Global Oats Market Size, Share, Trends & Growth Forecast Report - Segmented By Type (Steel Cut Oats, Rolled Oats, Oatmeal, Oat Flour, Others), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Industry Analysis (2025 to 2033)

Global Oats Market Size

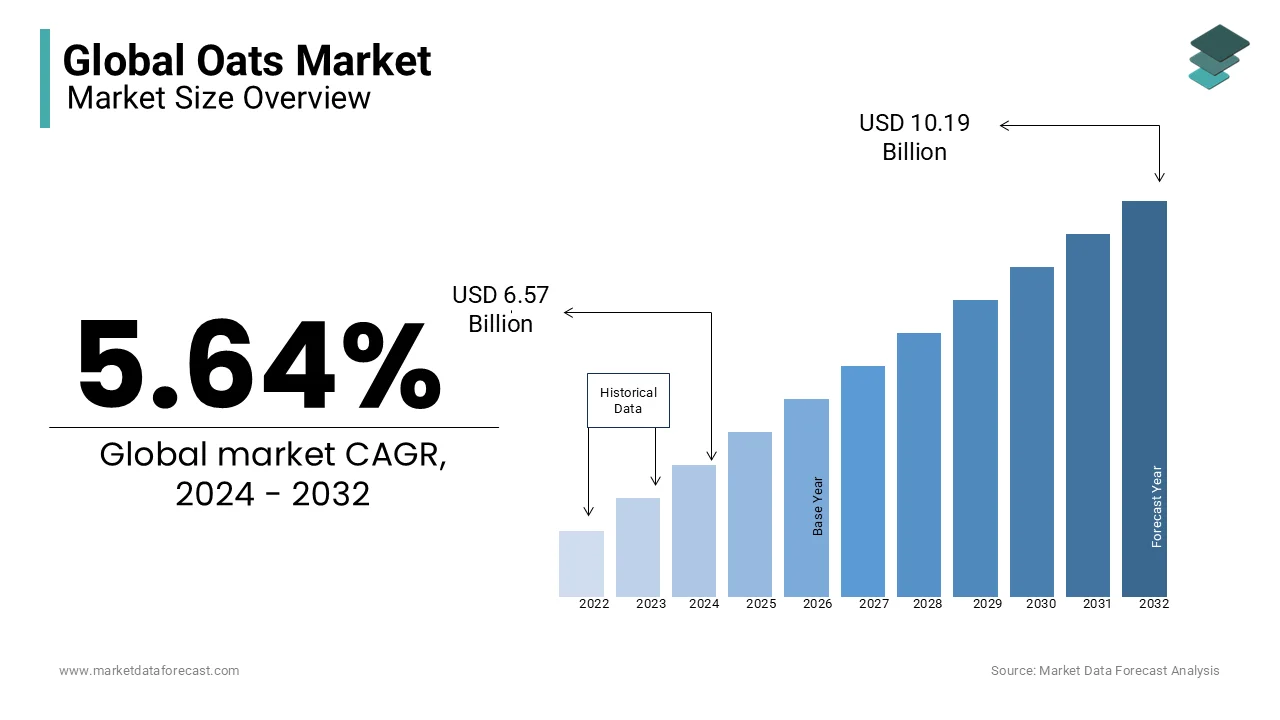

The Global oats market size was valued at USD 6.57 billion in 2024 and the global market size is expected to reach USD 10.76 billion by 2033 from USD 6.94 billion in 2025. The market's promising CAGR for the predicted period is 5.64%.

Oats are considered an excellent source of fiber that is made from oat grains. The main reason that drives the market is its nutritional value. The growing population of health-conscious people is forcing oats manufacturers to increase their production rates to meet growing demand. The rising demand for oats has led manufacturers to improve their research and development activities to produce various forms of oats to attract customers. The high demand for healthy baked goods is helping oats cookies gain popularity. Apart from that, the promotion of oats in various media is advancing in the oats business. The global oats market is supposed to show strong growth during the forecast period due to lifestyle changes and rapid urbanization. Oats are widely used cereal grains grown for its seed and are scientifically known as Avena sativa. Currently, oats rank seventh in the world production of cereals after maize, rice, wheat, barley, sorghum, and millet. Oats are internationally used as animal feed, cosmetics, and consumer food. They have high nutritional values like proteins, vitamins, minerals, dietary fiber, beta-gluten, unsaturated fatty acids, and antioxidants. High beneficial health effects, increasing awareness about animal nutritional requirements, changing farming practices, rise in confectionary food, increasing availability of low-cost ingredients, increase in disposable income, innovative seed breeding techniques, and rising health awareness are the factors driving the growth of the Global Oats Market. However, factors like environmental variation effects and high-cost equipment for farming are hampering the growth of the market.

