Global Oil Free Compressor Market Size, Share, Trends, & Growth Forecast Report Segmented By Compressor Type (Rotary Screw Compressors, Reciprocating Compressors, Scroll Compressors, and Centrifugal Compressors), Application, Power Source, Capacity, End User Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Oil Free Compressor Market Size

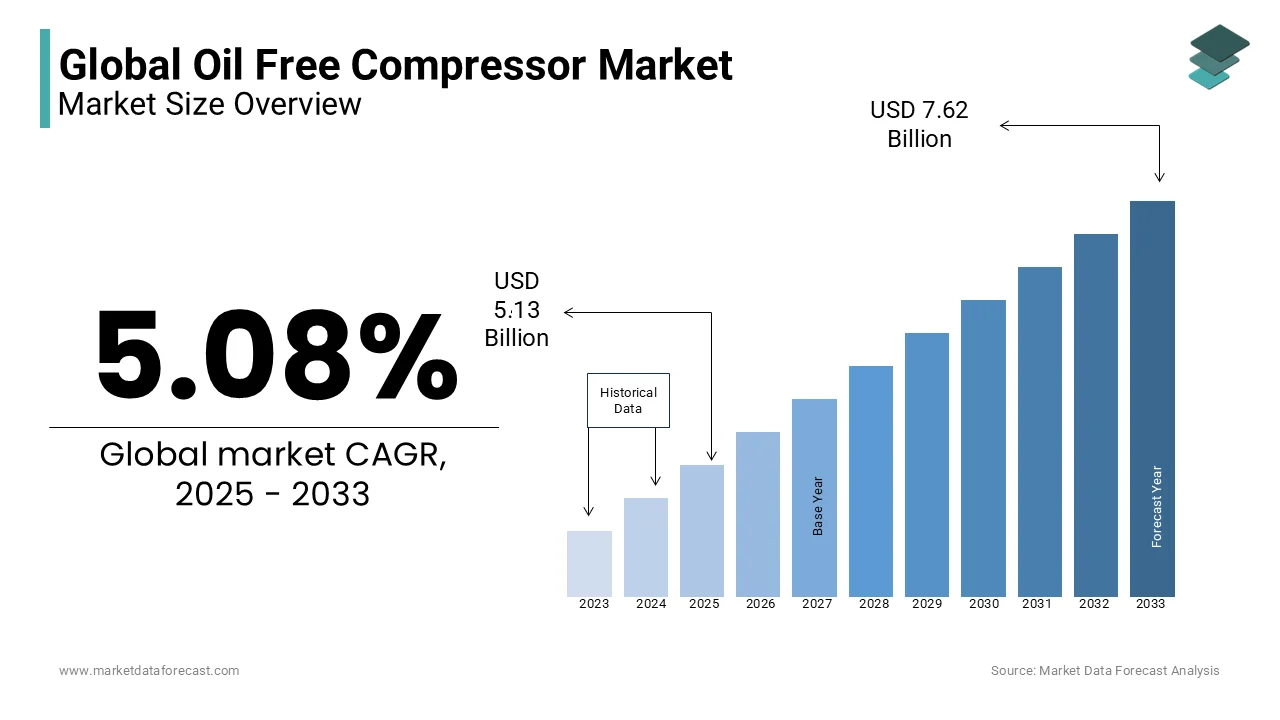

The global oil free compressor market was valued at USD 4.88 billion in 2024. The global market is estimated to reach USD 7.62 billion by 2033 from USD 5.13 billion in 2025, rising at a CAGR of 5.08% from 2025 to 2033.

Oil-free air compressors are specialized machines designed to deliver compressed air without the use of lubricating oil in the compression chamber to ensure clean and contaminant-free air. These compressors play a crucial role in industries where air purity is essential, such as pharmaceuticals, food and beverage processing, electronics manufacturing, and healthcare. Unlike conventional lubricated compressors, oil-free variants use alternative materials like Teflon-coated rotors or water-based lubrication to minimize friction and ensure efficient performance.

The oil-free air compressor market has been experiencing robust growth and the demand for these compressors is majorly attributed to the increasing regulatory mandates on air quality and the rising adoption of energy-efficient technologies. Governments and environmental agencies worldwide have introduced stringent air purity standards, particularly in industries where contamination could compromise product integrity. For instance, ISO 8573-1:2010 outlines air purity classifications that industries must adhere to, fostering demand for oil-free solutions.

