Global Olive Oil Market Size, Share, Trends, & Growth Forecast Report - Segmented By Type (Virgin Olive Oil, Extra Virgin Olive Oil, Processed Olive Oil And Others), Application (Food & Beverage, Pharmaceuticals, Personal And Beauty Care, And Others), Distribution Channel (Groceries, Online Stores, And Others), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2025 To 2033

Global Olive Oil Market Size

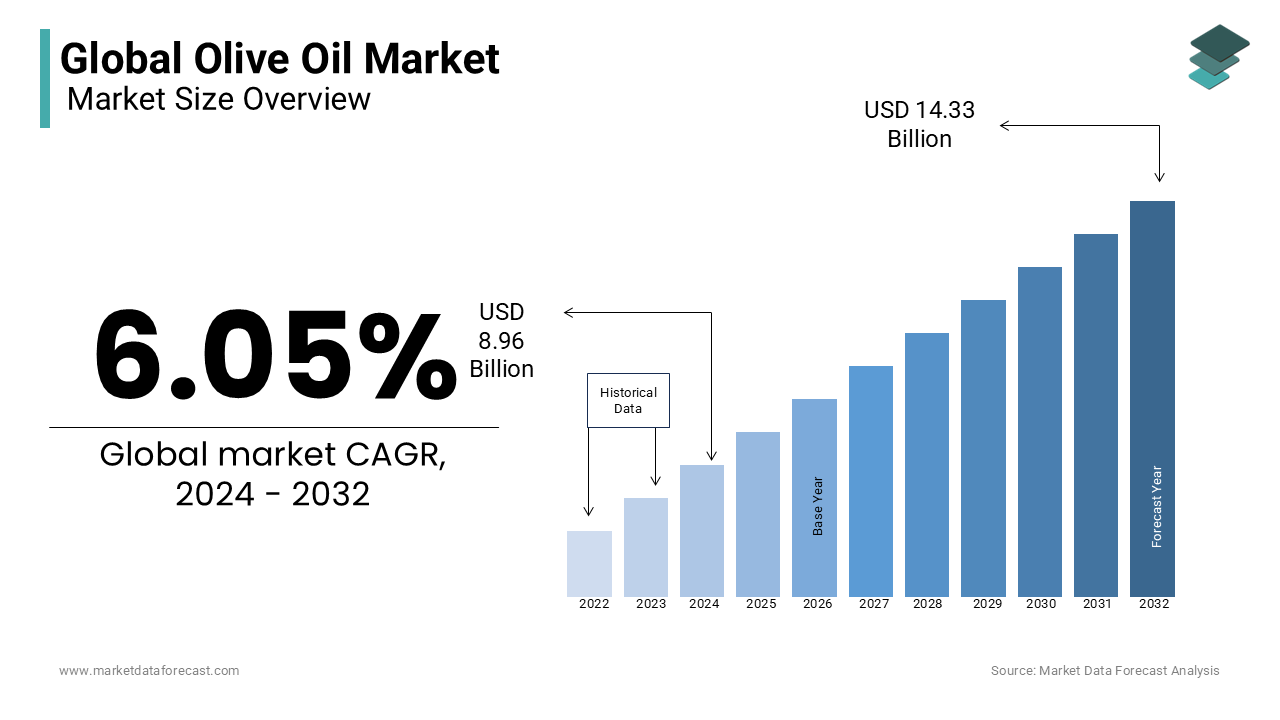

The global olive oil market size was calculated to be USD 8.96 billion in 2024 and is anticipated to be worth USD 15.20 billion by 2033 from USD 9.50 billion In 2025, growing at a CAGR of 6.05% during the forecast period. The olive oil industry has witnessed significant growth in recent years due to an increase in health-conscious consumers across the world.

The market offers various types of olive oil, such as extra virgin olive oil, light olive oil, pure olive oil, virgin olive oil, olive residue oil, and refined olive oil. Olive oil is a viscous liquid that is extracted from the fruits of the olive tree by pressing whole olives. It has a low smoke point of 240C, so it can be consumed as a raw material. Consuming olive oil is often considered healthy because it has a lower risk of heart disease and is associated with certain types of cancer, such as colorectal and breast cancer. It is also a good source of monounsaturated fatty acids and antioxidants, such as polyphenols, vitamins E and K, chlorophyll, and carotenoids.

Current Scenario of the Global Olive Oil Market

The olive oil industry has witnessed significant growth in recent years due to an increase in health-conscious consumers across the world. As cooking oil, olive oil is being increasingly consumed worldwide. Given its nutritional value and flavour, olive oil is consumed by large pools of the world's population. Currently, extra virgin olive oil is the highest quality olive oil consumed by most health-conscious people. Extra olive oil has less than 1% acidity, which makes it popular worldwide. The global olive oil market is experiencing significant growth as consumer awareness of this oil consumption and the many benefits of strong economic growth increase.

