF SE, Ashland, DCC, Mitsubishi Chemical Group Corporation, Evonik Industries AG, LyondellBasell Industries Holdings B.V., Sipchem Company, SINOPEC (China Petrochemical Corporation), Genomatica, Inc., and others |

SEGMENTAL ANALYSIS

By Application Insights

The tetrahydrofuran (THF) segment accounted for 30.8% of the global market share in 2024. The critical role that tetrahydrofuran (THF) plays as a solvent in PVC production and pharmaceutical manufacturing is majorly driving the growth of the THF segment in the global market. According to the U.S. Environmental Protection Agency (EPA), PVC demand has grown steadily due to its use in construction materials, with global PVC production exceeding 57 million metric tons in 2022. THF's importance also stems from its application in high-performance polymers, where it supports industries like packaging and textiles.

The polybutylene terephthalate (PBT) segment is predicted to expand at the highest CAGR of 8.2% during the forecast period owing to the increasing demand for lightweight materials in the automotive sector. The International Organization of Motor Vehicle Manufacturers (OICA) reports that global automotive production exceeded 85 million units in 2022, with electric vehicles (EVs) accounting for nearly 10% of total output. PBT’s excellent thermal stability and electrical insulation properties make it ideal for EV components and electronics.

REGIONAL ANALYSIS

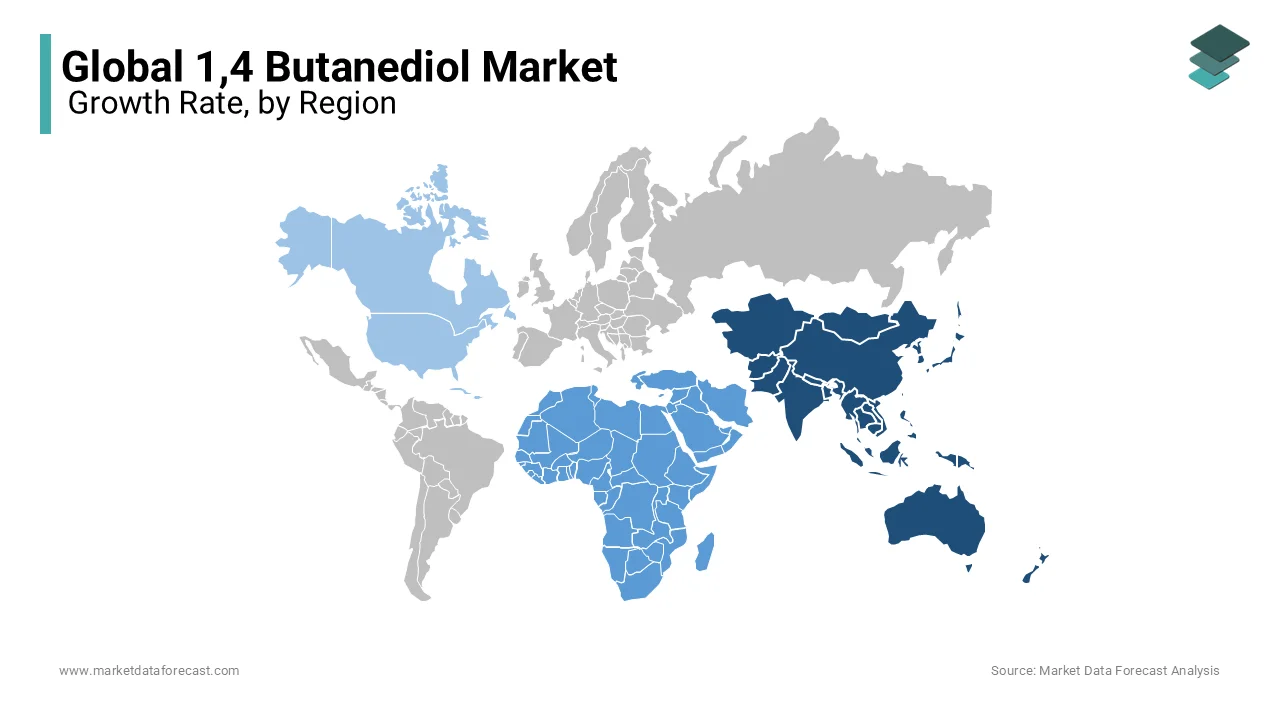

Asia Pacific dominated the 1,4 Butanediol market by holding 40.6% of the global market share in 2024 and the domination of the regional segment is primarily driven by China’s industrial expansion and India’s growing chemical sector. According to the International Energy Agency (IEA), China accounted for 60% of global electric vehicle (EV) production in 2022 which is propelling demand for materials like PBT. Additionally, Asia-Pacific contributes a substantial portion of global chemical sales and is underscoring its pivotal role. Government initiatives such as China’s "Made in China 2025" plan and India’s "Plastic Parks" scheme further bolster regional growth, making Asia-Pacific the largest and most dynamic market.

