Global Oil And Gas Equipment Rental Market Research Report - Segmentation By Equipment (Drilling equipment, Flow and pressure control equipment, Fishing equipment, and other equipment), by Application (Offshore and Onshore), and Market Share, Country, In-Depth Analysis, Forecast Data, and Detailed Overview, and Forecast, 2024 to 2032..

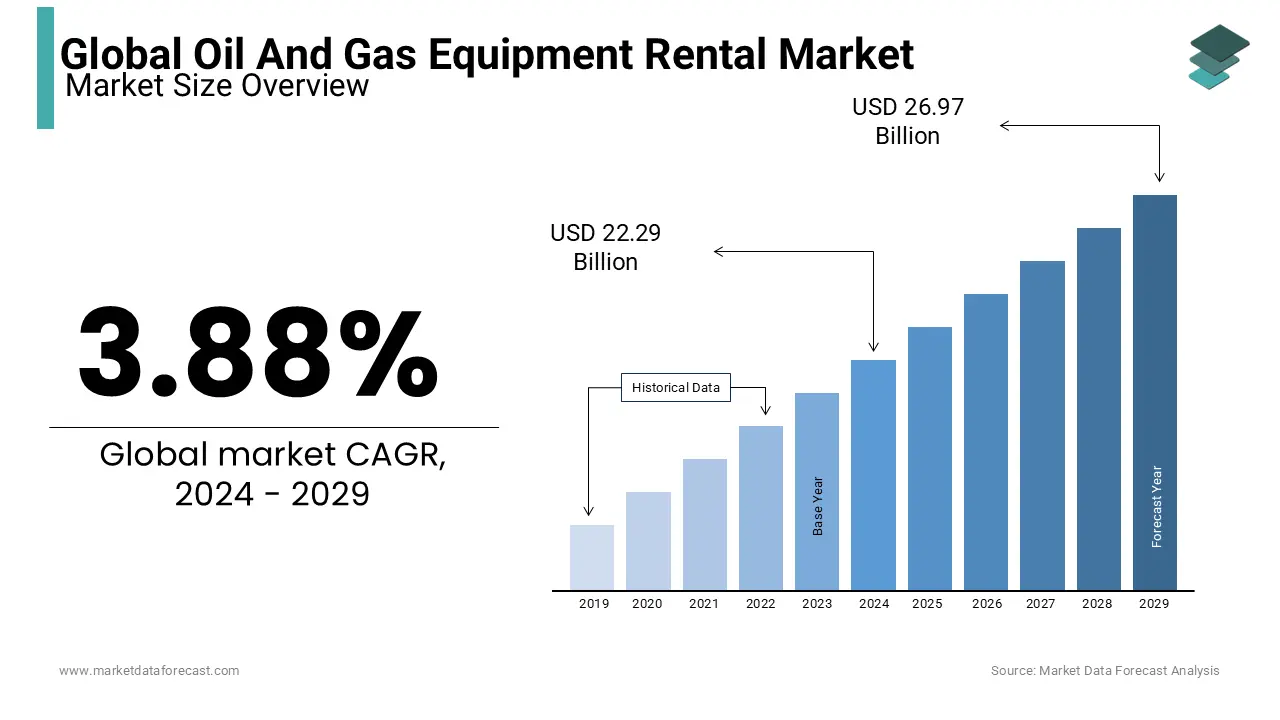

Global Oil and Gas Equipment Rental Market Size (2024-2032):

The Global Oil and Gas Equipment Rental Market was worth US$ 21.46 billion in 2023 and is anticipated to reach a valuation of US$ 30.23 billion by 2032 from US$ 22.29 billion in 2024 and is predicted to register a CAGR of 3.88% during 2024-2032.

Current Scenario of the Global Oil and Gas Equipment Rental Market

Oil and gas exploration is becoming more natural thanks to technological advances. The oil rig has enabled economically viable horizontal drilling, deep drilling, and unconventional hydrocarbon exploration. Industry leaders are making attractive investments in drilling operations for oil and gas exploration. Petroleum equipment and services refer to all products and services associated with the upstream energy industry. This includes drilling, well completions, well logging, well intervention, and many more, In most cases, oil and gas operators contract with an oilfield services contractor to perform drilling operations. Oil and Gas equipment not only helps in the establishment of oil and gas wells but also provides a comprehensive solution for the manufacture, repair, and maintenance of tools and equipment used for drilling wells.

MARKET DRIVERS AND RESTRAINTS

Oil and gas companies have begun to reorient their exploration activities toward unconventional, deep reservoirs of hydrocarbons such as shale gas, coalbed methane (CBM), compressed gas, and heavy oil. The petroleum industry today has advanced software and machinery to operate in a variety of deep and unconventional reservoir conditions.