The growing preference for rotary screw and centrifugal oil-free compressors due to their higher efficiency and lower maintenance requirements is one of the key trends in the global market. Additionally, the expansion of industrial automation, especially in emerging economies, is fueling demand for reliable compressed air systems. Asia-Pacific, led by countries like China and India, is witnessing rapid market expansion due to increased infrastructure development and manufacturing growth. Meanwhile, North America and Europe maintain steady demand, particularly in food processing and healthcare applications.

MARKET DRIVERS

Stringent Environmental Regulations

The enforcement of rigorous environmental regulations significantly propels the oil-free air compressor market. Governmental bodies worldwide have implemented strict standards to curb industrial emissions and prevent environmental contamination. For instance, the European Union's Industrial Emissions Directive mandates industries to minimize pollution through the adoption of best available techniques, which include the use of oil-free compressors to eliminate the risk of oil-laden emissions. Similarly, the United States Environmental Protection Agency enforces regulations under the Clean Air Act, compelling industries to reduce volatile organic compound emissions, thereby encouraging the shift towards oil-free compression technologies. These stringent policies drive industries to adopt oil-free air compressors, which offer a sustainable solution by ensuring contaminant-free air and reducing environmental impact.

Advancements in Compressor Technology

Technological advancements in compressor design and materials have markedly enhanced the performance and efficiency of oil-free air compressors, fueling market growth. Innovations such as the development of advanced coatings and high-precision components have improved compressor reliability and lifespan. For example, the integration of variable speed drives allows compressors to adjust their operating speed to match demand, resulting in energy savings of up to 35%, as noted by the U.S. Department of Energy. Additionally, advancements in monitoring and control systems enable predictive maintenance, reducing downtime and operational costs. These technological improvements make oil-free air compressors more appealing to industries seeking efficient and reliable solutions, thereby driving their increased adoption.

MARKET RESTRAINTS

High Initial Capital Expenditure

The substantial upfront costs associated with oil-free air compressors serve as a significant barrier to market expansion. These compressors often require advanced materials and precision engineering, leading to higher manufacturing expenses. Consequently, industries, particularly small and medium-sized enterprises, may hesitate to invest in oil-free models due to budget constraints. This financial hurdle can deter potential buyers, slowing the adoption rate of oil-free air compressors across various sectors.

Maintenance and Operational Challenges

While oil-free air compressors eliminate the need for lubrication in the compression chamber, they can present maintenance and operational challenges. The absence of oil can lead to increased wear on components, necessitating more frequent inspections and part replacements. Additionally, ensuring the production of contaminant-free compressed air requires stringent adherence to maintenance protocols. These factors can result in higher operational costs and complexity, potentially discouraging some industries from adopting oil-free air compressors.

MARKET OPPORTUNITIES

Growing Demand in the Food and Beverage Industry

The food and beverage sector's increasing emphasis on hygiene and product purity presents a significant opportunity for the oil-free air compressor market. Oil-free compressors are essential in preventing contamination during processing and packaging. According to the U.S. Department of Agriculture, the food processing industry is expanding, with a notable rise in establishments focusing on ready-to-eat products. This growth necessitates the adoption of oil-free air systems to meet stringent safety standards, thereby driving demand in this market segment.

Expansion of Pharmaceutical Manufacturing

The pharmaceutical industry's global expansion offers a substantial opportunity for oil-free air compressor adoption. These compressors are critical in maintaining sterile environments during drug production. The U.S. Food and Drug Administration highlights the importance of contamination control in pharmaceutical manufacturing, underscoring the need for oil-free systems. As pharmaceutical production scales up to meet global health demands, the reliance on oil-free air compressors is expected to increase, bolstering market growth.

MARKET CHALLENGES

Energy Consumption and Efficiency Concerns

The significant energy consumption associated with oil-free air compressors poses a notable challenge for the market. In California, industrial air compressors are estimated to consume more than 12% of annual manufacturing electricity consumption, approximately 5,400 gigawatt-hours, as reported by the California Energy Commission. This substantial energy usage raises concerns about operational costs and environmental impact, prompting industries to seek more energy-efficient alternatives or improvements in compressor technology to mitigate these issues.

Technological Limitations in High-Temperature Environments

Oil-free air compressors often face operational challenges in high-temperature settings. According to research by NASA's Glenn Research Center, these compressors may struggle with adequate heat dissipation during compression, leading to performance issues in elevated temperatures. This limitation can restrict their applicability in industries or regions where high ambient temperatures are common, thereby constraining market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.08% |

|

Segments Covered |

By Compressor Type, Application, Power Source, Capacity, End User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Kaeser Kompressoren, Hitachi, Eaton, Danfoss, Mitsubishi Electric, Parker Hannifin, ELGi Equipments, Gardner Denver, Atlas Copco, Boge Compressors, Sullair, Kobelco Compressors, Ingersoll Rand, compare, and Anest Iwata. |

SEGMENTAL ANALYSIS

By Compressor Type Insights

The rotary screw compressors segment dominated the market by holding 40.8% of the global market share in 2024 due to their continuous operation capabilities, high efficiency, and minimal maintenance requirements, making them ideal for various industrial applications. These compressors are particularly favored in manufacturing sectors where a steady supply of contaminant-free compressed air is essential. Their design allows for reliable performance under demanding conditions, contributing to their widespread adoption across industries.