MARKET DRIVERS

Rapid urbanization and intake of unhealthy food products have had a significant impact on health conditions. This has increased the demand for oats worldwide. The gradual transition to a healthy lifestyle supports the growth of the global oats market. Oats are made up of protein, minerals, dietary fiber, vitamins, and carbohydrates. Oats are also enriched with antioxidants that help protect the body from various chronic diseases like diabetes, cardiovascular disease, and cancer. The growing awareness of the multiple benefits of eating oats is accelerating the growth of the global oats market. Another reason that increases the demand for oats is the notable increase in the working class. A hectic lifestyle and long hours of work have reduced breakfast consumption worldwide. The need for a quick and nutritious breakfast appeals to consumers. Oats are easy to cook and stays fresh longer. Instant Oats has also found application in making cookies, bread, and muffins. Oats are available in different flavors, which provide a feast for consumers' taste buds, which should stimulate the worldwide oats market. The increase in obesity cases around the globe is increasing the demand for oats, as it reduces cholesterol levels, preventing obesity and overweight problems.

MARKET RESTRAINTS

The main limiting factor for the growth of the global oats market is the unavailability of oat products. Oats are mainly grown in Russia and account for almost 30% of world production. Canada, Australia, Spain, and Poland are other prominent nations that produce a significant amount of oat crops and these top 5 countries (including Russia) account for 55 to 60% of world crop production oats of the total world production, 70% is consumed in the animal feed industry. At the same time, the rest is used for food, seeds, and industrial uses. Consequently, limited production and limited availability for food use make it a high-end product.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.64% |

|

Segments Covered |

By Type, Application, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Quaker Oats Company, Bob’s Red Mill Natural Foods, Mornflake, Grain Millers Inc, Jordan’s Mill, Blue Lake Milling, Avena Food Ltd, The Hain Celestial Group, Inc, European Oat Millers, Wild Oats Marketing, LLC and Richardson International |