This paves the way for next-generation technology to be a tool for rigorous operations. For example, an advanced circulation radio frequency identification (RFID) subsystem helps facilitate well drilling and cleaning operations. The RFID-circulating submarine enables operators to reduce downtime. The application of advanced drilling and completion technologies has enabled economically viable drilling in shale formations. Traditional teams are not fully equipped to meet new challenges.

Technologies such as horizontal drilling and hydraulic fracturing have opened up significant oil and gas shale formations. There has been a significant increase in the horizontal component of the number of oil rigs. These are some factors for the Oil and Gas equipment rental market.

Exploration, drilling, and production activities in the marine environment require different environmental and technical considerations than oil and gas activities on land. Despite the challenges posed by harsh environmental conditions offshore, advances in exploration and production technology for application in ice-prone regions such as the Great Banks, the Bohai Sea, the Caspian Sea, the Inlet of Cook, and Sakhalin Island have developed economically viable solutions for production in these regions. The global slowdown in oil prices has led to a decline in drilling activity in recent years, putting additional pressure on drillers and offshore service providers. The exploration of new reserves and the depletion of current reserves have required the application of new extraction techniques and increased drilling complexity.

The demand for custom drilling equipment is driven by the increasing volume and complexity of good requirements to meet global production targets.

A significant number of high-specification rigs and associated equipment are expected to be delivered over the next five years. Most of the new high-tech rigs are expected to be used for horizontal drilling. All of this puts additional pressure on rental equipment providers as the demand for good operators varies from well to well. Rental equipment suppliers are expected to maintain an inventory of a wide variety of such equipment, which affects their economies of scale. Oil and Gas equipment suppliers have to constantly change their inventory, which in turn requires more capital. These factors are hampering the growth of the Oil and Gas equipment rental market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

3.88% |

|

Segments Covered |

By Equipment and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Weatherford International PLC, Transocean Ltd., Baker Hughes Company, Schlumberger Limited, Seadrill Ltd, and Others. |

SEGMENTAL ANALYSIS

Global Oil and Gas Equipment Rental Market Analysis By Equipment

Drilling rigs represent the largest share of the market for Oil and Gas equipment that drills oil wells deep underground. Increasing demand for rental equipment from China, Southeast Asia, and the Middle East would stimulate the segment on land. The presence of huge onshore shale reserves in the United States and Australia is likely to stimulate demand for onshore oil fields. Oil and Gas equipment is used in onshore and offshore applications. The operating cost of an offshore application is quite more expensive than the onshore application.

REGIONAL ANALYSIS

Relentless oil and gas exploration and production and growing unconventional hydrocarbon exploration activity are driving the North American Oil and Gas equipment rental market.

Oil and gas companies are investing in drilling activities to meet the growing demand for hydrocarbons, which is expected to boost the Oil and Gas equipment rental market in Europe. The huge growth potential in Asian countries like China, India, Indonesia, Japan, etc. is due to numerous infrastructure projects, massive demand for energy, and growing population. The government is keen to invest in exploring more oil fields in its region to reduce dependence on oil and gas imports, helping to tap into the growing oil field equipment rental market in Asia-Pacific. Middle East oil tycoon countries like Saudi Arabia, UAE, Iran, Iraq, Kuwait, etc., make a substantial contribution to global oil demand. These countries are eager to increase their production capacity, which increases the growth of the Oil and Gas equipment rental market in the MEA.

KEY PLAYERS IN THE GLOBAL OIL AND GAS EQUIPMENT RENTAL MARKET

Companies playing a prominent role in the global oil and gas equipment rental market include Weatherford International PLC, Transocean Ltd., Baker Hughes Company, Schlumberger Limited, Seadrill Ltd, and Others.

RECENT HAPPENINGS IN THE GLOBAL OIL AND GAS EQUIPMENT RENTAL MARKET

- In July 2019, Baker Hughes, a GE company (BHGE), signed a contract with i3 Energy plc for its drilling operation at Liberator. Under the terms of the contract, BHGE is likely to provide directional drilling, drilling fluids, bottlenecks, formation evaluation operations, and the wellhead.

- In November 2018, a five-year surface technology framework agreement was signed between oilfield service provider TechnipFMC and major oil company Chevron. Under contractual conditions, TechnipFMC will provide surface wellhead equipment and services in the United States and Canada.

DETAILED SEGMENTATION OF THE GLOBAL OIL AND GAS EQUIPMENT RENTAL MARKET INCLUDED IN THIS REPORT

This research report on the global oil and gas equipment rental market has been segmented and sub-segmented based on equipment and region.

By Equipment

- drilling equipment

- flow and pressure control equipment

- fishing equipment

- and other equipment

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]