The market in Middle East and Africa exhibits the CAGR of 6.8% over the forecast period due to the increasing investments in petrochemical infrastructure. The Organization of the Petroleum Exporting Countries (OPEC) revealed that Saudi Arabia’s Vision 2030 initiative has allocated $1 trillion to diversify its economy including significant investments in chemicals. Furthermore, the African Development Bank (AfDB) notes that Africa’s manufacturing sector grew annually from 2020–2022, creating opportunities for 1,4 BDO applications. These factors highlight the region’s potential to emerge as a key player in the global market.

North America captured a market share of 20.7% in the 1,4 Butanediol market and is driven by its strong automotive and pharmaceutical sectors. The U.S. International Trade Administration (ITA) reports that the U.S. chemical industry exported goods worth $494 billion in 2022, underscoring its global significance. Additionally, the National Highway Traffic Safety Administration (NHTSA) notes that electric vehicle sales in the U.S. grew by 55% in 2022, driving demand for lightweight materials like PBT. North America’s focus on sustainability is further supported by the Environmental Protection Agency (EPA), which found that over 30% of new plastics developed in the U.S. are bio-based, aligning with green manufacturing trends.

Europe is believed to have a steady growth in the coming years and is supported by its advanced automotive and packaging industries. According to the European Automobile Manufacturers Association (ACEA), Europe produced 16.7 million vehicles in 2022, with electric vehicles accounting for 12.1% of total production, boosting demand for materials like PBT. Furthermore, the European Chemical Industry Council (Cefic) states that Europe’s chemical industry contributes €587 billion annually to the economy and is making it a key driver of innovation. The European Green Deal, announced by the European Commission, aims to achieve 55% greenhouse gas reduction by 2030, promoting sustainable chemical production and supporting steady growth in this market.

Latin America is anticipated to grow decently and is driven by urbanization and industrialization. The World Bank estimates that Latin America’s urban population will reach 81% of the total population by 2030, increasing demand for construction materials and plastics. While economic volatility remains a challenge, government initiatives like Brazil’s "Industry 4.0" plan aim to modernize industrial infrastructure, fostering gradual market penetration.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

BASF SE, Ashland, DCC, Mitsubishi Chemical Group Corporation, Evonik Industries AG, LyondellBasell Industries Holdings B.V., Sipchem Company, SINOPEC (China Petrochemical Corporation), Genomatica, Inc. are playing dominating role in the global 1,4 butanediol market.

The 1,4-Butanediol (BDO) market is highly competitive, with several key players vying for market share through technological advancements, production expansion, and sustainability initiatives. The competition is driven by the increasing demand for BDO in various industries, including automotive, textiles, pharmaceuticals, and electronics, where it is used to produce spandex fibers, biodegradable plastics, and polyurethane coatings.

Leading players such as BASF SE, Dairen Chemical Corporation (DCC), and LyondellBasell Industries N.V. dominate the market with large production capacities, extensive global distribution networks, and strategic partnerships. Competition is further intensified by regional players in China, India, and South Korea, who offer cost-competitive alternatives.

A key differentiator in the market is the shift toward bio-based BDO production. Companies are increasingly focusing on sustainable manufacturing processes to comply with environmental regulations and meet the growing demand for eco-friendly alternatives. Technological advancements in catalytic processes and metabolic engineering have also fueled competition, as firms seek to develop cost-efficient and high-performance BDO solutions.

Overall, the BDO market remains fragmented, with strong competition among established multinational corporations and emerging players striving to gain a foothold through innovation, strategic investments, and expansion into high-growth regions.

STRATEGIES USED BY THE MARKET PLAYERS

Expansion of Production Capacity – BASF SE

One of the primary strategies used by BASF SE to strengthen its position in the 1,4-Butanediol (BDO) market is the continuous expansion of its production capacity across multiple global locations. With a presence in Germany, Malaysia, China, and Japan, BASF has strategically located its BDO production plants in key industrial hubs to meet growing global demand. The company has also invested in upgrading its facilities with state-of-the-art production technology, ensuring higher efficiency, cost-effectiveness, and sustainability. This expansion strategy allows BASF to secure its market share and maintain a strong supply chain, catering to industries such as automotive, electronics, and textiles. Additionally, BASF’s efforts in increasing bio-based BDO production demonstrate a commitment to environmentally friendly alternatives, giving it a competitive edge in the market.

