Global Oilfield Equipment Market Research Report - Segmentation, By Application (Onshore and Offshore), By Equipment Type (Drilling Equipment, Production Equipment)– Global Industry Analysis On Size, Trend, Share, Growth and Forecast 2024 to 2032.

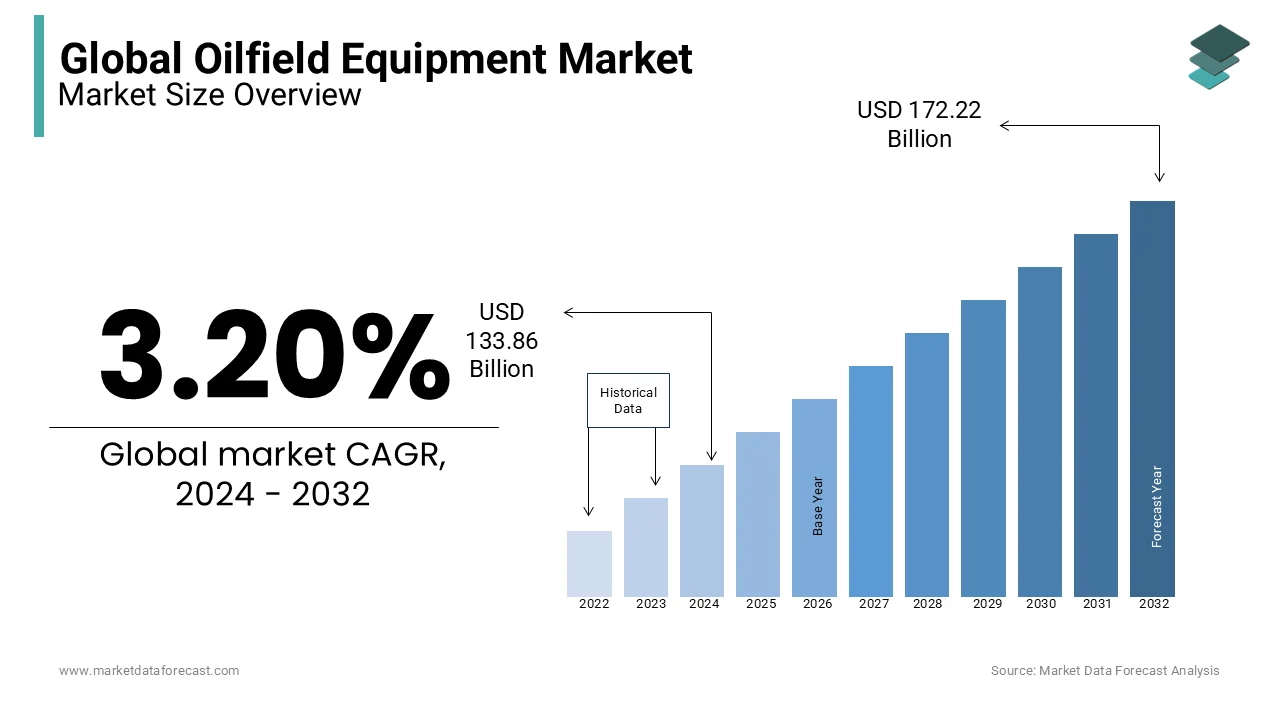

Global Oilfield Equipment Market Size (2024-2032):

The size of the global oilfield equipment market was worth US$ 129.71 Billion in 2023. The global market is anticipated to grow at a CAGR of 3.20% from 2024 to 2032 and be worth US$ 172.22 billion by 2032 from US$ 133.86 billion in 2024.

MARKET SCENARIO

Oilfield equipment is a collection of tools used for oil and gas exploration and drilling. Solid control equipment, well on-shore & off-shore drilling rigs, control equipment, drilling rig components, oilfield supply lots, tanks & vessels, pumps & motors, pump jacks & pumping units, and oilfield vehicles and machinery are all examples of this sort of equipment.

Additionally, throughout the projection period, modern technology in oilfield equipment provides attractive growth prospects for oilfield equipment market participants. The oil and gas industry's emerging technologies have the potential to boost oil and gas output. Furthermore, developments in oilfield equipment technology provide benefits such as increased safety, cost savings, increased process speed, and increased efficiency.

The digitalization of oil and gas refineries, pipelines, exploration sites, and infrastructure is aided by modern technology such as Artificial Intelligence, the Internet of Things, and analytics. This feature allows oil and gas firms to gather all relevant data on a single platform. Furthermore, oil and gas businesses are increasing their investment in innovative technologies to boost productivity, lower risks, and lower costs.

Amii and the Machine Intelligence Institute (Amii) cooperated to develop machine learning and artificial intelligence (AI) capabilities for the oil and gas sector to increase worker safety and decrease environmental consequences. Similarly, Schlumberger and Dataiku Technology formed a cooperation to develop and implement artificial intelligence solutions throughout the oil and gas industry.

Because of the existence of several international and local industry players, the worldwide oilfield equipment market is both segmented and competitive. Contracts, partnerships, collaborations, new product development, geographical expansions, joint ventures, and other creative methods have been implemented by such important companies to stay ahead of the curve while also responding to the expanding needs of their prestigious clientele. They also invest in a variety of research and development operations.