The scroll compressors segment is anticipated to exhibit a CAGR of 5.3% over the forecast period. This rapid expansion is driven by their compact design, quiet operation, and high efficiency, making them suitable for applications in the healthcare and electronics industries. The increasing demand for cleanroom environments and precision manufacturing processes in these sectors necessitates the use of oil-free compressors to prevent contamination. As these industries continue to grow, the adoption of scroll compressors is expected to rise accordingly.

By Application Insights

The manufacturing segment had 35.8% of the global market share in 2024 due to the extensive need for clean compressed air in various processes in the manufacturing industry, such as assembly lines, material handling, and equipment operation. The U.S. Bureau of Labor Statistics reports that the manufacturing industry employs over 12 million workers, underscoring its vast scale and the corresponding demand for reliable, oil-free compressed air systems to maintain product quality and operational efficiency.

The pharmaceutical segment is anticipated to register the fastest CAGR of 6.5% during the forecast period. This surge is driven by stringent regulatory standards requiring contaminant-free air in drug manufacturing processes. The U.S. Food and Drug Administration emphasizes the critical importance of maintaining sterile environments in pharmaceutical production to ensure product safety and efficacy. As the global demand for pharmaceuticals increases, the industry's reliance on oil-free air compressors for applications such as tablet coating, capsule manufacturing, and packaging is expected to rise, fueling market expansion.

By Power Source Insights

The electric-powered compressors segment held the largest share of 80.7% in the global market in 2024. This prevalence is due to their energy efficiency, lower operational costs, and reduced environmental impact compared to hydraulic and diesel counterparts. Industries such as manufacturing, healthcare, and food processing prefer electric compressors for their ability to provide consistent, clean, and oil-free air essential for maintaining product quality and adhering to stringent regulatory standards.

The diesel-powered segment is predicted to witness the fastest CAGR of 5.5% during the forecast period owing to the increasing demand for portable and robust compressors in remote or off-grid locations, particularly in the construction and mining industries. Diesel compressors offer the advantage of mobility and independence from electrical power sources, making them indispensable in large-scale infrastructure projects. The U.S. Energy Information Administration notes that diesel fuel remains a primary energy source in heavy-duty applications, underscoring the importance of diesel-powered compressors in sectors where flexibility and high power output are crucial.

By Capacity Insights

The Below 5 HP capacity segment held the leading share of 40.9% of the global market share in 2024. This dominance is attributed to the widespread use of low-capacity compressors in applications such as dental clinics, laboratories, and small-scale manufacturing, where the demand for compact, efficient, and oil-free air solutions is critical. The U.S. Department of Energy highlights that small-scale industries and medical facilities prefer these compressors due to their lower energy consumption and ability to provide contaminant-free air, essential for maintaining stringent hygiene and quality standards.

The 16 HP to 30 HP segment is experiencing the fastest growth and is projected to register a CAGR of 5.5% during the forecast period owing to the increasing adoption of medium-capacity oil-free compressors in industries such as food and beverage processing, electronics manufacturing, and pharmaceuticals. These sectors require reliable and oil-free compressed air systems to prevent contamination and comply with stringent regulatory standards. The U.S. Food and Drug Administration emphasizes the importance of maintaining contaminant-free environments in food and pharmaceutical production, thereby encouraging the use of oil-free compressors in this capacity range to ensure product integrity and safety.

By End User Industry Insights

The automotive segment accounted for 33.9% of the global market share in 2024. The dominance of automotive segment in the global market is primarily attributed to the industry's extensive use of oil-free compressors in painting, assembly, and air conditioning systems, where contaminant-free air is crucial for maintaining product quality and operational efficiency. The U.S. Bureau of Labor Statistics reports that the automotive manufacturing sector employs over 900,000 workers, highlighting its significant scale and the corresponding demand for reliable, oil-free compressed air systems.