- According to the Foreign Agricultural Services under the United States Department of Agriculture, in 2024/25, the production of olive oil in the world is projected to arrive close to 3.1 million tons, an increase of 27 per cent compared to the previous year. This signifies a rebound after two years of diminished harvests that substantially decreased global supplies and drove prices to their highest levels on record.

On the other hand, as of now, the market faces challenges due to high prices and climate change. Its prices are becoming uncontrollable, leaving producers and customers inquisitive about how much further they can rise. The prices have escalated in the past two years, with numbers reaching an all-time high of US 10281.37 dollars per metric ton in the month of January 2024. As per industry experts, the market for olive oil is extremely volatile because of supply demand and climate problems, making it tough to estimate how much costs will change in the forthcoming years and months.

Market Drivers

The growing awareness among consumers regarding the nutritional value and flavour associated with olive oil has been one of the factors boosting the global olive oil market growth.

- In a consumer survey published in Science Direct, primarily, 37 per cent of participants purchased their olive oil once, 52.8 per cent stated they bought in bulk quantity, used it daily accounted for 55.1 per cent, and around 2 tablespoons every day 27.4 per cent. Besides this, 29.5 per cent of the respondents' families consumed over 30 liters every year.

The health benefits associated with olive oil have also increased market demand, which is supposed to further increase in the coming years. Olive oil has benefits such as stroke prevention, rheumatoid arthritis treatment, healthy heart, depression, and stress, and this awareness among the public has grown exponentially in recent years due to social media, medical advice, and word of mouth. Virgin olive oil has gained great traction due to its chemical additive-free processing technology along with higher nutritional content. Furthermore, as the acceptance of olive oil for cooking increases, market demand in the food and beverage sector is expected to increase. The consistent demand for olive oil in the end-use industry is assumed to drive the global market throughout the outlook period. Olive oil is applied in the food and beverage industry, the cosmetics and beauty care industry and the pharmaceutical industry. The constant growth of these industries is likely to increase the demand for olive oil. Western lifestyles are increasingly being adopted by populations in developed countries. This is one of the main factors driving the world olive oil market. The increasing adoption of olive oil in a variety of applications in various industries, such as the cosmetic, pharmaceutical, food, and beverage industries worldwide, is a key factor that is presumed to accelerate the growth of the global olive oil market.

The growing olive oil production and increasing disposable income are further contributing to the olive oil market growth.

- As per the World Population Review, the production of olive oil by Spain in 2023-24 stood at 766.4 tons (biggest in the world), Italy at 288.9 tons, and Turkey at 210 tons.

Personal care products are mixed with olive oil extracts and are recognized have been gaining popularity worldwide due to their skin-related benefits. Another significant factor touted to accelerate global market growth in the near future is the launch of new, high-end olive oil products from leading manufacturers. Increased demand for cooking olive oil is foreseen to create a favourable market opportunity.

Market Restraints

The high cost, along with the availability of olive oil alternatives such as mustard oil, coconut oil, palm oil, etc., in the market, is a major impediment to the growth of the global market.

- The prices of olive oil in winter 2021/22 witnessed drought conditions which affected the Mediterranean region, the largest global supplier, leading to poor olive yields. In Spring 2022, the prices of olive oil started to climb when the poor yields resulted in restricted supplies. In Autumn 2022, drought situations in Spain are intensifying, with insufficient rainfall in November and October further harming olive crops.

Currently, the biggest challenge facing the olive oil market is a decrease in sales volume due to poor harvest conditions. Olive oil cultivation is challenging as the world warms up and it continues to have a warm climate throughout the year. On the other hand, the Greeks are trying to find other job opportunities in place of olive oil production. Greece, a major olive oil production region, cannot earn money due to the lack of an adequate packaging market. Italy, on the other hand, has earned its reputation in the global olive market by importing Greek products. A controlled environment for olive oil production and an improved market for packaging machines in a scarce country is an excellent way to solve these problems.

Market Opportunities

Currently, the olive oil market is under intense pressure and that burden seems to carry on as the impacts of climate change remain on course to amplify. Despite these trees being extraordinarily robust, their yield is highly sensitive to atmospheric conditions comprising hail, rain, drought, frost, and pests. The greater variation or dispersion in the climate has experienced a big impact in the last few years. In the future, it is believed that there will be a transition in the areas which are fit for the production of olive oil, however, this shift in land application takes time.

Additionally, by-products of olive oil and subsequent application in the aquafeed industry. Worldwide, there is a hunt for substitute ingredients for fish food for farming and the aquafeed industry has been assessing and integrating various agricultural source inputs in fish feeds, like olive oil, palm kernel, coconut, cotton seed, and soy, to promote the growth of aquaculture. This is because they are regarded as cost-effective comparatively, more ecologically sustainable and nutritionally sufficient in relation to other animal-oriented sources. Also, other sources of plant protein from agricultural by-products are presently under consideration. Hence, its application in this industry is expected to propel further in the coming years.