Strategic Partnerships & Collaborations – Dairen Chemical Corporation (DCC)

Dairen Chemical Corporation (DCC) has adopted a partnership-driven strategy to maintain and expand its leadership in the BDO market. By forming joint ventures and collaborations with regional and international chemical manufacturers, DCC has strengthened its global distribution network. The company works closely with partners in Asia, North America, and Europe to enhance its supply chain efficiency and market reach. Additionally, DCC’s collaborations with automotive, textile, and industrial polymer companies ensure that its BDO products meet the latest industry standards. This strategy allows DCC to not only expand its footprint but also share technology and resources, ultimately improving the cost-effectiveness and performance of its BDO-based products.

Investment in Sustainable & Bio-Based Alternatives – LyondellBasell Industries N.V.

LyondellBasell Industries N.V. has placed a strong emphasis on sustainability and innovation to maintain its competitive edge in the BDO market. The company is investing heavily in the development of bio-based and renewable BDO alternatives, reducing its reliance on fossil fuel-based production methods. By leveraging advanced catalytic processes and biotechnology, LyondellBasell is working towards lowering carbon emissions and improving the environmental footprint of its chemical production facilities. This focus on sustainability not only aligns with global environmental regulations but also appeals to industries looking for eco-friendly raw materials, such as biodegradable plastics, spandex, and specialty polymers. By adopting green manufacturing practices, LyondellBasell is securing its position as a leader in the future of sustainable chemical production.

TOP 3 PLAYERS IN THE MARKET

BASF SE

BASF SE, headquartered in Ludwigshafen, Germany, is one of the world's largest chemical manufacturers, with a strong presence in the BDO market. The company operates several large-scale production facilities across the globe, including in Germany, Malaysia, China, and Japan, with an estimated annual BDO production capacity of 670,000 metric tons. BASF’s BDO is widely used in producing tetrahydrofuran (THF), polybutylene terephthalate (PBT), and polyurethane (PU), which are essential materials for the automotive, textiles, and electronics industries. The company continuously invests in research and development, focusing on enhancing BDO production efficiency and sustainability. BASF has also made strategic moves toward bio-based BDO alternatives, aligning with the global push for eco-friendly chemical manufacturing.

Dairen Chemical Corporation (DCC)

Dairen Chemical Corporation (DCC), based in Taiwan, is another major player in the BDO market. The company specializes in the production of acetyl and allyl chemicals, including vinyl acetate monomer, VAE emulsions, and polytetramethylene ether glycol (PTMEG), in addition to BDO. With a vast network of seven production sites across Taiwan, China, Malaysia, and Singapore, DCC holds an estimated 700,000 metric tons of annual BDO production capacity, making it one of the world’s leading suppliers. The company serves over 100 countries, providing high-quality BDO for use in industries such as construction, automotive, and textiles. DCC’s strong distribution network and commitment to expanding its production capabilities have helped it maintain a dominant position in the global market.

LyondellBasell Industries N.V

LyondellBasell Industries N.V., headquartered in Houston, Texas, USA, is a global leader in plastics, chemicals, and refining. The company was formed in 2007 through the merger of Lyondell Chemical Company and Basell Polyolefins, making it one of the most influential players in the global petrochemical industry. LyondellBasell's BDO production is essential for the manufacturing of spandex fibers, engineering plastics, and polyurethane coatings, widely used in the automotive, textiles, and construction sectors. The company has a strong focus on sustainable and innovative production technologies, aiming to reduce its carbon footprint and enhance product performance. With a reputation for reliability and high-quality chemical manufacturing, LyondellBasell continues to shape the global BDO.

RECENT HAPPENINGS IN THE MARKET

- In September 2024, the world's first industrial-scale plant producing bio-based 1,4-Butanediol from renewable resources was inaugurated. This facility integrates a biorefinery into existing chemical processes, enabling the production of up to 30,000 tons per year of bio-based BDO directly from sugars. This innovation is significant for its potential to reduce greenhouse gas emissions by 50% compared to traditional methods.

MARKET SEGMENTATION

This research report on the global 1,4 butanediol market has been segmented and sub-segmented based on application, and region.

By Application

- Tetrahydrofuran (THF)

- γ-Butyrolactone (GBL)

- Polybutylene Terephthalate (PBT)

- Polyurethane

- Other Application

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the current size of the global 1,4-Butanediol market?

As of 2024, the global 1,4-Butanediol market was valued at USD 7.45 billion.

2. What is the projected growth of the 1,4-Butanediol market?

The market is expected to reach USD 17.36 billion by 2033, growing at a Compound Annual Growth Rate (CAGR) of 9.86% from 2025 to 2033.

3. Which region holds the largest share in the 1,4-Butanediol market?

The Asia-Pacific region dominates the market, attributed to rapidly expanding industries, a large consumer base with increasing income levels, and the availability of low-cost labor and resources.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]