The aerospace segment is anticipated to grow at the fastest CAGR of 6.8% over the forecast period due to the increasing demand for precision manufacturing and maintenance processes that require uncontaminated compressed air. The Federal Aviation Administration emphasizes the importance of maintaining stringent quality standards in aerospace manufacturing and maintenance, necessitating the use of oil-free compressors to prevent contamination. As the aerospace sector continues to grow, the reliance on oil-free air compressors for applications such as component fabrication, testing, and painting is expected to rise, further propelling market growth.

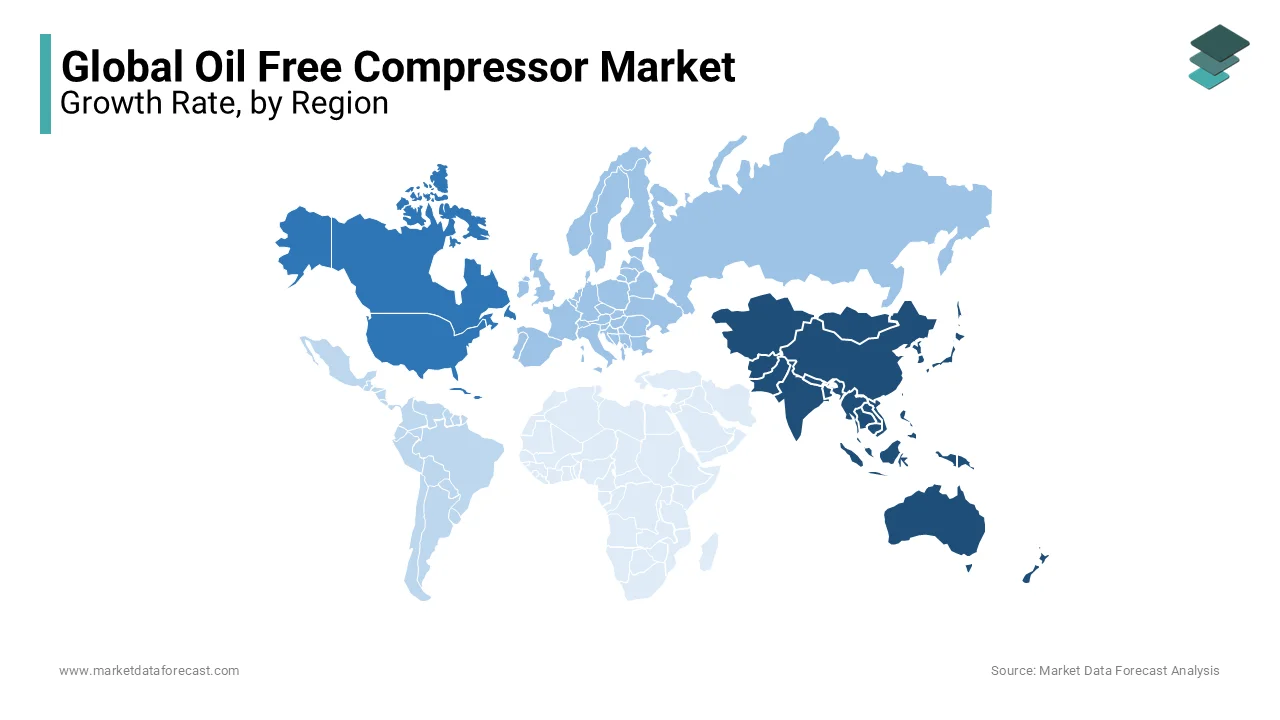

REGIONAL ANALYSIS

In the global oil-free air compressor market, Asia-Pacific was the most dominating regional segment and accounted for 53.1% of the global market share in 2024. This dominance is driven by rapid industrialization and urbanization in countries like China, India, and Japan, leading to increased demand in sectors such as automotive, electronics, and healthcare. The region's focus on environmental regulations and the need for oil-free compressed air in these industries further bolster its leading position.

North America is experiencing the fastest growth in this market due to the strong emphasis on sustainability and energy efficiency in industrial processes, particularly in the United States. Government incentives and regulations promoting clean and oil-free air solutions have accelerated adoption, making North America a key growth market in the sector.

Europe maintains a significant share in the oil-free air compressor market and the market in Europe driven by stringent environmental regulations and a well-established industrial base. The region's focus on reducing carbon emissions and enhancing energy efficiency supports the continued adoption of oil-free compressors.

Latin America and the Middle East & Africa are anticipated to exhibit moderate growth in the coming years. In Latin America, increasing industrialization and infrastructure development contribute to the demand for oil-free air compressors. The Middle East & Africa region is also expected to see growth due to expanding construction and energy sectors, which require reliable and clean compressed air solutions.