Market Challenges

Climate change has emerged as the biggest challenge to the growth of the olive oil market. This can be attributed to the increasing greenhouse gas emissions around the globe and particularly in Europe, which ultimately affects the production of olive oil. Subsequently, it raises the price of the end product.

- As per a study published in IntechOpen, there is an estimation of a 30 per cent decline in the production of olive oil by 2100 in the region of southern Spain, which is the biggest producer of this currently,

This is due to the ongoing escalation in temperature from the serious heat wave affecting a substantial part of Europe, most of non-irrigated olive tree plantations may become unviable for its cultivation. Therefore, there is a dire need to reduce this negative effect on this extremely advantageous Mediterranean diet by applying appropriate modelled adaptation.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.05% |

|

Segments Covered |

By Type, Application, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Del Monte Food, Inc., Cargill, Inc., Deoleo, Ybarra, Gruppo Salov, Sovena Group, Jaencoop, Macario SA, Maeva Group, And Lamasia |

SEGMENTAL ANALYSIS

By Type Insights

The virgin olive oil segment is attributed to holding the highest share of the market during the forecast period. The prominence of leading a healthy life by eating healthy food products that use olive oil, which contains low fat and is responsible for maintaining cholesterol and blood sugar levels, is attributed to enhancing the growth rate of the market. The virgin olive oil is extracted by pressing the olives but not by using heat or any chemicals, which is pure and good for health due to its antioxidant properties. It is budget-friendly and can be used by the middle-class economy people. The extra virgin olive oil segment is anticipated to have the fastest growth rate in the coming years. This type is unrefined, with a full flavor profile and high nutritional properties. The olives are ground into a paste, and the oil is extracted by pressing the paste, which is golden green in color.

By Application Insights

The food and beverages segment is leading with the dominant share of the market owing to the launch of effective and innovative food products according to people’s interest. The growing prominence for high-quality food products with naturally derived oil to manage proper weight and reduce the risk of many chronic illnesses is substantially elevating the growth rate of the market. The growing number of people making tasty food items using olive oil, as it is full of nutrients and antioxidants that boost the immunity system, shall drive the growth rate of the market.

By Distribution Channel Insights

The grocery segment is leading with the largest share of the market, with growing awareness among people to look over the ingredients used to avoid the risk of added chemicals. Online stores segment is also to have the prominent growth opportunities throughout the forecast period. Swift adoption of the advanced technologies in F&B industry is likely to promote the new opportunities for the olive oil demand through online stores. People now are more likely to order the required products through mobile applications that delivers to the doorstep which is inclined to showcase positive growth opportunities for the online stores segment