MARKET DRIVERS

Onshore projects are simpler to start than offshore projects and global crude oil prices have shown indications of recovery and are increasing at a fair rate. As a result of the optimism around the rebound of crude oil prices, coastal projects are likely to experience considerable growth throughout the projection period, fuelling demand for oilfield equipment.

Shale gas, coal bed methane (CBM), tight gas, and heavy oil are among the unconventional and deep hydrocarbon resources that oil and gas corporations have begun to explore. Currently, the petroleum sector has evolved IT-based gear and software to undertake operations in unconventional and deep reservoir settings. This opens the door for new-generation technology to be used as a tool to carry out difficult activities. For example, a sophisticated Radio Frequency Identification (RFID) circulation sub that aids in drilling and hole-cleaning operations. Operators can use the RFID circulation sub to cut down on non-productive time. Drilling in shale formations has become commercially viable because of the use of improved drilling and completion technology. Traditional equipment isn't up to the task of meeting the new problems. Horizontal drilling and hydraulic fracturing are two technologies that have opened up large shale oil and gas deposits. The horizontal component of the oil rig count has increased significantly.

MARKET RESTRAINTS

The discovery of new deposits and the depletion of existing ones have necessitated the use of new extraction techniques and increased the drilling's complexity.

The rising volume and complexity of well needs in order to fulfil worldwide production objectives are driving demand for bespoke drilling equipment. In the next five years, a large number of high-spec rigs and accompanying equipment are planned to be delivered. Horizontal drilling is projected to be the primary application for the majority of high-tech new rigs. All of this puts additional strain on rental equipment suppliers since well operator demand fluctuates from well to well. Rental equipment companies are required to have an inventory of a large range of these items, which has an impact on their economies of scale. Oilfield equipment suppliers must regularly update their inventory, which necessitates additional money. The expansion of the oilfield equipment rental business is hampered by these issues.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

3.20% |

|

Segments Covered |

By Application, Equipment Type, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ABB, Baker Hughes, Delta Corporation, Ethos Energy Group Limited, Integrated Equipment, Jereh Oilfield Equipment, MSP/Drilex, Inc., Sunnda Corporation, Uztel S.A, Weir Group, and Others. |

SEGMENTAL ANALYSIS

Global Oilfield Equipment Market Analysis By Application

Onshore equipment is expected to have the largest share of the Global Oilfield Equipment Market. In terms of application, the onshore segment of the oilfield equipment rental market is predicted to be the most lucrative in 2017. The onshore segment would be driven by rising demand for rental equipment from China, Southeast Asia, and the Middle East. Huge onshore shale reserves in the United States and Australia are expected to drive demand for onshore oilfields.

Offshore equipment is expected to see significant growth in the Global Oilfield Equipment Market. Oil and gas are extracted from extraordinary depths under the sea in offshore oil and gas production. Drilling on land is far easier, yet offshore production is critical to the world's energy supply. Because water covers 75% of the earth's surface, hydrocarbon reserves are more abundant in the sea than on land.

Global Oilfield Equipment Market Analysis By Equipment Type

Drilling equipment is expected to have the largest share of the Global Oilfield Equipment Market. In North America, extensive shale mining is taking place, and technical advancements in drilling equipment utilized in such unconventional shale deposits are projected to propel the drilling equipment industry forward.

REGIONAL ANALYSIS

North America is expected to have the largest share of the Global Oilfield Equipment Market. The rock studies activities for oil sands, carbonate rocks, and shale oil, as well as several other exploration activities, the United States has the largest market share, growing unconventional hydrocarbon production, the region becoming the new swing producer in global oil markets, the boom in production from both shale operations and deep water exploration and production in the Gulf of Mexico, enhanced capital spending by major oil companies, and increased drilling activities in the United States. In addition, the demand for non-conventional and conventional drilling, increased E&P investment, the strong presence of key companies, and continuous oil and gas exploration and production, as well as expanding unconventional hydrocarbon exploration activities, are all contributing to market expansion.

KEY PLAYERS IN THE GLOBAL OILFIELD EQUIPMENT MARKET

Companies prominent in the global oilfield equipment market include ABB, Baker Hughes, Delta Corporation, Ethos Energy Group Limited, Integrated Equipment, Jereh Oilfield Equipment, MSP/Drilex, Inc., Sunnda Corporation, Uztel S.A, Weir Group, and Others.

RECENT HAPPENINGS IN THE GLOBAL OILFIELD EQUIPMENT MARKET

- ABB has been awarded a $120 million contract to supply the Jansz-Io Compression project's total electrical power system. The Jansz-Io field lies about 200 kilometers off Australia's northwest coast, in ocean depths of around 1400 meters. The field is part of the Gorgon natural gas project, which is run by Chevron and is one of the world's largest natural gas ventures.

- Baker Hughes has increased its presence in Guyana by establishing a new local supercentre for oilfield services and equipment. The supercentre, which covers more than 8 acres, will serve regional consumers and help Baker Hughes' South American localization initiatives.

DETAILED SEGMENTATION OF THE GLOBAL OILFIELD EQUIPMENT MARKET INCLUDED IN THIS REPORT

This research report on the global oilfield equipment market has been segmented and sub-segmented based on application, equipment type and region.

By Application

- Onshore

- Offshore

By Equipment Type

- Drilling Equipment

- Production Equipment

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]