KEY MARKET PLAYERS

Kaeser Kompressoren, Hitachi, Eaton, Danfoss, Mitsubishi Electric, Parker Hannifin, ELGi Equipments, Gardner Denver, Atlas Copco, Boge Compressors, Sullair, Kobelco Compressors, Ingersoll Rand, compare, and Anest Iwata.

Top 3 Players in the market

In the global oil-free air compressor market, leading companies such as Atlas Copco, Ingersoll Rand, and Kaeser Kompressoren AG have established themselves as key players. These companies specialize in providing advanced compressed air solutions across various industries, including manufacturing, healthcare, and food processing.

While these firms are prominent in the industrial equipment sector, they do not have a significant presence in the global fintech market. The fintech industry is primarily driven by companies specializing in financial technologies, such as payment processing, digital banking, and financial software solutions. Therefore, the contributions of Atlas Copco, Ingersoll Rand, and Kaeser Kompressoren AG to the global fintech market are minimal, as their core competencies and business operations are focused on industrial applications rather than financial technologies.

Major Strategies Used by Key Players in the Oil-Free Air Compressor Market

Leading companies in the oil-free air compressor market, such as Atlas Copco, Ingersoll Rand, and Kaeser Kompressoren AG, deploy various strategies to strengthen their market position. These strategies focus on technological advancements, mergers & acquisitions, product diversification, and sustainability initiatives to enhance competitive advantage and expand global reach.

Technological Advancements and Innovation

Key players continually invest in research and development (R&D) to enhance compressor efficiency, reduce energy consumption, and improve operational performance.

- Atlas Copco has introduced advanced rotary screw and centrifugal compressors with Variable Speed Drive (VSD) technology, reducing energy consumption by up to 35%.

- Ingersoll Rand has focused on developing oil-free scroll compressors that meet stringent ISO 8573-1 Class 0 standards for industries requiring ultra-pure air, such as pharmaceuticals and electronics.

Strategic Mergers & Acquisitions

To expand their market presence and technological capabilities, leading companies engage in acquisitions.

- Ingersoll Rand acquired Gardner Denver to strengthen its industrial solutions portfolio.

- Atlas Copco expanded its compressor division through the acquisition of Walker Filtration, enhancing its global footprint in air treatment solutions.

These acquisitions enable companies to integrate cutting-edge technology and expand into emerging markets.

Product Diversification and Customization

Companies are offering tailor-made solutions to cater to diverse industries such as food & beverage, healthcare, and automotive.

- Kaeser Kompressoren AG provides customized oil-free air systems for energy-intensive manufacturing processes, ensuring reduced operational costs.

- Atlas Copco has introduced oil-free centrifugal air compressors to cater to high-demand industries requiring large-scale, contaminant-free air supply.

Sustainability and Energy Efficiency Initiatives

As environmental regulations tighten, market leaders emphasize sustainable solutions by launching energy-efficient and low-carbon compressors.

- Atlas Copco has committed to achieving carbon neutrality by integrating low-energy and oil-free air systems in industrial applications.

- Ingersoll Rand promotes Eco-friendly compressed air solutions, reducing emissions and aligning with global net-zero goals.

These strategic approaches enhance market share, drive revenue growth, and strengthen brand reputation, ensuring long-term competitiveness in the oil-free air compressor industry.

MARKET SEGMENTATION

This research report on the global oil free compressor market is segmented and sub-segmented into the following categories.

By Compressor Type

- Rotary Screw Compressors

- Reciprocating Compressors

- Scroll Compressors

- Centrifugal Compressors

By Application

- Manufacturing

- Healthcare

- Food and Beverage

- Pharmaceuticals

- Electronics

By Power Source

- Electric

- Hydraulic

- Diesel

By Capacity

- Below 5 HP

- 5 HP to 15 HP

- 16 HP to 30 HP

- Above 30 HP

By End User Industry

- Automotive

- Construction

- Textiles

- Aerospace

- Energy

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is driving the growth of the oil-free compressor market globally?

The demand for oil-free compressors is increasing due to stringent environmental regulations, rising industrial automation, and the need for clean compressed air in industries like pharmaceuticals, food & beverage, and electronics manufacturing.

How are technological advancements influencing the oil-free compressor market?

Innovations like energy-efficient designs, advanced cooling systems, and smart monitoring technologies are improving performance, reducing operational costs, and enhancing reliability.

How is government regulation affecting the adoption of oil-free compressors?

Environmental policies and strict air quality standards in industries like healthcare and food production are pushing companies to adopt oil-free compressors to ensure compliance.

What are the future trends in the oil-free compressor market?

The market is moving towards increased automation, integration of IoT for remote monitoring, energy-efficient models, and growing adoption in emerging economies due to industrial expansion.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]