REGIONAL ANALYSIS

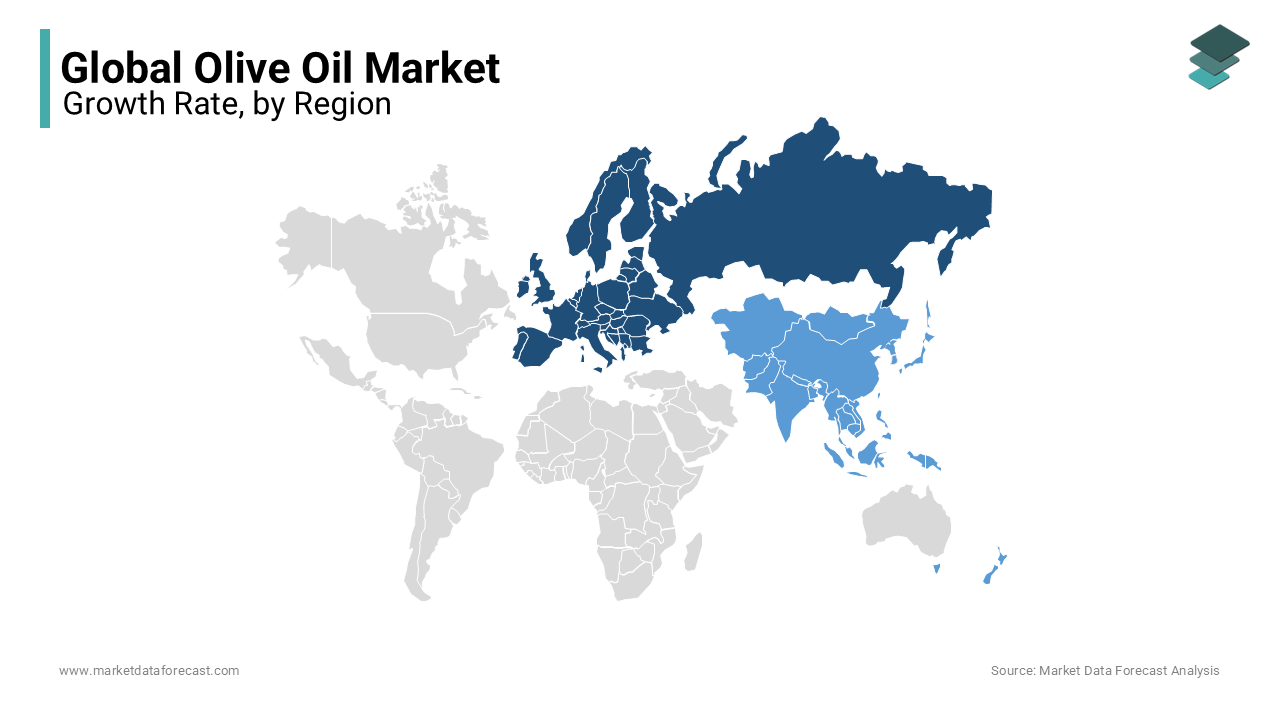

European countries such as Spain and Italy are the pioneers in olive oil. The European olive oil market has the highest sales share in the world market and is expected to dominate the target market during the prediction period. The presence of olive oil producers and the high consumption of olive oil in countries such as France, England, Italy and Germany in the region is driving its demand. Italy and Spain have dominated Japan's olive oil market over the years. The trade agreements between the EU and Japan will create a large open trading area that is expected to offer favorable opportunities for olive oil traders and exporters based in EU nations. European stakeholders in this market are ready to focus on capitalizing on the benefits of EU-Japan trade soon. Moreover, emerging countries like India, China and Japan have witnessed a sharp increase in demand for olive oil with domestic production. In addition, consistent government regulations that boost production in countries like Brazil are likely to boost the olive oil market. The Asia Pacific region is expected to be the fastest-growing region with an average annual growth rate of over 4.0% from 2019 to 2025. Consumption patterns in this area are changing. Consumers are health conscious and prefer low-fat and healthy foods. In countries like China and India, per capita spending on healthy food has increased significantly and China has been considered as a major producer and exporter in this vicinity.

KEY PLAYERS IN THE GLOBAL OLIVE OIL MARKET

Del Monte Food, Inc., Cargill, Inc., Deoleo, Ybarra, Gruppo Salov, Sovena Group, Jaencoop, Macario SA, Maeva Group and Lamasia are some of the major players in the global olive oil market.

RECENT HAPPENINGS IN THE MARKET

- In June 2024, the International Olive Council (IOC) approved the integration of the World Olive Germplasm Bank into the International Treaty on Plant Genetic Resources for Food and Agriculture. Moreover, the treaty, which has also been endorsed by the United Nations Food and Agriculture Organization and the Spanish Ministry of Agriculture, Fisheries and Food. It plays a crucial role in safeguarding agricultural biodiversity.

- In April 2024, Azerbaijan officially joined the International Olive Council (IOC). This will improve access to global markets, the efficient implementation of standardised processes, and the adoption of best agricultural practices. In addition, the Azerbaijani entrepreneurs and government have made substantial investments in developing a modern olive oil industry in the past few years.

- In November 2024, a delegation from China, comprising producers and other stakeholders from the olive oil industry expressed its desire to affiliate with the International Olive Council (IOC).

DETAILED SEGMENTATION OF GLOBAL OLIVE OIL MARKET INCLUDED IN THIS REPORT

This research report on the global olive oil market has been segmented and sub-segmented based on type, application, distribution channel & region.

By Type

- Virgin Olive Oil

- Extra Virgin Olive Oil

- Processed Olive oil

By Application

- Food & Beverages

- Pharmaceuticals

- Personal and Beauty Care

By Distribution Channel

- Groceries

- Online Stores

By Region

- North America

- Europe

- Middle East and Africa

- Latin America

- Asia Pacific

Frequently Asked Questions

1. What factors are driving the growth of the olive oil market?

Factors driving the growth of the olive oil market include increasing consumer awareness of its health benefits, rising demand for Mediterranean cuisine, growth in the food and beverage industry, and the adoption of olive oil in cosmetics and pharmaceuticals.

2. What are the challenges faced by the olive oil industry?

The olive oil industry faces challenges such as fluctuating olive yields due to weather conditions, competition from alternative cooking oils, counterfeit products affecting market reputation, and regulatory issues related to quality standards and labeling.

3. What are the emerging trends in the olive oil market?

Emerging trends in the olive oil market include the rise of boutique and artisanal olive oil brands, increased focus on traceability and authenticity, innovations in packaging for convenience and preservation, and the growing popularity of flavored olive oils.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]