REGIONAL ANALYSIS

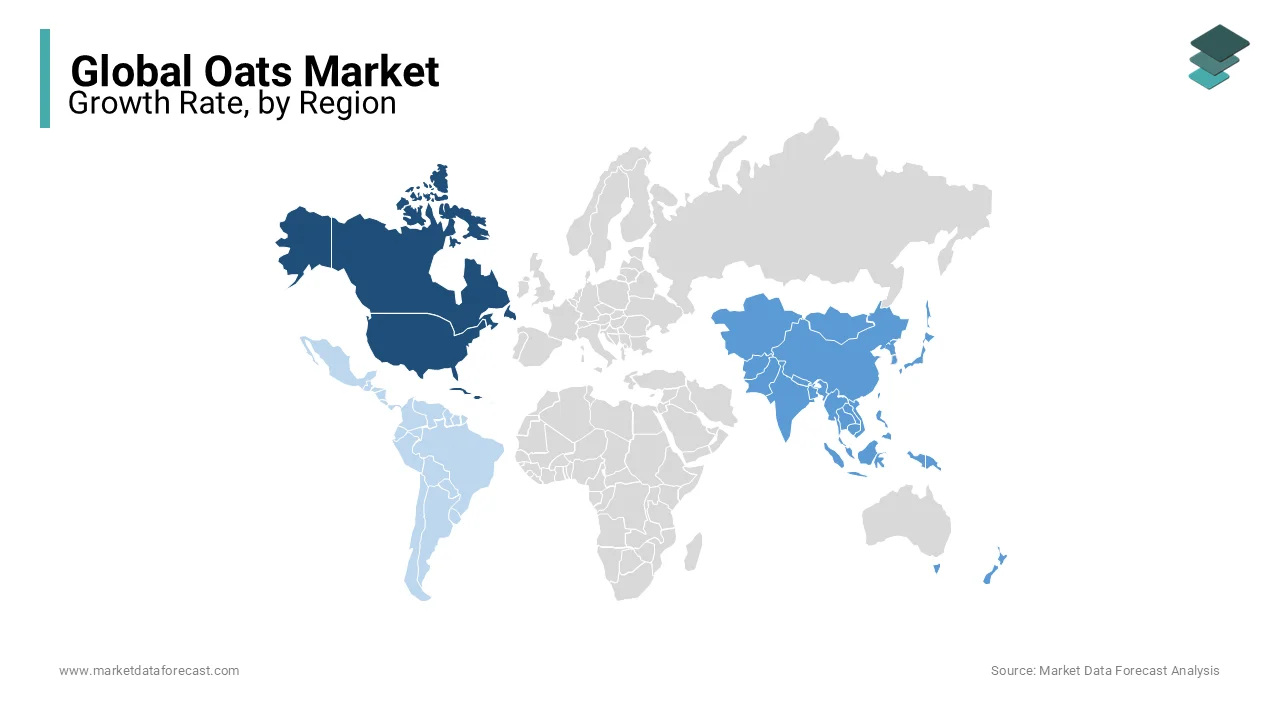

Among the regions mentioned above, the North American oats market is supposed to experience significant growth due to the increased consumption of healthy bars and snacks. Additionally, this factor is assumed to stimulate bulk production to meet oat demand, a factor that should support revenue growth in the global oats market in this region. The increased demand for organic oats among the health-conscious population is a factor that should improve the growth of the target market. The Asia Pacific Oats market is expected to contribute a significant portion of the target market's revenue, due to increased awareness of the benefits associated with consuming healthy foods. The oats market in the Asia-Pacific region is presumed to increase significantly in the coming years, due to rapid changes in the eating habits of the Asian population and the growing number of market leaders in the region.

Furthermore, the increased consumption of baked goods and the high demand for oatmeal cookies and cakes are one of the main factors that can stimulate growth in the target market. Another factor that should drive growth in the oats market in this region is the increased demand for oats from cosmetics and personal care manufacturers. Markets in Europe, the Middle East, Africa, and Latin America are also foreseen to experience considerable growth during the outlook period.

KEY MARKET PLAYERS

Key market players in the Oats Market are Quaker Oats Company, Bob’s Red Mill Natural Foods, Mornflake, Grain Millers Inc, Jordan’s Mill, Blue Lake Milling, Avena Food Ltd, The Hain Celestial Group, Inc, European Oat Millers, Wild Oats Marketing, LLC and Richardson International

RECENT HAPPENINGS IN THE MARKET

-

Quaker Oats Company, owned by PepsiCo, is trying to take advantage of the sharp increase in non-dairy milk sales in the United States with a new range of Oats -based beverages. Called Quaker Oat Beverage, the field will go on sale in January with three flavors available: Original, Original Sugar-Free, and Vanilla. Each 48 oz bottle will retail for the recommended price of $ 4.29. Quaker said the drink, suitable for cereal, smoothies, or coffee, is an excellent source of calcium and vitamin D and a good source of fiber.

-

In October, Oatly announced plans to open a factory in New Jersey in 2019. In addition to supporting production, the company also aims to launch more flavorings in its oat milk range to meet growing demand. PepsiCo owns Quaker Oats, and the launch of Quaker Oat Beverage is seen as PepsiCo's strategy to steer clear of sugary sodas.

- In November 2018, Nestlé cereals expanded its range of nutritious grains with the launch of Oer Cheerios Oat Cereal in the UK. The product claims to be made from whole oats and is rich in vitamin C, D, and folic acids. The World Health Organization recommends an increase in the consumption of whole grains, as well as an increase in fruits, vegetables, legumes, and nuts.

- In December 2018, Silk, owned by food giant Danone SA, launched Oat Yeah, a new oat milk product. The product acclaims as a non-dairy beverage with low sugar content in it.

MARKET SEGMENTATION

This research report on the global oats market has been segmented and sub-segmented based on type, application, & region.

By Type Insights

- Steel Cut Oats

- Rolled Oats

- Oatmeal

- Oat Flour

- Instant Oats

- Others

By Application Insights `

- Bakery Products

- Animal Feed

- Food Ingredients

- Health Care

- Cosmetic Products

- Others

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1.Are there any challenges in the oats market?

Some challenges in the oats market include price fluctuations, competition from alternative grains, supply chain disruptions, and environmental concerns related to agricultural practices. Additionally, market saturation and product differentiation pose challenges for oat producers and manufacturers.

2.What is the global production and consumption of oats?

Oats are cultivated in various regions worldwide, with major producers including Canada, Russia, the United States, Australia, and European countries. The global consumption of oats continues to rise, driven by increasing demand for healthy and convenient food products.

3.Are there any innovations in the oats market?

Yes, there are ongoing innovations in the oats market, including the development of new oat-based products, such as oat milk, oat-based meat alternatives, and oat-based snacks. Additionally, advancements in oat breeding and processing technologies aim to improve yield, quality, and sustainability in oat production.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com